Market

Burwick Files Lawsuit Against Meteora and Other LIBRA Backers

New York-based legal firm Burwick Law filed a class action lawsuit against the main parties involved in LIBRA, the Argentinian meme coin scandal. The lawsuit specifically targets KIP, Meteora, and Kelsier, but not President Javier Milei.

Over the past few months, the firm has filed several lawsuits against meme coin projects. It alleges serious financial misconduct from all these parties.

A LIBRA Lawsuit in New York

Given the firm’s recent actions, Burwick Law seems to be in a legal war against meme coin scammers. In December, it filed a suit against Hawk Tuah’s promoters. A month later, it sued Pump.fun, accusing the platform of IP violations.

Yesterday, Burwick filed another class-action lawsuit, this time centered around the LIBRA meme coin.

“Tonight, our firm filed a class action complaint in the Supreme Court of New York on behalf of our client. We allege that Kelsier, KIP, Meteora, and related parties orchestrated an unfair token launch (LIBRA), allegedly misleading purchasers and harming retail investors,” the firm claimed via social media.

The LIBRA launch in February turned into a massive fiasco, and this lawsuit joins active investigations and arrest warrants levied upon the principal actors.

Essentially, Burwick accuses several parties involved with LIBRA of “deceptive, manipulative, and fundamentally unfair” conduct. These people artificially inflated the token’s price and then caused a collapse—otherwise known as pump-and-dump.

Surprisingly, the suit does not name Argentine President Javier Milei as a defendant. In addition to being a significant political figure, Milei also downplayed his direct connections to the debacle.

Instead of targeting him, Burwick’s lawsuit is going after the private companies that directly facilitated the LIBRA launch: KIT, Meteora, and Kelsier.

“The complaint details how, according to our allegations, one-sided liquidity pools were used to artificially inflate LIBRA’s price. We further allege that approximately 85% of supply was withheld at launch, enabling insiders to profit while everyday buyers bore the losses,” Burwick Law stated.

Who Were the Culprits Behind the LIBRA Scandal?

The initial name behind the LIBRA meme coin launch was KIP Protocol, a Web3 AI base layer. However, the firm completely distanced itself from any rug pull allegations.

KIP claimed that it did not launch or profit from LIBRA and that it was only asked “to assist in managing the project’s financing initiative.” The other firms, however, have much clearer connections.

Meteora, a decentralized crypto exchange, was thoroughly involved in LIBRA. The company’s co-founder resigned in the immediate aftermath but maintained his innocence.

Notably, Meteora’s reputation was already damaged by the TRUMP meme coin. This small exchange was the first platform to host the token, which increased its TVL by over 300% in days to over $1.9 billion.

Kelsier Ventures, LIBRA’s market maker, seems especially vulnerable to lawsuits. In a shocking interview, CEO Hayden Davis defended his actions, admitting to past scams and claiming he did nothing out of the ordinary.

Davis was in talks to launch a similar meme coin with the Nigerian government and was recently tied to a Wolf of Wall Street-themed meme coin. It’s no wonder that Davis, of all the names involved with the whole scandal, is the only person with an active arrest warrant against him.

