Bitcoin

Is BTC Set for a Breakout After Gold?

Gold prices skyrocketed to an all-time high of $3,004 per ounce, fueled by escalating geopolitical tensions, mounting inflation concerns, and a surge in demand for safe-haven assets.

The milestone has reignited speculation over whether Bitcoin (BTC)—often referred to as “digital gold”—could experience a similar rally in the face of global uncertainty.

Gold vs Bitcoin: Can BTC Follow Gold’s Historic Rally?

On Friday, gold surged past the key $3,000 mark for the first time, setting a new all-time high for the 13th time this year. The rally pushed the precious metal’s total market capitalization beyond $20 trillion, according to data from CompaniesMarketCap.

Meanwhile, Bitcoin has taken a different trajectory. Its value has plummeted significantly as macroeconomic conditions continue to weigh on it.

The leading cryptocurrency is currently trading 23.3% below its all-time high, having dropped 14.5% over the past month. At press time, BTC was valued at $83,643, reflecting a 0.8% decline in the past 24 hours.

Despite Bitcoin’s short-term struggles, analysts suggest it could follow a path similar to gold’s historic rise.

In the latest X (formerly Twitter) post, an analyst compared the launch of the Gold exchange-traded funds (ETFs) in November 2004 to the launch of the Bitcoin ETF in January 2024. He suggested that Bitcoin may follow a similar price trajectory to gold after its ETF introduction.

The introduction of the Gold ETF provided institutional and retail investors easier access to gold exposure. Over time, gold saw a massive price increase, with cyclical tops and corrections but a long-term bullish trend.

As per the analysis, Bitcoin appears to be following a similar pattern. If the trend holds, BTC could see a similar multi-year growth trajectory, with its ETF launch acting as a catalyst for institutional adoption and sustained price appreciation.

Another market analyst echoed this sentiment, noting that gold and Bitcoin are following a five-step parabolic model. He predicted that Bitcoin could soon experience a significant breakout, akin to gold’s past performance.

“Bitcoin’s future is written in gold! Gold followed this pattern before its breakout. Now, Bitcoin is mirroring the move,” Merlijn wrote.

According to his projections, Bitcoin has completed its “fakeout” phase, with an all-time high on the horizon. His bold forecast? A surge to $150,000 is “loading.”

