Market

Pi Coin Secures CoinEx Listing Amid Market Struggles

Pi Network’s cryptocurrency, Pi Coin (PI), has secured another exchange listing with CoinEx, marking a notable milestone for the project.

However, the listing comes at a turbulent time for the project, as pioneers push for clarity on Pi Network’s funding sources.

Pi Coin Listed on CoinEx Exchange

PI officially launched for trading on CoinEx on March 18, 2025. The deposit and withdrawal window opened at 11:00 UTC, followed by trading at 11:30 UTC, allowing Pi holders to trade against Tether (USDT).

“After rigorous reviews, CoinEx will list PI (Pi) on March 18, 2025,” the exchange stated in its announcement.

With this latest listing, Pi Coin is now available on 12 exchanges, as per Coinranking data. Despite this expansion, the possibility of a Binance listing remains uncertain.

Although 86% of the Pi community voted in favor of a Binance listing, the exchange has yet to confirm if or when it will list PI. This has raised concerns about the project’s credibility.

“The failure to get listed on Binance, despite 86% of the community voting in favor, raises serious concerns about public trust in the project,” a pioneer wrote on X.

Pioneers Demand Transparency on Pi Network’s Funding Sources

As concerns surrounding Pi Network continue to rise, the project is now embroiled in another controversy. A growing number of users are calling for transparency about the network’s funding sources.

An investigation by one of Pi Network’s pioneers uncovered that SocialChain Inc., the company behind Pi Network, has received investments from three firms: 137 Ventures, Ulu Ventures, and Designer Fund. However, the investigation revealed a key issue: two of these investors have not included Pi Network in their official investment portfolios.

Additionally, none of these firms have disclosed the amount of money they have invested in Pi Network despite being forthcoming with investment details for other companies.

“Why is Pi Core Team keeping this under wraps? Pioneers deserve transparency. If Pi Network aims for long-term sustainability, the team must be more open about its financial backing and key partnerships,” the post read.

Notably, a previous lawsuit by former co-founder Vince McPhillip against Pi Network offers additional insight into the project’s funding methods. The complaint outlined a series of claims, including wrongful termination, intentional and negligent infliction of emotional distress, and breach of fiduciary duty.

Nonetheless, it detailed that the project had raised funds by selling financial instruments called SAFE (Simple Agreement for Future Equity).

According to the lawsuit, Pi Network sold SAFE agreements in September 2019 with a maximum valuation of $20 million. During this fundraising round, the project raised $500,000. A few months later, in February 2020, Pi Network conducted another fundraising round at the same $20 million valuation, raising an additional $300,000.

Despite these fundraising efforts, the lack of clear financial disclosure continues to fuel concerns within the Pi Network community.

Pi Coin Sees Double-Digit Price Decline

Amid these challenges, PI’s price performance has also taken a hit. The altcoin has seen a sharp decline in value, shedding 19.3% of its gains over the past week.

This drop has pushed the coin further down the cryptocurrency rankings, with PI falling from 12th to 21st place on CoinGecko. While the broader cryptocurrency market has also faced a downturn, PI’s losses have been more pronounced. At press time, PI was trading at $1.1, down 16.5% in the past 24 hours.

Despite this, Pi Network’s community engagement remains vibrant, particularly through PiFest 2025. The event has attracted 100,000 registered sellers worldwide, including 49,000 active participants on the Map of Pi.

Social media posts highlight strong participation from communities in Vietnam, Indonesia, and beyond, where users exchange goods and services using PI tokens.

Notably, the Pioneer Korea community has reported a consensus valuation of 1 PI at $50 —starkly contrasting its current market price on exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Mario Nawfal Denies $7M Meme Coin Rug Pull Allegations

Crypto entrepreneur Mario Nawfal faces allegations of orchestrating a meme coin rug pull involving the prominent streamer Adin Ross.

The controversy erupted after Nawfal’s X account, @RoundtableSpace, posted about a supposed partnership with Ross to launch a Solana-based token, ROSS. The post was swiftly deleted, raising suspicions of fraudulent activity.

Mario Nawfal Faces Allegations of Orchestrating $7 Million Rug Pull

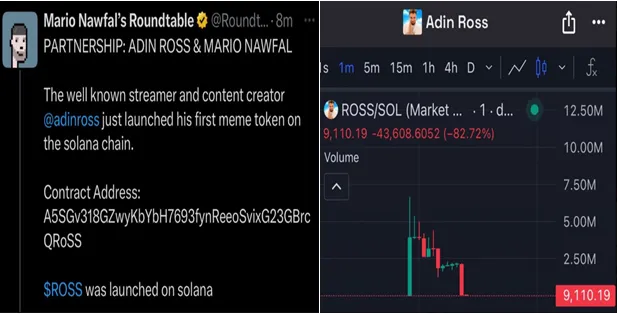

On Tuesday, @RoundtableSpace announced the launch of ROSS, claiming that Adin Ross was backing the project. The tweet contained a contract address, seemingly legitimizing the meme coin. However, within 20 minutes, the post was deleted, triggering immediate skepticism within the crypto community.

