Market

Onyxcoin (XCN) Drops 40% In March as Bears Take Over

Onyxcoin (XCN) has been under significant selling pressure, correcting by 9.4% over the last seven days and plunging by 43% in the past 30 days.

The downtrend has left XCN struggling to regain its footing as technical indicators continue to point toward a bearish market structure. Despite short-lived attempts at recovery, the asset has remained weighed down by persistent bearish momentum.

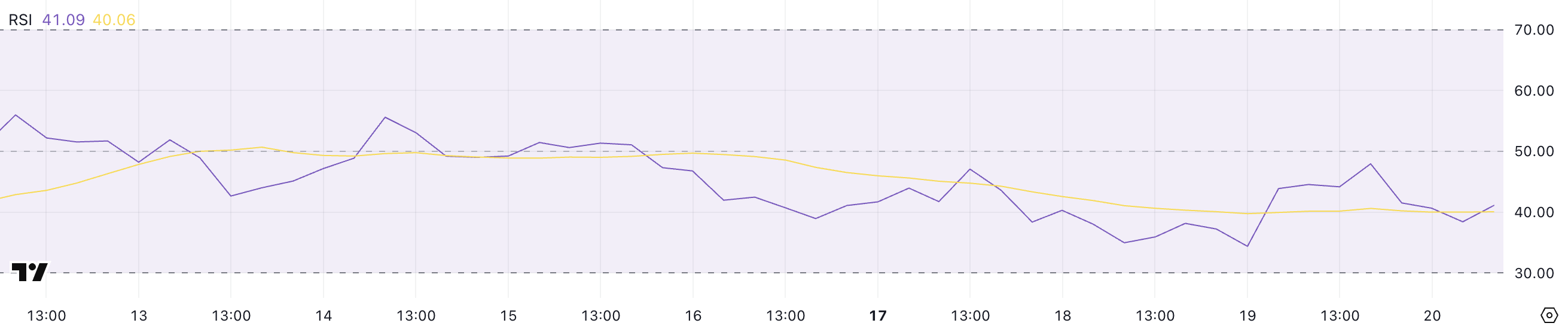

Onyxcoin RSI Has Been Below 50 For Almost 5 Days

Onyxcoin RSI is currently sitting at 41.09, marking a decline from yesterday’s level of 47.95. This drop indicates that bearish momentum has been gaining ground over the past 24 hours, pushing the RSI further away from the neutral 50 mark.

Since March 15, XCN’s RSI has remained consistently below 50, signaling that the asset has been under persistent selling pressure.

The continued weakness reflected in the RSI suggests that bulls are struggling to regain control, keeping the price in a bearish or consolidative phase.

The RSI (Relative Strength Index) is a momentum oscillator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Typically, an RSI above 70 signals that an asset might be overbought and due for a pullback, while an RSI below 30 indicates that the asset could be oversold and might see a bounce. With XCN’s RSI at 41.09 and stuck below 50 for several days, it suggests the market remains tilted toward bearish sentiment.

While it’s not yet in oversold territory, the ongoing sub-50 readings highlight the lack of bullish momentum and could imply continued sideways or downward movement unless buyers step in to reverse the trend.

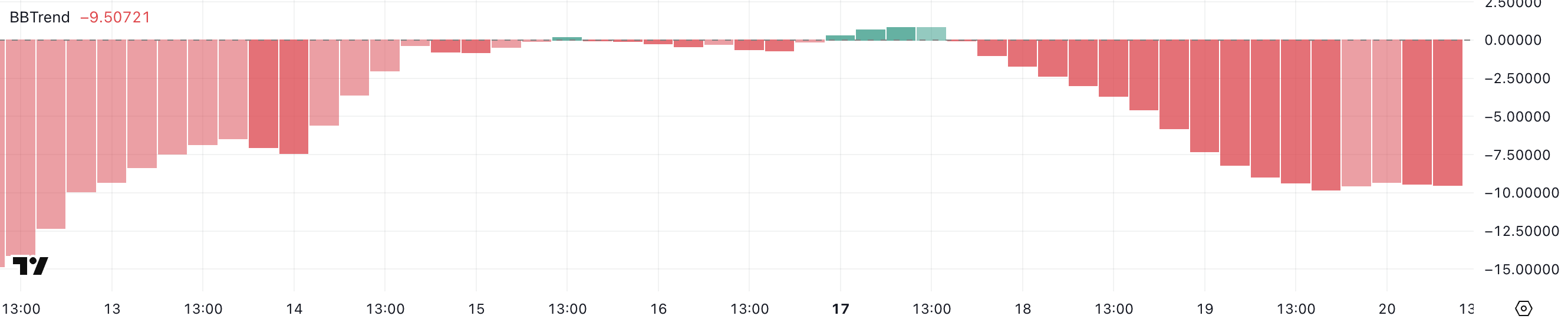

XCN BBTrend Shows Selling Pressure Is Still Here

Onyxcoin BBTrend is currently at -9.5 and has remained in negative territory for the past two days, signaling a bearish environment.