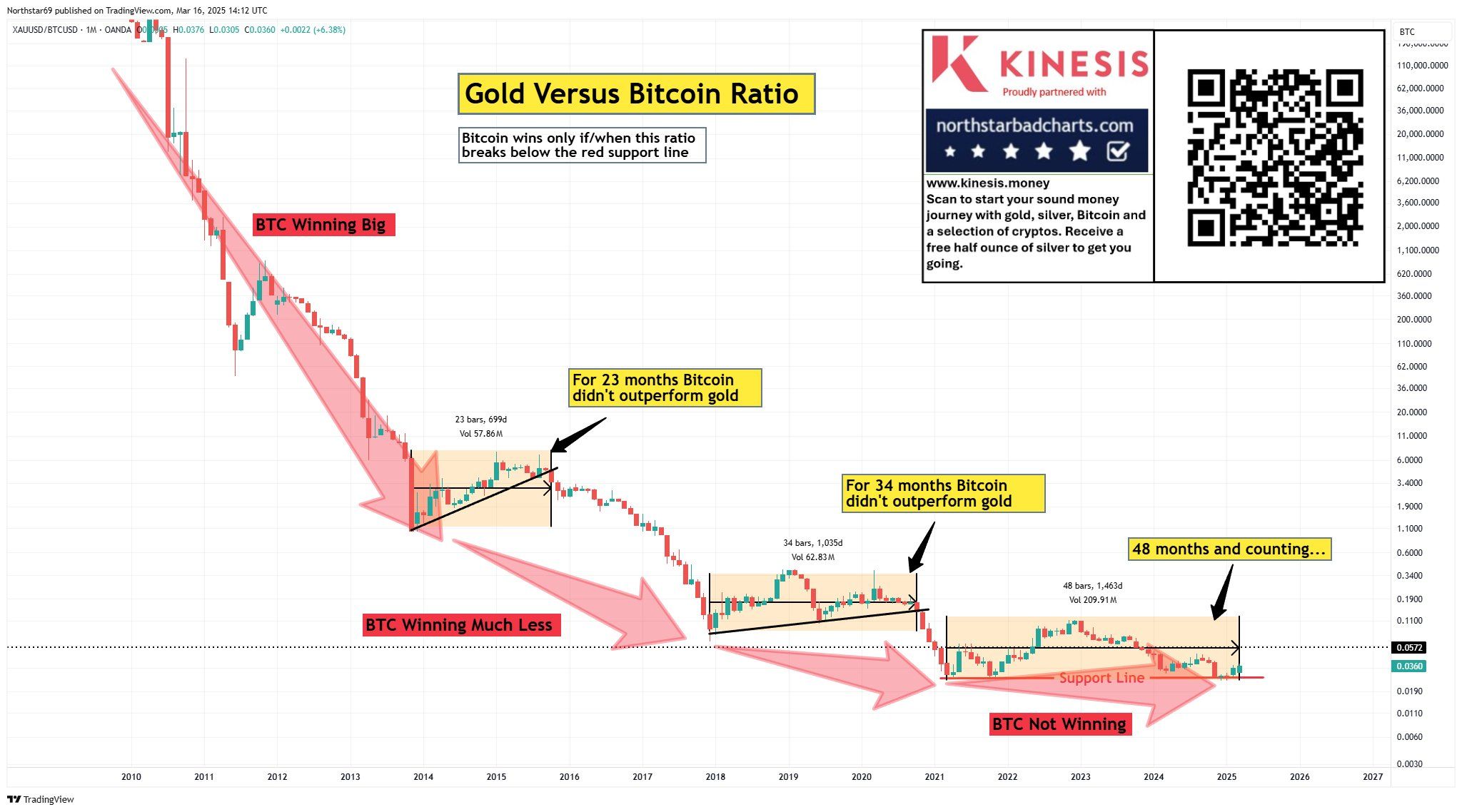

However, not all experts are convinced. Northstar, a market analyst, pointed out a concerning trend in the gold/bitcoin ratio. It has been in a prolonged downtrend. In fact, Bitcoin has failed to outperform gold for four years, marking the longest period on record.

He warned that gold’s breakout isn’t just about its price increase but what it signals.

“Historically, when gold breaks out versus stock markets, it initiates a capital rotation event, sending NASDAQ down 80% or so. Unfortunately, Bitcoin tracks NASDAQ,” the analyst remarked.

Adding to the skepticism, financial analyst Charlie Morris identified a divergence in ETF flows. While gold-backed funds have seen inflows amid the recent price surge, Bitcoin ETFs are experiencing a substantial downturn.

With Bitcoin trading at around $80,000, the coming months will be crucial in determining whether it can follow gold’s trajectory or continue to underperform. For now, the ongoing debate persists—will Bitcoin establish itself as a long-term store of value, or will gold’s enduring appeal continue to outshine the digital asset’s potential?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Pi Network, Trump Summit, XRP Commodity

This week, the crypto market recorded several significant developments, ranging from key controversies within the Pi Network ecosystem to Trump’s crypto summit and revelations of Bitcoin’s role in the dark web.

The following is a roundup of crucial developments that happened this week but will continue shaping the sector.

Pi Network Criticized Over Mainnet Migration

The controversial Pi Network was criticized by its community of Pioneers, making it a headline topic this week in crypto. It came amid widespread issues where Pioneers could not transfer their Pi coins to the mainnet before the migration deadline.

“The whole process is a joke. ~80% of my balance shows as unverified, although all of my security circle has completed KYC. No additional actions are listed to be taken to clear this up. Furthermore, nobody got back to me on a support ticket I opened weeks ago. What gives?” remarked a user.

Many users, frustrated by prolonged lockup periods, have turned to selling their accounts, raising concerns about the ecosystem’s integrity. The failure to meet migration deadlines has heightened fears of a potential price drop once unrestricted trading begins.

Adding to the concerns, KYC (Know Your Customer) verification issues plague the Pi Network community. Pioneers who cannot verify their identities risk losing access to their Pi coins, creating uncertainty ahead of Pi Day.

These situations led to increasing dissatisfaction among users who questioned the project’s transparency. Meanwhile, centralization concerns have escalated, as reports indicate that Pi Network’s Core Team holds 82.8 billion Pi coins. This revelation has sparked debates about whether the network is truly decentralized or controlled by a select few.

Dark Web Drug Market Moves Millions in Bitcoin

Another headline topic this week in crypto entailed the resurfacing of an ancient and long-dormant Bitcoin wallet. The crypto wallet, associated with the Silk Road-era dark web drug trade, suddenly resurfaced, moving $77.5 million worth of Bitcoin (BTC) after nine years.

“Nucleus Marketplace was a darknet drug market, and it was believed that the founder had either been apprehended by law enforcement or had exit-scammed when the market went offline in 2016. The BTC held in their wallets has not been moved until today,” Arkham revealed.

