Market

Trading Platform for USA and Canada

Editorial Note: The following content does not reflect the views or opinions of BeInCrypto. It is provided for informational purposes only and should not be interpreted as financial advice. Please conduct your own research before making any investment decisions.

CoinGecko says that over 200 crypto exchanges record over $131 billion daily trading volume. BTCC Exchange has emerged as one of the oldest, maintaining a good reputation over the past fourteen years.

Established in June 2011, BTCC is a highly secure exchange with zero security breaches since its founding. For traders in the United States and Canada, it provides different trade options and supports fiat deposits in USD and CAD. BTCC also has a copy trading feature and a broad selection of trading pairs.

Investors can use different trading strategies, such as perpetual futures, spot trading, and tokenized stocks and commodities. As the platform approaches its fourteenth anniversary in 2025, BTCC has become a leading exchange.

The exchange is improving its services, introducing new trading features, competitive fees, and massive rewards. This review will explore the features that make BTCC an ideal exchange for traders in North America. You will learn about its security, trading tools, fees, and bonuses.

Unmatched Security: 14 Years with Zero Breaches

One of BTCC’s most impressive attributes is its excellent security record. Since launching in 2011, the exchange has reported zero breaches or hacks. Compared to its competitors, exchanges like Bybit, Bitmart, and Binance have experienced security breaches.

BTCC uses a multi-layered security system that combines cold wallet storage and multi-signature authentication. Another aspect of its security is the integration of advanced encryption technologies. The exchange is also PCI DSS certified, which stands for Payment Card Industry Data Security Standard certified.

BTCC has many security features that protect assets from hackers for U.S. and Canadian traders who want safety. First, the exchange maintains a 1:1 storage of users’ assets. This means that once a user deposits Bitcoin at the exchange, it will be stored, and Tether will be stored if users deposit Tether.

Secondly, BTCC doesn’t support collateralising tokens for loans. The exchange does not issue tokens and is entirely self-funded, which prevents it from joining or participating in any staking or DeFi projects. Additionally, the exchange has a set of money laundering preventive (AML/CTF) measures.

Extensive Trading Options: Futures, Spot Trading, and Tokenized Assets

BTCC provides different trading products for investors and traders of all types. The exchange has over 360 USDT-M perpetual futures contracts and 240 spot trading pairs.

Additionally, investors can access more than 37 tokenized stocks and commodities. This allows traders to diversify their portfolios beyond traditional crypto assets.

