Bitcoin

Schiff Predicts A Catastrophic 85% BTC Drop—Details

A well-known American economist suggested a relationship between gold, NASDAQ and Bitcoin, saying that a decline in NASDAQ usually leads to a decrease in Bitcoin.

Peter Schiff explained in a post the correlation between the state of Bitcoin and the market situation of NASDAQ, adding that there is a negative relationship between gold and NASDAQ.

NASDAQ-Bitcoin Connection

Schiff, a renowned Bitcoin skeptic, told his followers on X that the bearish condition of the financial market might influence the price movement of the flagship crypto, saying that if NASDAQ goes down, Bitcoin follows.

The economist said that currently, NASDAQ is down 12%, and could affect Bitcoin. “If this correction turns out to be a bear market, and the correlation where a 12% decline in the NASDAQ equates to a 24% decline in Bitcoin holds, when the NASDAQ is down 20%, Bitcoin will be about $65K,” he added.

The NASDAQ is down 12%. If this correction turns out to be a bear market, and the correlation where a 12% decline in the NASDAQ equates to a 24% decline in Bitcoin holds, when the NASDAQ is down 20%, Bitcoin will be about $65K.

But if the NASDAQ goes into a bear market, history…

— Peter Schiff (@PeterSchiff) March 16, 2025

However, Schiff argued that once NASDAQ entered a bear market, the decline would be much larger, citing what happened in the past.

He explained that after the bursting of the Dot-com bubble, NASDAQ plummeted by nearly 80% while during the 2008 global financial crisis, it dropped by 55%, and, recently, during the pandemic crash in 2020, NASDAQ went down by around 30%.

“The average of those three bear markets is a 55% decline. If this bear market bottoms with just a 40% decline, that would put Bitcoin at about $20K. However, my bet would be that a drop of that magnitude would accelerate Bitcoin’s collapse to much lower levels,” he added.

Yellow Metal Continues To Shine

Schiff might have a bearish outlook on Bitcoin but offered a more optimistic view on gold, saying there is a negative relationship between NASDAQ and gold.

He said that since the NASDAQ peaked on December 16, 2023, gold has increased by 13%, which is an almost perfect 1-to-1 correlation.

“If that correlation holds too, a 40% drop in the NASDAQ would put gold over $3,800. However, my guess is that if a bear market in stocks coincides with a significant decline in the dollar on foreign exchange markets, gold will rise much higher,” he explained in a post.

Gold-Bitcoin Comparison

Schiff said that even if gold were at $3,800 gold and Bitcoin was at $20,000, in terms of gold, the firstborn crypto would decrease by 85%, adding that it would more likely end the comparison that Bitcoin is a store of value similar to gold.

“There will clearly be no justification for the US government or any state government to keep any Bitcoin in a Strategic Reserve. There will also be no reason for ETF investors to keep holding their positions either. With all that selling, it will be impossible for $MSTR to sell enough Bitcoin to avoid bankruptcy,” he said.

As of writing, Bitcoin is traded at $82,433 with a market cap of over $1.6 trillion.

Featured image from Pexels, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Bitcoin