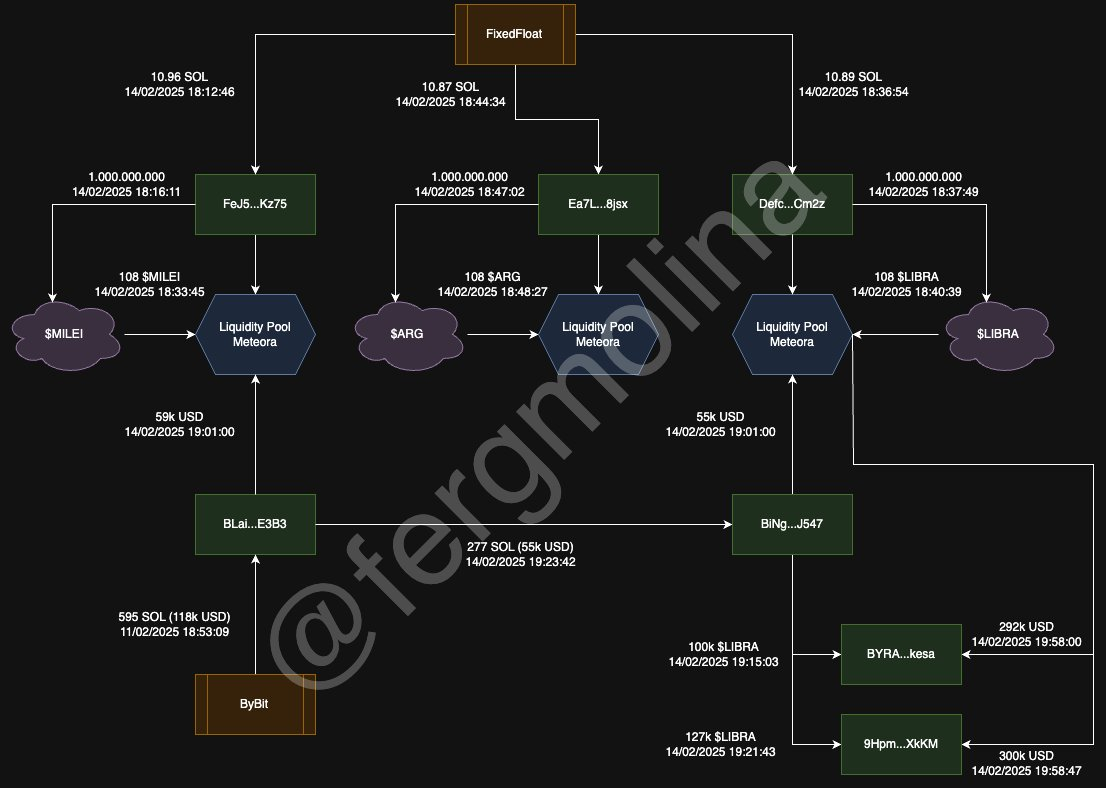

Additionally, data engineer Fernando Molina alleged that these parties tried to launch two other Argentina-centric tokens before LIBRA. A few telltale fingerprints connect it with ARG and MILEI, such as shared wallets, liquidity pools, and timing. Molina suggested that LIBRA’s creators could’ve created these assets as test coins, but isn’t certain.

There are quite a few unanswered questions about the whole LIBRA scandal, and it’s unclear how they’ll play into the lawsuit. Hopefully, investigations can help clear up some of the biggest mysteries.

After all, political meme coin schemes like this can damage the reputation of the whole industry. So, the current lawsuit from Burwick might be in everyone’s best interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

David Sacks Slams Media for Misleading Crypto Sale Narrative

David Sacks, the Trump administration’s AI and Crypto Czar, has criticized the media for portraying the cryptocurrency market negatively.

His remarks follow recent reports that referred to his sale of over $200 million in digital assets as a “dump.”

For context, David Sacks and his firm, Craft Ventures, liquidated their entire cryptocurrency portfolio just before President Trump took office.

“Crucially, you have already taken significant steps to minimize potential conflicts of interest due to digital asset holdings divesting from hundreds of millions of dollars in digital assets or digital asset-related industry entities,” the White House memo read.

According to the memo, Sacks’ sold assets included Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). It also involved the sale of various crypto-related funds and stocks, such as the Bitwise 10 Crypto Index Fund, Coinbase (COIN), and Robinhood (HOOD).

Nonetheless, Sacks took to X (formerly Twitter) to address media reports that used the term “dump” to describe his sale.

“I did not ‘dump’ my cryptocurrency; I divested it,” David Sacks posted.

He argued that the characterization was not only inaccurate but also intentionally misleading. The crypto czar stressed that it was designed to damage the broader credibility of the cryptocurrency market. Additionally, he emphasized that government ethics rules mandated his actions to avoid any appearance of conflicts of interest.

The statement from Sacks resonated with several industry leaders. Changpeng Zhao (CZ), former CEO of Binance, voiced his support on X.

“They sell clicks, not ethics,” CZ wrote.

David Nage, Portfolio Manager at Arca, also defended Sacks’ actions and criticized the media’s portrayal.

“The media’s “dump” spin shows crypto’s “don’t trust, verify” ethos clashing with legacy systems built on blind trust,” Nage replied.

Meanwhile, analyst Colin advocated for cutting off all government funding to media organizations. Furthermore, Bankless Co-owner David Hoffman claimed that media outlets often reflect the views and biases of society at large, especially regarding perceptions of cryptocurrency.

