Market

YZi Labs Backs Plume Network’s RWAfi Ecosystem

YZi Labs (formerly Binance Labs) has announced its investment in Plume Network (PLUME). It is a fully integrated, Layer 2 modular blockchain designed for the rapid adoption and integration of real-world assets (RWAs).

The investment marks a significant step in advancing blockchain infrastructure that seamlessly bridges traditional finance with decentralized finance (DeFi), further expanding the Real World Asset Finance (RWAfi) ecosystem.

YZi Labs Backs Plume Network to Grow RWAfi Ecosystem

In a press release shared with BeInCrypto, YZi Labs’ Investment Director Max Coniglio emphasized the strategic importance of the investment. He highlighted Plume’s potential to revolutionize RWA adoption.

“At YZi Labs, we invest in projects that harness blockchain technology to create real-world impact and Plume is a prime example—they are bringing real-world assets on-chain to unlock new capital, expand access, and drive adoption. By making RWAs as seamless as any other digital asset, Plume is bridging traditional finance and DeFi, paving the way for broader adoption,” Coniglio told BeInCrypto.

Notably, Plume Network provides an Ethereum Virtual Machine (EVM)-compatible environment that facilitates onboarding a wide range of assets. These include financial instruments, carbon credits, GPUs, and collectibles. Additionally, it seamlessly integrates these assets into a composable RWAfi ecosystem, enhancing their utility and enabling broader financial interactions.

Through its composable ecosystem, Plume enables users to earn rewards, trade, borrow, lend, swap, and engage in market speculation. By integrating real-world assets on-chain, Plume ensures they are as accessible and user-friendly as traditional crypto tokens.

Meanwhile, Chris Yin, co-founder and CEO of Plume, stressed that the platform aims to address the longstanding infrastructure gap that has hindered the widespread adoption of RWAs in the crypto space.

“Although stablecoins, the original RWA, have successfully proven to onboard new users into crypto, the rest of RWAs have struggled to achieve the same traction. With Plume, asset issuers of all kinds can become Web3 builders, seamlessly connecting to our community, ecosystem, and liquidity,” Yin said.

YZi Labs’ investment comes at a time when RWAs have emerged as one of the fastest-growing sectors in crypto. According to the data from DefiLlama, RWA’s total value locked (TVL) reached an all-time high of $9.9 billion last week.

Moreover, the RWA sector has emerged as the best-performing category over the past year, surging by an impressive 237.2%.

In contrast, the broader crypto market has experienced mixed results, with some sectors suffering deep losses. While Bitcoin (BTC) has gained 22.2% and privacy coins have risen by 28.2%, their growth pales in comparison to the explosive rise of real-world assets. Meanwhile, Ethereum (ETH) has dropped by 47.7%, and the decentralized finance (DeFi) sector has struggled even more with a 55.8% decline.

Despite its strong yearly performance, the RWA has faced a recent pullback. Month-to-date (MTD) sector performance data shows a -12.1% decline, suggesting a correction following its rapid growth. Bitcoin and Ethereum also posted losses, indicating a broader market downturn rather than an RWA-specific issue.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Stellar (XLM) Price Nears Death Cross; Recovery Looks Uncertain