What It Means for BTC’s Next Bull Run

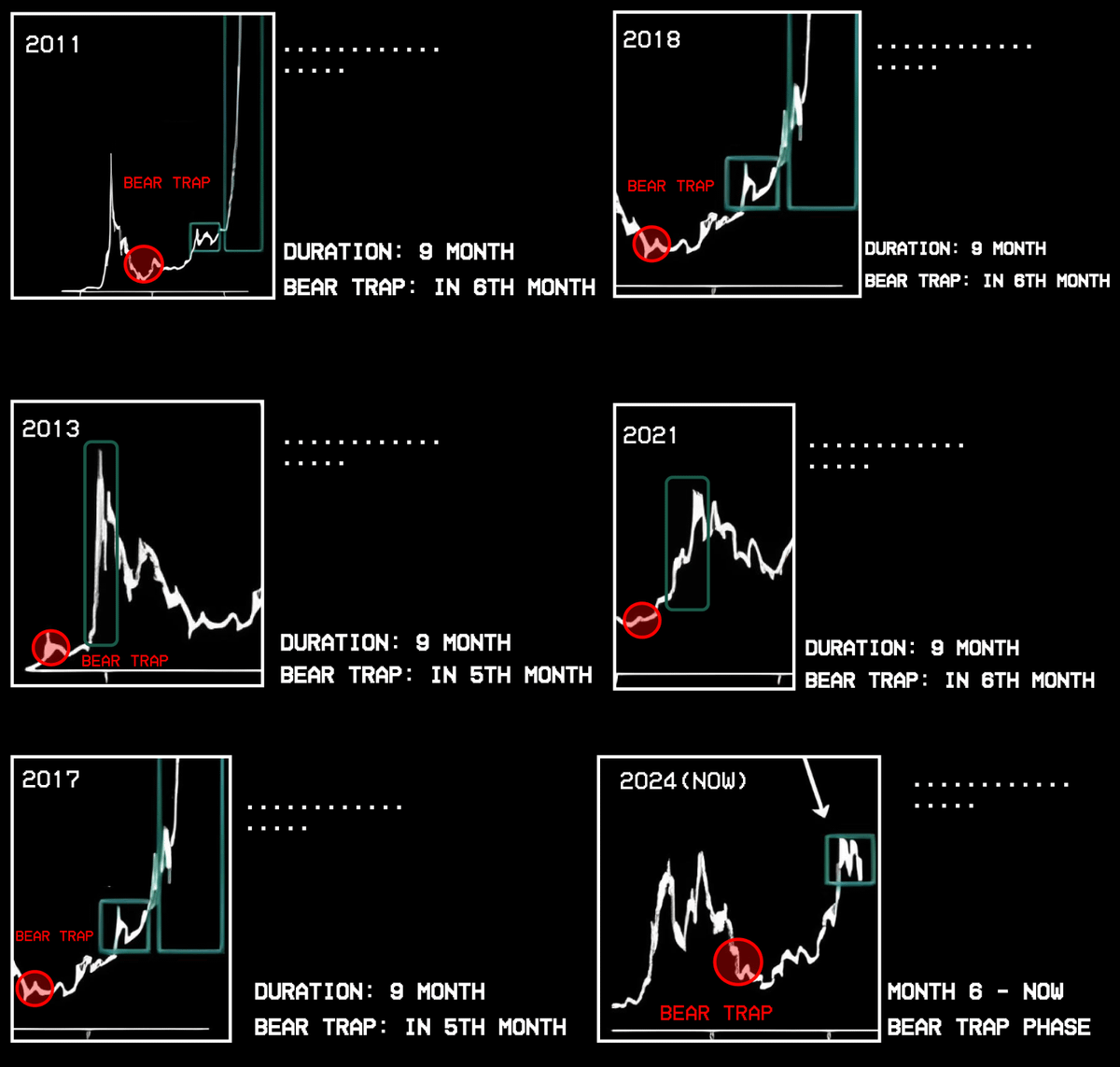

Bitcoin’s (BTC) price has historically experienced multiple bear traps. Depending on market conditions, these traps have appeared in short-term phases or larger timeframes.

Some analysts believe that Bitcoin is currently in such a bear trap and that a bull run will begin after the current phase ends.

What Does Bitcoin Bear Trap Cycle Mean?

