Market

Hyperliquid (HYPE) Might Hit $20 Amid Potential Golden Cross

Hyperliquid (HYPE) is showing strong technical signals across multiple indicators, with the token surging more than 15% in the last 24 hours. The platform continues to demonstrate impressive market performance, generating $47 million in fees over the past 30 days and outperforming major blockchain networks like Ethereum and Solana.

Technical indicators suggest a potential golden cross formation, meaning HYPE could test $21 or even $25.80 in the coming period.

Hyperliquid Revenue Places It Among Top Protocols In Crypto

Hyperliquid is currently one of the most successful protocols in crypto. Over the past 30 days, it has generated an impressive $47 million in fees and recently reached $1 trillion in perps volume.

While this places it behind major players such as Jito, Pumpfun, and PancakeSwap in terms of monthly revenue, Hyperliquid has surpassed significant blockchain apps and chains, including Solana, Ethereum, Raydium, and Phantom.

What makes Hyperliquid’s success particularly remarkable is that, unlike most other high-performing protocols that operate on established blockchain networks such as BNB, Solana, or Ethereum, Hyperliquid functions as its own independent chain.

With the exception of Tron, virtually all other major protocols rely on parent blockchains, whereas Hyperliquid has achieved its substantial revenue figures as a standalone entity.

Despite this impressive performance and unique positioning, HYPE has experienced considerable downward price pressure recently, trading below the $20 threshold for sixteen consecutive days, creating a notable disconnect between the protocol’s operational success and its market valuation.

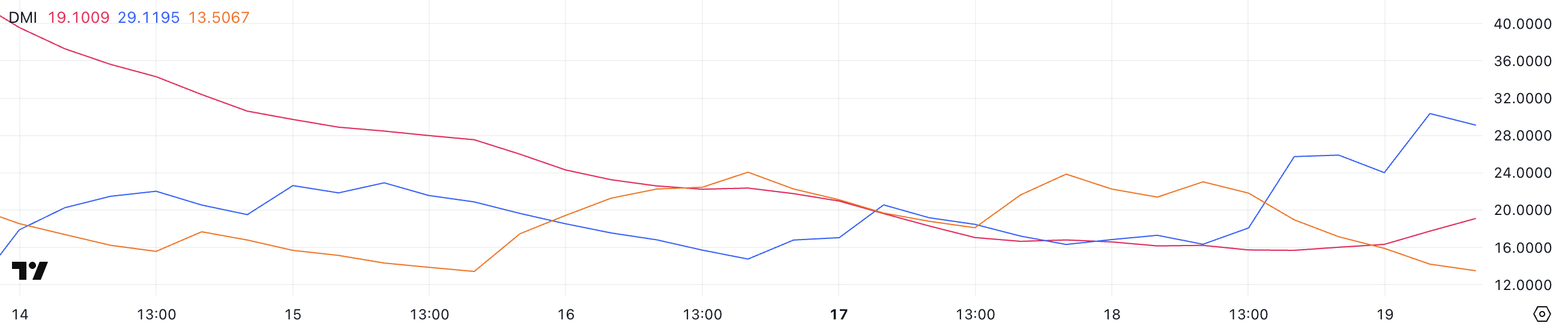

HYPE DMI Shows Buyers Are In Control

The HYPE DMI (Directional Movement Index) chart shows promising momentum shifts, with the ADX (Average Directional Index) rising from 15.7 to 19, suggesting a strengthening trend conviction.

More significantly, the +DI (Positive Directional Indicator) has surged from 18 to 29.1, while the -DI (Negative Directional Indicator) has declined from 21.8 to 13.5. This crossover pattern, where +DI rises above -DI, typically signals a potential bullish reversal.

The increasing spread between these indicators and the rising ADX suggests that buying pressure is overcoming selling pressure, potentially setting the stage for HYPE to break above its recent sub-$20 trading range.