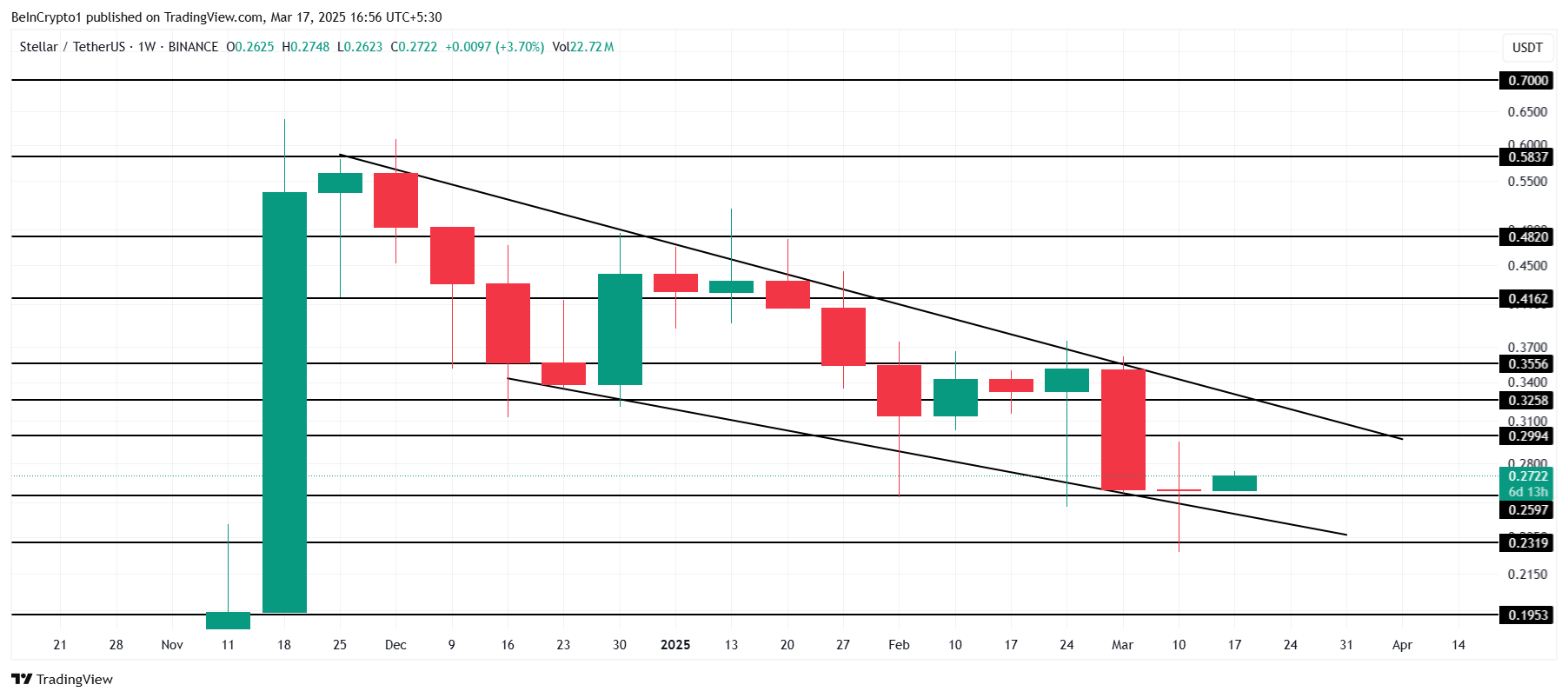

Stellar (XLM) has been experiencing a prolonged downtrend for nearly three months. Despite some attempts at recovery, the altcoin faces significant hurdles ahead.

This is due to a potential breakout above the $0.325 resistance looking increasingly unlikely. Given current market conditions, the price may continue to struggle.

Stellar Faces A Death Cross

Stellar’s price action is currently being influenced by the approaching Death Cross, a bearish signal in technical analysis. The 200-day Exponential Moving Average (EMA) is closing in on crossing over the 50-day EMA, which would mark the second Death Cross for Stellar this year. The previous crossover occurred in April 2024, and this new cross could further signal weakening price momentum for the altcoin.

The potential Death Cross suggests a shift toward more sustained selling pressure. This could prevent any breakout above the $0.30 level and potentially push the price lower.