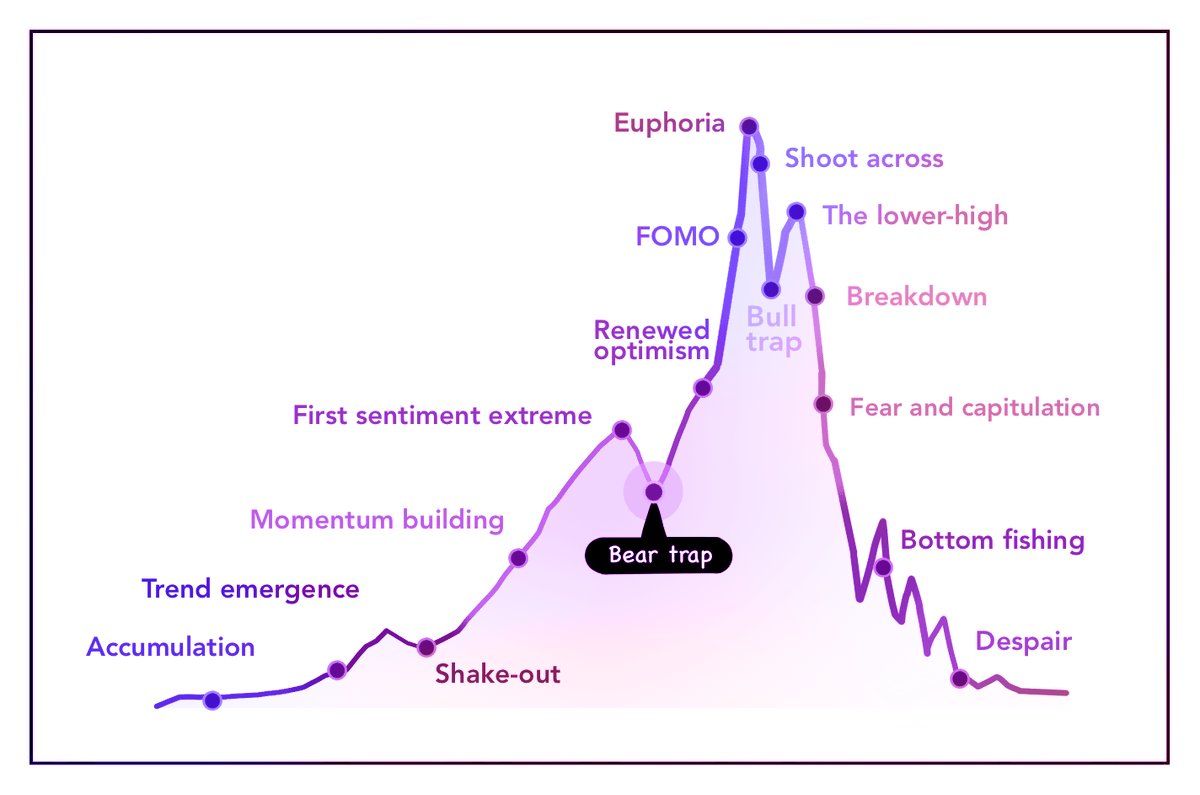

A bear trap occurs when an asset’s price (such as stocks, cryptocurrencies, or indices) shows a sharp decline. This drop convinces investors that a bearish trend is starting. However, the price soon reverses and rises again, “trapping” those who sold short or exited their positions, expecting further declines.

According to pseudonymous crypto analyst Finish, Bitcoin’s bull run cycles typically last around nine months. A bear trap often appears in the sixth month of the cycle. During this phase, Bitcoin’s price drops sharply, causing panic and sell-offs. But after that, the price recovers and reaches new highs.

Historical data from previous cycles—including 2011, 2013, 2017, 2021, and the current cycle (2024–2025)—show that this pattern repeats consistently.

“2025 cycle is the same. Six-month bear trap, then a new ATH,” Finish predicted.

In his analysis, Finish also explains the driving forces behind bear traps in each cycle. For example, the 2013 bear trap was triggered by the shutdown of Silk Road, an online black market, and China’s ban on Bitcoin, which caused market panic.

In 2017, the ICO boom fueled Bitcoin’s bull run, pushing its price to $20,000. However, a bear trap emerged in the sixth month due to the launch of Bitcoin futures on the CME exchange. This was combined with media hype and concerns over Tether (USDT), which faced transparency issues.

Similarly, in 2021, Bitcoin soared to $69,000. But the six-month bear trap was triggered by an overheated market sentiment and Elon Musk’s sudden shift in stance on Bitcoin payments.

For the 2024–2025 cycle, Finish believes Bitcoin is currently in its bear trap phase. Macroeconomic factors, especially policies from US President Donald Trump, play a crucial role.

Trump’s policies—such as interest rate cuts, tariff war, and his pledge to make the US the “crypto capital” of the world—have created optimism but also caused short-term price volatility. This aligns with the six-month bear trap model described by Finish.

