Market

Here’s Why XRP Holders Will Likely Drive Price To $3.00

XRP has been attempting a recovery recently, showing positive price movement. The surge is fueled by a shift in investor sentiment, with many holders now taking a more bullish stance toward the altcoin.

This change is likely to drive the price higher, possibly targeting the $3.00 mark.

XRP Holders Seem Bullish

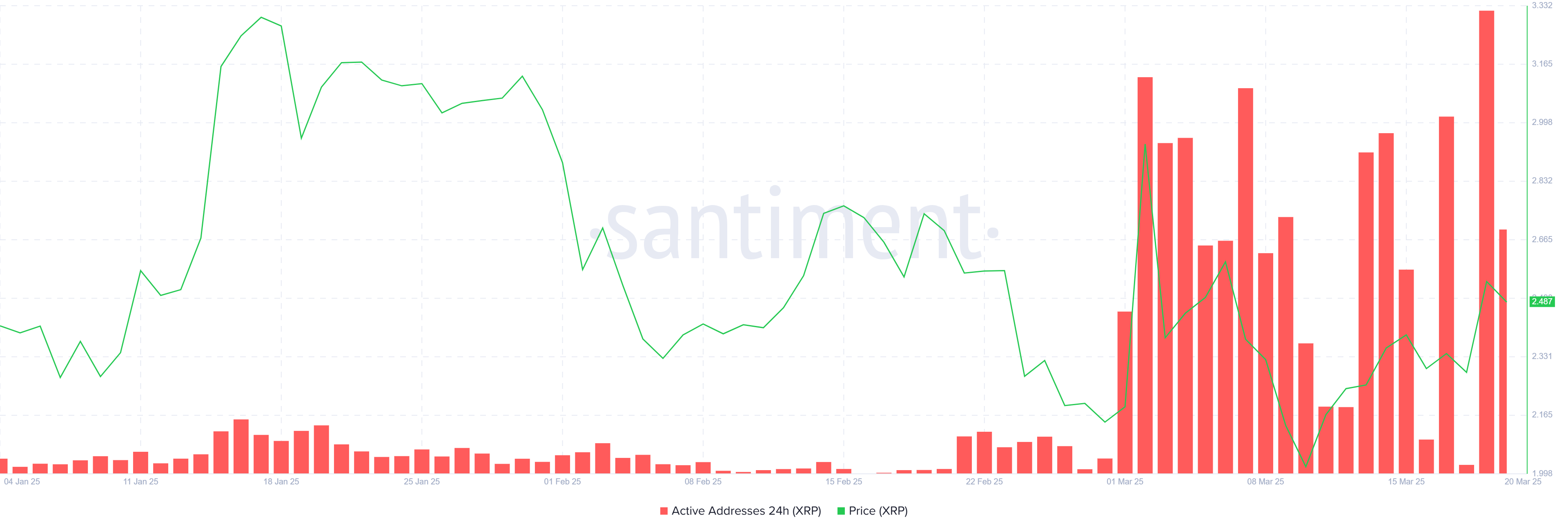

Active addresses on the XRP network have remained notably high throughout March, signaling increased investor engagement averaging at 363,000. This consistent activity is a clear indication that investor sentiment has shifted positively compared to January and February.

The growth in active addresses reflects stronger support for the altcoin as more participants continue to engage with the network. As the demand for XRP increases, this heightened engagement could push the price to higher levels.

