Market

Solana Hit by Bearish Signal After 3 Years, Price at Risk

Solana (SOL) has faced significant price challenges in recent weeks, with a notable drawdown that has left it struggling to recover.

This decline has triggered concerns in the market, further compounded by a key bearish signal. There is a rising concern among investors that these factors could lead to even more bearishness in the short term.

Solana Faces Strong Bearishness

Solana’s price has slipped below the realized price for the first time in almost 3 years. The realized price is a key metric that represents the average price at which an asset was last moved. When the spot price falls below this, it signals that the holders of Solana are collectively experiencing net unrealized losses.

This situation is often considered a bearish signal, as it suggests that investors are sitting on losses, which may prompt some to sell in an attempt to avoid further declines. As a result, the potential for panic selling increases when the price trades below the realized price.

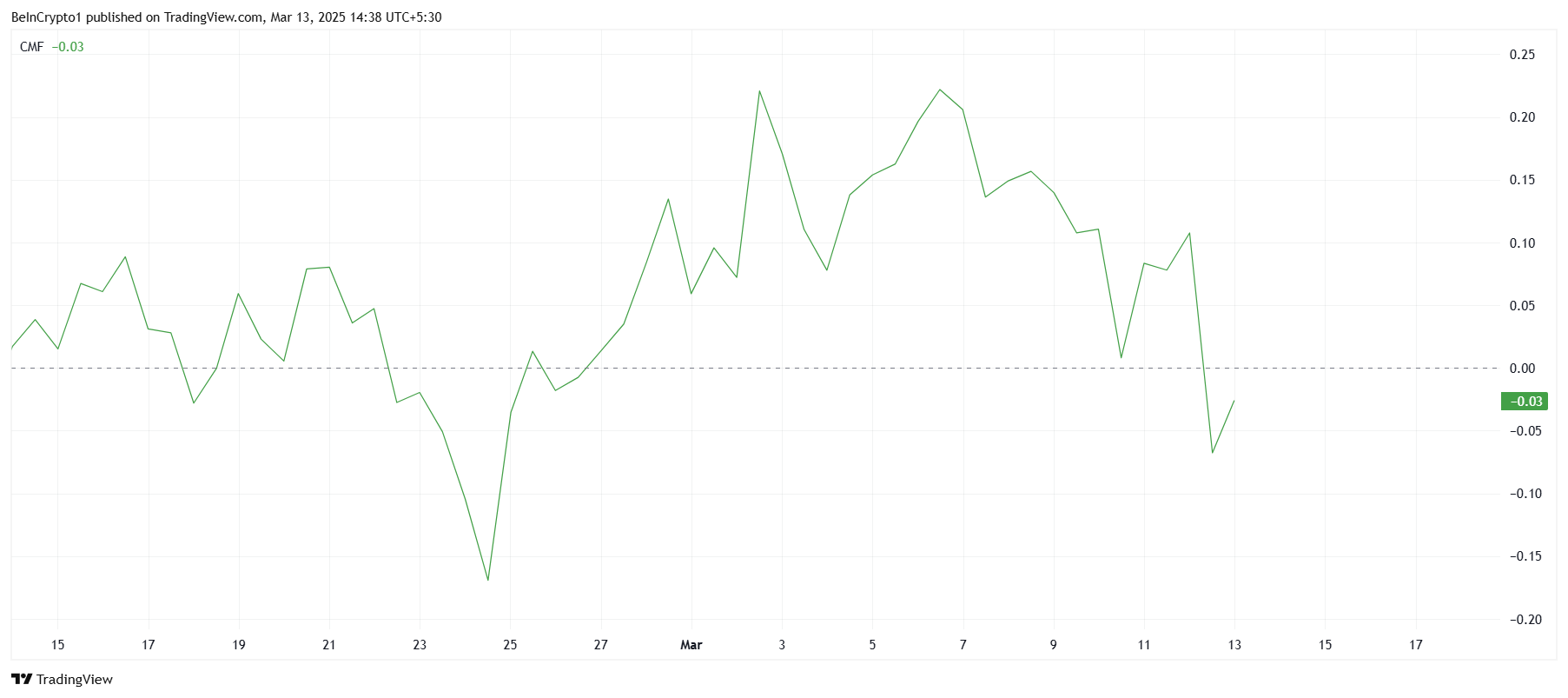

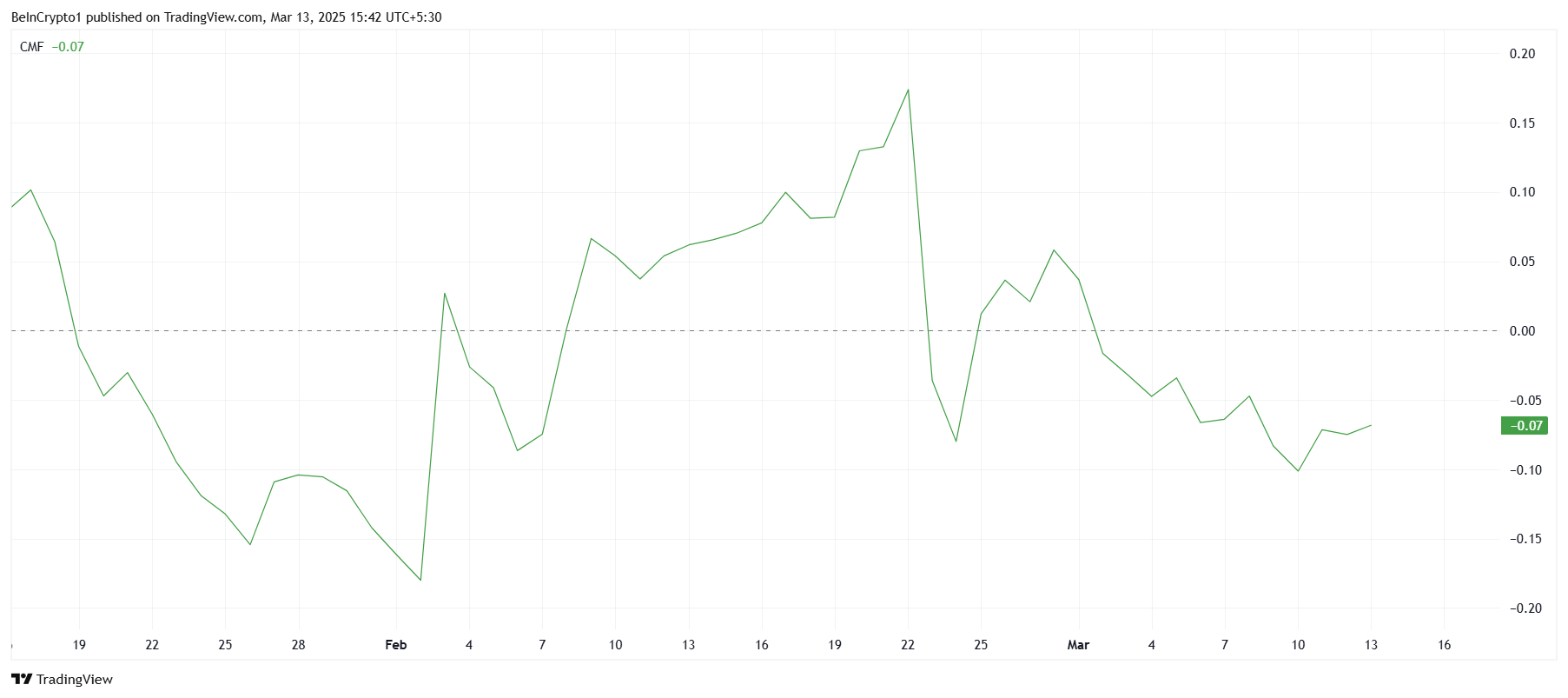

On a broader scale, Solana is also experiencing weak macro momentum, highlighted by the technical indicators. The Chaikin Money Flow (CMF), which measures the volume-weighted flow of money into and out of an asset, has noted a sharp downtick. The CMF is currently below the zero line, indicating that outflows are dominating inflows.

As the CMF remains negative, it suggests that Solana’s price recovery could be hindered. The lack of buying interest and the dominance of selling activity are likely to limit any significant upward movement.

SOL Price Is Vulnerable To A Decline

Solana’s price has been down nearly 30% over the last ten days, and it is currently trading at $125, just under the critical $126 resistance level. Despite recently bouncing off the support at $118, the overall sentiment and market conditions suggest that recovery may be short-lived. The price remains under pressure, with further declines possible if key levels fail to hold.

If Solana fails to secure $126 as support, the altcoin could drop back to $118 or even lower, possibly reaching $109. This scenario would reinforce the bearish outlook and prolong the struggle for recovery. Without a strong rally, Solana could face more losses in the short term.

However, if Solana manages to breach and flip $126 into support, it could trigger a bounce toward $133, followed by potential resistance at $143. A successful breach of $143 would invalidate the current bearish thesis and signal a more strong recovery. If this occurs, Solana could regain some of the losses it has recently suffered, offering hope for investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

How HBAR Price Falling to Critical Support Could Harm Traders

Hedera (HBAR) has been experiencing a continued downtrend in price despite the broader market showing a bullish macro outlook. However, the short-term market conditions indicate that HBAR could face further declines in the coming days.

