Market

Will Bitcoin Benefit from DXY Decline After FOMC’s Latest Move?

The US Dollar Index (DXY) fell following the latest Federal Open Market Committee (FOMC) meeting. This turnout triggered discussions about its implications for Bitcoin (BTC) and broader liquidity conditions.

Meanwhile, Bitcoin price reclaimed the $85,000 range. However, prospects for more gains remain debatable as the pioneer crypto continues in a horizontal chop.

Fed Revises Economic Projections Amid Growth Concerns

Market analysts and crypto experts suggest the declining dollar could create a more favorable environment for Bitcoin’s price recovery. This optimism comes despite lingering macroeconomic concerns.

On one hand, President Donald Trump is putting political pressure on the Federal Reserve (Fed), urging it to cut rates.

“The Fed would be MUCH better off CUTTING RATES as US Tariffs start to transition (ease!) their way into the economy. Do the right thing,” Trump wrote on Truth Social.

These remarks indicate potential political battles over monetary policy, further affecting risk asset performance.

However, the FOMC rejected further interest rate cuts, and the Fed made significant downward revisions to its 2025 economic projections. This painted a picture of weaker growth and persistent inflation.

The Fed cut its GDP growth forecast from 2.1% to 1.7% while raising its unemployment projection to 4.4%. Inflation expectations also increased, with PCE inflation forecasted at 2.7% and core PCE inflation at 2.8%. Notably, both of these were higher than previous estimates.

These revisions suggest a more challenging economic environment, with the DXY dropping in the aftermath.

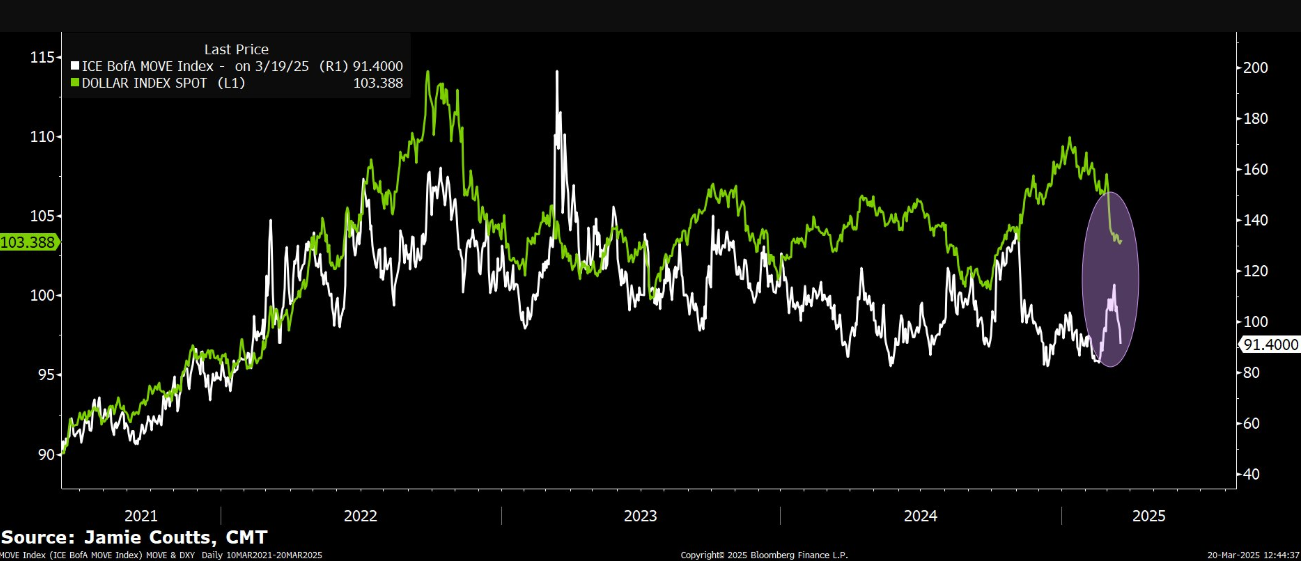

Real Vision’s chief crypto analyst, Jamie Coutts, who also built the crypto research product at Bloomberg Intelligence, commented on the turnout. In a post on X (Twitter), the analyst argued that quantitative tightening (QT) is effectively dead for the near future.

Coutts points to the decline in Treasury yield volatility and its correlation with the DXY downturn. He says these are key indicators of increased liquidity, which is generally bullish for Bitcoin.

