Market

Is Crypto AI the Next Big Thing? Survey Reveals Mixed Sentiment

A recent survey by CoinGecko has revealed that two in five crypto participants are optimistic about the potential of crypto artificial intelligence (AI) products and token prices in 2025.

However, while optimism is evident, a significant portion of the community remains uncertain. This indicates a mixed sentiment surrounding this emerging sector.

Are Crypto Participants Bullish on the Future of Crypto AI?

CoinGecko’s survey ran from February 20 to March 10, 2025, and gathered responses from 2,632 crypto enthusiasts worldwide. The respondents comprised a diverse mix, including long-term investors (51%), short-term traders (26%), builders (10%), and spectators on the sidelines (13%).

A closer look at experience levels revealed that 53% of participants were in their first crypto cycle (0-3 years), while 34% had 4-7 years of experience. The remaining 13% had over eight years in the space. Geographically, 93% of respondents hailed from Europe, Asia, North America, and Africa, providing a broad global perspective.

Importantly, the results indicated that 46.9% of respondents held a bullish outlook on crypto AI products, including their use cases and technology. This reflected confidence in the sector’s growth potential.

“Specifically, 19.9% felt somewhat bullish about crypto AI products, and a larger 27.0% of survey respondents were fully bullish,” CoinGecko reported.

Coingecko’s Research Analyst, Yuqian Lim, pointed out that the growing enthusiasm in the crypto sector might be linked to the enhanced and increasingly widespread applications of crypto when integrated with AI technology.

Conversely, 24.1% of respondents expressed bearish sentiments, signaling skepticism regarding the immediate prospects of crypto AI.

“Almost one out of every four survey respondents continue to feel skeptical about the potential of crypto AI technology and its use cases, at least in the immediate term,” the report added.

This divided sentiment also extended to perceptions of crypto AI prices, with 44.3% expressing optimism. Meanwhile, 26.4% leaned pessimistic.

“This perhaps shows that crypto participants are not differentiating between crypto AI’s investing or trading potential and the technology itself,” Lim noted.

She further emphasized that these market sentiments might reflect an expectation for crypto AI to move beyond conceptual stages and mature as a functional sector. Despite the divide between bullish and bearish perspectives, a significant portion of respondents maintained a neutral stance. 29.0% and 29.3% of the participants selected a neutral position on products and token prices, respectively.

In fact, survey results showed that the neutral response category received the highest selection compared to other sentiment options. This implied either indecision or a wait-and-see approach as the technology matures.

Additionally, sentiment varied significantly across different adoption groups. Despite being pioneers in the crypto AI narrative, only 46.8% of innovators were bullish on crypto AI products, with a similar 44.8% bullish on token prices. Notably, a significant portion, 28.9% for products and 30.0% for prices, were bearish.

In contrast, early adopters and the early majority showed greater optimism. The late majority displayed notably less bullishness. The laggards exhibited the strongest bearish sentiments, with 41.3% viewing crypto AI products negatively and 43.1% holding bearish views on token prices.

“The ‘Laggard’ group also had the smallest share of neutral sentiments, which suggests that this group has the strongest opinions despite being the latest to the crypto AI narrative,” the survey revealed.

The survey comes at a challenging time for the sector. It has seen a significant downturn after peaking earlier this year.

Major catalysts that previously triggered rallies have recently failed to spark the same momentum. This is exemplified by the AI coins market cap taking a dip following Nvidia’s GTC Conference.

Despite the downturn, the sector has shown a slight recovery, with a 4.3% increase recorded over the past day. However, this recovery was not isolated. The broader market also saw an uptick following the Fed’s decision to keep US interest rates unchanged.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

HBAR Traders Bet On Recovery, But Price Continues Falling

HBAR has experienced a consistent decline, and the price continues to move downward despite traders’ optimism for a potential recovery. The altcoin, which has faced downward pressure in recent weeks, has not yet found a solid support floor.

However, traders remain hopeful that a recovery could be on the horizon, though market conditions remain challenging.

