Market

Stellar (XLM) Jumps 10% as Bulls Take Charge: What’s Next?

Stellar (XLM) has surged more than 10% in the last 24 hours, attempting to recover from a 15% correction over the past month. Despite this rebound, XLM’s trend remains at an important point, with its market cap now standing at $8.6 billion.

Technical indicators show that buying pressure has increased significantly, with DMI and CMF both pointing to growing accumulation. However, XLM still faces key resistance levels, and whether it can sustain this momentum will determine if the price can break above $0.35 or if further consolidation is ahead.

XLM Chart Shows Buyers Are Now In Control

Stellar’s DMI chart shows that its Average Directional Index (ADX) has dropped to 28.7, down from 35.6 two days ago. ADX is a key indicator that measures the strength of a trend, regardless of direction, with values above 25 typically signaling a strong trend and values below 20 suggesting a weak or consolidating market.

A declining ADX, even while the price moves in a certain direction, indicates that the strength of the trend is fading.

In this case, the drop from 35.6 to 28.7 suggests that Stellar’s bearish trend is weakening, creating an opportunity for a possible shift in momentum.

Looking at the Directional Indicators, +DI has surged to 31.2 from 8, while -DI has dropped to 16.4 from 30.7. This major shift in buying and selling pressure suggests that bulls have regained control after a period of strong selling.

Since Stellar is attempting to transition from a downtrend into an uptrend, this increase in +DI is a positive signal. However, for the new trend to gain strength, ADX would need to stabilize and turn upward, confirming growing momentum.

If ADX continues declining, XLM could consolidate before making a decisive move, but if it rises alongside +DI, it will reinforce a stronger breakout to the upside.

XLM CMF Has Surged Since March 10

Stellar’s Chaikin Money Flow (CMF) indicator has risen to 0.13, recovering from -0.14 just three days ago, after briefly peaking at 0.18 a few hours ago. CMF measures buying and selling pressure by analyzing both price movement and volume on a scale from -1 to 1.

A positive CMF value suggests that buying pressure is dominant, while a negative reading indicates stronger selling activity.

Generally, values above 0.05 signal accumulation, whereas values below -0.05 indicate distribution, making CMF a useful tool for assessing whether capital is flowing into or out of an asset.

With Stellar’s CMF now at 0.13, buying pressure has clearly strengthened, reversing the prior bearish trend seen when CMF was negative.

This shift suggests that investors have been accumulating XLM over the past few days, supporting its recent price recovery. However, since CMF peaked at 0.18 before slightly declining, some short-term profit-taking may have occurred.

If CMF remains in positive territory and trends higher again, it will reinforce further upside potential, but if it starts dropping back toward negative values, it could signal weakening demand and a possible price pullback.

Will Stellar Surpass $0.35 In March?

Stellar’s EMA lines still indicate a bearish trend, with short-term EMAs positioned below the long-term ones. However, the recent upward movement in short-term EMAs suggests that momentum could be shifting, increasing the chances of a trend reversal.

If buying pressure continues, Stellar’s price could rise to test the resistance at $0.309, a key level that would determine whether the recovery can sustain itself.

A breakout above this resistance could fuel further upside, potentially pushing XLM toward $0.349. A stronger uptrend could lead to a rally toward $0.375.

On the downside, if the short-term recovery loses strength and buyers fail to establish an uptrend, Stellar could face renewed selling pressure.

In this scenario, the first key support level to watch would be $0.273, which has acted as a critical zone in previous price action. A breakdown below this level could expose XLM to further losses, with support at $0.252 as the next major level.

If bearish momentum intensifies, the price could decline further, potentially reaching $0.226, marking a deeper correction before any potential reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Steadies—Is a Meaningful Bounce on the Horizon?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin price started a recovery wave above the $80,500 zone. BTC is now rising and might aim for a move above the $84,000 and $85,000 levels.

- Bitcoin started a decent recovery wave above the $81,000 zone.

- The price is trading above $81,500 and the 100 hourly Simple moving average.

- There was a break below a short-term bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $82,500 and $84,000 levels.

Bitcoin Price Eyes Steady Increase

Bitcoin price remained stable above the $78,000 level. BTC formed a base and recently started a recovery wave above the $80,500 resistance level.

