Market

Uniswap Foundation Secures $165.5 Million for DeFi Innovation

The Uniswap (UNI) community has voted in favor of two significant governance proposals, allocating $165.5 million to the Uniswap Foundation to stimulate ecosystem development.

This move follows the launch of Uniswap v4 and Unichain earlier this year and has led to an uptick in UNI’s price.

Uniswap Secures Funding Approval for Growth and DeFi Innovation

In a recent post on X, the Uniswap Foundation celebrated the approval of two proposals introduced on February 14 as part of the “Uniswap Unleashed” initiative.

“This marks the beginning of our community’s next era: one that unlocks new opportunities to build, grow and to create and capture value,” the post read.

One of the most significant aspects of the governance decision is that it lays the groundwork for activating the much-anticipated “fee switch.” This mechanism enhances the protocol’s sustainability and rewards UNI token holders. Moreover, it signals a shift toward a more sustainable and rewarding ecosystem.

“These campaigns will lead to other benefits for the Uniswap community. For example, 65% of Unichain net chain revenue is set to be earned by UVN validators and stakers, once the UVN launches,” the proposal noted.

The first proposal outlines the Uniswap Foundation’s strategic priorities for 2025 and beyond. It focuses on four key areas. The first is scaling network supply by optimizing liquidity across active Ethereum Virtual Machine (EVM) chains.

