Market

When Will Bitcoin (BTC) Break to New All-Time Highs?

Bitcoin (BTC) is showing signs of a potential turnaround despite recent volatility, as key on-chain indicators and institutional flows point to improving sentiment. The Mayer Multiple remains below 1, hinting at undervaluation.

Meanwhile, institutional confidence appears to be returning, with BlackRock’s recent 2,660 BTC purchase marking the largest inflow into its Bitcoin ETF in six weeks. As the market stabilizes and adapts to macroeconomic pressures, Bitcoin’s path to new highs is beginning to take shape.

BTC Mayer Multiple Is Still Below 1

Bitcoin’s Mayer Multiple is currently sitting at 0.98, slightly above its recent low of 0.94 recorded on March 10.

This reading suggests that Bitcoin is still undervalued relative to its historical norms, as it continues to trade below its 200-day moving average.

The indicator has been hovering below the 1.0 mark for much of the recent consolidation period, raising questions about when BTC might regain enough momentum to push toward new highs.

The Mayer Multiple measures the ratio of Bitcoin’s current price to its 200-day moving average, providing insights into whether the asset is overextended or undervalued.

Historically, values below 0.8 tend to signal that Bitcoin is heavily discounted and could be in a long-term accumulation zone, while levels above 2.4 often indicate overheated, euphoric conditions.

With the current reading at 0.98, Bitcoin is approaching a neutral-to-bullish threshold.

The last time the Mayer Multiple dipped to 0.84, Bitcoin quickly rallied from $54,000 to $65,000 in just two weeks. It later stabilized between 1.2 and 1.4 before ultimately surging past $100,000 for the first time.

While history doesn’t always repeat, this current setup could be an early sign that Bitcoin is building the foundation for its next major leg higher.

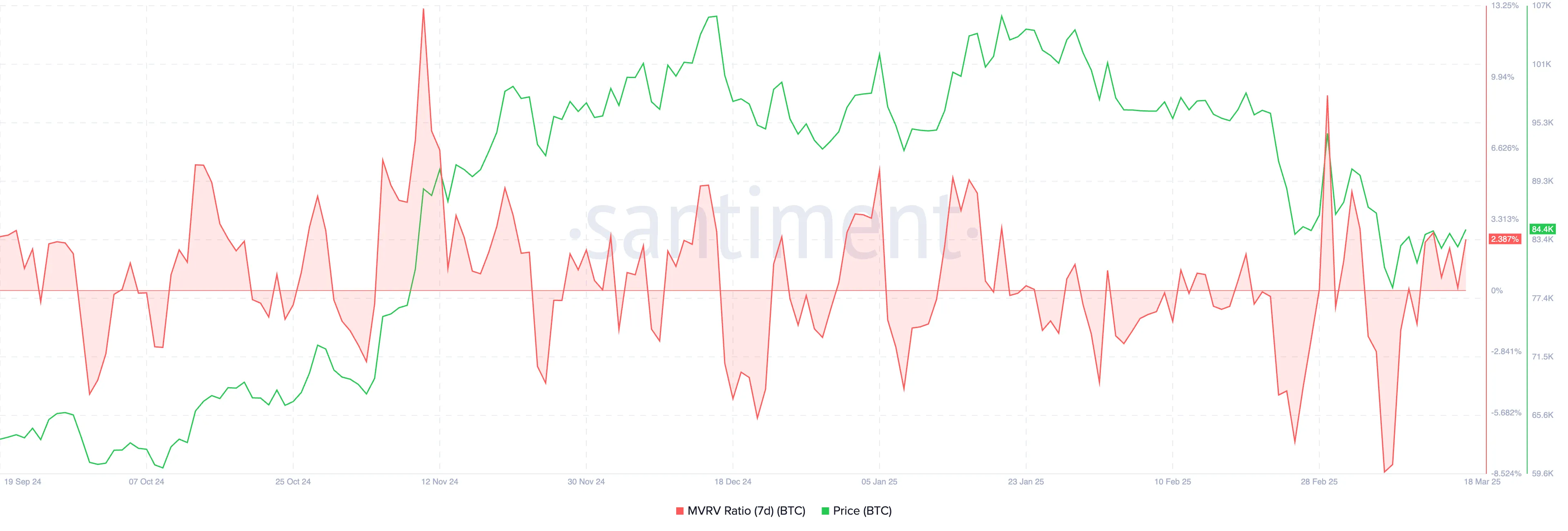

Bitcoin MVRV Brings An Important Threshold

Bitcoin’s 7-day MVRV (Market Value to Realized Value) ratio has climbed to 2.38%, recovering from a recent low of -8.44% on March 8.

