Market

FOMC Refuses to Cut Interest Rates, Disappointment Priced In

The FOMC concluded its latest meeting by announcing that it will not cut US interest rates. This decision was largely priced in, and the crypto market hasn’t seriously suffered.

Rate cuts would’ve provided a bullish narrative to juice fresh investment, which the market desperately needs. Bearish signals are growing alongside fears of a US recession.

Federal Reserve Says No to Rate Cuts

The Federal Reserve just finished its Federal Open Market Committee (FOMC), which determines much of US financial policy. The crypto industry was waiting with bated breath to see if the FOMC would decide to cut interest rates.

However, the FOMC made its report to the public and claimed that no rate cuts would be taking place.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%,” it said.

This news more or less fits with the industry’s expectations. Fed Chair Jerome Powell already clearly stated that the FOMC doesn’t plan to cut interest rates.

The industry hoped that rate cuts could provide a bullish narrative, especially while the markets are afraid. For now, it seems like it’ll need to find an optimistic signal somewhere else.

Rate cuts would be bullish for investors, especially for risk-on assets like cryptoassets. However, this isn’t the Federal Reserve’s only concern. The FOMC alluded to its “dual mandate” when denying rate cuts. In other words, it needs to juggle investor concerns with consumer inflation fears, uncertainty around Trump’s tariffs, and a possible US recession.

If the FOMC were to slash interest rates, it would likely boost US inflation. The most recent CPI report was better than expected, and some in the industry hoped that this would build confidence. Ultimately, the main hopes rested with President Trump, who personally advocated for rate cuts. However, he didn’t make a major intervention.

It’s not all bad, though. The FOMC also announced would slow Quantitative tightening (QT) by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.

Some members of the community were pleased by this news, as slower QT can increase market liquidity. This announcement is at least some consolation for investors.

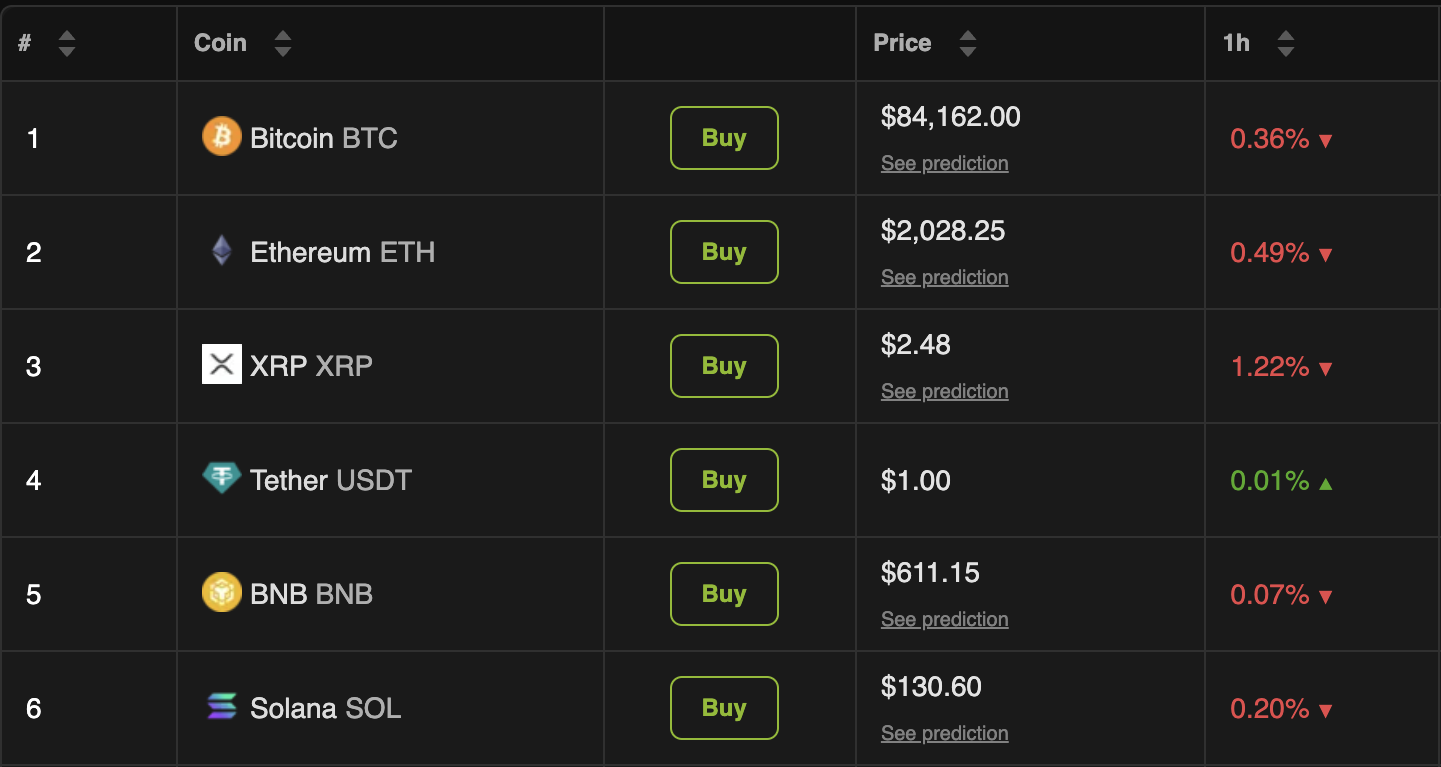

In any event, this lack of rate cuts was expected and priced in. The FOMC didn’t shock anybody by refusing to cut interest rates, and the market hasn’t been chaotic. A few of the top-performing cryptoassets suffered minor losses, but no substantial drops have materialized.

The crypto industry has been desperate for a bullish narrative, and some major players are visibly cracking at the seams.

The FOMC, however, did not provide this narrative via rate cuts. Hopefully, crypto will find something else to be optimistic about before a full-blown market correction takes hold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Uniswap Foundation Secures $165.5 Million for DeFi Innovation

The Uniswap (UNI) community has voted in favor of two significant governance proposals, allocating $165.5 million to the Uniswap Foundation to stimulate ecosystem development.

This move follows the launch of Uniswap v4 and Unichain earlier this year and has led to an uptick in UNI’s price.

Uniswap Secures Funding Approval for Growth and DeFi Innovation

In a recent post on X, the Uniswap Foundation celebrated the approval of two proposals introduced on February 14 as part of the “Uniswap Unleashed” initiative.

“This marks the beginning of our community’s next era: one that unlocks new opportunities to build, grow and to create and capture value,” the post read.

One of the most significant aspects of the governance decision is that it lays the groundwork for activating the much-anticipated “fee switch.” This mechanism enhances the protocol’s sustainability and rewards UNI token holders. Moreover, it signals a shift toward a more sustainable and rewarding ecosystem.

“These campaigns will lead to other benefits for the Uniswap community. For example, 65% of Unichain net chain revenue is set to be earned by UVN validators and stakers, once the UVN launches,” the proposal noted.

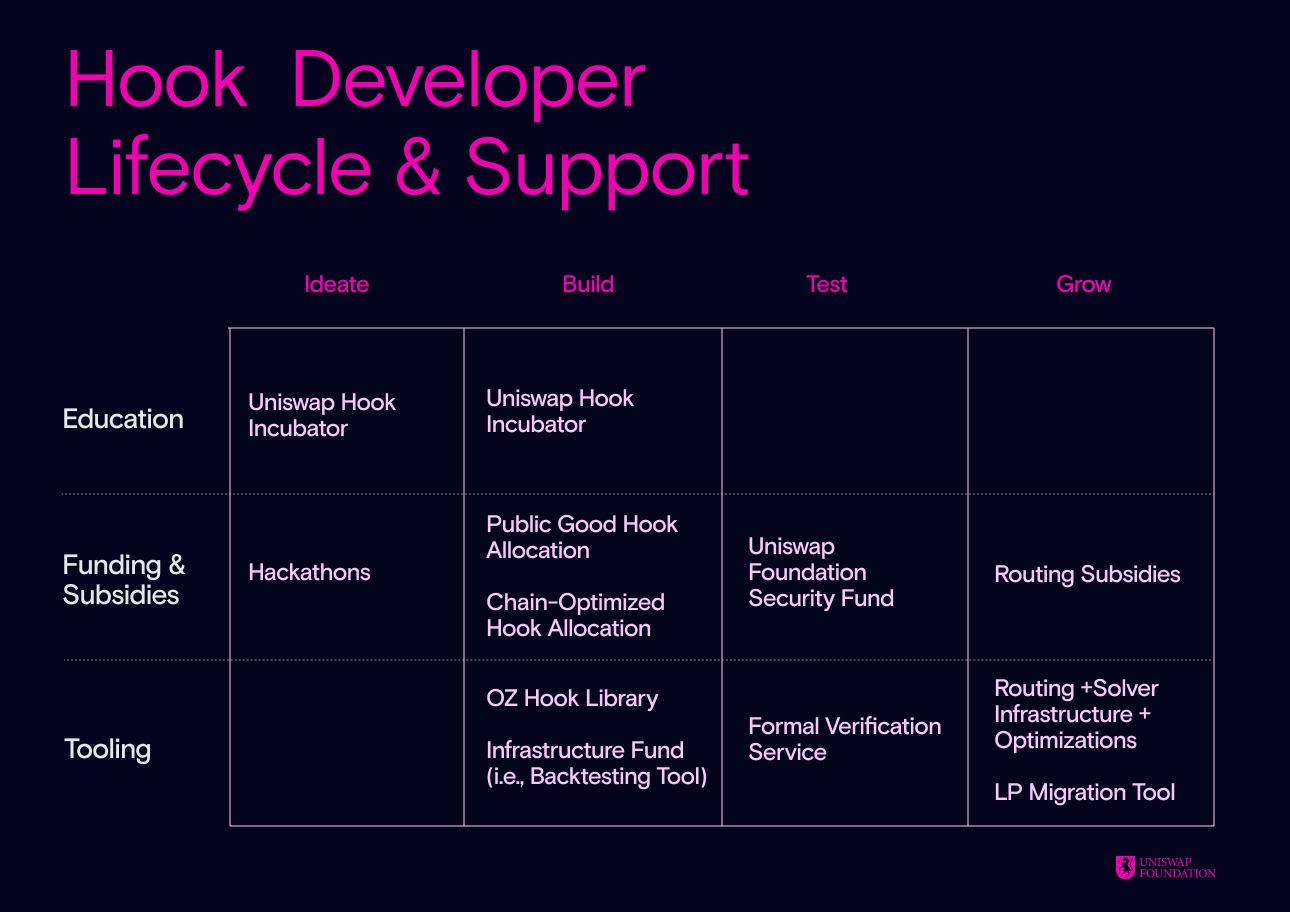

The first proposal outlines the Uniswap Foundation’s strategic priorities for 2025 and beyond. It focuses on four key areas. The first is scaling network supply by optimizing liquidity across active Ethereum Virtual Machine (EVM) chains.

The second priority is scaling network demand by developing platforms that encourage DeFi innovation and attract developers. This includes initiatives such as funding programs, infrastructure development, and educational resources. These aim to support developers throughout the hook development lifecycle.

In addition, the third priority is strengthening governance by activating revenue sources and onboarding new protocol contributors. It emphasizes distributing a portion of Unichain’s net chain revenue to validators and stakers and exploring the creation of a legal entity for governance purposes.

Lastly, the proposal aims to establish a Core Contributor Program. This program will create incentive-aligned development teams to advance the protocol and ecosystem.

The proposal also includes a total investment of $120.5 million, with $95.4 million allocated to the foundation’s grant budget and $25.1 million designated for operational costs.

“It reflects an investment into the success of the Uniswap Protocol and Unichain, and into value for the Uniswap community, and will be backstopped by best-in-industry transparency reporting and an unrelenting drive to create value,” the proposal read.

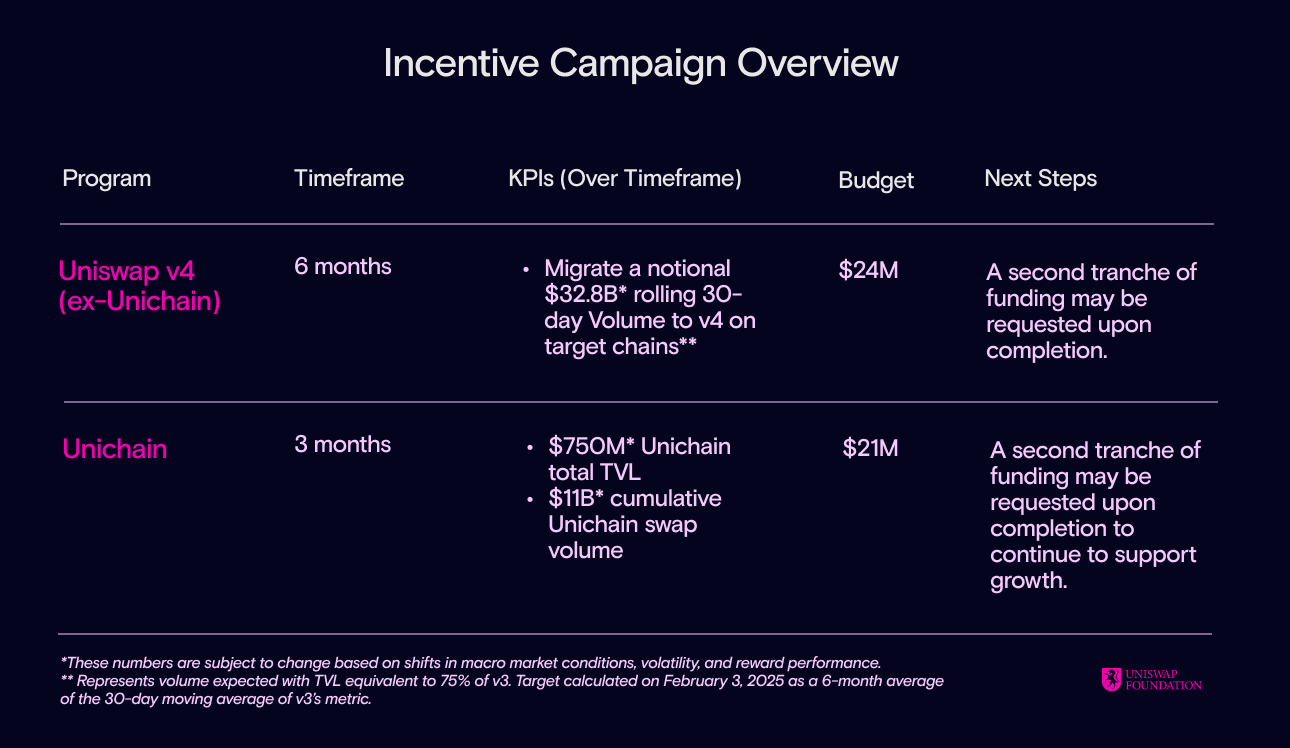

The second proposal, which included input from Gauntlet, focuses on funding two liquidity incentive programs to drive growth for Uniswap v4 and Unichain. Thus, the primary objective is to attract liquidity providers (LPs), swappers, and developers to these platforms, which will play key roles in DeFi’s future. The Uniswap Foundation requested a $45 million budget to support these liquidity incentives.

The Aera platform will be used to ensure full governance control over the funds. This platform will allow Uniswap Governance to recall unused funds if necessary. Gauntlet has already set up an Aera vault on the Ethereum (ETH) mainnet.

Furthermore, with the proposal’s approval, the vault will be resumed. A total of 7,588,532 UNI tokens will be deposited to fund ongoing liquidity incentives.

Meanwhile, UNI reacted positively to the news. According to data from BeInCrypto, its value surged by 7.5% over the past 24 hours.

At press time, UNI was trading at $6.8. Additionally, trading volume saw a remarkable 207.9% spike, further highlighting a substantial increase in activity.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Opens Community Voting for Mubarak and Broccoli Listing

Binance opened community voting for potential token listings today. The exchange’s users will vote to select two out of nine meme coins, including Mubarak and two Broccoli tokens.

The other candidates are BANANAS31, BID, KOMA, SIREN, TUT, and WHY. All these tokens are on the BNB Chain, but future votes will allow any token, provided that it’s been listed on Binance Alpha.

Will Binance List MUBARAK?

Binance, the world’s largest crypto exchange, can dramatically impact the market with its token listings. Earlier this month, the exchange claimed that it would begin hosting community votes to decide future listings.

This plan has already become a reality, as Binance announced its first round of voting today.

“We now invite users to participate and vote on the first batch of Vote to List projects… on Binance Square Official. The first batch of Vote to List is exclusively for BNB Smart Chain-based tokens. Future voting rounds will expand to include all tokens featured in Binance Alpha,” the exchange claimed.

The round will decide between nine different meme coins, two of which will receive the coveted listing. So far, the list contains a few favorites.

Mubarak, one of the candidates, has burst onto the scene recently. After it was listed on Binance Alpha and former CEO CZ transacted with it, Mubarak shot up to a $200 million market cap in 48 hours.

Binance’s former CEO has influenced several of the voting options. Two of the nine choices are themed after his dog, Broccoli, and part of a larger Broccoli-themed meme coin race.

Also, CZ suggested that he “will likely interact with a few of the more popular” Broccoli meme coins, helping fuel continued enthusiasm.

However, not everyone agrees with Binance’s new community-driven strategy. The exchange was already facing criticism for its meme coin listings, and this happened before it announced community voting.

Additionally, the exchange’s last community vote went in favor of Pi Network, but Binance never actually listed the asset.

Overall, the company has been taking its critics seriously regarding meme coin listings. Binance reminded its community that all nine voting candidates had already been listed on Binance Alpha and that listing votes would be a strict requirement.

Hopefully, this new program will foster community engagement and maintain Binance’s quality standards.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Redstone (RED) Shows Mixed Market Signals: Will It Hit $1?

Redstone (RED) has experienced a volatile week, climbing 25% over the past seven days despite pulling back 20% in the last three days.

This mixed performance reflects the current uncertainty surrounding RED’s price action. Technical indicators point to a market caught between consolidation and lingering bearish sentiment. While momentum indicators like RSI and ADX suggest weakening trend strength and growing indecision, price action continues to hold above key support levels.

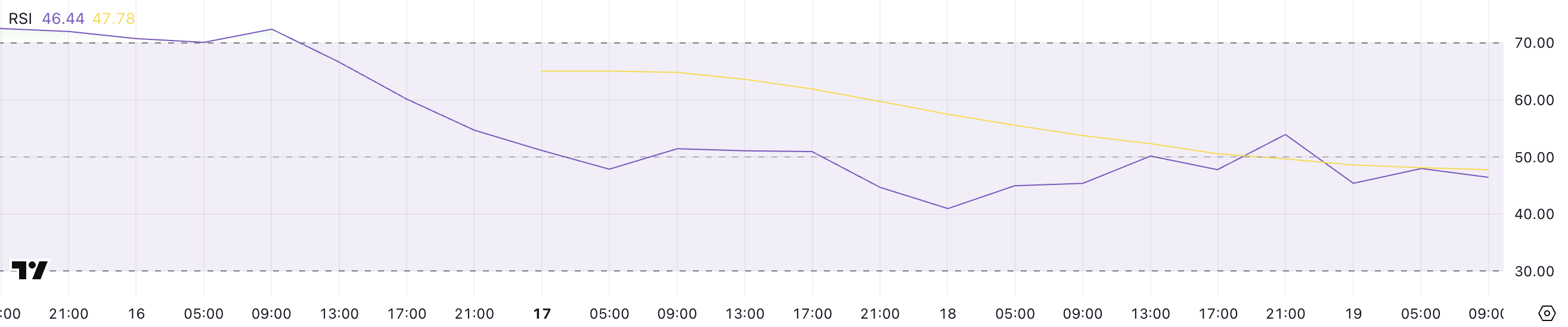

RED RSI Has Been Neutral For The Past Two Days

Redstone’s RSI (Relative Strength Index) has slipped to 46.44, down from 53.93 just a day ago. This recent decline suggests that bearish pressure has been increasing, pulling momentum away from the bulls.

For the past two days, RSI has been hovering around the 50 level, which typically signals indecision in the market, as neither buyers nor sellers have had clear control.

However, the move below 50 today signals that bearish momentum is starting to tilt the scales.

The RSI is a momentum oscillator that measures the speed and change of price movements. It typically ranges from 0 to 100. Values above 70 often indicate overbought conditions, while readings below 30 suggest oversold conditions.

The 50 mark acts as a midline that traders watch to gauge shifts in momentum—above 50 imply a bullish bias, while below 50 leans bearish.

Redstone’s RSI is now sitting at 46.44 after hovering near 50, which could mean the market is gradually tipping in favor of sellers as Redstone tries to establish itself as one of the most relevant leaders in the Oracle sector.

This shift may indicate further downside potential unless bulls regain control and push RSI back above 50 to reestablish bullish momentum.

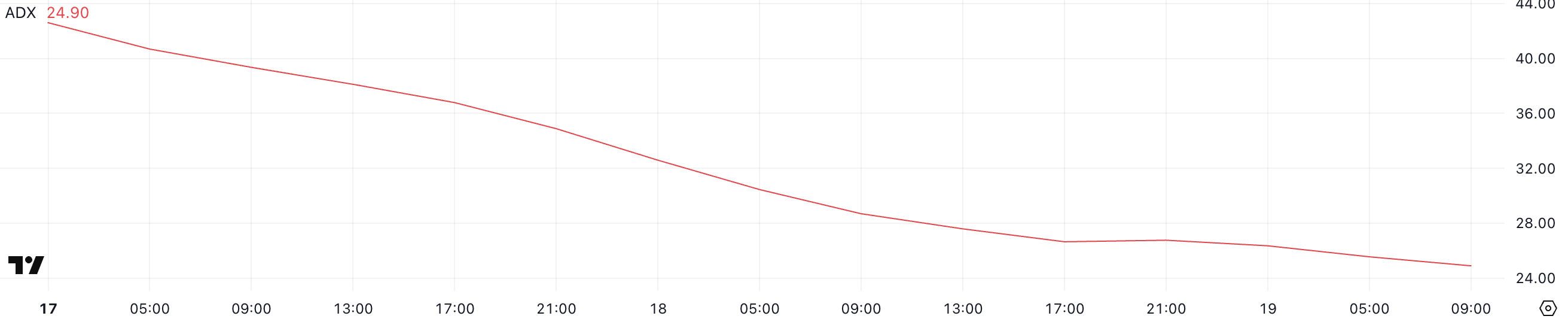

Redstone ADX Shows The Current Downtrend Is Fading Away

Redstone’s ADX (Average Directional Index) has dropped significantly to 24.9, down from 42.6 just two days ago. This sharp decline suggests a noticeable weakening in the strength of the current trend.

Previously, with ADX at 42.6, the market experienced strong directional movement, but the drop to the current level implies that the momentum behind that trend is fading.

Despite this, Redstone is still maintaining its position within a broader downtrend, indicating that bearish conditions have not yet reversed but may be losing steam.

The ADX is a technical indicator used to quantify the strength of a trend without indicating its direction. Typically, ADX values above 25 suggest a strong trend, while values below 20 often indicate a weak or non-trending market.

Readings between 20 and 25 are generally considered a gray area, where the trend might be losing conviction. With Redstone’s ADX now sitting at 24.9, it points to a market where the downtrend is still present but lacks the strong momentum it recently had.

This weakening trend could lead to potential price stabilization or even a short-term bounce, but as long as the downtrend structure remains intact, caution is warranted.

Will Redstone Rise Above $1 In The Next Days?

Redstone’s EMA (Exponential Moving Average) lines continue to suggest that the asset is in a consolidation phase. Its price action is moving sideways rather than trending strongly in either direction.

A key support level has been identified at $0.65, which is currently acting as a floor for price movement. If this support is tested and broken, Redstone could potentially fall further, with downside targets around $0.50.

Conversely, if the price starts to build bullish momentum, Redstone could attempt to break through resistance at $0.77. A successful breakout above this level could open the path toward $0.90 and $0.95, with the possibility of finally reclaiming the $1 mark for the first time since March 3, potentially making it one of the most trending altcoins in the market.

In Redstone’s case, the EMA lines reflecting sideways movement point to indecision among market participants. For now, the $0.65 support is pivotal – holding it could give bulls room to stage a rally while losing it could invite stronger selling pressure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoBinance Expands Support For StraitsX (XUSD) This Crypto, Here’s All

-

Bitcoin18 hours ago

Bitcoin18 hours agoIs Strategy’s Bitcoin Gamble About to Backfire?

-

Market18 hours ago

Market18 hours agoHBAR Price’s Recovery Set To Be Invalidated By Death Cross

-

Market21 hours ago

Market21 hours agoDavid Sacks Slams Media for Misleading Crypto Sale Narrative

-

Ethereum19 hours ago

Ethereum19 hours agoIs This A Bullish Signal?

-

Market19 hours ago

Market19 hours agoAI Coins Lose Steam Despite Nvidia’s Blackwell Ultra Debut

-

Regulation17 hours ago

Regulation17 hours agoUS SEC Drops Ripple Lawsuit

-

Market17 hours ago

Market17 hours agoMassive Outflows Spark 15% Drop in Pi Network Price