Ethereum

Ethereum Could Be Mirroring Bitcoin’s 2018-2021 Cycle Amid Record Selling

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Crypto analyst The Cryptagon has raised the possibility of the Ethereum price mirroring Bitcoin’s 2018 to 2021 cycle, which he indicated was bullish ETH. This development comes amid record selling among ETH investors, which continues to exert downward pressure on the crypto.

Ethereum Could Be Mirroring Bitcoin’s 2018-2021 Cycle

In a TradingView post, the Cryptagon stated that Ethereum has been repeating Bitcoin’s 2018 to 2021 cycle very closely. He remarked that ETH’s long-term holders may remain bullish just by looking at this BTC cycle, seeing as ETH could achieve a similar end result like the flagship witnessed in that cycle.

Related Reading

The analyst admitted that Ethereum has been under heavy pressure since early December last year and almost touched the 12-month falling support this week. However, despite this development, the Cryptagon suggested that this is not the time to be bearish on ETH, as it could still reach new highs as it mirrors Bitcoin’s 2021 cycle.

He noted that in the 2021 cycle, a rebound on the falling support caused a massive breakout above the falling resistance and the Bitcoin price rallied to the 1.618 Fibonacci extension. In line with this, the Cryptagon predicted that Ethereum could at least reach $8,000 in this market cycle as it repeats a similar price action.

This bullish outlook for Ethereum comes amid record selling, which threatens any bullish reversal for ETH. In an X post, Cryptoquant founder Ki Young Ju revealed that Ethereum has faced record active selling over the past three months.

This has contributed to ETH’s underperformance, with the altcoin being outperformed by other major altcoins like XRP and Solana over this period. While XRP touched its current all-time high (ATH) and SOL hit a new ATH, ETH has yet to come anywhere close to its current ATH.

The Most Important Price Level For ETH At The Moment

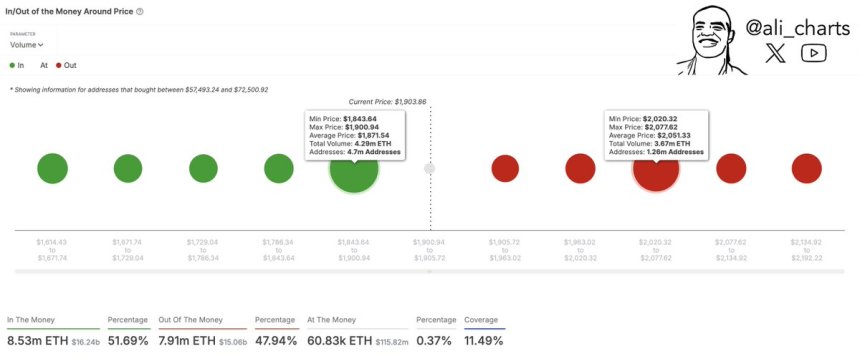

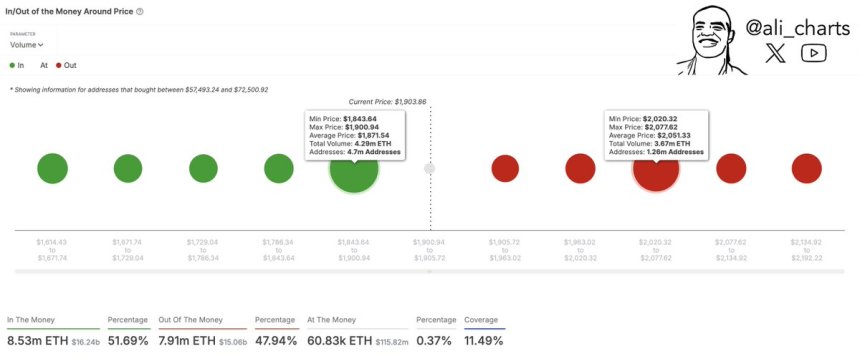

In an X post, crypto analyst Ali Martinez, revealed that $1,887 is the most important support level for Ethereum at the moment. At this level, investors bought 1.63 million ETH. A drop below this level could lead to another massive crash for the second-largest crypto by market cap, with many of these investors possibly selling off their coins in order to cut their losses.

Related Reading

Martinez has already raised the possibility of Ethereum crashing to as low as $800. He noted that the $4,000 price level had been holding a strong horizontal resistance trendline. However, ETH recently broke out of this trendline, which has significantly increased the probability of a 70% price drop to this $800 target.

At the time of writing, the Ethereum price is trading at around $1,893, up over 1% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Unsplash, chart from Tradingview.com

Ethereum

Ethereum Must Reclaim $2,050 To Start A Recovery Rally – Insights

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is now trading below the crucial $2,000 mark, struggling to find momentum after days of selling pressure and consolidation around $1,900. The broader crypto market remains under heavy bearish control, and ETH has lost over 57% of its value, making it increasingly difficult for bulls to stage a recovery.

