Market

XCN Traders Shift Focus as Active Addresses Plunge

Onyxcoin (XCN) has maintained its downward trajectory, plummeting by 10% over the past week as bearish sentiment grips the market.

With more traders turning away from the altcoin, its active address count has seen a sharp fall, signaling a loss of interest in the asset and low network participation.

XCN Struggles as Short Sellers Take Control

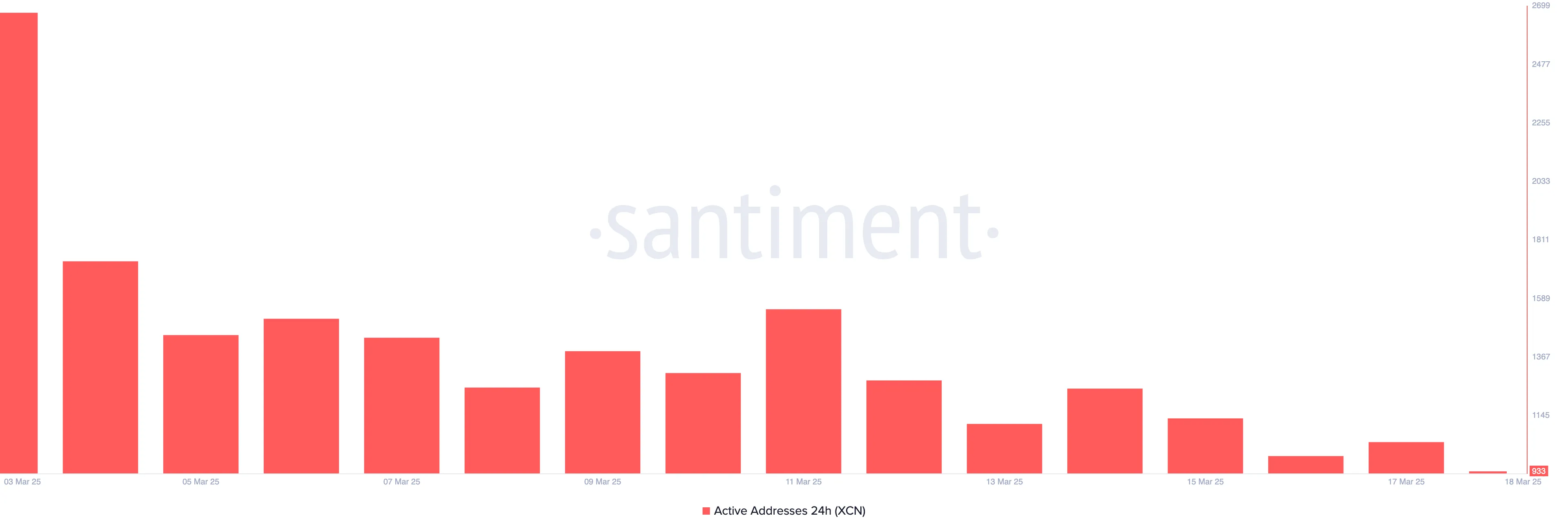

Since early March, Santiment’s data has revealed an aggressive fall in XCN’s daily active address count.

According to the on-chain data provider, on March 3, 2,673 unique addresses completed at least one transaction involving XCN. Since then, this figure has steadily declined, hitting a low of 1,044 on March 18.

This decline highlights waning network activity on Onyxcoin and the reduced demand for its altcoin, reinforcing the bearish sentiment surrounding XCN.