“After last night, QT is effectively dead (for some time). Treasury volatility has backed right off and is now mirroring the decline in DXY from earlier this month. This is all extremely liquidity-positive,” Coutts noted.

However, not everyone agrees on the extent of QT’s slowdown. Analyst Benjamin Cowen cautions that QT is still ongoing, albeit at a reduced pace.

“QT is not ‘basically over’ on April 1st. They still have $35 billion per month coming off from mortgage-backed securities. They just slowed QT from $60 billion per month to $40 billion per month,” Cowen wrote.

Bitcoin and the Dollar: A Delayed Reaction?

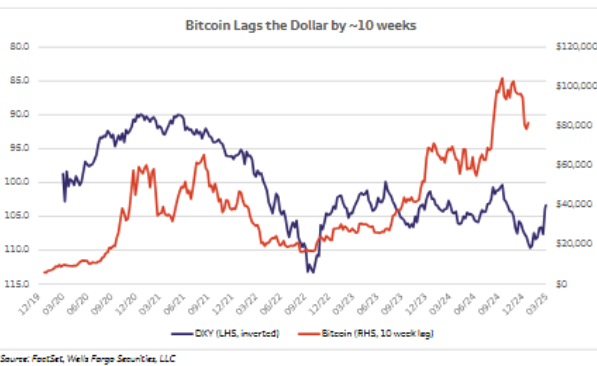

One of the most compelling arguments for Bitcoin’s potential recovery comes from VanEck’s Head of Digital Assets Research, Mathew Sigel. He points out that Bitcoin has historically tracked an inverted DXY on a 10-week lag. This suggests that the current downturn in BTC prices could be a delayed reaction to the strong dollar in late 2024.

If the pattern holds, the recent weakness in DXY could set the stage for a bullish phase in Bitcoin over the coming months.

Meanwhile, BitMEX co-founder Arthur Hayes is more cautious about Bitcoin’s trajectory. While he acknowledges that QT is slowing, he questions whether liquidity injections in the European Union—driven by military spending—could overshadow the US’s financial shifts.

“Will the re-arming of the EU paid for with printed EUR overwhelm the near-term negative fiscal impulse of the US? That’s the big macro question. If yes, correction over. If no, hold on to your butts,” Hayes wrote.

Hayes also speculated that Bitcoin’s recent drop to $77,000 might have marked the bottom. However, he warned that traditional markets might face further downside, which could influence crypto in the short term.

Based on these, the post-FOMC environment presents a mixed outlook for Bitcoin. On the one hand, falling DXY, lower Treasury yield volatility, and slowing QT point to increasing liquidity, a historically positive signal for BTC.

On the other hand, macroeconomic risks—including rising corporate bond spreads and potential instability in traditional markets—could still create headwinds.

With Bitcoin’s historical lag behind DXY movements, the coming weeks will reveal if a delayed rally materializes. Meanwhile, global liquidity conditions and political developments remain key factors that could influence Bitcoin’s next major move.

BeInCrypto data shows BTC was trading for $85,832 at press time. This represents a modest gain of almost 4% in the last 24 hours.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Reveals the Dark Side of Crypto Airdrops

While crypto airdrops are always expected to fuel fortunes and adoption, Binance’s latest report exposes deep flaws. Reduced rewards, insider profit, and bot exploits are increasingly impacting community trust in airdrops.

Once a growth engine, crypto airdrops now risk becoming liabilities. Can the industry fix them before users lose faith?

Binance’s Analysis of Recent Crypto Airdrops

This report highlights the flawed system that is turning excitement into frustration. With this, Binance poses the rhetoric: Are airdrops crypto’s golden ticket or a ticking time bomb?

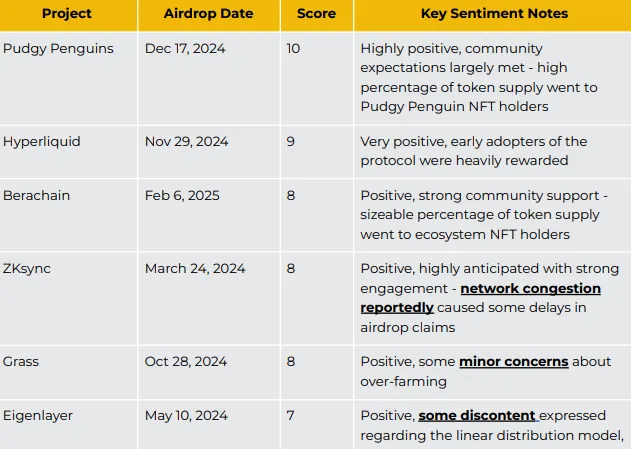

Binance exchange’s analysis gives Pudgy Penguins’ airdrop a near-universal 10/10 acclaim in community sentiment. Hyperliquid followed closely with a 9/10 rating after handsomely rewarding and setting new DeFi standards.

