Market

XRP Bulls Ready to Charge—Upside Break May Spark Rally

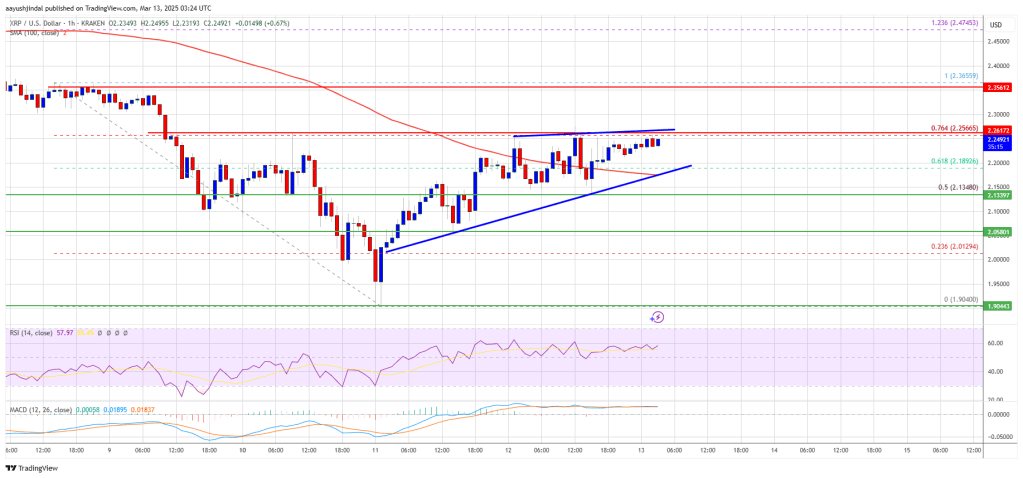

XRP price started a fresh recovery wave above the $2.00 zone. The price is now showing positive signs and might clear the $2.250 resistance zone.

- XRP price started a fresh recovery wave above the $2.120 resistance zone.

- The price is now trading above $2.150 and the 100-hourly Simple Moving Average.

- There is a short-term bullish trend line forming with support at $2.188 on the hourly chart of the XRP/USD pair (data source from Kraken).

- The pair might continue to move up if it clears the $2.250 resistance zone.

XRP Price Eyes Upside Break

XRP price remained supported and started a recovery wave from the $1.90 zone, like Bitcoin and Ethereum. The price was able to clear the $2.00 and $2.050 resistance levels.

There was a move above the $2.120 resistance. The price surpassed the 50% Fib retracement level of the downward wave from the $2.365 swing high to the $1.90 low. However, the bears are now active near the $2.250 resistance zone.

The price is now trading above $2.150 and the 100-hourly Simple Moving Average. There is also a short-term bullish trend line forming with support at $2.188 on the hourly chart of the XRP/USD pair.

On the upside, the price might face resistance near the $2.250 level. It is near the 76.4% Fib retracement level of the downward wave from the $2.365 swing high to the $1.90 low. The first major resistance is near the $2.3650 level.

The next resistance is $2.450. A clear move above the $2.450 resistance might send the price toward the $2.50 resistance. Any more gains might send the price toward the $2.550 resistance or even $2.650 in the near term. The next major hurdle for the bulls might be $2.80.

Another Decline?

If XRP fails to clear the $2.250 resistance zone, it could start another decline. Initial support on the downside is near the $2.1880 level and the trend line. The next major support is near the $2.120 level.

If there is a downside break and a close below the $2.120 level, the price might continue to decline toward the $2.050 support. The next major support sits near the $2.00 zone.

Technical Indicators

Hourly MACD – The MACD for XRP/USD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for XRP/USD is now above the 50 level.

Major Support Levels – $2.180 and $2.120.

Major Resistance Levels – $2.250 and $2.350.

Market

Aave Horizon RWA Product To Unlock Trillions in Tokenized Assets

Horizon, an initiative by Aave Labs, proposed a new financial product to bring real-world assets (RWAs) into decentralized finance (DeFi) under a regulatory framework.

The initiative is expected to generate new revenue streams for the Aave DAO, accelerate GHO adoption, and strengthen Aave’s role as a key player in the growing tokenized asset space. Amid accelerating institutional adoption, projections suggest that RWAs on blockchain networks could reach $16 trillion over the next decade.