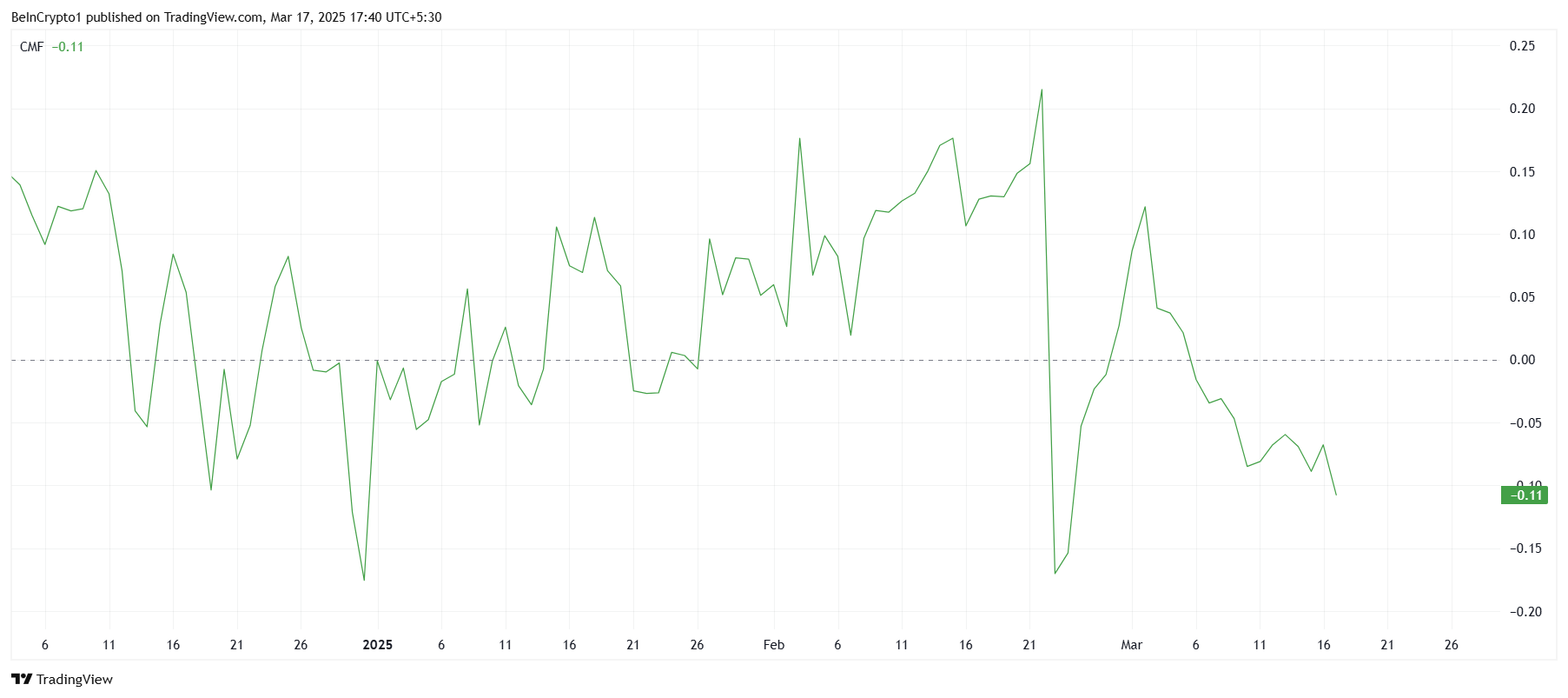

The overall macro momentum of Stellar is also reflecting a bearish outlook. The Chaikin Money Flow (CMF) indicator, which tracks the accumulation and distribution of assets, shows a sharp downtick this month. Currently, well below the zero line, this suggests that outflows are dominating inflows, indicating that investors are pulling their money out of XLM.

This outflow trend reflects growing bearish sentiment among investors, which tends to exacerbate the asset’s struggle to recover. Without an influx of buying pressure, XLM may find it difficult to regain upward momentum.

XLM Price Aims At Break Out

At the time of writing, XLM is trading at $0.272, holding above its support at $0.259. The altcoin has been moving within a descending wedge for the past three months, but given the current market conditions, a breakout from this pattern in the near term seems unlikely. The ongoing Death Cross and bearish market sentiment will likely keep XLM in this range.

As long as XLM remains consolidated under $0.299, it could face further declines. If the altcoin falls below $0.259, it might test $0.231 or lower. The formation of a Death Cross could trigger additional selling pressure, further confirming the bearish outlook for Stellar in the coming days.

For the bearish thesis to be invalidated, XLM would need to breach $0.299 and push past the $0.325 resistance level. A successful breakout above $0.355 could signal a reversal and allow the altcoin to move beyond the current downtrend, but such a scenario would require a shift in market sentiment and investor confidence.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Can Bulls Push Price to $0.26?

HBAR has recorded its first spot inflow in the past seven days, attracting $1.5 million in fresh capital.

This marks a positive shift in market sentiment as investors regain confidence in the altcoin. It also aligns with the broader market’s attempt to recover from recent downturns.