X (Twitter) user @cryptolyxe flagged the incident. The user accused Nawfal of faking a partnership with Ross to drive up the token’s value. Cryptolyxe provided screenshots showing the original tweet and a price chart depicting an 82.72% price crash, indicating a rug pull.

A rug pull is when early promoters artificially pump a token’s value before abandoning it, leaving investors with worthless assets. According to cryptolyxe, the token’s market cap soared to $7 million before plummeting to zero.

“So Mario Nawfal just posted a fake “partnership” with Adin Ross for a memecoin, then rugs the coin from $7m to 0, and deletes all the tweets… bruh,” cryptolyxe remarked.

In the aftermath, @RoundtableSpace issued a series of statements denying any wrongdoing. They claimed that an unauthorized individual from their team, @hardsnipe, was responsible for posting about the token without approval.

Nawfal’s team maintained that they acted quickly to delete the post and clarified that no official partnership with Adin Ross existed. Nawfal later alleged that his account had been compromised.

“Someone got access to both this account and Crypto Town Hall and posted a fake CA yesterday and today,” Nawfal indicated.

He further clarified that once the breach was discovered, delegate access was revoked. Reportedly, they also changed passwords to prevent further unauthorized posts.

Growing Concerns Over Meme Coin Rug Pulls

Despite Nawfal’s explanations, many in the crypto community remain unconvinced. Several users, including @nftkeano, pointed to Nawfal’s history of promoting dubious crypto projects, fueling doubts about whether this was an accident or a deliberate scam.

“This is literally your 3rd rug this month…,” Keano noted.

Adding to the controversy, Adin Ross’ team denied involvement with the token. Chat logs suggest internal confusion regarding Ross’ participation, reinforcing the claim that the partnership was never real.

While Nawfal’s team insists the ROSS meme coin post was a mistake caused by an unauthorized team member, the crypto community remains deeply skeptical. The quick deletion of the tweet and the sudden collapse of the token’s value raise questions. Nawfal’s history of controversies also does not bode well for his case, leaving many questioning the true nature of this event.

Whether this was a genuine mistake or an intentional scam, the incident reflects the ongoing risks in the crypto arena.

Three weeks ago, rumors circulated about the alleged sale of Kanye West’s X account. The supposed new owners used it to promote the Barkmeta meme coin, sparking fears of a meme coin rug pull.

The incident raised questions about celebrity involvement in crypto scams. Meanwhile, Barstool Sports founder Dave Portnoy faced backlash over accusations that he orchestrated a GREED rug pull.

After promoting the coin, Portnoy allegedly sold off a large portion of his holdings, leading to a price collapse that left investors at a loss.

Additionally, reports indicate that insiders behind the LIBRA meme coin have been linked to other controversial projects, including the MELANIA coin, which also faced rug pull allegations.

The growing trend of rug pulls highlights the risks investors face when buying tokens associated with high-profile figures or influencers.

Data on GeckoTerminal shows that ROSS has been down by over 95% in the last 24 hours and is trading around its floor price.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Massive Outflows Spark 15% Drop in Pi Network Price

Pi Network (PI) has recently experienced a significant decline, with the price falling by 15% in just 24 hours. The altcoin is now inching closer to falling below $1.00 as investors have moved to secure their gains.

This downtrend is a result of a combination of market conditions and rising outflows, which have created significant selling pressure on the asset.

