Bitcoin

Hyperliquid Whale’s $420 million Bitcoin Short Sparks Public ‘Hunt’

A whale wallet on the decentralized exchange (DEX) Hyperliquid has stirred the community by executing a high-leverage short position with a tight liquidation price. This trade caught the attention of other whale groups, triggering an unprecedented public “whale hunt” in the market.

Additionally, Hyperliquid believes that such easily trackable trading activity represents the future of decentralization.

Attempt to Liquidate a High-Leverage Trade Worth Over $420 Million

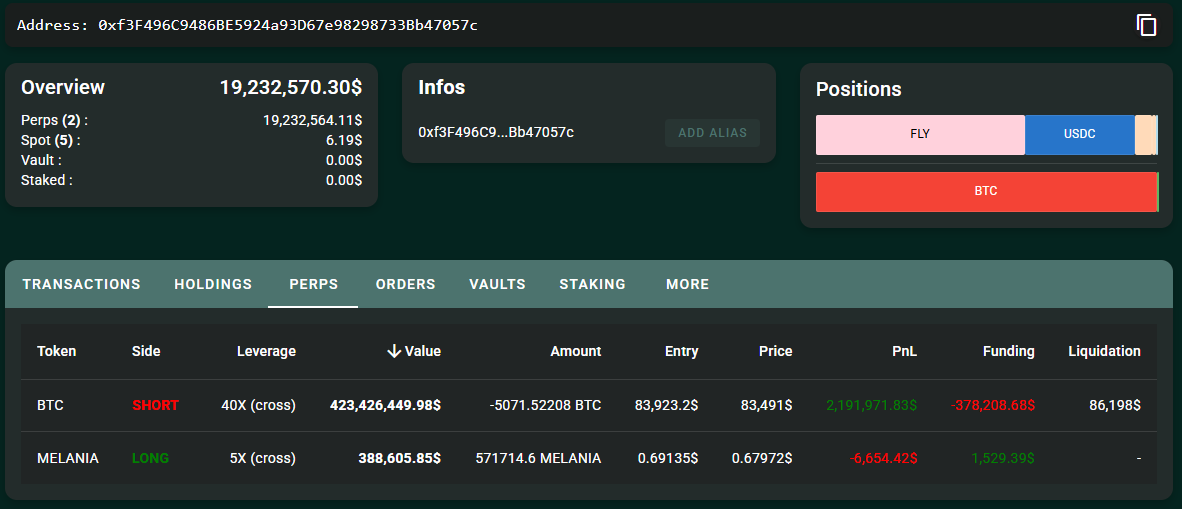

A whale with the wallet address 0xf3F496C9486BE5924a93D67e98298733Bb47057c opened a 40x leverage Short position on Bitcoin, totaling over $423 million. At the time of writing, its liquidation price stood at $86,198. Currently, the short position is in profit by over $2 million.

This whale has also recently executed large-leverage trades, raising suspicions among experts about potential ties to North Korean hackers.

The massive position size and tight liquidation price caught the attention of a user on X (formerly Twitter) named CBB. He called for a group effort to hunt the whale’s position by pushing BTC’s price higher. In a post on X, he claimed that “eight figures” (millions of dollars) had been committed to the plan.

“If you are willing to hunt this dude with size, drop a DM, setting up a team right now and already got good size,” CBB stated.

CBB also revealed that Justin Sun, founder of Tron (TRX), was part of the group. However, Sun has not officially confirmed this. Additionally, CBB invited Eric Trump, son of President Donald Trump, to join.

The story is still unfolding, and it’s unclear how far CBB’s whale-hunting effort will go. For now, the position remains profitable, and Bitcoin is trading at $83,460, just 3% away from liquidation.

A Kaiko report from early March states that Bitcoin’s 1% market depth is $300 million. This means pushing BTC up by 1% could require at least $300 million in capital.

Many X users are following the event like a high-stakes drama. CryptoVikings believes that the Hyperliquid whale is publicly shorting while simultaneously going long on a centralized exchange (CEX).