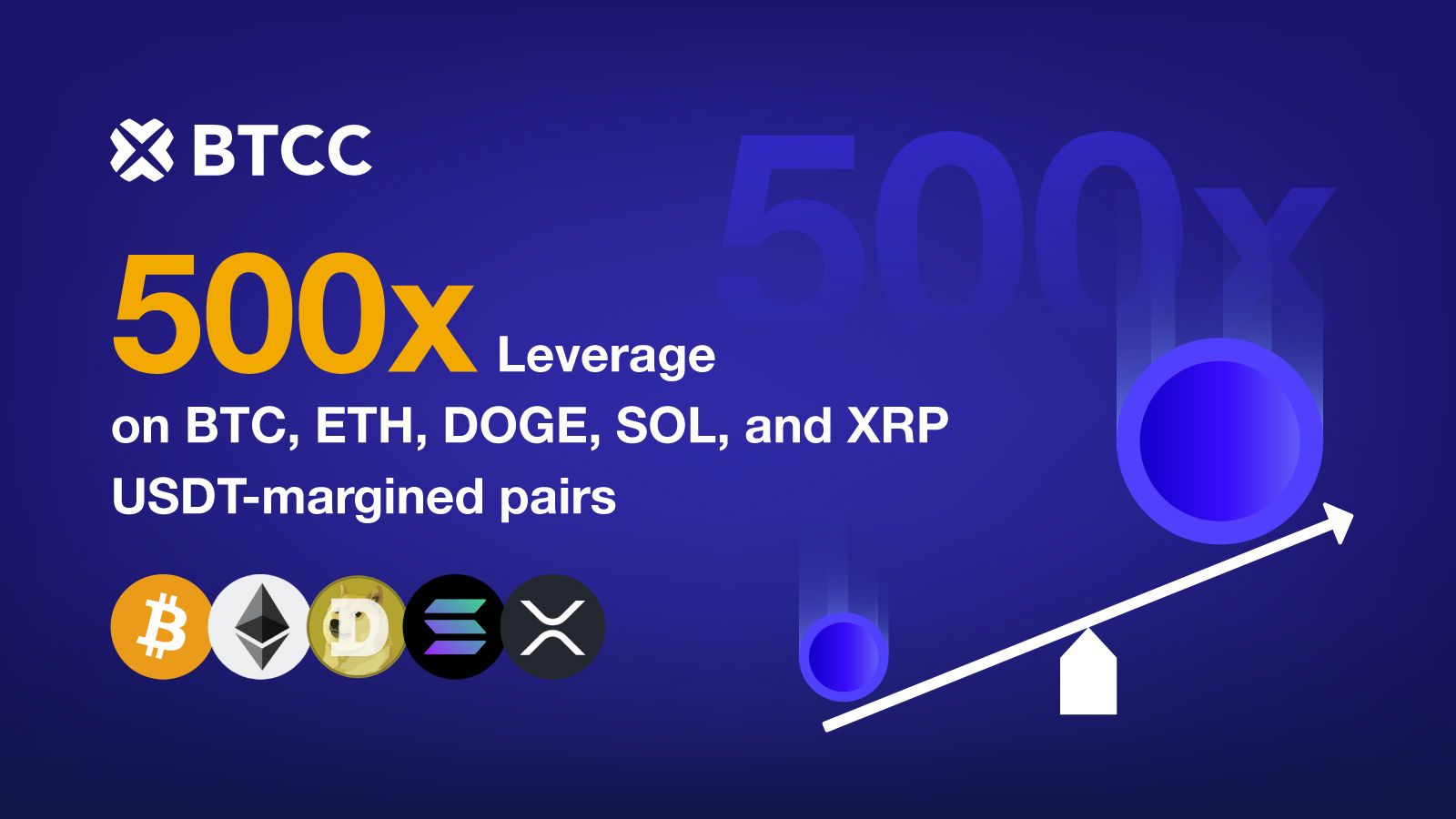

In the futures trading section, BTCC allows traders to increase their trading positions to 500x on select pairs. Bitcoin, Ethereum, Ripple, Dogecoin, and Solana are some tokens eligible for this leverage ratio. Beyond these flagship pairs, BTCC supports over 300 perpetual futures contracts with leverage of up to 50x. It was created to suit traders who want a flexible way of increasing their trading profits.

The tokenized assets available on BTCC include gold, silver, and U.S. stock market instruments. Some examples are stocks of MicroStrategy, Visa, and 3M Company. BTCC is ahead of exchanges like Bitget or Tapbit because it combines crypto and traditional assets. This feature benefits North American traders who want to gain exposure to multiple asset classes without using numerous platforms.