Horizon Proposes RWA Product as Licensed Instance of Aave Protocol

In a press release shared with BeInCrypto, Aave Labs’ Horizon proposed launching an RWA product as a licensed instance of the Aave Protocol. This initiative aims to enable institutions to use tokenized money market funds (MMFs) as collateral to borrow stablecoins like USDC and Aave’s GHO.

The move is expected to unlock liquidity for stablecoins and expand institutional access to DeFi. Specifically, it would make DeFi more accessible to regulated financial entities while benefiting the Aave ecosystem.

The interest comes amid growing demand for tokenized real-world assets. Blockchain technology enhances liquidity, reduces costs, and enables programmable transactions.

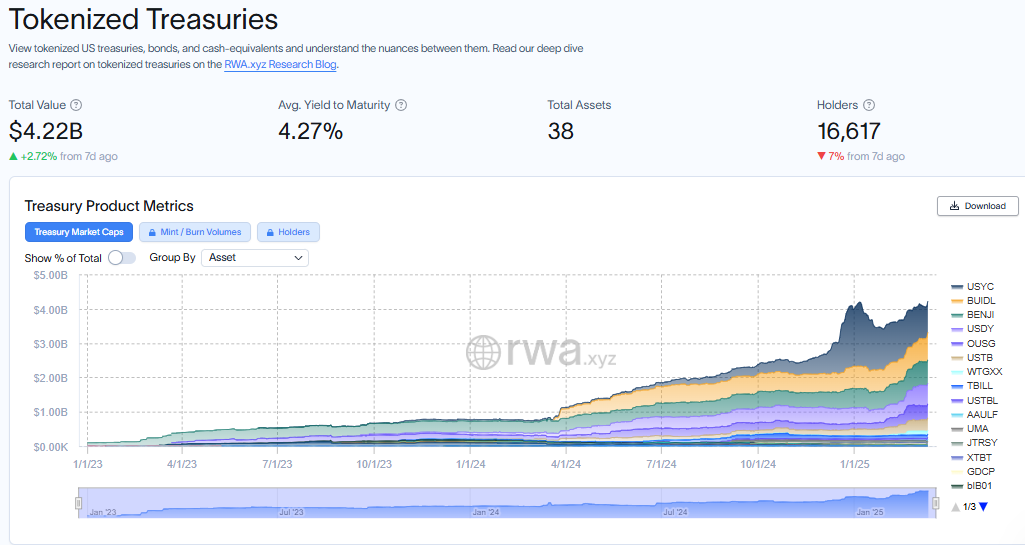

Furthermore, tokenization on blockchain has made traditional assets more accessible on-chain, with tokenized US Treasuries growing by 408% year-over-year to reach $4 billion.

Subject to approval by the Aave DAO, Horizon’s RWA product will initially launch as a licensed instance of Aave V3. Later, it would transition to a custom deployment of Aave V4 when it becomes available. Horizon has proposed a structured profit-sharing mechanism to ensure long-term alignment with the Aave DAO.

“…a 50% revenue share to Aave DAO in Year 1, alongside strategic incentives to drive ecosystem growth,” Horizon told BeInCrypto.

Additionally, if Horizon launches its token, 15% of its supply will be allocated to the Aave DAO treasury and ecosystem incentives. A portion will also be set aside for staked AAVE holders.

Meanwhile, the rise of RWAs is transforming the financial playing field, and institutions are taking note. Tokenized assets are emerging as a bridge between traditional finance (TradFi) and DeFi, providing investors new opportunities to access yield-bearing assets. Key players include BlackRock (BUILD), Franklin Templeton, and Grayscale.

Institutions To Access Regulated But Permissionless Stablecoin Liquidity

However, DeFi’s open and permissionless nature poses regulatory challenges. It lacks the compliance frameworks required for large-scale institutional participation.

Institutional adoption remains limited without tailored solutions, and integrating RWAs into DeFi at scale remains a significant challenge.

Horizon seeks to bridge this gap by allowing institutions to access permissionless stablecoin liquidity. It will also meet the compliance and risk management requirements of asset issuers.

Tokenized asset issuers can enforce transfer restrictions and maintain asset-level controls. According to the announcement, this would ensure only qualified users can borrow USDC and GHO.

“…separate GHO Facilitator will enable GHO minting with RWA collateral, offering predictable borrowing rates optimized for institutions. This enhances security, scalability, and institutional adoption of RWAs in DeFi,” Horizon added.

