Market

Berachain (BERA) Struggles at $6 Despite Weaker Bearish Signals

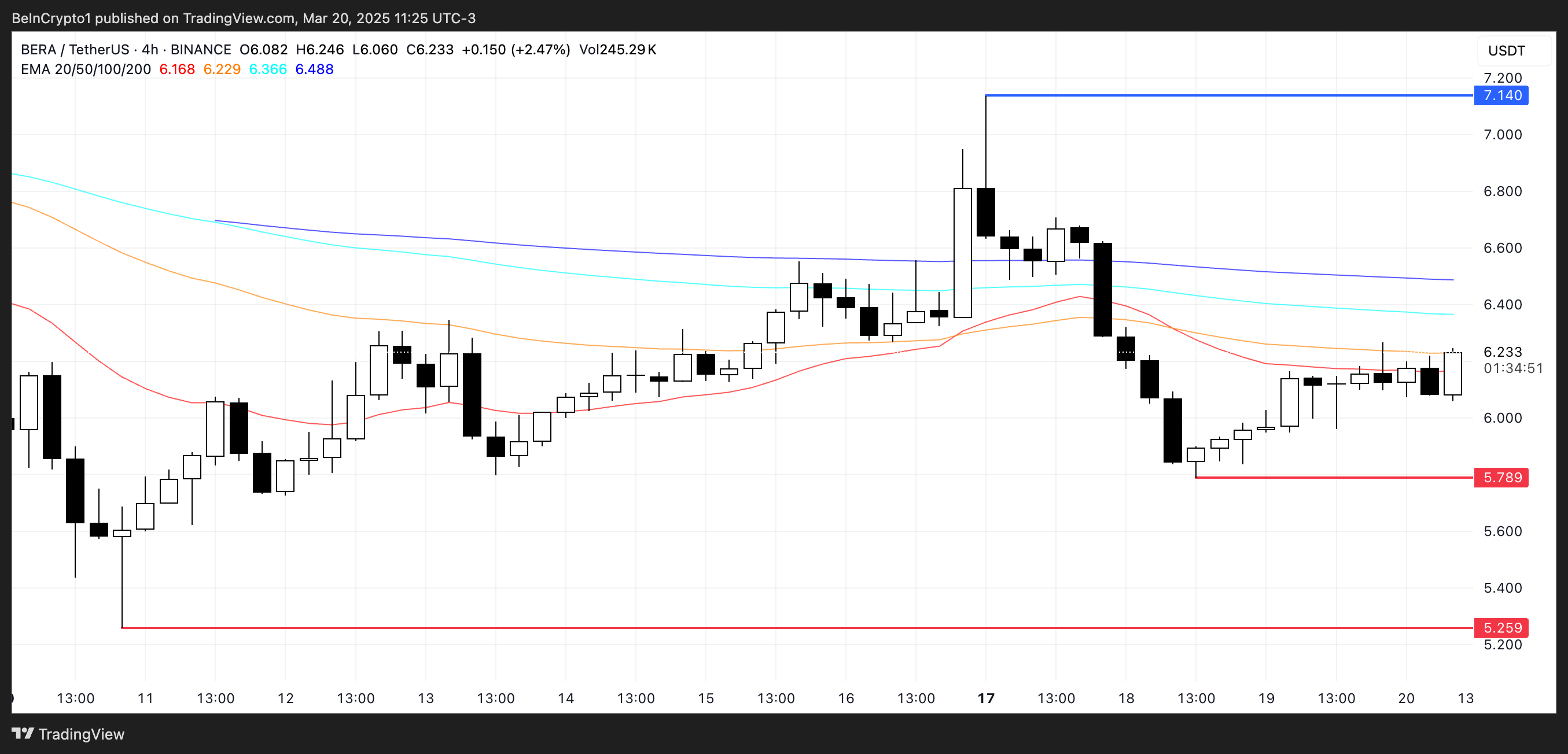

Berachain (BERA) is currently trading around $6.05, with a market cap sitting near $653 million, after pulling back from a recent high of $7.08 reached on March 17.

