Market

AI Coins Lose Steam Despite Nvidia’s Blackwell Ultra Debut

Artificial intelligence (AI) coins faced an unexpected setback as Nvidia’s highly anticipated GPU Technology Conference (GTC) failed to ignite the enthusiasm investors had hoped for.

Despite the unveiling of Nvidia’s latest AI chips, the AI cryptocurrency market saw a decline of 2.8%. Meanwhile, Nvidia’s own stock also took a hit.

AI Crypto Tokens Slide as Nvidia CEO Unveils Next-Gen Chips in Conference

The Nvidia GTC conference in San Jose, California, has long been a pivotal event for the tech and AI industries, often serving as a catalyst for market movements. This year, expectations were high as CEO Jensen Huang took the stage on March 18 to showcase Nvidia’s next-generation AI chips.

This included the Blackwell Ultra, set for release in the second half of 2025. Huang also provided a glimpse into the company’s roadmap with the Vera Rubin and Rubin Ultra chips slated for 2026 and 2027, respectively.

He emphasized the chips’ capabilities in advancing AI reasoning and agentic AI—systems designed to plan and act autonomously—positioning Nvidia as a leader in the AI space.

“These last two to three years have seen a fundamental breakthrough in AI. We call it agentic AI,” Huang said.

The CEO previously highlighted the potential of AI agents, predicting it to become a multi-trillion-dollar opportunity. This remark sparked a surge in AI agent tokens.

In fact, AI tokens saw significant gains following Nvidia’s impressive fourth-quarter earnings report in February. Thus, investors hoped for a similar impact from the conference. Yet, this time, the unveiling of new hardware failed to replicate that momentum.

While eight of the top 10 AI coins saw small gains, it wasn’t much. Additionally, the latest data revealed a 2.8% decline in the total market capitalization of AI-related cryptocurrencies following the keynote. Among the sectors, AI Applications experienced the steepest drop, posting a double-digit decline of 17.6%.

Other affected sectors included AI Agent Launchpad, which saw a decrease of 9.5%, and AI Agents, which dipped by 7.7%. In addition, the AI Framework sector fell by 2.1%. The Bittensor Ecosystem also faced a decline, albeit smaller, at 1.7%.

Nvidia’s stock (NVDA) mirrored the broader sector’s disappointment. According to Google Finance, the shares fell 3.4% on Tuesday, contributing to a year-to-date decline of 14.0%.

The drop came amid a broader market rout, with tech stocks facing pressure from macroeconomic uncertainty and shifting investor sentiment.

The emergence of competitors, such as China’s DeepSeek, which claimed to have built a cost-effective AI chatbot earlier this year, may also be weighing on sentiment, raising questions about Nvidia’s unchallenged dominance and impact in the AI sector.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

FOMC Refuses to Cut Interest Rates, Disappointment Priced In

The FOMC concluded its latest meeting by announcing that it will not cut US interest rates. This decision was largely priced in, and the crypto market hasn’t seriously suffered.

Rate cuts would’ve provided a bullish narrative to juice fresh investment, which the market desperately needs. Bearish signals are growing alongside fears of a US recession.

Federal Reserve Says No to Rate Cuts

The Federal Reserve just finished its Federal Open Market Committee (FOMC), which determines much of US financial policy. The crypto industry was waiting with bated breath to see if the FOMC would decide to cut interest rates.

However, the FOMC made its report to the public and claimed that no rate cuts would be taking place.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. Uncertainty around the economic outlook has increased. The Committee is attentive to the risks to both sides of its dual mandate. In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 4.25% to 4.5%,” it said.

This news more or less fits with the industry’s expectations. Fed Chair Jerome Powell already clearly stated that the FOMC doesn’t plan to cut interest rates.

The industry hoped that rate cuts could provide a bullish narrative, especially while the markets are afraid. For now, it seems like it’ll need to find an optimistic signal somewhere else.

Rate cuts would be bullish for investors, especially for risk-on assets like cryptoassets. However, this isn’t the Federal Reserve’s only concern. The FOMC alluded to its “dual mandate” when denying rate cuts. In other words, it needs to juggle investor concerns with consumer inflation fears, uncertainty around Trump’s tariffs, and a possible US recession.

If the FOMC were to slash interest rates, it would likely boost US inflation. The most recent CPI report was better than expected, and some in the industry hoped that this would build confidence. Ultimately, the main hopes rested with President Trump, who personally advocated for rate cuts. However, he didn’t make a major intervention.