Hedera Traders Are Placing Long Contracts

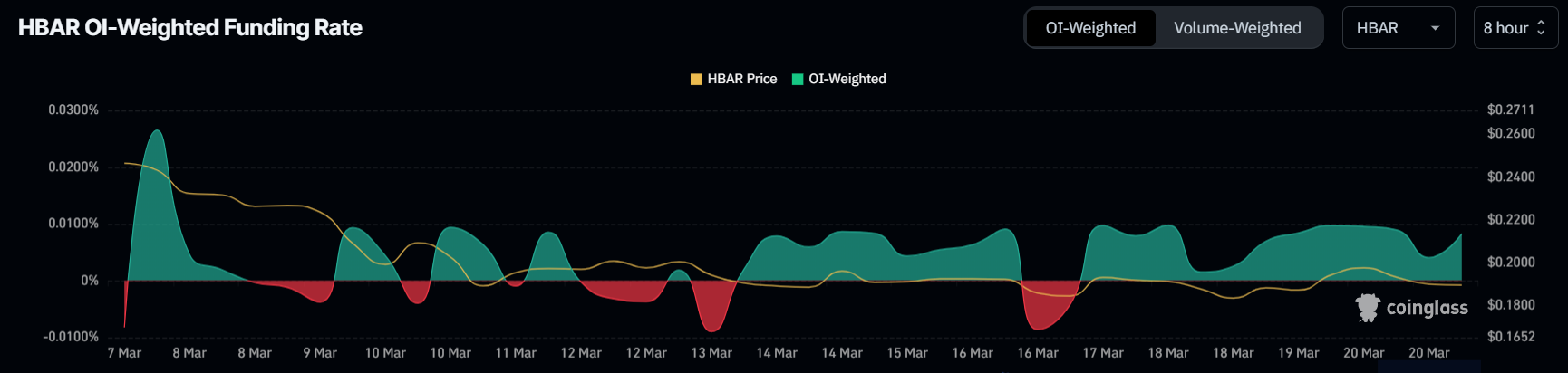

Currently, HBAR’s funding rate is positive, indicating that long positions are dominating short contracts in the market. This suggests that traders are betting on an eventual rise in HBAR’s price, hoping to profit from the recovery. The positive funding rate typically reflects investor confidence, but the market conditions and recent price action make it difficult for these positions to materialize in profit.

Despite the positive sentiment from long traders, the broader market conditions have not been favorable for HBAR. While traders are still placing bets on a price rise, there is a significant risk of losses if the market continues its downtrend.