Earlier, on March 17, BBTrend briefly turned positive at 0.83 but failed to sustain upward momentum, quickly reverting back below zero. This inability to maintain positive readings suggests that bullish attempts have been weak and short-lived, reinforcing the notion that sellers continue to dominate the market.

The deepening negative value of the BBTrend reflects ongoing pressure on XCN’s price, keeping it under strain.

The BBTrend, or Bollinger Band Trend indicator, measures price trends based on the positioning of price action relative to the Bollinger Bands.

When BBTrend values are above zero, it indicates that the price is trading above the midline (typically the 20-period moving average), suggesting bullish momentum. Conversely, negative values point to prices trending below the midline, indicating bearish momentum.

With XCN’s BBTrend at -9.5 and struggling to establish positive values, it signals that the asset continues to lack strong bullish pressure, leaving the price vulnerable to further downside or prolonged consolidation.

Will Onyxcoin Fall Below $0.010 In March?

Onyxcoin EMA lines are showing a bearish configuration, with short-term moving averages positioned below the long-term ones.

This alignment suggests that downward momentum is prevailing, increasing the likelihood of further price declines. If XCN continues to trend lower, it could fall below the key support at $0.010, a level not seen since January 17.

However, if Onyxcoin manages to regain the strong bullish momentum it demonstrated at the end of January – when it became one of the best-performing altcoins in the market – it could reverse this setup.

In that case, XCN might challenge resistance levels at $0.014 and $0.020, with the potential to climb as high as $0.026 if buyers step in aggressively.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

