Market

Gate.io Joins Forces with Oracle Red Bull Racing in F1

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

In a world where extreme speed meets cutting-edge technology, only true game changers can maintain their lead. Recently, Gate.io officially announced its sponsorship of Oracle Red Bull Racing in F1, sparking widespread market attention and discussion.

Whether it’s the eight-time championship-winning Red Bull Racing team in F1, or Gate.io, a Web3 pioneer driving industry transformation through innovation, both share the same relentless pursuit of excellence – pushing limits and continuously evolving to dominate their respective arenas.

As the 2025 F1 season approaches, Gate.io and Oracle Red Bull Racing will join forces to drive innovation through technology, define the future through speed, and create a legacy worthy of game changers.

Technology-Driven Excellence: The Relentless Pursuit of Game Changers

In both the crypto market and F1, speed, precision, and innovation determine victory. The partnership between Gate.io and Oracle Red Bull Racing is more than just a branding collaboration—it is the convergence of two industry leaders who share a deep-rooted competitive spirit.

- Leading with Speed: While Oracle Red Bull Racing team in F1 pushes the boundaries of aerodynamics, Gate.io builds its competitive edge through trading speed. In 2024, Gate.io launched 873 new tokens, including 437 first-listings worldwide, continuously accelerating industry innovation and helping users capture market opportunities.

- Winning with Precision: Just as Oracle Red Bull Racing fine-tunes its race strategy through data analytics, Gate.io optimizes every trade with intelligent order matching and advanced algorithms, ensuring transactions are executed at the best possible price, giving users an edge in volatile markets.

- Global Influence: With over 500 million F1 fans worldwide, and Gate.io’s user base surpassing 21 million and growing, this partnership strengthens the global presence of both game changers, extending their reach into new markets.

Branding Momentum Transition: A Strategic Expansion for the Future

Gate.io’s sponsorship of Oracle Red Bull Racing is more than just a branding opportunity—it’s a strategic global expansion plan.

- Targeted Engagement: This partnership is not just about exposure; it’s about reaching the right audience. F1’s global fanbase includes high-net-worth individuals, tech enthusiasts, and finance professionals—key demographics for the crypto industry. Through this collaboration, Gate.io aims to bridge the gap between traditional investors and the future of digital finance.

- Alliance of Champions: Just as Oracle Red Bull Racing dominates F1, Gate.io is a pioneer in crypto space. As one of the longest-standing exchanges, Gate.io continues to lead through technological innovation, security, and market leadership. This partnership is more than just brand exposure—it’s a union of two elite forces.

- Brand Influence: Gate.io’s branding will be featured on Oracle Red Bull Racing’s rear wing, nose, headrests, wheel covers, and even on the helmet of four-time World Champion, Max Verstappen. This symbolizes Gate.io’s strength as an industry leader and reinforces its commitment to innovation and excellence on a global stage.

In the race for market leadership, Gate.io is accelerating with precision and vision, steering toward a broader and more influential future.

Digital Acceleration: Breaking Barriers to Stay Ahead

Like the F1 circuit, the digital asset industry is a battlefield where every second defines the future. In this post-CEX era, Gate.io is not just witnessing the evolution of industry. It is actively driving it forward, redefining industry standards through technological breakthroughs and strategic brand expansion.

- Industry Leader: In January 2025, Gate.io’s total reserves surpassed $10.328 billion, ranking fourth globally. The exchange continues to enhance security frameworks and risk management systems, ensuring a stable and trustworthy trading environment.

- Brand Accelerator: By integrating blockchain technology with mainstream culture, Gate.io is reshaping public perceptions of crypto. In February 2025, Gate.io sponsored the Token of Love Music Festival, bridging the gap between blockchain technology and global pop culture, drawing Web3 enthusiasts worldwide and broadcasting the creativity and vitality of the crypto industry to the global audience.

- Value Creator: Gate.io recently completed its Q4 2024 GT token burn, bringing the total burned supply to 177 million GT, reinforcing its commitment to the long-term value of its platform token. With GT surging over 300% in 2024, Gate.io once again proved its strategic foresight in the market.