However, the fallout is swift and severe when airdrops fail to deliver. The Binance research cites Redstone (RED), which originally pledged 9.5% of its token supply to the community and slashed it to 5% at the last moment.

This triggered widespread backlash and a dismal 2/10 sentiment score, according to Binance’s Grok AI analysis.

It also cites Scroll’s October 2024 airdrop as another disaster, highlighting vague rules and an unclear eligibility snapshot leading to a disappointing 3/10 rating.

Similarly, in February 2025, Kaito distributed 43.3% of its supply to insiders while allocating a mere 10% to the community. The move saw influencers quickly dump their holdings, eroding trust.

Further, the report cites Sybil farming, where bots amass tokens in bulk. Technical failures such as Magic Eden’s botched claim process in December 2024 have further fueled user discontent.

Why Most Airdrops Fail to Deliver

Beyond exposing flaws, Binance’s report dissects the mechanics behind these failures—last-minute allocation changes, like Redstone’s, signal poor planning and damage credibility. Lack of transparency, as seen in Scroll’s unclear eligibility criteria, breeds suspicion of favoritism.

Insider-heavy token distributions, such as Kaito’s, alienate retail participants. Meanwhile, technical inefficiencies, including Magic Eden’s malfunctioning wallet claims, turn airdrops into frustrating user experiences.

With billions at stake, these issues are no longer minor hiccups but existential threats to the legitimacy of the crypto airdrop model.

“Tokens are a new asset class….Airdrops are their wild frontier,” wrote Binance macro researcher Joshua Wong.

Despite the turmoil, Binance outlines a potential path forward to restore confidence in crypto airdrops. First, it calls for transparency, urging retroactive airdrops to set clear eligibility criteria in advance.

Meanwhile, engagement-based models should commit to fixed point-to-token ratios.

Next, projects must prioritize genuine community engagement, treating tokens as more than just digital assets as tools for building loyal ecosystems.

Finally, technical solutions such as on-chain monitoring and proof-of-humanity tools, like those employed by LayerZero, could help combat Sybil farming and enhance fairness.

Taken together, Binance’s report is a wake-up call that while crypto airdrops present a unique opportunity to democratize wealth and strengthen blockchain communities, they also risk collapsing under the weight of mismanagement and exploitation.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana (SOL) Risks Falling to $120 as Bearish Signals Grow

Solana (SOL) is under pressure after failing to sustain its recent rally and is now trading lower, following Bitcoin and Ethereum’s recent patterns. Despite briefly surging earlier this week, SOL has dropped over 3% in the past 24 hours.

Technical indicators are showing growing bearish signals, with sellers regaining control in the short term. Traders are watching key support and resistance levels as Solana struggles to regain its bullish momentum.