This potential drop to critical support levels could pose risks for traders, especially if they fail to manage their positions effectively.

HBAR Is Facing Uncertainity

The Ichimoku Cloud indicator is currently presenting a bearish outlook for HBAR. The cloud itself is signaling downward momentum, and the presence of candlesticks below the basis line confirms this negative sentiment. This indicates that the market sentiment is leaning toward the bearish side, and any hope for a bullish reversal seems distant at the moment.

Furthermore, the expanding Ichimoku Cloud suggests that the bearish pressure on HBAR is likely to intensify. As the cloud widens, it indicates that downward momentum could continue in the short term.

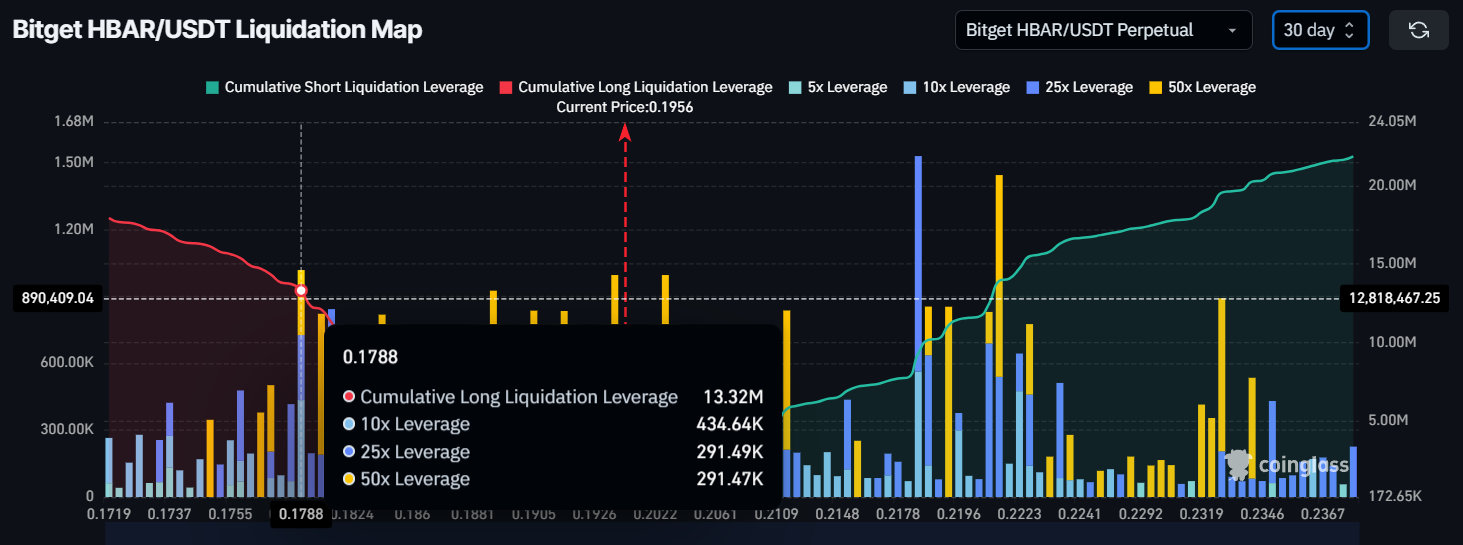

In terms of macro momentum, the liquidation map shows a concerning scenario if HBAR continues its downward trend. If the price falls to its critical support level of $0.177, it could trigger $13.3 million worth of long liquidations. This liquidation could impact market sentiment and cause traders to retreat, fearing further losses.

The resulting liquidation could further pressure HBAR’s price, accelerating the decline and creating more bearish sentiment in the market. As traders pull back, it could exacerbate the existing downtrend, leading to a cycle of selling and additional losses.

HBAR Price Is Looking For A Breakout

HBAR is currently trading at $0.195, within a descending channel. The altcoin is trying to secure this level of support, but the current market conditions do not offer much hope for a bullish outcome. The factors discussed, including the bearish Ichimoku Cloud and the potential for liquidation, suggest that a recovery is unlikely in the near term.

Given the ongoing market conditions, HBAR is vulnerable to losing $0.195 support. If this happens, the price could fall to $0.177, which has been a critical support level for HBAR over the past weeks. If the price breaks below this level, it signals a continuation of the bearish trend and a breakdown of the pattern, resulting in further price declines.