- Meme Ecosystem Pioneer: Through its Pilot Section and MemeBox, Gate.io is actively fostering the explosive growth of the Meme ecosystem, helping users capitalize on emerging market trends in real-time.

In F1, only those who relentlessly optimize their technology and strategy can stay ahead. In crypto, only those who continuously innovate can remain dominant across market cycles. Gate.io understands this fundamental truth—and with over 12 years of technical expertise, it has solidified its position as a long-term leader.

Game Changers Never Stop

The F1 race never slows down, and neither does Gate.io’s evolution.As Oracle Red Bull Racing’s cars cut through the air, breaking limits to cross the finish line, and as Gate.io accelerates through market fluctuations to achieve new milestones, both are driven by the same belief: “Only game changers can shape the future.”

Disclaimer: This content does not constitute an offer, solicitation, or recommendation. You should always seek independent professional advice before making investment decisions. Gate.io may restrict or prohibit certain services in specific jurisdictions. For more details, please read the User Agreement.

Disclaimer

This article contains a press release provided by an external source and may not necessarily reflect the views or opinions of BeInCrypto. In compliance with the Trust Project guidelines, BeInCrypto remains committed to transparent and unbiased reporting. Readers are advised to verify information independently and consult with a professional before making decisions based on this press release content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XCN Traders Shift Focus as Active Addresses Plunge

Onyxcoin (XCN) has maintained its downward trajectory, plummeting by 10% over the past week as bearish sentiment grips the market.

With more traders turning away from the altcoin, its active address count has seen a sharp fall, signaling a loss of interest in the asset and low network participation.

XCN Struggles as Short Sellers Take Control

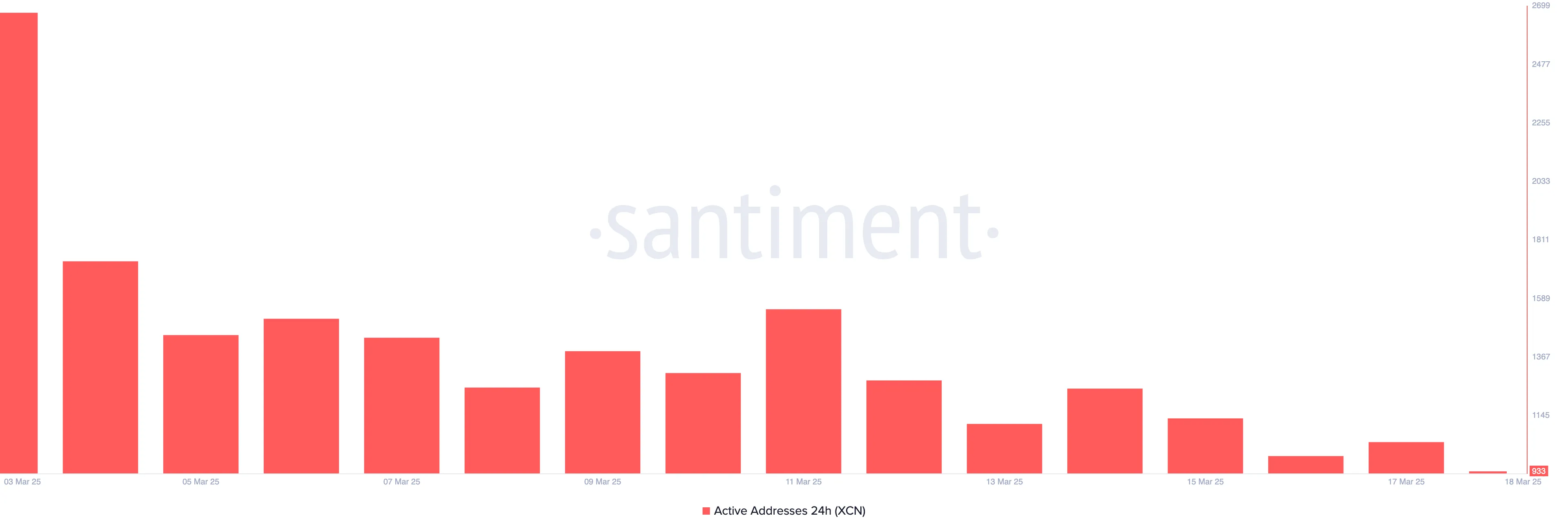

Since early March, Santiment’s data has revealed an aggressive fall in XCN’s daily active address count.