The bulls pushed the price above the $82,000 resistance level. However, the bears were active near the $84,000 resistance zone. A high was formed at $84,200 and the price corrected some gains. There was a move below the $83,000 level.

The price dipped below the 50% Fib retracement level of the upward move from the $76,818 swing low to the $84,200 high. Besides, there was a break below a short-term bullish trend line with support at $83,000 on the hourly chart of the BTC/USD pair.

Bitcoin price is now trading above $81,200 and the 100 hourly Simple moving average. On the upside, immediate resistance is near the $82,450 level. The first key resistance is near the $84,000 level. The next key resistance could be $85,000.

A close above the $85,000 resistance might send the price further higher. In the stated case, the price could rise and test the $86,500 resistance level. Any more gains might send the price toward the $88,000 level or even $96,200.

Another Drop In BTC?

If Bitcoin fails to rise above the $82,450 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $80,500 level. The first major support is near the $79,600 level or the 61.8% Fib retracement level of the upward move from the $76,818 swing low to the $84,200 high.

The next support is now near the $78,500 zone. Any more losses might send the price toward the $77,000 support in the near term. The main support sits at $76,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $80,500, followed by $79,600.

Major Resistance Levels – $82,450 and $84,000.

Market

Ethereum Price Consolidates and Eyes Recovery—Is a Bounce Incoming?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

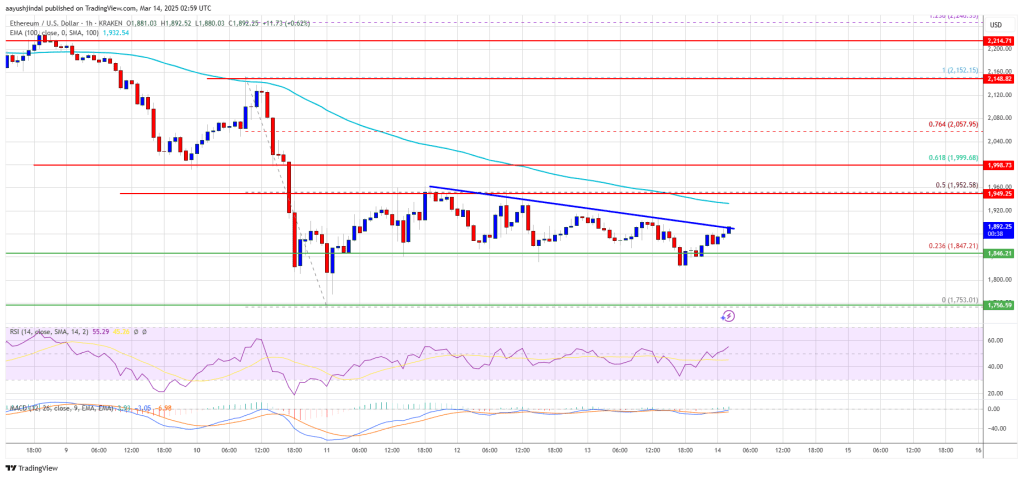

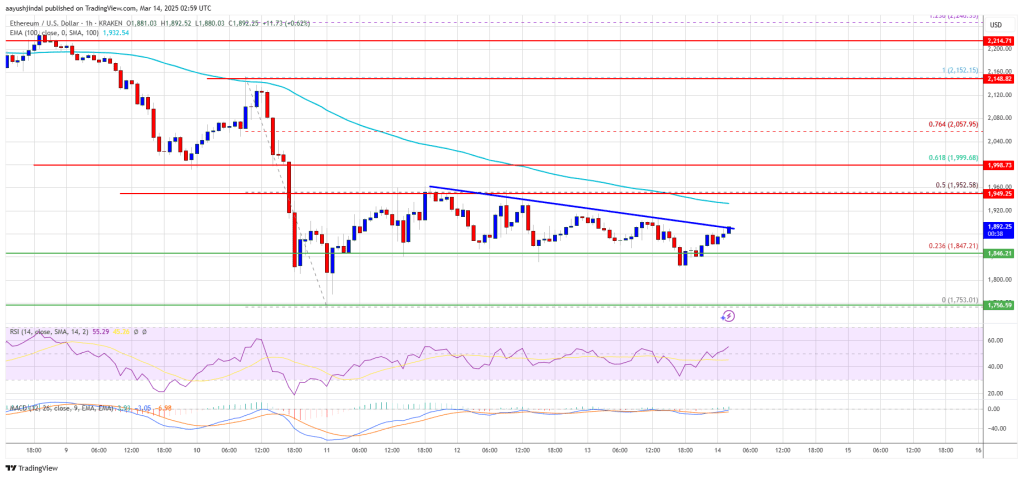

Ethereum price started a recovery wave above the $1,820 zone. ETH is now consolidating and facing hurdles near the $1,950 resistance.