The proposed product builds on the institutional framework established by Aave Arc. To ensure a smooth integration, Horizon will implement a permissioned token supply. It will also feature withdrawal mechanisms, stablecoin borrowing for qualified users, and permissioned liquidation workflows.

The initiative is expected to enhance the security, scalability, and institutional adoption of RWAs within DeFi.

However, despite Aave’s permissionless design being one of its greatest strengths, integrating RWAs presents challenges beyond smart contract development.

A licensed instance of Aave’s protocol will require an off-chain legal structure, regulatory coordination, and active supervision. It is imperative to note that the Aave DAO is not designed to handle these functions independently.

Operationally, the Aave DAO and its service providers will oversee the functionality of Horizon’s RWA product. However, Horizon will retain independence in configuring the instance and steering its strategic direction.

The proposal now calls on the Aave DAO to approve Horizon’s RWA product as the protocol’s licensed instance.

The next steps involve refining the proposal with the Aave community and service providers. If there is a consensus on moving forward, the proposal will proceed to a Snapshot vote.

If the vote is in favor, the proposal will advance to the final governance stage for approval.

BeInCrypto data shows that the AAVE price was trading at $173.44 as of this writing, down by 0.24% since Thursday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana Hit by Bearish Signal After 3 Years, Price at Risk

Solana (SOL) has faced significant price challenges in recent weeks, with a notable drawdown that has left it struggling to recover.

This decline has triggered concerns in the market, further compounded by a key bearish signal. There is a rising concern among investors that these factors could lead to even more bearishness in the short term.

Solana Faces Strong Bearishness

Solana’s price has slipped below the realized price for the first time in almost 3 years. The realized price is a key metric that represents the average price at which an asset was last moved. When the spot price falls below this, it signals that the holders of Solana are collectively experiencing net unrealized losses.

This situation is often considered a bearish signal, as it suggests that investors are sitting on losses, which may prompt some to sell in an attempt to avoid further declines. As a result, the potential for panic selling increases when the price trades below the realized price.