He argued that most people are not involved in crypto. In fact, they may not want it to succeed because accepting its potential for wealth creation would force them to confront a sense of “cognitive dissonance” — the discomfort of holding conflicting beliefs, such as not being involved in crypto while seeing others benefit from it.

“Media is titling headlines to cater to this need,” he added.

Interestingly, this comes amid growing opposition to Trump’s establishment of a digital asset stockpile and strategic bitcoin reserve. In fact, a survey has revealed that a majority of voters share concerns about the US government’s involvement in crypto and blockchain development. Many believe the government should reduce its investment in these technologies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin trades above $83k as traders anticipate FOMC results

Key takeaways

- BTC is up less than 1% today as traders await crucial Fed meeting results.

- PepeX, the world’s first AI-powered meme launchpad, will begin presale on March 24.

BTC tops $83k ahead of FOMC

Bitcoin, the leading cryptocurrency by market cap, dropped below $81,500 on Tuesday but has since undergone a correction and now trades above $83k. At press time, the Bitcoin price is $83,261 and could rally higher if the bullish momentum continues.

The positive performance comes ahead of the FOMC meeting results later today. Analysts are not expecting the Fed to cut interest rates today. Still, investors are looking to see if the apex bank will turn dovish due to the recent economic and market uncertainties.

What is PepeX?

PepeX is a project looking to change the memecoin ecosystem for the benefit of the users. Pump.fun has been the primary memecoin launchpad in the market, but data indicates that no one has made money but them.

They made money while snipers and insiders took everything: only 0.4% of traders made $10k or more. However, PepeX is coming to change the narrative and give back power to the traders.

PepeX is an AI-powered meme coin launchpad seeking to democratize meme coins and supercharge the next phase of the meme coin supercycle. With PepeX, there is no coding, no complex tokenomics, just pure creativity and proper DeFi.

How is PepeX better than other memecoin launchpads?

PepeX is a neo-fair-launch platform that is transparent, profitable for the community, and not just a playground for insiders looking to exit on retail cash. This launchpad has a unique working model.

Unlike other memecoin launchpads, PepeX.fun is Powered by anti-sniping protections and transparent bubble maps. Thus ensuring that founders and developers can’t hoard the majority of tokens only to dump them later. Instead, PepeX grants devs a transparent 5% allocation, and if their project flops, they take the hit. No more cruel exit liquidity schemes, just real accountability.

In their whitepaper, the team explained that PepeX’s AI-powered marketing bot connects directly to project Telegram and X accounts, automating shilling and growth strategies like a pro. All listed tokens will have autonomous AI marketing to manage their social profiles and communities.

PepeX.fun’s AI-powered Moonshot Engine allows devs to upload any image (doge, frog, your face) and type their chosen ticker. The LLM will then auto-generate hyper-viral memes, a token with an anti-snipe code, LP pools, X/TG agents for accounts, and box-ready content.

PepeX presale to commence in five days

Similar to other great projects, PepeX will launch a presale to enable investors to get in early and purchase its native token at a possible discount. The presale commences on March 24th and will last for 90 days.

PepeX has a total token supply of 5 billion, with 2.250 billion available to investors during the presale. 10% of the total supply will be allocated to the development of PepeX’s products and services, another 10% as liquidity, 15% for marketing, 15% for staking &rewards, and the remaining 5% as treasury.

The PEPX token’s value will rise at increment levels of 5% from stage 1 to the last one, allowing early investors to enjoy an unrealized profit of up to 311.5% before the token lists on exchanges.

Should you participate in PepeX’s presale?

A compelling case to key in on this project is the unique approach PepeX is bringing to the memecoin launchpad ecosystem. PepeX seeks to break the wheel of Pump.fun by introducing a launchpad that completely focuses on the community, ensuring they don’t lose their hard-earned money.

With smart contract development, AI agent ecosystem, DEX partnerships, and decentralised AI launchpad takeover all on the cards, PepeX could become a key project within the memecoin ecosystem. Purchasing its native $PEPX token during presale could be an excellent investment choice in the medium to long term.

Market

Pi Coin Secures CoinEx Listing Amid Market Struggles

Pi Network’s cryptocurrency, Pi Coin (PI), has secured another exchange listing with CoinEx, marking a notable milestone for the project.

However, the listing comes at a turbulent time for the project, as pioneers push for clarity on Pi Network’s funding sources.

