Market

Stellar (XLM) Price Nears Death Cross; Recovery Looks Uncertain

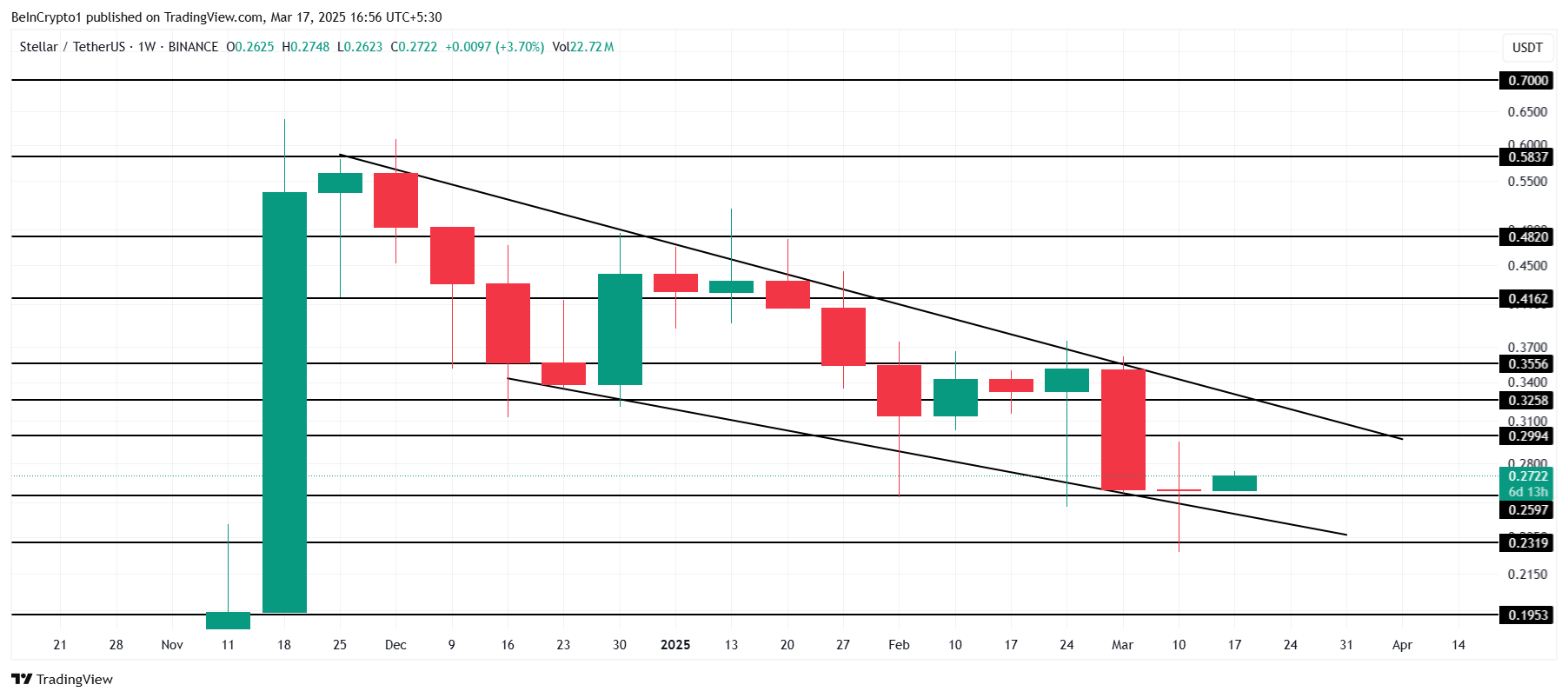

Stellar (XLM) has been experiencing a prolonged downtrend for nearly three months. Despite some attempts at recovery, the altcoin faces significant hurdles ahead.

This is due to a potential breakout above the $0.325 resistance looking increasingly unlikely. Given current market conditions, the price may continue to struggle.

Stellar Faces A Death Cross

Stellar’s price action is currently being influenced by the approaching Death Cross, a bearish signal in technical analysis. The 200-day Exponential Moving Average (EMA) is closing in on crossing over the 50-day EMA, which would mark the second Death Cross for Stellar this year. The previous crossover occurred in April 2024, and this new cross could further signal weakening price momentum for the altcoin.

