Market

HBAR Price’s Recovery Set To Be Invalidated By Death Cross

HBAR, the native crypto token of the Hedera network, has recently attempted a recovery rally, but the price lacks the support needed to maintain its upward momentum.

With broader market cues turning bearish and investor sentiment weakening, the altcoin could face further price declines, extending recent losses. The formation of a Death Cross may signal additional struggles ahead for HBAR holders.

Hedera Is Facing A Challenge

The Exponential Moving Averages (EMAs) for HBAR are nearing the formation of a Death Cross, a bearish indicator that could push prices lower. A Death Cross occurs when the 200-day EMA crosses over the 50-day EMA, signaling that the broader market momentum is shifting toward the downside. The last time this happened was in June 2024; HBAR entered a prolonged downtrend that lasted for five months and resulted in a significant price decline.

Currently, there is a 13% gap before the 200-day EMA overtakes the 50-day EMA. This suggests that the Death Cross is becoming increasingly likely. If this happens, the momentum could shift even further into the negative, and HBAR might struggle to recover.

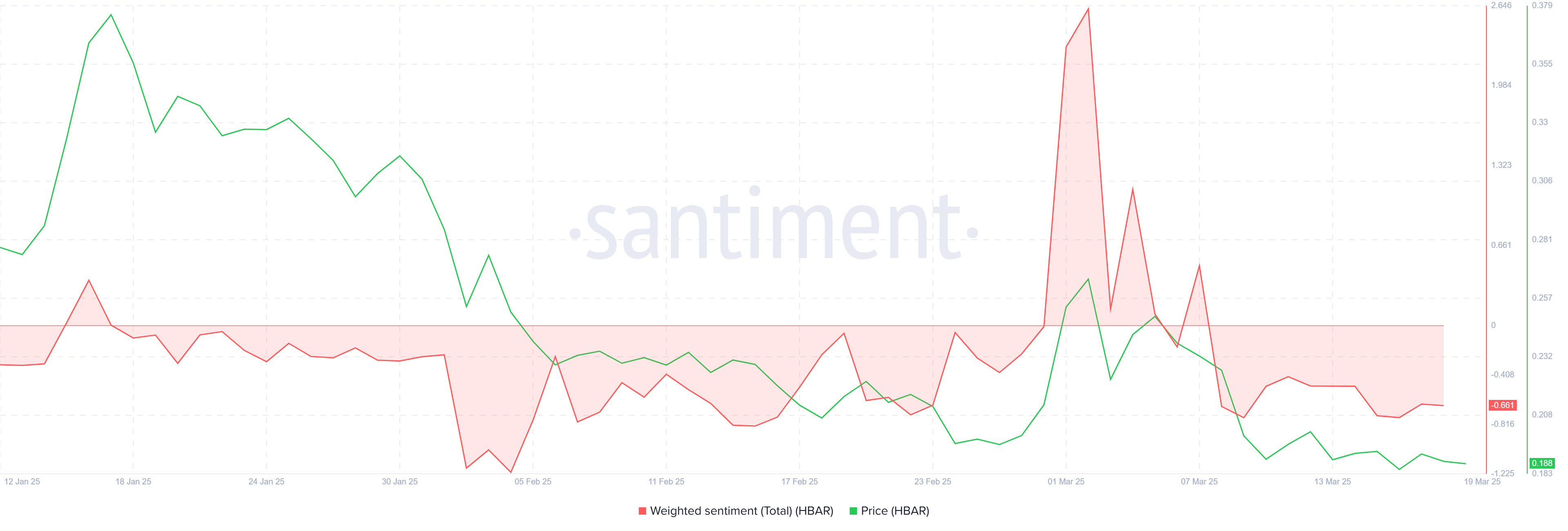

Investor sentiment has been negative for most of this month. Although February saw a brief period of bullish activity, it quickly faded, leaving HBAR without significant support. This lack of conviction among investors is concerning, as it suggests that further upward movement may be difficult to sustain.

The cautious sentiment of investors reflects the broader uncertainty in the crypto market. If this pattern continues, HBAR could face additional headwinds, further delaying its recovery. The inability to regain momentum could keep the altcoin stuck in a downtrend for an extended period, increasing the risk for investors.