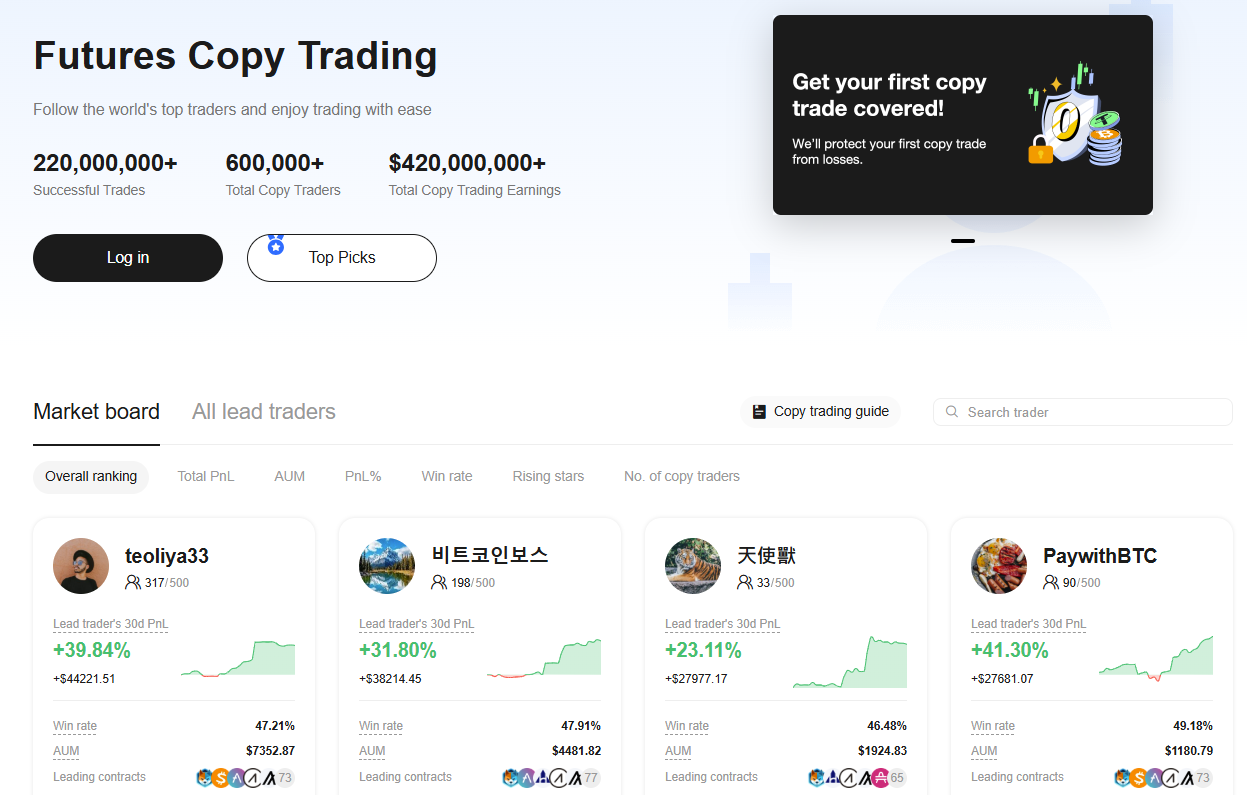

Copy Trading: A Revolutionary Feature for Beginners

BTCC has a copy trading feature, so beginners can quickly learn how to make profits by copying pro traders’ trades. On this exchange, those new to crypto trading can see the trades of expert traders and execute their strategies in real time.

This exchange has different risk management tools within the copy trading system. It has different notification settings, and you can set stop-loss levels for individual traders. These tools allow users to manage potential losses while benefiting from expert strategies.

To encourage participation, BTCC provides a zero-loss first-trade insurance policy. This insurance policy covers up to 50 USDT in losses for a trader’s first copy trade. According to their website, they have more than 600,000 active copy traders.

User Experience and Mobile Accessibility

BTCC tries to provide a good trading environment for its users. Its website and app have a user-friendly interface for beginners and professional traders. Features include real-time market data, advanced charting tools, and a one-click payment system.

BTCC has a mobile app available on iOS and Android for traders who prefer mobile trading. The app is quite fast and has all the essential trading tools, including features like live market updates, customizable alerts, and copy trading. The iOS app is available on the App Store, while Android users can download the app from Google Play.

VIP Program, Trading Fees, and Deposit Options

BTCC offers a competitive fee structure. The spot taker/maker fee starts from 0.3% / 0.2%. However, as your VIP level increases on the exchange, the fees begin to reduce. Those in special VIP level 5 can receive up to 35% reduction in their spot trading fees.

On the other hand, their futures trading fees start from 0.045% / 0.025% taker/maker. However, this can be reduced to 0.01% / 0.007% if you join their VIP program. The VIP membership rewards traders with lower trading fees, priority customer support, and different trading campaigns. VIP members also receive fee discounts and coupon-based rewards.

Deposits and withdrawals are simple. It supports fiat deposits in USD and CAD. A complete list of deposit and withdrawal fees is available here.

BTCC is known for many rewards and promotions for new and existing traders. One of the most notable promotions is the 10,055 USDT new user reward. Traders can claim this reward by visiting this page.

Additional promotional campaigns include the TOKEN2049 Trade-to-Win event, the referral program offering up to 35% commission, and 10,060 USDT in rebates. During this promotion, there were weekly giveaways on X. These promotions make BTCC particularly attractive for those who want new opportunities that come with trading.