It’s not all bad, though. The FOMC also announced would slow Quantitative tightening (QT) by reducing the monthly redemption cap on Treasury securities from $25 billion to $5 billion.

Some members of the community were pleased by this news, as slower QT can increase market liquidity. This announcement is at least some consolation for investors.

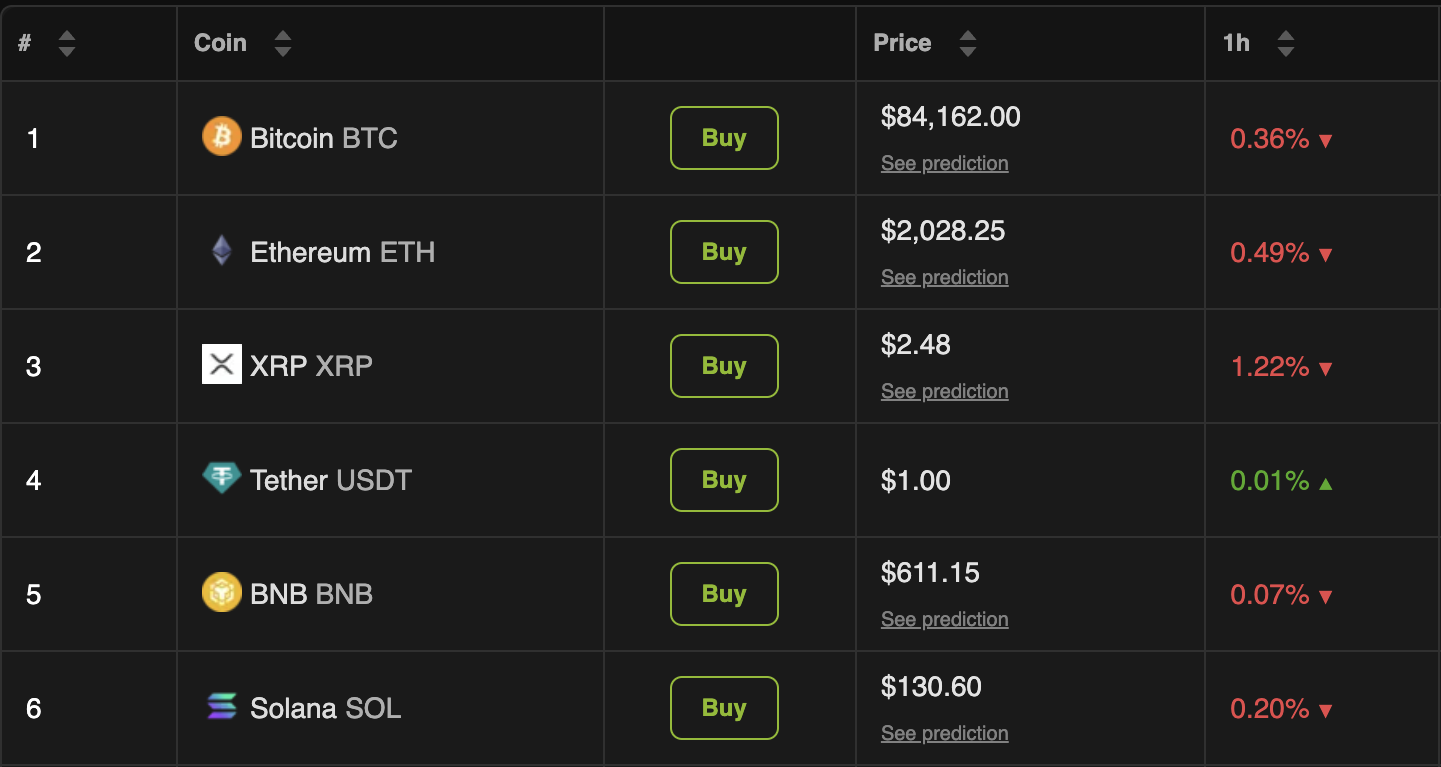

In any event, this lack of rate cuts was expected and priced in. The FOMC didn’t shock anybody by refusing to cut interest rates, and the market hasn’t been chaotic. A few of the top-performing cryptoassets suffered minor losses, but no substantial drops have materialized.

The crypto industry has been desperate for a bullish narrative, and some major players are visibly cracking at the seams.

The FOMC, however, did not provide this narrative via rate cuts. Hopefully, crypto will find something else to be optimistic about before a full-blown market correction takes hold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XCN Traders Shift Focus as Active Addresses Plunge

Onyxcoin (XCN) has maintained its downward trajectory, plummeting by 10% over the past week as bearish sentiment grips the market.