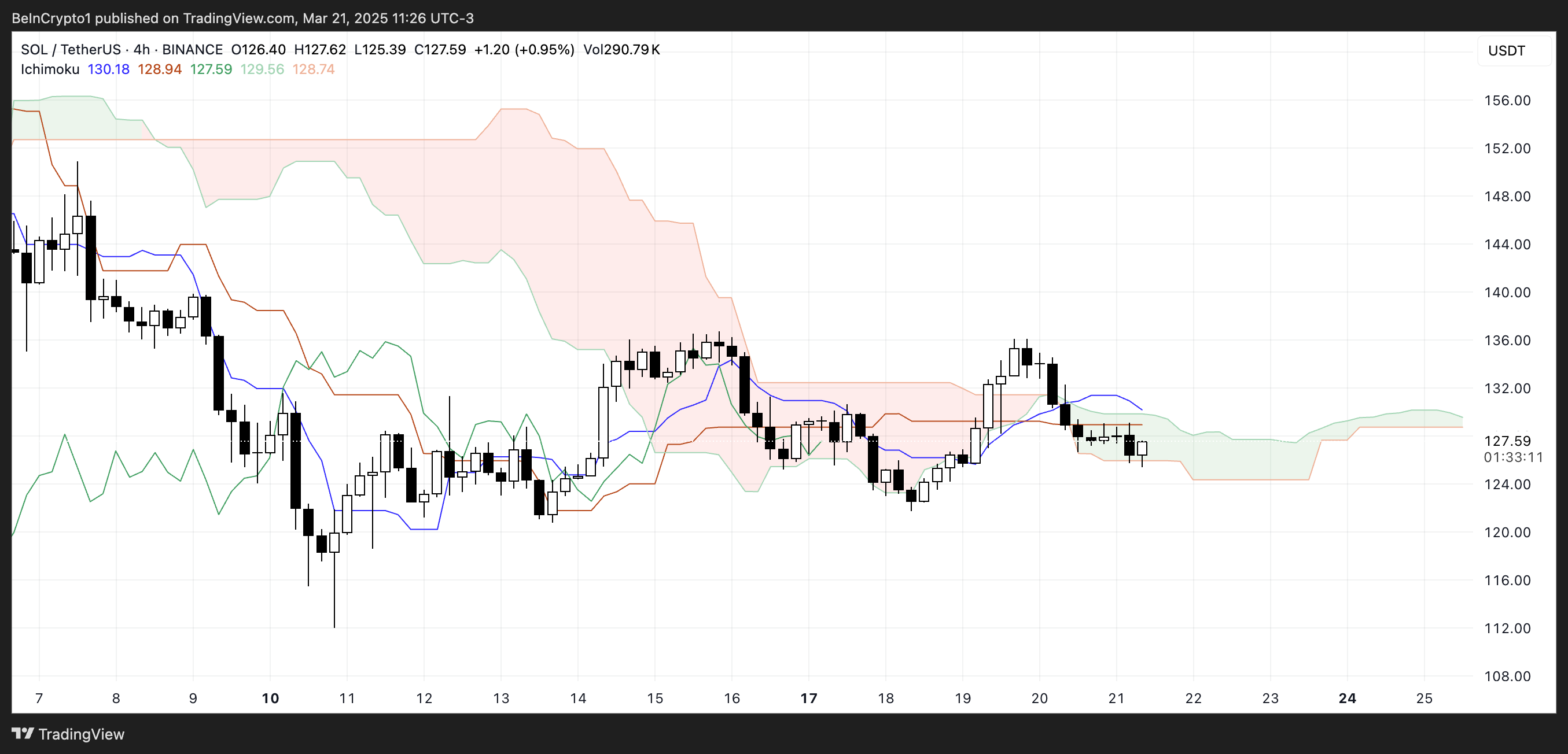

SOL Ichimoku Cloud Shows The Setup Is Turning Bearish

Solana is currently trading below the Ichimoku Cloud, indicating a bearish trend in the short term. The price has fallen under both the Tenkan-sen (blue line) and Kijun-sen (red line), suggesting downward momentum is still in play.

The cloud ahead is thin and flat, signaling weak trend strength and the potential for continued sideways or bearish price action unless buyers step in soon.

Additionally, the Lagging Span (green line) is positioned below both the price and the cloud, reinforcing the bearish sentiment. The price is hovering near the lower boundary of the cloud, which could act as immediate resistance if Solana attempts a rebound.

If sellers maintain control, SOL could face further downside pressure, while a breakback above the cloud would be needed to hint at a possible trend reversal.

