Bitcoin

$3.29 Billion Bitcoin & Ethereum Options Expiry

The crypto market is set to see $3.29 billion in Bitcoin and Ethereum options expire today, a development that could trigger short-term price volatility and impact traders’ profitability.

Of this total, Bitcoin (BTC) options account for $2.88 billion, while Ethereum (ETH) options represent $417 million.

Bitcoin and Ethereum Holders Brace For Volatility

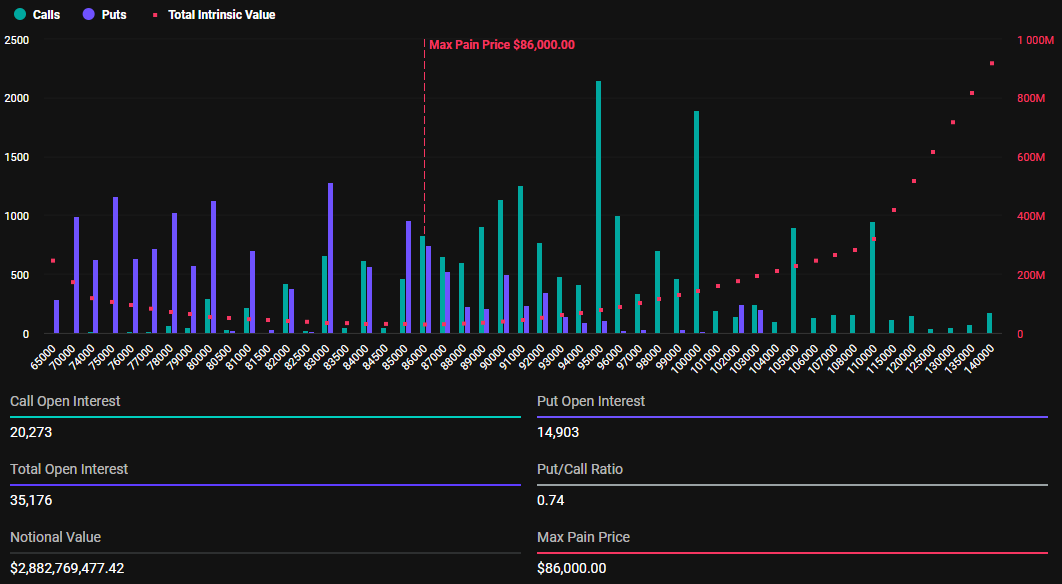

According to data on Deribit, 35,176 Bitcoin options will expire today, slightly higher than last week, where 29,005 BTC contracts went bust. The options contracts due for expiry today have a put-to-call ratio of 0.74 and a maximum pain point of $86,000.

The put-to-call ratio indicates a generally bullish sentiment despite the pioneer crypto’s ongoing descent from the $90,000 mark.