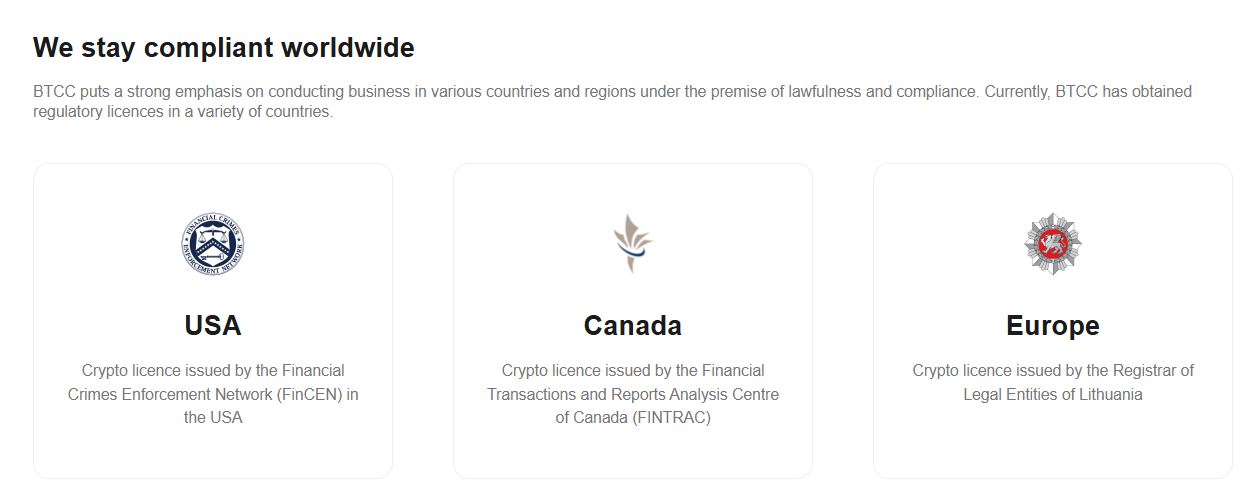

Regulatory Compliance and Global Presence

BTCC operates with full regulatory compliance in the jurisdictions where it offers services. The exchange holds licenses from FinCEN in the United States, FINTRAC in Canada, and Lithuania’s Financial Crime Investigation Service in Europe.

The exchange also engages in major blockchain events worldwide, including TOKEN2049 Dubai 2025, Paris Blockchain Week 2024, and BTCC Japan’s first offline event. Many trusted websites have reviewed this exchange, and their verdicts are favorable. Benzinga, Trustpilot, and CoinGecko recognize BTCC as a top crypto exchange.

Conclusion: Is BTCC Worth It for U.S. and Canadian Traders?

After many reviews and verdicts, BTCC Exchange is considered one of the industry’s safest and most competitive crypto exchanges. It has been operating for about 14 years and has recorded zero breaches. It also has different security guarantees, such as two-factor authentication, regulatory licenses, and cold wallet storage systems.

This crypto exchange also offers different trading strategies. There’s futures trading, copy trading, tokenized assets, and a VIP program for new and experienced traders in North America. For those ready to start, more details can be found on the BTCC official website.

Disclaimer

This article is sponsored content and does not represent the views or opinions of BeInCrypto. While we adhere to the Trust Project guidelines for unbiased and transparent reporting, this content is created by a third party and is intended for promotional purposes. Readers are advised to verify information independently and consult with a professional before making decisions based on this sponsored content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano (ADA) Bulls Advance as Sellers Lose Grip

Cardano (ADA) is down nearly 8% over the past 30 days but has gained almost 3% in the last 24 hours as short-term momentum picks up.

The token’s market cap stands at $26 billion, while its trading volume has surged 30% in the past day, reaching $903 million. Technical indicators are starting to show early signs of a potential trend reversal after a period of bearish pressure. Here’s a closer look at the key signals and price levels shaping ADA’s outlook this week.

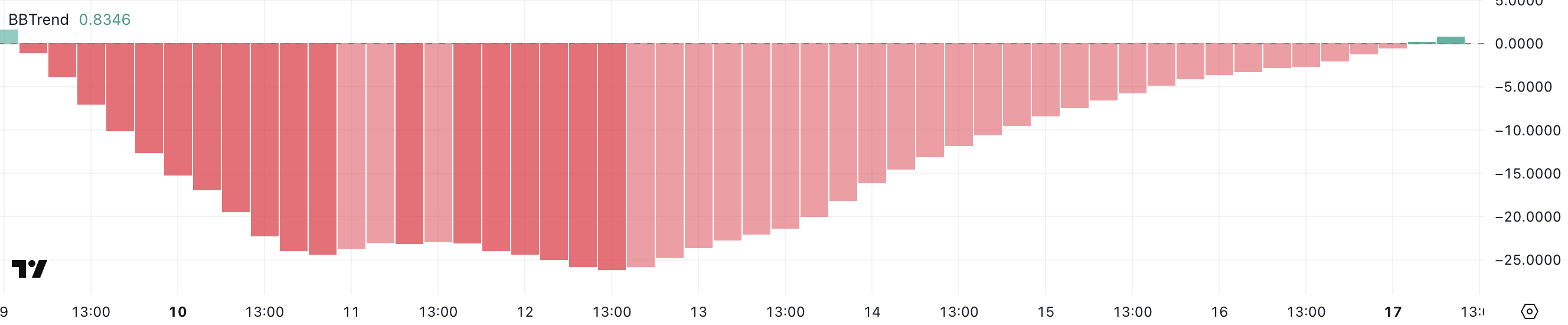

ADA BBTrend Is Now Positive After 6 Days

Cardano’s BBTrend has just turned positive, ending a six-day streak in negative territory, which included a low of -26.13 on March 12. The indicator is now sitting at 0.83, signaling a shift in momentum after the recent downtrend.