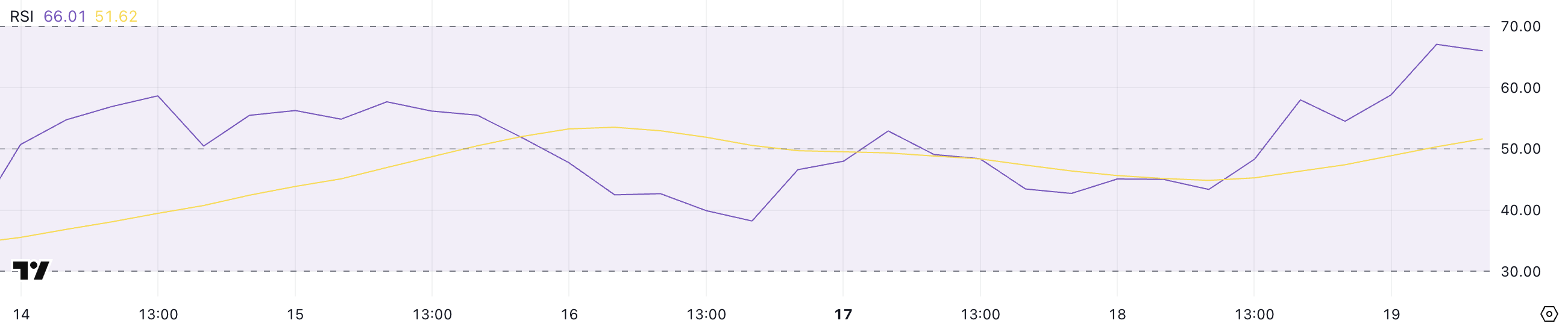

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Readings above 70 are typically considered overbought, and below 30 are considered oversold.

HYPE’s RSI climbing from 54.5 to 66 indicates growing bullish momentum that hasn’t yet reached extreme levels. This uptick suggests strengthening buyer interest while remaining below the overbought threshold of 70.

The fact that HYPE hasn’t reached overbought levels since December 2024 implies there may still be room for price appreciation before any potential pullback.

Together with the DMI indicators, this RSI reading reinforces the possibility of continued upward movement in HYPE’s price in the near term.

Will Hyperliquid Rise Above $20 This Week?

The HYPE Exponential Moving Average (EMA) lines are converging toward a potential golden cross formation, which occurs when a shorter-term moving average crosses above a longer-term one.

This technical pattern typically signals a strong bullish momentum shift that could propel HYPE to test its immediate resistance level at $17. Should buyers successfully break through this threshold, the path would open for HYPE to climb toward the $21 mark.

In scenarios where exceptional buying pressure materializes, Hyperliquid could extend its gains to challenge the significant resistance level at $25.80, representing a substantial recovery from its recent sub-$20 trading range.

Conversely, if the anticipated uptrend fails to materialize and bearish sentiment prevails, HYPE could experience renewed downward pressure, forcing it to test the critical support level at $12.43.

The importance of this support cannot be overstated, as a breach below this floor could trigger accelerated selling, potentially pushing HYPE under the psychologically significant $12 level for the first time since December 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Onyxcoin (XCN) Drops 40% In March as Bears Take Over

Onyxcoin (XCN) has been under significant selling pressure, correcting by 9.4% over the last seven days and plunging by 43% in the past 30 days.

The downtrend has left XCN struggling to regain its footing as technical indicators continue to point toward a bearish market structure. Despite short-lived attempts at recovery, the asset has remained weighed down by persistent bearish momentum.

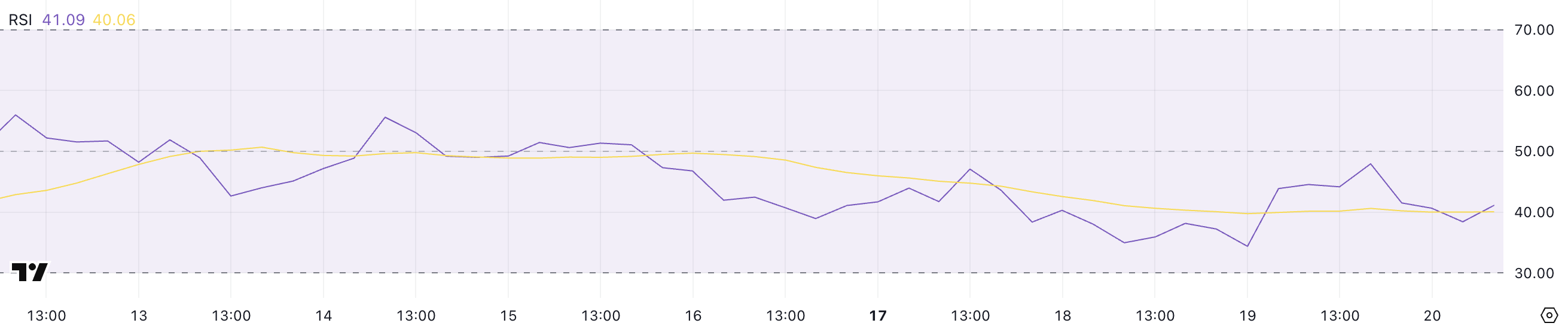

Onyxcoin RSI Has Been Below 50 For Almost 5 Days

Onyxcoin RSI is currently sitting at 41.09, marking a decline from yesterday’s level of 47.95. This drop indicates that bearish momentum has been gaining ground over the past 24 hours, pushing the RSI further away from the neutral 50 mark.