Bullish Momentum Builds as HBAR Gains $2 Million in Inflows

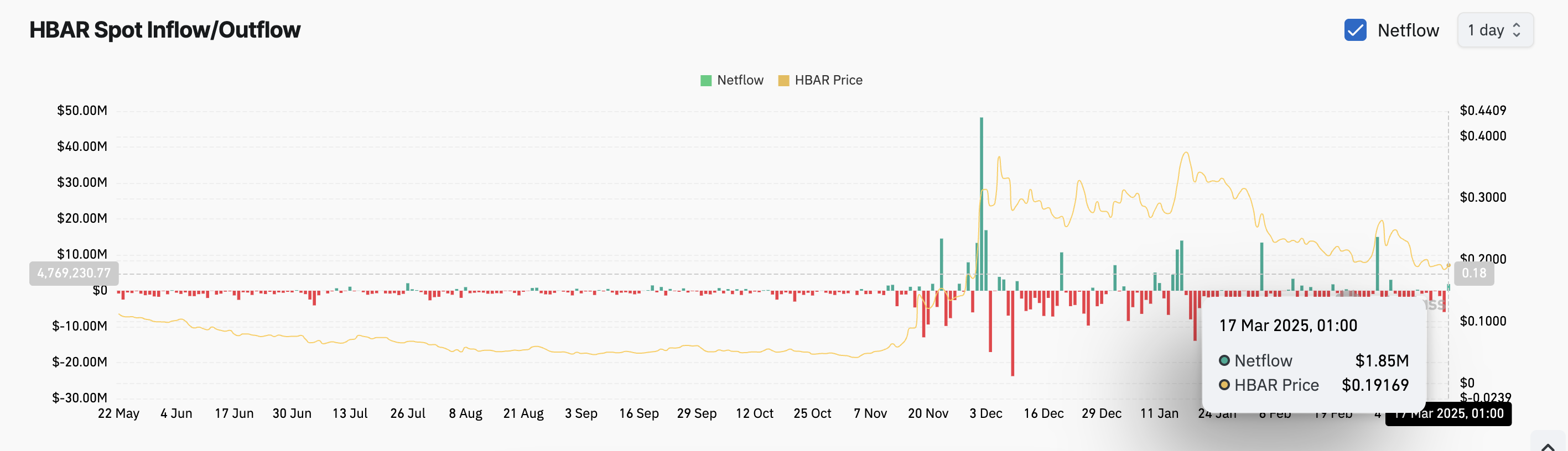

HBAR’s spot inflows surged to nearly $2 million on Monday, signaling a resurgence in bullish sentiment toward the altcoin. Data from Coinglass reveals that this is the first time HBAR has attracted fresh capital in seven days, marking a shift in investor confidence.

According to the on-chain data provider, between March 11 and 16, the altcoin faced consistent sell pressure, with spot outflows exceeding $10 million. This latest inflow suggests a bullish reversal in market sentiment, hinting at a possible recovery as investors regain interest in HBAR.