While this is still a relatively low reading, the move back into positive territory could be an early sign of strengthening buying pressure.

The BBTrend (Bollinger Band Trend) measures the strength and direction of price movement relative to the Bollinger Bands. Positive values indicate an uptrend, while negative values point to a downtrend.

Since ADA’s BBTrend hasn’t risen above 10 since March 8, the current reading of 0.83 suggests that, although the bearish pressure has eased, momentum remains weak. For a stronger bullish signal, traders would typically look for the BBTrend to push above 10, confirming a more decisive upward move.

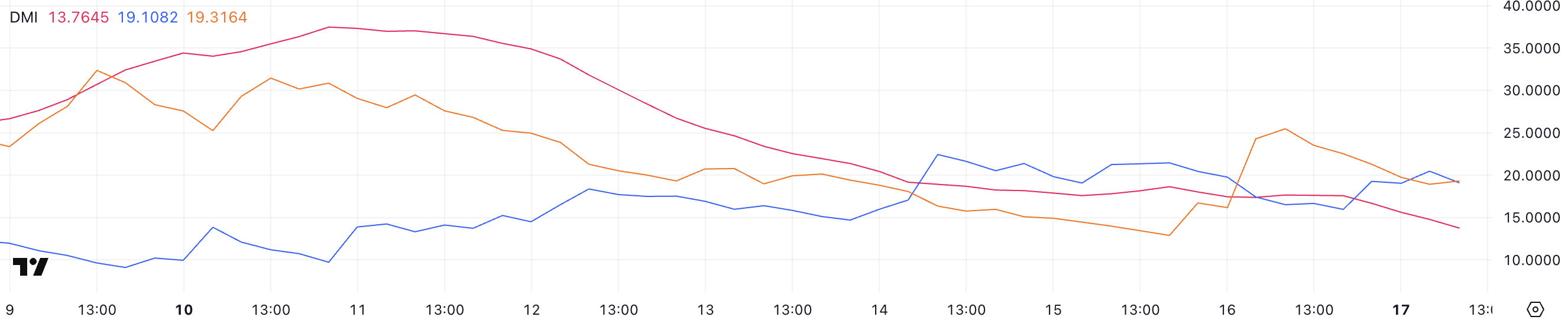

Cardano DMI Shows Sellers Are Losing Control

Cardano’s DMI chart shows that its ADX has dropped to 13.7 from 17.5 in the past 24 hours, suggesting a weakening trend strength. While the ADX is still signaling a trend, the lower reading points to reduced momentum compared to the previous day.

The Average Directional Index (ADX) measures the strength of a trend, regardless of its direction.

Readings above 25 indicate a strong trend, while readings below 20 often signal a weak or range-bound market. Currently, ADA’s +DI has risen to 19.1 from 15.96, while the -DI has dropped to 19.31 from 25.48, showing that bearish momentum is fading as bullish pressure slowly builds.

With the +DI and -DI lines close to crossing, ADA appears to be in the early stages of attempting to reverse from a downtrend to a potential uptrend, though a stronger ADX would be needed to confirm a solid trend shift.

Will Cardano Rise Above $1.10 Soon?