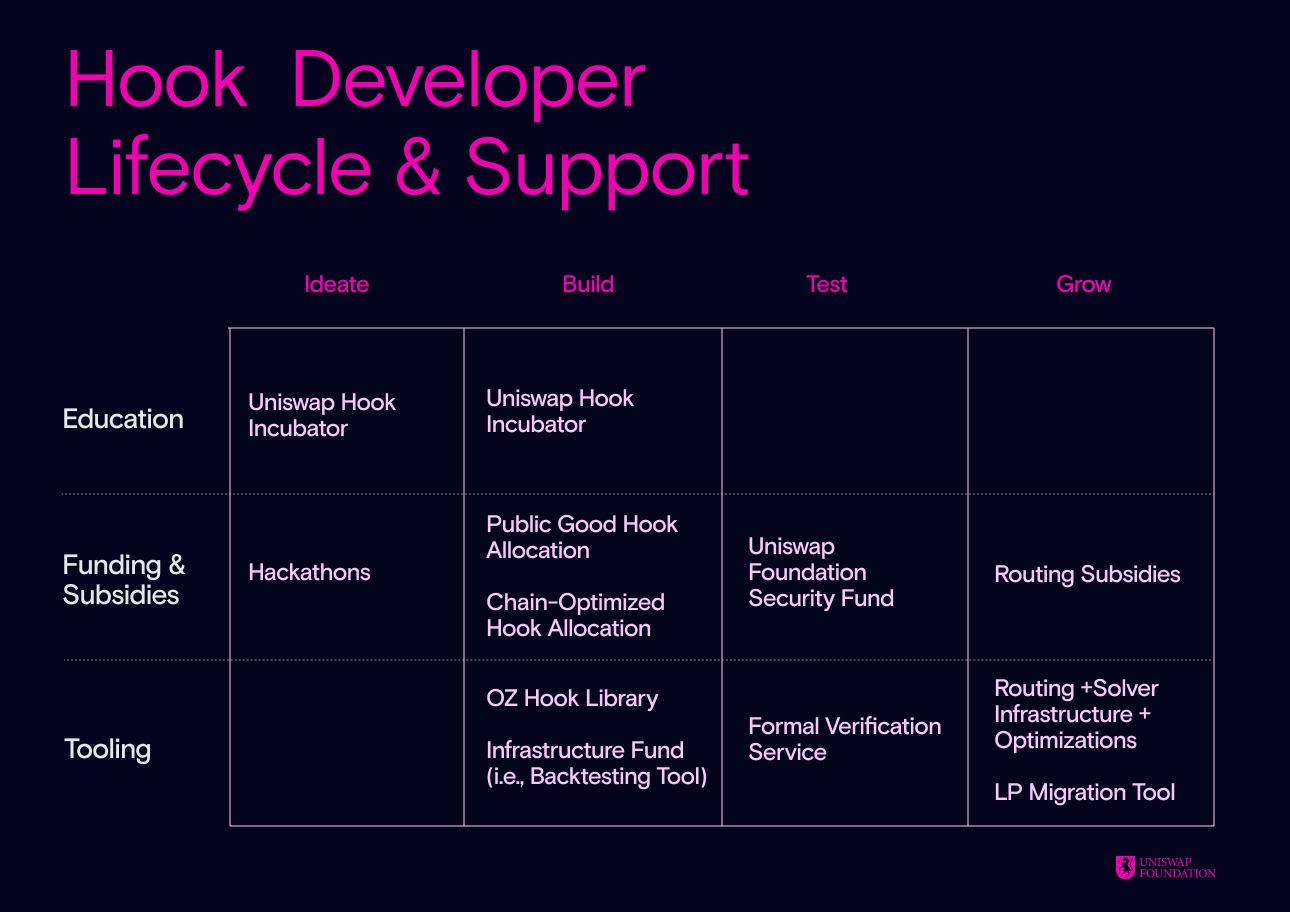

The second priority is scaling network demand by developing platforms that encourage DeFi innovation and attract developers. This includes initiatives such as funding programs, infrastructure development, and educational resources. These aim to support developers throughout the hook development lifecycle.

In addition, the third priority is strengthening governance by activating revenue sources and onboarding new protocol contributors. It emphasizes distributing a portion of Unichain’s net chain revenue to validators and stakers and exploring the creation of a legal entity for governance purposes.

Lastly, the proposal aims to establish a Core Contributor Program. This program will create incentive-aligned development teams to advance the protocol and ecosystem.

The proposal also includes a total investment of $120.5 million, with $95.4 million allocated to the foundation’s grant budget and $25.1 million designated for operational costs.

“It reflects an investment into the success of the Uniswap Protocol and Unichain, and into value for the Uniswap community, and will be backstopped by best-in-industry transparency reporting and an unrelenting drive to create value,” the proposal read.

