Altcoin

Dogecoin Price Primed for Rally to $6 As DOGE Active Addresses Jump 400%

Dogecoin price has bounced back from its crucial support levels at $0.16, trading 2.54% up, and moving back to its weekly resistance of $0.175. On-chain data also shows that the DOGE address activity has surged by 400% amid strong investor sentiment. Some market analysts believe that the gates for a parabolic rally in Dogecoin are still open.

Dogecoin Price to See A Parabolic Rally to $6?

Crypto market analysts are hopeful of a Dogecoin price rally all the way to $6 as the bulls take charge, bouncing back from the support of $6. Popular crypto analyst Ali Martinez displays Dogecoin’s price movement on a weekly timeframe from 2015 through early 2025.

The technical analysis shows DOGE trading within a long-term logarithmic upward channel defined by parallel trend lines. As we can see from the above image, as long as DOGE holds above the crucial support levels, it can rally further all the way to $6 and beyond.

DOGE Active Addresses Surge 400%

Citing on-chain data from Santiment, crypto analyst Ali Martinez highlighted a major spike in Dogecoin (DOGE) network activity. According to the report, active Dogecoin addresses have surged by 400%, reaching nearly 395,000. This significant uptick in activity underscores growing interest in the popular meme coin.

Furthermore, analyst Ali Martinez also pointed out the Stochastic RSI crossover for the Dogecoin price, referring to it as the starting point of the new bullish phase. A bullish crossover in the Stochastic RSI on Dogecoin’s weekly chart could signal a potential sharp rally, based on historical trends. Previous instances of this crossover have led to significant price surges, with gains of 88%, 187%, and even 444%.

Short Term Target for DOGE

While the expectations of a parabolic Dogecoin price rally to $6 could be far-fetched for now, it is still aiming for 200-300% gains from here onwards. Prominent crypto analyst Marzell has highlighted a critical support level for Dogecoin (DOGE) in recent technical analysis. According to the analyst, maintaining the $0.14750 level is crucial for a bullish breakout scenario.

Furthermore, the analyst added that DOGE is showing promising signs of a breakout from its current falling wedge pattern. If the support holds firm, the analyst predicts a strong rally, potentially pushing DOGE prices toward the $0.46 to $0.65 range.

An increase in the DOGE user engagement could provide the meme coin the necessary momentum needed to overcome resistance levels and initiate a bullish trend.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Sets $100 As “Realistic” Target For XRP Price In This Bull Run

Crypto analyst XRP Captain has provided an ultra bullish outlook for the XRP price. He suggested that the crypto could reach triple digits in this market cycle while asserting that such an ambitious price target is realistic.

Analyst Sets “Realistic” Target Of $100 For The XRP Price

In an X post, XRP Captain stated that $100 is a realistic target for the XRP price in this bull run. However, the analyst failed to mention when exactly XRP could reach this ambitious target or what could spark the parabolic rally to this price target.

This prediction comes just as crypto Egrag Crypto stated that XRP will reach double digits in this market cycle and then triple digits in the next cycle. Meanwhile, crypto analyst Dark Defender has provided an even more bullish outlook for the coin than XRP Captain.

Dark Defender recently predicted that the XRP price could rally to $333 if it mirrors its performance in the 2017 bull run. Analysts like Egrag Crypto have also alluded to the coin’s historical performance in 2017 as the reason it could enjoy massive gains in this bull run.

Insight Into The Crypto’s Current Price Action

In an X post, Dark Defender stated that the XRP price is forming Wave 1 on the daily chart. He remarked that he expects the crypto to move towards $2.42 first. The analyst affirmed that the real momentum will start after XRP stands above the Ichimoku clouds.

The analyst then highlighted $2.22 and $2.04 as the support levels to watch out for while the targets are $4.2932 and $5.8563. As CoinGape reported, crypto analyst Rose Premium also predicted that XRP could soon reach $5 as BlackRock gears up for ETF filing.

Egrag Crypto stated that XRP’s dominance is showing tremendous strength. He noted that the dominance is on the verge of closing above the 2021 high of 6%, surpassing Fib 0.6, which he considers a critical level and a super bullish sign once this close happens.

