Market

SEC Likely to Approve Multiple Altcoin ETFs by Q2 2025

The SEC declared today that proof-of-work cryptoassets are not bound by securities regulations. Based on this clarity and the commissions latest actions, BeInCrypto analysts predict that the SEC will approve multiple altcoin ETFs together by the end of Q2 2025

Meanwhile, Caroline Crenshaw, an anti-crypto SEC Commissioner, made another statement of public dissent today. She claimed that this ruling is full of loopholes, but it’s doubtful that these objections can stop a dedicated pro-crypto agenda.

SEC is Laying the Groundwork to Approve more ETFs

In a press release today, the Commission decided that proof-of-work cryptoassets are not considered securities under US law. Like Bitcoin, the entire asset class should be considered commodities. The SEC’s decision here could have huge implications for altcoin ETFs.

“It is the [SEC’s] view that mining activities do not involve the offer and sale of securities [and] that participants in mining activities do not need to register transactions with the Commission under the Securities Act or fall within one of the Securities Act’s exemptions from registration,” the SEC’s statement claimed.

This regulatory clarity could change the odds of ETF approval for a few proof-of-work (PoW) cryptoassets. For example, Litecoin, which falls in this category, was already very likely to receive approval.

With this ruling, more asset managers might be inclined to offer ETFs for other PoW coins, like Monero or Kaspa.

However, this trend also goes beyond PoW cryptoassets in general. The SEC has been systematically declaring several assets to be commodities.

For example, in February, it declared that meme coins are not securities. This potentially clearly the regulatory roadblock for Dogecoin ETFs.

SEC Wants Paul Atkins to Join Under a Clean Slate

In other words, the SEC could be declaring all these assets to not be securities as a way of laying foundations for any future ETF applications. When viewed through this angle, even a few apparent setbacks could be the groundwork for future gains.

Case in point, the Comission delayed ETF applications for Solana and XRP last week. However, the CFTC has since approved futures trading on both assets, boosting their ETF odds.

Meanwhile, the Commission also dropped its landmark lawsuit against Ripple, which hinged on the supposition that XRP is a security.

So, all of these decisions are collectively removing any regulatory hurdles that can restrict altcoin funds from entering the institutional markets.

Next week, the Senate will reportedly begin confirmation hearings on Paul Atkins, Trump’s pick to be the next SEC Chair. By the time those applications meet another deadline, Atkins could be seated.

It’s likely that Atkins will have an easy decision to approve a bunch of different altcoin ETFs, as Mark Uyeda and Hester Peirce are already clarifying securities and commodities debate.

“Donald Trump’s pick for SEC chair Paul Atkins will face the Senate Banking Committie next Thursday for his nomination hearing. Trump’s pick for OCC, Jonathan Gould, will also have his hearing,” wrote Eleanor Terrett.

Crenshaw Speaks Out Once Again

Given the current regulatory trends and SEC actions, BeInCrypto projects that the Comission is preparing to approve several altcoin ETFs during Q2 2025.

However, not everyone on the Commission is prepared to go along with it. Caroline Crenshaw, a Commissioner who recently broke ranks to publicly dissent with the SEC’s pro-crypto turn, criticized today’s decision too.

“Buried in the footnotes, the statement reveals its true limitation: one actually would have to conduct a Howey analysis to know if a specific mining arrangement constitutes an investment contract. For the sake of investors, other market participants, and the markets themselves, I hope that readers do not mistake it for something more than it is,” she said.

Crenshaw asserted that the SEC’s argument is full of several other serious loopholes, and doesn’t actually guarantee that PoW tokens are free from securities laws.

She said that today’s decision is the tenth such “non-binding interpretation” in nine weeks, although she stopped short of directly accusing her colleagues of making biased rulings to favor the crypto industry.

Still, Crenshaw’s time at the SEC is running out. If nobody wishes to test these loopholes, it’s functionally the same as if they did not exist.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This is Why Coinbase is Considering Deribit Acquisition

Coinbase is reportedly in talks to acquire Deribit, but nothing is certain yet. If the deal goes through, it could turn Coinbase into a “crypto empire,” thanks to the lucrative derivatives market.

Last year, Deribit posted nearly $1.2 trillion in options, futures, and spot trading. Coinbase has comparatively little derivatives volume, and this merger could supercharge the firm.