However, if HBAR manages to bounce off the $0.195 support level, it could potentially rise to $0.222, breaking out of the current pattern. This would completely invalidate the bearish outlook and help investors note recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Crypto Stocks Post Losses, But Bear Market Fears Diminish

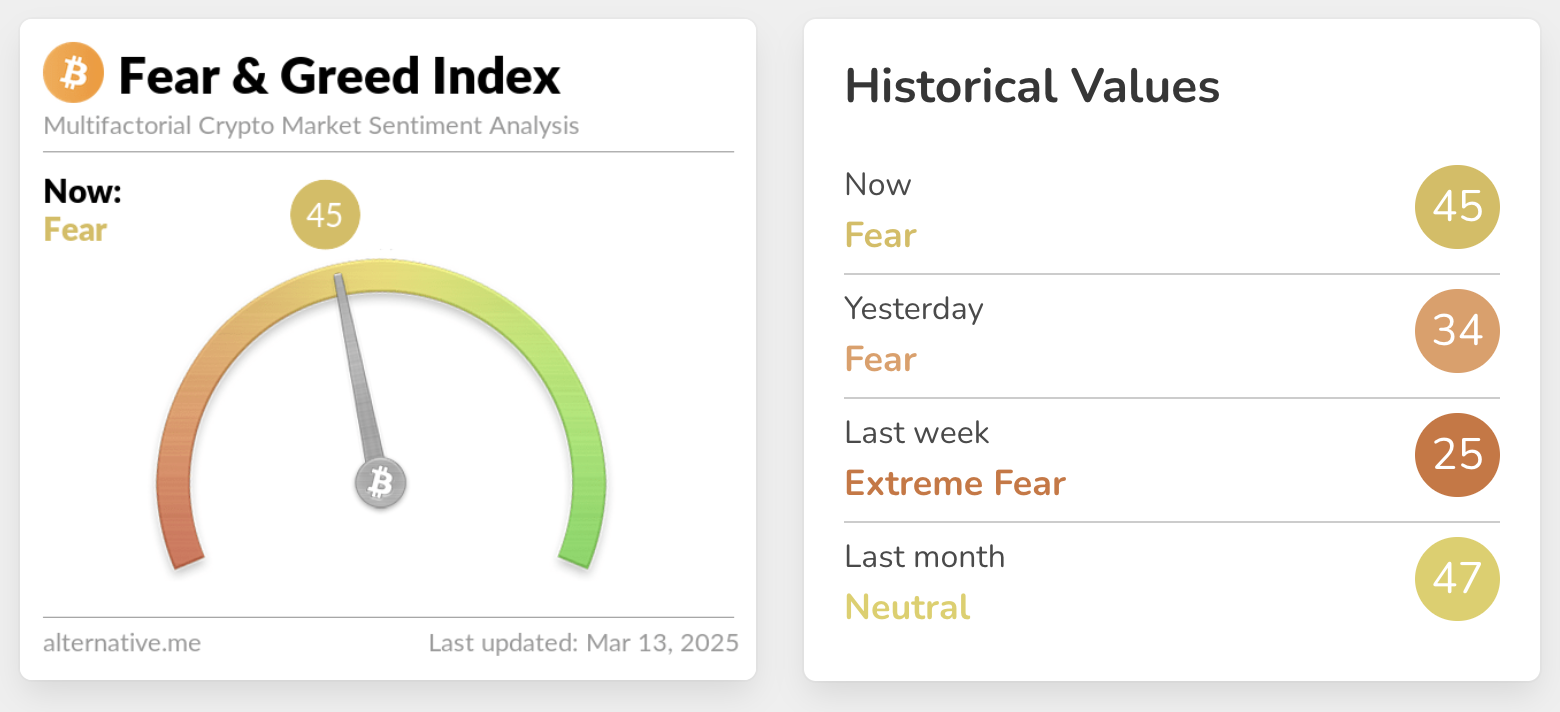

The Crypto Fear and Greed Index rebounded from its recent lows, showing diminished concerns of a bear market. However, several crypto stocks have posted huge losses, and gold is surging towards an all-time high.

The constant market volatility has helped exhaust short-term and speculative traders, rebuilding a little stability. The latest US CPI report was better than expected, and it may help create interest rate cuts for a more long-term solution.

Have We Avoided a Crypto Bear Market?

Over the past few weeks, rumors of a bear market have circulated through the crypto space. Two weeks ago, the Crypto Fear and Greed Index reached its lowest level since the FTX collapse, and recession fears have kept markets reeling.