The asset has been consolidating after the recent price drop, as technical indicators suggest mixed signals. While bearish trends are still present, some early signs of bullish momentum are starting to emerge.

Berachain RSI Shows A Bullish Momentum Could Appear Soon

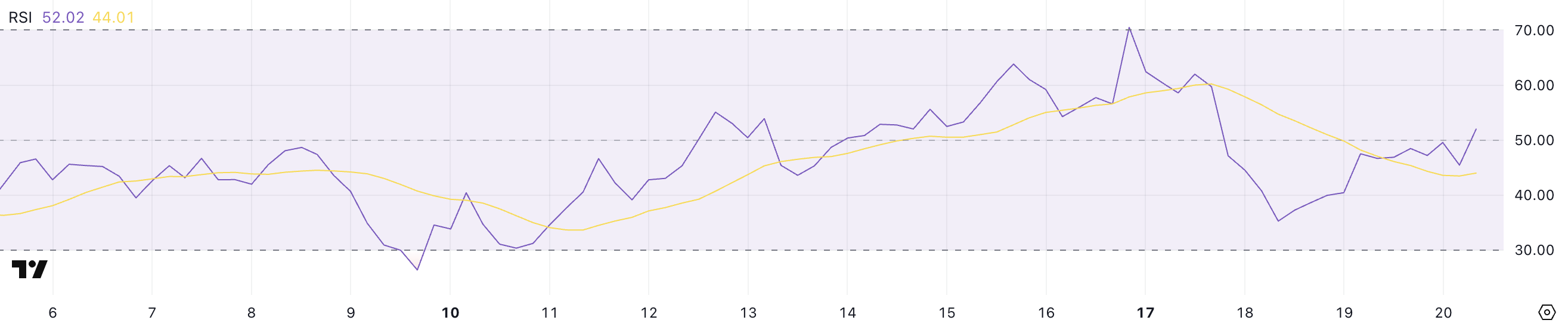

Berachain is showing signs of stabilizing after recent volatility, with its RSI currently sitting at 52, up from 35 just two days ago.

This rebound follows a sharp decline from an overbought level of 70.5, which was reached four days ago before the RSI cooled off.

The rise back above 50 suggests that bullish momentum is starting to regain some control after the recent correction, though the market remains relatively balanced between buyers and sellers for now.

The RSI (Relative Strength Index) is a momentum oscillator that measures the speed and magnitude of recent price changes, helping to identify potential overbought or oversold conditions.

Typically, an RSI above 70 signals that an asset might be overbought and due for a pullback, while an RSI below 30 points to oversold conditions, which could precede a price bounce.

With BERA’s RSI at 52, it is now in neutral territory, signaling neither an overbought nor an oversold condition. This suggests that while the selling pressure has eased, buyers still need to build more momentum to drive a sustained uptrend.

BERA CMF Is Rising, But Buying Pressure Is Still Building

Berachain CMF is currently at -0.01, an improvement from -0.23 yesterday, indicating that selling pressure has started to ease.

However, despite this slight recovery, the CMF is still hovering in negative territory, suggesting that the market is not yet seeing strong capital inflows.

What’s notable is that BERA’s CMF hasn’t climbed above 0.10 since March 14, signaling a prolonged period of weak buying volume and cautious investor sentiment.

The Chaikin Money Flow (CMF) is a volume-based indicator that measures the flow of money into and out of an asset over a given period.

Values above 0 indicate buying pressure or accumulation, while values below 0 signal selling pressure or distribution. With BERA’s CMF still near neutral but below zero, it shows that while sellers are losing momentum, buyers have yet to take control firmly.

Until the CMF pushes decisively into positive territory – particularly above 0.10 – any upward price movement may struggle to sustain itself without stronger capital inflows.

Can Berachain Surge To $7?

Berachain EMA lines continue to reflect a bearish setup, with short-term moving averages positioned below the long-term ones.

This indicates that downward momentum still dominates the market. However, if Berachain manages to reverse this trend and build bullish momentum, the price could first target the resistance around $7.14.