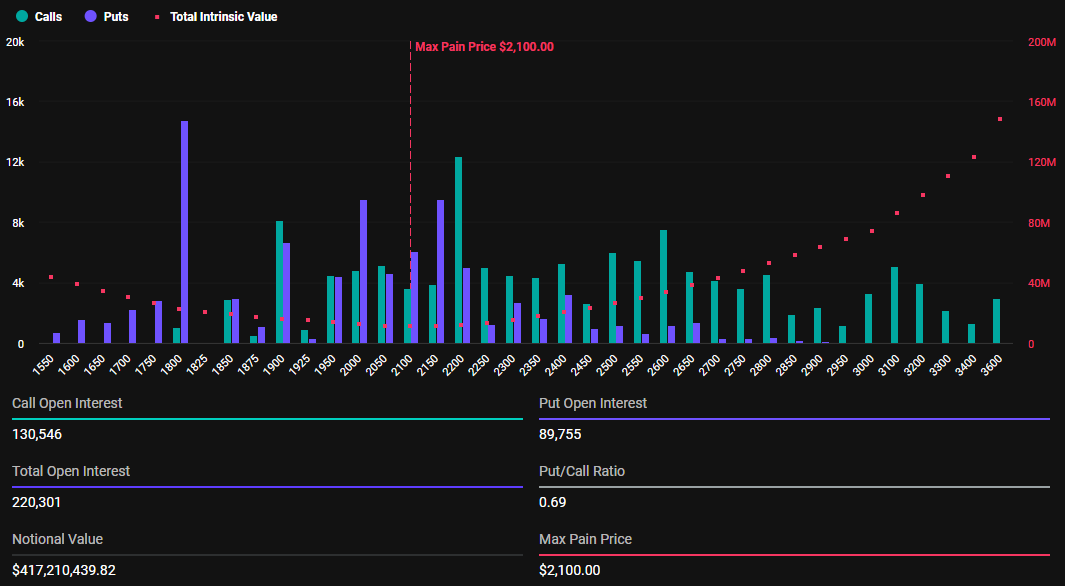

Meanwhile, 220,301 Ethereum options will expire today, down from 223,395 last week. With a put-to-call ratio of 0.69 and a max pain point of $2,100, the expirations could influence ETH’s short-term price movement.

As the options contracts near expiration at 8:00 UTC today, Bitcoin and Ethereum prices are expected to approach their respective maximum pain points. According to BeInCrypto data, BTC was trading for $81,992 as of this writing, whereas ETH was exchanging hands for $1,891.

This suggests a potential recovery for Bitcoin and Ethereum prices as smart money aims to move them toward the “max pain” level. According to the Max Pain theory in options trading, prices tend to gravitate toward strike prices where the highest number of contracts, both calls and puts, expire worthless.

“Max pain has been ticking lower week after week. Do you see this continuing, or is a reversal coming?” Deribit analysts posed.

Nevertheless, price pressure on BTC and ETH will likely ease after 08:00 UTC on Friday when Deribit settles the contracts. However, the sheer scale of these expirations could still fuel heightened volatility in the crypto markets.

Analysts Discuss Crypto Market Sentiment

According to analysts at Greeks.live, market sentiment is predominantly bearish in the short-term despite positive US CPI (Consumer Price Index) data earlier this week.

“Traders are watching key potential support levels and discussing a potential bottom for BTC, with some suggesting $60,000 levels as a possible downside target,” the analysts wrote.

The analysts also note that some believe President Trump’s tariffs and inflation are more significant market drivers than geopolitical events like a Ukraine peace deal.

“Vladimir Putin says he agrees with proposals for ceasefire – but adds he has questions and Russia ‘now on the offensive in all areas’,” Sky News reported.

Analysts note that peace and stability could fuel market confidence, which could be bullish for stocks and crypto. This aligns with a recent JPMorgan survey, in which 51% of traders identified tariffs and inflation as the top market movers for the year.

Elsewhere, analyst Tony Stewart discusses option flows in the crypto market, focusing on Bitcoin derivatives trading on Deribit. He indicates shifts in market sentiment and trading strategies that saw put buyers and call sellers profit from the March 11 price dip to 76,500 levels, followed by a less supported bounce back due to heavy selling of calls above $90,000.

According to Stewart, this highlights a strategic rotation by traders, moving from overly optimistic March and June call positions to more conservative April and May calls. It also reflects adjustments to market volatility.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

US Strategic Bitcoin Reserve Sparks Crypto Regulation Surge

The creation of the US Strategic Bitcoin Reserve has ignited a wave of legislative and regulatory action across the nation. States like Massachusetts and Nebraska are exploring new measures to regulate and protect cryptocurrency users.

As state governments look to expand their involvement in the space—whether by adopting Bitcoin as a store of value or adopting blockchain technology—these regulatory moves signal the growing influence of governments in the crypto space.

US Strategic Bitcoin Reserve Launch Prompts Enhanced Crypto Regulations

Last week, President Donald Trump signed an executive order to establish a US Strategic Bitcoin Reserve and a digital asset stockpile. The move marked a significant shift in the federal government’s stance toward cryptocurrency.

Notably, at the state level, at least 18 states are pursuing legislation to create a Bitcoin reserve. Beyond this, state governments have started exploring crypto laws to regulate the industry and protect consumers.

In Nebraska, Governor Jim Pillen signed the Controllable Electronic Record Fraud Prevention Act (LB609) into law. This bill regulates transactions involving digital assets like cryptocurrencies.

It mandates that operators of controllable electronic record kiosks be licensed and disclose risks, fees, and fraud warnings to customers. LB609 also requires the use of blockchain analytics to detect fraud and sets refund policies for customers defrauded within 30 days.