US Officially Removes Tornado Cash Sanctions, TRON Rallies 75%

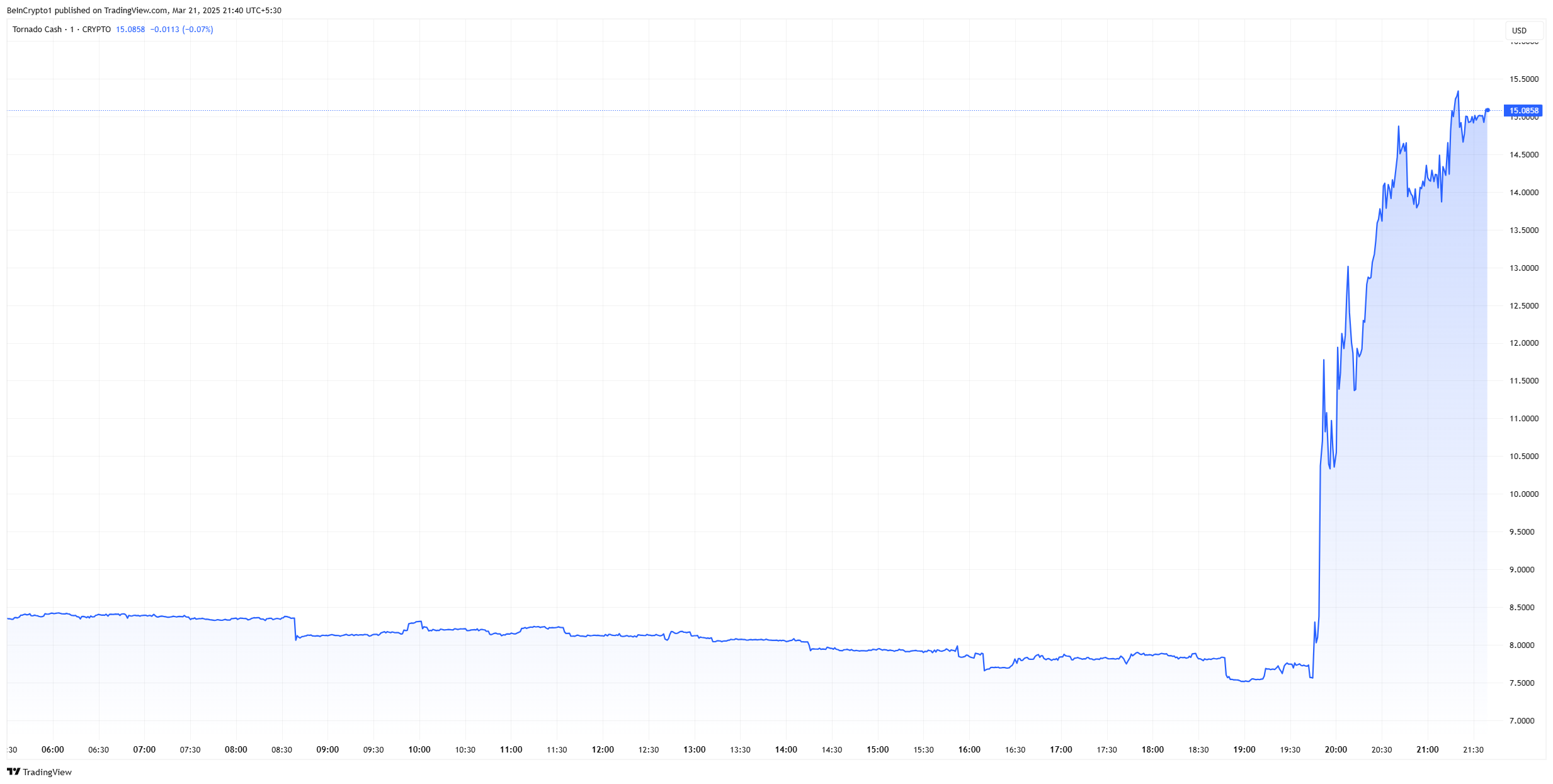

The US Treasury removed TORN, the native asset of Tornado Cash mixer, from the Office of Foreign Assets Control’s sanctions list. As a result, TRON has rallied 75% in the past hour.

The sanctions were previously caused by allegations of North Korean money laundering.

US Treasury Reverses Tornado Cash Sanctions

Tornado Cash, the decentralized privacy protocol, has been in many disputes over allegations that it enables North Korean money laundering.

In 2022, the US government sanctioned many of its wallets and brought charges against co-founder Roman Semenov the following year. Today, however, the US Treasury removed these sanctions on Tornado Cash:

“Based on the Administration’s review of the novel legal and policy issues raised by use of financial sanctions against financial and commercial activity occurring within evolving technology and legal environments, we have exercised our discretion to remove the economic sanctions against Tornado Cash,” the Treasury’s press release read.

The US Treasury’s sanctions against Tornado Cash are only one element of the continuing legal dispute. A Dutch court convicted another co-founder last year, although he was released on house arrest.

Last November, a US federal appeals court struck down the sanctions on Tornado Cash, prompting a 400% price spike. TORN jumped again when a Texas District Court concurred with this decision.

The Treasury officially removed the sanctions against Tornado Cash today, and TORN has already jumped over 75% and counting:

Despite the positive developments, there are still plenty of unaddressed concerns. As crypto sleuth ZachXBT recently noted, North Korean money laundering is an epidemic in the space right now.

The Treasury’s statement expressed its “deep concern” about continued laundering, even from Secretary Scott Bessent:

“Digital assets present enormous opportunities for innovation and value creation for the American people. Securing the digital asset industry from abuse by North Korea and other illicit actors is essential to establishing US leadership and ensuring that the American people can benefit from financial innovation and inclusion,” claimed Bessent.

Ultimately, it’s up to Tornado Cash to address the Treasury’s concerns. Even though the Trump administration is significantly backtracking on crypto enforcement, Trump allies like Bessent are clearly uneasy.

If further North Korean money laundering continues on the platform, it may damage all this recent progress.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is Trump Tanking the Market on Purpose? Experts Weigh In

Trump’s economic policies have created much uncertainty in the past few months, stunting stock markets and rocking investor confidence. However, as the United States faces a significant debt maturity of $7 trillion and high yields, theorists wonder whether Trump’s tariffs can get the Federal Reserve to bring interest rates down.

BeInCrypto spoke with Erwin Voloder, Head of Policy of the European Blockchain Association, and Vincent Liu, Chief Investment Officer at Kronos Research, to understand why Trump might be using tariff threats to boost American consumers’ purchasing power. They warn, however, that the risks far outweigh the benefits.