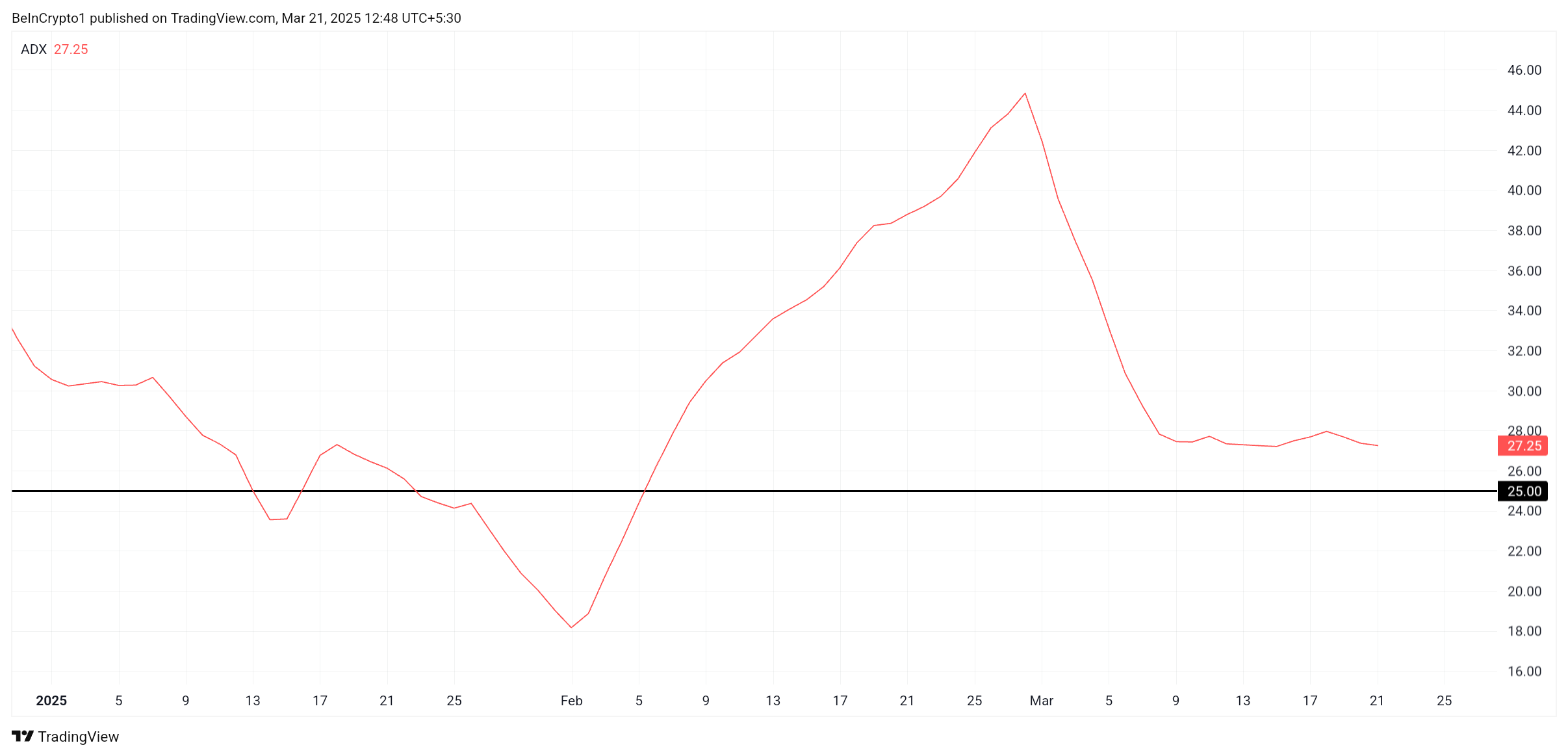

The macro momentum for HBAR is influenced by the ADX (Average Directional Index) indicator, which currently shows a strong downtrend. With the ADX well above the 25.0 threshold, the bearish trend is firmly in place and will likely continue. This suggests that HBAR’s price could face additional downward pressure before finding a solid support level.

Although traders are betting on a recovery, the ongoing strength of the downtrend indicated by the ADX raises concerns. Until the momentum shifts or key market conditions change, it remains uncertain when the price will stabilize or turn bullish.

HBAR Price Holds Above Key Support

HBAR is currently trading at $0.184, a 6% drop over the last 48 hours. The altcoin failed to secure the $0.197 support level, which may lead to further declines in the short term. If the bearish trend persists, HBAR could continue sliding, potentially testing lower levels.

The next significant support for HBAR lies at $0.177, a level that has held strong multiple times in the last three months. Should the price drop to this support, it could consolidate around this range, signaling a potential pause in the downtrend. However, this support will need to be held to prevent a deeper decline.

If the market conditions improve, HBAR could see a recovery, with $0.197 flipping into support. A successful breach of $0.222 could further boost the altcoin, invalidating the bearish outlook and signaling a shift toward positive price momentum. However, this scenario depends on stabilizing broader market conditions.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Bears Persist Despite SEC Lawsuit Drop

XRP’s price reaction has remained muted following the US Securities and Exchange Commission’s (SEC) decision to drop its lawsuit against Ripple.

The bearish sentiment against the altcoin continues to strengthen, signaling an extended period of potential price consolidation or a downturn.

Ripple’s Legal Win Fails to Ignite XRP Rally—What’s Holding It Back?

On March 19, the SEC dropped its appeal and lawsuit against Ripple Labs, ending the five-year-long legal battle. While many anticipated this significant development would trigger a bullish rebound for XRP, its performance has remained lackluster.