The potential Death Cross suggests a shift toward more sustained selling pressure. This could prevent any breakout above the $0.30 level and potentially push the price lower.

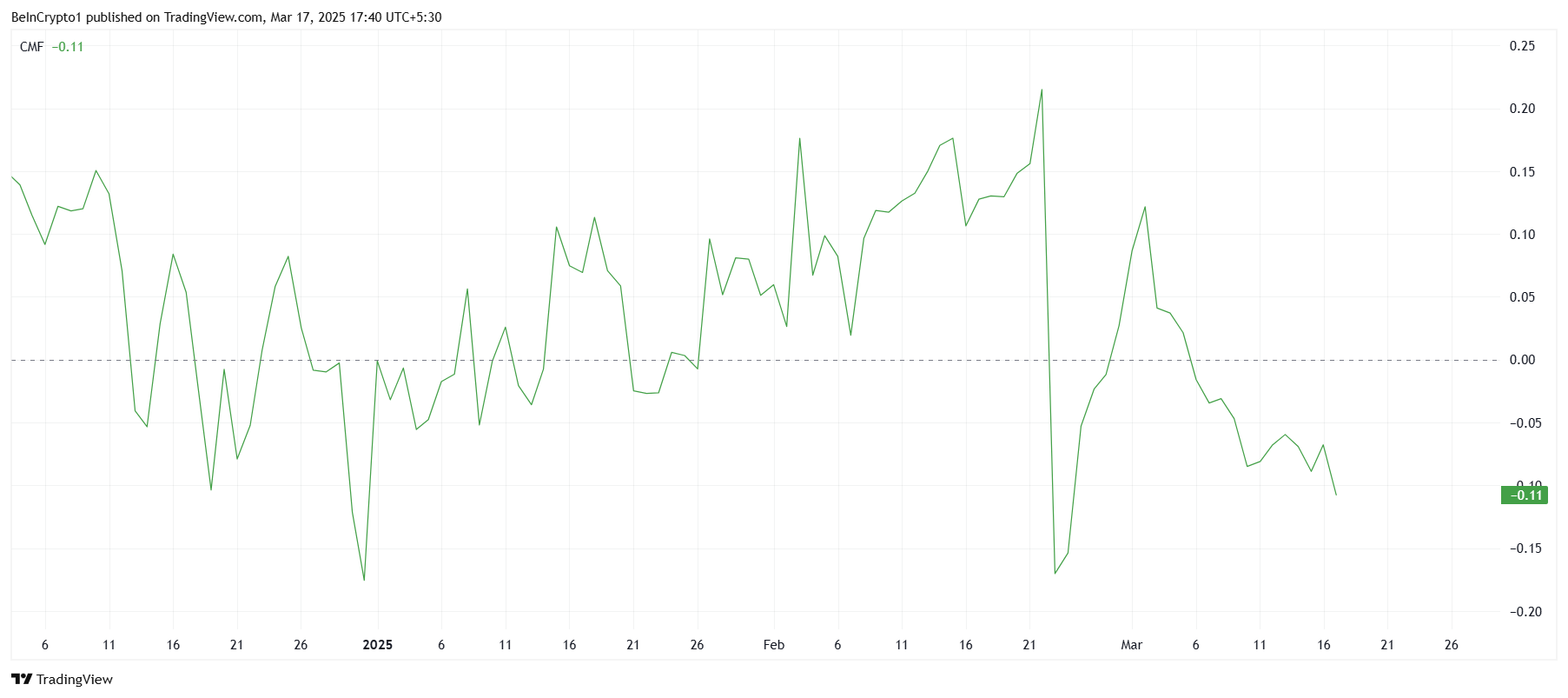

The overall macro momentum of Stellar is also reflecting a bearish outlook. The Chaikin Money Flow (CMF) indicator, which tracks the accumulation and distribution of assets, shows a sharp downtick this month. Currently, well below the zero line, this suggests that outflows are dominating inflows, indicating that investors are pulling their money out of XLM.

This outflow trend reflects growing bearish sentiment among investors, which tends to exacerbate the asset’s struggle to recover. Without an influx of buying pressure, XLM may find it difficult to regain upward momentum.