The US Debt Dilemma

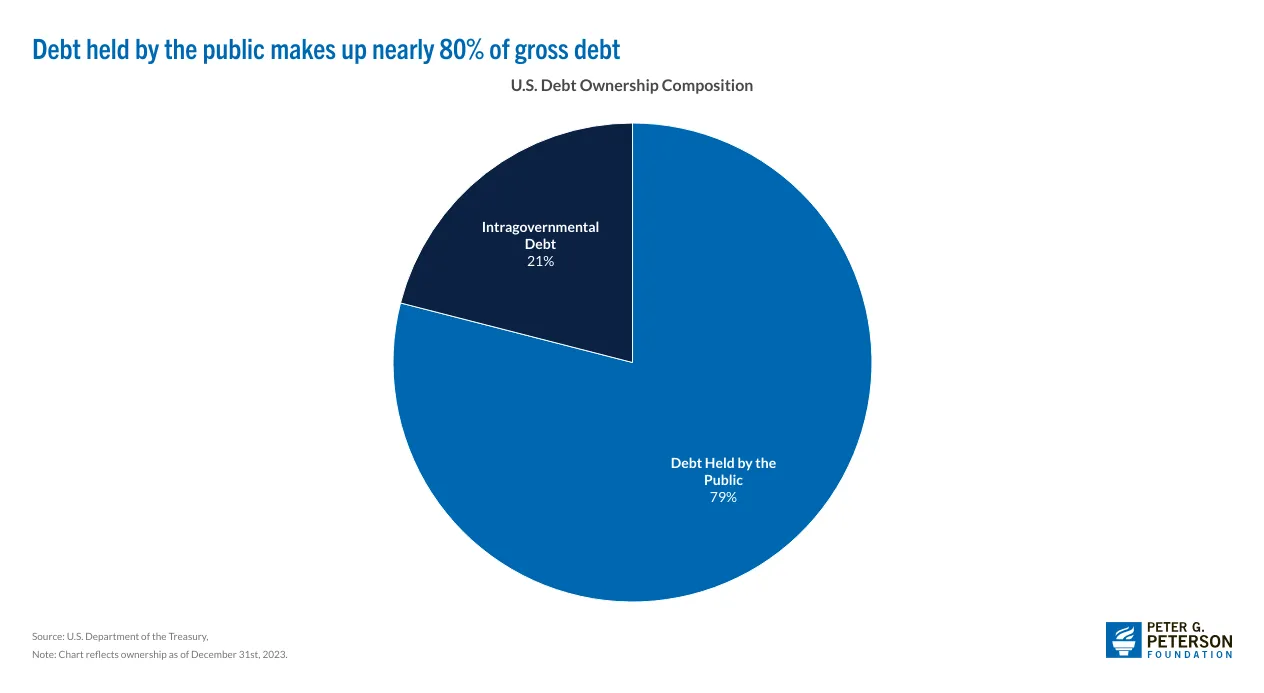

The United States currently has a national debt of $36.2 trillion, the highest of any country in the world. This figure reflects the total sum of funds the federal government has acquired through borrowing to finance past expenditures.

In other words, the US owes foreign and domestic investors a lot of money. It will also have to repay certain loans in the next few months.

When the government borrows money, it issues debt securities, like Treasury bills, notes, and bonds. These securities have a specific maturity date. Before this deadline, the government must pay back the original amount borrowed. In the next six months, the United States will have to pay back around $7 trillion in debt.

The government has two options: It can either use available funds to repay the maturity debt or refinance it. If the federal government opts for the latter, it must take out further loans to repay the current debt, increasing the already ballooning national debt.

Since the US has a history of opting for the refinancing option, direct repayment seems unlikely. However, steep interest rates currently complicate refinancing.

High Interest Rates: An Obstacle to Debt Refinancing

Refinancing allows the government to roll over the debt, meaning it doesn’t need to find the money from available funds to pay off the old debt immediately. Instead, it can issue new debt to cover the old one.

However, the Federal Reserve’s interest rate decisions significantly impact the federal government’s ability to refinance its debt.

This week, the Federal Reserve announced that it will keep interest rates between 4.25% and 4.50%. The Reserve has steadily increased percentages past the 4% benchmark since 2022 to control inflation.

While this is good news for investors who expect higher yield returns on their bonds, it’s a bad outlook for the federal government. If it issues new debt to cover the old one, it would have to pay more in interest, which will strain the federal budget.

“In practical terms, even a 1% higher interest rate on $7 trillion equates to $70 billion more in interest expense per year. A 2% difference would be $140 billion extra annually– real money that could otherwise fund programs or reduce deficits,” Voloder told BeInCrypto, adding that “the US already has a national debt exceeding $36 trillion. Higher refinancing rates compound the debt problem, as more tax revenue must go just to pay interest, creating a vicious cycle of larger deficits and debt.”

This scenario indicates that the United States needs to proceed cautiously with its monetary policies. With looming debt repayment deadlines and concerns over inflation, the government should embrace stability over uncertainty.

However, the Trump administration seems to be doing the opposite by threatening its neighbors with steep tariffs. The main question is: Why?

Trump’s Tariff Policies: A Strategy or a Gamble?

During Trump’s first and second terms in office, he has continuously toyed with a tariff policy targeting his neighbors Canada and Mexico and his longtime rival China.

In his most recent inaugural address, Trump reaffirmed his commitment to this trade policy, claiming it would bring money back into the United States.

“I will immediately begin the overhaul of our trade system to protect American workers and families. Instead of taxing our citizens to enrich other countries, we will tariff and tax foreign countries to enrich our citizens. For this purpose, we are establishing the External Revenue Service to collect all tariffs, duties, and revenues. It will be massive amounts of money pouring into our Treasury, coming from foreign sources,” Trump said.