Pi Coin Listed on CoinEx Exchange

PI officially launched for trading on CoinEx on March 18, 2025. The deposit and withdrawal window opened at 11:00 UTC, followed by trading at 11:30 UTC, allowing Pi holders to trade against Tether (USDT).

“After rigorous reviews, CoinEx will list PI (Pi) on March 18, 2025,” the exchange stated in its announcement.

With this latest listing, Pi Coin is now available on 12 exchanges, as per Coinranking data. Despite this expansion, the possibility of a Binance listing remains uncertain.

Although 86% of the Pi community voted in favor of a Binance listing, the exchange has yet to confirm if or when it will list PI. This has raised concerns about the project’s credibility.

“The failure to get listed on Binance, despite 86% of the community voting in favor, raises serious concerns about public trust in the project,” a pioneer wrote on X.

Pioneers Demand Transparency on Pi Network’s Funding Sources

As concerns surrounding Pi Network continue to rise, the project is now embroiled in another controversy. A growing number of users are calling for transparency about the network’s funding sources.

An investigation by one of Pi Network’s pioneers uncovered that SocialChain Inc., the company behind Pi Network, has received investments from three firms: 137 Ventures, Ulu Ventures, and Designer Fund. However, the investigation revealed a key issue: two of these investors have not included Pi Network in their official investment portfolios.

Additionally, none of these firms have disclosed the amount of money they have invested in Pi Network despite being forthcoming with investment details for other companies.

“Why is Pi Core Team keeping this under wraps? Pioneers deserve transparency. If Pi Network aims for long-term sustainability, the team must be more open about its financial backing and key partnerships,” the post read.

Notably, a previous lawsuit by former co-founder Vince McPhillip against Pi Network offers additional insight into the project’s funding methods. The complaint outlined a series of claims, including wrongful termination, intentional and negligent infliction of emotional distress, and breach of fiduciary duty.

Nonetheless, it detailed that the project had raised funds by selling financial instruments called SAFE (Simple Agreement for Future Equity).

According to the lawsuit, Pi Network sold SAFE agreements in September 2019 with a maximum valuation of $20 million. During this fundraising round, the project raised $500,000. A few months later, in February 2020, Pi Network conducted another fundraising round at the same $20 million valuation, raising an additional $300,000.

Despite these fundraising efforts, the lack of clear financial disclosure continues to fuel concerns within the Pi Network community.

Pi Coin Sees Double-Digit Price Decline

Amid these challenges, PI’s price performance has also taken a hit. The altcoin has seen a sharp decline in value, shedding 19.3% of its gains over the past week.

This drop has pushed the coin further down the cryptocurrency rankings, with PI falling from 12th to 21st place on CoinGecko. While the broader cryptocurrency market has also faced a downturn, PI’s losses have been more pronounced. At press time, PI was trading at $1.1, down 16.5% in the past 24 hours.

Despite this, Pi Network’s community engagement remains vibrant, particularly through PiFest 2025. The event has attracted 100,000 registered sellers worldwide, including 49,000 active participants on the Map of Pi.

Social media posts highlight strong participation from communities in Vietnam, Indonesia, and beyond, where users exchange goods and services using PI tokens.

Notably, the Pioneer Korea community has reported a consensus valuation of 1 PI at $50 —starkly contrasting its current market price on exchanges.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoAnalyst Reveals Next Major Support

-

Market23 hours ago

Market23 hours agoCAKE Spot Inflows Surge to $3.5M, Fueling 21% Price Rally

-

Market22 hours ago

Market22 hours agoNew Bitcoin Whales Adds Over 200,000 BTC to Their Holdings

-

Bitcoin21 hours ago

Bitcoin21 hours agoBitcoin ETFs Inflows Reach $274 Million: Is Demand Returning?

-

Market21 hours ago

Market21 hours agoBitcoin Pepe thrives as risk aversion hurts Bitcoin, Dogecoin

-

Altcoin13 hours ago

Altcoin13 hours agoADA Bulls Target $1 as Cardano Price Double Bottom Pattern Hints at Reversal

-

Market12 hours ago

Market12 hours ago3 Crypto Smart Money Wallets Are Dumping Fast This March

-

Altcoin15 hours ago

Altcoin15 hours agoJustin Sun Reveals Plan To Integrate TRX On Solana