“HL whale strategy was simple. Short huge amount at high leverage publicly in Hyperliquid to gain attention. Long in CEX at the same time. He expected MMs and institutions would take out liquidation, pushing BTC $1K above, triggering a short squeeze and a good pump. He would make net profit on his longs. But MMs & exchanges understood the strategy. They first pushed the price down to liquidate his CEX position, then pumped the price much higher to hunt him on both sides,” CryptoVikings predicted.

Hyperliquid has embraced the event, praising public trading transparency as the future of decentralization.

“Hyperliquid has redefined trading. When a whale shorts $450M+ BTC and wants a public audience, it’s only possible on Hyperliquid…Anyone can photoshop a PNL screenshot. No one can question a Hyperliquid position, just like no one can question a Bitcoin balance. The decentralized future is here,” Hyperliquid stated.

The market is watching closely as this whale war continues to unfold.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin ETFs Inflows Reach $274 Million: Is Demand Returning?

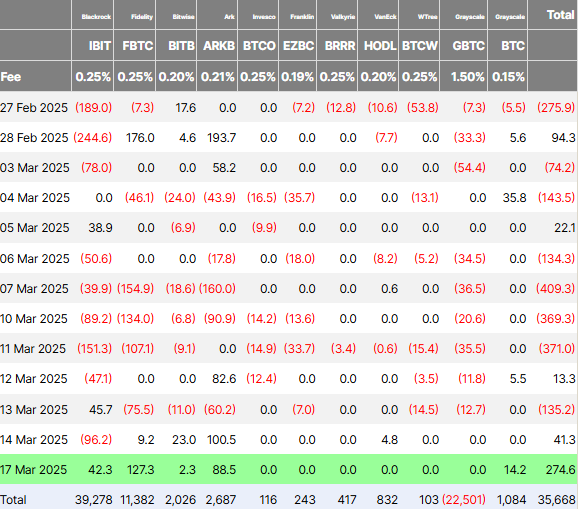

After weeks of outflows, Bitcoin exchange-traded funds (ETFs) have finally reversed course, recording $274.6 million in inflows on March 17.

This marks the largest single-day net inflow in 41 days, hinting at renewed investor interest. While one positive day does not confirm a trend, it raises an important question: Is demand returning to Bitcoin ETFs, or is this just a temporary reprieve?

Bitcoin ETFs See First Major Inflows in Weeks

According to the latest data on Farside Investors, BlackRock’s iShares Bitcoin Trust (IBIT) recorded $42.3 million in inflows on Monday. Despite the positive flows, IBIT failed to lead the way amid ongoing headwinds due to stock market correlation.

Fidelity’s Bitcoin ETF (FBTC) attracted $127.28 million, making it the day’s biggest gainer. The ARK Bitcoin ETF (ARKB), managed by ARK Invest and 21Shares, also saw significant interest, pulling in $88.5 million.

On the other hand, the Grayscale Bitcoin Trust (GBTC), which has been at the center of major outflows, remained flat at $0 million. This is notable because GBTC has lost billions in assets since transitioning to a spot ETF.

Meanwhile, Grayscale’s other Bitcoin product saw a modest inflow of $14.22 million. Other Bitcoin ETFs, including those from Valkyrie, Invesco, Franklin, and WisdomTree, recorded no daily inflows.

However, while Bitcoin ETFs had a strong showing, Ethereum-based spot ETFs continued their downward trajectory. Data on Farside investors showed they logged their ninth consecutive day of net outflows at $7.3 million.

“Bitcoin spot ETFs attract $275 million in inflows, while Ethereum ETFs experience outflows, reflecting shifting investor preferences,” one user on X suggested.

Notably, while this could suggest the returning demand for Bitcoin ETFs after weeks of outflows, analysts say one green day does not make a trend. Nevertheless, it is a shift worth watching.