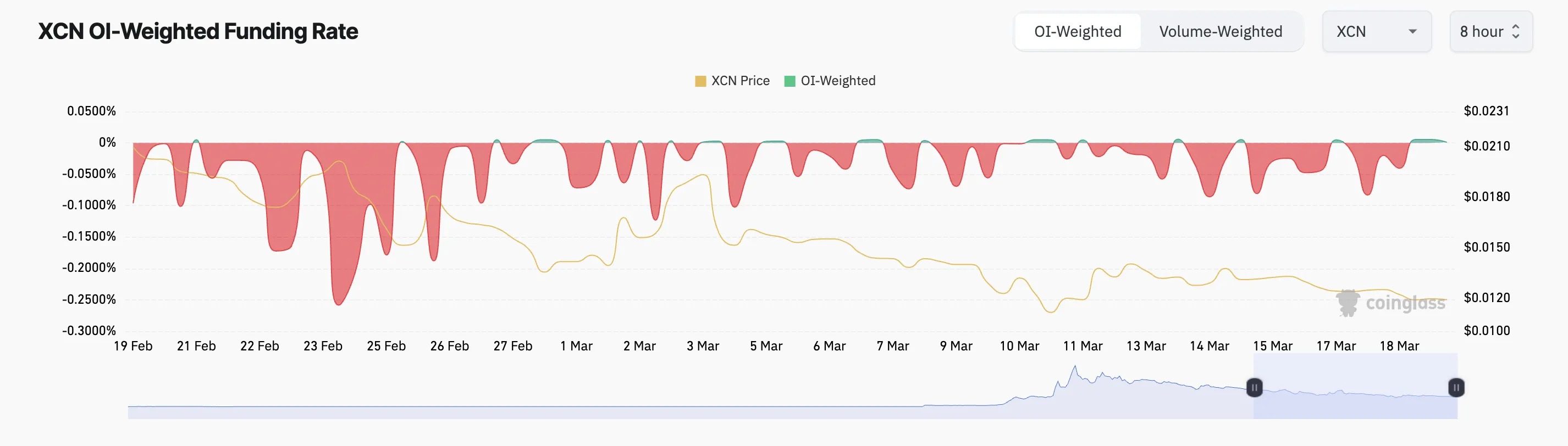

Moreover, the month has been marked by a significant rise in the demand for short positions, as reflected by the altcoin’s predominantly negative funding rate.

An asset’s funding rate is a periodic fee exchanged between its long and short traders in perpetual futures contracts. When the funding rate is mostly negative, short sellers dominate the coin’s futures markets.

The rising demand for XCN shorts highlights the market’s bearish outlook. Sellers are maintaining control and limiting any potential short-term recovery.

XCN Faces Strong Selling Pressure

The token’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, the momentum indicator is below zero at -0.19.

The CMF indicator measures fund flows into and out of an asset. When its value is negative, selling pressure outpaces buying activity. This indicates the likelihood of a further price decline as demand remains weak. In this scenario, XCN’s price could slip to $0.0075.

Conversely, the token’s price could rocket toward $0.022 if buyers regain market control.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Top 3 BNB Meme Coins to Watch Closely This Week

BNB meme coins are gaining traction as the BNB ecosystem experiences a surge. PancakeSwap has been leading DEX volumes globally over the past seven days, surpassing both Raydium and Uniswap.

Among the top contenders making waves are Mubarak, Palu, and FairMint, each capturing significant attention in this fast-moving space. Mubarak is leading the pack with explosive early growth, while Palu is emerging as a potential flagship meme coin. Meanwhile, FairMint is positioning itself as a unique launchpad, aiming to become BNB’s version of Pumpfun.

Mubarak

Mubarak has quickly become one of the most talked-about meme coins in the BNB ecosystem over the past few days. Yesterday, its market cap briefly approached the $200 million mark before pulling back to around $112 million today.

The project surged onto the scene with remarkable traction, fueled by growing hype and speculative interest in BNB-based assets.

In just a short period, Mubarak has gained over 20,000 holders, recorded daily volumes of $66 million, and witnessed nearly 35,000 transactions per day. However, despite this initial momentum, the token is now undergoing a sharp correction, down 25% in the past 24 hours.

Even so, with the BNB ecosystem continuing to attract fresh capital and broader market attention, there is still potential for Mubarak to rebound and possibly retest its previous highs near the $200 million market cap level if buying interest returns.