According to the on-chain data provider, on March 3, 2,673 unique addresses completed at least one transaction involving XCN. Since then, this figure has steadily declined, hitting a low of 1,044 on March 18.

This decline highlights waning network activity on Onyxcoin and the reduced demand for its altcoin, reinforcing the bearish sentiment surrounding XCN.

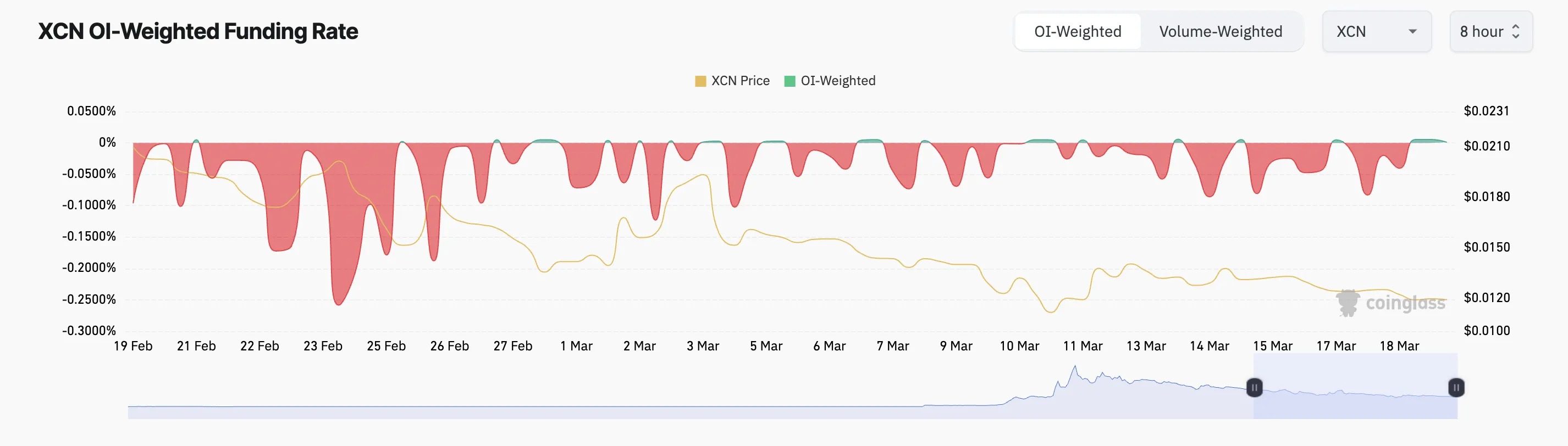

Moreover, the month has been marked by a significant rise in the demand for short positions, as reflected by the altcoin’s predominantly negative funding rate.

An asset’s funding rate is a periodic fee exchanged between its long and short traders in perpetual futures contracts. When the funding rate is mostly negative, short sellers dominate the coin’s futures markets.

The rising demand for XCN shorts highlights the market’s bearish outlook. Sellers are maintaining control and limiting any potential short-term recovery.

XCN Faces Strong Selling Pressure

The token’s Chaikin Money Flow (CMF) supports this bearish outlook. At press time, the momentum indicator is below zero at -0.19.

The CMF indicator measures fund flows into and out of an asset. When its value is negative, selling pressure outpaces buying activity. This indicates the likelihood of a further price decline as demand remains weak. In this scenario, XCN’s price could slip to $0.0075.