Since March 15, XCN’s RSI has remained consistently below 50, signaling that the asset has been under persistent selling pressure.

The continued weakness reflected in the RSI suggests that bulls are struggling to regain control, keeping the price in a bearish or consolidative phase.

The RSI (Relative Strength Index) is a momentum oscillator that measures the speed and magnitude of recent price changes to evaluate overbought or oversold conditions.

Typically, an RSI above 70 signals that an asset might be overbought and due for a pullback, while an RSI below 30 indicates that the asset could be oversold and might see a bounce. With XCN’s RSI at 41.09 and stuck below 50 for several days, it suggests the market remains tilted toward bearish sentiment.

While it’s not yet in oversold territory, the ongoing sub-50 readings highlight the lack of bullish momentum and could imply continued sideways or downward movement unless buyers step in to reverse the trend.

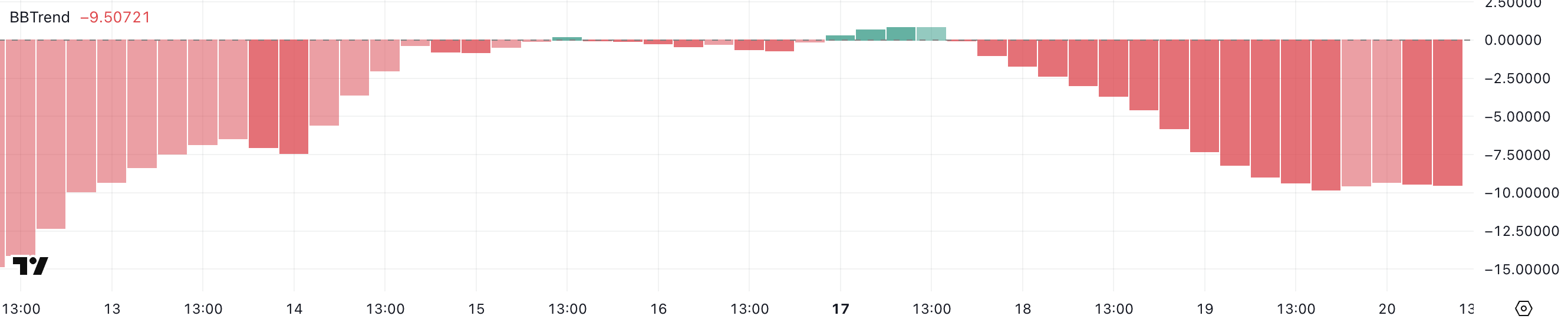

XCN BBTrend Shows Selling Pressure Is Still Here

Onyxcoin BBTrend is currently at -9.5 and has remained in negative territory for the past two days, signaling a bearish environment.

Earlier, on March 17, BBTrend briefly turned positive at 0.83 but failed to sustain upward momentum, quickly reverting back below zero. This inability to maintain positive readings suggests that bullish attempts have been weak and short-lived, reinforcing the notion that sellers continue to dominate the market.

The deepening negative value of the BBTrend reflects ongoing pressure on XCN’s price, keeping it under strain.

The BBTrend, or Bollinger Band Trend indicator, measures price trends based on the positioning of price action relative to the Bollinger Bands.

When BBTrend values are above zero, it indicates that the price is trading above the midline (typically the 20-period moving average), suggesting bullish momentum. Conversely, negative values point to prices trending below the midline, indicating bearish momentum.

With XCN’s BBTrend at -9.5 and struggling to establish positive values, it signals that the asset continues to lack strong bullish pressure, leaving the price vulnerable to further downside or prolonged consolidation.

Will Onyxcoin Fall Below $0.010 In March?

Onyxcoin EMA lines are showing a bearish configuration, with short-term moving averages positioned below the long-term ones.

This alignment suggests that downward momentum is prevailing, increasing the likelihood of further price declines. If XCN continues to trend lower, it could fall below the key support at $0.010, a level not seen since January 17.

However, if Onyxcoin manages to regain the strong bullish momentum it demonstrated at the end of January – when it became one of the best-performing altcoins in the market – it could reverse this setup.