“Cryptocurrency is an important, emerging industry, and we’ve been working hard to build Nebraska into a cryptocurrency leader,” Governor Pillen stated.

He further emphasized that a key aspect of these efforts is ensuring protections to prevent criminals from exploiting Nebraskans.

Meanwhile, in Massachusetts, State Representative Kate Lipper-Garabedian has proposed legislation to establish a commission to explore the impact of blockchain technology and cryptocurrency on the state.

The H88 bill is titled “An Act establishing a special commission on blockchain and cryptocurrency.”

“A special commission is hereby established for the purposes of making an investigation relative to blockchain technology to develop a master plan of recommendations for fostering the appropriate expansion of blockchain technology in the Commonwealth,” the bill reads.

It outlines the formation of a commission comprising 25 members, including lawmakers, business representatives, and blockchain experts. Key areas of focus include evaluating the feasibility and risks of blockchain adoption in government and business.

It will also assess the impact of cryptocurrency on state revenues and taxation and explore the possibility of regulating the energy consumption linked to cryptocurrency mining. Another important focus will be consumer protection and enhancing technological literacy around blockchain and cryptocurrency. Lastly, the commission will identify best practices to ensure that blockchain technology can benefit the state and its residents.

Massachusetts is also considering a separate bill to establish its Strategic Bitcoin Reserve. This would allow the State Treasurer to invest up to 10% of the funds in the Commonwealth Stabilization Fund into Bitcoin or other digital assets. In contrast, Nebraska currently has no such legislation.

As legislative efforts gain traction, governments are increasingly collaborating with cryptocurrency exchanges to navigate this new frontier. Coinbase CEO Brian Armstrong recently highlighted the increasing engagement between crypto firms and government bodies.

“In the wake of the US Strategic Bitcoin Reserve launching, we’re seeing many more take an interest,” Armstrong posted.

He shared that the company has partnered with 145 government entities in the US, covering federal, state, and local levels. Additionally, it works with 29 international government bodies.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin’s New Phase: Glassnode Reveals Distribution Shift

According to Glassnode, Bitcoin (BTC) is experiencing a prolonged distribution phase. Furthermore, both market momentum and capital flows have shifted into negative territory, suggesting a decrease in demand.

This shift, coupled with rising investor uncertainty, is contributing to a broader decline in overall market sentiment and confidence.