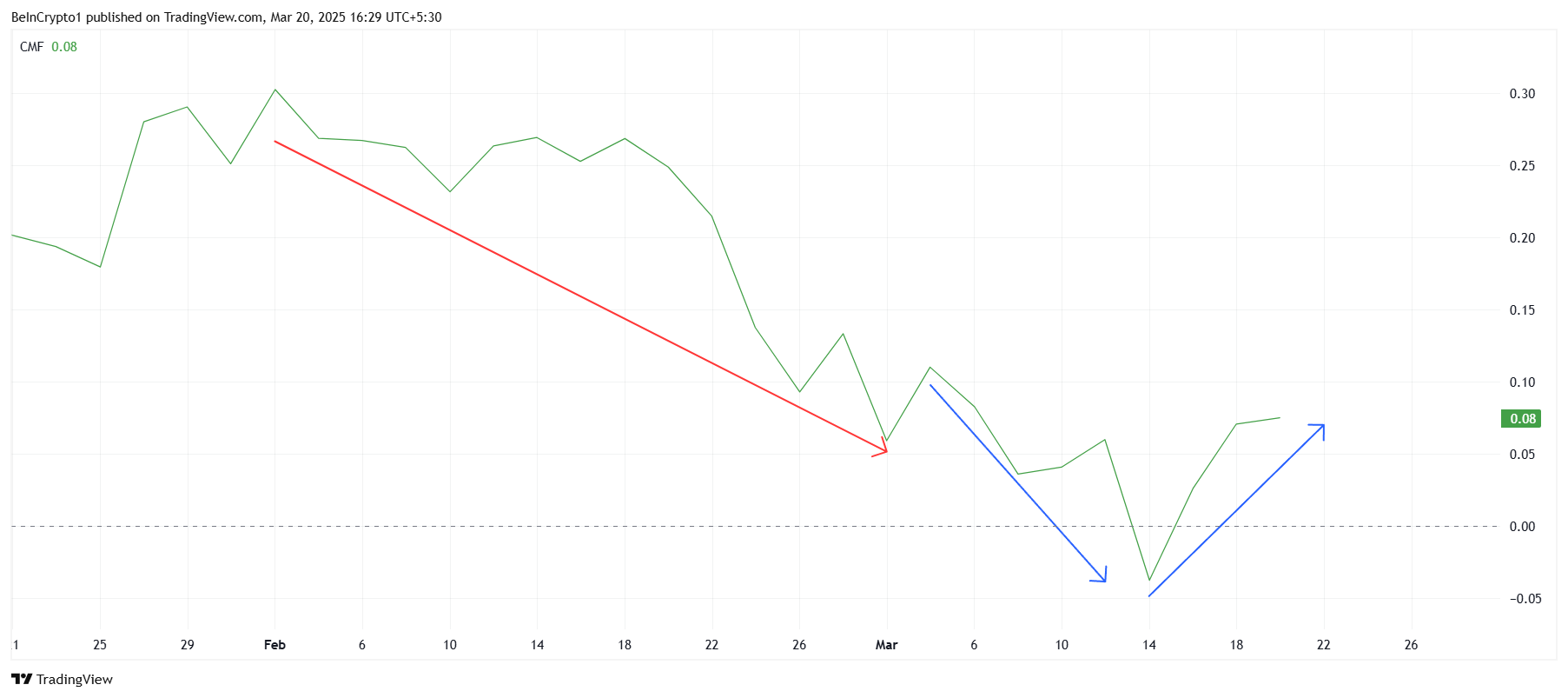

The Chaikin Money Flow (CMF) indicator shows a clear shift in investor behavior. While March began with significant outflows, the trend reversed as investors poured money back into XRP. This positive change comes after a month of outflows in February, reflecting a shift towards accumulation.

As market conditions fluctuate, XRP investors have shown resilience, continuing to buy into the asset despite external volatility. The increase in capital inflows suggests that the market is stabilizing, with XRP gaining support from those confident in its future. This shift in momentum offers XRP room to grow and continue its upward trajectory.

XRP Price Faces Resistance

XRP price is trading at $2.48 today, marking a 22% increase over the last ten days. The altcoin is now testing the resistance at $2.56, a level it has struggled to surpass in the past. Given the positive market sentiment and increased investor participation, XRP could break through this barrier.

If XRP manages to flip the $2.56 resistance into support, the next target will be $3.00. Overcoming the $2.95 resistance would pave the way for further gains, with the price potentially climbing towards the $3.00 mark. The current bullish momentum supports this outlook as investors appear ready to push the price higher.