Conversely, the token’s price could rocket toward $0.022 if buyers regain market control.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Russian Crypto Exchange Garantex Is Back Under a New Name

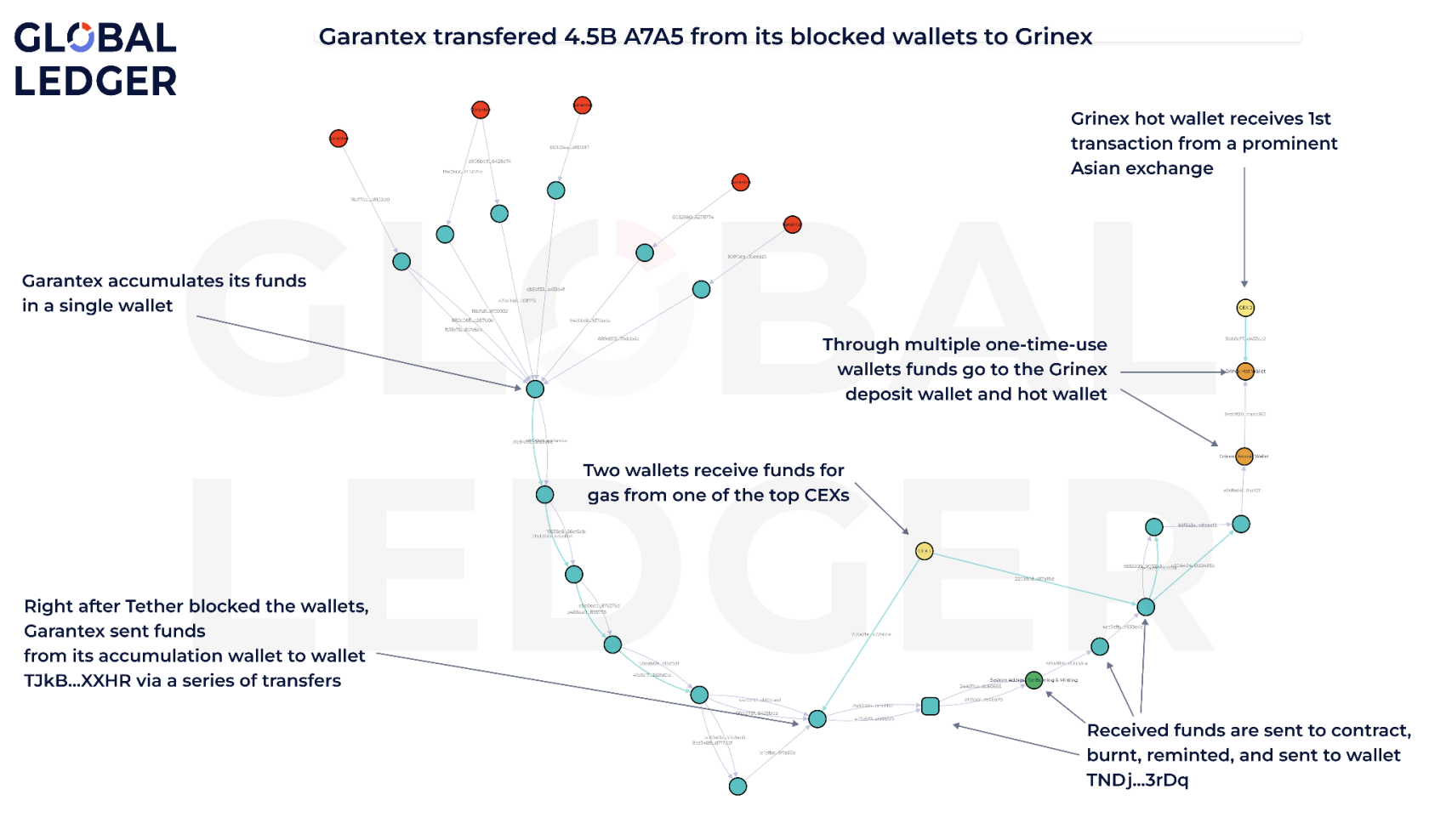

A comprehensive report from Global Ledger claims that Garantex’s founders created a new exchange, Grinex, just a week after the previous exchange was shut down by US and EU authorities. The new platform, Grinex, has already processed $36 million in incoming transactions.

Global Ledger shared this report exclusively with BeInCrypto.

Is Garantex Back Under a New Name?

Garantex, a Russian crypto exchange, was shut down last week, but apparently, it isn’t out. Earlier this month, Tether froze some of its wallets containing USDT worth $28 million, and the US Department of Justice seized its domains, as its co-founder was arrested.