This rebound signals that short-term holders are beginning to see modest profits, but historical patterns suggest that stronger price momentum usually follows once the 7D MVRV crosses above the 5% mark.

At its current level, BTC still appears to be in a transition phase. Sentiment is shifting, but it hasn’t fully flipped into a bullish breakout scenario.

The 7D MVRV measures the ratio between Bitcoin’s market value and the average price paid by short-term holders (typically those who acquired BTC in the last 7 days). When the ratio is negative, it indicates these holders are underwater, while positive readings imply they are sitting on profits.

Historically, BTC tends to gain upward momentum when the 7D MVRV moves beyond +5%, as it suggests confidence among short-term participants is returning. Given that BTC is still below this threshold, it may need further accumulation or consolidation before it can convincingly push toward creating new highs.

If the ratio continues to climb and surpass 5%, that could trigger renewed bullish activity and a potential breakout toward fresh all-time highs.

Will Bitcoin (BTC) Create New Highs Soon?

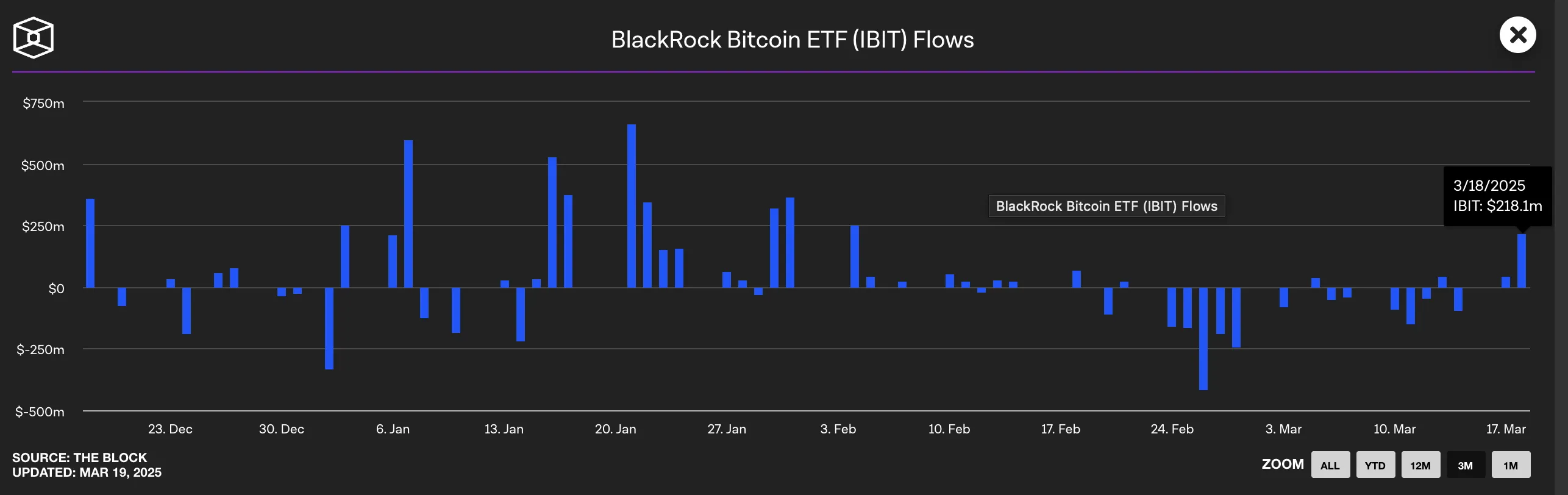

Despite Bitcoin’s 11.4% decline over the past 30 days, institutional bullish sentiment appears to be back, with BlackRock signaling renewed confidence in BTC.

The world’s largest asset manager recently added 2,660 Bitcoin to its iShares Bitcoin Trust (IBIT), marking the biggest inflow into the fund in the past six weeks.

This significant buy comes after a period of uncertainty in IBIT flows since early February, suggesting that institutions are once again positioning for potential upside as market conditions evolve.

BlackRock’s latest buy could signal a broader shift in sentiment as big players overlook short-term volatility and refocus on Bitcoin’s long-term value.

Institutional interest is picking up again while the market slowly adapts to macro pressures like Trump’s proposed tariffs.