A breakout above this level could open the door for a move toward $7.50 or even $8, a price level not seen since March 3.

On the downside, if BERA fails to establish an uptrend and bearish momentum persists, the price could fall back to test the key support at $5.78.

Losing this level would likely deepen the bearish outlook, potentially driving Berachain price lower toward $5.25 in the near term.

For now, the EMA alignment suggests that sellers still have the upper hand, but a shift in momentum could quickly change the market structure and trigger a rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SOL Circulation at 5-Month Low As Solana Price Stalls Below $135

Solana (SOL) has struggled to maintain upward momentum in recent weeks. Although the cryptocurrency showed signs of an uptrend, it is now facing challenges due to declining demand for SOL.

The market environment is also deteriorating, which is contributing to the struggles. At $129, Solana is stalled below the key $135 barrier. There is no clear indication of a breakout in sight.

Solana Struggles To Find Demand

The Velocity of Solana has fallen to a 5-month low, signaling weakening demand. Velocity measures the rate at which an asset is circulated within the market. Solana’s current circulation levels are on par with those seen in October 2024, a clear indicator that the cryptocurrency is losing traction.

The drop in Velocity suggests that fewer investors are actively trading SOL, further adding to the bearish sentiment surrounding the token. This lack of demand makes a recovery increasingly difficult, as it implies that traders are hesitant to enter the market.

The ongoing low demand for SOL further confirms a bearish outlook. Many investors are likely waiting for a more favorable environment before committing to new positions, which could delay any potential recovery as the token struggles to attract fresh capital.