In that case, XCN might challenge resistance levels at $0.014 and $0.020, with the potential to climb as high as $0.026 if buyers step in aggressively.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Here’s Why XRP Holders Will Likely Drive Price To $3.00

XRP has been attempting a recovery recently, showing positive price movement. The surge is fueled by a shift in investor sentiment, with many holders now taking a more bullish stance toward the altcoin.

This change is likely to drive the price higher, possibly targeting the $3.00 mark.

XRP Holders Seem Bullish

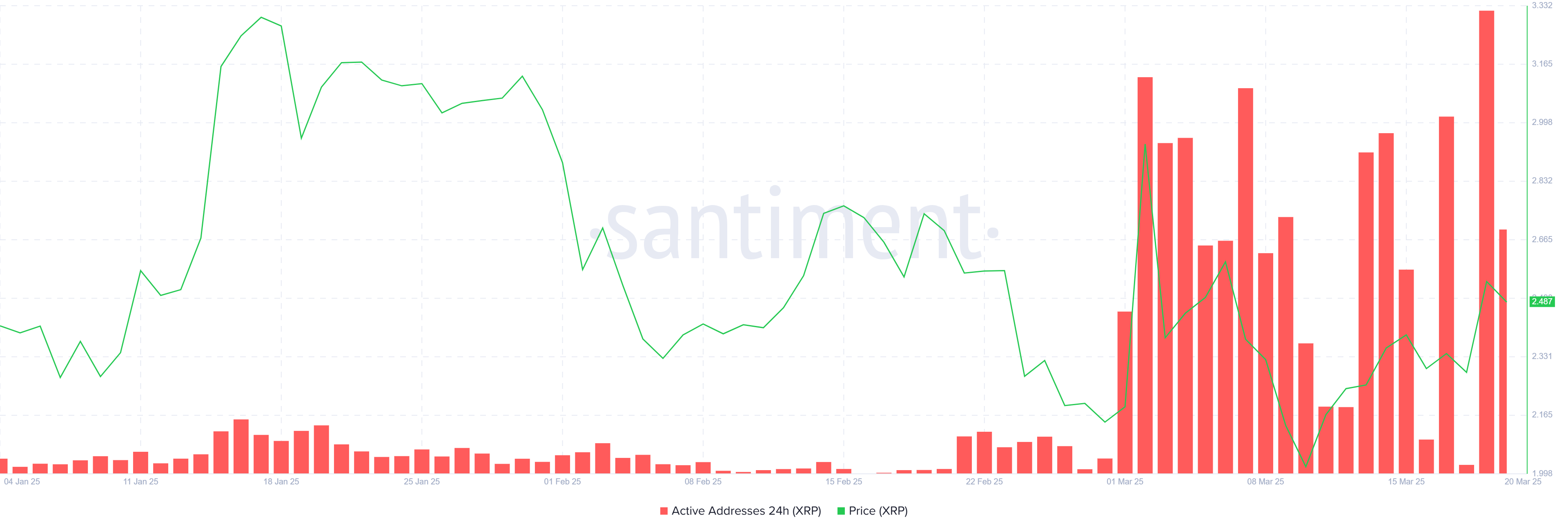

Active addresses on the XRP network have remained notably high throughout March, signaling increased investor engagement averaging at 363,000. This consistent activity is a clear indication that investor sentiment has shifted positively compared to January and February.

The growth in active addresses reflects stronger support for the altcoin as more participants continue to engage with the network. As the demand for XRP increases, this heightened engagement could push the price to higher levels.