Related Reading

With Ethereum now below a multi-year support level, this zone could flip into strong resistance, further complicating any potential rebound. The market is in a highly volatile phase, and traders are watching closely for signs of strength or further downside risks.

On-chain data highlights two key price levels for Ethereum’s immediate trajectory. $1,870 currently serves as its critical support; meanwhile, $2,050 is now its most challenging resistance, acting as a major barrier that ETH must reclaim to confirm a trend reversal.

For now, Ethereum remains vulnerable, with uncertainty driving price action. If bulls fail to defend current support, ETH could see further declines, but a successful reclaim of resistance could spark renewed confidence in the market. The next few days will be crucial in determining ETH’s short-term direction.

Ethereum Faces Critical Test As Bulls Struggle To Reclaim $2,000

Ethereum is at a crucial turning point, trading near its lowest level since October 2023 as bears maintain control. After weeks of selling pressure and uncertainty, bulls must reclaim the $2,000 mark as soon as possible to prevent further downside and restore market confidence.

Related Reading

The broader macroeconomic landscape remains uncertain, with trade war fears and global financial instability weighing heavily on both crypto and US stock markets. These factors have set the stage for a potential deeper correction, leaving investors on edge. However, some analysts believe a market recovery is still possible in the coming months, particularly if Ethereum can regain key resistance levels.

Top analyst Ali Martinez recently shared on-chain metrics, identifying $1,870 as Ethereum’s strongest support level. This means that if ETH breaks below this zone, a further decline could be imminent. On the upside, $2,050 is now Ethereum’s most challenging resistance, acting as a crucial barrier that bulls must overcome.

If Ethereum successfully reclaims $2,050, it will signal a strong trend reversal, potentially setting the stage for a powerful recovery rally. The next few trading sessions will be critical, as ETH must either hold its ground or risk further downside, with investors closely monitoring price action.

ETH Bulls Must Hold Above $1,900

Ethereum is currently trading at $1,920, following days of consolidation below the crucial $2,000 level. Despite attempts to push higher, bulls have struggled to reclaim lost ground, leaving ETH in a vulnerable position.

To confirm a recovery, ETH must break above the $2,000 mark and push beyond the 4-hour 200-moving average (MA) and exponential moving average (EMA) around $2,400. A successful reclaim of these levels would signal renewed buying momentum, potentially setting the stage for a strong rally toward higher resistance zones.

However, if Ethereum fails to reclaim these levels, selling pressure could intensify, driving ETH toward lower demand zones around $1,750. A breakdown below this level would put even more pressure on bulls, potentially leading to further downside and extended bearish sentiment.

Related Reading

With market conditions still fragile, ETH’s short-term direction remains uncertain. Bulls must step in soon to defend key levels, or Ethereum risks losing further ground, making a quick recovery much more difficult. The next few days will be crucial, as ETH traders watch for a breakout or further downside movement in response to broader market trends.

Featured image from DALL-E, chart from TradingView

Ethereum

Ethereum Must Reclaim $2,050 To Start A Recovery Rally – Insights

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum (ETH) is now trading below the crucial $2,000 mark, struggling to find momentum after days of selling pressure and consolidation around $1,900. The broader crypto market remains under heavy bearish control, and ETH has lost over 57% of its value, making it increasingly difficult for bulls to stage a recovery.

Related Reading

With Ethereum now below a multi-year support level, this zone could flip into strong resistance, further complicating any potential rebound. The market is in a highly volatile phase, and traders are watching closely for signs of strength or further downside risks.

On-chain data highlights two key price levels for Ethereum’s immediate trajectory. $1,870 currently serves as its critical support; meanwhile, $2,050 is now its most challenging resistance, acting as a major barrier that ETH must reclaim to confirm a trend reversal.

For now, Ethereum remains vulnerable, with uncertainty driving price action. If bulls fail to defend current support, ETH could see further declines, but a successful reclaim of resistance could spark renewed confidence in the market. The next few days will be crucial in determining ETH’s short-term direction.

Ethereum Faces Critical Test As Bulls Struggle To Reclaim $2,000

Ethereum is at a crucial turning point, trading near its lowest level since October 2023 as bears maintain control. After weeks of selling pressure and uncertainty, bulls must reclaim the $2,000 mark as soon as possible to prevent further downside and restore market confidence.

Related Reading

The broader macroeconomic landscape remains uncertain, with trade war fears and global financial instability weighing heavily on both crypto and US stock markets. These factors have set the stage for a potential deeper correction, leaving investors on edge. However, some analysts believe a market recovery is still possible in the coming months, particularly if Ethereum can regain key resistance levels.

Top analyst Ali Martinez recently shared on-chain metrics, identifying $1,870 as Ethereum’s strongest support level. This means that if ETH breaks below this zone, a further decline could be imminent. On the upside, $2,050 is now Ethereum’s most challenging resistance, acting as a crucial barrier that bulls must overcome.

