Market

How CEXs Are Blending with DEXs

The introduction of DEX integration features by centralized exchanges (CEX), transforming them into hybrid platforms, reflects a growing trend of blending centralization and decentralization to attract both traditional users and DeFi enthusiasts.

With increasing regulatory pressure on CEX, like KYC and AML requirements, decentralized exchanges (DEX) have become a more appealing option due to their anonymity and decentralized nature. Integrating DEX functionalities allows CEX to retain users while still complying with regulations.

CEX-DEX Integration for Growth

CEX and DEX represent the two primary exchange models in the crypto market. The boundaries between the two types of exchanges are increasingly blurred in today’s evolving market. Both models are beginning to adopt and integrate each other’s strengths to meet users’ growing and diverse demands.

Recently, several centralized exchanges have launched hybrid platforms. For example, Binance introduced Binance Alpha 2.0 (another updated version of Binance Alpha), enabling CEX users to purchase DEX tokens without withdrawals, combining CEX convenience with access to decentralized tokens.

Similarly, MEXC launched DEX+, blending on-chain and off-chain trading for a seamless experience. This reflects a trend of integrating centralization and decentralization to appeal to traditional users and DeFi participants.

“This is a brilliant move. Allowing CEX users to buy any DEX tokens directly from the CEX, no withdrawals needed.” said former Binance CEO CZ.