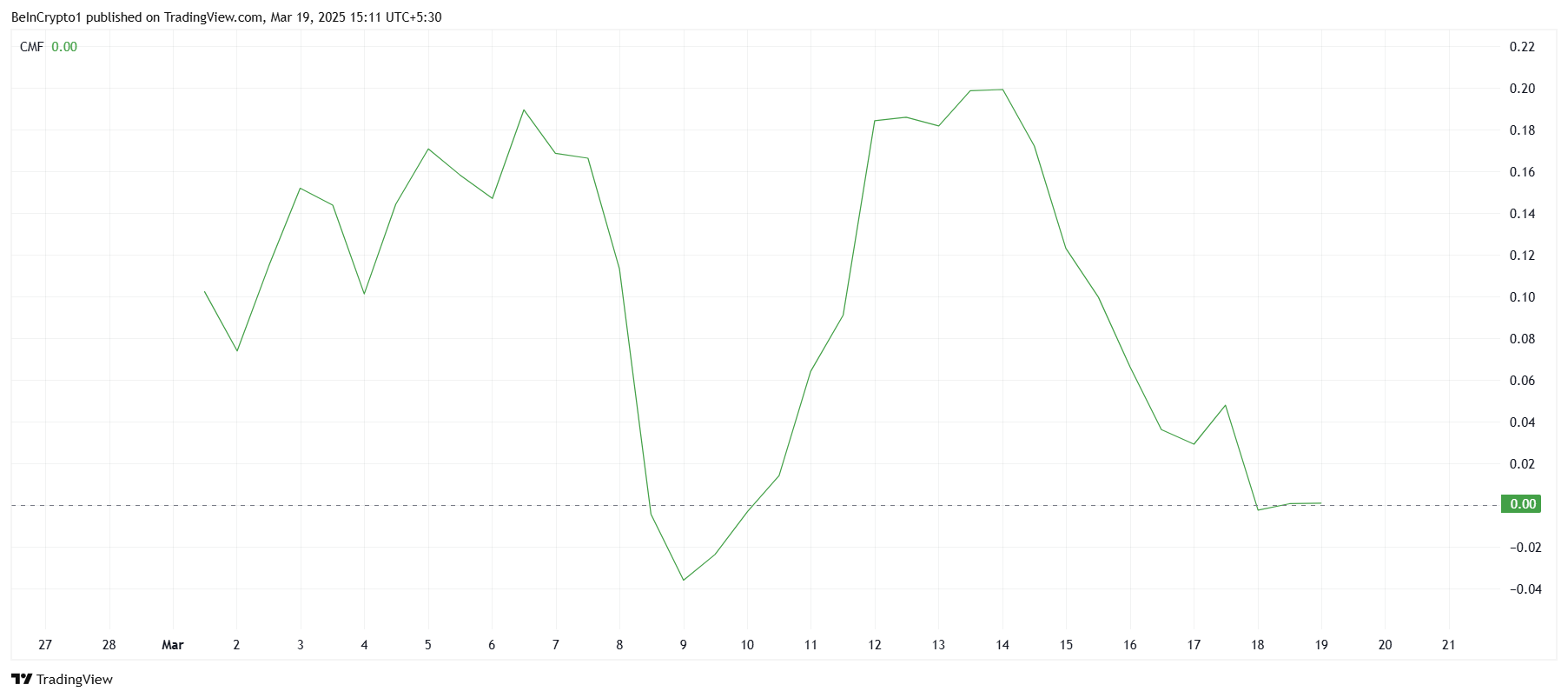

Pi Network Is Facing Outflows

The Chaikin Money Flow (CMF) indicator is reflecting the market’s weakening sentiment, showing a sharp downtick this week. At present, the CMF is hovering around the zero line, signaling that outflows are beginning to outweigh inflows. This trend is a bearish sign for Pi Network, as it indicates that investors are choosing to sell off their holdings to lock in profits.

If the CMF dips below the zero line, it would signal that outflows are fully dominating, which could exacerbate the sell-off. This shift would lead to even more downward pressure on the asset, prolonging the negative trend and pushing the price further down.