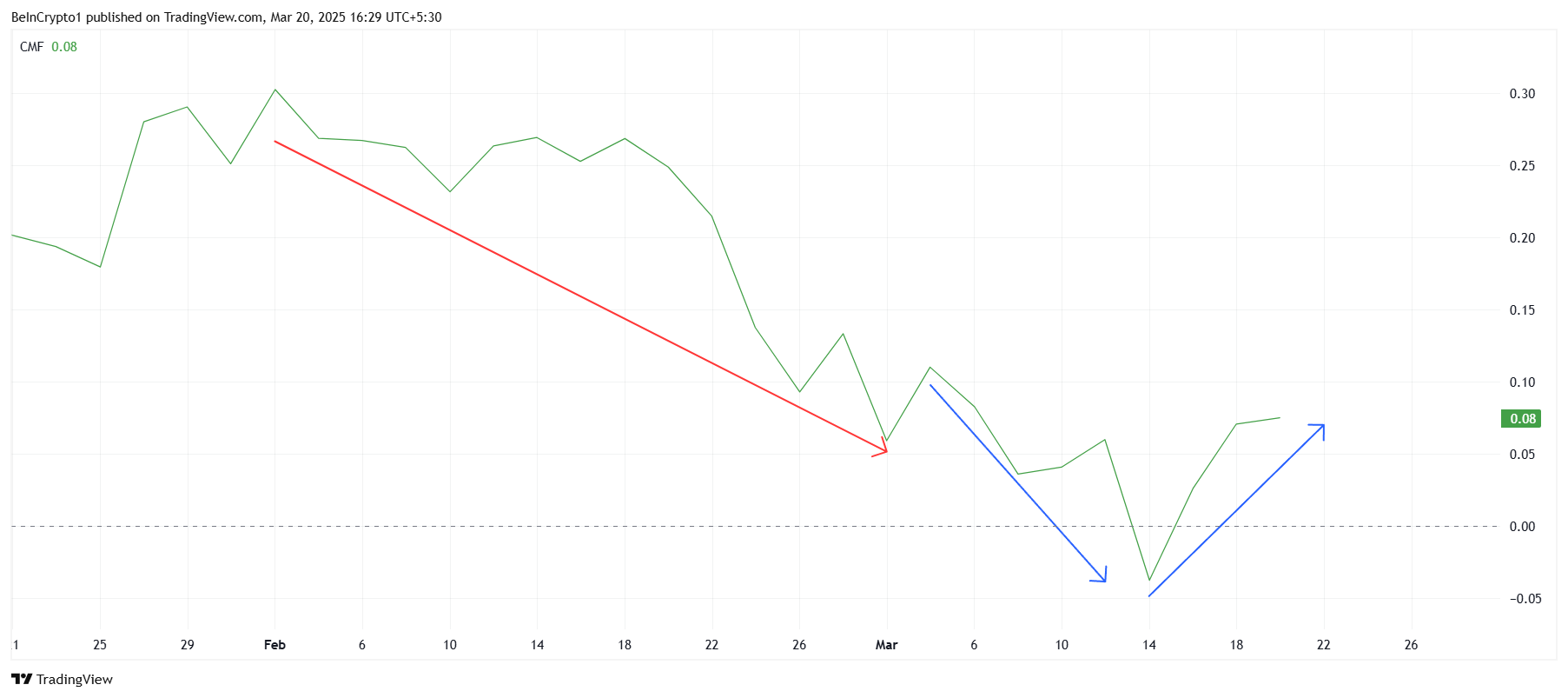

The Chaikin Money Flow (CMF) indicator shows a clear shift in investor behavior. While March began with significant outflows, the trend reversed as investors poured money back into XRP. This positive change comes after a month of outflows in February, reflecting a shift towards accumulation.

As market conditions fluctuate, XRP investors have shown resilience, continuing to buy into the asset despite external volatility. The increase in capital inflows suggests that the market is stabilizing, with XRP gaining support from those confident in its future. This shift in momentum offers XRP room to grow and continue its upward trajectory.

XRP Price Faces Resistance

XRP price is trading at $2.48 today, marking a 22% increase over the last ten days. The altcoin is now testing the resistance at $2.56, a level it has struggled to surpass in the past. Given the positive market sentiment and increased investor participation, XRP could break through this barrier.

If XRP manages to flip the $2.56 resistance into support, the next target will be $3.00. Overcoming the $2.95 resistance would pave the way for further gains, with the price potentially climbing towards the $3.00 mark. The current bullish momentum supports this outlook as investors appear ready to push the price higher.

However, if XRP fails to breach the $2.56 resistance, it could face a pullback to $2.27. Losing the support at $2.27 would invalidate the bullish outlook, sending the price down to $2.14.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BNB Chain Overtakes Solana in Weekly DEX Trading Volume