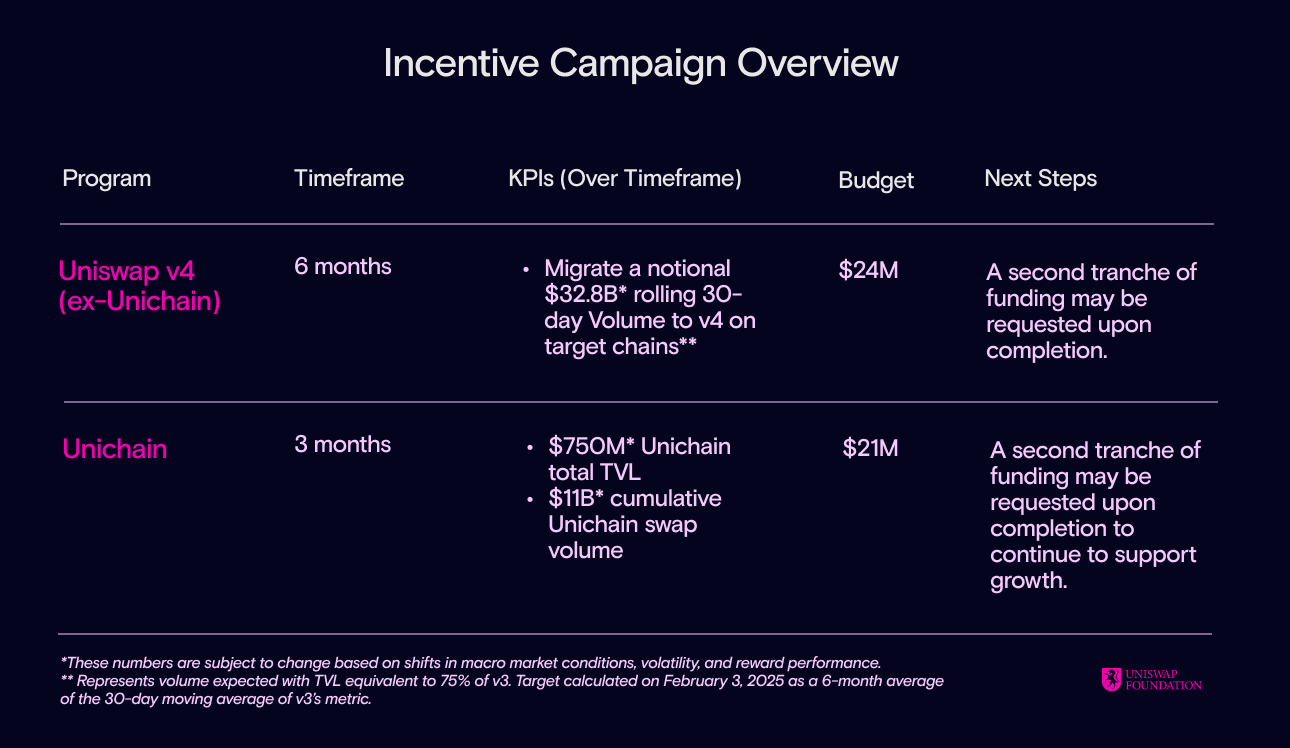

The second proposal, which included input from Gauntlet, focuses on funding two liquidity incentive programs to drive growth for Uniswap v4 and Unichain. Thus, the primary objective is to attract liquidity providers (LPs), swappers, and developers to these platforms, which will play key roles in DeFi’s future. The Uniswap Foundation requested a $45 million budget to support these liquidity incentives.

The Aera platform will be used to ensure full governance control over the funds. This platform will allow Uniswap Governance to recall unused funds if necessary. Gauntlet has already set up an Aera vault on the Ethereum (ETH) mainnet.

Furthermore, with the proposal’s approval, the vault will be resumed. A total of 7,588,532 UNI tokens will be deposited to fund ongoing liquidity incentives.

Meanwhile, UNI reacted positively to the news. According to data from BeInCrypto, its value surged by 7.5% over the past 24 hours.

At press time, UNI was trading at $6.8. Additionally, trading volume saw a remarkable 207.9% spike, further highlighting a substantial increase in activity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Tether Buys $33 Billion US Bonds Amid Forthcoming Regulation