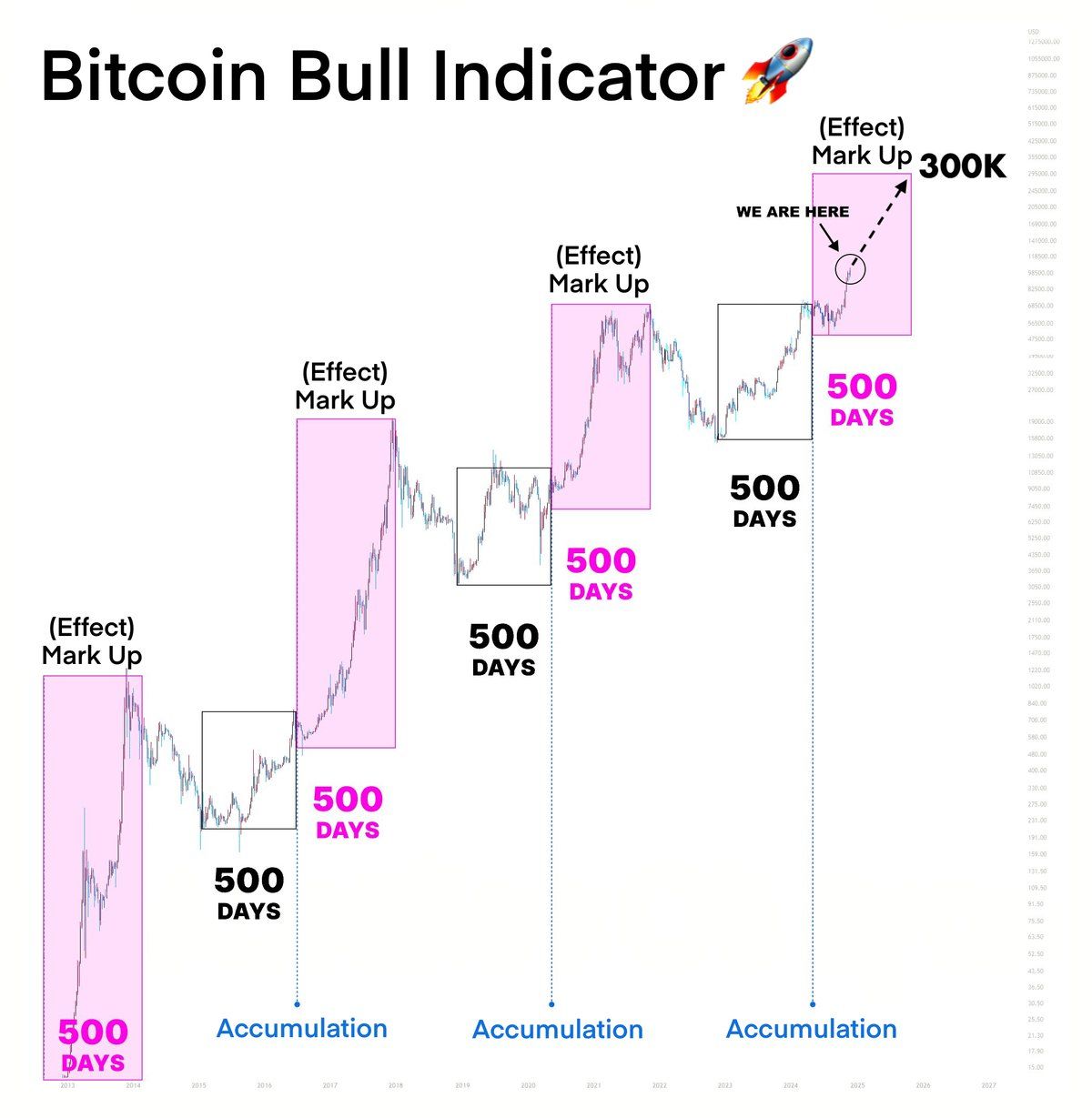

Additionally, analyst Danny agrees with this outlook. He predicts that Bitcoin’s biggest bull run will officially begin in April 2025 once the current bear trap phase ends. Danny suggests that Bitcoin could reach $300,000 by 2026.

“We’re in the Markup phase, just past a classic bear trap. Historically, the biggest gains follow as Bitcoin dominance dips and capital shifts to mid- and low-cap tokens,” Danny predicted.