The analyst further remarked that if the dominance successfully closes above Fib 0.5, it could surge straight to Fib 0.888, which is his target of 15 to 20%. He added that this would align with the highs from 2015. It is worth mentioning that the Egrag Crypto previously asserted that XRP will flip Ethereum to become the second-largest crypto by market cap.

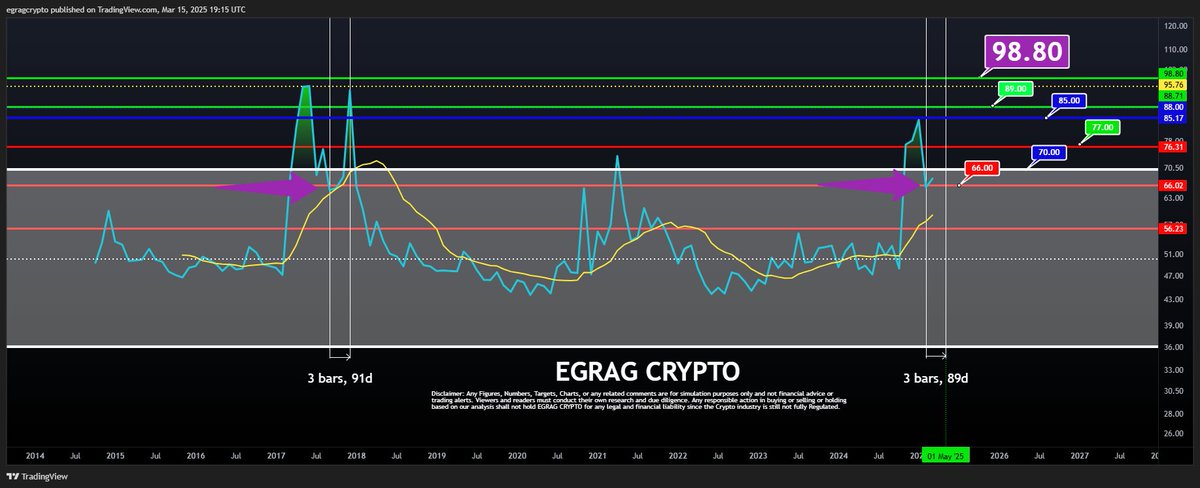

In another X post, the analyst stated that XRP’s Relative Strength Index (RSI) is steadily ticking upwards and that it is just a matter of time before market participants witness a celestial move.

Egrag Crypto also highlighted key RSI targets. He stated that 70 is for bullish confirmation, 77 is for bullish momentum, 85 is for bullish continuation, and 89 is for a parabolic rally for the XRP price.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

21Shares To Liquidate Bitcoin and Ethereum Futures ETFs, Here’s All

21Shares has announced that it is bringing down the curtain on its Bitcoin and Ethereum futures exchange-traded funds (ETFs). The issuer is eyeing March 28 as a tentative date for the liquidation of both ETFs amid a wave of new filings in the US.

21Shares Set To Liquidate Bitcoin and Ethereum ETFs

According to an announcement, crypto ETF issuer 21Shares has disclosed plans to ditch its Bitcoin and Ethereum futures ETFs. Per the announcement, the affected ETFs are the ARK 21Shares Active Bitcoin Ethereum Strategy ETF and the ARK 21Shares Active On-Chain Bitcoin Strategy ETF.

While the press release did not give clear reasons for the liquidations, it hinged its decision on a periodic review of its offerings. The statement cited a need to align existing product lineups with market dynamics and clients’ needs in a changing landscape.

However, pundits say the liquidations are a result of jarring ETF outflows in recent months.

Shareholders can sell their holdings up until March 27, a date touted as the last trading day for both ETFs. 21Shares plans to put the final nail in the coffin for both ETFs on March 28, liquidating all remaining assets.

“Shareholders who continue to hold shares of a Fund on the Fund’s Liquidation Date will receive a liquidating distribution with a value equal to their proportionate ownership interest in the Fund,” read the press release.