Bitcoin ETFs Have Lost Billions in Recent Weeks

Just a week ago, Bitcoin ETFs had recorded four straight weeks of net outflows totaling more than $4.5 billion. Profit-taking, regulatory concerns, and broader economic uncertainty fueled the shift in investor sentiment.

The crypto market as a whole has also seen capital flight. As BeInCrypto reported, total crypto outflows exceeded $800 million last week, signaling strong negative sentiment among institutional investors.

With this context, while Monday’s inflow of $274 million could be seen as a sign of stabilization, it is too early to determine whether this marks the beginning of a broader recovery.

Nevertheless, the sudden surge in ETF inflows raises the question of whether this is a resurgence of the so-called “Trump crypto boom” or a case of fear of missing out (FOMO). Some analysts believe hedge funds and institutional players drive the action more than retail investors.

Crypto entrepreneur Kyle Chassé has previously argued that hedge funds play a major role in Bitcoin’s ETF flows. He claims that large investors strategically withdraw and reinvest capital to manipulate price movements, making it difficult to determine organic demand.

“The ETF “demand” was real, but some of it was purely for arbitrage. There was a genuine demand for owning BTC, just not as much as we were led to believe. Until real buyers step in, this chop & volatility will continue,” the analyst explained.

If true, the latest ETF inflows might not represent new buyers. Rather, it could mean recycling institutional capital to capitalize on short-term price swings.

Adding to the uncertainty, many investors are considering the Federal Reserve’s upcoming policy decisions. Some have speculated that the Fed will pivot toward monetary easing (QE) soon, but industry experts warn that such expectations are misguided.

Nic Puckrin, a financial analyst and founder of The Coin Bureau, believes those anticipating imminent QE are “deluded.” He notes that the Fed’s fund rate remains at 4.25-4.5%, and historically, QE does not begin until rates approach zero.

“…why is anyone suddenly expecting a massive injection of liquidity into the system? Realistically, if large-scale monetary stimulus is going to come from anywhere, it will be China or Europe, both of which have already implemented monetary easing measures. The most we can expect from Powell tomorrow is a hint at the timing of the next interest rate cut, but we may not even get that. And so, investors should prepare for the markets to throw another tantrum this week,” Puckrin told BeInCrypto.

.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin’s Halving Cycle No Longer Drives Price Trends

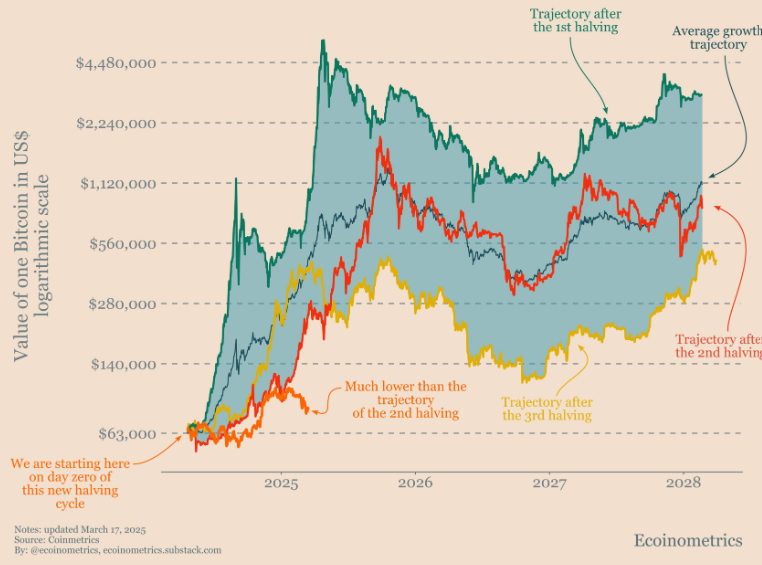

Bitcoin (BTC) has gone through three previous halving cycles with a relatively clear price pattern. The supply decreased, demand surged, and Bitcoin’s price skyrocketed afterward. However, in the fourth halving cycle, there is a deviation.