Despite the lingering uncertainty, Bitcoin price setup for new highs is growing stronger as confidence returns. If macro conditions stabilize, Bitcoin could be ready for another push higher soon.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pakistan Moves to Legalize Cryptocurrency with Clear Regulations

Pakistan, the world’s fifth most populous country, is developing a clear regulatory framework to legalize cryptocurrency trading. The government aims to attract foreign investment and expand the country’s digital ecosystem.

This decision signals a major shift in how the government regulates crypto.

What Is the Current State of Crypto Adoption in Pakistan?

Pakistan wants to create clear rules for digital assets to strengthen its local crypto ecosystem. Bilal bin Saqib, CEO of the Pakistan Crypto Council, explained this in an interview with Bloomberg TV.

He estimated that 15 to 20 million Pakistanis use cryptocurrency, making up about 8% of the population.

“Our message is clear – Pakistan is done sitting on the sidelines! We want Pakistan as the leader in blockchain-powered finance. Pakistan is a low-cost high-growth market with 60% of the population under 30. We have a web3 native workforce ready to BUIDL.” Saqib said.

The government launched this initiative shortly after appointing Saqib as Chief Advisor to the Finance Minister on digital asset management in early March 2025. He also advises on artificial intelligence (AI) applications to improve government efficiency, enhance decision-making, and drive public sector innovation.

Several Asian nations have started embracing cryptocurrency, and Pakistan is following this trend. US President Donald Trump’s pro-crypto policies have influenced this regional shift.

“Trump is making cryptocurrency a national priority, and every country, including Pakistan, must keep up with this trend,” Saqib said.

In March 2025, the Pakistani government announced the creation of the Pakistan Crypto Council (PCC) to oversee the integration and use of blockchain technology and digital assets in the financial sector.

Finance Minister Muhammad Aurangzeb leads the council, working alongside the Governor of the State Bank of Pakistan and the Chairman of the Securities and Exchange Commission of Pakistan (SECP). PCC aims to develop clear regulatory guidelines for cryptocurrency adoption, collaborate with international organizations, and promote responsible innovation.

However, Pakistan has taken different positions on crypto regulation over the years. In 2023, Finance Minister Aisha Ghaus Pasha insisted that cryptocurrency “would never be legalized” due to restrictions from the Financial Action Task Force (FATF). This international organization demanded that Pakistan tighten financial controls to avoid placement on the “gray list” for money laundering and terrorist financing risks.

Despite this previous opposition, the government has recently adopted a more pragmatic approach. Instead of banning cryptocurrency, officials are working on a strict regulatory framework. The plan focuses on anti-money laundering (AML) and counter-terrorism financing (CTF) measures while protecting investors and integrating cryptocurrency into the formal economy.

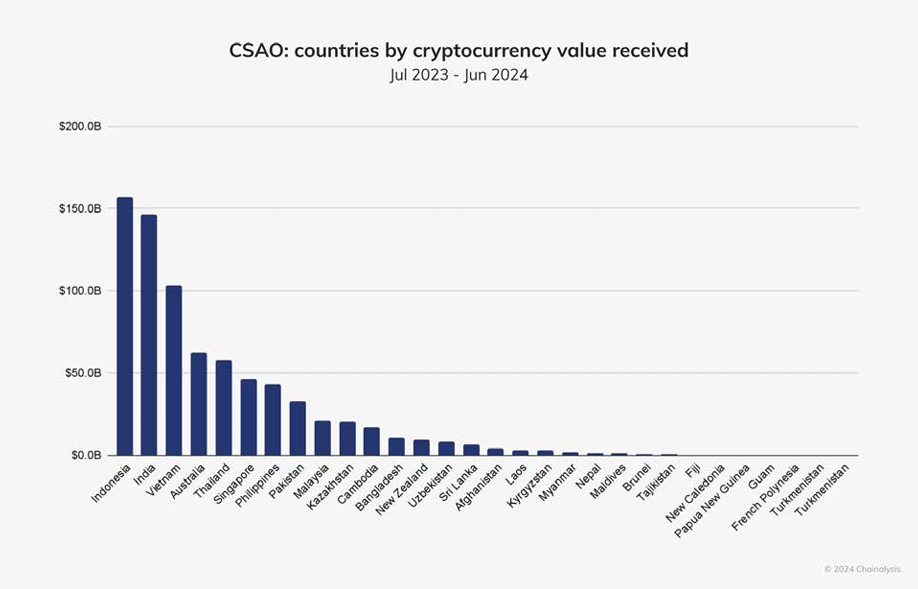

The “2024 Global Adoption Index” by Chainalysis ranked Pakistan ninth worldwide in crypto adoption. The country also holds the fifth spot in the Central & Southern Asia and Oceania (CSAO) region, with over $30 billion in remittances flowing through digital assets.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BFI Allocates $90 Million to Healthcare & Climate Action with Crypto

Blockchain philanthropy is gaining momentum, with Blockchain For Impact (BFI) surpassing $90 million in allocations toward healthcare, biomedical research, and climate resilience.