If Ethereum successfully reclaims $2,050, it will signal a strong trend reversal, potentially setting the stage for a powerful recovery rally. The next few trading sessions will be critical, as ETH must either hold its ground or risk further downside, with investors closely monitoring price action.

ETH Bulls Must Hold Above $1,900

Ethereum is currently trading at $1,920, following days of consolidation below the crucial $2,000 level. Despite attempts to push higher, bulls have struggled to reclaim lost ground, leaving ETH in a vulnerable position.

To confirm a recovery, ETH must break above the $2,000 mark and push beyond the 4-hour 200-moving average (MA) and exponential moving average (EMA) around $2,400. A successful reclaim of these levels would signal renewed buying momentum, potentially setting the stage for a strong rally toward higher resistance zones.

However, if Ethereum fails to reclaim these levels, selling pressure could intensify, driving ETH toward lower demand zones around $1,750. A breakdown below this level would put even more pressure on bulls, potentially leading to further downside and extended bearish sentiment.

Related Reading

With market conditions still fragile, ETH’s short-term direction remains uncertain. Bulls must step in soon to defend key levels, or Ethereum risks losing further ground, making a quick recovery much more difficult. The next few days will be crucial, as ETH traders watch for a breakout or further downside movement in response to broader market trends.

Featured image from DALL-E, chart from TradingView

Ethereum

Whales Accumulate Over 420,000 Ethereum In Five Days – Rally On The Horizon?

Ethereum Whale Accumulation Suggests Long-Term Optimism

Ethereum has been in a steep downtrend, losing over 57% of its value since late December. Despite brief attempts to recover, ETH continues to fail at reclaiming crucial price levels, signaling further downside risks. Ethereum is now trading below a multi-year support level, which has flipped into strong resistance, making it even harder for bulls to regain momentum.

Adding to the negative outlook, macroeconomic uncertainty and trade war fears continue to weigh on both crypto and traditional markets, leading to increased risk-off sentiment among investors. With the US stock market also struggling, Ethereum remains under pressure, setting the stage for a potentially deeper correction.

However, not all signs are bearish. Some analysts believe that Ethereum could recover in the coming months, and on-chain data is showing potential signs of accumulation. Crypto analyst Ali Martinez shared Santiment data, revealing that whales have bought more than 420,000 Ethereum in the last five days.

Historically, large-scale whale accumulation tends to be a strong long-term bullish signal for Ethereum. When whales increase their holdings, it usually suggests growing confidence in ETH’s future price appreciation. In previous cycles, whale buying at low prices has often preceded major rallies, as accumulation reduces the available supply on exchanges, increasing buying pressure over time.

Related Reading: $90K Emerges As Bitcoin Psychological Battleground – Key Level Dictates Market Sentiment

For now, Ethereum must reclaim key levels to confirm a trend reversal. If whales continue accumulating, ETH may be setting up for a long-term recovery, even if short-term price action remains volatile.

ETH Bulls Fight To Reclaim Key Levels

Ethereum is currently trading at $1,900, facing continued resistance after days of struggling below the $2,000 mark. The broader market weakness and selling pressure have made it difficult for bulls to regain momentum, leaving ETH vulnerable to further downside if key levels are not reclaimed soon.

To confirm a recovery, bulls must push ETH above $2,000 and then break through the critical $2,250 resistance. A successful reclaim of these levels would mark the beginning of a potential recovery phase, allowing Ethereum to build momentum for a larger move upward.

However, if ETH fails to reclaim these levels, selling pressure could intensify, driving the price toward lower demand zones. A break below current support would likely send ETH down to the $1,700 range, and if bearish momentum persists, a further decline to $1,600 could follow.

With market sentiment still fragile, the next few days will be crucial in determining whether Ethereum can stabilize and recover or if it will face deeper corrections. Bulls need to step in soon to prevent further downside and regain control over price action.

Featured image from DALL-E, chart from TradingView

-

Altcoin23 hours ago

Altcoin23 hours agoHere’s Why The Dogecoin And XRP Prices are Jumping Again

-

Altcoin22 hours ago

Altcoin22 hours agoBTC Rebounds Ahead of FOMC, Macro Heat Over?

-

Altcoin21 hours ago

Altcoin21 hours agoShiba Inu Price Recover: These Levels Are Important To Watch On The Way To ATHs

-

Regulation12 hours ago

Regulation12 hours agoPakistan unveils new ‘crypto council’ amid push for regulation

-

Market12 hours ago

Market12 hours agoStellar (XLM) Price Could Surge To $0.38 — Analyst Explains How

-

Altcoin12 hours ago

Altcoin12 hours agoSolana Price Eyes $178 Following $314 Million Bridged From Ethereum

-

Altcoin11 hours ago

Altcoin11 hours agoCrypto Market Peak? Stablecoin Supply Surge Says There’s More Room To Run

-

Altcoin17 hours ago

Altcoin17 hours agoEthereum Needs A Leader—Or Its Future Could Be In Jeopardy, Ex-Engineer Warns