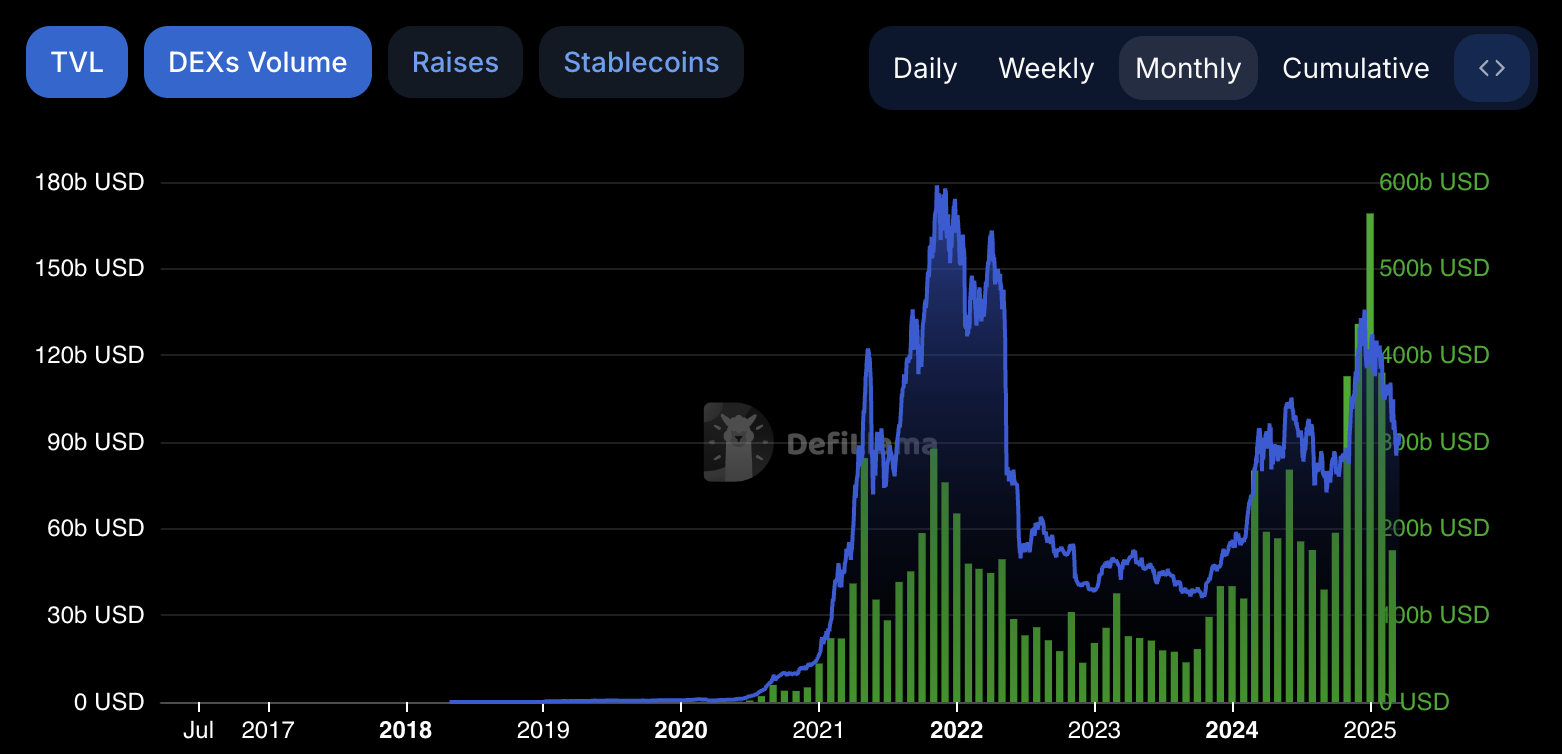

Interestingly, DEXs started gaining prominence in 2020. They slightly surpassed CEX in on-chain trading volume in 2020, and peaked in 2021. The rise of platforms like Solana contributed to this sudden growth. But DEXs slowly started losing momentum in 2022 and 2023.

According to a report by OAK Research, at the beginning of 2024, DEXs accounted for just 9.3% of the trading volume market share compared to CEXs. However, in January 2025, DEXs surpassed $320 billion in monthly trading volume as they captured over 20% of the spot trading volume for the first time in crypto history.

Similaryly, according to data from DeFiLlama, Total Value Locked (TVL) in DEX was approximately $163.6 billion at the beginning of 2022. In 2023, the TVL dropped to around $52 billion and stayed around the same figure for most of 2024.

Nevertheless, by December 2024, this figure had surged to around $140 billion, marking an increase of nearly 160% since the beginning of the year. This shows the rising preference for DEXs among crypto traders.

According to CoinGecko, around 959 DEX platforms are now active in 2025, compared to 217 CEXs.

Benefits and Challenges of CEX-DEX Integration

The current differences between CEX and DEX creates disadvantages for users. As a result, users seek to combine the strengths of both models: the speed and liquidity of CEX with the control and transparency of DEX. The launches of Binance Alpha 2.0 and MEXC DEX+ demonstrate how major exchanges are addressing this need.

Moroever, DEXs led innovation in the current cycle with AMMs and liquidity pools, forcing CEXs to adapt to avoid falling behind.

With mounting regulatory pressure on CEXs, the anonymity and decentralization of DEXs make it more attractive. DEX integration enables CEX to retain users while navigating compliance.

However, creating hybrid platforms comes with challenges. Integrating on-chain and off-chain systems requires complex infrastructure, potentially leading to errors or high gas fees for DEX users. Additionally, hybrid platforms may face stricter regulatory scrutiny, especially when combining CEX’s fiat-to-crypto trading with decentralized tokens.

Despite these hurdles, given the advantages outlined, hybrid platforms like Binance Alpha 2.0 and MEXC DEX+ will continue to emerge.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tether Buys $33 Billion US Bonds Amid Forthcoming Regulation