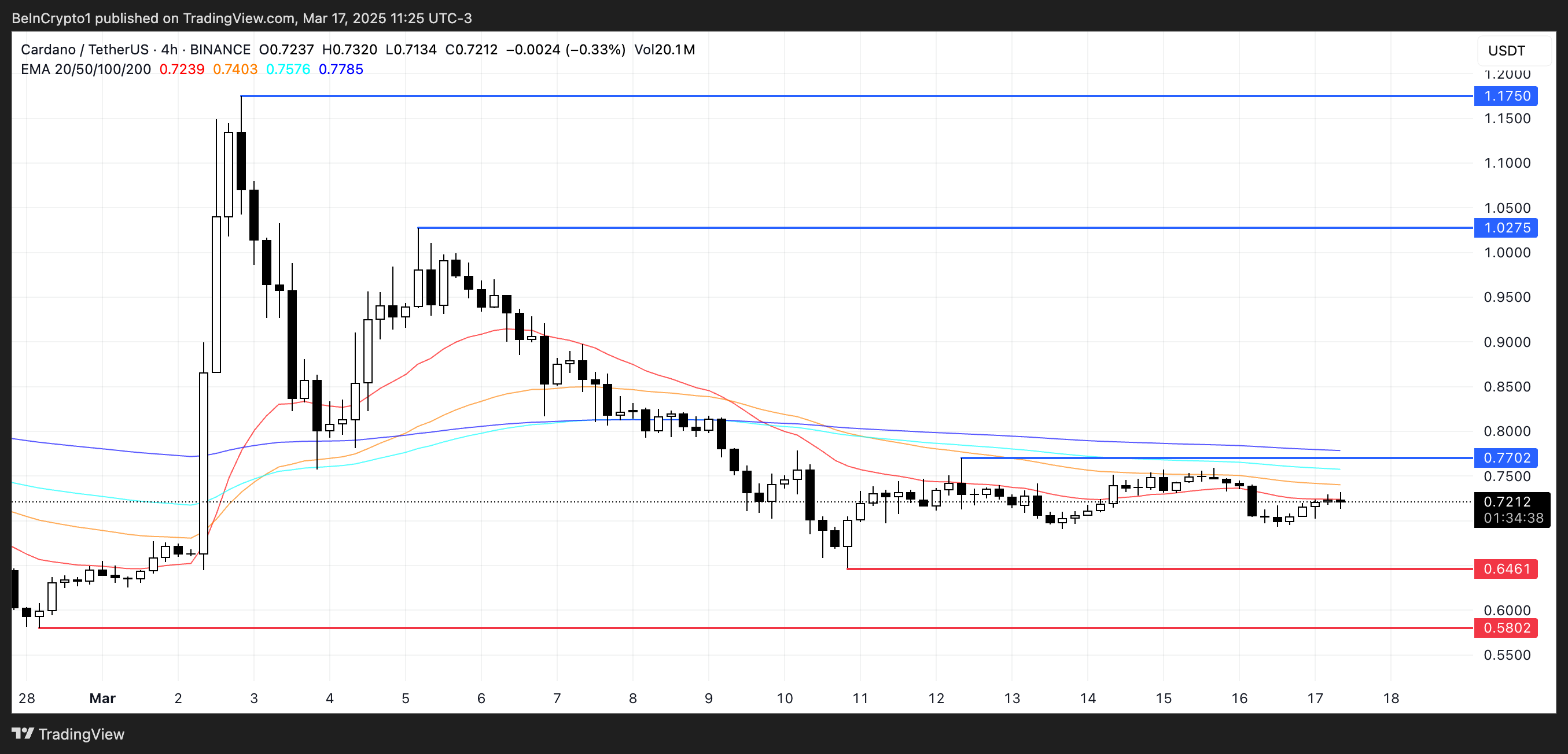

ADA’s EMA lines have shown signs of consolidation over the past few days, though the overall structure remains bearish. Short-term EMAs are still positioned below the long-term ones.

However, recent signals from both the BBTrend and DMI indicators suggest that this trend could be shifting, with early signs of bullish momentum building.

If Cardano’s price manages to confirm an uptrend, it could first challenge the resistance at $0.77. A breakout above this level may open the path toward $1.02 and even $1.17, marking the first time ADA trades above $1 since March 3.

On the downside, if bearish pressure returns, ADA could retest support at $0.64, and a breakdown below this could push prices as low as $0.58, revisiting levels not seen since February 28.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Extreme USDT Volatility Recorded On Chain

Solana just celebrated its fifth birthday, and a recent study shows highly exaggerated USDT volatility on the network’s transport layer. This suggests a high level of speculative interest in the platform, fueled by the meme coin craze and other factors.

Web3 payments solutions platform Mercuryo shared this insight exclusively with BeInCrypto.

Solana’s Extreme USDT Volatility

Solana, the second-largest blockchain in the industry, just celebrated its fifth birthday. Its genesis block was mined on March 16, 2020. In honor of this milestone, Web3 infrastructure firm Mercuryo conducted a study on it.

According to this study, USDT volatility on Solana’s transport layer is currently at an “extreme” level.

“Solana captivates the interest of crypto traders across the globe. As Solana celebrates its fifth birthday, our transaction data on Tether tokens on the Solana transport layer suggests an unparalleled level of trading activity amid an explosion of interest in trading opportunities on Solana that we’ve seen over the past 12 months,” claimed Greg Waisman, Co-founder and COO at Mercuryo.