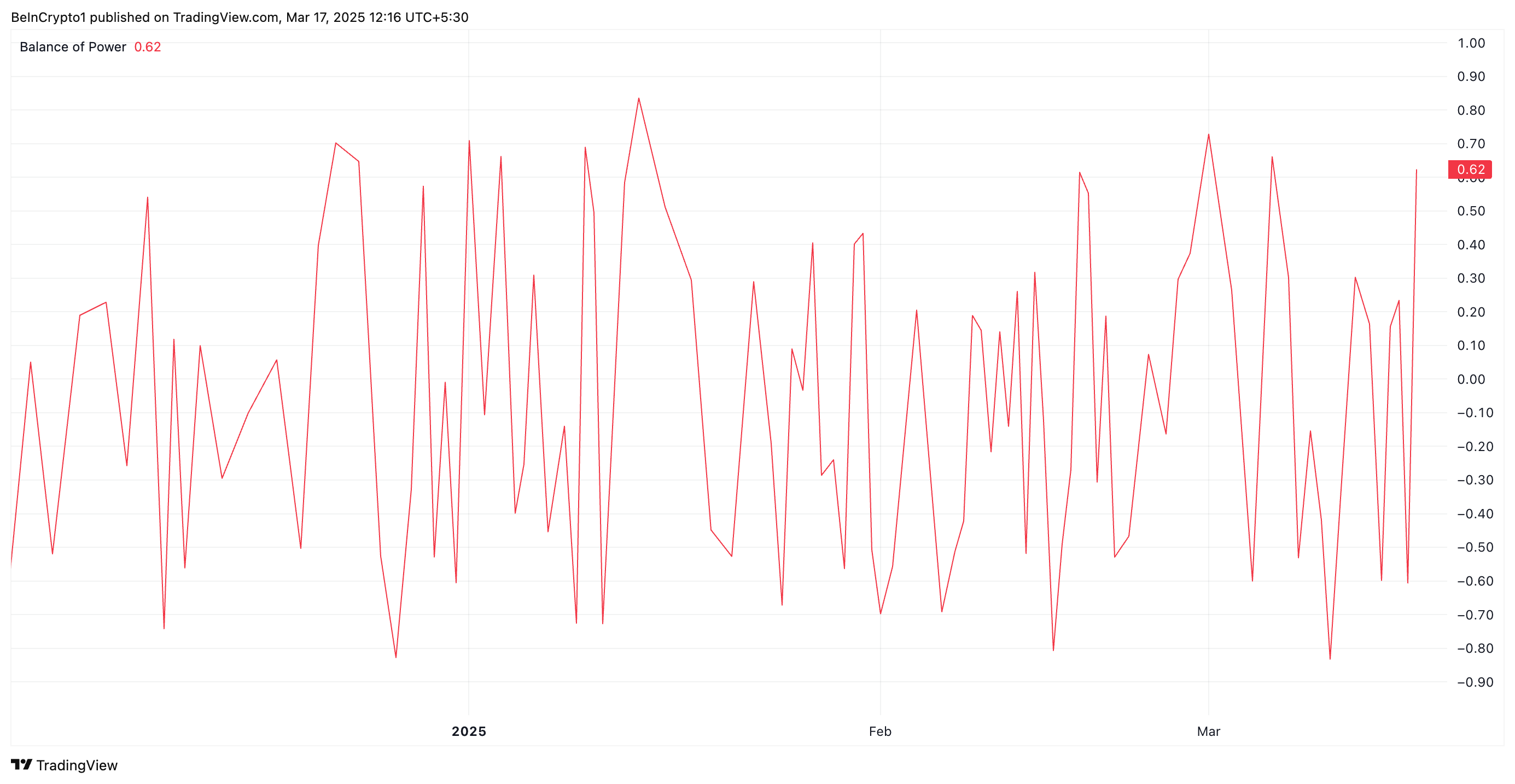

Furthermore, the altcoin’s positive Balance of Power (BoP) highlights this renewed interest. At press time, this momentum indicator is in an upward trend at 0.62.

The BoP indicator measures the strength of buyers against sellers in the market to identify momentum shifts. A positive BoP like this suggests that buying pressure outweighs selling pressure, indicating growing demand and potential price appreciation.

If HBAR’s BoP remains positive, it confirms the bullish dominance, reinforcing the current buying pressure and supporting a sustained uptrend in the asset’s value.

HBAR Eyes $0.22 as Demand Grows—Will Bulls Maintain Momentum?

HBAR exchanges hands at $0.19 at press time, trading above the support floor at $0.17. As demand grows, the altcoin could climb toward the resistance at $0.22.

A successful break above this level could propel HBAR’s price to $0.26, a high it last traded at on March 4.

Conversely, the bullish outlook would be invalidated if sellers regain dominance and profit-taking strengthens. In this case, HBAR’s price could fall to $0.17.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

CME Opens Solana Futures Trading, Helping ETF Odds

The CME opened futures trading on Solana today, with FalconX making the first block trade. This development could provide liquidity and institutional legitimacy, even potentially helping the case for a Solana ETF.

When the SEC under Gary Gensler was considering Bitcoin and Ethereum ETFs, CME futures helped determine approval. Now that Solana has this stamp of approval, too, it could improve its chances with the Commission.

CME Offers Solana Futures Contracts

After some rumors and back-and-forth, Solana, a leading cryptoasset, finally has a substantial market for futures contracts. In January, the CME hinted it might launch SOL and XRP futures but quickly clarified that no official decision had happened. Now, however, the CME debuted Solana futures and FalconX made the first trade:

“FalconX is proud to execute the first block trade in CME SOL futures with StoneX. This highly anticipated launch marks a historic moment for the Solana ecosystem, allowing institutional investors to manage risk and price exposure on a regulated venue,” Josh Barkhordar, Head of US Sales at FalconX, said in a press release.

The CME is not the first market to offer Solana futures, as Coinbase began offering them in February after seeking CFTC approval.

However, the CME is much bigger. It is very much a pillar of the TradFi ecosystem, with well over $100 billion in total assets. As Matthew Sigel, VanEck’s Head of Digital Assets Research, noted, this could be very important for a Solana ETF.

The Solana ETF recently suffered a few setbacks; the SEC delayed several applications, prompting sizable outflows from Solana spot trading. Experts have previously noted that a sizable futures trading market helped persuade the SEC to approve ETFs for Bitcoin and Ethereum. The CME’s new Solana futures market could serve a similar function.