Will Coinbase Acquire Deribit

Coinbase, one of the world’s largest crypto exchanges, has gone through a few changes recently. Since the SEC dropped its lawsuit against the company, it’s been able to expand its services. According to a new report from Bloomberg, Coinbase is currently in talks to acquire Deribit.

Deribit is the world’s largest crypto derivatives exchange, an industry sector that isn’t Coinbase’s strong suit. The firm first filed to offer these services in 2021, but Coinbase Derivatives hasn’t been a huge share of its trade volume. Granted, it sought approval for new futures contracts in January, but this is not a primary source of revenue.

However, since the crypto market has suffered from lasting doldrums, there may be an opportunity for future growth. Earlier this month, Coinbase traffic dropped 29%, and a Deribit acquisition may give it huge new revenue streams. Bloomberg claimed that Deribit’s total trade volume last year was nearly $1.2 trillion, which could be a huge asset:

“Anyone else notice how Coinbase is quietly becoming a crypto empire? They’re about to buy Deribit – one of the biggest crypto derivatives exchanges out there. They’re turning into a global powerhouse. Smart move targeting derivatives – that’s where the real volume is,” Zach Humphries claimed in a social media post.

The report had no clear stance on how likely a deal between Coinbase and Deribit might be nor how much it might cost. In January, Deribit considered an offer to get acquired by Kraken for $5 billion, but the deal fell through. If Coinbase pulled the trigger on it, it could become one of the most important business deals in crypto history.

Until we have more information, it’s difficult to make any firm statements about likely outcomes. For example, Deribit was forced out of one of its largest markets last month due to EU sanctions, but a Coinbase acquisition may not change that equation. If a deal does happen, Coinbase will have a real chance to dominate a very lucrative market.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SPX Rallies, While TOSHI, PNUT Simmer

The crypto market had a rather stable week, with the leader, Bitcoin, safe from witnessing any sharp rise or fall. This extended to the meme coins as well, with the lack of volatility resulting in altcoins taking a direction.

BeInCrypto has analyzed three meme coins that took different directions as the market conditions improved.

Toshi (TOSHI)

TOSHI saw a 22% decline this week, but it managed to hold above the critical support level of $0.000331. This resistance has helped prevent further downside, though the ongoing bearish trend has put the meme coin under pressure.

If the bearish momentum continues, TOSHI risks falling below the $0.000331 support, potentially hitting $0.000194. A drop to this level would result in significant losses for investors and may signal deeper bearish sentiment in the market.

Should TOSHI manage to bounce off the $0.000331 support, a recovery toward $0.000420 is likely. A breach above $0.000420 could propel TOSHI towards $0.000577, indicating a potential rally. This positive price action would mark a shift in sentiment.

Peanut The Squirrel (PNUT)

PNUT has experienced minimal price movement, slipping by 4% over the last seven days to trade at $0.163. Unlike many altcoins, it neither saw a significant surge nor a sharp decline. The price action has remained relatively stable, reflecting the market’s cautious sentiment toward the meme coin.

There is a chance that PNUT could face further declines, potentially testing the support level at $0.152. If the price fails to hold this level, it could fall to $0.137. This would signal increased bearish pressure, making it difficult for PNUT to recover unless market conditions improve substantially.

However, if PNUT capitalizes on a recovery and benefits from an improving market sentiment, it could rise to $0.182. A successful breach of this resistance would invalidate the current bearish outlook.

SPX6900 (SPX)

SPX has performed exceptionally well this week, registering a 26% gain. The altcoin is trading at $0.427 at the time of writing, positioning itself as one of the top-performing tokens.

SPX is currently testing the $0.406 support level. If successful in holding this support, the altcoin could see further upside, targeting $0.568. This would help recover losses sustained toward the end of February, pushing SPX toward a more stable and upward trajectory in the coming weeks.

If SPX fails to maintain $0.406 as support, it could face a sharp decline. Falling to $0.250 would mark a significant drop, reaching a five-month low. This would invalidate the bullish outlook and potentially dampen investor sentiment for the altcoin moving forward.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Here’s Why Shiba Inu Price’s 3-Month Downtrend Could Continue

Shiba Inu (SHIB), the popular meme coin, has been struggling to break out of a downtrend that has persisted for the past three months.