Solana’s USDT volatility has already spiked five times in 2025 alone. The network’s daily USDT trade volumes fluctuated dramatically in the past two months.

This consisted of three spikes and two drops, both of which were significantly smaller than the spikes. Both drops were in the 60%- 70% range, while the increases ranged between 100% and a whopping 137%.

More specifically, Solana saw a 100% increase in USDT trading on January 13. A week later, this activity dropped by 63% and again surged by 129% on January 27. This level of unprecedented capital movements is often rare for any blockchain network.

Mercuryo claims that this volatility is caused by several factors, but the explosion of Solana meme coins is particularly important. Thanks to major meme coin launchpads like Pump.fun, Solana trade volumes have spiked in recent months, even surpassing Ethereum on a few occasions. This rising interest helps fuel intense activity and these wild swings.

Over the past five years, its network has processed more than 408 billion transactions and nearly $1 trillion worth of value on decentralized exchanges. While Solana has shown gradual growth since 2023, the volatility of capital inflow has been chaotic, to say the least.

Ultimately, this enhanced level of volatility shows that Solana has a lot of interest among crypto traders. The network has grown remarkably over the last five years, and it’s already poised to make major advancements in the near future.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

BinaryX Token Swap Drives 41% Price Rally

BinaryX (BNX) has emerged as the market’s top gainer today, surging 41% in the past 24 hours. The altcoin currently trades at $1.75, noting a 412% uptick in daily trading volume during that period.

The rally comes as traders position themselves ahead of the highly anticipated BNX-to-FORM token swap, scheduled for March 21.

BNX Gains Momentum as Traders Bet Big Ahead of Token Swap

BinaryX launched the Four.Meme platform on July 3, 2024, and later rebranded to Four for a more cohesive identity. However, due to the widespread use of FOUR in the meme coin community, the team opted to change to FORM, announcing a 1:1 token swap from BNX to FORM scheduled for March 21.

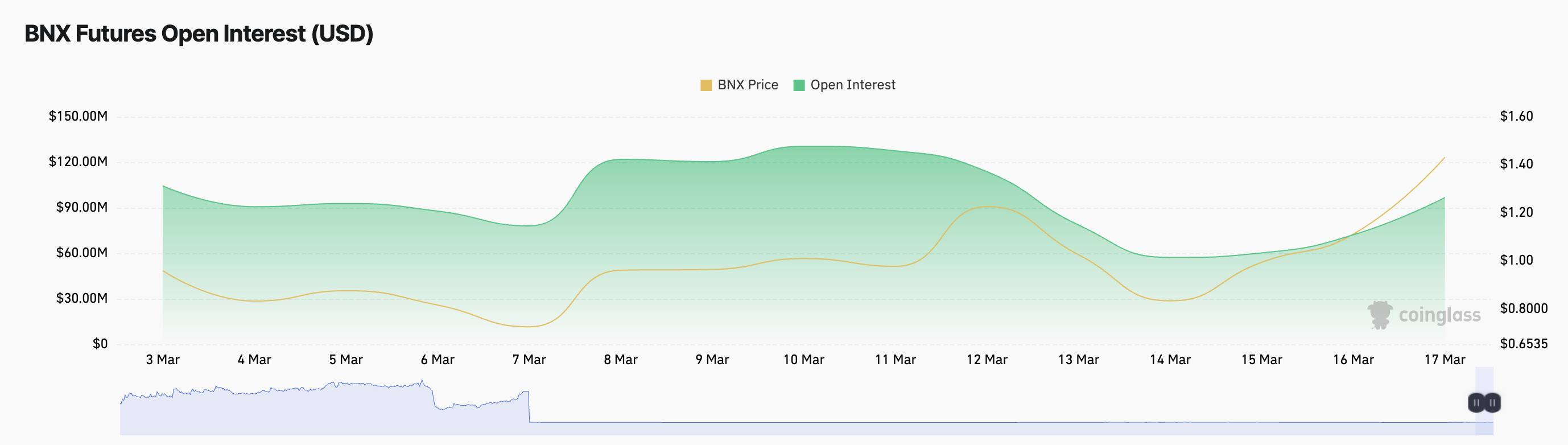

As the market awaits this swap, traders have increased their accumulation of the BNX token. This is reflected by the altcoin’s open interest, which has climbed 33% in the past 24 hours and stands at $96 million at press time.