However, if XRP fails to breach the $2.56 resistance, it could face a pullback to $2.27. Losing the support at $2.27 would invalidate the bullish outlook, sending the price down to $2.14.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why BTC Price Stayed Unchanged

GameStop’s announcement that it would invest in Bitcoin drove excitement across the crypto community. Within hours, the video game and electronics retailer experienced a significant hike in stock prices. However, Bitcoin’s price remained the same.

In a conversation with BeInCrypto, representatives from Quantum Economics and CryptoQuant explained that Bitcoin’s price was bound to be indifferent to this type of announcement. GameStop lacks the size and scale to meaningfully impact the asset’s trading value, while overall hawkish market sentiment limited significant price movements.

Understanding GameStop’s Bitcoin Move

On March 26, GameStop announced an update to its investment policy, revealing that it had added Bitcoin as a Treasury Reserve Asset. Mirroring MicroStrategy’s Bitcoin plan, GameStop gambled on crypto exposure to strengthen its financial position in 2025.

“GameStop adding Bitcoin to their balance sheet is a huge win for corporate adoption of the world’s leading cryptocurrency,” Mati Greenspan, Founder and CEO of Quantum Economics, told BeInCrypto in response.

The company’s stock prices jumped as high as 12% in a matter of hours before seeing corrections. Community members reacted favorably, including high-profile figures like Scottie Pippen, six-time NBA champion.

As Pippen’s tweet suggests, GameStop’s announcement parallels recent efforts by different institutional players to acquire Bitcoin holdings. However, unlike previous cases, the company’s initiative did not impact Bitcoin’s price performance.

Market Indifference Explained

A day before GameStop’s announcement, the price of Bitcoin peaked at $88,474. Yesterday, it fell to a high of $88,199. At the time of press, Bitcoin’s price rests at $86,691. In other words, Bitcoin’s trading value has remained unphased by GameStop’s acquisition.

On previous occasions, these announcements have pushed BTC’s price by significant percentage points, unleashing a wave of bullish sentiment in trading activity.

When Tesla, for example, announced in February 2021 that it had bought $1.5 billion worth of Bitcoin, the move briefly pushed up the cryptocurrency’s price by as much as 20%.

Other major players like Strategy (formerly MicroStrategy) and BlackRock and nation-states like El Salvador and Bhutan have also acquired massive amounts of Bitcoin. But in yesterday’s announcement, GameStop failed to mention how much BTC it was eyeing.

The firm did mention that it would be issuing $1.3 billion in 0% convertible senior notes to finance this acquisition. Yet, compared to the broader trend of publicly listed firms buying Bitcoin, this figure is rather underwhelming.

“The announcement lacked key details —most importantly, how much Bitcoin they’re actually buying. While they’re sitting on about $4.8 billion in cash, we’ve seen no indication of what portion, if any, will be allocated to BTC,” Greenspan told BeInCrypto.

As a result, the market was left guessing. Without a clear figure, investors had no reason to react strongly. Instead, the statement served as a message of intent rather than a concrete market-moving event.

But even if GameStop had clarified just how much Bitcoin it was willing to buy, it still wouldn’t have made much of a difference in Bitcoin’s price. This is because of the underlying macroeconomic factors that have kept BTC below $90,000 for nearly a month now.

Why Didn’t GameStop’s Announcement Move Bitcoin’s Price?

According to its most recent quarterly report, GameStop has a nearly $4.8 billion cash balance. Per yesterday’s announcement, the company plans to raise $1.3 billion through a private offering of convertible senior notes.

It clarified, however, that the net proceeds from this offering will be used for “general corporate purposes,” which may include the acquisition of Bitcoin.

However, this remains to be seen. This vagueness creates a situation with much speculation but no concrete information.

For Greenspan, even if GameStop used its entire cash balance to purchase Bitcoin, BTC’s overall price would remain unchanged.