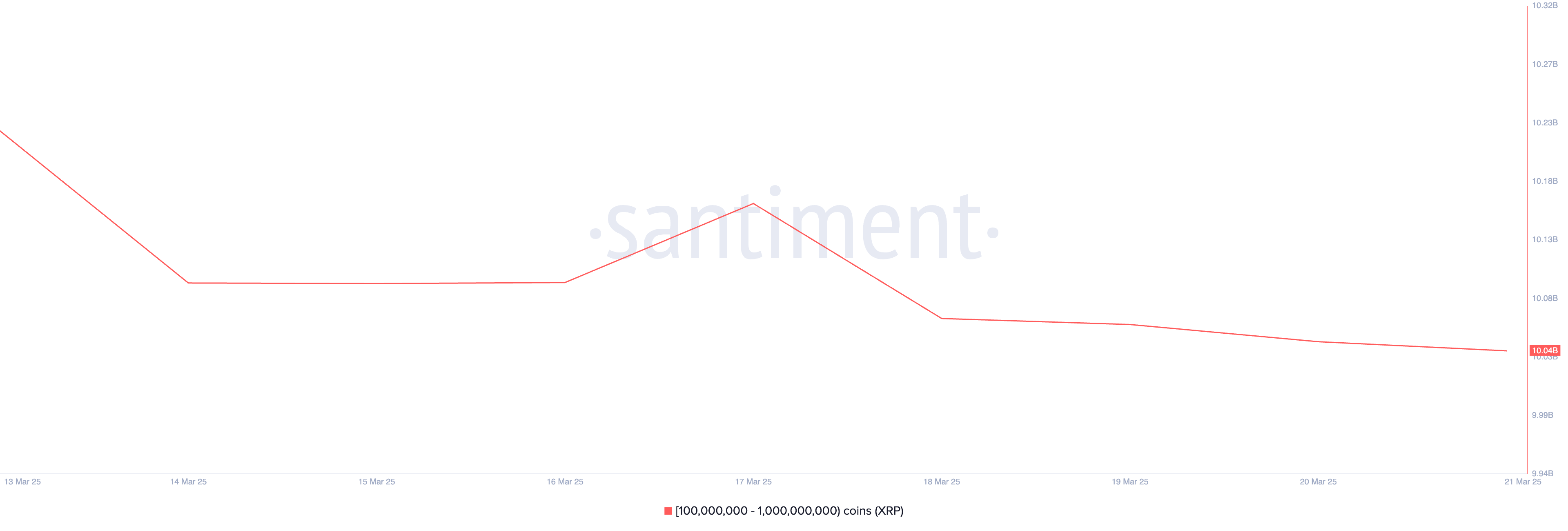

Market participants remain overwhelmingly bearish on the altcoin, keeping its price under persistent pressure. The decline in XRP whale accumulation highlights this bearish bias.

According to Santiment, large whales holding between 100 million and 1 billion XRP have offloaded a cumulative 20 million XRP, worth approximately $50 million, since March 19.

This sell-off is part of an ongoing distribution trend that began earlier this month and shows no signs of reversal even after the SEC’s decision. Despite Ripple’s legal victory, these major XRP holders have yet to regain confidence and resume accumulation.

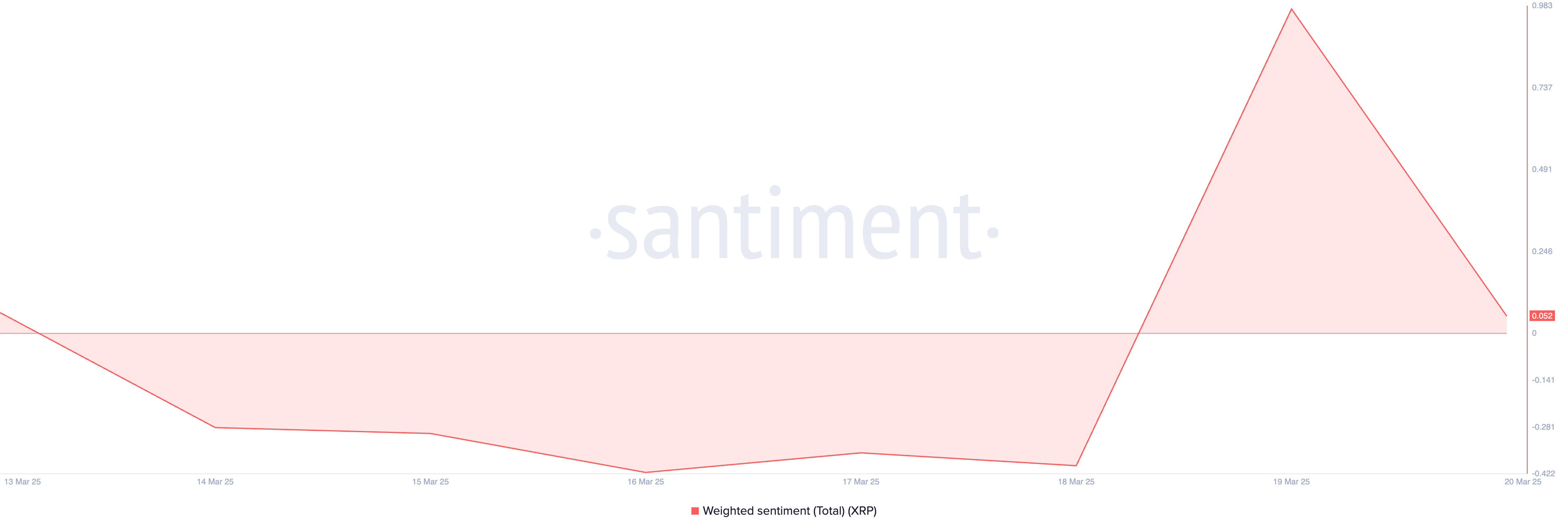

Moreover, the token’s falling weighted sentiment reflects the bearish pressure in the XRP market. At press time, it is poised to break below the center line at 0.052.