However, some analysts have lowered their expectations for Bitcoin’s growth. Ecoinometrics observes that Bitcoin’s growth rate in this cycle is significantly lower than in previous cycles. Ki Young Ju, founder of CryptoQuant, has analyzed Bitcoin’s PnL cycle signals and predicts that Bitcoin’s bull run has already ended.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

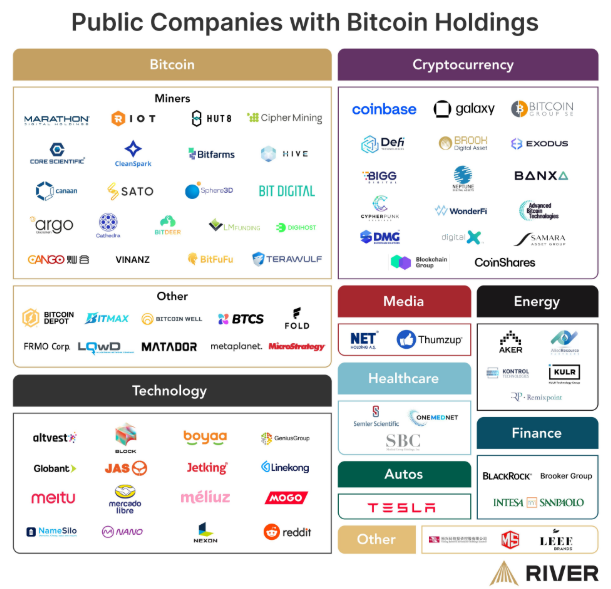

The Bitcoin Boom: 80 Public Companies Are Betting Big on BTC in 2025

The number of publicly traded companies buying and holding Bitcoin (BTC) has surged to 80 in 2025, a 142% increase from just 33 companies in 2023.

This trend reflects the growing acceptance of Bitcoin as both a strategic reserve asset and a hedge against inflation.

Why Public Companies Are Holding Bitcoin in 2025

Digital asset brokerage firm River revealed that 80 public companies hold Bitcoin, up from just 33 two years ago.

“80 public companies are now buying Bitcoin. Two years ago there were 33. Two years from now there will be…?,” River posed.

The companies embracing Bitcoin span multiple industries, with a strong concentration in technology and finance. The technology sector accounts for half of the public companies holding Bitcoin. Bitcoin Treasuries data shows firms like MicroStrategy (now Strategy), Tesla, and Block stand at the forefront of integrating Bitcoin into their financial strategies.

Financial institutions comprise 30% of the total, including Fold Holdings and Coinbase Global, which have indirect exposure via ETFs (exchange-traded funds). The cryptocurrency mining industry represents 15%, with mining giants such as Marathon Digital and Riot Platforms holding significant Bitcoin reserves.

The remaining 5% comprises companies from other sectors, including retail and energy. These firms experiment with Bitcoin holdings for transactions and balance sheet diversification.

Several key factors are driving the adoption of Bitcoin among public companies. Inflation hedging has become a major consideration as firms look for alternative stores of value beyond traditional assets.

“Bitcoin is the currency of freedom, a hedge against inflation for middle-class Americans, a remedy against the dollar’s downgrade from the world’s reserve currency, and the off-ramp from a ruinous national debt. Bitcoin will have no stronger advocate than Howard Lutnik,” US Health and Human Services Secretary Robert F. Kennedy Jr said recently.

Many companies have also adopted Bitcoin as a treasury reserve strategy, betting on its long-term appreciation. On this matter, firms like Strategy lead the way.

Additionally, investor pressure has played a role as institutional investors and shareholders increasingly push companies to diversify into digital assets. Regulatory clarity and pro-crypto policies in some regions have further encouraged corporate adoption.

Cumulative Bitcoin Holdings Continue to Rise

Meanwhile, public companies have been accumulating Bitcoin at an unprecedented rate. Between 2020 and 2023, they collectively held approximately 200,000 BTC. In 2024 alone, an additional 257,095 BTC was acquired, doubling the total from five years ago.