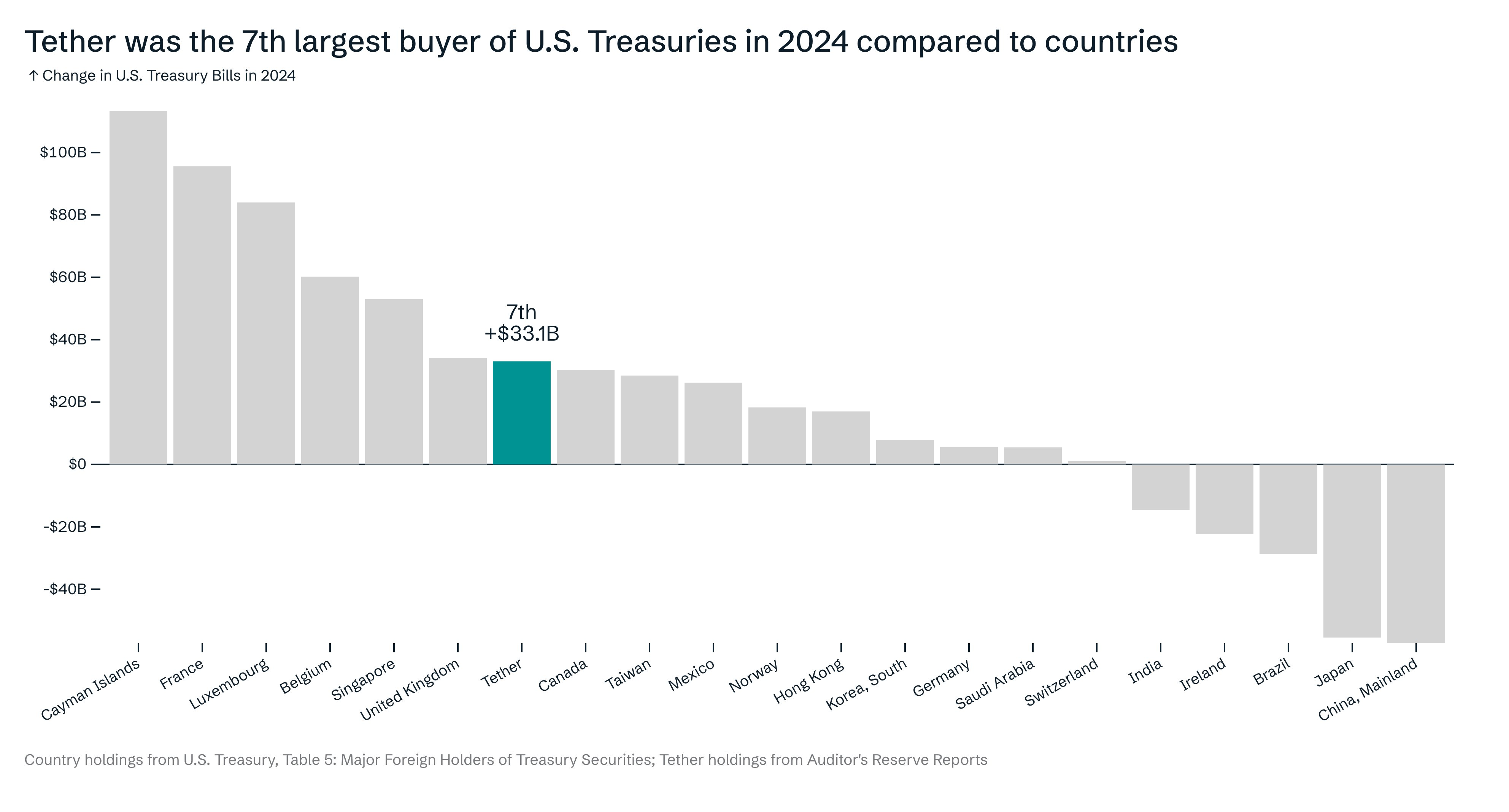

Tether surprised the market by announcing that it purchased over $33 billion in Treasury bonds last year. This makes Tether the seventh-largest buyer of US bonds, ahead of countries like Canada, Mexico, and Germany.

In a speech today, President Trump claimed that stablecoins will be used to promote dollar dominance worldwide. By purchasing these bonds, Tether could be securing an incredibly valuable partnership.

Why is Tether Buying US Treasury Bonds?

Tether, the world’s largest stablecoin issuer, might have a significant opportunity on its hands soon. At the Digital Assets Summit earlier today, President Trump alluded to some big plans for future stablecoin policies in the US.

An important factor in these plans may be that Tether is now one of the world’s largest purchasers of US Treasury bonds:

“Tether was the 7th largest buyer of US Treasuries in 2024, compared to countries. Tether brings the US dollar to more than 400 million people predominantly in emerging markets and developing countries. Without a doubt, Tether built the biggest distribution network for the US Dollar,” Tether CEO Paolo Ardoino said in a pair of social media posts.

This could potentially boost USDT compliance efforts with the forthcoming stablecoin regulation. The proposed GENIUS Act, which is pending congressional approval, requires stablecoin issuers to hold reserve assets in the US, denominated in the US treasury.

So, this purchase could allow Tether to comply with the upcoming US regulation, unlike the EU’s MiCA.

“Insane. Tether has become an essential partner to the United States in less than a decade,” wrote Anthony Pompliano.

In his speech today, President Trump didn’t make many firm commitments about future stablecoin policy. He did, however, claim that dollar-backed stablecoins will “expand the dominance of the US dollar” for years in the future.

If the US government substantially influences the stablecoin market, Tether could be a good conduit for Trump’s partnership.

Could Tether and Trump Drive USD Dominance?

All the proposed stablecoin regulations in the US include a clear demand: issuers must be subject to third-party audits. Tether has never allowed one, although its new CFO supports an audit.

This speed bump has already moved Coinbase to state that it would remove Tether’s products if asked, just like it was pushed out of the EU last December.