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions. It is a bearish signal when it attempts to fall into the negative territory.

It means that XRP investors are increasingly skeptical about the token’s near-term outlook. This prompts them to trade less, worsening the token’s decline.

XRP at a Crossroads: Rally to $2.61 or Drop to $1.47?

XRP exchanges hands at $2.39, trading above the support floor at $2.13. If bearish sentiment lingers, the token could experience a pull toward this low. Should the bulls fail to defend this support, XRP’s price could fall further to $1.47.

Conversely, a resurgence in bullish bias would invalidate this bearish projection. If XRP demand spikes and profit-taking stalls, its price could climb to $2.61.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETFs Battle $5.3 Billion Loss, Recovery Signals Emerge

Despite the strong performance last year, the market’s volatility has shifted the outlook for Bitcoin exchange-traded funds (ETFs) in 2025. A series of major sell-offs have wiped out nearly all the inflows the ETFs received earlier in 2025.

This downturn coincides with Bitcoin’s continued price decline, leaving the ETFs struggling to maintain their momentum as investor sentiment shifts.

Bitcoin ETFs Face Major Setback in 2025

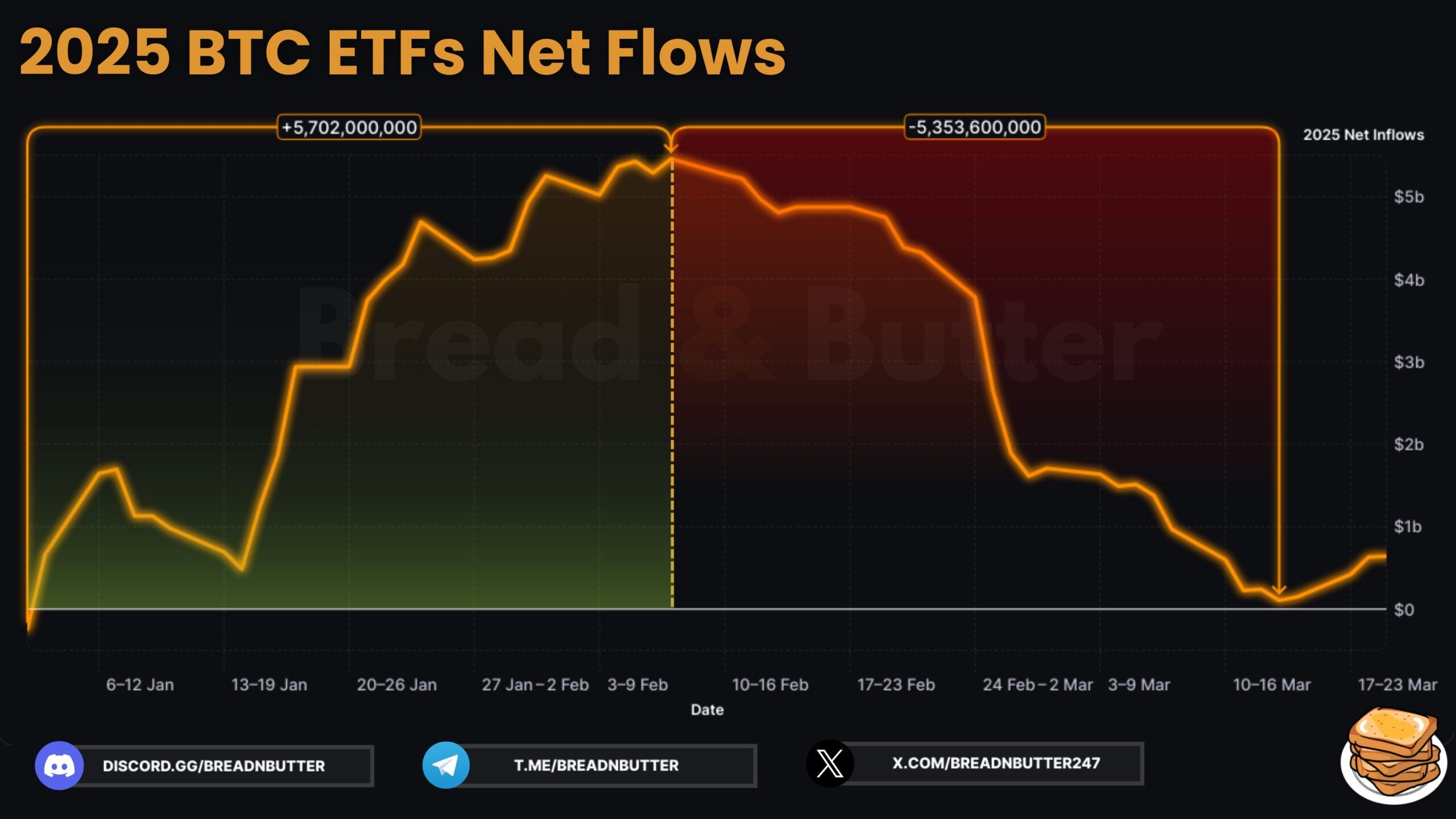

According to a recent post by Bread & Butter on X (formerly Twitter), Bitcoin ETFs had a promising start to the year. Between January 1 and February 7, they saw cumulative inflows of $5.7 billion.

However, a substantial sell-off quickly followed, erasing $5.3 billion of those gains. As a result, net inflows for the year plunged to a low of $106 million.

In fact, the largest weekly net outflow was recorded in the final week of February, at $2.7 billion. That’s not all. Since the ETFs began trading, they have experienced outflows in three separate months. February stands out as the most significant, with a staggering $3.5 billion recorded as the largest monthly outflow to date.

Nonetheless, the post revealed a positive shift, noting that inflows into Bitcoin ETFs have resumed. Since March 14, the ETFs have recorded consecutive days of inflows, pushing the year-to-date net inflows to over $600 million.

Notably, on March 17, BTC ETFs recorded their highest single-day inflow in 41 days. Amid this renewed momentum, BeInCrypto highlighted that asset managers Fidelity and ARK Invest were acquiring substantial amounts of Bitcoin, contributing to a bullish trend.