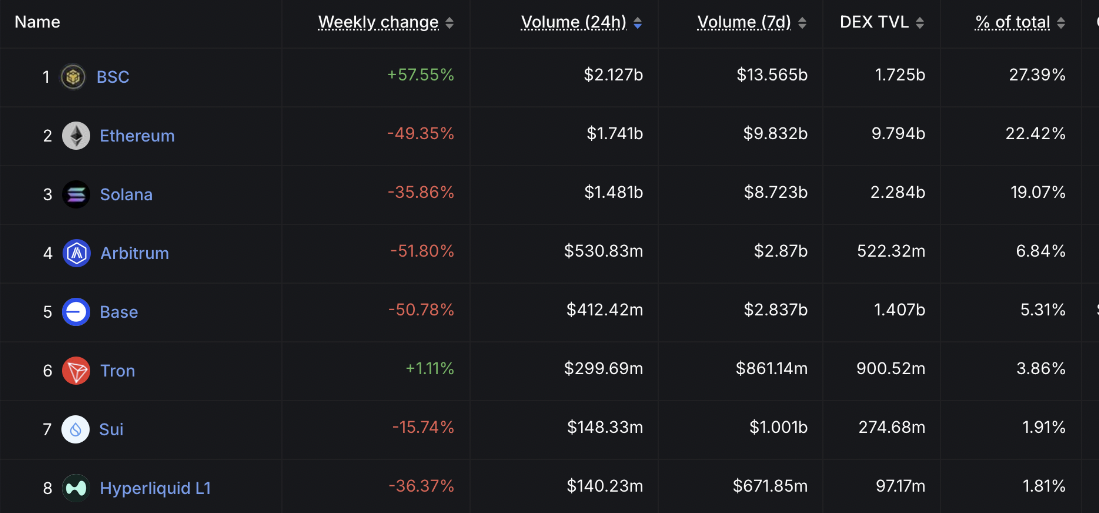

BNB Chain, the blockchain ecosystem previously associated with Binance, has shot to the top of the DEX market, overtaking Ethereum and Solana.

Over the past week, BNB Chain has been leading in trading volume and fee generation, showing strong growth despite broader market doldrums. The network exclusively discussed this milestone with BeInCrypto today.

Is BNB Chain Overtaking Solana in the DEX Market?

Decentralized exchanges have seen heightened activities in the past few months, mostly driven by meme coins and speculative trading. Solana has been by far the most popular network for DEX activities. However, in the past week, the BNB chain has threatened Solana’s dominance.

“For six consecutive days, since March 15, DEXs built on BSC have accounted for over 30% of the total DEX market share, outpacing other chains and reinforcing BNB Chain’s position in the DeFi space,” the firm claimed in an exclusive press release shared with BeInCrypto.

The network has seen several positive developments recently, such as expanding into RWA tokenization and AI integration. Yet, BNB’s success in the DEX segment has been crucial, as it shows that traders’ preferences might be shifting.

Earlier today, meme coins on BNB significantly boosted its DEX volume, helping explain where some of this dominance comes from. It seems that the network is slowly building credibility among the meme coin community.

Just yesterday, Binance opened a community vote to determine the exchange’s future token listings. The candidates in this first vote were all built on its blockchain, and some of these, such as Mubarak, are looking at huge price rallies.

Binance claimed that BNB Chain has earned more than $1.6 million in fees daily since March 17. This puts the ecosystem ahead of BTC in terms of growth rate over the last week.

This growth is more impressive because it took place despite bearish market signals.

Still, not everything is looking rosy for BNB Chain, even in the meme coin market. Earlier today, blockchain security firm SlowMist identified a critical exploit vulnerability on four.meme, a token launch pad in BNB’s ecosystem.

Some have worried that this may discourage investors from this whole category of DEXs.

However, PancakeSwap, another BNB-based DEX, is still going strong. Earlier this month, it posted $80 billion in monthly volume and credited BNB Chain’s recovery for this activity boom.

Changpeng “CZ” Zhao, former CEO of Binance, also created a meme coin rally by revealing his BNB holdings last month. All these factors signal strong market confidence.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoWhen Will Bitcoin (BTC) Break to New All-Time Highs?

-

Altcoin23 hours ago

Altcoin23 hours agoBrad Garlinghouse Predicts XRP Will Be Included In Digital Asset Stockpile

-

Regulation22 hours ago

Regulation22 hours agoPresident Trump To Address Crypto Summit Amid Bitcoin Reserve Strategy

-

Ethereum21 hours ago

Ethereum21 hours agoEthereum’s Price Action Paints One Of Its Worst Charts Ever, What Comes Next For ETH?

-

Market14 hours ago

Market14 hours agoNinjaTrader Could Become Part of Kraken in $1.5 Billion Deal

-

Market19 hours ago

Market19 hours agoTop 3 BNB Meme Coins to Watch Closely This Week

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveal XRP Price Path To $5 as Ripple Vs SEC Lawsuit Ends

-

Market20 hours ago

Market20 hours agoPi Network Pioneers Allege Bot Activity on CoinMarketCap