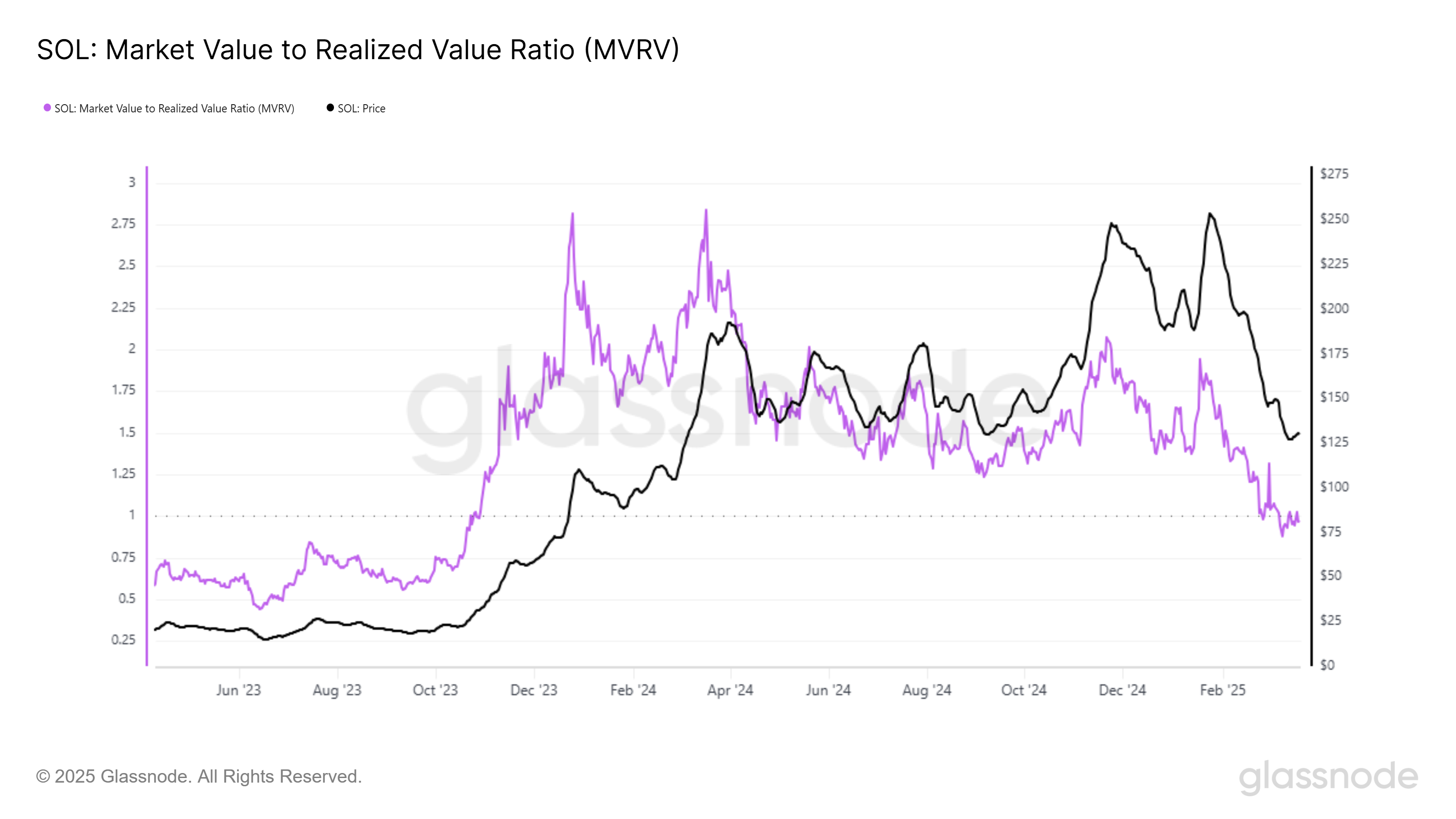

Analyzing the 2-week Market Value to Realized Value (MVRV) Ratio, a key metric that tracks the average profit or loss of recent buyers, reveals that the ratio is currently below the zero line. This suggests that investors who purchased SOL within the last two weeks are now facing losses.

This situation could lead to one of two scenarios: either investors hold their positions, hoping for a price recovery, or they sell to cut their losses.

If the latter occurs, increased selling pressure could push the price lower and potentially invalidate any attempts at recovery. In this scenario, the market would likely remain bearish until sentiment shifts.

SOL Price Is Struggling

Solana is currently trading at $130, struggling to break through the critical $135 resistance. While there has been a short-term uptrend, the likelihood of SOL breaching this level seems low. This suggests that the price could remain range-bound for the near future.

The combination of low demand and weak market sentiment points toward a potential decline. Solana may fall through its uptrend support line, with the next significant support levels lying at $125 and potentially $118.

This scenario would delay any recovery, pushing the token further into a bearish trend.

On the other hand, if Solana manages to break through the $135 resistance, the altcoin’s price push toward $148. A sustained move above this level could propel SOL to $150, invalidating the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hyperliquid (HYPE) Open Interest Surges to $44 Million

Hyperliquid’s native crypto token HYPE has recently experienced a significant 40% price decline. However, the altcoin is showing signs of recovery.

Traders have become increasingly bullish on HYPE, with many believing it can regain the losses sustained in the recent downturn. This renewed confidence, supported by positive market movements, has sparked hopes of a price rebound.