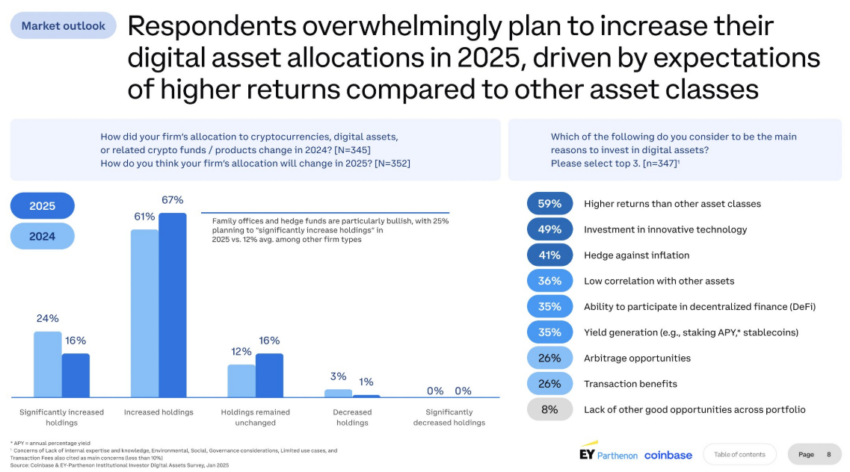

In the first quarter of 2025, an estimated 50,000 to 70,000 BTC has already been added. Noteworthy, MicroStrategy and Fold Holdings lead the acquisitions. Coinbase’s recent institutional investor survey also indicated that 83% of institutions plan to increase their crypto asset allocation by 2025.

The surge in Bitcoin adoption by public companies coincides with a new wave of crypto-related IPOs (initial public offerings). Notable firms, including Gemini and Kraken, plan to go public, highlighting increased institutional confidence in the digital asset space. These IPOs provide fresh capital inflows and further legitimize the broader crypto market.

Bitcoin has also become a financial lifeline for struggling companies seeking to boost their stock prices. Some firms with declining revenues have turned to Bitcoin investments to attract new investors and strengthen their market position. As a result, Bitcoin is playing an increasingly significant role in corporate strategies.

Despite the impressive growth in corporate Bitcoin adoption, public crypto companies still represent only 5.8% of the total crypto market capitalization, according to a CoinGecko report. This suggests that there is still significant room for expansion.

Beyond corporate treasuries, Bitcoin’s rising adoption also influences financial planning in other areas. Parents increasingly choose Bitcoin as an alternative to traditional college savings plans, betting on its long-term growth potential to fund education expenses.

With 80 public companies now holding Bitcoin, the trend shows no signs of slowing. If the current growth trajectory continues, institutional adoption will deepen as more companies turn to Bitcoin.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin ETFs Inflows Reach $274 Million: Is Demand Returning?

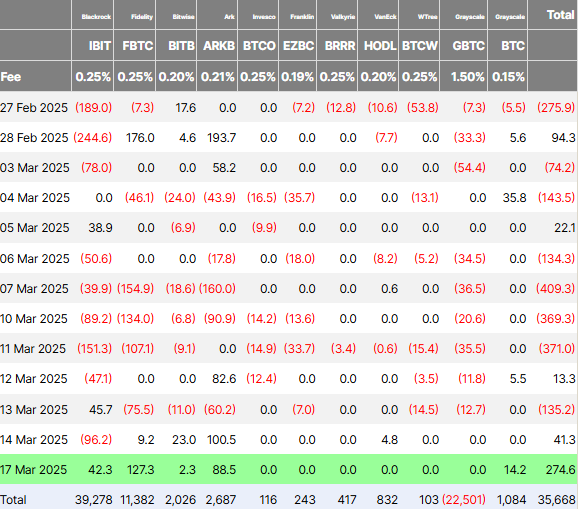

After weeks of outflows, Bitcoin exchange-traded funds (ETFs) have finally reversed course, recording $274.6 million in inflows on March 17.

This marks the largest single-day net inflow in 41 days, hinting at renewed investor interest. While one positive day does not confirm a trend, it raises an important question: Is demand returning to Bitcoin ETFs, or is this just a temporary reprieve?

Bitcoin ETFs See First Major Inflows in Weeks

According to the latest data on Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) recorded $42.3 million in inflows on Monday. Despite the positive flows, IBIT failed to lead the way amid ongoing headwinds due to stock market correlation.