With more traders turning away from the altcoin, its active address count has seen a sharp fall, signaling a loss of interest in the asset and low network participation.

XCN Struggles as Short Sellers Take Control

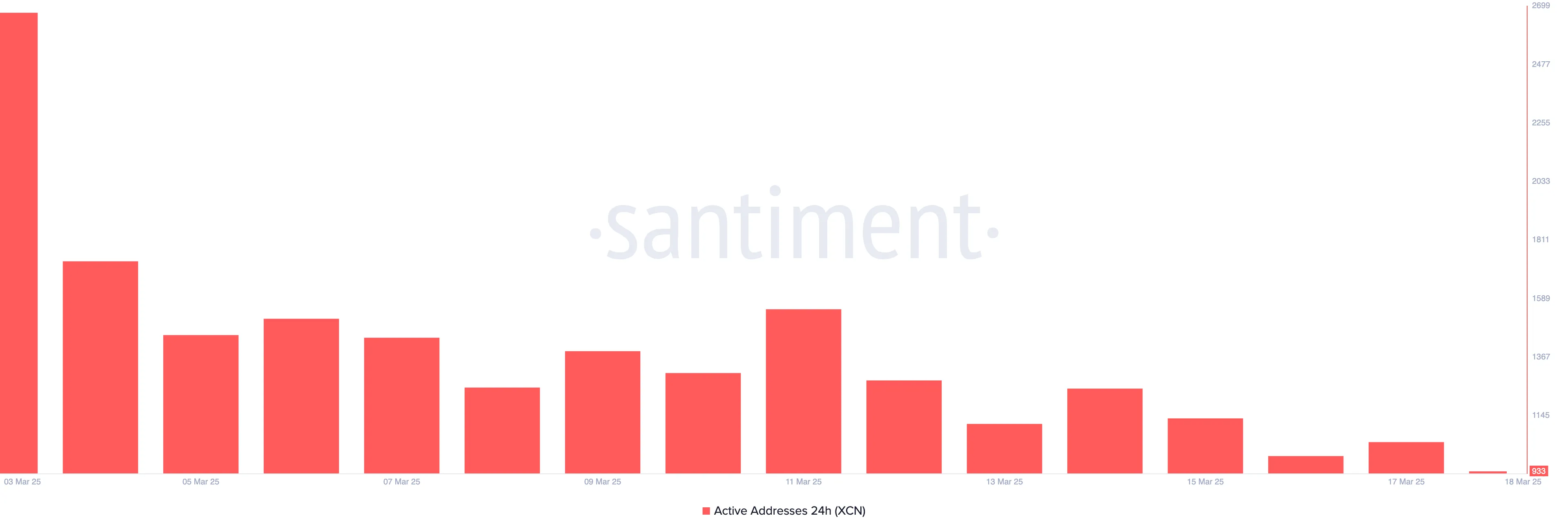

Since early March, Santiment’s data has revealed an aggressive fall in XCN’s daily active address count.

According to the on-chain data provider, on March 3, 2,673 unique addresses completed at least one transaction involving XCN. Since then, this figure has steadily declined, hitting a low of 1,044 on March 18.

This decline highlights waning network activity on Onyxcoin and the reduced demand for its altcoin, reinforcing the bearish sentiment surrounding XCN.

