Market

XRP Price To $110? Bollinger Bands Creator Reveals Why It Will Become A Market Leader

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

The XRP price could be staging a parabolic rally to new all-time highs of $110. While an analyst shares a technical analysis to back this ambitious target, Bollinger Bands creator John Bollinger declares XRP to be a market leader in the crypto space.

Analyst Predicts New XRP Price Target To $110

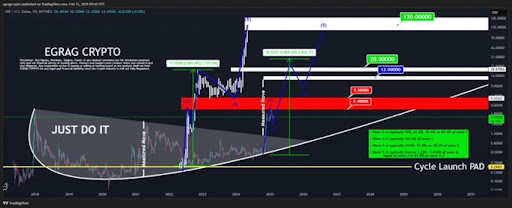

In a rather lengthy X (formerly Twitter) post, market expert Egrag Crypto went deep into his analysis for the XRP price, basing his predictions on its Elliott Wave structure. The crypto analyst confidently forecasted that XRP was heading towards a new $110 ATH. This bullish target would represent a whopping 3,974% increase from its current market value.

Related Reading

Firstly, Egrag Crypto outlines XRP’s five-wave structure, underscoring that each wave could push the cryptocurrency to a new target. The analyst reveals that XRP is currently in Wave 2 of its Elliott Wave structure and is closely approaching Wave 3, which is expected to trigger the most explosive increase.

In Wave 1, XRP saw an impressive 733% increase to new highs. However, in its current Wave 2, Egrag Crypto highlights that its 2017 fractal appears more profound. With the formation of a Double Bottom pattern, the analyst has predicted a potential price breakdown for the cryptocurrency.

Egrag Crypto further forecasts that Wave 3 will trigger a reversal and cause the price to skyrocket by 1,185%. This massive price increase would effectively place the XRP price at a potential target between $22 and $24. For a more conservative target, the analyst estimates a surge of around $22 to $24.

For Wave 4, Egrag Crypto predicts another major retracement similar to Wave 2. However, this time, the analyst believes XRP could decline by either 14.6%, 23.6%, or 38.2% from Wave 3’s price high. This correction would mark a 65% drop from Wave 3’s peak, bringing the cryptocurrency’s price down to $8. He also highlights a worse-case bearish scenario where XRP crashes as low as $3.4.

Notably, Egrag Crypto shares three potential bullish targets for Wave 5, the final part of the Elliott Wave Structure. He forecasts that the altcoin could surge between $32 to $48, $60 to $70, or $95 to $110. The analyst has based his optimistic forecast on past cycle trends, where 2017 saw a major price rally for XRP.

Bollinger Bands Creator Says The Asset To Become Leader

In other news, Bollinger, the creator of the renowned Bollinger Band technical analysis tool, has highlighted XRP in his latest post, questioning whether it could take a leading role in the crypto market. The technical analyst asserts that Ripple has held up better than other primary crypto vehicles.

Considering its legal battles with the US SEC and present regulatory challenges, Ripple continues to remain resilient, aiming to gain clarity during the final stages of the five-year-long lawsuit. Meanwhile, the XRP price, which is currently trading at $2.4, has experienced a recent uptick, increasing by almost 4% in the last day, according to CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Market

Stellar (XLM) Price Could Surge To $0.38 — Analyst Explains How

Semilore Faleti is a cryptocurrency writer specialized in the field of journalism and content creation. While he started out writing on several subjects, Semilore soon found a knack for cracking down on the complexities and intricacies in the intriguing world of blockchains and cryptocurrency.

Semilore is drawn to the efficiency of digital assets in terms of storing, and transferring value. He is a staunch advocate for the adoption of cryptocurrency as he believes it can improve the digitalization and transparency of the existing financial systems.

In two years of active crypto writing, Semilore has covered multiple aspects of the digital asset space including blockchains, decentralized finance (DeFi), staking, non-fungible tokens (NFT), regulations and network upgrades among others.

In his early years, Semilore honed his skills as a content writer, curating educational articles that catered to a wide audience. His pieces were particularly valuable for individuals new to the crypto space, offering insightful explanations that demystified the world of digital currencies.

Semilore also curated pieces for veteran crypto users ensuring they were up to date with the latest blockchains, decentralized applications and network updates. This foundation in educational writing has continued to inform his work, ensuring that his current work remains accessible, accurate and informative.

Currently at NewsBTC, Semilore is dedicated to reporting the latest news on cryptocurrency price action, on-chain developments and whale activity. He also covers the latest token analysis and price predictions by top market experts thus providing readers with potentially insightful and actionable information.

Through his meticulous research and engaging writing style, Semilore strives to establish himself as a trusted source in the crypto journalism field to inform and educate his audience on the latest trends and developments in the rapidly evolving world of digital assets.

Outside his work, Semilore possesses other passions like all individuals. He is a big music fan with an interest in almost every genre. He can be described as a “music nomad” always ready to listen to new artists and explore new trends.

Semilore Faleti is also a strong advocate for social justice, preaching fairness, inclusivity, and equity. He actively promotes the engagement of issues centred around systemic inequalities and all forms of discrimination.

He also promotes political participation by all persons at all levels. He believes active contribution to governmental systems and policies is the fastest and most effective way to bring about permanent positive change in any society.

In conclusion, Semilore Faleti exemplifies the convergence of expertise, passion, and advocacy in the world of crypto journalism. He is a rare individual whose work in documenting the evolution of cryptocurrency will remain relevant for years to come.

His dedication to demystifying digital assets and advocating for their adoption, combined with his commitment to social justice and political engagement, positions him as a dynamic and influential voice in the industry.