The transfer raised questions about the potential for further illicit financial activity. It also begged queries on whether authorities are monitoring these funds.

The transaction serves as a reminder of cryptocurrency’s controversial past and ongoing use in underground markets.

SEC May Reclassify XRP as a Commodity

Rumors surfaced this week that the US SEC (Securities and Exchange Commission) may reclassify XRP as a commodity rather than a security. This development follows recent legal victories for Ripple, which successfully argued that XRP sales on secondary markets do not constitute securities transactions.

“This speculation gained traction after Vermont state regulators announced they were dropping their case against Coinbase, citing the newly established SEC Crypto Task Force. This could set a major precedent for Ripple,” a user on X shared.

If true, this move could significantly affect Ripple’s longstanding legal battle with the SEC and redefine how cryptocurrencies are regulated. Specifically, if the SEC categorizes XRP as a commodity, this would place it under the jurisdiction of the CFTC (Commodity Futures Trading Commission) rather than the SEC, potentially leading to a more favorable regulatory environment for Ripple and its investors.

Such a milestone could pave the way for an XRP ETF in the US. However, no official confirmation has been provided, and the crypto community remains divided on the implications.

Some believe it would provide much-needed clarity and regulatory relief. Others caution that a reclassification could result in additional oversight and compliance requirements.

Meanwhile, many draw similarities between Ethereum (ETH) and XRP. In their opinion, this merits XRP for a commodity status or classification.

Trump’s Crypto Summit Sparks Frustration

Also this week in crypto, US President Donald Trump hosted a much-anticipated crypto summit at the White House. The event aimed to further position Trump’s administration as an ally to the digital asset industry.

However, the event fell short of expectations, lacking clear policy proposals and tangible commitments. Instead of offering concrete regulatory guidance, the summit largely consisted of broad statements about innovation in the US, economic growth, and opposition to excessive government control over crypto.

“That Summit was the most embarrassing thing I’ve ever witnessed,” popular NFT trader Clemente lamented.

Additionally, the summit failed to address key issues such as stablecoin regulations, central bank digital currencies (CBDCs), and the future of Bitcoin and Ethereum in the US. Critics argue that if Trump truly wants to appeal to crypto investors, he must outline a comprehensive policy framework rather than relying on vague assurances.

Binance and Coinbase Traffic Drops Nearly 30%

Meanwhile, amid a broader market lull, Binance and Coinbase, two of the largest centralized exchanges (CEXs), saw a nearly 30% drop in traffic. Spot and derivatives trading volumes have also declined, reflecting skittishness from retail investors.

The downturn was caused by reduced trading activity, growing investor uncertainty, and declining retail interest in crypto. The decline in traffic suggests that fewer users are engaging with crypto trading platforms as market sentiment remains bearish.

Many analysts believe this trend is driven by lower volatility, reduced speculative activity, and regulatory concerns. President Trump’s tariffs, particularly in the US and Europe, fuel these concerns.

Additionally, the lack of major bullish catalysts, such as Bitcoin ETF (exchange-traded funds) inflows or institutional adoption, has kept many traders on the sidelines. BeInCrypto reported that US Bitcoin ETF holdings have since fallen below Satoshi’s BTC stash as outflows continue.

Another factor contributing to the reduced traffic is the growing competition from decentralized exchanges (DEXs) and alternative trading platforms that offer lower fees and fewer regulatory constraints.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Howells Loses Appeal to Dig Up Landfill for Lost Bitcoin

James Howells, a Welsh man who lost 8,000 bitcoins to a landfill, has been fighting for years. He lost another appeal, trying to get the right to purchase and excavate the site, and plans to go to the European Court of Human Rights.

The city of Newport plans to seal off the landfill and turn it into a solar farm in 2026. It has a long-term economic vision for the site, and zero interest in Howells’ dogged efforts.

Howells’ Quest to Recover Landfill Bitcoin

The price of Bitcoin has shot up wildly in the last few years. There’s no shortage of anecdotes from people who purchased BTC long ago and lost or spent it all. Some people, however, go further than others with their regrets.

James Howells, a man who lost a hard drive with 8,000 bitcoins on it, has fought for years to excavate the landfill where it rests.

Despite British courts repeatedly refusing to let Howells dig up the landfill and recover his Bitcoin, the potential gain is too great to forget.

He offered the Newport local council $72 million in 2021 and tried to purchase the landfill this February. Today, his legal battle to force the issue met another setback, as another appeals petition was shut down:

“Appeal request to the Royal Court of Appeal: refused. The Great British Injustice System strikes again… The state always protects the state. Next stop: the European Court of Human Rights,” Howells posted on social media.