Hyperliquid Finds Strong Support

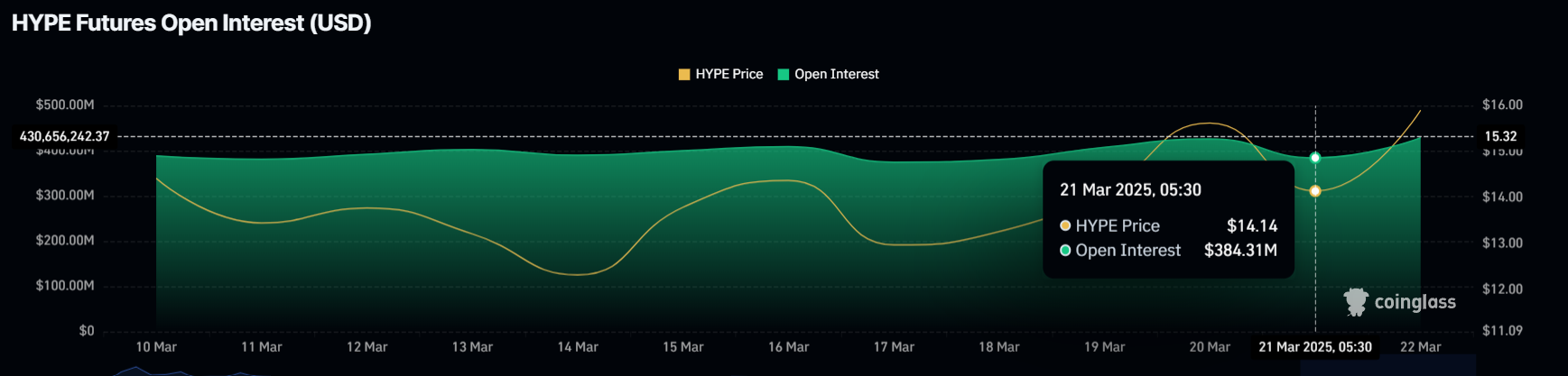

Over the past 24 hours, the Open Interest for Hyperliquid has risen by $44 million, bringing the total to $428 million. This increase follows a recent uptick in price, which added momentum to the ongoing recovery.

The growth in Open Interest suggests that traders are becoming more confident in HYPE’s potential for a price rise. This influx of interest has fueled optimism among investors and traders alike, with many viewing this as a sign of further upside.

As a result, there is a renewed sense of enthusiasm among HYPE enthusiasts, who believe the altcoin is well-positioned to reclaim lost value. This positive sentiment could contribute to continued price growth, particularly as market conditions remain favorable for a recovery.