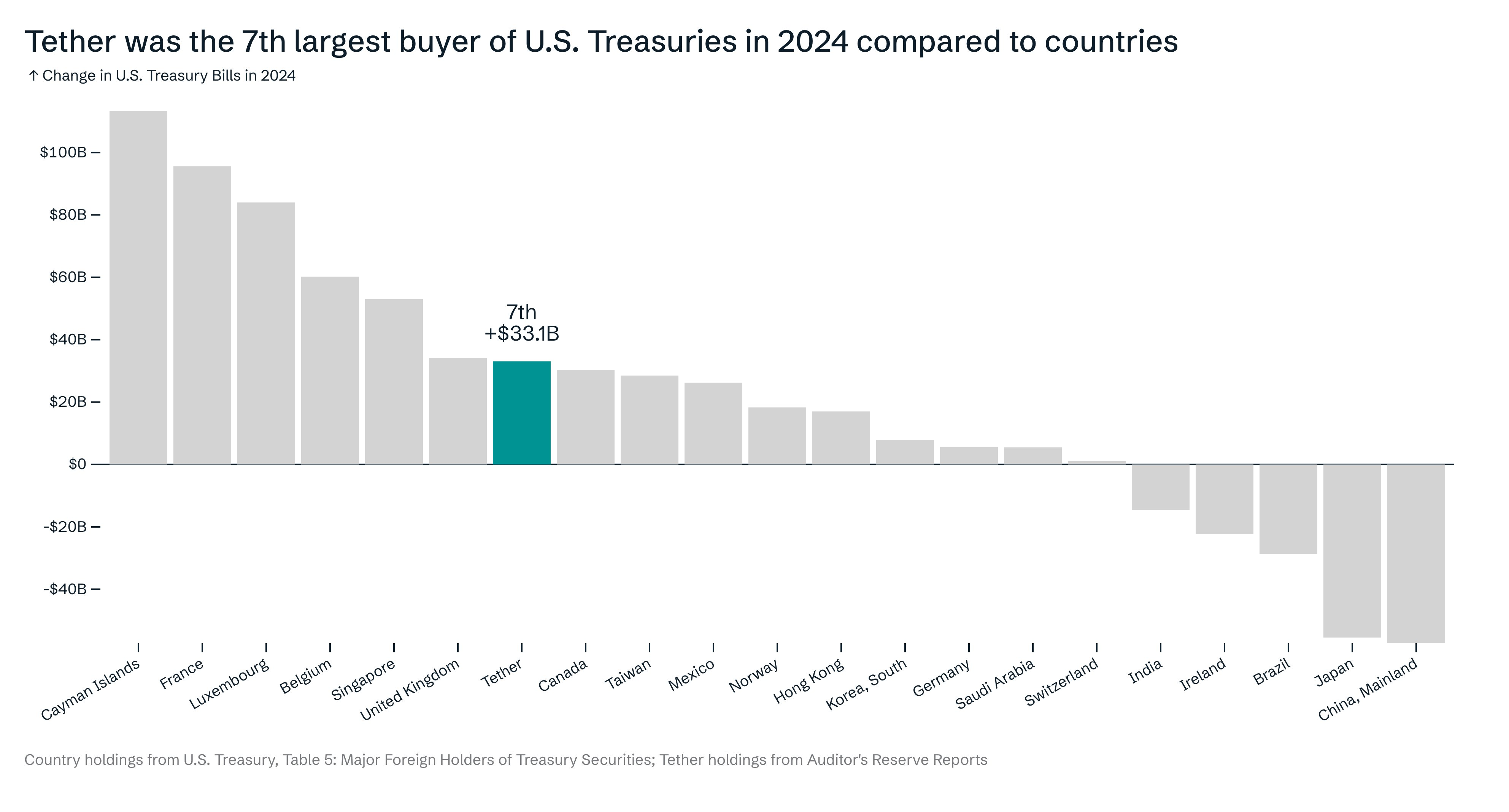

Tether surprised the market by announcing that it purchased over $33 billion in Treasury bonds last year. This makes Tether the seventh-largest buyer of US bonds, ahead of countries like Canada, Mexico, and Germany.

In a speech today, President Trump claimed that stablecoins will be used to promote dollar dominance worldwide. By purchasing these bonds, Tether could be securing an incredibly valuable partnership.

Why is Tether Buying US Treasury Bonds?

Tether, the world’s largest stablecoin issuer, might have a significant opportunity on its hands soon. At the Digital Assets Summit earlier today, President Trump alluded to some big plans for future stablecoin policies in the US.

An important factor in these plans may be that Tether is now one of the world’s largest purchasers of US Treasury bonds:

“Tether was the 7th largest buyer of US Treasuries in 2024, compared to countries. Tether brings the US dollar to more than 400 million people predominantly in emerging markets and developing countries. Without a doubt, Tether built the biggest distribution network for the US Dollar,” Tether CEO Paolo Ardoino said in a pair of social media posts.

This could potentially boost USDT compliance efforts with the forthcoming stablecoin regulation. The proposed GENIUS Act, which is pending congressional approval, requires stablecoin issuers to hold reserve assets in the US, denominated in the US treasury.

So, this purchase could allow Tether to comply with the upcoming US regulation, unlike the EU’s MiCA.

“Insane. Tether has become an essential partner to the United States in less than a decade,” wrote Anthony Pompliano.

In his speech today, President Trump didn’t make many firm commitments about future stablecoin policy. He did, however, claim that dollar-backed stablecoins will “expand the dominance of the US dollar” for years in the future.