However, the ensuing uncertainty about trade relationships and consequent retaliatory actions from affected countries have inevitably created instability, causing investors to react sharply to the news.

Earlier this month, markets experienced a widespread selloff, driven by anxieties surrounding Trump’s tariff policies. These resulted in a sharp decline in US stocks, a drop in Bitcoin’s value, and a surge in Wall Street’s fear index to its highest point of the year.

A similar scenario also played out during Trump’s first presidency.

“Intentionally rising economic uncertainty via tariffs carries steep risks: markets could overreact, plunging and increasing percentages for a possible recession, as seen in 2018’s trade war drop,” Liu said.

Whenever traditional financial markets are affected, crypto also suffers by association.

“In the immediate term, Trump’s production-first, America-First economics means digital asset markets must grapple with higher volatility and less predictable policy inputs. Crypto is not isolated from macro trends and is trading increasingly in tandem with tech stocks and risk conditions,” Voloder said.

While some view Trump’s measures as careless and erratic, others see them as calculated. Some analysts have viewed these policies as a means to get the Federal Reserve to lower interest rates.

Is Trump Using Tariffs to Influence the Federal Reserve?

In a recent video, Anthony Pompliano, CEO of Professional Capital Management, argued that Trump was trying to lower Treasury yields by intentionally creating economic uncertainty.

Tariffs can disrupt trade relationships by acting as taxes on imported goods, consequently increasing the cost of goods for consumers and businesses. Given that these policies are often a great source of economic uncertainty, they can create a sense of instability in the economy.

As evidenced by the market’s strong reaction to Trump’s tariff announcements, investors were spooked out of fear of an economic slowdown or looming recession. Consequently, businesses might reduce risky investments while consumers limit spending to prepare for price spikes.

Investor habits may also change. With less confidence in a volatile stock market, investors may shift from stocks to bonds to seek safe-haven assets. US Treasury bonds are considered one of the safest investments in the world. In turn, this flight to safety increases their demand.

When demand for bonds increases, bond prices go up. This series of events indicates that investors are bracing themselves for prolonged economic uncertainty. In response, the Federal Reserve may be more inclined to lower interest rates.

Trump achieved this during his first presidency.

“The theory that tariffs could lift bond demand hinges on fear sparking market shifts. Tariff uncertainty might trigger equity sell-offs, boosting Treasuries and lowering yields to ease $7 trillion in US debt refinancing evidenced by 2018, when trade shocks cut yields from 3.2% to 2.7%. Yet, with inflation at 3-4% and yields at 4.8%, success is not guaranteed. This will require tariffs to be credible enough to adjust markets without stoking inflation,” Liu told BeInCrypto.

If the Reserve lowers interest rates, Trump can acquire new debt at a lower price to pay off the impending debt maturity.

The plan may also benefit the average American consumer– to an extent.

Potential Benefits

Treasury yields are a benchmark for many other interest rates in the economy. Therefore, if Trump’s trade policies get Treasury yields to fall, this could have a trickle effect. The Federal Reserve could lower interest rates on other loans, such as mortgages, car loans, and student loans.

In turn, borrowing rates would drop, and disposable income would increase. Thus, the average American citizen can contribute to overall economic growth with greater purchasing power.

“For an American family, a drop in mortgage rates can mean substantial savings on monthly payments for a new home or refinance. Businesses might find it easier to finance expansions or hire new workers if they can borrow at 3% instead of 6%. In theory, greater access to low-interest loans could stimulate economic activity on Main Street, aligning with Trump’s goal of revving growth,” Voloder explained.

However, the theory relies on investors reacting very specifically, which is not guaranteed.

“It’s a high-stakes bet with a narrow margin for error for success depending on many different economic factors,” Liu said.

In the end, the risks heavily outweigh the potential benefits. In fact, consequences can be grave.

Inflation and Market Instability

The theory of deliberately causing market uncertainty hinges on the fact that the Federal Reserve would bring down interest rates. However, the Reserve is intentionally keeping interest rates high to contain inflation. A tariff war threatens to spur inflation.

“Yields could hit 5% if inflation spikes, not drop, and [Jerome] Powell’s high odds of holding rates steadily undermine the plan,” Liu said.

To that point, Voloder added:

“If the plan backfires and yields don’t fall enough, the US might end up refinancing at high rates anyway and with a weaker economy, which would be the worst outcome.”

Meanwhile, since tariffs directly increase the cost of imported goods, this cost is often passed on to consumers. This scenario creates higher prices for a wide range of products and causes inflationary pressures, eroding purchasing power and destabilizing the economy.

“Inflation stemming from tariffs means each dollar earned buys less. This stealth tax hurts lower-income families the most, as they spend a higher fraction of their income on affected essentials,” Voloder said.