As of the latest data, the daily total net inflow reached $165.7 million on March 20. Yet, this growth was uneven across the 11 ETFs.

Only four recorded inflows, with iShares Bitcoin Trust ETF (IBIT), leading at $172.1 million, followed by Fidelity Wise Origin Bitcoin Fund (FBTC) with $9.2 million, Grayscale Bitcoin Mini Trust ETF (BTC) with $5.2 million, and VanEck Bitcoin ETF(HODL) with $11.9 million.

Meanwhile, four ETFs saw zero flows, and three—Grayscale Bitcoin Trust(GBTC), Bitwise Bitcoin ETF (BITB), and Franklin Templeton Digital Holdings Trust (EZBC)—experienced outflows, reflecting a mixed market performance.

“It remains to be seen whether this marks the beginning of a sustained rebound or just a temporary relief,” the post read.

This comes as Bitcoin’s price continues to navigate turbulent waters. The cryptocurrency has faced significant setbacks due to shifting macroeconomic conditions, leading to a notable decline.

According to BeInCrypto data, BTC has depreciated by 12.1% over the past month and 2.0% in the last 24 hours alone. At press time, it was trading at $84,147.

However, analysts suggest that the worst may be over. Arthur Hayes, former CEO of BitMEX, pointed to a potential bullish shift, citing his custom US bank credit supply index, which was moving upwards.

“Doesn’t mean we are done dumping but the odds are shifting more bullish,” he said.

Market observers have also compared Bitcoin to gold. They predict that BTC may follow a similar trajectory and emerge from its current “fakeout” phase. Others believe Bitcoin is in a bear trap that could soon end.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoKey Indicators Suggest Short-Lived Gains

-

Market20 hours ago

Market20 hours agoWhy $2.66 Is The Most Important Level To Beat

-

Market19 hours ago

Market19 hours agoSolana Faces Overvaluation: Price Stagnation Ahead?

-

Market22 hours ago

Market22 hours agoTrump’s Digital Asset Summit Speech Talks Stablecoins

-

Market18 hours ago

Market18 hours agoBNB Chain Overtakes Solana in Weekly DEX Trading Volume

-

Market17 hours ago

Market17 hours agoHere’s Why XRP Holders Will Likely Drive Price To $3.00

-

Regulation17 hours ago

Regulation17 hours agoUS SEC Exempts Proof-Of-Work Mining From Security Obligations

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum CLS Shows Price Will Rebound Above $2,600, Here’s Why