If the US government substantially influences the stablecoin market, Tether could be a good conduit for Trump’s partnership.

Could Tether and Trump Drive USD Dominance?

All the proposed stablecoin regulations in the US include a clear demand: issuers must be subject to third-party audits. Tether has never allowed one, although its new CFO supports an audit.

This speed bump has already moved Coinbase to state that it would remove Tether’s products if asked, just like it was pushed out of the EU last December.

However, Tether may be able to solve many of these problems by purchasing Treasury bonds. Among other requirements, the GENIUS Act mandates that stablecoin issuers hold much of their reserves in US Treasuries.

It was previously theorized that Tether may need to sell its Bitcoin due to this regulation, but the fact that the company has been buying treasury bonds changes the speculations.

“Should Congress pass the GENIUS Act, the regulatory clarity might also attract traditional banking firms into the stablecoin ecosystem, fueling healthy competition. The stablecoin market can potentially hit $3 trillion in the next 5 years, a sign that the asset class can dominate the global payment ecosystem in the coming years. The essence of these regulations will be to preserve the hegemony of the US dollar, albeit in a tokenized form such as stablecoins. In the long run, the regulatory clarity will mutually benefit the crypto industry and the US economy,” Agne Linge, Head of Growth at WeFi told BeInCrypto.

Tether has purchased a staggering amount of Treasury bonds in the last year, but this might not guarantee a partnership with Trump and the US government.

Several major banks are eyeing stablecoin launches, and several people in Trump’s orbit allegedly discussed partnering with Binance to launch one, too. So far, there’s no evidence Tether had a similar deal.

Still, Tether purchased over $33 billion in US Treasury bonds in one year, and that’s bound to make an impact. If Trump’s administration decides to use Tether to promote dollar dominance, it could change everything.

It’s too soon to confidently state that such predictions will come true. Tether may still need a third-party audit despite buying these Treasury bonds. Still, if the stars align, its dominant position in the stablecoin market could be supercharged.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CyberCapital’s Justin Bons Slams Pi Network as a Scam

Pi Network is facing renewed scrutiny after Justin Bons, founder of CyberCapital, publicly branded the project a “scam.”

Bons raised concerns about the project’s technology, business model, and tokenomics, arguing that they are deeply flawed and potentially harmful to investors.

Is Pi Network a Scam? Justin Bons Thinks So

In a series of posts on X (formerly Twitter), Bons pointed out several issues with the network. He suggested that contrary to its claims of decentralization, Pi Network remains heavily centralized.

“PI is fully permissioned (centralized) and everything requires KYC, even simple transactions! PI is an investment scam; it is that bad,” he wrote.

Bons also criticized the five-year-delayed mainnet launch, calling the network’s promises of innovation and decentralization misleading. Notably, one of the major claims the executive made was that Pi Network’s core technology was copied from Stellar (XLM).

Despite this, he argued that the absence of a Turing-complete virtual machine (VM) limits Pi Network’s potential for decentralized finance (DeFi), making it a “pipedream.” Moreover, he explained that this renders the network neither scalable nor programmable.

Bons also drew attention to the network’s referral program, which he likened to a Multi-Level Marketing (MLM) scheme. He argued that this system generates unnecessary costs for the network without providing real benefits to users.

Further compounding his concerns, Bons highlighted a Ponzi-like mechanism within Pi Network’s “mining” process. He revealed that the lockup period benefits insiders by inflating the token price, allowing early investors to exit with profits.

Transparency, or the lack thereof, was another significant issue Bons flagged. He criticized the Pi network for not revealing insider token allocations despite enforcing Know Your Customer (KYC) procedures. He noted that insiders might control as much as 20% of the network’s supply, which contradicts the project’s fairness claims.

“PI made it into the top 20 is an embarrassment to our industry,” Bons concluded.

Previously, Bybit CEO Ben Zhou had shared similar concerns, calling PI a scam and describing it as “more dangerous than meme coins.”

Will Pi Coin (PI) be listed on Binance?

Meanwhile, the latest wave of criticism comes amid mounting discontent among pioneers toward Binance. On March 19, the exchange revealed its first batch of Vote to List projects. The list included meme coins associated with the former CEO’s dog and the Mubarak (MUBARAK) token, among others.