In this context, the Reserve would likely hike Treasury yields. The scenario could also gravely affect the health of the United States’ job market economy.

Impact on Jobs and Consumer Confidence

The economic uncertainty of tariffs can deter businesses from continuing to invest in the United States. In this context, companies may delay or cancel expansion plans, reduce hiring, and cut back on research and development projects.

“The impact on jobs is a major concern. Intentionally cooling the economy to force rate cuts is essentially flirting with higher unemployment. If markets drop and business confidence wanes, companies often respond by cutting back on hiring or even laying off workers,” Voloder said.

Rising prices and market volatility could also damage consumer confidence. This dynamic would reduce consumer spending, which is a major driver of overall economic growth.

“Americans face higher prices and eroded purchasing power as a direct result of tariffs and uncertainty. Tariffs on everyday goods –from groceries to electronics– act like a sales tax that consumers ultimately pay. These costs hit consumers at a time when wage growth may stall if the economy slows. So, any extra cash saved from lower interest payments could be offset by rising prices for consumer goods and possibly higher taxes down the road,” Voloder told BeInCrypto.

The consequences are not just limited to the United States, however. As with any trade dispute, countries will feel inclined to respond– and recent weeks have proven that they already have.

Trade Wars and Diplomatic Tensions

Both countries responded sharply when Trump imposed 25% tariffs on products entering the US from Canada and Mexico.

Canadian Prime Minister Justin Trudeau called the trade policy a “very dumb thing to do.” He then announced retaliatory tariffs on American exports and gave notice that a trade war would have consequences for both countries. Mexico’s President Claudia Sheinbaum did the same.

In response to Trump’s 20% tariff on Chinese imports, Beijing imposed retaliatory tariffs of up to 15% on various significant US agricultural products, including beef, chicken, pork, and soybeans.

Additionally, ten American companies now face restrictions in China after being placed on the country’s ‘reliable entity list.’ This list prevents them from engaging in import/export trade with China and limits their ability to make new investments there.

The Chinese Embassy in the United States also said that it wasn’t scared by intimidation.

Tariffs will also have consequences beyond harming international relations.

Global Supply Chain Disruptions

International trade wars could disrupt global supply chains and harm export-oriented businesses.

“From a macro perspective there is also the fear of trade war escalation globally which could have the boomerang effect of denting US exports and manufacturing, meaning US farmers losing export markets or factories facing costlier inputs. This global tit-for-tat could amplify the downturn and also strain diplomatic relations. Additionally, if international investors see US policy as chaotic, they might reduce investment in the US over the longer term,” Voloder told BeinCrypto.

Inflationary pressures and economic downturns could also push individuals to embrace digital assets.

“Additionally, if the US pursues mercantilist policies that alienate foreign creditors or weaken confidence in the dollar’s stability, some investors might increase allocations to alternative stores of value like gold or Bitcoin as a hedge against currency or debt crises,” Voloder explained.

Consumers might experience shortages of essential goods, while businesses would see increased production costs. Those that rely on imported materials and components would be particularly affected.

A High-Risk Strategy: Is it Worth it?

The theory that tariffs could lower yields by creating uncertainty is a highly risky and potentially damaging strategy. The negative effects of tariffs, such as inflation, trade wars, and economic uncertainty, far outweigh potential short-term benefits.

As products become more expensive and businesses reduce their workforce to equilibrate their balance sheets, the average American consumer will experience the brunt of the consequences.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

KAVA Coin Surges to 30-Day High, Defying Market Downturn

Layer-1 (L1) coin KAVA emerged as the market’s top gainer on Friday, defying the broader downturn to post gains over the past 24 hours. While most cryptocurrencies have struggled within a narrow range in recent weeks, KAVA has surged, setting itself apart from the pack.

Now trading at a 30-day high, the altcoin shows strong bullish momentum and could be gearing up for even more upside.

KAVA Defies Market Downtrend, Surges to 30-Day High

KAVA is up 7% over the past day. It trades at a 30-day high of $0.55, bucking the general market decline to record 21% gains over the past month. With a strengthening bullish bias, the L1 coin eyes more gains.