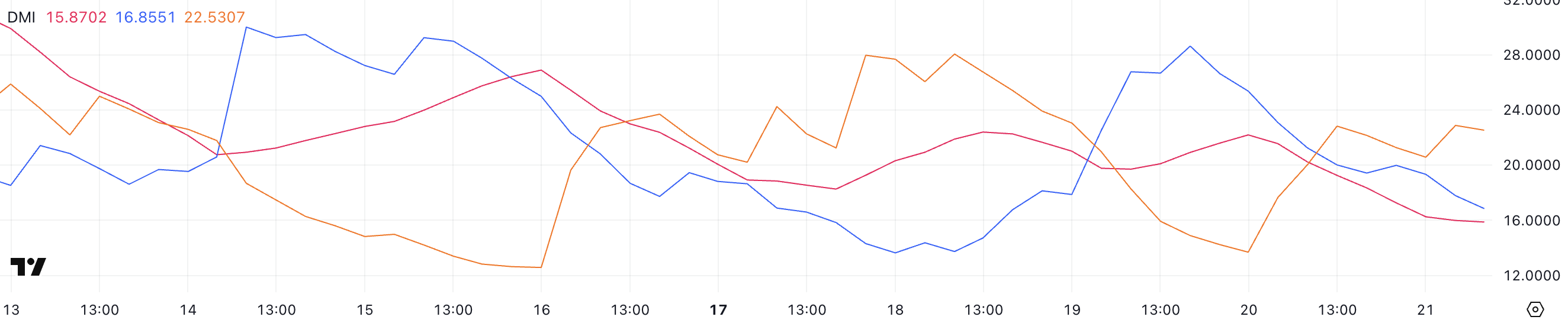

Solana DMI Shows Sellers Regain Control After The Brief Surge

Solana’s DMI chart shows that the ADX has dropped to 15.87 from 22.18 yesterday, indicating a weakening trend.

The Average Directional Index (ADX) measures the strength of a trend, with values above 25 suggesting a strong trend and values below 20 pointing to weak or consolidating price action.

At the same time, the +DI has fallen sharply to 16.85 from 28.62, showing a loss of bullish momentum. Meanwhile, the -DI has risen to 22.53 from 14.88, suggesting growing bearish pressure.

With the -DI now above the +DI and the ADX below 20, Solana could remain under selling pressure or enter a range-bound phase as bears take short-term control.