Increased ETF Activity In The Cryptoverse

Despite the wave of outflows, the ETF space is sizzling with frenetic activity. Buoyed by impressive returns, 21Shares slashed fees to 0.49% for its Bitcoin Ethereum Core ETPs.

Bitwise has rolled out its OWNB ETF to track companies holding Bitcoin on their balance sheets. Bitcoin ETF investors continue to put their faith in offerings in the face of price amid Rex Shares launching the first Bitcoin Corporate Bond Convertible ETF

Outside of Bitcoin, several issuers have filed for XRP, HBAR, DOGE, and AVAX ETFs with the US SEC. For Ethereum investors, CBOE has applied to the SEC to approve staking in Fidelity’s ETH ETF.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

21Shares To Liquidate Bitcoin and Ethereum Futures ETFs, Here’s All

21Shares has announced that it is bringing down the curtain on its Bitcoin and Ethereum futures exchange-traded funds (ETFs). The issuer is eyeing March 28 as a tentative date for the liquidation of both ETFs amid a wave of new filings in the US.

21Shares Set To Liquidate Bitcoin and Ethereum ETFs

According to an announcement, crypto ETF issuer 21Shares has disclosed plans to ditch its Bitcoin and Ethereum futures ETFs. Per the announcement, the affected ETFs are the ARK 21Shares Active Bitcoin Ethereum Strategy ETF and the ARK 21Shares Active On-Chain Bitcoin Strategy ETF.

While the press release did not give clear reasons for the liquidations, it hinged its decision on a periodic review of its offerings. The statement cited a need to align existing product lineups with market dynamics and clients’ needs in a changing landscape.

However, pundits say the liquidations are a result of jarring ETF outflows in recent months.

Shareholders can sell their holdings up until March 27, a date touted as the last trading day for both ETFs. 21Shares plans to put the final nail in the coffin for both ETFs on March 28, liquidating all remaining assets.

“Shareholders who continue to hold shares of a Fund on the Fund’s Liquidation Date will receive a liquidating distribution with a value equal to their proportionate ownership interest in the Fund,” read the press release.

Increased ETF Activity In The Cryptoverse

Despite the wave of outflows, the ETF space is sizzling with frenetic activity. Buoyed by impressive returns, 21Shares slashed fees to 0.49% for its Bitcoin Ethereum Core ETPs.

Bitwise has rolled out its OWNB ETF to track companies holding Bitcoin on their balance sheets. Bitcoin ETF investors continue to put their faith in offerings in the face of price amid Rex Shares launching the first Bitcoin Corporate Bond Convertible ETF

Outside of Bitcoin, several issuers have filed for XRP, HBAR, DOGE, and AVAX ETFs with the US SEC. For Ethereum investors, CBOE has applied to the SEC to approve staking in Fidelity’s ETH ETF.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin19 hours ago

Altcoin19 hours agoBTC Regains $84K; ETH, XRP, SOL Pump

-

Altcoin15 hours ago

Altcoin15 hours agoShiba Inu Price Jumps Amid Massive 535M SHIB Token Burn, 20% Gains Ahead?

-

Ethereum16 hours ago

Ethereum16 hours agoEthereum FUD Spikes After 13% Price Drop: Bottom Signal?

-

Ethereum14 hours ago

Ethereum14 hours agoWhy Up-Only For 217 Days Is Possible

-

Altcoin16 hours ago

Altcoin16 hours agoUS SEC Remains Silent on XRP, SOL, & ADA Roles, Clarifies John Deaton

-

Ethereum12 hours ago

Ethereum12 hours agoEthereum Struggles Below $2K as Bitcoin Recovers—Will ETH Catch Up?

-

Altcoin12 hours ago

Altcoin12 hours agoDogecoin Price Registers Deviation From Macro Channel, Analyst Sets $6 Target

-

Ethereum11 hours ago

Ethereum11 hours agoEthereum Headed For $1,250 Or Ready For A Reversal? Analysts Weigh In

✓ Share: