Market

Mario Nawfal Denies $7M Meme Coin Rug Pull Allegations

Crypto entrepreneur Mario Nawfal faces allegations of orchestrating a meme coin rug pull involving the prominent streamer Adin Ross.

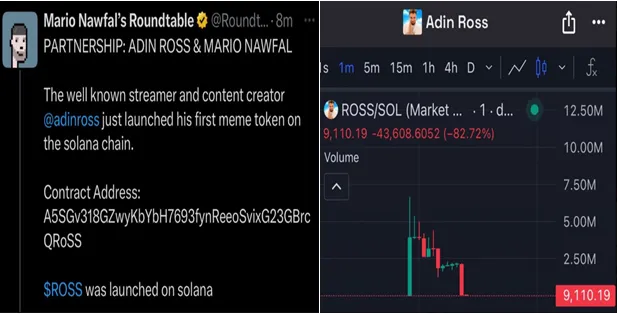

The controversy erupted after Nawfal’s X account, @RoundtableSpace, posted about a supposed partnership with Ross to launch a Solana-based token, ROSS. The post was swiftly deleted, raising suspicions of fraudulent activity.

Mario Nawfal Faces Allegations of Orchestrating $7 Million Rug Pull

On Tuesday, @RoundtableSpace announced the launch of ROSS, claiming that Adin Ross was backing the project. The tweet contained a contract address, seemingly legitimizing the meme coin. However, within 20 minutes, the post was deleted, triggering immediate skepticism within the crypto community.

X (Twitter) user @cryptolyxe flagged the incident. The user accused Nawfal of faking a partnership with Ross to drive up the token’s value. Cryptolyxe provided screenshots showing the original tweet and a price chart depicting an 82.72% price crash, indicating a rug pull.

A rug pull is when early promoters artificially pump a token’s value before abandoning it, leaving investors with worthless assets. According to cryptolyxe, the token’s market cap soared to $7 million before plummeting to zero.

“So Mario Nawfal just posted a fake “partnership” with Adin Ross for a memecoin, then rugs the coin from $7m to 0, and deletes all the tweets… bruh,” cryptolyxe remarked.

In the aftermath, @RoundtableSpace issued a series of statements denying any wrongdoing. They claimed that an unauthorized individual from their team, @hardsnipe, was responsible for posting about the token without approval.

Nawfal’s team maintained that they acted quickly to delete the post and clarified that no official partnership with Adin Ross existed. Nawfal later alleged that his account had been compromised.

“Someone got access to both this account and Crypto Town Hall and posted a fake CA yesterday and today,” Nawfal indicated.

He further clarified that once the breach was discovered, delegate access was revoked. Reportedly, they also changed passwords to prevent further unauthorized posts.

Growing Concerns Over Meme Coin Rug Pulls

Despite Nawfal’s explanations, many in the crypto community remain unconvinced. Several users, including @nftkeano, pointed to Nawfal’s history of promoting dubious crypto projects, fueling doubts about whether this was an accident or a deliberate scam.

“This is literally your 3rd rug this month…,” Keano noted.

Adding to the controversy, Adin Ross’ team denied involvement with the token. Chat logs suggest internal confusion regarding Ross’ participation, reinforcing the claim that the partnership was never real.

While Nawfal’s team insists the ROSS meme coin post was a mistake caused by an unauthorized team member, the crypto community remains deeply skeptical. The quick deletion of the tweet and the sudden collapse of the token’s value raise questions. Nawfal’s history of controversies also does not bode well for his case, leaving many questioning the true nature of this event.

Whether this was a genuine mistake or an intentional scam, the incident reflects the ongoing risks in the crypto arena.

Three weeks ago, rumors circulated about the alleged sale of Kanye West’s X account. The supposed new owners used it to promote the Barkmeta meme coin, sparking fears of a meme coin rug pull.

The incident raised questions about celebrity involvement in crypto scams. Meanwhile, Barstool Sports founder Dave Portnoy faced backlash over accusations that he orchestrated a GREED rug pull.

After promoting the coin, Portnoy allegedly sold off a large portion of his holdings, leading to a price collapse that left investors at a loss.

Additionally, reports indicate that insiders behind the LIBRA meme coin have been linked to other controversial projects, including the MELANIA coin, which also faced rug pull allegations.

The growing trend of rug pulls highlights the risks investors face when buying tokens associated with high-profile figures or influencers.

Data on GeckoTerminal shows that ROSS has been down by over 95% in the last 24 hours and is trading around its floor price.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hyperliquid (HYPE) Might Hit $20 Amid Potential Golden Cross

Hyperliquid (HYPE) is showing strong technical signals across multiple indicators, with the token surging more than 15% in the last 24 hours. The platform continues to demonstrate impressive market performance, generating $47 million in fees over the past 30 days and outperforming major blockchain networks like Ethereum and Solana.

Technical indicators suggest a potential golden cross formation, meaning HYPE could test $21 or even $25.80 in the coming period.

Hyperliquid Revenue Places It Among Top Protocols In Crypto

Hyperliquid is currently one of the most successful protocols in crypto. Over the past 30 days, it has generated an impressive $47 million in fees and recently reached $1 trillion in perps volume.

While this places it behind major players such as Jito, Pumpfun, and PancakeSwap in terms of monthly revenue, Hyperliquid has surpassed significant blockchain apps and chains, including Solana, Ethereum, Raydium, and Phantom.

What makes Hyperliquid’s success particularly remarkable is that, unlike most other high-performing protocols that operate on established blockchain networks such as BNB, Solana, or Ethereum, Hyperliquid functions as its own independent chain.

With the exception of Tron, virtually all other major protocols rely on parent blockchains, whereas Hyperliquid has achieved its substantial revenue figures as a standalone entity.

Despite this impressive performance and unique positioning, HYPE has experienced considerable downward price pressure recently, trading below the $20 threshold for sixteen consecutive days, creating a notable disconnect between the protocol’s operational success and its market valuation.

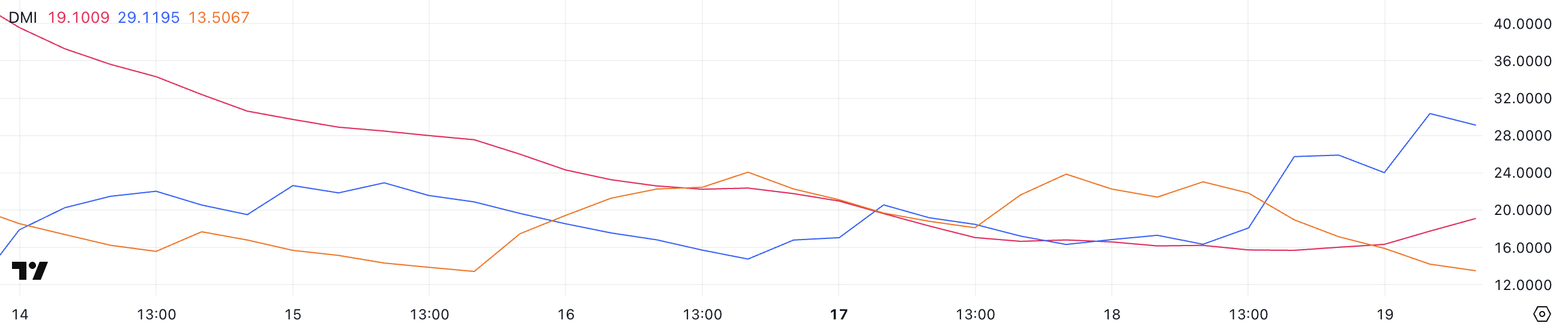

HYPE DMI Shows Buyers Are In Control

The HYPE DMI (Directional Movement Index) chart shows promising momentum shifts, with the ADX (Average Directional Index) rising from 15.7 to 19, suggesting a strengthening trend conviction.

More significantly, the +DI (Positive Directional Indicator) has surged from 18 to 29.1, while the -DI (Negative Directional Indicator) has declined from 21.8 to 13.5. This crossover pattern, where +DI rises above -DI, typically signals a potential bullish reversal.

The increasing spread between these indicators and the rising ADX suggests that buying pressure is overcoming selling pressure, potentially setting the stage for HYPE to break above its recent sub-$20 trading range.

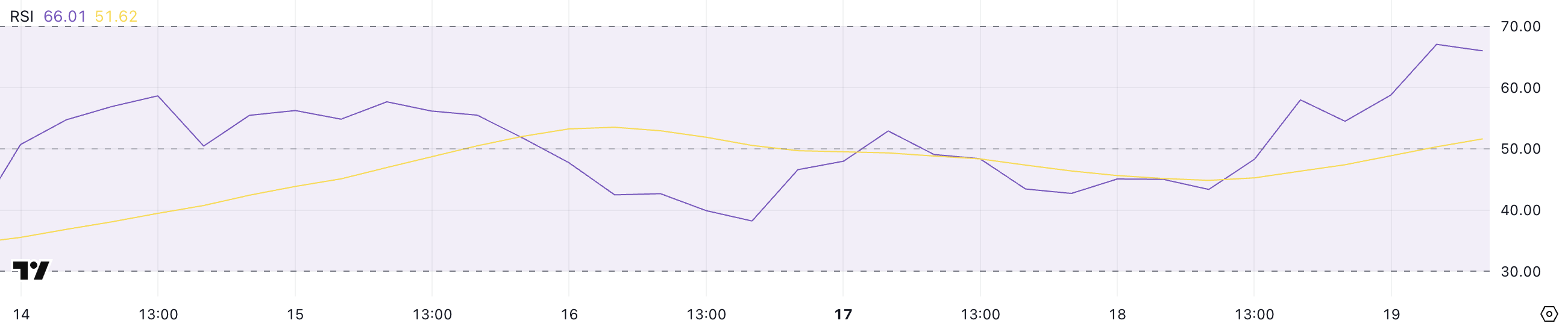

The Relative Strength Index (RSI) is a momentum oscillator that measures the speed and change of price movements. Readings above 70 are typically considered overbought, and below 30 are considered oversold.

HYPE’s RSI climbing from 54.5 to 66 indicates growing bullish momentum that hasn’t yet reached extreme levels. This uptick suggests strengthening buyer interest while remaining below the overbought threshold of 70.

The fact that HYPE hasn’t reached overbought levels since December 2024 implies there may still be room for price appreciation before any potential pullback.

Together with the DMI indicators, this RSI reading reinforces the possibility of continued upward movement in HYPE’s price in the near term.

Will Hyperliquid Rise Above $20 This Week?

The HYPE Exponential Moving Average (EMA) lines are converging toward a potential golden cross formation, which occurs when a shorter-term moving average crosses above a longer-term one.

This technical pattern typically signals a strong bullish momentum shift that could propel HYPE to test its immediate resistance level at $17. Should buyers successfully break through this threshold, the path would open for HYPE to climb toward the $21 mark.

In scenarios where exceptional buying pressure materializes, Hyperliquid could extend its gains to challenge the significant resistance level at $25.80, representing a substantial recovery from its recent sub-$20 trading range.

Conversely, if the anticipated uptrend fails to materialize and bearish sentiment prevails, HYPE could experience renewed downward pressure, forcing it to test the critical support level at $12.43.

The importance of this support cannot be overstated, as a breach below this floor could trigger accelerated selling, potentially pushing HYPE under the psychologically significant $12 level for the first time since December 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

What to Expect from XRP Price After the Ripple Lawsuit

XRP is rallying after the SEC officially dropped its lawsuit against Ripple, triggering a 13% price surge in the past 24 hours. Strong technical signals and growing market participation are supporting the bullish momentum.

XRP’s network activity is also hitting record levels, with active addresses soaring to new highs. As traders digest the legal victory and positive market signals, XRP’s outlook is strengthening, increasing the chances of further upside in the near term.

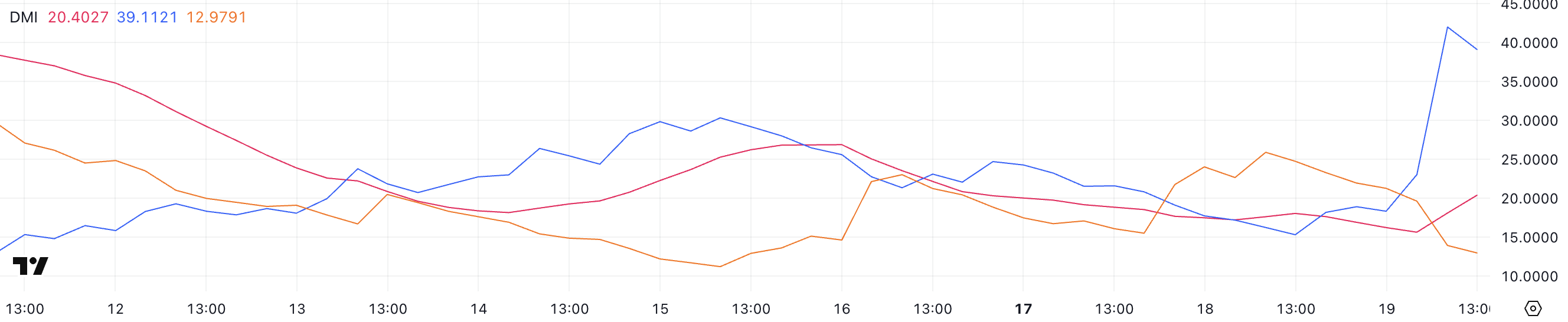

XRP DMI Shows Buyers Are In Full Control

XRP’s DMI chart reveals a notable shift in momentum, with its ADX (Average Directional Index) rising to 20.4 from 15.64 following the news that the SEC is dropping its lawsuit against Ripple.

This increase signals a strengthening market trend, as the ADX tracks the overall strength of a trend without specifying its direction.

The recent surge suggests that the price action is gaining conviction, especially as the market digests the positive legal developments surrounding Ripple.

The ADX is often used alongside the +DI and -DI indicators, which help identify trend direction. Typically, an ADX above 25 confirms a strong trend, while values below 20 suggest a weak or range-bound market.

In XRP’s case, the +DI has jumped from 18.3 to 39, while the -DI has dropped from 19.63 to 12.97, indicating a clear bullish divergence.

This sharp rise in buying strength (+DI) combined with a weakening bearish signal (-DI) supports the idea that XRP is attempting to maintain and possibly extend its uptrend. If this dynamic continues, it could see further upside in the short term as bullish momentum builds.

XRP Active Addresses Are Reaching New Records

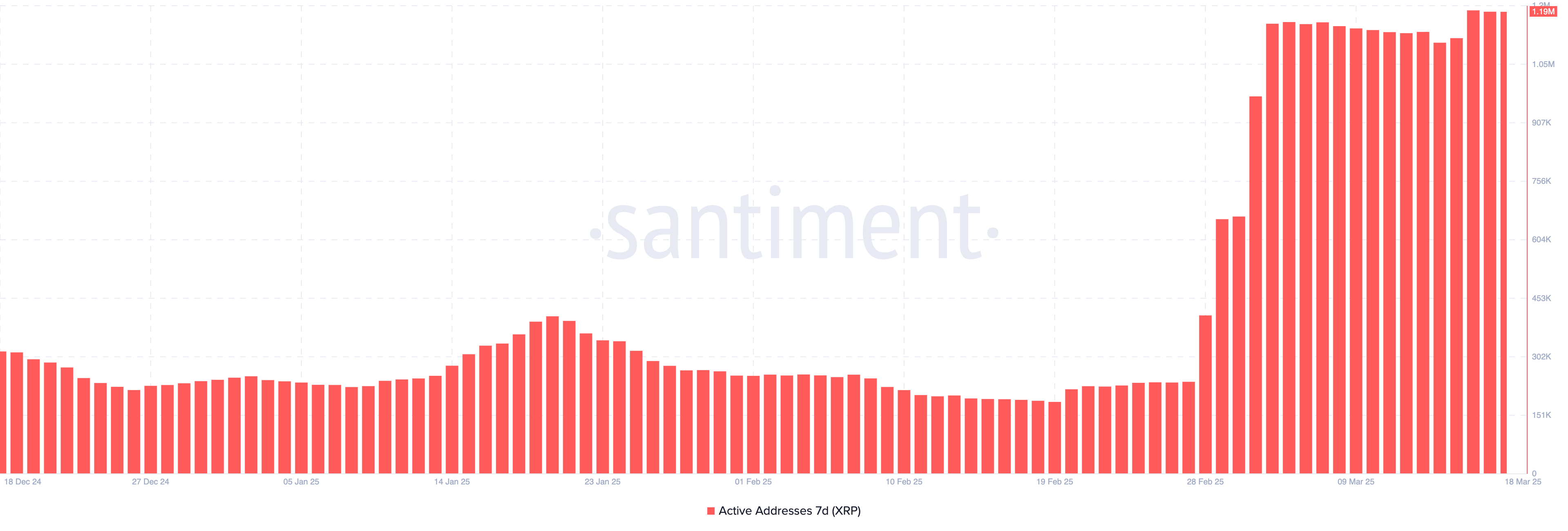

XRP’s network activity has been surging, with the number of 7-day Active Addresses reaching an all-time high of 1.19 million. This is a massive increase from the 237,000 recorded on February 27, marking an almost fivefold rise in just a few weeks.

The spike in active addresses signals that XRP’s blockchain is seeing heightened participation, whether from retail traders, institutional players, or speculative interest.

Such elevated levels of activity are rarely seen and could indicate growing attention and usage of the network.

Tracking the number of active addresses is crucial as it offers insight into the level of user engagement and real demand on the blockchain.

Generally, an increase in active addresses can suggest that more participants are transacting or interacting with the network, which often correlates with stronger liquidity and potentially higher price volatility. In XRP’s case, this record-breaking surge in activity could act as a bullish signal, hinting at growing interest and possibly renewed capital inflows.

While it doesn’t guarantee immediate price appreciation, such strong network participation could help support XRP’s price and reduce downside risk, especially if coupled with other bullish technical or fundamental factors.

Can XRP Reach $3 Soon?

Its EMA lines are currently pointing to a potential new golden cross forming soon.

Should this scenario unfold, XRP price may first challenge the resistance at $2.648. If buying momentum strengthens further, the price might push toward $2.99, potentially breaking above the barrier at $3.

Conversely, a renewed downtrend could take shape if the bullish momentum fails to materialize and XRP’s price struggles to hold above its current range.

In this case, the key support level at $2.47 would become clear. A breakdown below this threshold could expose XRP to further downside risk, testing $2.21 and possibly driving it down to as low as $1.90.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Predicts XRP Price Could Rebound To $4, But Bulls Must Hold This Line

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst CoinsKid has predicted that the XRP price could soon rally to $4, which represents a new all-time high (ATH) for the altcoin. He also warned that XRP bulls must hold the line to avoid a potential drop to as low as $1.64.

Analyst Predicts XRP Price Could Rebound To $4

In an X post, CoinsKid predicted that the XRP price could rebound to as high as $4 if the altcoin takes out the local January 2025 high, when it rallied to its current ATH at around $3.4. He added that XRP may go beyond this $4 target on the bull run in the crypto market. In the meantime, the analyst warned that XRP bulls must hold the line to avoid a significant correction.

Related Reading

CoinsKid said that failure to hold the 20 Weighted Moving Average could spark a deeper correction for the altcoin, sending the altcoin to a minimal target of $1.64. The analyst went further to discuss XRP’s current price action. He noted that the altcoin is missing a 5th wave from the July 2024 bottom.

The analyst further opined that the XRP price has been in a wave 4 irregular expanded flat ABC correction since December 2024. He revealed that XRP is currently holding the 20 Weighted Moving Average, which is a sign of strength from the bulls. However, he warned that they must continue to hold the line to avoid a drop to as low as $1.64.

Meanwhile, he mentioned that the RSI and the retail top were the key data points that pointed to an XRP price correction back in December. As to what could spark this price rebound to $4, CoinsKid alluded to the global money supply, which shows that liquidity is entering the market soon after leaving in December.

$5 Is Also In Sight For The Asset

Crypto analyst Dark Defender has also predicted that the XRP price could rally to as high as $5.85, although it would face significant resistance at $3.39, around its current all-time high. The analyst also highlighted $2.30 and $2.22 as the support levels that XRP needs to hold above as it eyes a rally to this $5 target.

Meanwhile, the analyst also revealed that the primary correction for the price on the weekly, daily, and 4-hour structure is over. He noted that there will be more minor ups and downs. However, Dark Defender suggested XRP was well primed for a bullish reversal. He added that the altcoin has started wave 1 with the aim of rallying to this $5 target.

Related Reading: Crypto Pundit Reignites $100 XRP Price Target, What You Should Know

At the time of writing, the XRP price is trading at around $2.28, up in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

-

Altcoin15 hours ago

Altcoin15 hours agoBinance Expands Support For StraitsX (XUSD) This Crypto, Here’s All

-

Ethereum23 hours ago

Ethereum23 hours agoBullish Breakout On The Ethereum 4-Hour Chart Says Price Is Headed For $2,500

-

Bitcoin13 hours ago

Bitcoin13 hours agoIs Strategy’s Bitcoin Gamble About to Backfire?

-

Market23 hours ago

Market23 hours agoSolana Risks Falling to $120 Amid Weak TVL and Whale Activity

-

Market12 hours ago

Market12 hours agoHBAR Price’s Recovery Set To Be Invalidated By Death Cross

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Price: Analyst Predicts ‘Most Hated Rally In Crypto’

-

Bitcoin22 hours ago

Bitcoin22 hours agoSchiff Predicts A Catastrophic 85% BTC Drop—Details

-

Market22 hours ago

Market22 hours agoCoinbase Launches Verified Pools for Retail Users