XLM Price Aims At Break Out

At the time of writing, XLM is trading at $0.272, holding above its support at $0.259. The altcoin has been moving within a descending wedge for the past three months, but given the current market conditions, a breakout from this pattern in the near term seems unlikely. The ongoing Death Cross and bearish market sentiment will likely keep XLM in this range.

As long as XLM remains consolidated under $0.299, it could face further declines. If the altcoin falls below $0.259, it might test $0.231 or lower. The formation of a Death Cross could trigger additional selling pressure, further confirming the bearish outlook for Stellar in the coming days.

For the bearish thesis to be invalidated, XLM would need to breach $0.299 and push past the $0.325 resistance level. A successful breakout above $0.355 could signal a reversal and allow the altcoin to move beyond the current downtrend, but such a scenario would require a shift in market sentiment and investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Analyst Reveals Next Major Support

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst MadWhale has raised the possibility of the XRP price experiencing a breakdown below the crucial $2 support level. The analyst also revealed the next major support if XRP drops below this support level.

XRP Price Could Drop To $1.90 If It Loses $2 Support

In a TradingView post, MadWhale predicted that the XRP price could drop to the major support at $1.90 if it loses the psychological $2 level. He noted that XRP has demonstrated a classic triple-top formation, with each successive peak showing weaker momentum. In line with this, the analyst asserted that a break below the 42 threshold appears imminent as XRP nears a formidable resistance zone.

Related Reading

MadWhale further stated that the downward move is expected to extend to at least $1.9, representing an 18% decline. The analyst added that such a price decline aligns with the primary target and a key daily support level. Crypto analyst Ali Martinez had also suggested that XRP could drop to as low as $1.2 if it loses the $2 support.

The analyst revealed that the XRP price was forming a head-and-shoulders pattern on the weekly chart, which puts the $2 support level in the spotlight. His accompanying chart showed that the crypto could drop to $1.2 if it breaks below $2. However, despite this bearish outlook, other crypto analysts, such as Egrag Crypto, have highlighted some positive aspects of the XRP price.

Egrag Crypto stated that the XRP price’s dominance was showing tremendous strength and predicted that if it successfully closed above Fib 0.5, it could soon rally to the Fib 0.888 level. Crypto analyst Dark Defender predicted that XRP could rally to a new all-time high (ATH) if it continues to hold the crucial support levels at $2.04 and $2.22.

The Altcoin Still In Waiting Mode

Crypto analyst CasiTrades stated that the XRP price is holding strong but is still in waiting mode. She added that the bullish structure remains intact, with the altcoin holding above $2.26, which is the key .382 retracement support. The analyst noted that XRP’s price has spent some time flipping the consolidation to support, indicating that markets are setting up for the next move.

Related Reading

The crypto analyst revealed the $2.70 and $3.05 resistance levels and $2.25 support level as the key levels to watch. She remarked that the XRP price needs to flip $2.70 and $3.05 to become support for the confirmation of the next wave up. Meanwhile, CasiTrades suggested that XRP risks dropping to as low as $1.54 if it loses the lower support support at $1.90.

The crypto analyst also mentioned that the price needs to break above $3.40, its current ATH, to confirm a new trend. Until then, the wait for signs of confirmation continues, which she claimed may not be obvious until wave 3 in the market cycle. CasiTrades asserted that key Fib levels have been breached, and the market is on the edge of a breakout.

At the time of writing, the XRP price is trading at around $2.29, down over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Medium, chart from Tradingview.com

Market

Bubblemaps (BMT) Surges 100% After Binance Listing and Airdrop

Binance is listing Bubblemaps (BMT), causing a 100% rally for the newly launched altcoin. The exchange also put BMT in its HODLer Airdrops program, further driving engagement and market interest.

BMT will provide key benefits to Bubblemaps, powering its analysis platform and allowing increased community participation in its research and investigations.

Binance to List and Airdrop Bubblemaps (BMT)

Bubblemaps, a renowned blockchain analytics platform, has been building its BMT token for months now. In January, it announced an upcoming token launch, and Binance hosted the TGE on PancakeSwap one week ago.

Now, Binance is listing BMT and adding it to the HODLer Airdrops program.