Binance’s Palu (Palu)

As BNB meme coins continue to dominate the spotlight, several projects are competing to become the face of the ecosystem, much like Shiba Inu did with Ethereum and Bonk with Solana.

One of the contenders is Palu, a relatively new token launched just under six days ago. Palu has already attracted nearly 5,000 holders and reached a market cap of $864,000, slightly down from its recent high of almost $900,000.

The project is positioning itself to potentially fill the role of a flagship meme coin within the BNB chain.

Despite suffering a sharp 75% correction over the past 24 hours – a scenario not uncommon among meme coins across various blockchains – Palu is still maintaining solid activity, with daily trading volumes near $4 million.

If sentiment in the BNB meme coins sector stabilizes and Palu regains its momentum, the project could attempt to climb back toward key psychological milestones, with market cap targets of around $1 million and possibly even $2 million in the near term.

FairMint FAIR (FAIR)

FairMint is a newly launched BNB meme coins launchpad that has been live for less than three days.

Trying to differentiate itself from other platforms such as Pumpfun, FairMint introduces distinctive mechanics.

For example, it enables all users to mint tokens at the same price while also ensuring that 95% of tokens maintain liquidity at the mint price via single-sided liquidity provisioning.

Currently, FairMint has gathered close to 3,500 holders, boasts a daily trading volume of $11.7 million, and records over 24,000 transactions per day.

While Pumpfun has established itself as the leading launchpad on Solana, the BNB chain still lacks a dominant player in this niche.

If FairMint can sustain its strong early momentum and community engagement, FairMint could be poised to push toward market cap milestones of $5 million and potentially even $10 million in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network Pioneers Allege Bot Activity on CoinMarketCap

Pi Network’s community sentiment poll on CoinMarketCap fell dramatically today, leading to allegations of bot activity. Negative votes swarmed the site’s poll, while other community ratings stayed positive.

However, there is no clear proof either for or against these claims. Pi Network has suffered criticism and price setbacks recently, and its supporters have swayed polls, votes, and ratings on multiple occasions.

Since its launch on February 20, Pi Network has seen more than its share of controversies. Critics have attacked its accessibility, governance, transparency, and more, and multiple governments have called it a scam.

Today, however, Pi supporters raised concerns about bot activity on CoinMarketCap after the token’s community sentiment plummeted:

“It looks like somebody is using bots to vote against PI. I am 99% sure this is not an organic poll. Over 1.94 Million votes is even bigger than the BTC vote. 77% of the PI community is bullish on CoinGecko. Why is it so different on CoinMarketCap?” a Pioneer asked on social media.

Specifically, this user noted that Pi’s community sentiment plunged 90% in less than a day and that this poll had more participants than Bitcoin’s.

Other platforms with a similar voting mechanism kept Pi’s rating steady, leading him to conclude that bot activity was involved.

It’s very difficult to assess the veracity of these Pi Network bot allegations for several reasons. First of all, the token’s price has suffered dramatically this week.

Many users lost huge sums of Pi tokens after the KYC migration deadline, and massive investor sell-offs have triggered a price rout. Some of this negative sentiment may be genuine.

Additionally, it’s interesting that CoinMarketCap is the only platform involved in the Pi Network bot voting allegations. The firm refused to acknowledge Pi as one of the largest tokens by market cap, but it eventually relented.

Either the platform or its community could bear resentment towards Pi after these setbacks.

Furthermore, the community does have a reputation for vote brigading. Bybit’s CEO has repeatedly criticized Pi, and the token’s supporters review-bombed the Bybit app in response. They did a similar practice with Binance after the exchange delayed a Pi listing.

Ultimately, it seems very unlikely that disgruntled Pi supporters or committed haters spiked this poll without any bot activity. The negative votes came in absurdly fast, were isolated to one platform, and exceeded the votes for even the largest cryptoassets.