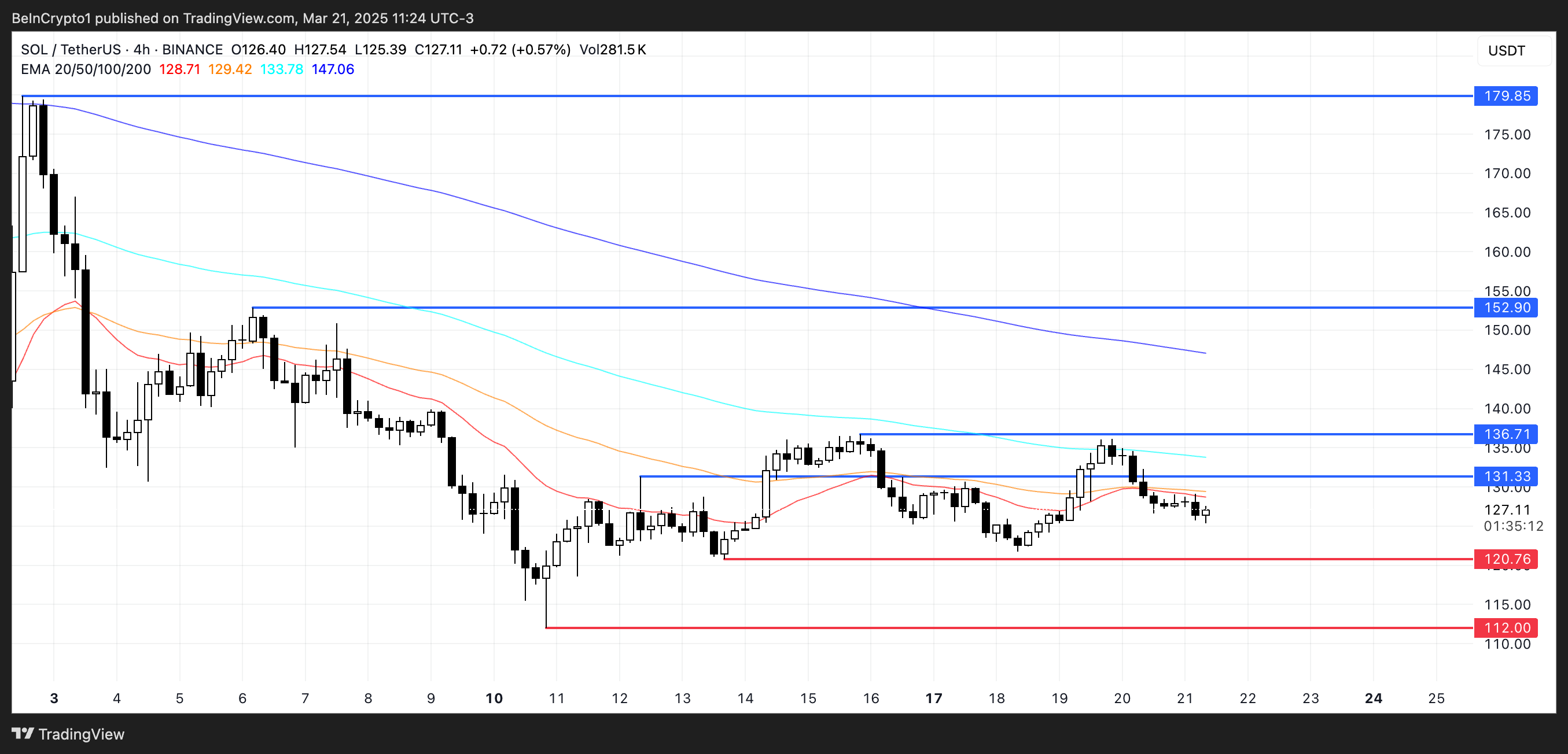

Solana Could Fall Until $112 If Bearish Momentum Intensifies

Solana followed a similar pattern to Bitcoin and Ethereum, briefly rallying between March 19 and 20 before reversing and dropping over 3% in the last 24 hours.

The price is now approaching key support around $120, and a break below this level could trigger a deeper decline toward $112 or even below $110.

Despite the recent corrections, according to Charles Wayn, founder of decentralized Web3 super-app Galxe, told BeInCrypto that Solana’s success shows blockchains need niches:

“As Solana celebrates the arrival of its first futures ETF, it has firmly disproved those who doubted its survival since its launch five years ago. While not becoming the “Ethereum killer” it was touted to be, it has – among other things – emerged as the blockchain for meme coin trading. With $3 billion in daily meme coin trading volume at the peak of the frenzy, Solana’s pump.fun is the largest and highest-grossing meme coin launchpad in the market. Solana has truly found its niche in the crypto market over the last five years – and now it’s time for other blockchains to find theirs.”

He also points out Solana’s success in the meme coins sector:

“Solana’s success in the meme coin sector demonstrates the need for multiple Layer1 blockchains in the crypto ecosystem. Indeed, many competitors have come into the space to challenge Solana as the retail chain, but its dominance in meme coins has kept it popular with new and mainstream users. There will always be faster, cheaper, more composable and more UX-friendly chains – however, specialized Layer1s that focus on a specific aspect of the industry are going to become more prevalent. Crucially, discovering a niche will allow chains to remain competitive and attract developers and users,” says Wayn.

If Solana price manages to regain bullish momentum, it could first target resistances at $131 and $136. It recently tried and failed twice to break that resistance.

A stronger recovery could lead to a rally toward $152.9 and potentially $179.85, which would mark its highest price since early March.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 Bullish AI Coins From This Week

RSS3, JAM, and ALI are the top-performing AI coins of the third week of March 2025. RSS3 and JAM have both surged 78% in the past seven days, while ALI is up 48%.

Combined, they stand out for their strong price action and growing market caps. Here’s a breakdown of why these AI coins are making headlines this week.