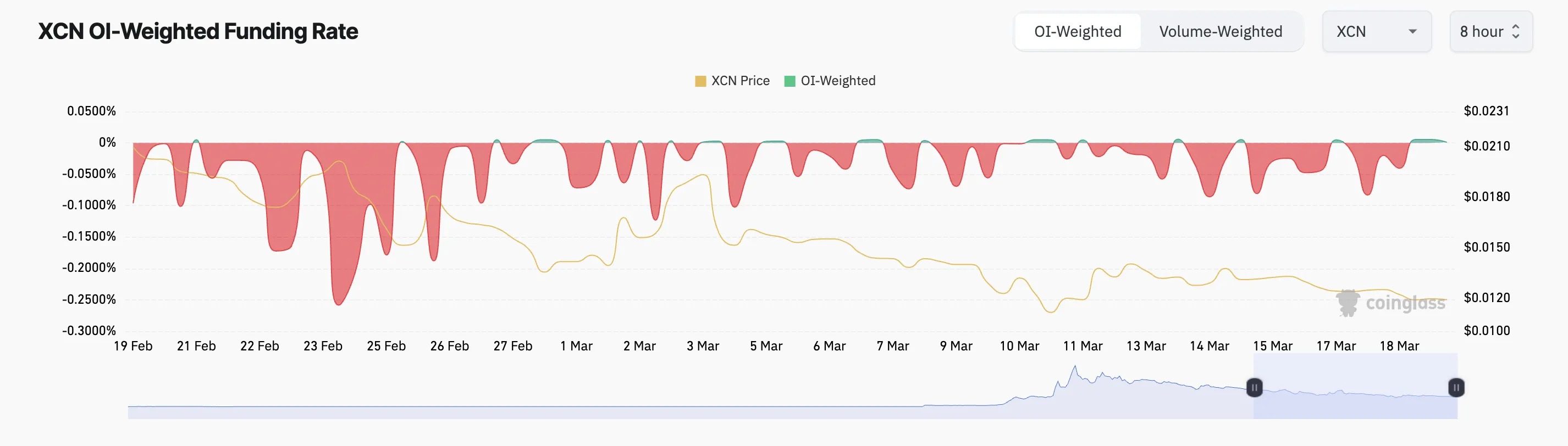

Moreover, the month has been marked by a significant rise in the demand for short positions, as reflected by the altcoin’s predominantly negative funding rate.

An asset’s funding rate is a periodic fee exchanged between its long and short traders in perpetual futures contracts. When the funding rate is mostly negative, short sellers dominate the coin’s futures markets.

The rising demand for XCN shorts highlights the market’s bearish outlook. Sellers are maintaining control and limiting any potential short-term recovery.

XCN Faces Strong Selling Pressure

The token’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, the momentum indicator is below zero at -0.19.

The CMF indicator measures fund flows into and out of an asset. When its value is negative, selling pressure outpaces buying activity. This indicates the likelihood of a further price decline as demand remains weak. In this scenario, XCN’s price could slip to $0.0075.

Conversely, the token’s price could rocket toward $0.022 if buyers regain market control.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