As of now, it remains challenging to find definitive proof either way.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hyperliquid (HYPE) Might Hit $20 Amid Potential Golden Cross

Hyperliquid (HYPE) is showing strong technical signals across multiple indicators, with the token surging more than 15% in the last 24 hours. The platform continues to demonstrate impressive market performance, generating $47 million in fees over the past 30 days and outperforming major blockchain networks like Ethereum and Solana.

Technical indicators suggest a potential golden cross formation, meaning HYPE could test $21 or even $25.80 in the coming period.

Hyperliquid Revenue Places It Among Top Protocols In Crypto

Hyperliquid is currently one of the most successful protocols in crypto. Over the past 30 days, it has generated an impressive $47 million in fees and recently reached $1 trillion in perps volume.

While this places it behind major players such as Jito, Pumpfun, and PancakeSwap in terms of monthly revenue, Hyperliquid has surpassed significant blockchain apps and chains, including Solana, Ethereum, Raydium, and Phantom.

What makes Hyperliquid’s success particularly remarkable is that, unlike most other high-performing protocols that operate on established blockchain networks such as BNB, Solana, or Ethereum, Hyperliquid functions as its own independent chain.

With the exception of Tron, virtually all other major protocols rely on parent blockchains, whereas Hyperliquid has achieved its substantial revenue figures as a standalone entity.

Despite this impressive performance and unique positioning, HYPE has experienced considerable downward price pressure recently, trading below the $20 threshold for sixteen consecutive days, creating a notable disconnect between the protocol’s operational success and its market valuation.

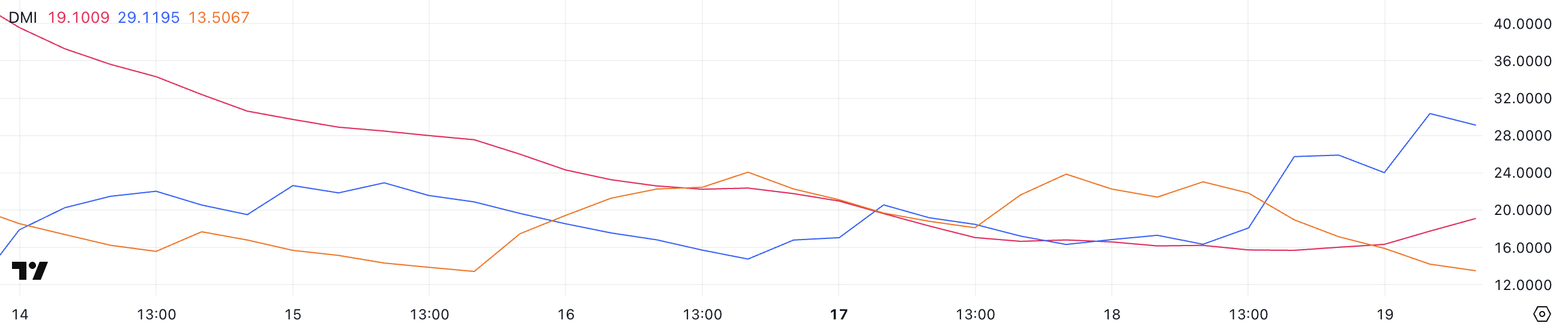

HYPE DMI Shows Buyers Are In Control

The HYPE DMI (Directional Movement Index) chart shows promising momentum shifts, with the ADX (Average Directional Index) rising from 15.7 to 19, suggesting a strengthening trend conviction.

More significantly, the +DI (Positive Directional Indicator) has surged from 18 to 29.1, while the -DI (Negative Directional Indicator) has declined from 21.8 to 13.5. This crossover pattern, where +DI rises above -DI, typically signals a potential bullish reversal.

The increasing spread between these indicators and the rising ADX suggests that buying pressure is overcoming selling pressure, potentially setting the stage for HYPE to break above its recent sub-$20 trading range.