The initiative, founded by Polygon co-founder Sandeep Nailwal, has also earmarked an additional $200 million for future efforts, signaling the growing role of cryptocurrency in global giving.

Crypto Donations Gain Mainstream Traction

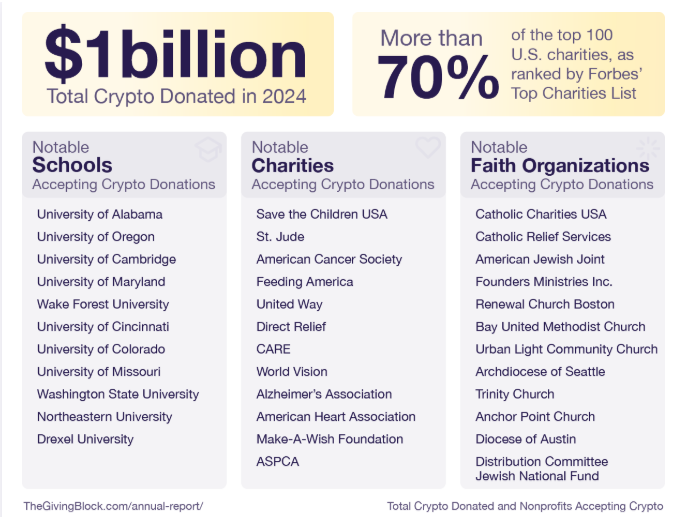

BFI’s expansion aligns with broader trends in cryptocurrency-based philanthropy. According to a recent report by The Giving Block, global crypto donations exceeded $1 billion in 2024. For the most part, clearer regulations and increasing nonprofit acceptance of digital assets drove the surge.

Currently, over 70% of major US charities accept crypto donations. Healthcare and medical initiatives account for 14% of contributions. Analysts predict crypto philanthropy could reach $2.5 billion by the end 2025.

BFI is leveraging this shift by integrating blockchain’s transparency and decentralized funding model to address systemic challenges in healthcare and climate action. The initiative aims to ensure funds reach their intended targets efficiently, avoiding bureaucratic delays that often hinder traditional charitable efforts.

Among BFI’s notable projects is its partnership with the SELCO Foundation. The venture saw a $6 million investment accelerate the solarization of 25,000 public health centers in India. The initiative, which might have taken a decade to implement through conventional means, has significantly improved medical service reliability.

In a statement shared with BeInCrypto, BFI revealed plans to launch large-scale programs to sustain its impact. Its flagship initiative, the BFI-BIOME Virtual Network Program, aims to support 46 startups through grants, fellowships, and partnerships with 15 medical colleges over three years. The program is expected to engage over 600 researchers in more than 50 projects.

The European Biomedical Exchange Program will also help Indian startups navigate international regulations and secure venture capital investment.

“We’re building scalable systems to transform healthcare for generations by combining blockchain’s transparency with collaborative funding,” read the announcement, citing Nailwal.

With an additional $200 million set aside for upcoming projects, BFI aims to expand its reach in medical research, startup development, and climate resilience. Meanwhile, the challenges surrounding crypto philanthropy are becoming more pronounced.

Challenges for Crypto Philanthropy

However, crypto donations also raised concerns regarding illicit funding. According to a report from Chainalysis, the HTS rebel group in Syria received crypto donations before claiming victory in the Syrian Civil War.

This case highlights the dual-edged nature of crypto philanthropy, where digital assets can be used for humanitarian causes and nefarious activities.

In South Korea, universities have struggled with managing cryptocurrency donations due to regulatory uncertainties and tax complexities. This has led to hesitancy in accepting digital asset contributions despite their potential to fund research and scholarships.

Adding to the complexities, embattled crypto exchange FTX recently ramped up its legal actions, filing 20 lawsuits targeting political donations and fraudulent transactions linked to the FTX collapse. This reflects the broader risks associated with unregulated crypto donations and the need for transparency in digital asset philanthropy.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Is Crypto AI the Next Big Thing? Survey Reveals Mixed Sentiment

A recent survey by CoinGecko has revealed that two in five crypto participants are optimistic about the potential of crypto artificial intelligence (AI) products and token prices in 2025.