Data suggests that Bitcoin’s growth trajectory no longer follows the historical range set by previous cycles. Many industry experts believe Bitcoin has entered a completely different phase compared to before.

What’s Different About Bitcoin’s Fourth Halving Cycle?

Observations from Ecoinometrics show that Bitcoin’s growth rate in this cycle is significantly lower than in previous ones. This indicates that the halving event no longer plays a central role in driving Bitcoin’s price as it did before.

If Bitcoin were to grow similarly to previous cycles, its price could range from $140,000 to $4,500,000, starting from $63,000. However, Bitcoin is currently trading at around $80,000.

“At this stage of the cycle, the lower bound of the historical range should be around $250,000.” – Ecoinometrics commented.

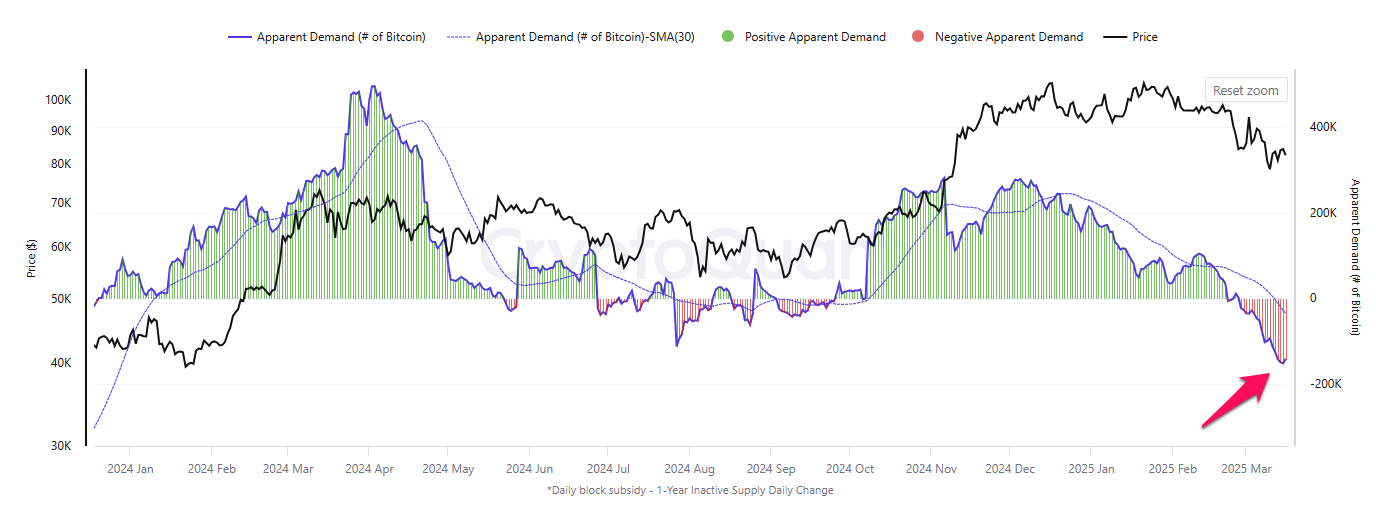

Another crucial factor is that Bitcoin demand has dropped to its lowest level in over a year, according to CryptoQuant data. The Bitcoin Apparent Demand metric compares new supply to inactive supply held for over a year, highlighting the true demand.

This means that even though the halving event reduces supply, Bitcoin’s price may struggle to rally without new capital inflows or strong investor interest.