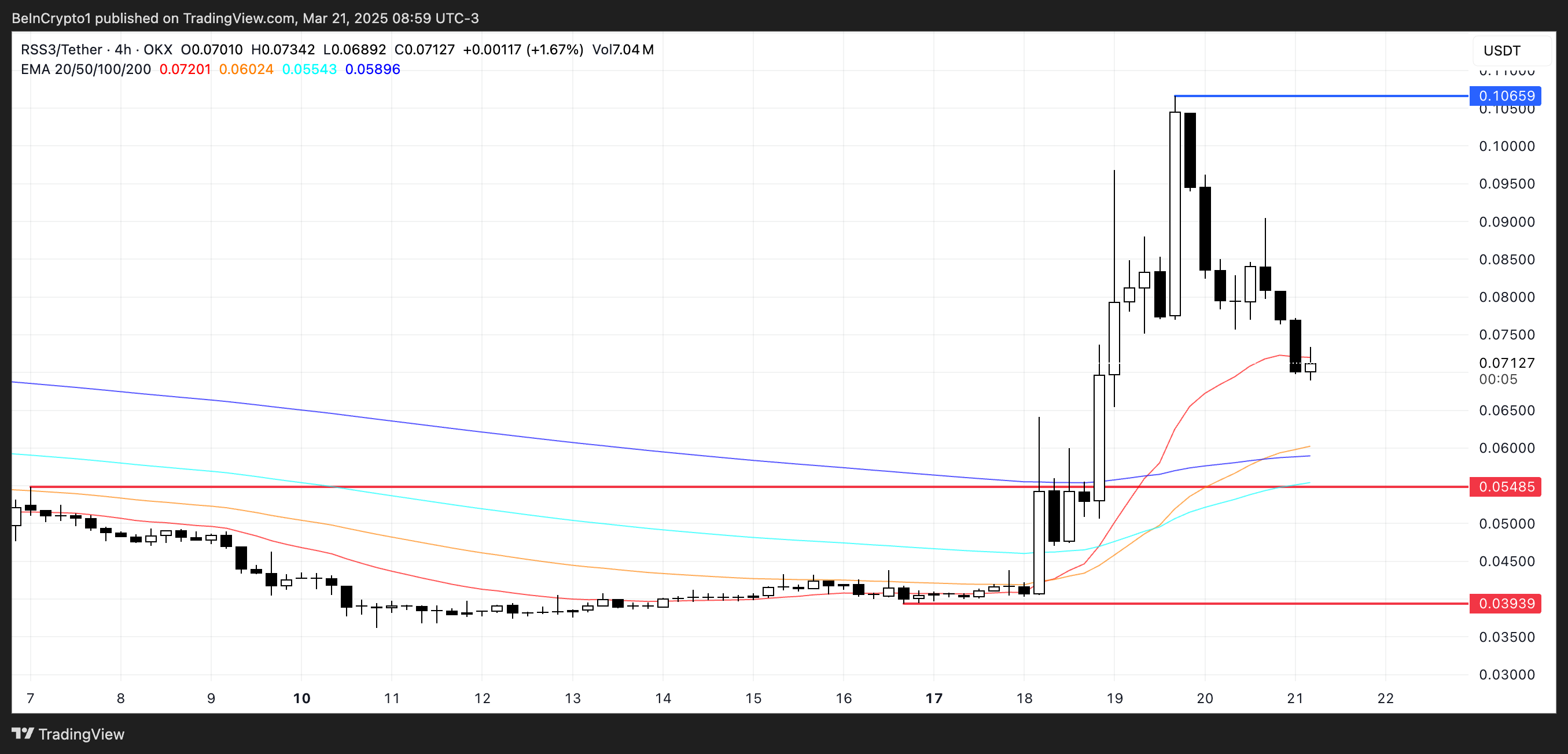

RSS3 has surged over 78% in the past week, pushing its market cap to $51 million.

The strong rally has made it one of the top performers among AI coins, despite the general correction in that sector.

RSS3 is a decentralized network that indexes and structures open information. Inspired by the original RSS, it supports the Open Information Initiative, aiming to power the Open Web and open artificial intelligence.

If momentum continues, RSS3 could retest resistance at $0.106, possibly reaching $0.11 for the first time since January 17. If momentum fades, support sits at $0.054, with further downside risk to $0.039.

JAM

JAM is one of the hottest AI coins on the Base network. It has soared 78% over the past week and reached a market cap of $18 million.

JAM powers JamAI, a platform where users can create AI agents with unique personalities. It combines elements of an AI agents platform and a crypto launchpad, with roots as a creator community on Farcaster.

JAM has been setting fresh all-time highs, and if momentum holds, it could break above $0.0050 and aim for $0.0075. If momentum fades, key support levels sit at $0.0039 and $0.0026.