Besides that, the CME’s Solana futures market offers a few significant advantages. First of all, it provides a sense of institutional legitimacy, which may encourage institutional investment.

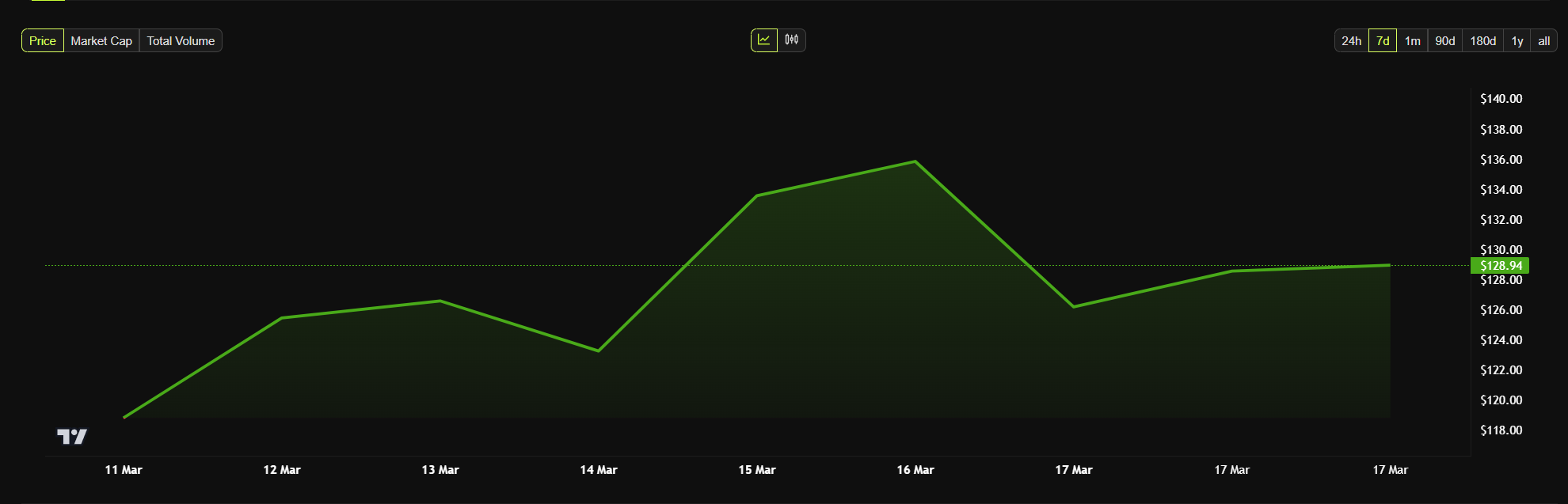

Additionally, it will greatly increase liquidity in the market. This could have a huge impact on Solana’s future market behavior, but it hasn’t changed SOL’s price in the short term.

Even if the new futures trading didn’t immediately bump Solana’s price, that’s very understandable. A development like this will hopefully set up future successes, but that doesn’t always translate to a short-term price bump.

If it encourages liquidity, institutional investment, or even a Solana ETF, then the CME could end up creating some very bullish outcomes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market12 hours ago

Market12 hours agoSolana Price’s Biggest Test: Breaching $180 Resistance

-

Bitcoin11 hours ago

Bitcoin11 hours agoBitcoin Bulls Eye Comeback After $10 Billion Liquidation Shakeout—Analyst

-

Altcoin13 hours ago

Altcoin13 hours agoBNB Price Can Hit Fresh ATH As Mubarak Leads Meme Coin Frenzy

-

Altcoin11 hours ago

Altcoin11 hours agoLawyers React As Expert Hints At Ripple Vs SEC Case End

-

Bitcoin10 hours ago

Bitcoin10 hours agoWhy Bitcoin And Crypto Will Not Recover Before US Equities Market: Expert

-

Altcoin9 hours ago

Altcoin9 hours agoBinance Unveils Major Backing For MKR, EPIC, & These 3 Crypto, What’s Happening?

-

Altcoin7 hours ago

Altcoin7 hours agoThe New Frontier of Altcoin Futures Trading: Gate.io’s Ecosystem Innovation.

-

Ethereum7 hours ago

Ethereum7 hours ago130,000 Ethereum Moved Off Exchanges – Bullish Signal?