“To put things in perspective, Bitcoin’s on-chain volume alone averages around $14 billion per day — and that’s not even counting exchanges or ETFs. So even if GameStop went all-in, it still wouldn’t make a dent,” he said.

Meanwhile, the announcement must also be considered in light of the larger sentiment surrounding the crypto market at the moment.

A Bearish Moment for Bitcoin

Market sentiment has been particularly cautious lately. Between Trump’s tariff announcements and rumors about a possible recession, Bitcoin’s price has remained stagnant.

“Overall market sentiment remains the least bullish since January 2023 as measured by CryptoQuant’s Bitcoin Bull Score Index. The index goes from 0 (least bullish) to 100 (most bullish), and it has been at 20 since late February,” Julio Moreno, Head of Research at CryptoQuant, told BeInCrypto.

While major event announcements have driven Bitcoin prices up in the past, the wider market has been focused on other factors affecting trading behaviors.

“Bitcoin spot demand growth remains in contraction territory, declining by 297K Bitcoin in the last 30 days, the largest contraction for such a period since December 2023. The market is more focused on the macro developments, given expectations of a slowing down economy and the uncertainty regarding Trump’s Administration tariffs and trade policy,” Moreno added.

Given the greater pessimism dampening overall market sentiment, announcements of corporate purchases are unable to garner enough force to impact Bitcoin prices positively.

Meanwhile, given how far institutional adoption of crypto has come, corporate announcements don’t have the same impact as they used to.

Has Corporate Adoption Become Old News?

There’s a case to be made that the general public has become desensitized to corporate Bitcoin treasury announcements. According to data from Bitcoin Treasuries, private companies worldwide hold 381,560 BTC worth over $33.2 billion, twice as large as public companies.

“More pertinently, institutional adoption is so last cycle,” Greenspan said.

Many more recent announcements that extend beyond the scope of BTC holdings in private companies have rocked the market, causing prices to surge.

The market went berserk when spot Bitcoin ETFs began trading in January last year. For the first time, Bitcoin became available to a much wider pool of institutional investors who were previously hesitant to invest directly in the cryptocurrency.

This event led to a significant influx of capital into the Bitcoin market, driving up demand and prices.

Almost a year later, when Trump, a presidential candidate who promised to make the United States a cryptocurrency pioneer, won the elections, Bitcoin prices reached new highs.

Other, more recent events, like Trump’s announcement of a national strategic crypto reserve, had similar impacts on the market.

According to Greenspan, events like this last one will create future spikes in BTC’s price. For him, the new adoption cycle will focus on Bitcoin acquisition by entire nations.

National BTC Reserves Set to be Newest Market Driver

While countries like the United States, China, and Ukraine currently hold stockpiles of Bitcoin mainly seized from law enforcement activities, more countries are deliberately purchasing additional Bitcoin for strategic purposes.

El Salvador, for example, has gradually increased purchases of Bitcoin. Today, it holds a little over 6,000 in holdings. Meanwhile, Bhutan’s Bitcoin stockpile has already surpassed the $1 billion mark.

Other jurisdictions, such as Brazil, Poland, Hong Kong, and Japan, have also had lawmakers consider adding Bitcoin to their fiscal reserves.

For Greenspan, these announcements will generate real change in BTC’s future trading activity.

“This bull run is mainly about nation-state adoption. Let’s face it: as fun and nostalgic as GameStop is, it simply can’t compete with the scale and significance of entire countries stepping into the Bitcoin arena,” he said.

In the grand scheme of Bitcoin’s market, GameStop’s announcement, though notable, pales in comparison to the potential impact of large-scale events such as national policy changes or major economic shifts.