Open interest tracks the total number of outstanding derivative contracts, such as futures or options, that have not been settled. When it rises during a price rally like this, it indicates increasing market participation. It signals the bullish conviction among BNX holders as more traders open new positions to capitalize on the upward momentum.

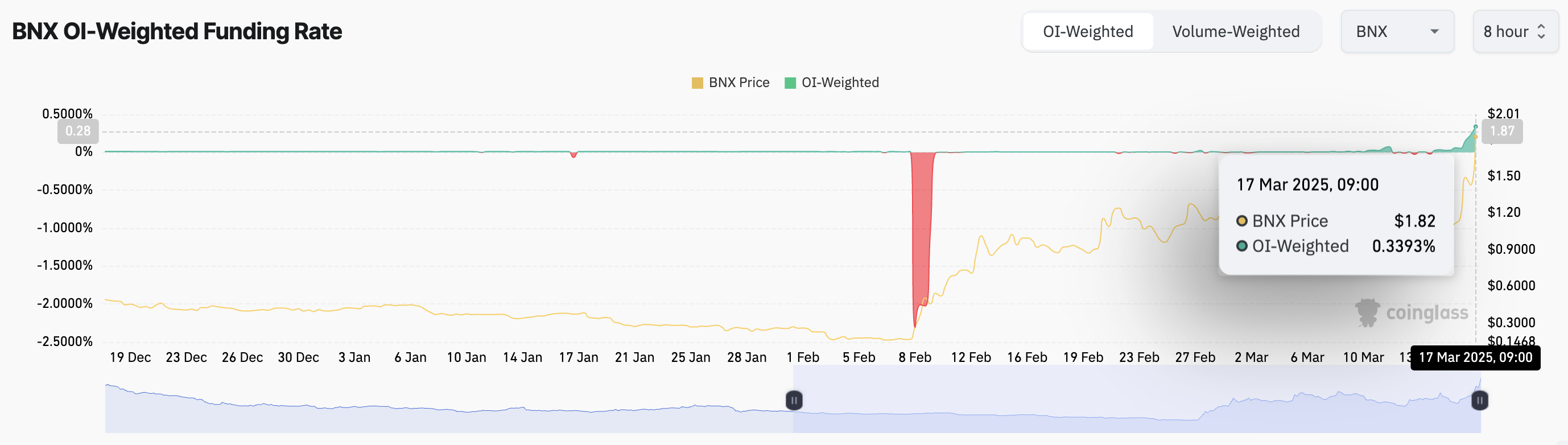

Moreover, its funding rate is also positive, supporting this bullish outlook. This is currently at 0.339%.

The funding rate is a periodic fee exchanged between long and short traders in perpetual futures contracts to keep prices aligned with the spot market. A positive funding rate such as this means long traders are paying short traders. It indicates strong buying pressure among BNX traders and confirms the bullish sentiment in the market.

BNX Trades Above Key EMA—Can Bulls Push It Past $1.85?

BNX trades above its 20-day exponential moving average (EMA) at its current price. This key moving average measures an asset’s price over the past 20 trading days, giving more weight to recent prices to help identify short-term trends.

When it sits below an asset’s price, it is a bullish signal suggesting that the market is in an uptrend and buyers are in control.

If BNX buyers strengthen their control and demand soars, they could drive the altcoin’s price past the resistance at $1.77 and toward $2.19.

However, if selloffs gain momentum, BNX could shed its recent gains and plunge to $1.77.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin16 hours ago

Altcoin16 hours agoBinance Unveils Major Backing For MKR, EPIC, & These 3 Crypto, What’s Happening?

-

Altcoin19 hours ago

Altcoin19 hours agoBNB Price Can Hit Fresh ATH As Mubarak Leads Meme Coin Frenzy

-

Bitcoin17 hours ago

Bitcoin17 hours agoBitcoin Bulls Eye Comeback After $10 Billion Liquidation Shakeout—Analyst

-

Bitcoin16 hours ago

Bitcoin16 hours agoWhy Bitcoin And Crypto Will Not Recover Before US Equities Market: Expert

-

Bitcoin13 hours ago

Bitcoin13 hours agoWhy Are the Purchases Shrinking?

-

Market13 hours ago

Market13 hours agoChaos Labs, Monad & Voltix

-

Altcoin18 hours ago

Altcoin18 hours agoLawyers React As Expert Hints At Ripple Vs SEC Case End

-

Market18 hours ago

Market18 hours agoSolana Price’s Biggest Test: Breaching $180 Resistance