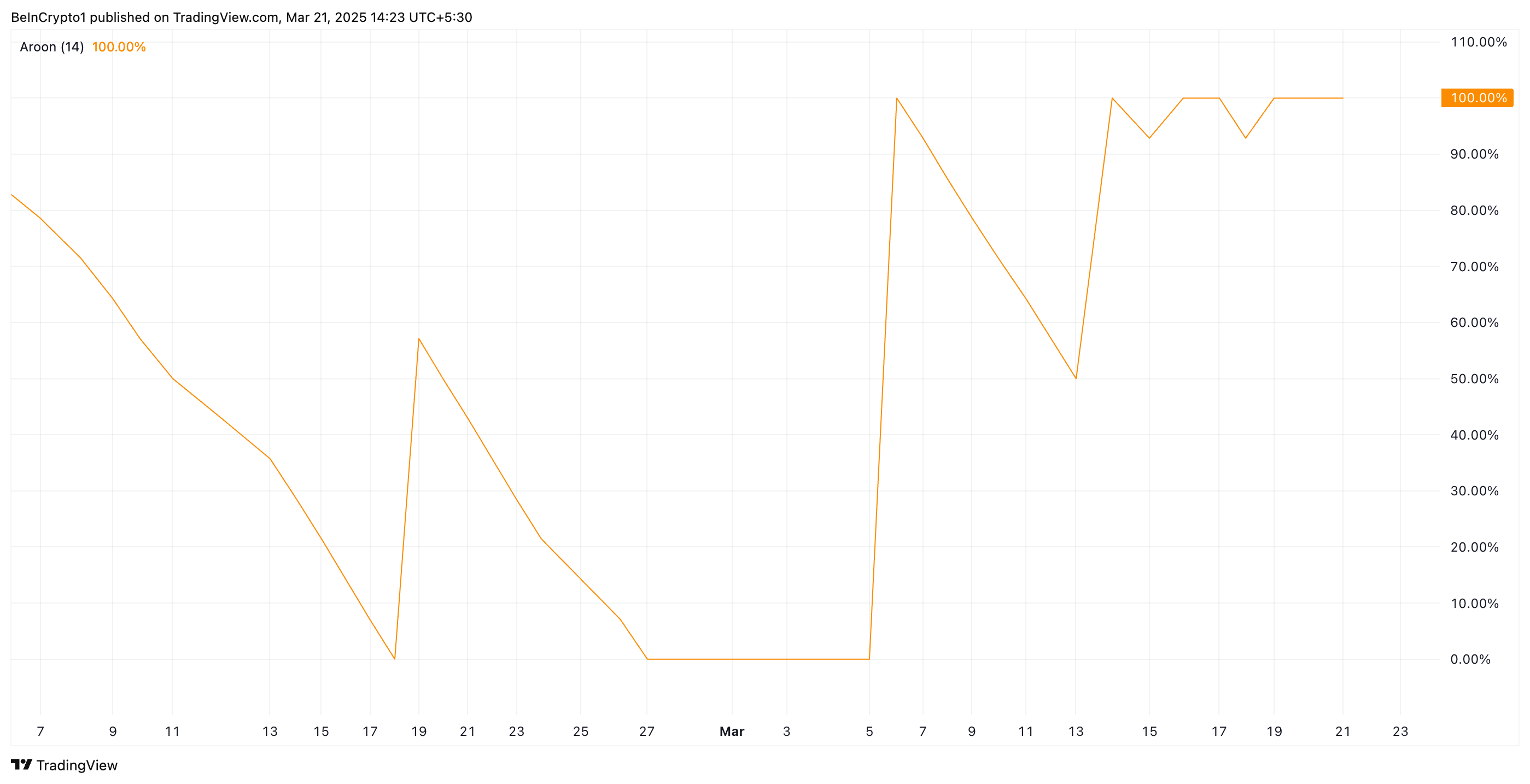

On the KAVA/USD one-day chart, the coin’s Aroon Up Line is at 100%, confirming the strength of its current uptrend.

The indicator measures the strength of an asset’s price trends. It consists of two lines: Aroon Up, which tracks the time since the highest high, and Aroon Down, which tracks the time since the lowest low.

When the Aroon Up line is at 100% or near it, the asset has recently hit a new high and is in a strong uptrend. This is true of KAVA, which trades at its highest price in 30 days. It reflects the strong bullish momentum in the coin’s spot markets, indicating that buyers are in control and its price may continue rising.