However, a new report shows that Garantex’s team has already launched a similar exchange, Grinex.

“Swiss blockchain analytics company Global Ledger has completed its investigation and gathered conclusive evidence that Grinex, the exchange that emerged shortly after the dramatic collapse of Garantex, is, in fact, a direct continuation of Garantex itself,” Global Ledger claimed in an exclusive press release shared with BeInCrypto.

The center of this claim comes from on-chain analysis. A7A5, a ruble-backed stablecoin, was listed on Garantex less than a month before its shutdown.

Soon after, its creators confirmed via Telegram that the asset was listed on Grinex. Global Ledger tracked a massive A7A5 liquidity transfer from Garantex to Grinex, proving a connection.

Garantex Users Are Receiving Lost Funds On Grinex

According to Global Ledger’s research, these exchanges have incredibly similar interfaces. Also, a marketing statement on the Russian crypto tracking site ‘CoinMarketRating’ claims that the owners of Garantex created Grinex.

Most notably, some users who lost funds on Garantex have reported receiving reimbursements on Grinex.

Sources also claim that Grinex customers are visiting the Garantex office in person, and many users are moving assets to the new exchange.

Overall, all facts reflect that Grinex has found a way to remain operational, despite the earlier crackdown. The US Department of Justice sanctioned Garantex in 2023.

The case of Grinex is another example of how Russia has been using crypto to actively evade international sanctions. Even if law enforcement acts quickly against Grinex, it could resurface.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Death Cross Forms, Pointing to Potential Breakdown

A week ago, a death cross appeared on Solana’s (SOL) one-day chart, signaling a growing bearish momentum.

While the coin’s price has since consolidated within a range, rising selling pressure suggests a potential breakdown in the near term.

Solana’s Death Cross and Bearish Momentum Fuel Fears

BeInCrypto’s assessment of the SOL/USD one-day chart reveals that a death cross emerged seven days ago. This is a bearish pattern formed when an asset’s short-term moving average (the 50-day) crosses below its long-term moving average ( the 200-day).

It confirms a shift from a bullish trend to a bearish one, indicating weakening momentum and increased downside risk. Since the pattern emerged, SOL’s price has traded within a narrow range. It has since oscillated between resistance formed at $136.92 and a support floor of $121.18.

However, with selling pressure mounting, SOL appears poised for a breakdown below this support level. The widening gap between its 50-day and 200-day SMAs reinforces the likelihood of this happening in the near term.

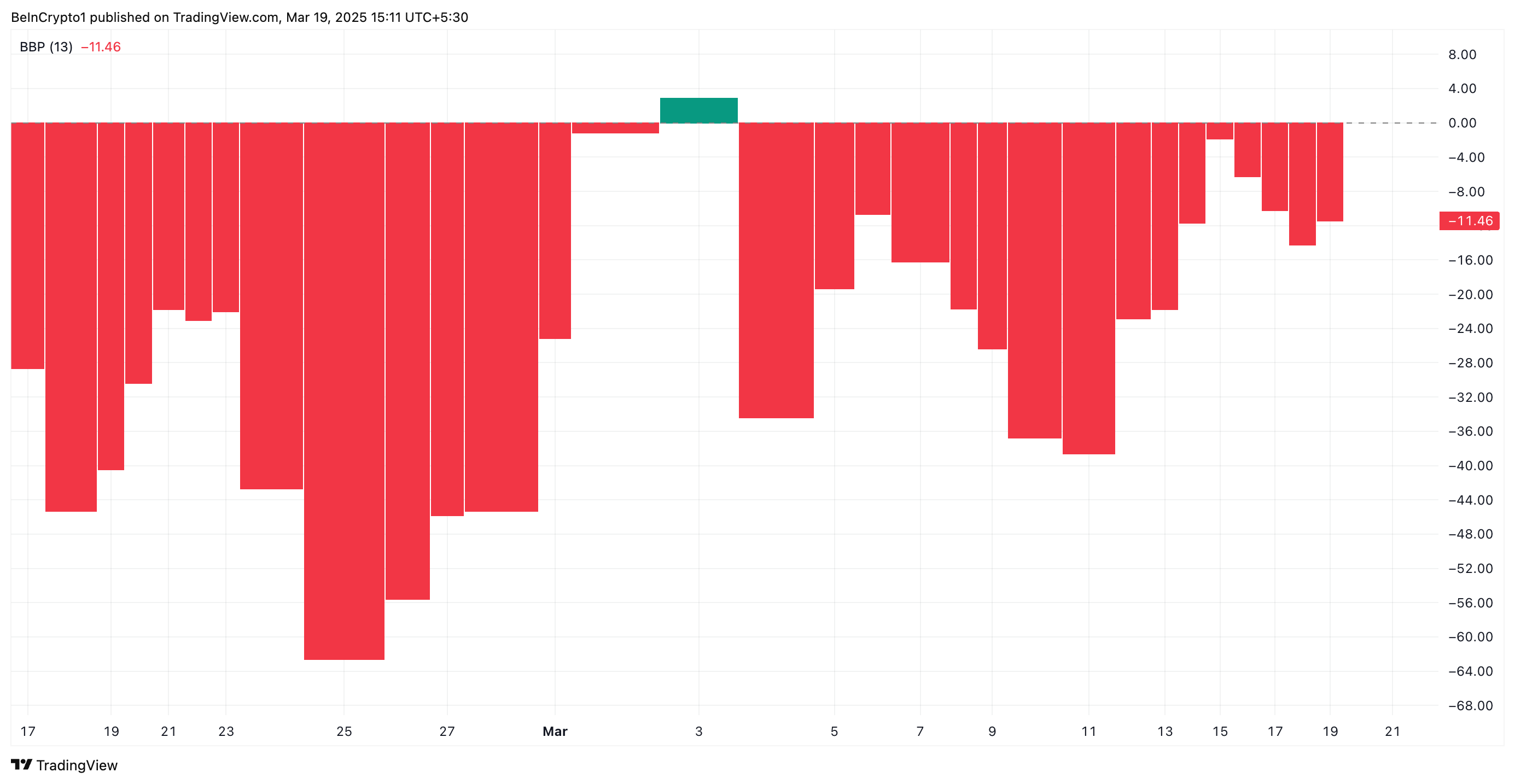

Adding to this bearish outlook, SOL’s negative Elder-Ray Index indicates that sellers are gaining control. This indicator currently stands at -11.46 at press time.

The Elder-Ray Index measures the strength of buyers (bull power) and sellers (bear power) by comparing an asset’s high and low prices to its exponential moving average (EMA). When the index is negative, it indicates that bear power is dominant.

This confirms the increased selling pressure among SOL traders and hints at the likelihood of a break below the support formed at $121.18.

SOL Bears Eye $110 as Selling Pressure Mounts—Will Support Hold?

SOL’s breakdown below the $121.18 support zone would exacerbate the downward pressure on its price. Such a breach would offer another confirmation of the bearish trend in the market and could cause the coin’s price to plummet toward $107.88.

On the other hand, if market sentiment improves and SOL demand spikes, it could break above the resistance at $136.92 and soar to $152.87.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Regulation23 hours ago

Regulation23 hours agoCoinbase CLO Slams US Treasury for Defying Court Ruling In Tornado Cash Case

-

Market22 hours ago

Market22 hours agoTop 3 Base Meme Coins to Watch Closely This Week

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Predicts XRP Price To Reach $20 With 18 XRP ETFs On The Horizon

-

Market21 hours ago

Market21 hours agoBitcoin ETF Issuers Purchase Over $40 Million in BTC

-

Altcoin21 hours ago

Altcoin21 hours agoADA Bulls Target $1 as Cardano Price Double Bottom Pattern Hints at Reversal

-

Market20 hours ago

Market20 hours ago3 Crypto Smart Money Wallets Are Dumping Fast This March

-

Altcoin23 hours ago

Altcoin23 hours agoJustin Sun Reveals Plan To Integrate TRX On Solana

-

Market23 hours ago

Market23 hours agoNigeria Turns to Crypto to Combat Inflation and Naira Devaluation