- Ethereum started a recovery wave above the $1,820 level.

- The price is trading below $1,920 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $1,900 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,900 and $1,950 resistance levels to start a decent increase.

Ethereum Price Faces Resistance

Ethereum price formed a base above the $1,760 level and started a recovery wave, like Bitcoin. ETH was able to clear the $1,820 and $1,850 resistance levels.

The bulls pushed the price above the $1,920 level. There was a move above the 23.6% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low. However, the bears seem to be active near the $1,950 resistance zone.

Ethereum price is now trading below $1,920 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,900 level.

There is also a short-term bearish trend line forming with resistance at $1,900 on the hourly chart of ETH/USD. The next key resistance is near the $1,950 level or the 50% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low.

The first major resistance is near the $1,990 level. A clear move above the $1,990 resistance might send the price toward the $2,050 resistance. An upside break above the $2,050 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,120 resistance zone or even $2,250 in the near term.

Another Drop In ETH?

If Ethereum fails to clear the $1,950 resistance, it could start another decline. Initial support on the downside is near the $1,845 level. The first major support sits near the $1,800 zone.

A clear move below the $1,800 support might push the price toward the $1,750 support. Any more losses might send the price toward the $1,720 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,920

Market

Ethereum Price Consolidates and Eyes Recovery—Is a Bounce Incoming?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave above the $1,820 zone. ETH is now consolidating and facing hurdles near the $1,950 resistance.

- Ethereum started a recovery wave above the $1,820 level.

- The price is trading below $1,920 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $1,900 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,900 and $1,950 resistance levels to start a decent increase.

Ethereum Price Faces Resistance

Ethereum price formed a base above the $1,760 level and started a recovery wave, like Bitcoin. ETH was able to clear the $1,820 and $1,850 resistance levels.

The bulls pushed the price above the $1,920 level. There was a move above the 23.6% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low. However, the bears seem to be active near the $1,950 resistance zone.

Ethereum price is now trading below $1,920 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,900 level.

There is also a short-term bearish trend line forming with resistance at $1,900 on the hourly chart of ETH/USD. The next key resistance is near the $1,950 level or the 50% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low.

The first major resistance is near the $1,990 level. A clear move above the $1,990 resistance might send the price toward the $2,050 resistance. An upside break above the $2,050 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,120 resistance zone or even $2,250 in the near term.

Another Drop In ETH?

If Ethereum fails to clear the $1,950 resistance, it could start another decline. Initial support on the downside is near the $1,845 level. The first major support sits near the $1,800 zone.

A clear move below the $1,800 support might push the price toward the $1,750 support. Any more losses might send the price toward the $1,720 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is gaining momentum in the bullish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,920

-

Ethereum20 hours ago

Ethereum20 hours agoEthereum Net Taker Volume Signals Huge Selling Pressure – Can Bulls Hold Key Levels?

-

Market24 hours ago

Market24 hours agoSolana Hit by Bearish Signal After 3 Years, Price at Risk

-

Market23 hours ago

Market23 hours agoAave Horizon RWA Product To Unlock Trillions in Tokenized Assets

-

Regulation16 hours ago

Regulation16 hours agoRipple Secures DFSA License in the UAE

-

Market20 hours ago

Market20 hours agoCelestia TIA) Price Nears Consolidation After 31% Rally

-

Market19 hours ago

Market19 hours agoCrypto Stocks Post Losses, But Bear Market Fears Diminish

-

Market21 hours ago

Market21 hours agoXCN Dip Signals More Downside as Bearish Indicators Intensify

-

Altcoin21 hours ago

Altcoin21 hours agoRipple Moves $457 Million XRP Amid Potential US SEC Settlement