However, the Index now reports a significant rebound, and crypto traders are evidently regaining some confidence.

The pertinent question, then, is why has this happened. By all accounts, crypto investors have a lot of reasons to fear a bear market.

Several private firms that maintain significant Bitcoin holdings, like Metaplanet, MicroStrategy, and Marathon, all recorded double-digit percentage drops in their stock value this week.

Meanwhile, traditional assets like gold are spiking.

Gold is a risk-off asset, and cryptoassets are generally considered risk-on. If fears of an imminent recession define the TradFi market, this will have a negative impact on investments in the crypto space.

However, a few points could diminish fears of a crypto bear market. For one, the US CPI report for February was less bad than expected, which may help fuel future cuts to US interest rates.

Since the report dropped, Bitcoin and other cryptoassets recovered a little, and some corporate BTC holders like Tesla also posted a slight rebound. This optimism may or may not prove fragile, but it’s helped keep the market upright.

More importantly, the constant volatility in this market might be causing some benefits. As President Trump repeatedly flip-flopped on tariffs, crypto sentiment has yo-yoed between bear market fears and resurgent optimism.

This has exhausted most of the short-term and speculative traders in this market, at least for the time being.

In short, all capital markets are in chaos right now. Parts of the crypto market are showing cautious optimism, but all the ingredients of a bear market are still in play.

The industry has been agitating for interest rate cuts, but it may face serious hurdles. Ultimately, we’ll need a major bullish development to dispel these lingering market fears.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Celestia TIA) Price Nears Consolidation After 31% Rally

Celestia (TIA) has shown a recent recovery, reaching $3.60 after a 31% rise in the past 48 hours. This price action helped the altcoin recover most of its recent losses.

However, despite the positive movement, further gains might be challenging as signs point to potential consolidation in the near future.

Celestia Is Heading In No Direction

The Bollinger Bands are closing in on a squeeze, signaling that volatility in Celestia’s price could be coming to an end. Historically, such squeezes have often been followed by periods of price stabilization, where the price moves sideways.

This suggests that while TIA has seen some positive movement, it may struggle to pick a clear direction in the short term. During this time, TIA might hover between the support and resistance levels, awaiting stronger market cues to spark a breakout in either direction.

In terms of macro momentum, Celestia’s market sentiment is being influenced by the Chaikin Money Flow (CMF), which has remained below the zero line for the past few days. This indicator shows that capital inflows into Celestia have been relatively weak.

While the CMF’s position below the zero line typically signals bearish sentiment, the absence of strong volatility could prevent further declines. This lack of momentum may keep TIA from experiencing a sharp drop, but it also limits its ability to build on recent gains.

TIA Price Needs A Push

At the time of writing, Celestia’s price is holding steady at $3.60, comfortably above the $3.50 support level. However, it is still under the resistance of $3.83, which has historically been a challenging barrier for the altcoin. Despite the 31% rise over the last 48 hours, this resistance may continue to pose challenges for Celestia’s upward movement.

Given the current market conditions, Celestia is likely to face some struggle beneath the $3.83 resistance. The price could consolidate within a range between $3.83 and $3.50 until stronger market signals prompt a breakout. The consolidation phase may keep the price contained, delaying further price movement for the time being.

On the other hand, if Celestia successfully breaches the $3.83 resistance level, it could pave the way for further recovery, potentially driving the price to $4.50. A successful breakout beyond this level would invalidate the bearish-neutral outlook and could trigger a new phase of growth for Celestia.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoWhy Bitcoin Reserve Bills Fail: VeChain Executive Weighs In

-

Altcoin19 hours ago

Altcoin19 hours agoSolana Price At Risk As Alameda Unstakes $23 Million SOL

-

Market13 hours ago

Market13 hours agoSolana (SOL) Faces Many Challenges—Can Bulls Hold the Line?

-

Bitcoin9 hours ago

Bitcoin9 hours agoUS Strategic Bitcoin Reserve Sparks Crypto Regulation Surge

-

Ethereum23 hours ago

Ethereum23 hours agoThis Ethereum Monthly RSI Chart Just Crashed To New Lows To Break 2022 Records, What Happened Last Time?

-

Market22 hours ago

Market22 hours agoSolana ETF Delay Fuels Bearish Sentiment, $16M Pulled from SOL

-

Market8 hours ago

Market8 hours agoPEPE Whales Propel 11% Rally, Fueling Market Optimism

-

Altcoin22 hours ago

Altcoin22 hours agoAnalyst Reveal How Ethereum Price $8,000 Move Could Be In Play