“Binance is excited to announce the 12th project on the HODLer Airdrops page – Bubblemaps (BMT). Users who subscribed their BNB to Simple Earn (Flexible and/or Locked) and/or On-Chain Yields products… will get the airdrops distribution. Binance will then list BMT at 2025-03-18 15:00 (UTC) and open trading,” the firm claimed in an announcement.

As the world’s largest crypto exchange, Binance listing always tends to boost token valuations. The exchange has also recently announced a new listing process based on community votes and interest.

At the time of writing, BMT price is up nearly 100% today, and its daily trading volume has surged 230%. Current market sentiment suggests significant hype and speculative around the new token.

Bubblemap’s data analytics tools have been instrumental in investigating crypto crimes, and it’s opening these to community participation. BMT holders will be able to submit cases and vote on on-chain research priorities through the new IntelDesk feature, helping decide new goals.

Meanwhile, BMT is the 12th asset to be in Binance’s HODLer Airdrops program. This program rewards BNB holders by periodically distributing free tokens from new projects.

This is mutually beneficial for both parties; Binance can reward its loyal users, and the exposure gives these new projects a real notoriety boost.

Ultimately, Bubblemaps’ token getting listed on Binance seems like a win for everybody. Sophisticated crypto investigations can be a thankless business, and BMT’s success directly subsidizes the platform’s work.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

StilachiRAT Malware Targeting Digital Wallets

Microsoft’s incident response team has discovered a new remote access trojan (RAT) called StilachiRAT that poses a serious threat to cryptocurrency users.

StilachiRAT can collect system information, steal login credentials, and extract data from digital wallets. Although it has not yet spread widely, its potential impact worries the crypto community.

How Does StilachiRAT Threaten Crypto Investors?

StilachiRAT is more than just another malware—it represents an evolution in cyber threats targeting digital assets.

Microsoft reported on March 17 that once StilachiRAT infiltrates a system, it begins reconnaissance. It gathers details about the operating system, hardware identifiers, camera presence, and active Remote Desktop Protocol (RDP) sessions. Then, it focuses on stealing credentials stored in Chrome and data from the clipboard, where users often copy passwords or wallet keys.

This trojan specifically targets 20 cryptocurrency wallet extensions on Google Chrome. Some well-known wallets at risk include Metamask, Trust Wallet, Coinbase Wallet, TronLink, TokenPocket, BNB Chain Wallet, OKX Wallet, Sui Wallet, and Phantom.

“StilachiRAT targets a list of specific cryptocurrency wallet extensions for the Google Chrome browser. It accesses the settings in the following registry key and validates if any of the extensions are installed,” Microsoft warned.

Microsoft’s report highlights StilachiRAT’s advanced anti-forensic capabilities. It can delete event logs and assess system conditions to avoid detection.

To mitigate the threat, Microsoft advises users to download software only from official sources and avoid suspicious websites or attachments. Enabling real-time protection in Microsoft Defender and using browsers with SmartScreen can help block malicious sites.

Additionally, Microsoft recommends enabling multi-factor authentication (MFA) and regularly updating software to minimize risks.

“In some cases, remote access trojans (RATs) can masquerade as legitimate software or software updates. Always download software from the official website of the software developer or from reputable sources,” Microsoft advises.