Bitcoin Enters Prolonged Distribution Phase

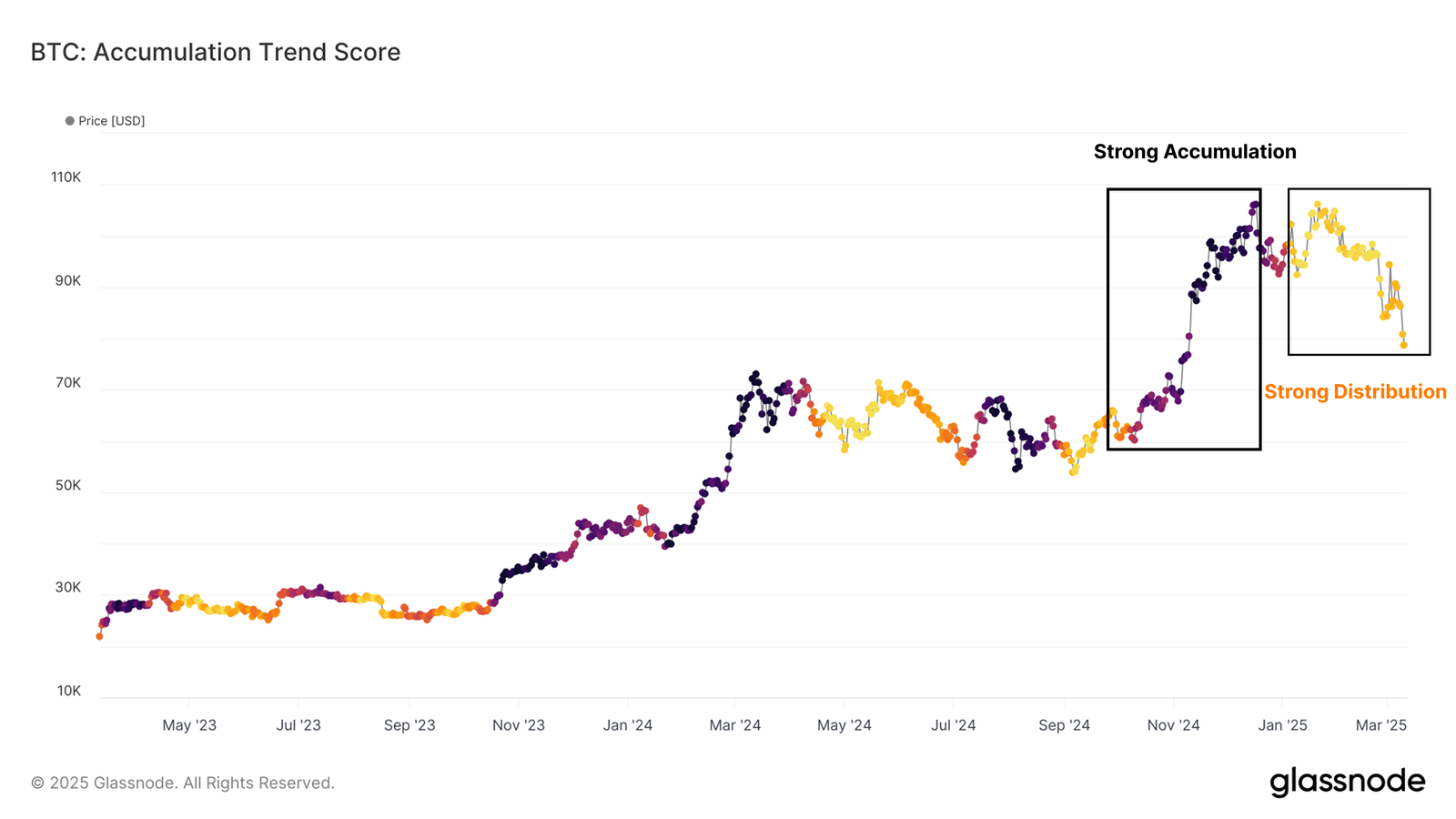

In its latest weekly newsletter, Glassnode pointed out that Bitcoin’s market structure has entered a post-all-time-high (ATH) distribution phase. This phase marks a natural progression of Bitcoin’s cyclical behavior.

The cycle is driven by alternating periods of accumulation and distribution, with capital shifting between different investor groups over time.

“The latest distribution phase commenced in January 2025, aligning with Bitcoin’s sharp correction from $108,000 to $93,000,” the newsletter read.

In addition, Glassnode highlighted that The Accumulation Trend Score remains below 0.1.

This suggests that market participants are more focused on liquidating their holdings rather than adding to their positions. Thus, until the trend reverses, the market may face continued downward pressure.