HBAR Price Is Struggling

HBAR’s price is currently trading at $0.187, moving within a descending channel. The altcoin is approaching the critical support level of $0.177, and it is likely that HBAR could test this support or potentially break through it in the near future. A failure to hold at $0.177 could signal further downside risk for the altcoin.

If HBAR breaks through the $0.177 support, the next key level to watch is $0.154. This would represent a deeper decline and extend losses for investors, potentially delaying recovery for the cryptocurrency. At this point, consolidation could become the most likely scenario, with HBAR struggling to regain bullish momentum.

However, if HBAR manages to flip $0.195 into support and push past $0.222, it could invalidate the bearish outlook and trigger a breakout. Such a move would shift the trend toward recovery, offering hope for a sustained rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump to Speak at Digital Asset Summit, First for a President

President Donald Trump is set to speak at the Digital Asset Summit (DAS) in New York on March 20.

This is the first time a sitting US president will participate in a crypto conference.

Donald Trump to Make Historic Appearance at the Digital Asset Summit

Earlier this month, Donald Trump hosted the first-ever White House Crypto Summit. Although the community wasn’t particularly happy with the developments at the summit, it gave several significant updates on the US Bitcoin Reserve and the government’s current regulatory stance.

Reports indicate that Trump’s appearance may not be live. Some sources suggest he could deliver a pre-recorded message instead.

Either way, this marks the first time an active US president is set to formally address a crypto conference.

“Got some clarity on this — multiple sources on the ground at the DAS Conference tell me President Trump is/was planning to livestream into the conference at some point today or tomorrow to address the crowd. I’m told this may yet happen but could also be done via a taped recoding,” wrote Eleanor Terrett.

The summit will also feature key lawmakers, including Representatives Ro Khanna and Tom Emmer, alongside industry leaders such as MicroStrategy’s Michael Saylor and Ripple CEO Brad Garlinghouse.

Earlier today, Garlinghouse announced that the SEC dropped its appeal and XRP lawsuit against the firm in a landmark decision.

The crypto market has shown signs of recovery this week. Earlier today, the Feds announced that it won’t hold any rate cuts currently. Yet, two more rate cuts are planned for later this year.

Trump’s address at DAS could have further implications. If he signals a more favorable regulatory approach to digital assets, the market could respond positively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Whales Fuel Bullish Momentum by Acquiring 190 Million Coins

Cardano has noted significant whale activity over the past 24 hours, aligning with the broader market recovery. During that period, the total crypto market capitalization has added another $50 billion, signaling renewed bullish momentum.

As bullish pressure strengthens, ADA appears poised to re-commence an upward trend.

Cardano Sees Heavy Whale Accumulation

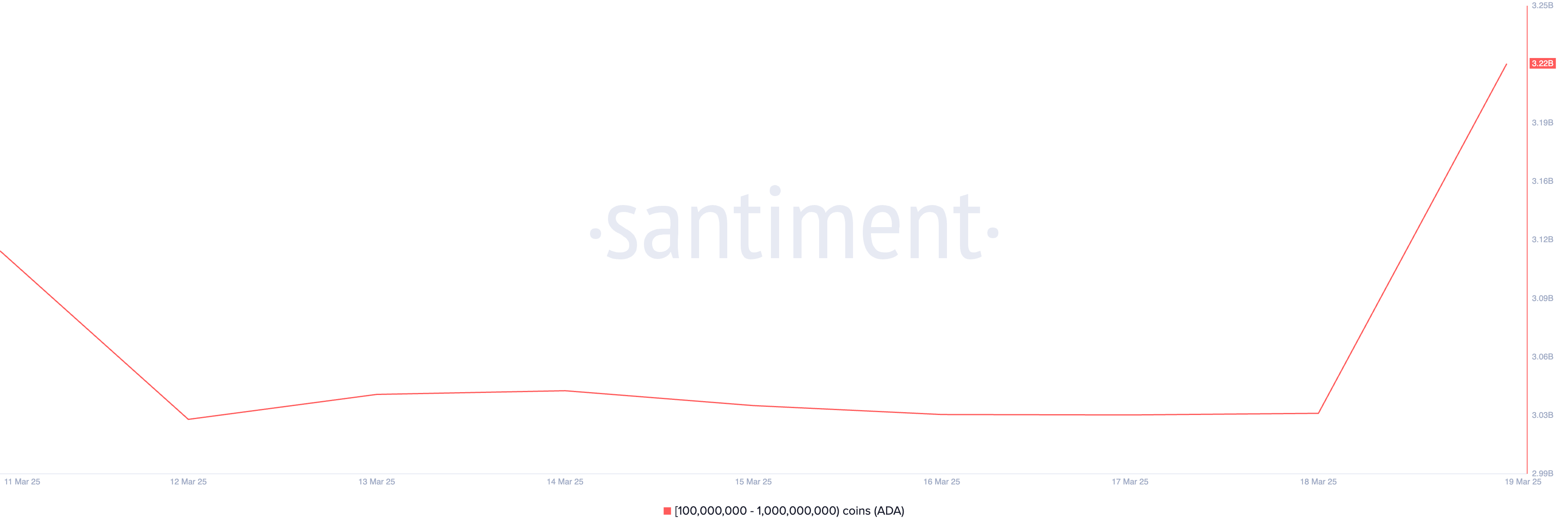

On-chain data shows that Cardano whales, holding between 100 million and 1 billion coins, have acquired 190 million ADA in the past 24 hours. This cohort of large ADA investors currently holds 3.22 billion coins.

When whales increase their coin holdings, it signals strong confidence in the asset’s future price potential.

Large-scale accumulation like this would reduce ADA’s available supply in the market, which can drive up its price if demand remains steady. The trend indicates a bullish outlook, as whales typically buy in anticipation of higher prices.

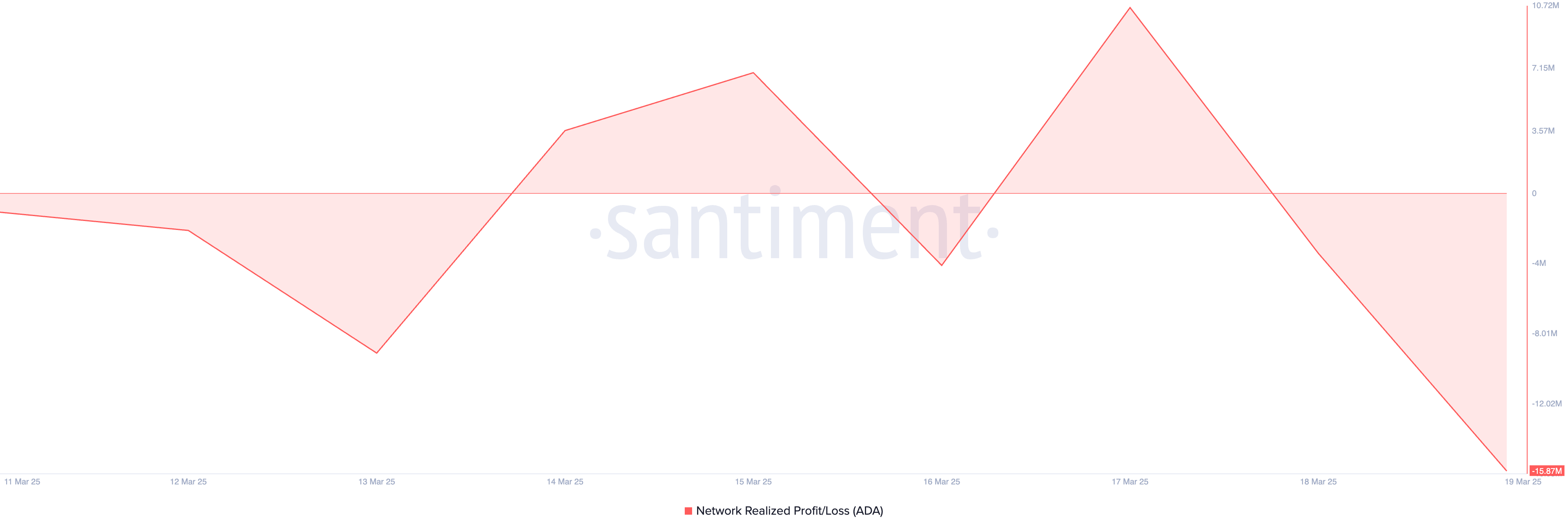

ADA’s Network Realized Profit/Loss (NPL) further supports this bullish outlook. At press time, it stands at -15.87 million.

This metric measures the net profit or loss of all coins moved on the blockchain depending on their acquisition cost. When an asset’s NPL is negative, many investors are holding at a loss.

This situation is known to reduce the selling pressure in the market, as traders may choose to hold their assets instead of realizing losses, which could support a potential price rebound.

The steady dip in ADA’s NPL indicates that many holders are sitting on unrealized losses. To avoid selling at a loss, they may choose to hold onto their investments, reducing selling pressure. The increased holding time could, in turn, drive up ADA’s price as supply tightens in the market.

ADA’s Buying Pressure Increases—Will It Fuel a Price Breakout?

At press time, ADA trades at $0.72. On the daily chart, the coin’s Chaikin Money Flow (CMF) is in an uptrend and poised to cross above the zero line, highlighting the rise in buying pressure.

The indicator measures fund flows into and out of an asset. When it attempts to break above the zero line, it signals a potential shift from selling pressure to buying pressure.

If the breakout is sustained, it would confirm strengthening bullish momentum in the ADA market and hint at a potential price uptrend. In this case, the coin’s price could rally toward $0.82.

However, if selloffs intensify, this bullish projection will be invalidated. In that scenario, ADA’s price could fall to $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FOMC Refuses to Cut Interest Rates, Disappointment Priced In

The FOMC concluded its latest meeting by announcing that it will not cut US interest rates. This decision was largely priced in, and the crypto market hasn’t seriously suffered.

Rate cuts would’ve provided a bullish narrative to juice fresh investment, which the market desperately needs. Bearish signals are growing alongside fears of a US recession.

Federal Reserve Says No to Rate Cuts

The Federal Reserve just finished its Federal Open Market Committee (FOMC), which determines much of US financial policy. The crypto industry was waiting with bated breath to see if the FOMC would decide to cut interest rates.

However, the FOMC made its report to the public and claimed that no rate cuts would be taking place.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%,” it said.

This news more or less fits with the industry’s expectations. Fed Chair Jerome Powell already clearly stated that the FOMC doesn’t plan to cut interest rates.

The industry hoped that rate cuts could provide a bullish narrative, especially while the markets are afraid. For now, it seems like it’ll need to find an optimistic signal somewhere else.

Rate cuts would be bullish for investors, especially for risk-on assets like cryptoassets. However, this isn’t the Federal Reserve’s only concern. The FOMC alluded to its “dual mandate” when denying rate cuts. In other words, it needs to juggle investor concerns with consumer inflation fears, uncertainty around Trump’s tariffs, and a possible US recession.

If the FOMC were to slash interest rates, it would likely boost US inflation. The most recent CPI report was better than expected, and some in the industry hoped that this would build confidence. Ultimately, the main hopes rested with President Trump, who personally advocated for rate cuts. However, he didn’t make a major intervention.

It’s not all bad, though. The FOMC also announced would slow Quantitative tightening (QT) by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.

Some members of the community were pleased by this news, as slower QT can increase market liquidity. This announcement is at least some consolation for investors.

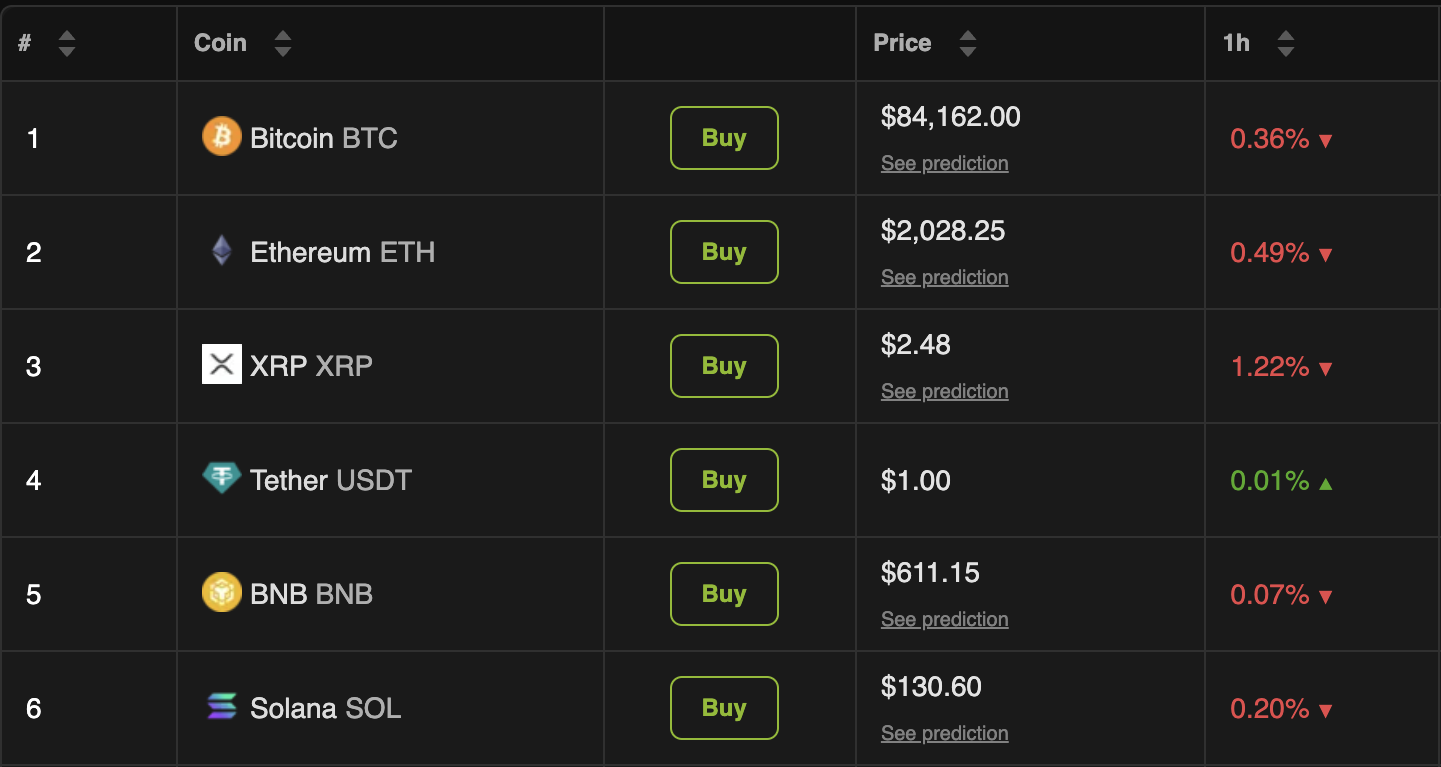

In any event, this lack of rate cuts was expected and priced in. The FOMC didn’t shock anybody by refusing to cut interest rates, and the market hasn’t been chaotic. A few of the top-performing cryptoassets suffered minor losses, but no substantial drops have materialized.

The crypto industry has been desperate for a bullish narrative, and some major players are visibly cracking at the seams.

The FOMC, however, did not provide this narrative via rate cuts. Hopefully, crypto will find something else to be optimistic about before a full-blown market correction takes hold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin24 hours ago

Altcoin24 hours agoADA Bulls Target $1 as Cardano Price Double Bottom Pattern Hints at Reversal

-

Market23 hours ago

Market23 hours ago3 Crypto Smart Money Wallets Are Dumping Fast This March

-

Altcoin21 hours ago

Altcoin21 hours agoDogecoin Price Eyes Breakout To $0.29 In The Short Term

-

Regulation21 hours ago

Regulation21 hours agoWill Crypto Market Crash Tomorrow After Federal Reserve Interest Rate Decision?

-

Ethereum19 hours ago

Ethereum19 hours agoBullish Breakout On The Ethereum 4-Hour Chart Says Price Is Headed For $2,500

-

Bitcoin9 hours ago

Bitcoin9 hours agoIs Strategy’s Bitcoin Gamble About to Backfire?

-

Market19 hours ago

Market19 hours agoSolana Risks Falling to $120 Amid Weak TVL and Whale Activity

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum Price: Analyst Predicts ‘Most Hated Rally In Crypto’