Disclaimer

Following the Trust Project guidelines, this feature article presents opinions and perspectives from industry experts or individuals. BeInCrypto is dedicated to transparent reporting, but the views expressed in this article do not necessarily reflect those of BeInCrypto or its staff. Readers should verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Alpha Lists Ghibli Meme Coins Amid ChatGPT Hype

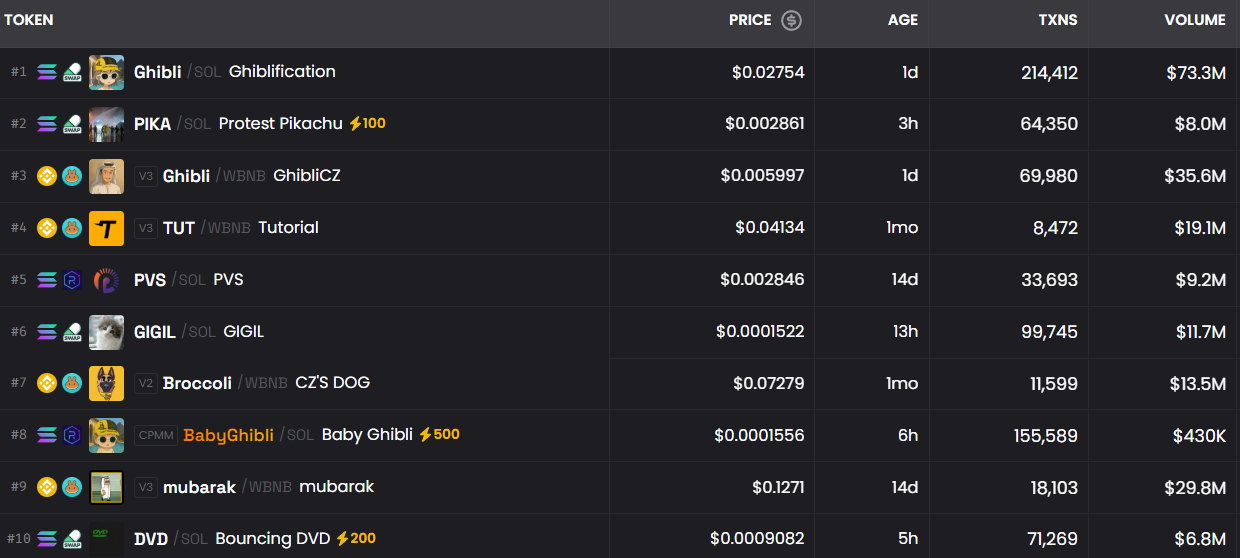

After today’s viral trend of Studio Ghibli-themed images, Binance Alpha has listed two similar-themed meme coins – Ghiblification (Ghibli) and GhibliCZ (Ghibli).

Ghiblification reached over $35 million in the market today, earlier today, while GhibliCZ hit $14 million. This massive hype has influenced Binance to add the tokens to its pre-listing Alpha platform.

Why are Ghibli Meme Coins Taking Over the Crypto Market?

Studio Ghibli is trending in the crypto space after OpenAI’s release of its latest image generation feature. Social media users, including celebrities, have been using this feature today to create images in the distinctive style of Studio Ghibli.

This style is renowned for films like Spirited Away and My Neighbor Totoro. The internet quickly became flooded with AI-generated Ghibli-style images, sparking the creation and rapid appreciation of related meme coins.

Several Ghibli-themed meme coins flooded decentralized exchanges. Ghiblification (GHIBLI) was the first token to take off. The Solana meme coin soared over 50,000% to hit $36 million in market cap.

GhibliCZ also hit a $14 million cap in hours. However, it was launched on the BNB chain. Ghiblification rallied another 30% following the Binance Alpha listing. According to Dexscreener, the token has more buy orders than sell.

How is Binance Alpha Listing Different?

Binance Alpha is a platform within Binance Wallet that spotlights early-stage crypto projects. It generally lists tokens with strong community interest and growth potential.

While some of these tokens may be considered for future listings on the main Binance Exchange, such inclusion is not guaranteed.

The primary distinction between a Binance Alpha listing and a regular Binance Exchange listing lies in the level of vetting and the intended purpose.

“I am probably the last guy to try this. Not going to change my profile pic, as it will put the bluetick into review mode again. And I quite like my current non-ghibli profile pic,” Binance founder CZ wrote after uploading his Ghibli image on X.