However, Tether may be able to solve many of these problems by purchasing Treasury bonds. Among other requirements, the GENIUS Act mandates that stablecoin issuers hold much of their reserves in US Treasuries.

It was previously theorized that Tether may need to sell its Bitcoin due to this regulation, but the fact that the company has been buying treasury bonds changes the speculations.

“Should Congress pass the GENIUS Act, the regulatory clarity might also attract traditional banking firms into the stablecoin ecosystem, fueling healthy competition. The stablecoin market can potentially hit $3 trillion in the next 5 years, a sign that the asset class can dominate the global payment ecosystem in the coming years. The essence of these regulations will be to preserve the hegemony of the US dollar, albeit in a tokenized form such as stablecoins. In the long run, the regulatory clarity will mutually benefit the crypto industry and the US economy,” Agne Linge, Head of Growth at WeFi told BeInCrypto.

Tether has purchased a staggering amount of Treasury bonds in the last year, but this might not guarantee a partnership with Trump and the US government.

Several major banks are eyeing stablecoin launches, and several people in Trump’s orbit allegedly discussed partnering with Binance to launch one, too. So far, there’s no evidence Tether had a similar deal.

Still, Tether purchased over $33 billion in US Treasury bonds in one year, and that’s bound to make an impact. If Trump’s administration decides to use Tether to promote dollar dominance, it could change everything.

It’s too soon to confidently state that such predictions will come true. Tether may still need a third-party audit despite buying these Treasury bonds. Still, if the stars align, its dominant position in the stablecoin market could be supercharged.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CyberCapital’s Justin Bons Slams Pi Network as a Scam

Pi Network is facing renewed scrutiny after Justin Bons, founder of CyberCapital, publicly branded the project a “scam.”

Bons raised concerns about the project’s technology, business model, and tokenomics, arguing that they are deeply flawed and potentially harmful to investors.

Is Pi Network a Scam? Justin Bons Thinks So

In a series of posts on X (formerly Twitter), Bons pointed out several issues with the network. He suggested that contrary to its claims of decentralization, Pi Network remains heavily centralized.

“PI is fully permissioned (centralized) and everything requires KYC, even simple transactions! PI is an investment scam; it is that bad,” he wrote.

Bons also criticized the five-year-delayed mainnet launch, calling the network’s promises of innovation and decentralization misleading. Notably, one of the major claims the executive made was that Pi Network’s core technology was copied from Stellar (XLM).

Despite this, he argued that the absence of a Turing-complete virtual machine (VM) limits Pi Network’s potential for decentralized finance (DeFi), making it a “pipedream.” Moreover, he explained that this renders the network neither scalable nor programmable.

Bons also drew attention to the network’s referral program, which he likened to a Multi-Level Marketing (MLM) scheme. He argued that this system generates unnecessary costs for the network without providing real benefits to users.

Further compounding his concerns, Bons highlighted a Ponzi-like mechanism within Pi Network’s “mining” process. He revealed that the lockup period benefits insiders by inflating the token price, allowing early investors to exit with profits.

Transparency, or the lack thereof, was another significant issue Bons flagged. He criticized the Pi network for not revealing insider token allocations despite enforcing Know Your Customer (KYC) procedures. He noted that insiders might control as much as 20% of the network’s supply, which contradicts the project’s fairness claims.

“PI made it into the top 20 is an embarrassment to our industry,” Bons concluded.

Previously, Bybit CEO Ben Zhou had shared similar concerns, calling PI a scam and describing it as “more dangerous than meme coins.”

Will Pi Coin (PI) be listed on Binance?

Meanwhile, the latest wave of criticism comes amid mounting discontent among pioneers toward Binance. On March 19, the exchange revealed its first batch of Vote to List projects. The list included meme coins associated with the former CEO’s dog and the Mubarak (MUBARAK) token, among others.

Nonetheless, despite Pi Coin (PI) receiving an 86% vote in favor, the community expressed frustration over Binance’s failure to list it.

“Stop acting like some third rate junk exchange and fulfill your promises before you start the next vote. I don’t know if CZ would have behaved like this if he was still at Binance, he wouldn’t be proud of your behavior,” a user wrote on X.