Despite recent efforts to regain momentum, SHIB’s price failed to sustain upward movement, indicating that the altcoin may not be able to recover just yet. As market conditions continue to fluctuate, Shiba Inu could face further challenges in its attempts at recovery.

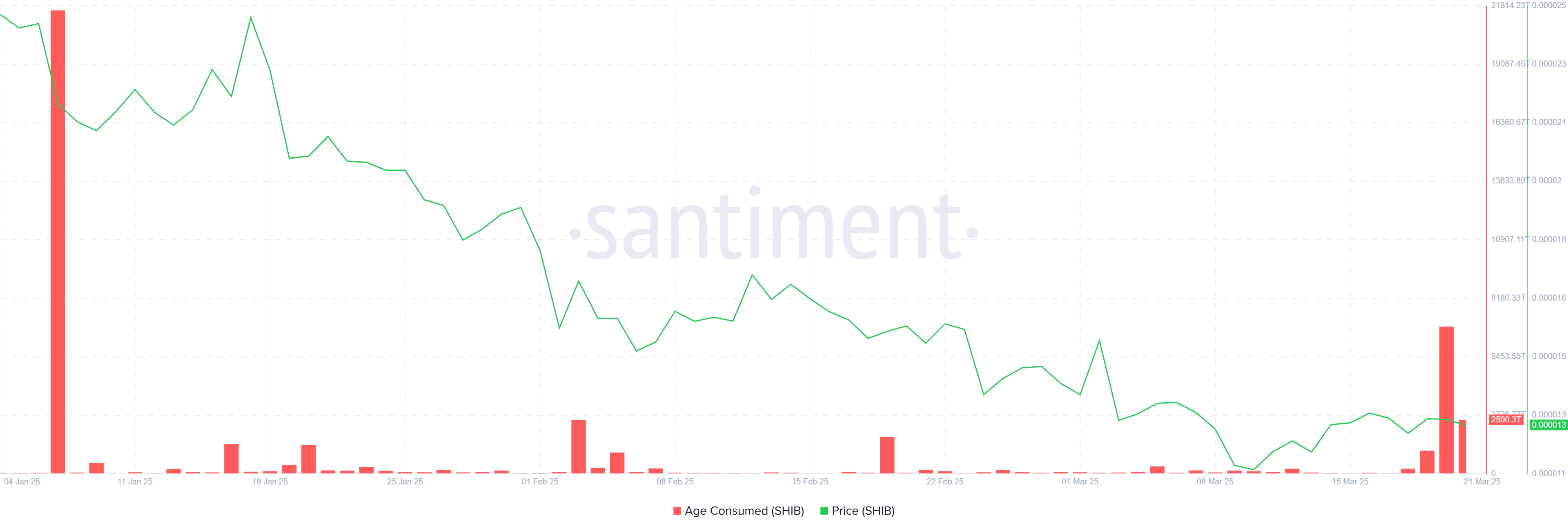

Shiba Inu Sees LTHs Panicking

Investor sentiment has taken a bearish turn, as evidenced by the rising Age Consumed metric. This metric tracks the movement of coins that have been held for an extended period of time. During a price decline, a spike in Age Consumed often indicates that long-term holders (LTHs) are selling their positions to offset losses.

In the case of Shiba Inu, the increasing movement of HODLed coins suggests that investors are not confident in the short-term price recovery. As a result, the market’s outlook remains cautious, with LTHs likely contributing to the selling pressure. Additionally, the current shift in market sentiment reflects growing uncertainty among Shiba Inu holders.