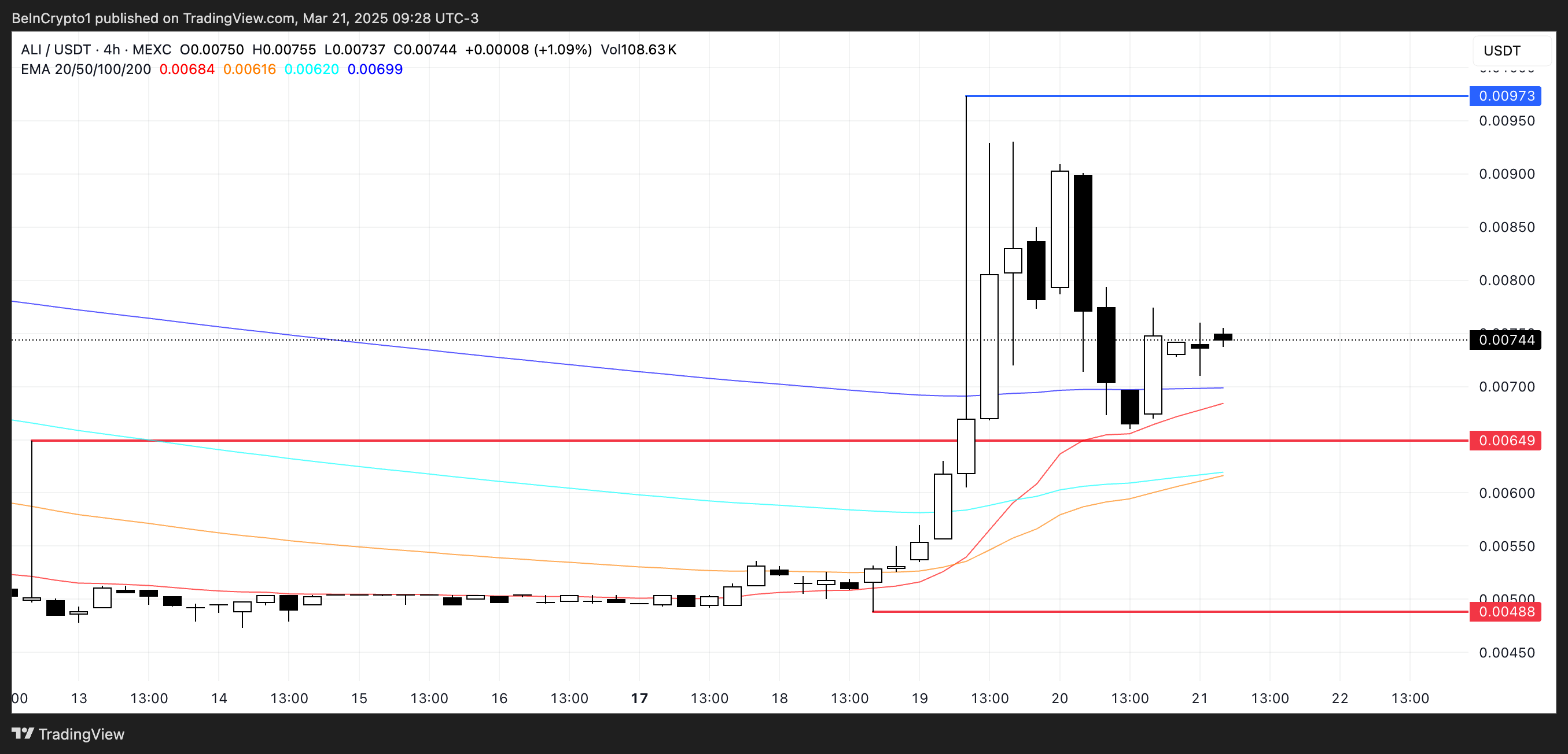

Artificial Liquid Intelligence (ALI)

Artificial Liquid Intelligence is driving several AI-focused crypto projects, including the AI Protocol, which builds a decentralized infrastructure for tokenized AI systems.

The company is also behind Alethea AI and its on-chain agentic AI characters, blending AI with blockchain to create interactive digital personas. Additionally, its ALI Agents Beta is set to launch soon, featuring staking, rewards, and upgraded AI functions.

ALI has gained over 48% in the past week, making it one of the best-performing crypto AI agents coins.

If momentum continues, ALI could push toward $0.0097, with a chance to break above $0.010. However, if a pullback occurs, support levels sit at $0.0064 and $0.0048.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoWhy Is Solana DEX ORCA Price Skyrocketing 170% Today?

-

Altcoin21 hours ago

Altcoin21 hours agoCan Shiba Inu Price Hit $0.01 As SHIB Burn Rate Rockets 500%?

-

Market17 hours ago

Market17 hours agoGerman Regulators Reject Ethena’s USDe MiCA Application

-

Market24 hours ago

Market24 hours agoBitcoin ETFs Battle $5.3 Billion Loss, Recovery Signals Emerge

-

Altcoin16 hours ago

Altcoin16 hours agoAnalyst Predicts XRP Price Could Hit New ATH As Ripple Lawsuit Ends

-

Market23 hours ago

Market23 hours agoXRP Bears Persist Despite SEC Lawsuit Drop

-

Market22 hours ago

Market22 hours agoHBAR Traders Bet On Recovery, But Price Continues Falling

-

Market21 hours ago

Market21 hours agoIs Binance Favoring BNB Chain in Token Listings and Delistings?