Nonetheless, despite Pi Coin (PI) receiving an 86% vote in favor, the community expressed frustration over Binance’s failure to list it.

“Stop acting like some third rate junk exchange and fulfill your promises before you start the next vote. I don’t know if CZ would have behaved like this if he was still at Binance, he wouldn’t be proud of your behavior,” a user wrote on X.

The community has even gone as far as giving Binance a 1-star rating on the Google Play Store. However, this might have worsened PI’s prospects rather than improving them.

“Do not try to pressure us into listing your coin by spreading FUD or negative comments about Binance, or you will be blacklisted,” Binance noted.

The dual blows of Bons’ criticism and Binance’s snub have coincided with a devastating market slump for PI. The token’s price plummeted below $1.0 today for the first time since late February.

Over the past day, PI has declined by 20.1%, with weekly losses extending to 48.7%. At press time, Pi Coin was trading at $0.91. Its ranking has also taken a hit, sliding to 27th place on CoinGecko, a significant drop from its earlier position.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analysts Predict Choppy Price Action

After the FOMC (Federal Open Market Committee) minutes and the digital asset summit on Wednesday and Thursday, respectively, approximately $2.09 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today.

The expiration may influence market conditions, with investors monitoring potential shifts.

Over $2 Billion in Options Expiry Today

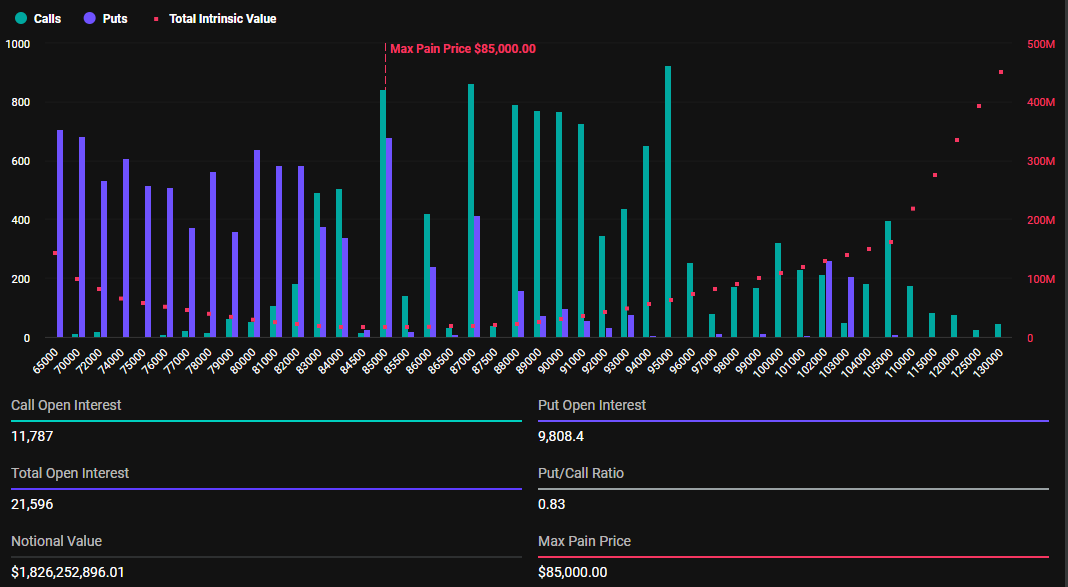

According to Deribit, $1.826 billion in Bitcoin options expire today. The maximum pain point of these contracts stands at $85,000.

These options include 21,596 contracts, slightly fewer than last week’s 35,176. Despite recent volatility, the put-to-call ratio of 0.83 indicates a general bullish sentiment.