The community has even gone as far as giving Binance a 1-star rating on the Google Play Store. However, this might have worsened PI’s prospects rather than improving them.

“Do not try to pressure us into listing your coin by spreading FUD or negative comments about Binance, or you will be blacklisted,” Binance noted.

The dual blows of Bons’ criticism and Binance’s snub have coincided with a devastating market slump for PI. The token’s price plummeted below $1.0 today for the first time since late February.

Over the past day, PI has declined by 20.1%, with weekly losses extending to 48.7%. At press time, Pi Coin was trading at $0.91. Its ranking has also taken a hit, sliding to 27th place on CoinGecko, a significant drop from its earlier position.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analysts Predict Choppy Price Action

After the FOMC (Federal Open Market Committee) minutes and the digital asset summit on Wednesday and Thursday, respectively, approximately $2.09 billion in Bitcoin (BTC) and Ethereum (ETH) options expire today.

The expiration may influence market conditions, with investors monitoring potential shifts.

Over $2 Billion in Options Expiry Today

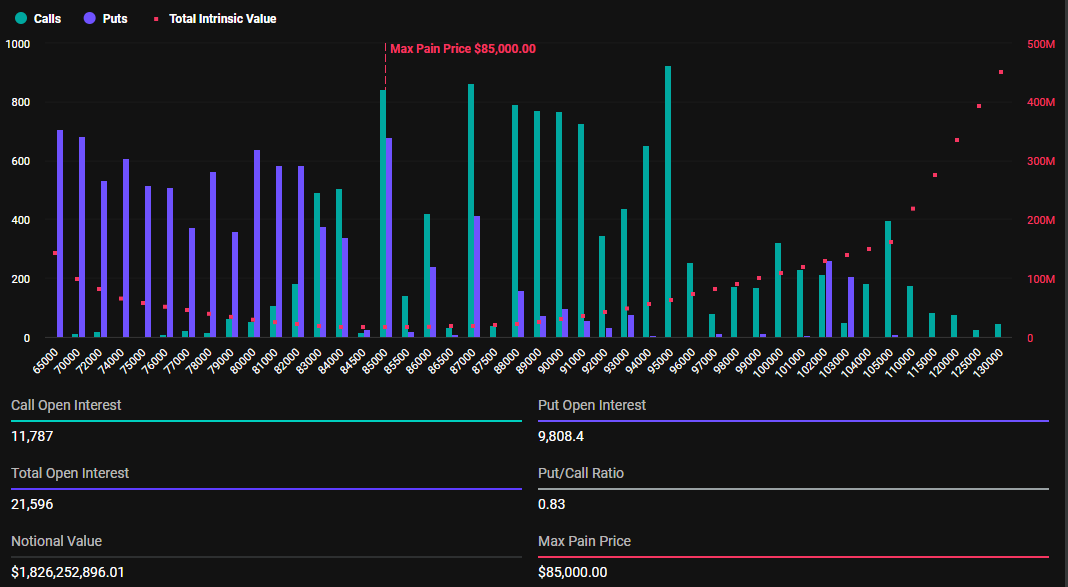

According to Deribit, $1.826 billion in Bitcoin options expire today. The maximum pain point of these contracts stands at $85,000.

These options include 21,596 contracts, slightly fewer than last week’s 35,176. Despite recent volatility, the put-to-call ratio of 0.83 indicates a general bullish sentiment.