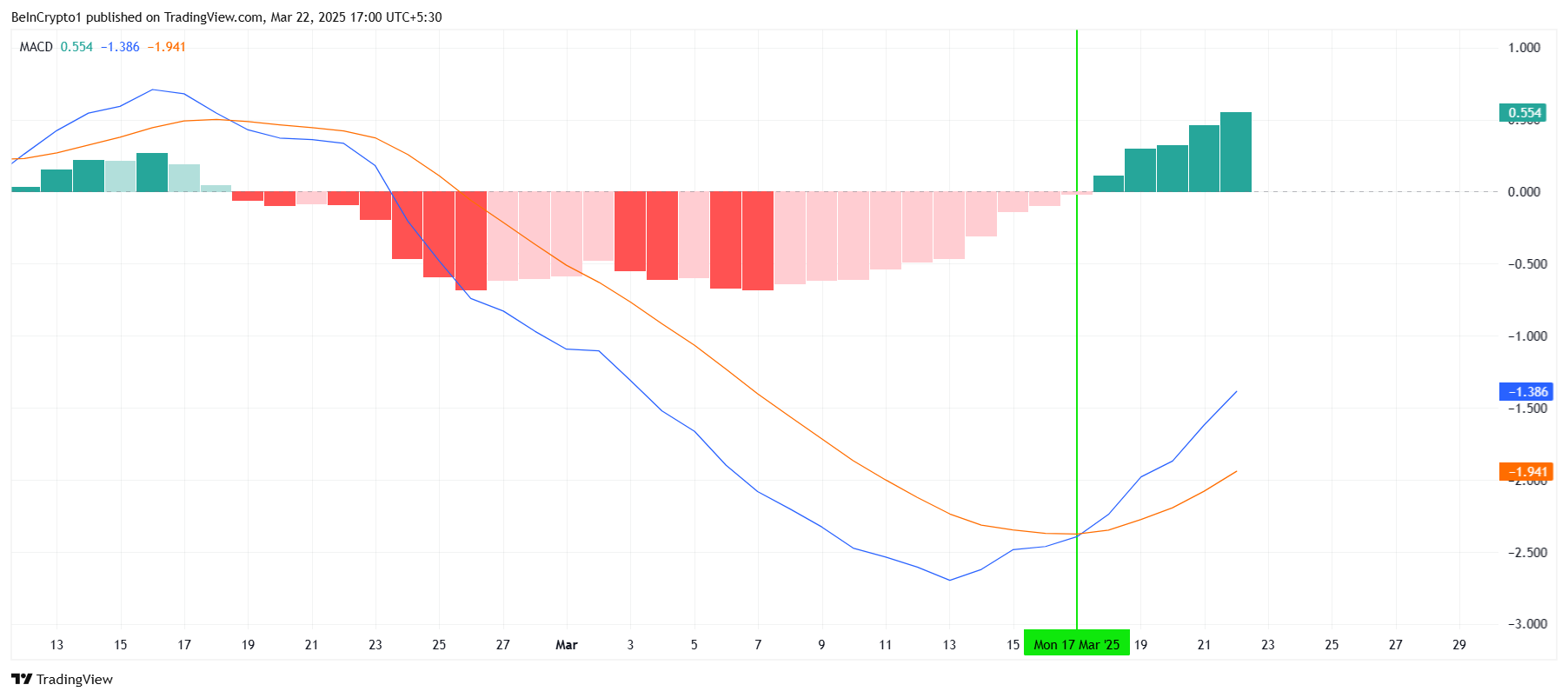

The overall macro momentum of Hyperliquid has shown significant improvement in recent days. Key technical indicators, such as the Moving Average Convergence Divergence (MACD), reflect a shift from a bearish to a bullish trend this week.

This change marks the end of a month-long bearish crossover and signals the potential for further upward momentum.

As the bullish momentum rises, it provides HYPE with the room needed to continue its recovery. The shift in the MACD reflects a positive shift in market sentiment, suggesting that the altcoin may be in a stronger position moving forward.

HYPE Price Faces Barrier

HYPE’s price is currently trading at $16.10, up by 14% over the last 24 hours. The altcoin is just under the $16.50 resistance level, having already recovered about half of its recent 40% decline. This price movement shows that Hyperliquid has significant upside potential.

Given the current momentum, there is a possibility that HYPE will breach the $16.50 barrier and continue its upward trajectory. If this occurs, the altcoin could move toward $19.16, potentially reaching $20.00 in the near future.

However, if the $16.50 resistance level proves too strong, HYPE may struggle to maintain its upward momentum. In this case, the price could fall back to $13.44, invalidating the bullish outlook and erasing recent gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network To Launch PiDaoSwap Decentralized Exchange (DEX)

The Pi Network community is taking a significant step toward financial independence, developing its decentralized exchange (DEX), PiDaoSwap.

According to social media reports, the initiative will aim to curb alleged price manipulation by external exchanges.

PiDaoSwap to Launch on the Pi Network Ecosystem

Reportedly, PiDaoSwap is in the final stages of launching a multi-functional DEX on the Pi Network mainnet. The platform will ensure that the PI coin price reflects the actual market value of the token rather than being distorted by third-party platforms.

The announcement cited price manipulation by outside entities, a malpractice that impedes Pi Network’s growth and development.

“Once completed, the Pi price will be reflected at its true value and will no longer be manipulated by current external exchanges,” Pi Network VietNames claimed.

Pi Network VietNames is a community-driven profile that shares updates, opinions, and news about Pi Network.

Although in the final stages of development, PiDaoSwap specified that it was awaiting Know Your Business (KYB) approval from the Pi core team before launching.

For now, the prospective platform has secured Twitter’s organizational verification, signaling progress in its development.

Meanwhile, Pi Network’s imminent PiDaoSwap launch comes amid escalating frustrations within the PI community. Certain platforms reportedly use bots to alter Pi’s valuation artificially, affecting community sentiment.

Similarly, there are also allegations of fake price listings by external exchanges.

A recent BeInCrypto report echoes this sentiment amid allegations of bot activity on CoinMarketCap. This fueled skepticism about centralized price tracking mechanisms on the platform.

According to Pi Network VietNames, these manipulations have severely impacted the project’s credibility and adoption.

Meanwhile, Binance remains evasive when listing Pi coins. Despite community support, Pi Coin’s Binance listing decision remains unresolved, leading to frustration among fans.