According to reports, the presiding judge dismissed Howells’ arguments. He said that the effort didn’t have “any real prospect of success” and that “there is no compelling reason” why the Court should consider his appeal.

Also, Newport’s city council is not interested in Bitcoin and plans to seal off and redevelop the landfill site in 2026.

Indeed, there are many sad cases of lost Bitcoin, though few are quite so flamboyant as Howells’ landfill saga.

In 2021, the British government estimated that $140 billion worth of Bitcoin had been lost. This number has shot up tremendously since then. Even if Howells could excavate the site, it’s very unlikely that his hard drive will remain functional.

In short, storing cryptoassets on a hard wallet is probably the safest method, but anything is possible. Freak accidents like Howells’ can and have destroyed vast sums of money all over the world.

Overall, he is still determined to get his Bitcoin back from the landfill, but it seems like an impossible task.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Kentucky Passes Bill to Protect Bitcoin Rights

Kentucky lawmakers have approved HB 701, a bill that aims to strengthen Bitcoin self-custody rights and create a friendly environment for crypto mining operations across the state.

The bill, introduced by Representatives Adam Bowling and T.J. Roberts, gained unanimous approval from both legislative chambers on March 14.

Kentucky’s Push Pro-Bitcoin Policies

HB 701 strengthens individual rights by clearly allowing the self-custody of digital assets like Bitcoin through privately controlled wallets. It also safeguards Bitcoin mining operations by preventing discriminatory zoning regulations that could unfairly target miners.

Additionally, it removes certain financial licensing requirements for small-scale miners, lowering entry barriers for independent participants in the industry.

Kentucky’s Senate Majority highlighted these protections on X (formerly Twitter), stating that the bill shields node operators and staking providers from liability for validated transactions.

It also ensures that digital asset mining and staking activities remain exempt from money transmitter and securities regulations. The Attorney General’s Office has the authority to enforce these exemptions.

“[The bill] shields node operators and staking providers from liability for validated transactions and exempts digital asset mining and staking from money transmitter and securities regulations. The Attorney General’s Office is authorized to enforce violations,” Kentucky’s Senate Majority explained on X.

Meanwhile, a significant provision of the bill clarifies that Bitcoin mining and staking services will not be classified as securities. This distinction provides greater regulatory certainty for industry participants.

Beyond mining and self-custody, the HB 701 bill safeguards individuals’ rights to use digital assets for payments. It prohibits additional taxes or fees on digital asset transactions beyond those imposed on standard financial payments.

Overall, this provision aims to enhance Bitcoin’s utility as a medium of exchange within the state.

“Digital assets used as a method of payment shall not be subject to additional taxes, withholdings, assessments, or charges that are based solely on the use of the digital asset as the method of payment,” the bill stated.

With approval from both houses, the bill now awaits the governor’s signature. If signed into law, it will reinforce Kentucky’s reputation as a crypto-friendly state and encourage further innovation in the digital asset sector.

Meanwhile, HB 701’s passage comes as lawmakers consider a separate bill to establish a Bitcoin reserve. This initiative would allocate a portion of Kentucky’s excess funds to digital assets, providing the state with an alternative store of value.

Although the bill does not explicitly mention Bitcoin, it references digital assets—excluding stablecoins—with a market capitalization exceeding $750 billion. Bitcoin’s market capitalization is currently at $1.7 trillion, making it the only asset meeting these criteria.

Despite this proposal remaining under review, Kentucky’s proactive approach places it among states pushing for greater Bitcoin adoption.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin16 hours ago

Altcoin16 hours agoBinance Unveils Major Backing For MKR, EPIC, & These 3 Crypto, What’s Happening?

-

Altcoin19 hours ago

Altcoin19 hours agoBNB Price Can Hit Fresh ATH As Mubarak Leads Meme Coin Frenzy

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Bulls Eye Comeback After $10 Billion Liquidation Shakeout—Analyst

-

Bitcoin16 hours ago

Bitcoin16 hours agoWhy Bitcoin And Crypto Will Not Recover Before US Equities Market: Expert

-

Bitcoin13 hours ago

Bitcoin13 hours agoWhy Are the Purchases Shrinking?

-

Market13 hours ago

Market13 hours agoChaos Labs, Monad & Voltix

-

Altcoin18 hours ago

Altcoin18 hours agoLawyers React As Expert Hints At Ripple Vs SEC Case End

-

Altcoin14 hours ago

Altcoin14 hours agoThe New Frontier of Altcoin Futures Trading: Gate.io’s Ecosystem Innovation.