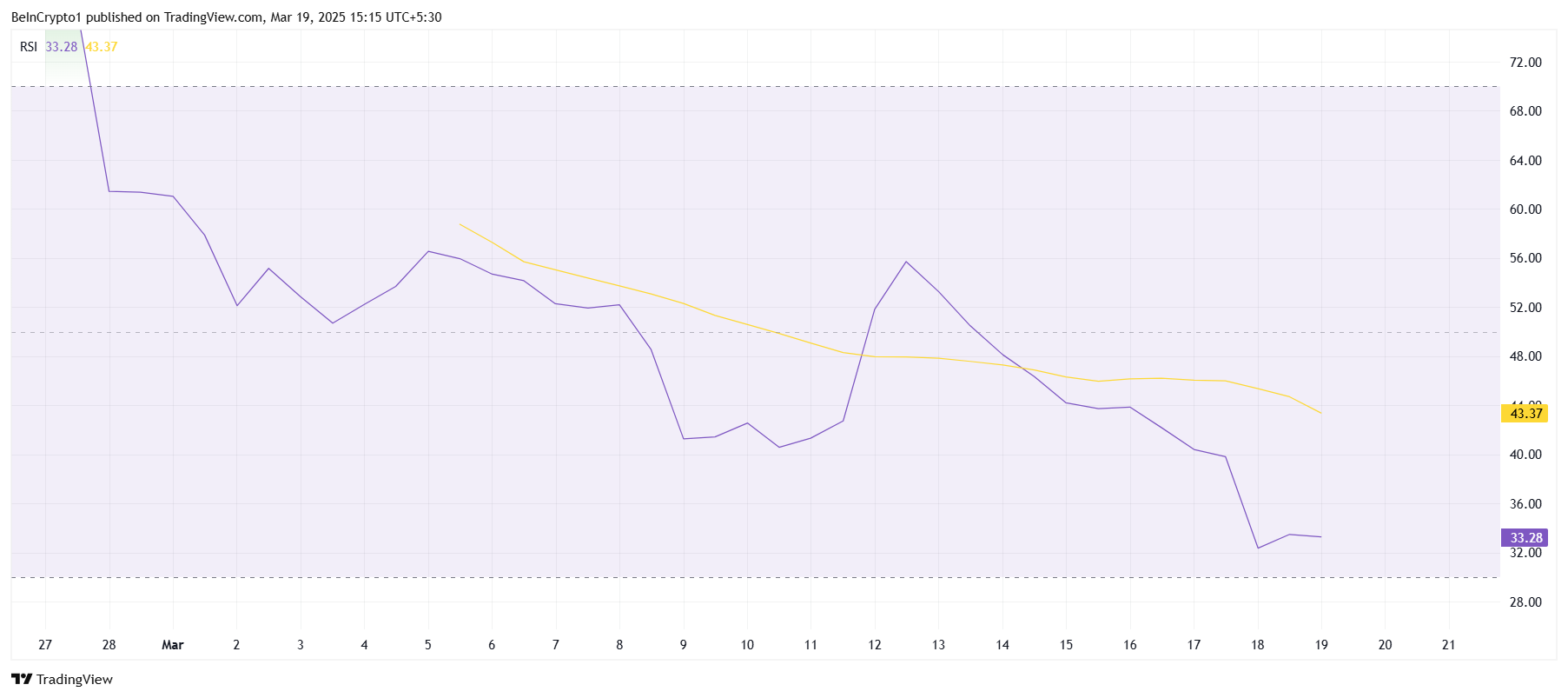

The overall market sentiment continues to reflect bearish conditions, with the Relative Strength Index (RSI) nearing the oversold threshold of 30.0. This suggests that Pi Network, along with other altcoins, is facing substantial selling pressure. The general market trend is pushing most cryptocurrencies down, and PI appears to be no exception.

The RSI level is a critical technical indicator, and its position indicates that Pi Network may be headed for a further decline. While the market continues to show weak bullish momentum, the lack of significant support and investor confidence could lead to PI price suffering in the short term.

PI Price Aims For Break Out

Currently, PI is trading at $1.14, a 15% drop from its previous value. The altcoin has fallen below its support level of $1.19 and is moving within a descending wedge pattern. This suggests that further downside movement is likely, with the asset testing its lower trendline.

If these bearish conditions persist, PI is likely to fall through the trendline and reach the support level of $0.92. This would bring PI closer to the critical $1.00 level, potentially triggering more selling from investors as the downward momentum builds. A drop below $1.00 would be concerning, as it would mark a significant loss for holders.

However, if PI manages to reclaim $1.19 as a support floor, the altcoin has a chance at recovery. A successful rebound above $1.19 could pave the way for a rise toward $1.43. This would help PI potentially break out of its current pattern and invalidate the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

