Market

Trump’s Digital Asset Summit Speech Talks Stablecoins

President Trump just gave a brief pre-recorded speech at the Digital Asset Summit, his first such address as a sitting head of state. He focused on past accomplishments and alluded to new stablecoin developments.

Trump implied that he may be helping create more dollar-backed stablecoins in the near future, but he didn’t make a firm commitment. Still, the federal government could use such an asset to provide huge amounts of liquidity to the whole crypto ecosystem.

Trump’s Summit Speech

Since taking office, President Trump has had a huge impact on US crypto policy. Yesterday, it was announced that Trump would speak at the Digital Asset Summit in New York City this morning. Via pre-recorded broadcast, he talked about his existing accomplishments and emphasized his hope for stablecoin regulation:

“I’ve called on Congress to create simple, common-sense rules for stablecoins and market structure. With the right legal framework, institutions large and small will be enabled to invest, innovate, and take part in one of the most exciting technological revolutions in modern history,” he said.

This isn’t Trump’s first experience speaking at a Summit like this; two weeks ago, he hosted a Crypto Summit at the White House. However, this didn’t have a huge impact on markets. Comparatively, he made a huge splash when he spoke before a crowd at the Bitcoin Conference in Nashville. The community hoped that his speech today would build bullish sentiment.

Lately, the crypto community has been desperate for a bullish narrative. Credible fears of a US recession are discouraging investment, and the “Made in USA” assets have suffered from previous disappointments. However, stablecoin regulations may be able to more fully integrate crypto with the US economy and the global economy in general.

“With the dollar-backed stablecoins, you [the community] will help expand the dominance of the US dollar for many, many years to come. It’ll be at the top, and that’s where we want to keep it,” he added.

This clear signal that Trump wants to aid dollar-backed stablecoins, possibly even creating new ones, could be huge. Recently, members of his greater orbit were allegedly in talks with Binance about creating such an asset. By fusing the US economy with these tokens, Trump could provide a huge amount of liquidity for the entire space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

SatLayer CEO Luke Xie Talks Bitcoin Restaking and DeFi’s Future

Bitcoin has long been regarded as a store of value, often compared to digital gold. However, with the rapid advancements in decentralized finance (DeFi) and blockchain infrastructure, the demand for new ways to utilize Bitcoin beyond passive holding has surged.

SatLayer, a pioneering Bitcoin-based infrastructure provider, is at the forefront of this transformation. Through restaking and Bitcoin Validated Services (BVS), SatLayer aims to unlock new use cases for Bitcoin (BTC), ensuring its integration into the changing financial ecosystem. BeInCrypto spoke exclusively with SatLayer’s Co-Founder and CEO, Luke Xie, to explore how Bitcoin’s role expands and what the future holds for Bitcoin-based infrastructure.

Beyond a Store of Value: Bitcoin’s Next Evolution

According to Xie, Bitcoin has transitioned through multiple phases—from an experimental digital currency to a widely recognized store of value. Now, as the broader crypto ecosystem has evolved with smart contract capabilities, Bitcoin holders have sought new opportunities beyond simply holding their assets.

Xie highlights that Bitcoiners have observed Ethereum (ETH) and other chains, including Solana (SOL), offering staking and yield-generating opportunities. Meanwhile, Bitcoin itself has remained largely passive.

According to Xie, SatLayer’s mission is to change that by introducing restaking. In doing so, it enables Bitcoin holders to generate yield while securing decentralized applications (dApps).

“Naturally Bitcoiners, who’ve watched this innovation occur while they’ve been hodling hard, want a piece of that action: the yield, the use cases, the onchain opportunities. As we all know, the Bitcoin network was not built for that sort of stuff, but developers have painstakingly assembled the infrastructure for Bitcoin DeFi on Layer 2. The fees are low, the throughput is high, and the sort of primitives you’d hope to find – for trading, borrowing, and much more – are all in place,” Xie told BeInCrypto.