Binance Alpha serves as a pre-listing platform. It provides users with access to emerging projects that have not yet undergone the comprehensive due diligence required for a full exchange listing.

In contrast, tokens listed on the Binance Exchange have completed rigorous evaluations.

It’s important to note that tokens featured on Binance Alpha may pose higher risks and be subject to significant price volatility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HyperLiquid Responds to JELLY Crisis Amid Community Backlash

HyperLiquid provided some key updates following yesterday’s JELLY incident, detailing its main takeaways and security upgrades. Although HYPE’s price crashed yesterday, it has been slowly stabilizing today.

However, lingering criticisms remain about HyperLiquid’s actions during the crisis. It responded quickly to non-illegal activities that threatened itself but remained comparatively passive in the face of February’s Bybit hack.

HyperLiquid Responds to JELLY Crisis

HyperLiquid, a popular DEX, is recovering from the aftermath of a major scandal. Yesterday, HyperLiquid delisted JELLY after a short squeeze nearly caused the firm to take $230 million in losses.

This attracted a wave of condemnation from the community, which feared another FTX-style collapse. Today, HyperLiquid posted a response to the situation:

“Yesterday is a good reminder to stay humble, hungry, and focused on what matters: building a better financial system owned by the people. Users with JELLY long positions at the time of settlement will be refunded by the Foundation. This results in all JELLY traders being settled at a price advantageous to them, except flagged addresses,” it claimed.

HyperLiquid also detailed a few security measures that it will take to avoid another incident similar to the JELLY squeeze. For one thing, it implemented more stringent token delistings and open interest caps.

Most importantly, the platform made significant tweaks to its liquidation protocols, putting several guard rails on the main cause of the turmoil.

So far, it’s unclear whether HyperLiquid’s measures will be able to stave off another JELLY incident. If nothing else, HYPE’s rebound today reflects restored community sentiment.

Less than a week ago, HYPE was seeing strong bullish momentum, but yesterday’s events caused a notable crash. However, the altcoin managed to tick back up today, avoiding further losses.

The crypto community has been strongly criticizing how the exchange handles the situation. The concern centers around a simple question: Is Hyperliquid truly a decentralized exchange? Delisting a token and seizing investor funds goes against the central ethos of DeFi.

ZachXBT, the renowned crypto sleuth, was particularly frustrated by the company’s actions. Months ago, he identified a potential North Korean security breach, which the firm denied.

However, HyperLiquid acted quickly to neutralize the JELLY trades, proving that it has the capacity for that sort of rapid response.

“HyperLiquid has recently seen illicit flows [and] said it’s decentralized, so it cannot do anything. Now, HyperLiquid made a centralized decision to quickly close the position at an arbitrary price for an entity using the protocol as intended. If something like that could be done for JELLY, it likely should have been done for both,” ZachXBT stated.

Ultimately, HyperLiquid has time to reflect and update its strategies from the JELLY incident. Yesterday’s events rattled the whole crypto community, but catastrophe was avoided.

Hopefully, the platform can act in good faith to protect user funds and its decentralized ethos.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Finds Support—But Can It Power Through $90K?

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Eyes 10x Breakout After Elon Musk Ghibli Anime

-

Market20 hours ago

Market20 hours agoTrump’s Expected Signature Could End IRS Regulation on DeFi

-

Altcoin20 hours ago

Altcoin20 hours agoShiba Inu Price Eyes 2x Gains As SHIB Burn Rate Shoots 60,000%

-

Market19 hours ago

Market19 hours agoBNB Price Eyes Upside—Key Levels to Watch for a Breakout

-

Market18 hours ago

Market18 hours agoSend Direct Message to Crypto Leaders

-

Altcoin18 hours ago

Altcoin18 hours agoPepe Coin Whale Bags 500M Tokens; PEPE Price Breakout Ahead?

-

Market22 hours ago

Market22 hours agoPi Network Price Falls Further Below $1 Amid High Sell-Off