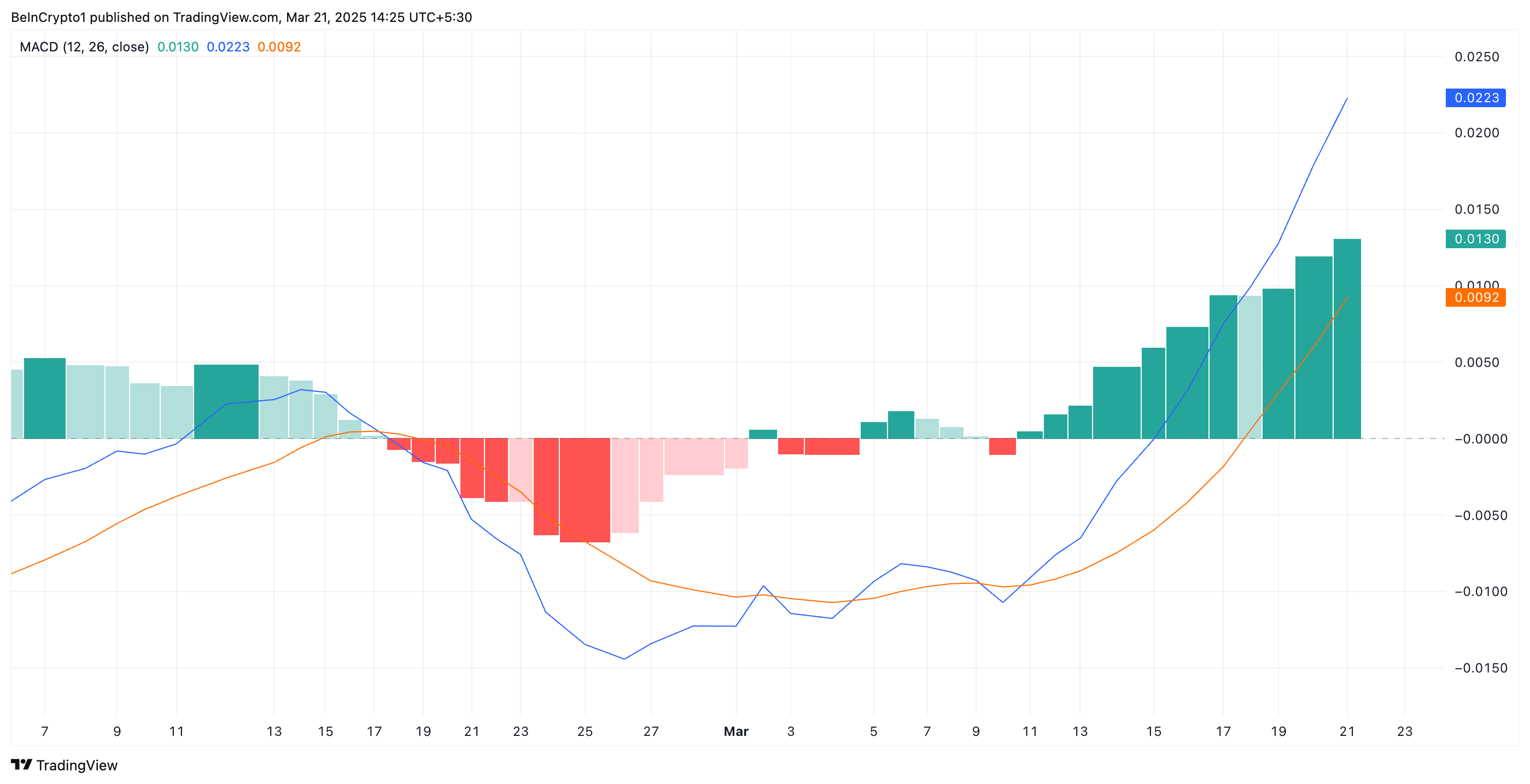

Further, the coin’s Moving Average Convergence Divergence (MACD) setup confirms this bullish outlook. At press time, KAVA’s MACD line (blue) rests above its signal line (orange).

The MACD indicator measures the strength and direction of an asset’s momentum. It helps traders identify potential trend reversals and momentum shifts.

When the MACD line is above the signal line, it is a bullish signal, often interpreted by traders as a buy signal.

KAVA’s Uptrend Remains Intact, Eyeing a Three-Month High at $0.74

KAVA has traded within an ascending parallel channel since March 10. This bullish pattern is formed when an asset’s price moves between two upward-sloping parallel trendlines, indicating a sustained uptrend.

It signals consistent higher highs and higher lows, showing strong bullish pressure as KAVA buyers dominate the market. If this continues, the coin’s price could break past resistance at $0.58 and climb toward a three-month high of $0.74.

On the other hand, if buying activity weakens, KAVA could shed its recent gains and fall to $0.48.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Confirms XRP Price Is Still On Path To $130

-

Market23 hours ago

Market23 hours agoSolana Faces Overvaluation: Price Stagnation Ahead?

-

Market22 hours ago

Market22 hours agoBNB Chain Overtakes Solana in Weekly DEX Trading Volume

-

Market21 hours ago

Market21 hours agoHere’s Why XRP Holders Will Likely Drive Price To $3.00

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Exempts Proof-Of-Work Mining From Security Obligations

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum CLS Shows Price Will Rebound Above $2,600, Here’s Why

-

Market19 hours ago

Market19 hours agoCardano (ADA) Stalls as Volume Hits $1 Billion in 24 Hours

-

Market18 hours ago

Market18 hours agoSEC Likely to Approve Multiple Altcoin ETFs by Q2 2025