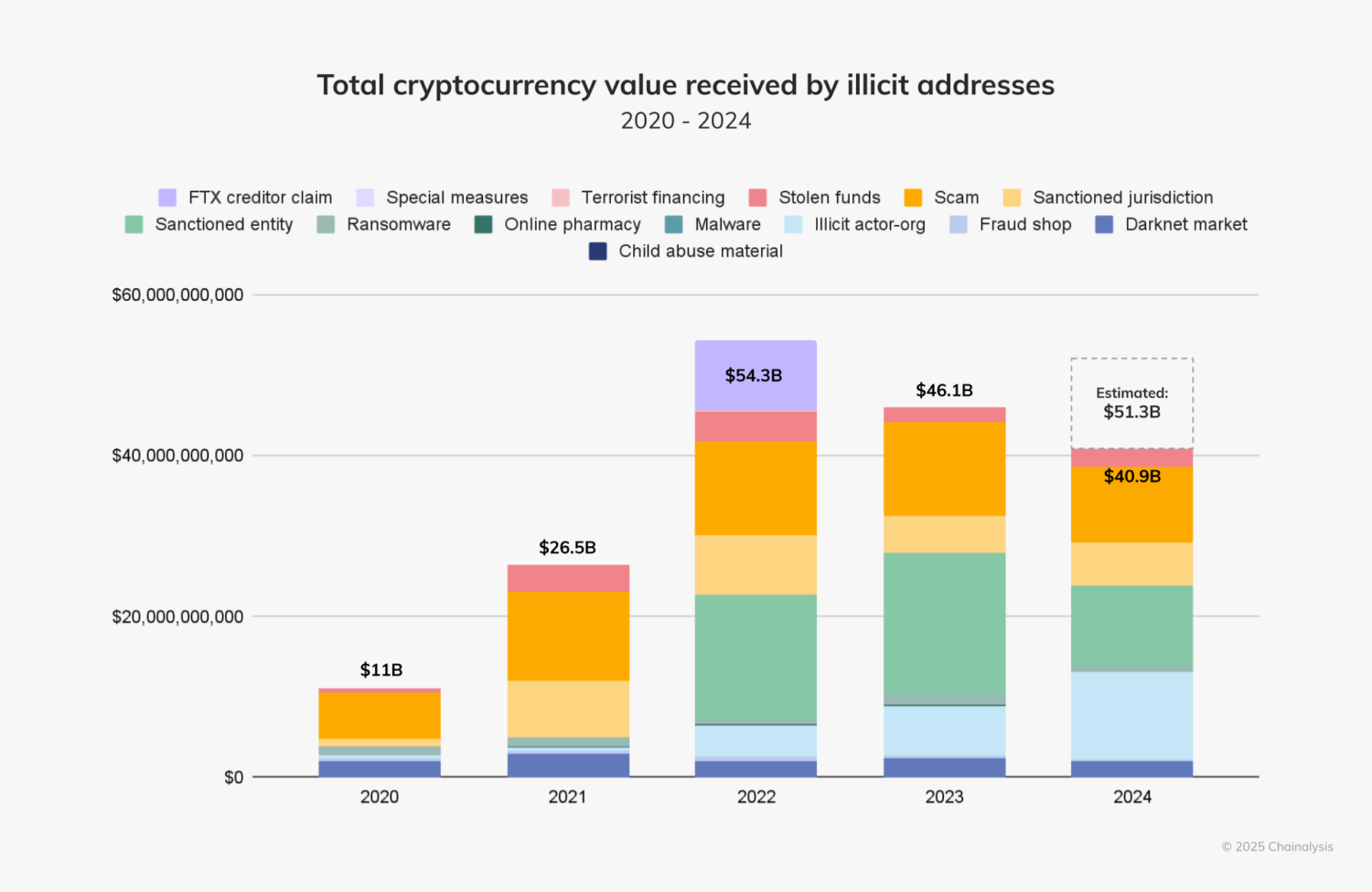

According to Chainalysis’ 2025 Crypto Crime Trends report, illicit cryptocurrency transactions range from $40 billion to $50 billion annually. These funds are stolen through various methods, including ransomware and malware attacks.

Chainalysis estimates that the volume of illicit crypto transactions in 2024 could exceed $51 billion, with an average annual increase of 25% between reporting periods.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market15 hours ago

Market15 hours agoCardano (ADA) Bulls Advance as Sellers Lose Grip

-

Altcoin18 hours ago

Altcoin18 hours agoXRP Price Targets $30 As Analyst Reveals Bullish Double Bottom Breakout

-

Bitcoin22 hours ago

Bitcoin22 hours agoFrench Banker Warns of Crypto-Induced Crisis

-

Market22 hours ago

Market22 hours agoCan Bulls Push Price to $0.26?

-

Market17 hours ago

Market17 hours agoBinaryX Token Swap Drives 41% Price Rally

-

Altcoin17 hours ago

Altcoin17 hours agoEthereum Price Remains In Deep Correction As Standard Chartered Slashes ETH Target By 60%

-

Blockchain21 hours ago

Blockchain21 hours agoEthena Labs and Securitize to launch Converge, a new blockchain for DeFi

-

Market16 hours ago

Market16 hours agoExtreme USDT Volatility Recorded On Chain