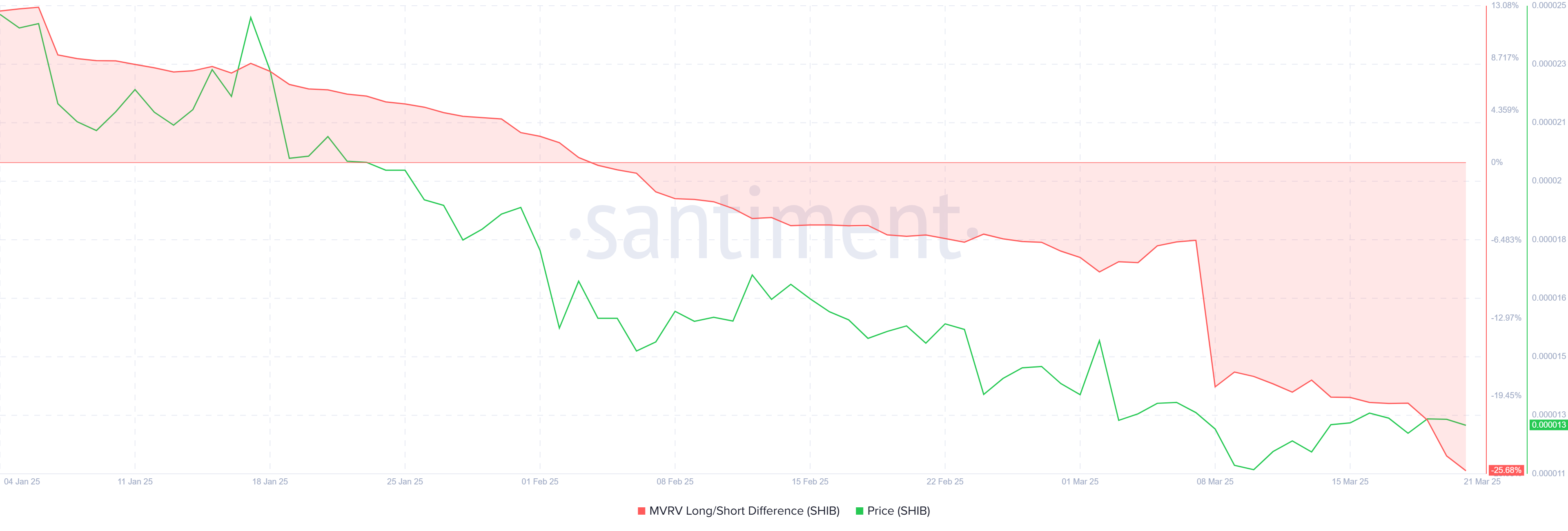

The macro momentum of Shiba Inu is also showing signs of weakness. The MVRV Long/Short Difference indicator, which measures the profit levels of short-term holders (STHs) versus long-term holders, suggests that STHs are dominating in terms of profits.

As STHs remain in control, the market could experience continued volatility, with investors hesitant to buy into the token without confirmation of sustained price growth. With short-term holders more likely to liquidate their assets quickly, Shiba Inu faces increased risks of further price declines.

SHIB Price Breakout Could Be Reversed

Shiba Inu’s price is currently hovering at $0.00001276, just above the support level of $0.00001275. After a brief breakout in the last 48 hours, SHIB failed to maintain upward momentum and is now facing resistance. The market sentiment suggests that further price drops could be on the horizon, and the coin could potentially slide back into the long-standing downtrend.

If the downtrend persists, SHIB could dip below $0.00001141, extending the current bear market. This would confirm the continuation of the negative price action and delay any potential recovery. Investors should remain cautious and prepare for more uncertainty in the short term.

However, should Shiba Inu manage to rebound from the support level of $0.00001275, it could potentially rise toward $0.00001462, clearing a significant resistance barrier. A break above this level would invalidate the bearish outlook and signal the start of a more substantial recovery for SHIB, allowing it to regain some of its lost value.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Confirms XRP Price Is Still On Path To $130

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum CLS Shows Price Will Rebound Above $2,600, Here’s Why

-

Regulation22 hours ago

Regulation22 hours agoPaul Atkins To Face Nomination Hearing for US SEC Chair Role

-

Altcoin20 hours ago

Altcoin20 hours agoWhat’s Next for Dogecoin Price As Key Support Retests, Analysts Weigh In

-

Market20 hours ago

Market20 hours agoWho Is the 50X Hyperliquid Whale? ZachXBT Reveals Details

-

Market24 hours ago

Market24 hours agoCardano (ADA) Stalls as Volume Hits $1 Billion in 24 Hours

-

Market22 hours ago

Market22 hours agoBerachain (BERA) Struggles at $6 Despite Weaker Bearish Signals

-

Ethereum15 hours ago

Ethereum15 hours agoEthereum Needs to Break This Key Level For A ‘Bullish Flip’, Analyst Predicts