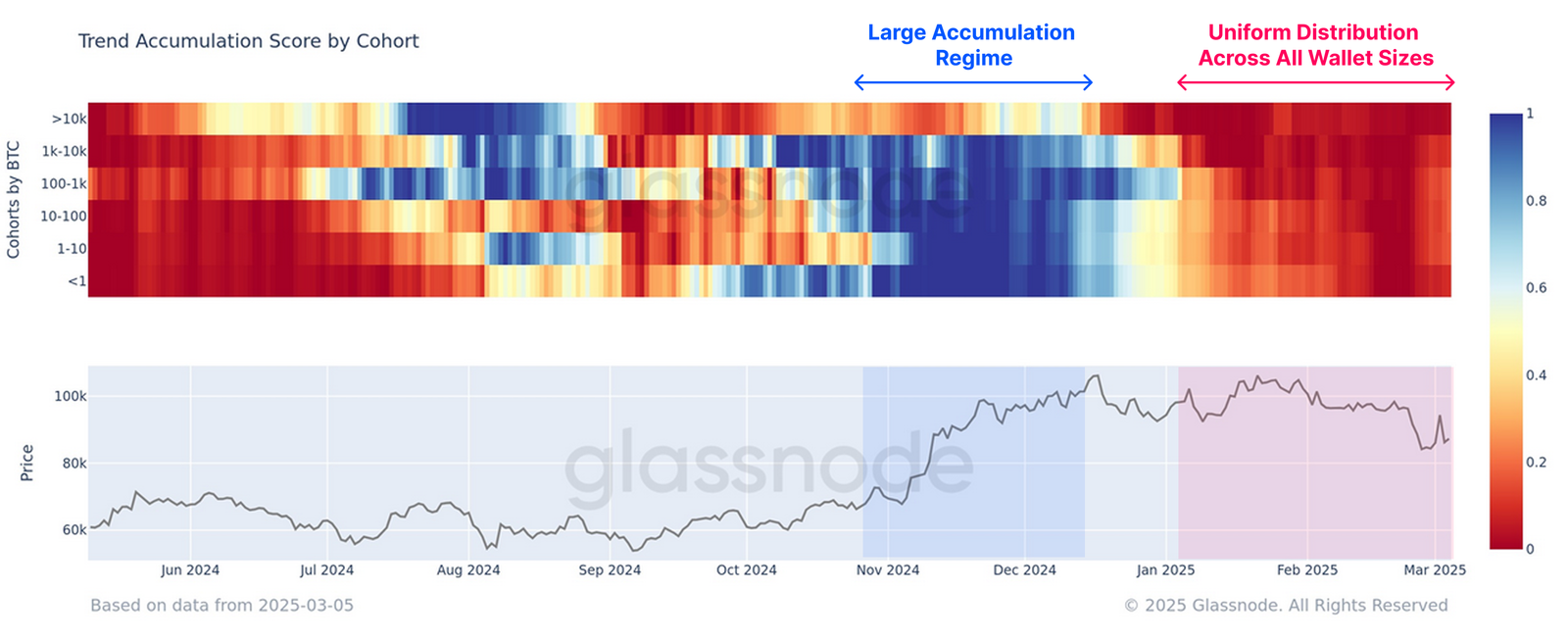

Meanwhile, the distribution isn’t specific to any single investor group. As per Glassnode, over the past two months, all wallet size categories have been actively distributing.

This has significantly intensified the sell-side pressure on the market. Moreover, the newsletter added that the selling activity has become more pronounced since mid-January.

A substantial portion of the sell-side pressure has come from coins being sold at a loss. This has further weighed on the market’s overall strength.

“This showcases that the current market downturn has been a challenging environment for investors, with many exiting the market below their cost basis under the pressure of the drawdown,” Glassnode explained.

In addition to distribution, market sentiment has also shifted. Investor sentiment has leaned more cautious. Glassnode revealed that accumulation decreased as macroeconomic uncertainty grew, especially after events like the Bybit hack and rising US tariff tensions.

The analytics firm noted that during price pullbacks between mid-December and February, investors were buying Bitcoin, especially in the $95,000–$98,000 range. They believed the bull trend would continue.

However, by late February, liquidity tightened, and external risks grew. Therefore, confidence in further accumulation began to fade.

“The lack of dip-buying at lower levels suggests that capital rotation is underway, potentially leading to a more prolonged consolidation or corrective phase before the market finds a firm support base,” Glassnode added.