Whether through his meticulous reporting at NewsBTC or his fervent promotion of fairness and equity, Semilore continues to inform, educate, and inspire his audience, striving for a more transparent and inclusive financial future.

Market

Bitcoin ETF investors hold strong despite a 25% BTC price drop: Here’s why

- US Bitcoin ETFs collectively manage $115 billion in assets

- Since mid-February, Bitcoin ETFs have witnessed total outflows of nearly $5 billion

- Bitcoin’s decline continues as selling pressure intensifies

Even as Bitcoin’s price has tumbled 25% since the start of 2025, a staggering 95% of investors in US spot Bitcoin ETFs have held firm, resisting the urge to sell.

Despite market volatility and macroeconomic uncertainties, Bloomberg data suggests that the overwhelming majority of ETF holders remain unfazed, showcasing strong conviction in Bitcoin’s long-term potential.

Bitcoin ETFs show resilience

Bloomberg ETF strategist James Seyffart reported that inflows into Bitcoin ETFs have slightly declined to $35 billion, down from their $40 billion peak.

However, this still represents over 95% of investor capital remaining in ETFs, even as Bitcoin’s price struggles.

Institutional investors, including Goldman Sachs, continue to maintain significant exposure, with more than $1.5 billion invested in Bitcoin ETFs.

As of now, US Bitcoin ETFs collectively manage $115 billion in assets, underscoring the staying power of both retail and institutional investors despite the crypto market downturn.

Bitcoin ETF outflows persist

Since mid-February, Bitcoin ETFs have witnessed total outflows of nearly $5 billion.

On March 13 alone, outflows reached $135 million, according to Farside Investors.

However, BlackRock’s iShares Bitcoin Trust (IBIT) remains an exception, attracting net inflows of $45.7 million amid the broader sell-off.

Bitcoin price faces pressure

Bitcoin’s decline continues as selling pressure intensifies due to macroeconomic concerns, including the Trump administration’s ongoing tariff battle.

While BTC briefly surged above $84,000 following the release of US CPI data on Wednesday, it failed to hold above key resistance levels.

At press time, Bitcoin is trading at $81,953, down 1.56% on the day, with daily trading volume dropping 22% to under $30 billion.

According to Coinglass data, 24-hour liquidations have spiked to $75 million, with $52 million in long positions being wiped out.

CryptoQuant CEO Ki Young Ju noted that Bitcoin demand appears “stuck” at current levels but emphasized that it is still “too early to call it a bear market.”

Long-term Bitcoin holders continue accumulating

Despite Bitcoin ETF outflows, on-chain data reveals that long-term holders are accumulating more BTC.

Crypto analyst Ali Martinez reported that these investors have added over 131,000 BTC to their wallets in the past month alone, signaling confidence in Bitcoin’s long-term trajectory.

With Bitcoin’s price volatility and ETF outflows persisting, the coming weeks could be crucial in determining whether investors’ diamond hands will hold firm or if selling pressure will intensify.

Market

Bitcoin Price Steadies—Is a Meaningful Bounce on the Horizon?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $80,500 zone. BTC is now rising and might aim for a move above the $84,000 and $85,000 levels.

- Bitcoin started a decent recovery wave above the $81,000 zone.

- The price is trading above $81,500 and the 100 hourly Simple moving average.

- There was a break below a short-term bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $82,500 and $84,000 levels.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $78,000 level. BTC formed a base and recently started a recovery wave above the $80,500 resistance level.

The bulls pushed the price above the $82,000 resistance level. However, the bears were active near the $84,000 resistance zone. A high was formed at $84,200 and the price corrected some gains. There was a move below the $83,000 level.

The price dipped below the 50% Fib retracement level of the upward move from the $76,818 swing low to the $84,200 high. Besides, there was a break below a short-term bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair.

Bitcoin price is now trading above $81,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,450 level. The first key resistance is near the $84,000 level. The next key resistance could be $85,000.

A close above the $85,000 resistance might send the price further higher. In the stated case, the price could rise and test the $86,500 resistance level. Any more gains might send the price toward the $88,000 level or even $96,200.

Another Drop In BTC?

If Bitcoin fails to rise above the $82,450 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $80,500 level. The first major support is near the $79,600 level or the 61.8% Fib retracement level of the upward move from the $76,818 swing low to the $84,200 high.

The next support is now near the $78,500 zone. Any more losses might send the price toward the $77,000 support in the near term. The main support sits at $76,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $80,500, followed by $79,600.

Major Resistance Levels – $82,450 and $84,000.

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why The Dogecoin And XRP Prices are Jumping Again

-

Altcoin22 hours ago

Altcoin22 hours agoBTC Rebounds Ahead of FOMC, Macro Heat Over?

-

Altcoin21 hours ago

Altcoin21 hours agoShiba Inu Price Recover: These Levels Are Important To Watch On The Way To ATHs

-

Regulation12 hours ago

Regulation12 hours agoPakistan unveils new ‘crypto council’ amid push for regulation

-

Market12 hours ago

Market12 hours agoStellar (XLM) Price Could Surge To $0.38 — Analyst Explains How

-

Altcoin12 hours ago

Altcoin12 hours agoSolana Price Eyes $178 Following $314 Million Bridged From Ethereum

-

Altcoin11 hours ago

Altcoin11 hours agoCrypto Market Peak? Stablecoin Supply Surge Says There’s More Room To Run

-

Altcoin17 hours ago

Altcoin17 hours agoEthereum Needs A Leader—Or Its Future Could Be In Jeopardy, Ex-Engineer Warns