However, while optimism is evident, a significant portion of the community remains uncertain. This indicates a mixed sentiment surrounding this emerging sector.

Are Crypto Participants Bullish on the Future of Crypto AI?

CoinGecko’s survey ran from February 20 to March 10, 2025, and gathered responses from 2,632 crypto enthusiasts worldwide. The respondents comprised a diverse mix, including long-term investors (51%), short-term traders (26%), builders (10%), and spectators on the sidelines (13%).

A closer look at experience levels revealed that 53% of participants were in their first crypto cycle (0-3 years), while 34% had 4-7 years of experience. The remaining 13% had over eight years in the space. Geographically, 93% of respondents hailed from Europe, Asia, North America, and Africa, providing a broad global perspective.

Importantly, the results indicated that 46.9% of respondents held a bullish outlook on crypto AI products, including their use cases and technology. This reflected confidence in the sector’s growth potential.

“Specifically, 19.9% felt somewhat bullish about crypto AI products, and a larger 27.0% of survey respondents were fully bullish,” CoinGecko reported.

Coingecko’s Research Analyst, Yuqian Lim, pointed out that the growing enthusiasm in the crypto sector might be linked to the enhanced and increasingly widespread applications of crypto when integrated with AI technology.

Conversely, 24.1% of respondents expressed bearish sentiments, signaling skepticism regarding the immediate prospects of crypto AI.

“Almost one out of every four survey respondents continue to feel skeptical about the potential of crypto AI technology and its use cases, at least in the immediate term,” the report added.

This divided sentiment also extended to perceptions of crypto AI prices, with 44.3% expressing optimism. Meanwhile, 26.4% leaned pessimistic.

“This perhaps shows that crypto participants are not differentiating between crypto AI’s investing or trading potential and the technology itself,” Lim noted.

She further emphasized that these market sentiments might reflect an expectation for crypto AI to move beyond conceptual stages and mature as a functional sector. Despite the divide between bullish and bearish perspectives, a significant portion of respondents maintained a neutral stance. 29.0% and 29.3% of the participants selected a neutral position on products and token prices, respectively.

In fact, survey results showed that the neutral response category received the highest selection compared to other sentiment options. This implied either indecision or a wait-and-see approach as the technology matures.

Additionally, sentiment varied significantly across different adoption groups. Despite being pioneers in the crypto AI narrative, only 46.8% of innovators were bullish on crypto AI products, with a similar 44.8% bullish on token prices. Notably, a significant portion, 28.9% for products and 30.0% for prices, were bearish.

In contrast, early adopters and the early majority showed greater optimism. The late majority displayed notably less bullishness. The laggards exhibited the strongest bearish sentiments, with 41.3% viewing crypto AI products negatively and 43.1% holding bearish views on token prices.

“The ‘Laggard’ group also had the smallest share of neutral sentiments, which suggests that this group has the strongest opinions despite being the latest to the crypto AI narrative,” the survey revealed.

The survey comes at a challenging time for the sector. It has seen a significant downturn after peaking earlier this year.

Major catalysts that previously triggered rallies have recently failed to spark the same momentum. This is exemplified by the AI coins market cap taking a dip following Nvidia’s GTC Conference.

Despite the downturn, the sector has shown a slight recovery, with a 4.3% increase recorded over the past day. However, this recovery was not isolated. The broader market also saw an uptick following the Fed’s decision to keep US interest rates unchanged.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoMassive Outflows Spark 15% Drop in Pi Network Price

-

Market18 hours ago

Market18 hours agoADA Whales Fuel Bullish Momentum by Acquiring 190 Million Coins

-

Market23 hours ago

Market23 hours agoMario Nawfal Denies $7M Meme Coin Rug Pull Allegations

-

Market22 hours ago

Market22 hours agoSolana Death Cross Forms, Pointing to Potential Breakdown

-

Ethereum21 hours ago

Ethereum21 hours agoCrypto Pundit Says Bears Will Continue To Dominate Ethereum Price, Here’s For How Long

-

Market21 hours ago

Market21 hours agoRussian Crypto Exchange Garantex Is Back Under a New Name

-

Regulation21 hours ago

Regulation21 hours agoRipple CLO Reveals What Next With Cross Appeal Against SEC

-

Market20 hours ago

Market20 hours agoXCN Traders Shift Focus as Active Addresses Plunge