Meanwhile, other concerns emerge regarding restrictions on using “Pi-related” branding. These are related to the intellectual property (IP) and trademark policies outlined by the Pi Network.

“As a community-driven ecosystem project under PIDao, with DAO as our core focus, would this still be prohibited? Or do we need to modify our project name and domain accordingly,” PiDaoSwap wrote.

Pi Network’s official documentation prohibits using “Pi-related” branding without approval. Therefore, this suggests modifications could be necessary before the prospected PiDaoSwap debuts.

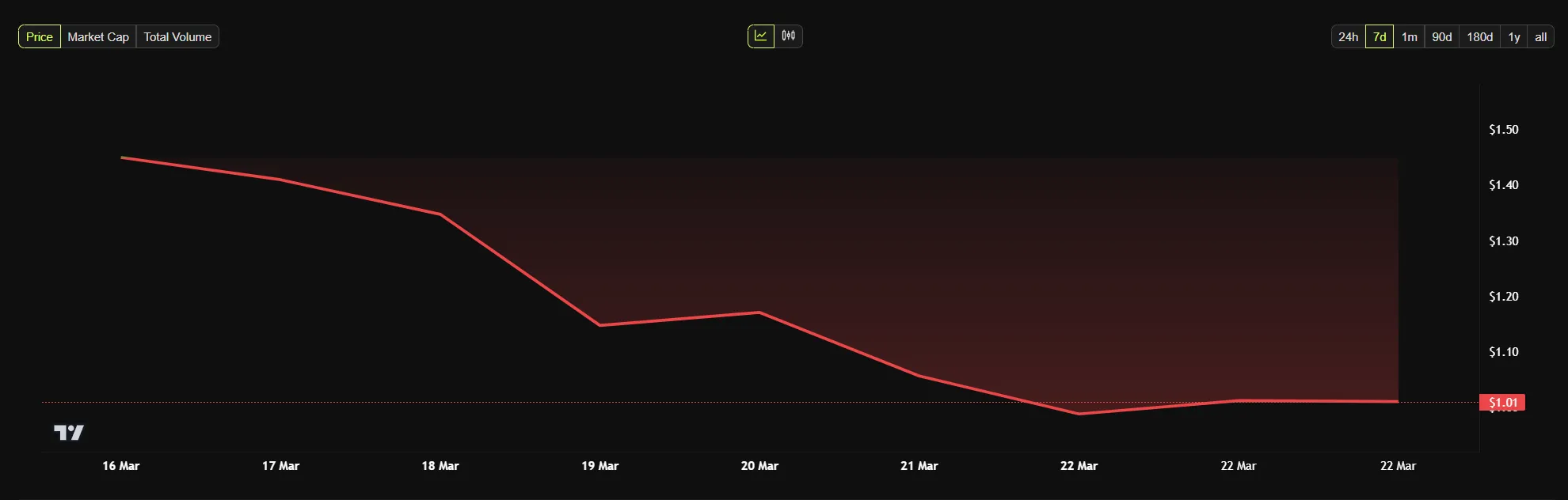

Meanwhile, PI fell below $1 on Saturday, down by over 30% in the past week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoEthereum Price Eyes Reversal as ETH/BTC Hits Key Support

-

Altcoin22 hours ago

Altcoin22 hours agoBinance Coin (BNB) Price Update: What’s Happening Today

-

Market19 hours ago

Market19 hours agoEthereum (ETH) Can’t Breach $2,000 As Sellers Take Control

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Price Forms Megaphone Bottom Not Seen Since 2020, Here’s What Happened Last Time

-

Bitcoin22 hours ago

Bitcoin22 hours agoPi Network, XRP, Trump, Binance

-

Market22 hours ago

Market22 hours agoXRP Network’s DEX Trading Volume Is Less Than $50,000

-

Market21 hours ago

Market21 hours agoBitcoin Faces Resistance at $85,000 As Whale Buying Levels Off

-

Market20 hours ago

Market20 hours agoTether Is Preparing Audits to Meet US Stablecoin Regulation