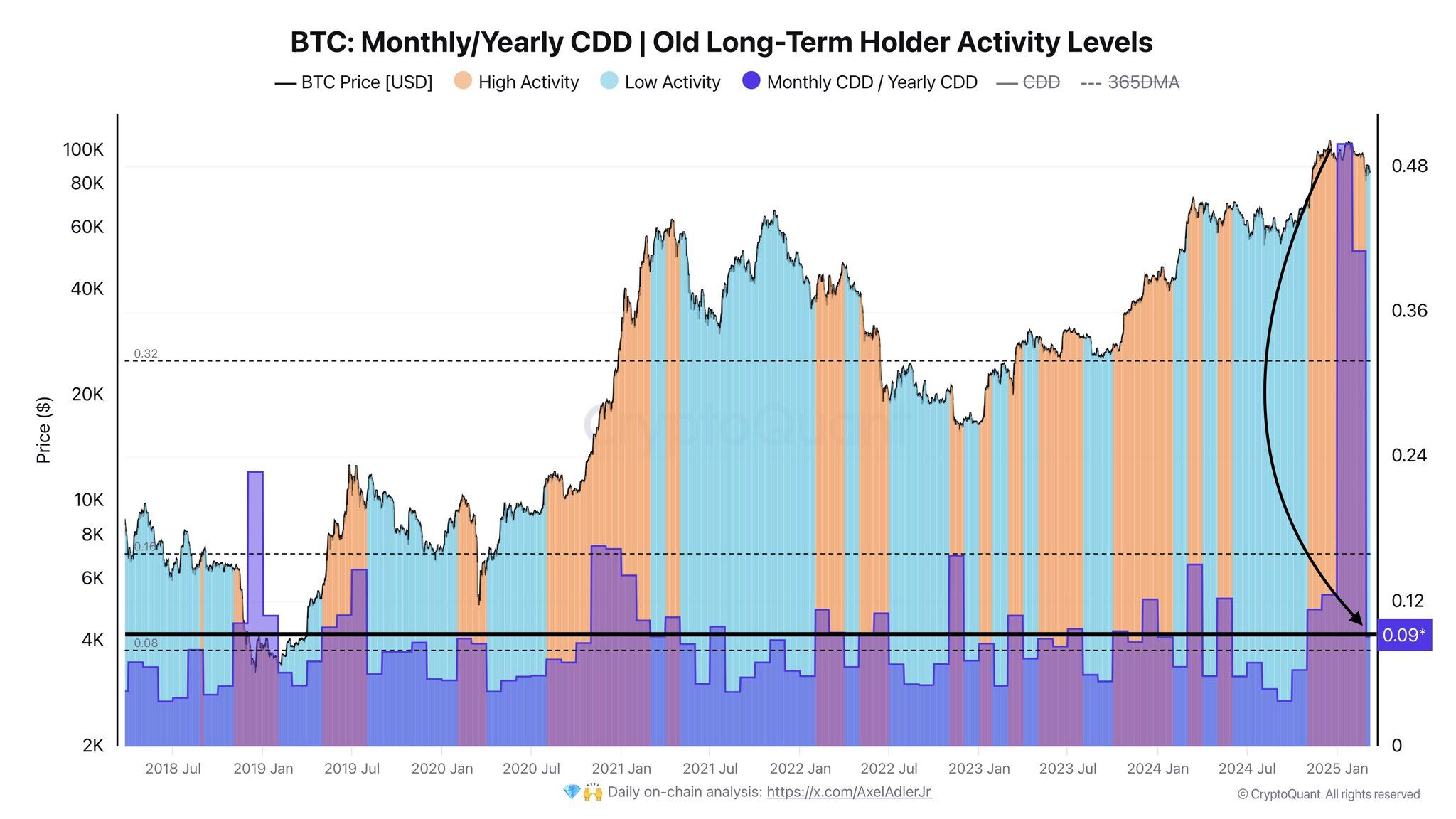

However, not all are pessimistic. An on-chain analyst – Axel Adler, observed that the largest distribution of Bitcoin by long-term holders in recent years appears to have ended.

As per his analysis, activity metrics have shifted from high-selling activity to lower levels of accumulation. This shift suggests that long-term holders may be regaining confidence, potentially signaling a stabilization or future upward movement in the market.

“This reduction in supply typically precedes stabilization and a new market cycle, representing a potentially positive market signal,” he posted on X.

As Bitcoin continues to navigate this phase, its price has shown significant volatility. BeInCrypto reported that BTC fell below $80,000 amid recession fears. Nonetheless, it managed a slight recovery as tariff and geopolitical tensions eased.

At press time, BTC was trading at $83,424. As per BeInCrypto data, this marked modest gains of 2.0% over the last day.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Price Jumps as US CPI Data Falls Below Expectations

The US CPI (Consumer Price Index) data shows inflation eased to 2.8% in February, a positive surprise as it is below the expected 2.9% Year over Year (YoY).

This softer-than-expected inflation print boosted risk appetite, as traders now see an increased probability of rate cuts by the Federal Reserve (Fed) later in the year.

US CPI Below Expectations at 2.8%

Bitcoin (BTC) responded with a modest upward move, jumping to $83,371. The surge comes as lower inflation reduces the likelihood of further tightening and supports risk-on sentiment. Stock markets also reacted positively, with major indices posting gains following the release.

While inflation cooled in February, the Core CPI came in at 3.1% YoY, also beating estimates of 3.2%. Core inflation excludes volatile items like food and energy. Notably, this marks the first decline in headline and Core CPI since July 2024 and suggests inflation is cooling down in the US.

If inflation continues to trend lower, the Fed could shift to a more dovish stance, potentially opening the door to more liquidity entering the markets. Meanwhile, the reaction for traditional assets was as expected, with the US dollar and Japanese yen dropping.