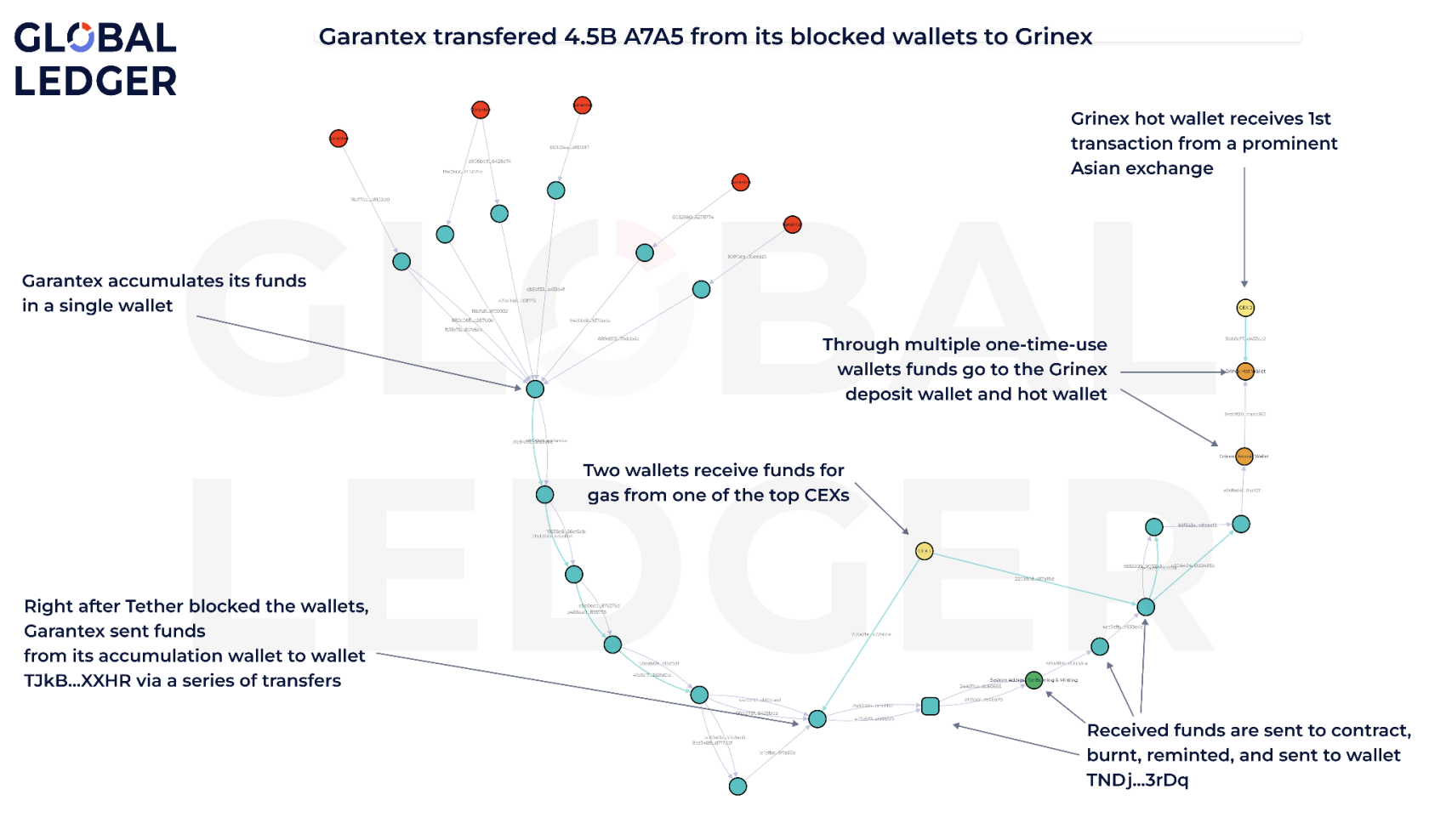

Russian Crypto Exchange Garantex Is Back Under a New Name

A comprehensive report from Global Ledger claims that Garantex’s founders created a new exchange, Grinex, just a week after the previous exchange was shut down by US and EU authorities. The new platform, Grinex, has already processed $36 million in incoming transactions.

Global Ledger shared this report exclusively with BeInCrypto.

Is Garantex Back Under a New Name?

Garantex, a Russian crypto exchange, was shut down last week, but apparently, it isn’t out. Earlier this month, Tether froze some of its wallets containing USDT worth $28 million, and the US Department of Justice seized its domains, as its co-founder was arrested.

However, a new report shows that Garantex’s team has already launched a similar exchange, Grinex.

“Swiss blockchain analytics company Global Ledger has completed its investigation and gathered conclusive evidence that Grinex, the exchange that emerged shortly after the dramatic collapse of Garantex, is, in fact, a direct continuation of Garantex itself,” Global Ledger claimed in an exclusive press release shared with BeInCrypto.

The center of this claim comes from on-chain analysis. A7A5, a ruble-backed stablecoin, was listed on Garantex less than a month before its shutdown.

Soon after, its creators confirmed via Telegram that the asset was listed on Grinex. Global Ledger tracked a massive A7A5 liquidity transfer from Garantex to Grinex, proving a connection.

Garantex Users Are Receiving Lost Funds On Grinex

According to Global Ledger’s research, these exchanges have incredibly similar interfaces. Also, a marketing statement on the Russian crypto tracking site ‘CoinMarketRating’ claims that the owners of Garantex created Grinex.

Most notably, some users who lost funds on Garantex have reported receiving reimbursements on Grinex.

Sources also claim that Grinex customers are visiting the Garantex office in person, and many users are moving assets to the new exchange.

Overall, all facts reflect that Grinex has found a way to remain operational, despite the earlier crackdown. The US Department of Justice sanctioned Garantex in 2023.

The case of Grinex is another example of how Russia has been using crypto to actively evade international sanctions. Even if law enforcement acts quickly against Grinex, it could resurface.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoTop 3 Base Meme Coins to Watch Closely This Week

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Predicts XRP Price To Reach $20 With 18 XRP ETFs On The Horizon

-

Market22 hours ago

Market22 hours agoBitcoin ETF Issuers Purchase Over $40 Million in BTC

-

Altcoin22 hours ago

Altcoin22 hours agoADA Bulls Target $1 as Cardano Price Double Bottom Pattern Hints at Reversal

-

Market21 hours ago

Market21 hours ago3 Crypto Smart Money Wallets Are Dumping Fast This March

-

Altcoin19 hours ago

Altcoin19 hours agoDogecoin Price Eyes Breakout To $0.29 In The Short Term

-

Market15 hours ago

Market15 hours agoThe Web3 Solution to AI Copyright and Ownership

-

Market20 hours ago

Market20 hours agoBurwick Files Lawsuit Against Meteora and Other LIBRA Backers