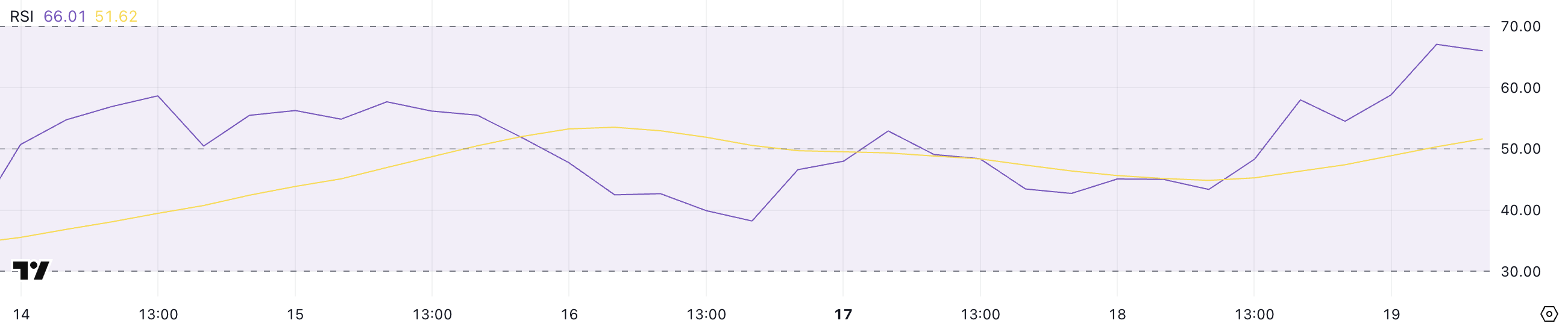

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Readings above 70 are typically considered overbought, and below 30 are considered oversold.

HYPE’s RSI climbing from 54.5 to 66 indicates growing bullish momentum that hasn’t yet reached extreme levels. This uptick suggests strengthening buyer interest while remaining below the overbought threshold of 70.

The fact that HYPE hasn’t reached overbought levels since December 2024 implies there may still be room for price appreciation before any potential pullback.

Together with the DMI indicators, this RSI reading reinforces the possibility of continued upward movement in HYPE’s price in the near term.

Will Hyperliquid Rise Above $20 This Week?

The HYPE Exponential Moving Average (EMA) lines are converging toward a potential golden cross formation, which occurs when a shorter-term moving average crosses above a longer-term one.

This technical pattern typically signals a strong bullish momentum shift that could propel HYPE to test its immediate resistance level at $17. Should buyers successfully break through this threshold, the path would open for HYPE to climb toward the $21 mark.

In scenarios where exceptional buying pressure materializes, Hyperliquid could extend its gains to challenge the significant resistance level at $25.80, representing a substantial recovery from its recent sub-$20 trading range.

Conversely, if the anticipated uptrend fails to materialize and bearish sentiment prevails, HYPE could experience renewed downward pressure, forcing it to test the critical support level at $12.43.

The importance of this support cannot be overstated, as a breach below this floor could trigger accelerated selling, potentially pushing HYPE under the psychologically significant $12 level for the first time since December 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoThe Web3 Solution to AI Copyright and Ownership

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Expands Support For StraitsX (XUSD) This Crypto, Here’s All

-

Bitcoin16 hours ago

Bitcoin16 hours agoIs Strategy’s Bitcoin Gamble About to Backfire?

-

Market15 hours ago

Market15 hours agoHBAR Price’s Recovery Set To Be Invalidated By Death Cross

-

Regulation15 hours ago

Regulation15 hours agoUS SEC Drops Ripple Lawsuit

-

Market14 hours ago

Market14 hours agoMassive Outflows Spark 15% Drop in Pi Network Price

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum Whales Are ‘Officially Under Water’ For The First Time Since 2023 – Details

-

Bitcoin19 hours ago

Bitcoin19 hours agoWhat It Means for BTC’s Next Bull Run