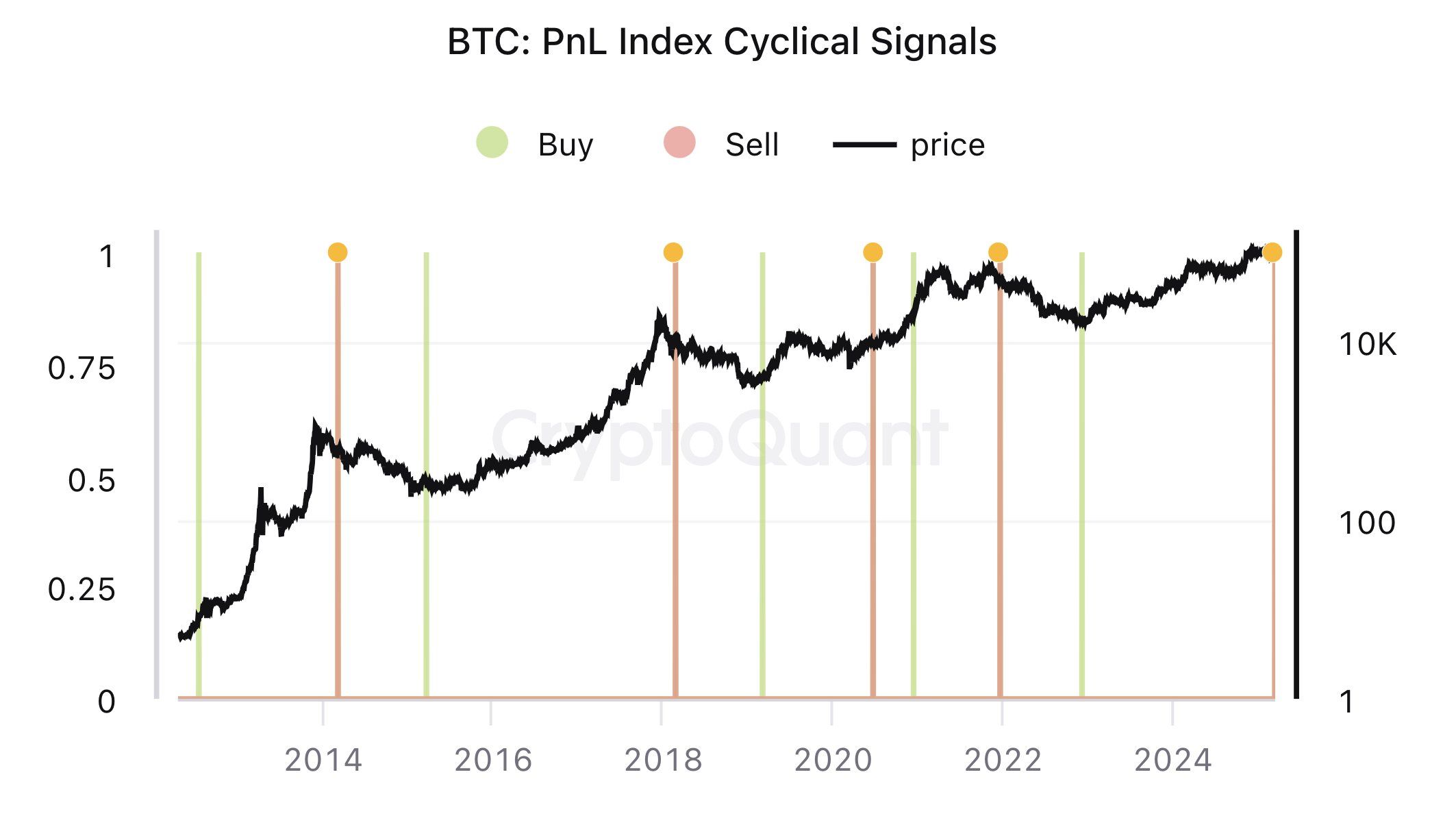

Alongside Bitcoin Apparent Demand, Ki Young Ju, founder of CryptoQuant, also analyzed the Bitcoin PnL Index Cyclical Signals. This metric applies a 365-day moving average to key on-chain data like MVRV, SOPR, and NUPL. It signals “Buy” or “Sell” at major turning points in a large cycle rather than short-term fluctuations.

Based on this data, Ki Young Ju predicted that Bitcoin’s bull cycle has ended.

“Bitcoin bull cycle is over, expecting 6–12 months of bearish or sideways price action,” Ki Young Ju predicted.

Charles Edwards, founder of Capriole Investments, pointed out another key difference in this Bitcoin cycle. Unlike the previous one, which benefited from expansionary monetary policies by central banks, this time, central banks are either tightening or maintaining neutral policies.

During the last cycle, Bitcoin thrived as central banks injected liquidity into the economy, creating a favorable environment for risk assets like crypto. However, the current monetary stance lacks that same supportive force, making it harder for Bitcoin to sustain strong upward momentum.

Despite this, Charles Edwards remains somewhat optimistic. He noted that US liquidity is showing technical signs of a potential recovery.

“This Bitcoin cycle we have largely been battling a flat monetary cycle, versus last cycle’s strong uptrend (green). That may be about to change. We are now seeing the first signs of a potential major multi-year bottom in US Liquidity, with an eve/adam bottom forming today. It’s been almost 4 years since tightening began. 2025 would make sense for a monetary policy trend change amid tariff stressors. Let’s see if this new trend can stick,” Charles Edwards predicted.

The halving cycle was once the most important factor influencing Bitcoin’s price. However, current data paints a different picture. Weak demand, unfavorable monetary policies, and expert predictions suggest that Bitcoin has entered a new phase.

In this environment, macroeconomic factors and institutional capital flows will likely dictate Bitcoin’s price trends more than the halving event itself.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Pi Network, Trump Summit, XRP Commodity

This week, the crypto market recorded several significant developments, ranging from key controversies within the Pi Network ecosystem to Trump’s crypto summit and revelations of Bitcoin’s role in the dark web.

The following is a roundup of crucial developments that happened this week but will continue shaping the sector.

Pi Network Criticized Over Mainnet Migration

The controversial Pi Network was criticized by its community of Pioneers, making it a headline topic this week in crypto. It came amid widespread issues where Pioneers could not transfer their Pi coins to the mainnet before the migration deadline.

“The whole process is a joke. ~80% of my balance shows as unverified, although all of my security circle has completed KYC. No additional actions are listed to be taken to clear this up. Furthermore, nobody got back to me on a support ticket I opened weeks ago. What gives?” remarked a user.

Many users, frustrated by prolonged lockup periods, have turned to selling their accounts, raising concerns about the ecosystem’s integrity. The failure to meet migration deadlines has heightened fears of a potential price drop once unrestricted trading begins.

Adding to the concerns, KYC (Know Your Customer) verification issues plague the Pi Network community. Pioneers who cannot verify their identities risk losing access to their Pi coins, creating uncertainty ahead of Pi Day.

These situations led to increasing dissatisfaction among users who questioned the project’s transparency. Meanwhile, centralization concerns have escalated, as reports indicate that Pi Network’s Core Team holds 82.8 billion Pi coins. This revelation has sparked debates about whether the network is truly decentralized or controlled by a select few.

Dark Web Drug Market Moves Millions in Bitcoin

Another headline topic this week in crypto entailed the resurfacing of an ancient and long-dormant Bitcoin wallet. The crypto wallet, associated with the Silk Road-era dark web drug trade, suddenly resurfaced, moving $77.5 million worth of Bitcoin (BTC) after nine years.

“Nucleus Marketplace was a darknet drug market, and it was believed that the founder had either been apprehended by law enforcement or had exit-scammed when the market went offline in 2016. The BTC held in their wallets has not been moved until today,” Arkham revealed.

The transfer raised questions about the potential for further illicit financial activity. It also begged queries on whether authorities are monitoring these funds.

The transaction serves as a reminder of cryptocurrency’s controversial past and ongoing use in underground markets.

SEC May Reclassify XRP as a Commodity

Rumors surfaced this week that the US SEC (Securities and Exchange Commission) may reclassify XRP as a commodity rather than a security. This development follows recent legal victories for Ripple, which successfully argued that XRP sales on secondary markets do not constitute securities transactions.

“This speculation gained traction after Vermont state regulators announced they were dropping their case against Coinbase, citing the newly established SEC Crypto Task Force. This could set a major precedent for Ripple,” a user on X shared.

If true, this move could significantly affect Ripple’s longstanding legal battle with the SEC and redefine how cryptocurrencies are regulated. Specifically, if the SEC categorizes XRP as a commodity, this would place it under the jurisdiction of the CFTC (Commodity Futures Trading Commission) rather than the SEC, potentially leading to a more favorable regulatory environment for Ripple and its investors.

Such a milestone could pave the way for an XRP ETF in the US. However, no official confirmation has been provided, and the crypto community remains divided on the implications.

Some believe it would provide much-needed clarity and regulatory relief. Others caution that a reclassification could result in additional oversight and compliance requirements.

Meanwhile, many draw similarities between Ethereum (ETH) and XRP. In their opinion, this merits XRP for a commodity status or classification.

Trump’s Crypto Summit Sparks Frustration

Also this week in crypto, US President Donald Trump hosted a much-anticipated crypto summit at the White House. The event aimed to further position Trump’s administration as an ally to the digital asset industry.

However, the event fell short of expectations, lacking clear policy proposals and tangible commitments. Instead of offering concrete regulatory guidance, the summit largely consisted of broad statements about innovation in the US, economic growth, and opposition to excessive government control over crypto.

“That Summit was the most embarrassing thing I’ve ever witnessed,” popular NFT trader Clemente lamented.

Additionally, the summit failed to address key issues such as stablecoin regulations, central bank digital currencies (CBDCs), and the future of Bitcoin and Ethereum in the US. Critics argue that if Trump truly wants to appeal to crypto investors, he must outline a comprehensive policy framework rather than relying on vague assurances.

Binance and Coinbase Traffic Drops Nearly 30%

Meanwhile, amid a broader market lull, Binance and Coinbase, two of the largest centralized exchanges (CEXs), saw a nearly 30% drop in traffic. Spot and derivatives trading volumes have also declined, reflecting skittishness from retail investors.

The downturn was caused by reduced trading activity, growing investor uncertainty, and declining retail interest in crypto. The decline in traffic suggests that fewer users are engaging with crypto trading platforms as market sentiment remains bearish.

Many analysts believe this trend is driven by lower volatility, reduced speculative activity, and regulatory concerns. President Trump’s tariffs, particularly in the US and Europe, fuel these concerns.

Additionally, the lack of major bullish catalysts, such as Bitcoin ETF (exchange-traded funds) inflows or institutional adoption, has kept many traders on the sidelines. BeInCrypto reported that US Bitcoin ETF holdings have since fallen below Satoshi’s BTC stash as outflows continue.

Another factor contributing to the reduced traffic is the growing competition from decentralized exchanges (DEXs) and alternative trading platforms that offer lower fees and fewer regulatory constraints.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market15 hours ago

Market15 hours agoCardano (ADA) Bulls Advance as Sellers Lose Grip

-

Bitcoin22 hours ago

Bitcoin22 hours agoFrench Banker Warns of Crypto-Induced Crisis

-

Market22 hours ago

Market22 hours agoCan Bulls Push Price to $0.26?

-

Market18 hours ago

Market18 hours agoPancakeSwap (CAKE) Surges 40%, Is the Buying Phase Over?

-

Altcoin17 hours ago

Altcoin17 hours agoXRP Price Targets $30 As Analyst Reveals Bullish Double Bottom Breakout

-

Market17 hours ago

Market17 hours agoBinaryX Token Swap Drives 41% Price Rally

-

Altcoin16 hours ago

Altcoin16 hours agoEthereum Price Remains In Deep Correction As Standard Chartered Slashes ETH Target By 60%

-

Market16 hours ago

Market16 hours agoExtreme USDT Volatility Recorded On Chain