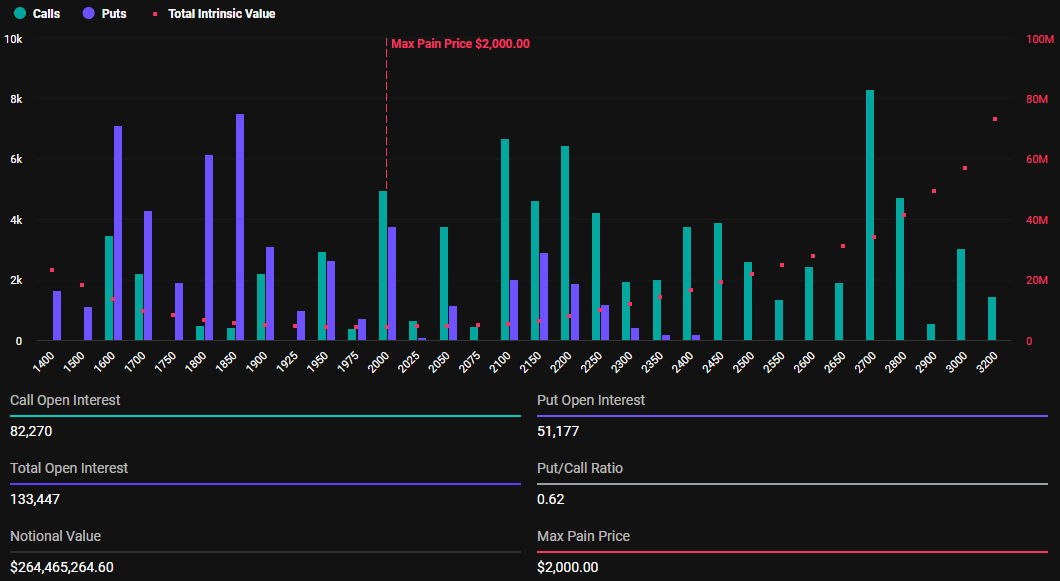

Ethereum has $264.46 million in options expiring, involving 133,447 contracts. This figure is also lower than the previous week’s 223,395 contracts. The maximum pain point for these options is $2,000, and the put-to-call ratio is 0.62.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC traded for $84,414, whereas ETH exchanged hands for $1,977.

This suggests a modest upside for Bitcoin and Ethereum towards the $85,000 and $2,000 strike prices, respectively. This surge is plausible given smart money’s Strategy in options trading, pushing prices toward the “max pain” level. Here, the highest number of contracts, both calls and puts, expire worthless.

“Will we see a volatility squeeze or a slow unwind?” Deribit posed in a post on X (Twitter).

Based on Bitcoin and Ethereum’s put-to-call ratios, both below 1, call options (purchases) have a higher prevalence than put options (sales).

Market Sentiment Ahead of Today’s Options Expiry

Analysts from crypto options trading tool Greeks.live provided insights on the current market sentiment, highlighting a divided trader community. On the one hand, some expect a price drop after the FOMC meeting, as policymakers rejected further interest rate cuts, effectively disappointing the crypto market.

On the other hand, some anticipate a temporary rise before choppy conditions. With this, the analysts note the range between $83,000 and $85,000 as the area of interest, with expected volatility around President Trump-related developments and potential MicroStrategy (now Strategy) purchases.

“Expect chop and drift lower before heading higher again on Monday, despite the current pump not being viewed as sustainable,” Greeks.live analysts observed.

Elsewhere, BeInCrypto reported that Bitget exchange CEO Gracy Chen is confident BTC will hold above the $73,000 to $78,000 range, paving the way for a potential rally to $200,000. She attaches her optimism to the US strategic Bitcoin reserve’s potential to drive institutional legitimacy and long-term price stability.

Even as Bitget’s Chen remains optimistic, traders and investors should brace for short-term volatility. Historically, options expirations tend to cause temporary price movements. However, the market usually stabilizes shortly after.

This calls for vigilance and analysis of technical indicators and market sentiment to manage potential volatility effectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoWill Bitcoin Benefit from DXY Decline After FOMC’s Latest Move?

-

Market17 hours ago

Market17 hours agoTrump’s Digital Asset Summit Speech Talks Stablecoins

-

Market15 hours ago

Market15 hours agoWhy $2.66 Is The Most Important Level To Beat

-

Market20 hours ago

Market20 hours agoBFI Allocates $90 Million to Healthcare & Climate Action with Crypto

-

Market19 hours ago

Market19 hours agoPakistan Moves to Legalize Cryptocurrency with Clear Regulations

-

Market16 hours ago

Market16 hours agoKey Indicators Suggest Short-Lived Gains

-

Market18 hours ago

Market18 hours agoStablecoins Adoption Challenges: Transparency As A Barrier

-

Market10 hours ago

Market10 hours agoCardano (ADA) Stalls as Volume Hits $1 Billion in 24 Hours