Fidelity’s Bitcoin ETF (FBTC) attracted $127.28 million, making it the day’s biggest gainer. The ARK Bitcoin ETF (ARKB), managed by ARK Invest and 21Shares, also saw significant interest, pulling in $88.5 million.

On the other hand, the Grayscale Bitcoin Trust (GBTC), which has been at the center of major outflows, remained flat at $0 million. This is notable because GBTC has lost billions in assets since transitioning to a spot ETF.

Meanwhile, Grayscale’s other Bitcoin product saw a modest inflow of $14.22 million. Other Bitcoin ETFs, including those from Valkyrie, Invesco, Franklin, and WisdomTree, recorded no daily inflows.

However, while Bitcoin ETFs had a strong showing, Ethereum-based spot ETFs continued their downward trajectory. Data on Farside investors showed they logged their ninth consecutive day of net outflows at $7.3 million.

“Bitcoin spot ETFs attract $275 million in inflows, while Ethereum ETFs experience outflows, reflecting shifting investor preferences,” one user on X suggested.

Notably, while this could suggest the returning demand for Bitcoin ETFs after weeks of outflows, analysts say one green day does not make a trend. Nevertheless, it is a shift worth watching.

Bitcoin ETFs Have Lost Billions in Recent Weeks

Just a week ago, Bitcoin ETFs had recorded four straight weeks of net outflows totaling more than $4.5 billion. Profit-taking, regulatory concerns, and broader economic uncertainty fueled the shift in investor sentiment.

The crypto market as a whole has also seen capital flight. As BeInCrypto reported, total crypto outflows exceeded $800 million last week, signaling strong negative sentiment among institutional investors.

With this context, while Monday’s inflow of $274 million could be seen as a sign of stabilization, it is too early to determine whether this marks the beginning of a broader recovery.

Nevertheless, the sudden surge in ETF inflows raises the question of whether this is a resurgence of the so-called “Trump crypto boom” or a case of fear of missing out (FOMO). Some analysts believe hedge funds and institutional players drive the action more than retail investors.

Crypto entrepreneur Kyle Chassé has previously argued that hedge funds play a major role in Bitcoin’s ETF flows. He claims that large investors strategically withdraw and reinvest capital to manipulate price movements, making it difficult to determine organic demand.

“The ETF “demand” was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” the analyst explained.

If true, the latest ETF inflows might not represent new buyers. Rather, it could mean recycling institutional capital to capitalize on short-term price swings.

Adding to the uncertainty, many investors are considering the Federal Reserve’s upcoming policy decisions. Some have speculated that the Fed will pivot toward monetary easing (QE) soon, but industry experts warn that such expectations are misguided.

Nic Puckrin, a financial analyst and founder of The Coin Bureau, believes those anticipating imminent QE are “deluded.” He notes that the Fed’s fund rate remains at 4.25-4.5%, and historically, QE does not begin until rates approach zero.

“…why is anyone suddenly expecting a massive injection of liquidity into the system? Realistically, if large-scale monetary stimulus is going to come from anywhere, it will be China or Europe, both of which have already implemented monetary easing measures. The most we can expect from Powell tomorrow is a hint at the timing of the next interest rate cut, but we may not even get that. And so, investors should prepare for the markets to throw another tantrum this week,” Puckrin told BeInCrypto.

.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoAnalyst Reveals Next Major Support

-

Market21 hours ago

Market21 hours agoBitcoin Pepe thrives as risk aversion hurts Bitcoin, Dogecoin

-

Market23 hours ago

Market23 hours agoCAKE Spot Inflows Surge to $3.5M, Fueling 21% Price Rally

-

Market22 hours ago

Market22 hours agoNew Bitcoin Whales Adds Over 200,000 BTC to Their Holdings

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin ETFs Inflows Reach $274 Million: Is Demand Returning?

-

Altcoin15 hours ago

Altcoin15 hours agoJustin Sun Reveals Plan To Integrate TRX On Solana

-

Market20 hours ago

Market20 hours agoStilachiRAT Malware Targeting Digital Wallets

-

Regulation15 hours ago

Regulation15 hours agoCoinbase CLO Slams US Treasury for Defying Court Ruling In Tornado Cash Case