“Both overall and core are down! This clearly raises expectations for an interest rate cut. Both interest rates and the dollar/yen exchange rate responded with declines. This will be positive for stock prices,” an analyst on X observed.

Some analysts are taking these inflation numbers with a pinch of salt, as Donald Trump’s trade tariffs could lead to higher consumer prices.

Notwithstanding, many analysts view the latest inflation data as a tailwind for Bitcoin, which has historically benefited from easier monetary conditions. Now, all eyes are on the Fed’s upcoming policy guidance as traders look for confirmation that the path to rate cuts is opening up.

“A high print would not be very welcomed (as usual). Especially during uncertain times in the market like now, this kind of economic data usually has an increased impact. A high number would likely move the bond yields back up which is the opposite of what the administration is seemingly trying to achieve currently. Then there’s also FOMC next week and the Fed will definitely be looking at this CPI print as well,” analyst Daan Crypto Trades remarked.

Meanwhile, this CPI data comes after a good JOLTS (Job Openings and Labor Turnover Survey) report on Tuesday, which gave the market a reason to stop falling. Notably, Fed Chair Jerome Powell stated on Friday that the US central bank would take a cautious approach to monetary policy easing, adding that the economy currently “continues to be in a good place.”

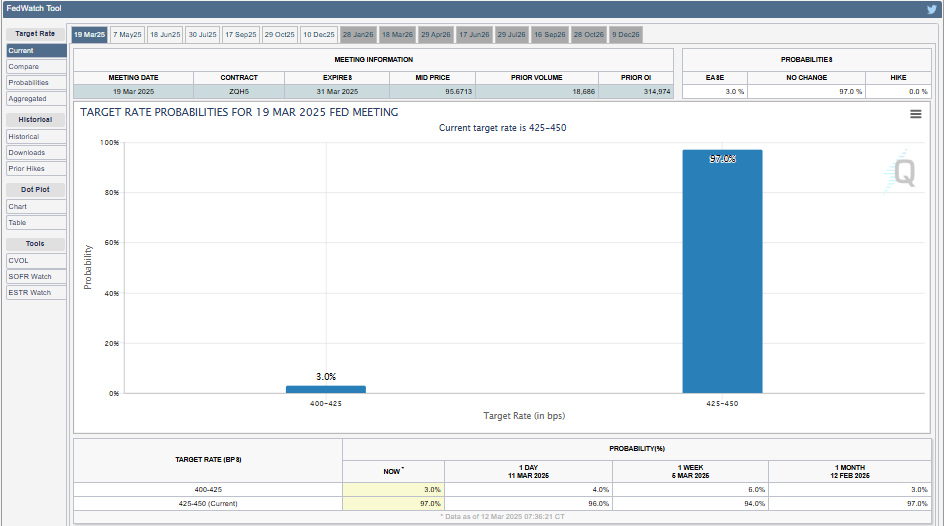

According to data from the CME Fedwatch tool, markets are betting on an interest rate cut at the Fed’s next meeting.

“Inflation just came in at 2.8% which is lower than expectations. The real number is even lower. The Fed should cut rates immediately,” chimed Anthony Pompliano, the founder of Professional Capital Management.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market20 hours ago

Market20 hours agoEl Salvador’s IMF Deal Could be Affected By Bitcoin Purchases

-

Altcoin19 hours ago

Altcoin19 hours agoCan ADA Drop to $0.30?

-

Altcoin20 hours ago

Altcoin20 hours agoAltcoins At Risk Of More Losses As Market Shifts Heavily Toward A Bitcoin Season

-

Regulation20 hours ago

Regulation20 hours agoRipple Secures DFSA License in the UAE

-

Altcoin11 hours ago

Altcoin11 hours agoSEI Price Jumps 7.3% As World Liberty Financial Loads Up 541,242 Coins

-

Market24 hours ago

Market24 hours agoCrypto Stocks Post Losses, But Bear Market Fears Diminish

-

Altcoin18 hours ago

Altcoin18 hours agoDogecoin Price Closes Daily Candle With Lower Wick, Why Another Crash Could Be Coming

-

Altcoin17 hours ago

Altcoin17 hours agoDogecoin Price Set For Massive Rebound After Indicators Call The Bottom