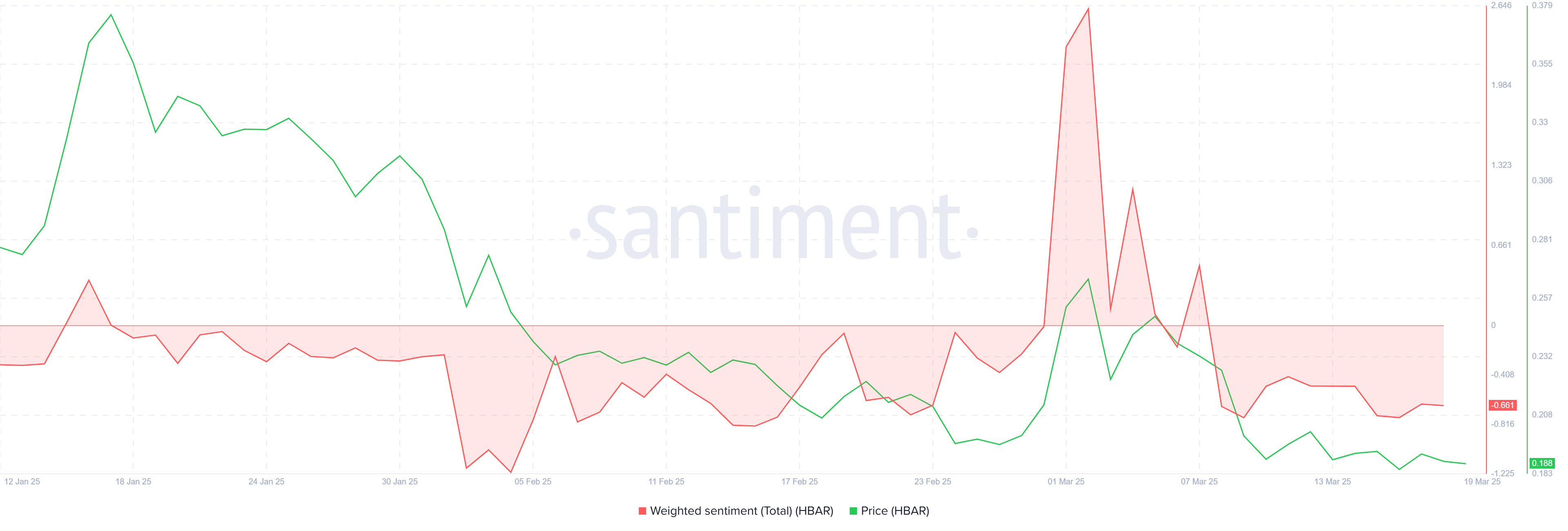

HBAR Price’s Recovery Set To Be Invalidated By Death Cross

HBAR, the native crypto token of the Hedera network, has recently attempted a recovery rally, but the price lacks the support needed to maintain its upward momentum.

With broader market cues turning bearish and investor sentiment weakening, the altcoin could face further price declines, extending recent losses. The formation of a Death Cross may signal additional struggles ahead for HBAR holders.

Hedera Is Facing A Challenge

The Exponential Moving Averages (EMAs) for HBAR are nearing the formation of a Death Cross, a bearish indicator that could push prices lower. A Death Cross occurs when the 200-day EMA crosses over the 50-day EMA, signaling that the broader market momentum is shifting toward the downside. The last time this happened was in June 2024; HBAR entered a prolonged downtrend that lasted for five months and resulted in a significant price decline.

Currently, there is a 13% gap before the 200-day EMA overtakes the 50-day EMA. This suggests that the Death Cross is becoming increasingly likely. If this happens, the momentum could shift even further into the negative, and HBAR might struggle to recover.

Investor sentiment has been negative for most of this month. Although February saw a brief period of bullish activity, it quickly faded, leaving HBAR without significant support. This lack of conviction among investors is concerning, as it suggests that further upward movement may be difficult to sustain.

The cautious sentiment of investors reflects the broader uncertainty in the crypto market. If this pattern continues, HBAR could face additional headwinds, further delaying its recovery. The inability to regain momentum could keep the altcoin stuck in a downtrend for an extended period, increasing the risk for investors.

HBAR Price Is Struggling

HBAR’s price is currently trading at $0.187, moving within a descending channel. The altcoin is approaching the critical support level of $0.177, and it is likely that HBAR could test this support or potentially break through it in the near future. A failure to hold at $0.177 could signal further downside risk for the altcoin.

If HBAR breaks through the $0.177 support, the next key level to watch is $0.154. This would represent a deeper decline and extend losses for investors, potentially delaying recovery for the cryptocurrency. At this point, consolidation could become the most likely scenario, with HBAR struggling to regain bullish momentum.

However, if HBAR manages to flip $0.195 into support and push past $0.222, it could invalidate the bearish outlook and trigger a breakout. Such a move would shift the trend toward recovery, offering hope for a sustained rally.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoAnalyst Reveals Next Major Support

-

Altcoin20 hours ago

Altcoin20 hours agoJustin Sun Reveals Plan To Integrate TRX On Solana

-

Regulation20 hours ago

Regulation20 hours agoCoinbase CLO Slams US Treasury for Defying Court Ruling In Tornado Cash Case

-

Market19 hours ago

Market19 hours agoTop 3 Base Meme Coins to Watch Closely This Week

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Predicts XRP Price To Reach $20 With 18 XRP ETFs On The Horizon

-

Market18 hours ago

Market18 hours agoBitcoin ETF Issuers Purchase Over $40 Million in BTC

-

Altcoin18 hours ago

Altcoin18 hours agoADA Bulls Target $1 as Cardano Price Double Bottom Pattern Hints at Reversal

-

Market17 hours ago

Market17 hours ago3 Crypto Smart Money Wallets Are Dumping Fast This March