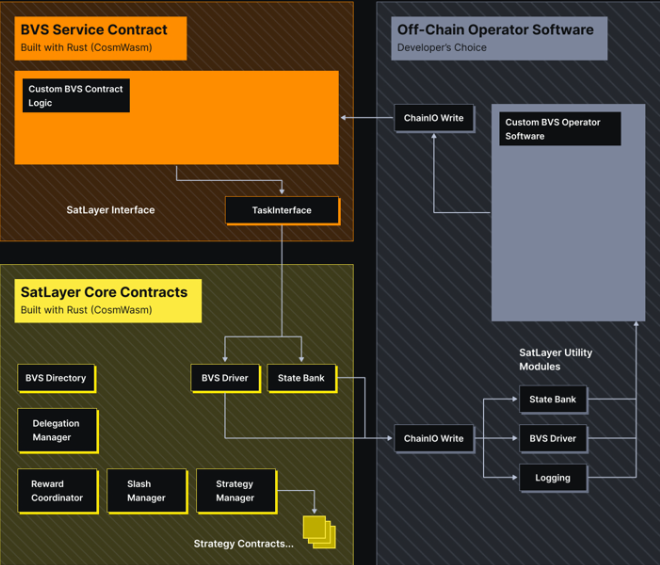

Bitcoin Validated Services (BVS): Enhancing Security and Utility

At the core of SatLayer’s vision is Bitcoin Validated Services (BVS). This concept allows dApps to be secured by restaked BTC. Unlike native tokens, which may lack liquidity and stability, Bitcoin’s unmatched value and liquidity make it the ideal asset for securing DeFi protocols.

BVS enables Bitcoin holders to collateralize their assets while simultaneously earning staking rewards. Xie explained how BVS enhances the security and utility of dApps.

“BVS describes any decentralized application or protocol that uses restaked BTC to secure its network. In real terms, this means that participants will use restaked BTC as collateral in return for having the right to validate network transactions. Because Bitcoin is valuable, this effectively eliminates the incentive for validators to act dishonestly,” Xie noted.

Any crypto asset, such as a native token, could serve as collateral for this purpose. However, it will be less liquid, valuable, and stable than BTC.

Restaking on Bitcoin: Unlocking Yield and Security

Further, Xie shared that SatLayer’s restaking mechanism is designed to be user-friendly and secure. By leveraging Wrapped Bitcoin (WBTC) or BTC Liquid Staking Tokens (LSTs), users can participate in restaking through the SatLayer platform, selecting protocols like Lombard, Lorenzo, or SolvBTC to restake with.

This process allows BTC holders to earn rewards while actively participating in securing emerging Bitcoin-based applications. The system mirrors the success of Ethereum-based restaking protocols like EigenLayer (EIGEN). It allows Bitcoin holders to contribute to network security without custodial risk.

Binance’s recent integration with Babylon, a major staking infrastructure provider, is a significant boost to this ecosystem. BeInCrypto reported that Binance has incorporated Babylon’s BTC staking solutions into its offerings. This marks a major step in legitimizing Bitcoin staking at scale.

This integration provides Bitcoin holders on Binance seamless access to staking and restaking services, further driving institutional and retail adoption. Likewise, with partnerships like Babylon, SatLayer enhances Bitcoin’s staking ecosystem.

“It’s a symbiotic relationship in which everyone benefits – Babylon, SatLayer, and most importantly Bitcoin holders,” he added.

By collaborating with Babylon, SatLayer strengthens Bitcoin’s DeFi presence. It creates a strong framework where BTC can be staked and restaked without compromising security. The synergy between these platforms accelerates Bitcoin’s growth from a passive store of value into an active financial instrument within the broader crypto economy.

Security and Future Innovations

Security remains a top priority for SatLayer. Xie emphasizes that rigorous audits and careful protocol design ensure that Bitcoin restaking maintains the security and decentralization that Bitcoin is known for.

Looking ahead, SatLayer plans to introduce AI-powered yield optimization. The firm also anticipates on-chain insurance backed by Bitcoin collateral and streamlined restaking services. Xie also sees Bitcoin infrastructure growing rapidly over the next five years.

“It’s still very early for restaking, so the obvious answer is a massive increase in TVL and the number of active users. It’s a self-fulfilling Simpsons nuclear power plant ‘days without incident’ narrative: the longer that Bitcoin restaking operates successfully, the greater the trust it will gain,” Xie concluded.

As Bitcoin grows, SatLayer’s innovations could be crucial in transforming the world’s most valuable cryptocurrency into a yield-generating asset. With Bitcoin’s infrastructure expanding, coupled with these developments, the pioneer crypto could go beyond its role as digital gold and transition into a fully integrated, yield-generating asset within the broader crypto economy.

Its dominance in the digital economy is poised to grow beyond being just a store of value.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase to Rival Binance With BNB Perpetual Futures

Coinbase International Exchange and Coinbase Advanced will introduce support for BNB perpetual futures starting next week.

This development marks a significant expansion of Coinbase’s derivatives offerings. The BNB-PERP market will launch on or after 9:30 AM UTC on April 3, 2025.

Coinbase Will Support BNB Perpetual Contracts

In an official statement, Coinbase International Exchange confirmed the move and revealed plans to add support for BNB perpetual futures starting next week.

“We will add support for BNB perpetual futures on Coinbase International Exchange and Coinbase Advanced. The opening of our BNB-PERP market will begin on or after 9:30 am UTC 3 APRIL 2025,” read the announcement.

Coinbase Traders, the official account for advanced trading on the platform, echoed the announcement in a post on X (Twitter). Introducing BNB perpetual futures on Coinbase’s international platforms presents new opportunities for traders.

For Coinbase users, this means access to perpetual futures contracts, a type of derivative that does not have an expiration date. It allows traders to hold positions indefinitely. The feature will be available on Coinbase International Exchange, catering to non-US users, and Coinbase Advanced, which is tailored for experienced traders.

This move strengthens Coinbase’s derivatives market and positions the exchange as a competitor to Binance, which already supports BNB futures. Expanding its futures offerings allows Coinbase to attract more traders looking for diversified investment opportunities.

For BNB users, the listing on a major global exchange like Coinbase International expands market reach and trading opportunities. This increased exposure could influence BNB’s market value due to heightened demand and trading volume.

Changpeng Zhao’s Reaction Sparks Criticism

For BNB, listing on a prominent exchange like Coinbase enhances its accessibility and credibility. This increased availability could boost adoption, though traders should remain cautious of speculative price movements and volatility surrounding the launch. Binance founder Changpeng Zhao (CZ) commented on the development.

“No one applied for this. Focus on building. Listing comes naturally. BNB,” CZ chimed.

His remark suggests the strength of the Binance ecosystem, rather than direct listing applications, drives BNB’s growth and adoption.

Market sentiment remains mixed, with some traders expressing optimism about BNB’s future. Meanwhile, others challenge Coinbase’s “natural listing” of BNB perpetual futures, questioning the transparency and fairness of the selection process.

“Listing comes naturally? Doors that open naturally are often already open for some and locked for others. If there’s no application, who decides who gets “naturally” listed? True decentralization isn’t about not knocking — it’s about removing the doorman,” one user remarked.

This critique aligns with broader blockchain debates on true decentralization, which is expected to reduce trust and control disparities, not create new gatekeepers.

Nevertheless, with perpetual futures, leverage opportunities become a key factor. BNB traders on Coinbase can control larger positions with less capital. Notably, while leverage can amplify potential gains, it also increases the risk of significant losses.

Meanwhile, BeInCrypto data shows BNB was trading for $628.40 as of this writing, down by almost 2% in the last 24 hours. The listing is also expected to increase liquidity and volatility for BNB, particularly around the launch date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

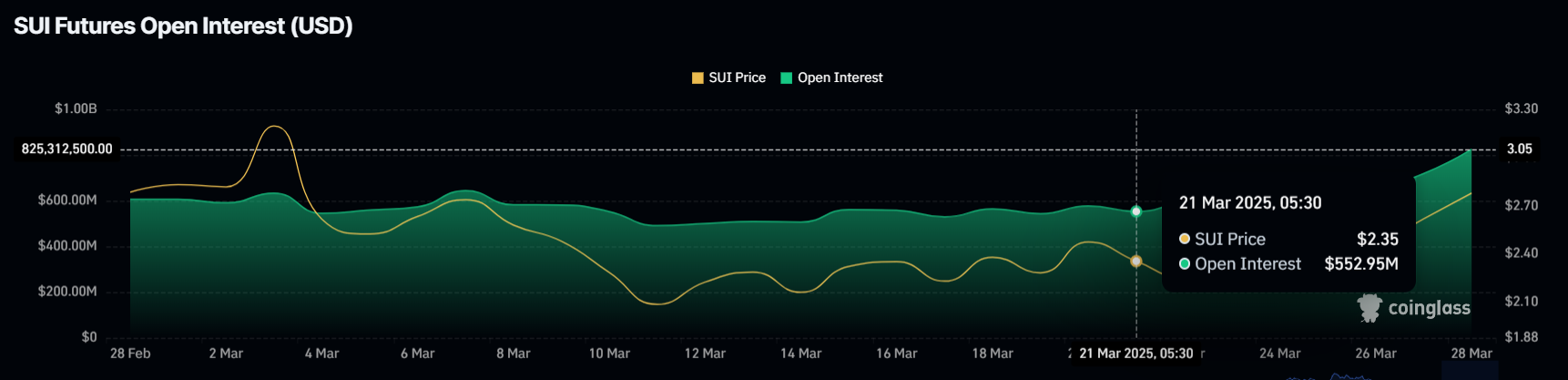

SUI Open Interest Surges 50%, Death Cross Could Fade Quickly

SUI has shown signs of recovery, and the crypto token’s price is trading at $2.65, which is just below the crucial resistance level of $2.77. This resistance stands as the last hurdle before the altcoin can reach the $3.00 mark.

Supported by improved market conditions and trader sentiment, SUI has been gaining momentum recently.

SUI Traders Are Optimistic

SUI’s Open Interest has surged by $273 million over the past week, increasing by 50%. The current Open Interest now stands at $825 million, signaling strong confidence. This rise in Open Interest indicates that more traders are actively participating in the market, and many are optimistic about the altcoin’s future prospects.

The positive funding rate also reinforces this sentiment, suggesting that long contracts dominate the market. With a majority of traders betting on upward movement, the market sentiment remains bullish for SUI.

Despite the recent formation of a Death Cross nine days ago, the macro momentum for SUI remains strong. A Death Cross, where the 50-day EMA crosses below the 200-day EMA, is typically a bearish signal, often indicating a potential price decline.

However, given the improving market conditions and strong investor support, the expected bearish decline may not materialize as strongly as it traditionally would. SUI’s price action suggests that the Death Cross may fade quickly, as it does not align with the current market environment.

SUI Price Is In For A Rise

SUI is currently trading at $2.65, just below the key resistance level of $2.77. Breaching this barrier could trigger a rally toward $3.00. If the altcoin successfully breaks above $2.77, it will likely continue its path toward $3.00, marking a strong recovery and potential for further growth.

Given the increasing market confidence and the positive Open Interest, SUI could aim to breach the next critical resistance at $3.18. Achieving this would help recover recent losses and potentially send SUI to new highs. A breakthrough $3.18 would indicate that the altcoin is poised for a significant rally.

However, if SUI fails to maintain its upward momentum and falls back to the support of $2.47, it could be vulnerable to further declines. A drop below $2.47 would likely strengthen the bearish implications of the Death Cross. This could potentially push the price down to $2.22 or lower, delaying recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market22 hours ago

Market22 hours agoHow the LIBRA Scandal is Undermining Milei’s Trust in Argentina

-

Market21 hours ago

Market21 hours agoPaul Atkins Reveals $6 Million in Crypto Exposure

-

Market20 hours ago

Market20 hours agoWill Bitcoin Hit $90,000 in April? Analysts Weigh In

-

Market23 hours ago

Market23 hours ago4 Altcoins That Could Hit New All-Time Highs in April 2025

-

Market16 hours ago

Market16 hours agoShould You Buy Movement (MOVE) For April 2025?

-

Altcoin16 hours ago

Altcoin16 hours agoDogecoin Price Prediction: Here’s What Needs To Happen For DOGE To Recover Above $0.3

-

Altcoin22 hours ago

Altcoin22 hours agoBonk Inu Acquires Exchange Art Marketplace, BONK Price To Rally?

-

Regulation21 hours ago

Regulation21 hours agoUS SEC Chair Nominee Paul Atkins To Prioritize Regulatory Clarity For Crypto Industry