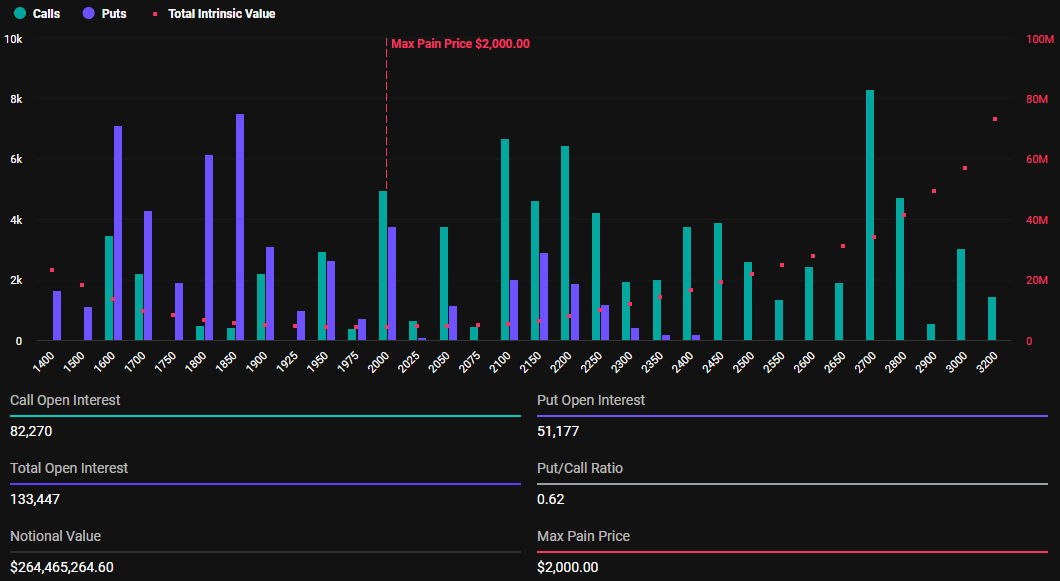

Ethereum has $264.46 million in options expiring, involving 133,447 contracts. This figure is also lower than the previous week’s 223,395 contracts. The maximum pain point for these options is $2,000, and the put-to-call ratio is 0.62.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC traded for $84,414, whereas ETH exchanged hands for $1,977.

This suggests a modest upside for Bitcoin and Ethereum towards the $85,000 and $2,000 strike prices, respectively. This surge is plausible given smart money’s Strategy in options trading, pushing prices toward the “max pain” level. Here, the highest number of contracts, both calls and puts, expire worthless.

“Will we see a volatility squeeze or a slow unwind?” Deribit posed in a post on X (Twitter).

Based on Bitcoin and Ethereum’s put-to-call ratios, both below 1, call options (purchases) have a higher prevalence than put options (sales).

Market Sentiment Ahead of Today’s Options Expiry

Analysts from crypto options trading tool Greeks.live provided insights on the current market sentiment, highlighting a divided trader community. On the one hand, some expect a price drop after the FOMC meeting, as policymakers rejected further interest rate cuts, effectively disappointing the crypto market.

On the other hand, some anticipate a temporary rise before choppy conditions. With this, the analysts note the range between $83,000 and $85,000 as the area of interest, with expected volatility around President Trump-related developments and potential MicroStrategy (now Strategy) purchases.

“Expect chop and drift lower before heading higher again on Monday, despite the current pump not being viewed as sustainable,” Greeks.live analysts observed.

Elsewhere, BeInCrypto reported that Bitget exchange CEO Gracy Chen is confident BTC will hold above the $73,000 to $78,000 range, paving the way for a potential rally to $200,000. She attaches her optimism to the US strategic Bitcoin reserve’s potential to drive institutional legitimacy and long-term price stability.

Even as Bitget’s Chen remains optimistic, traders and investors should brace for short-term volatility. Historically, options expirations tend to cause temporary price movements. However, the market usually stabilizes shortly after.

This calls for vigilance and analysis of technical indicators and market sentiment to manage potential volatility effectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoWill Bitcoin Benefit from DXY Decline After FOMC’s Latest Move?

-

Market15 hours ago

Market15 hours agoWhy $2.66 Is The Most Important Level To Beat

-

Market23 hours ago

Market23 hours agoHow CEXs Are Blending with DEXs

-

Market19 hours ago

Market19 hours agoPakistan Moves to Legalize Cryptocurrency with Clear Regulations

-

Market17 hours ago

Market17 hours agoTrump’s Digital Asset Summit Speech Talks Stablecoins

-

Market16 hours ago

Market16 hours agoKey Indicators Suggest Short-Lived Gains

-

Market20 hours ago

Market20 hours agoBFI Allocates $90 Million to Healthcare & Climate Action with Crypto

-

Market18 hours ago

Market18 hours agoStablecoins Adoption Challenges: Transparency As A Barrier