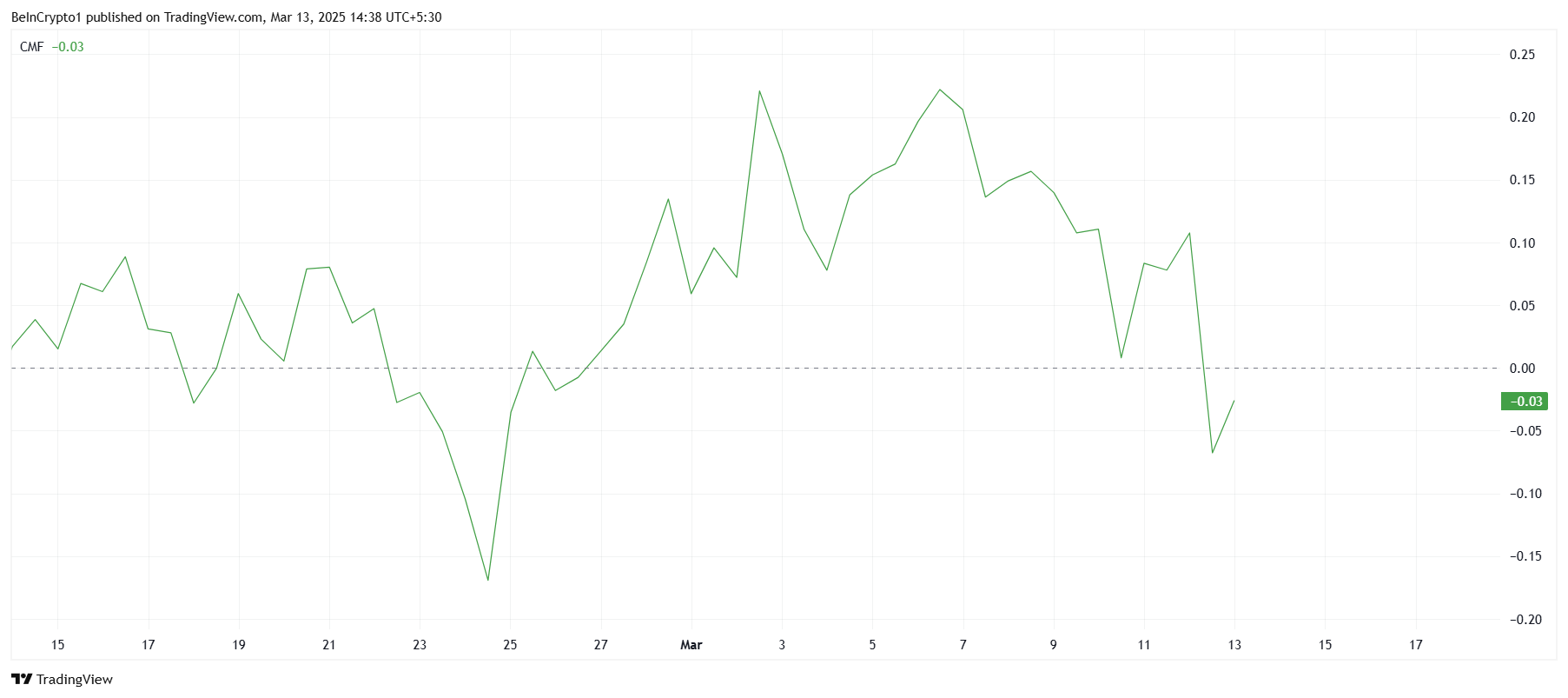

On a broader scale, Solana is also experiencing weak macro momentum, highlighted by the technical indicators. The Chaikin Money Flow (CMF), which measures the volume-weighted flow of money into and out of an asset, has noted a sharp downtick. The CMF is currently below the zero line, indicating that outflows are dominating inflows.

As the CMF remains negative, it suggests that Solana’s price recovery could be hindered. The lack of buying interest and the dominance of selling activity are likely to limit any significant upward movement.

SOL Price Is Vulnerable To A Decline

Solana’s price has been down nearly 30% over the last ten days, and it is currently trading at $125, just under the critical $126 resistance level. Despite recently bouncing off the support at $118, the overall sentiment and market conditions suggest that recovery may be short-lived. The price remains under pressure, with further declines possible if key levels fail to hold.

If Solana fails to secure $126 as support, the altcoin could drop back to $118 or even lower, possibly reaching $109. This scenario would reinforce the bearish outlook and prolong the struggle for recovery. Without a strong rally, Solana could face more losses in the short term.

However, if Solana manages to breach and flip $126 into support, it could trigger a bounce toward $133, followed by potential resistance at $143. A successful breach of $143 would invalidate the current bearish thesis and signal a more strong recovery. If this occurs, Solana could regain some of the losses it has recently suffered, offering hope for investors.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

This Crypto Analyst Correctly Predicted XRP Price Crash Below $2, Here’s The Rest Of The Forecast

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A new XRP price forecast has emerged, offering insights into the cryptocurrency’s next bearish move. A crypto analyst who previously predicted XRP‘s crash below $2 has provided a more comprehensive outlook, outlining key support and resistance areas that will determine XRP’s next target.

According to TradingView crypto analyst, ‘MMBTrader,’ the XRP price is set to dump below the $2 threshold. As of writing, CoinMarketCap reports that XRP is trading at $2.2, reflecting a modest 3% increase in value in the last 24 hours.

XRP Price Projected To Crash To $1.5

Related Reading

The TradingView crypto expert has identified a Head and Shoulder pattern on the XRP daily chart, consisting of three peaks: left shoulder, head, and right shoulder. Typically, a classic Head and Shoulder pattern is considered one of the most common indicators of a potential price breakdown, with the price of a cryptocurrency expected to reverse from bullish to bearish.

Looking at the price chart, a break below the pattern’s neckline around the $1.95 price point would confirm XRP’s bearish position. If the cryptocurrency fails to hold the $1.95 support level, a sharp drop, possibly up to 50%, is expected. This massive crash would effectively place the price around the $1.5 level or even as low as $1.2.

While he expects a possible crash to $1.5, MMBTrader also projects an alternative bullish scenario in which the XRP price initiates a strong rebound. The analyst revealed that if the cryptocurrency consolidates near $2 without breaking lower, then a bounce to new highs could follow.

Additionally, the TradingView expert believes that the asset could also experience a significant rally toward $5 after its projected 50% price crash. He highlights that if XRP can hold the support level near $1.5, then a strong reversal could occur, potentially triggering a bullish move between $4 and $4.5.

Whales Scoop Up $385 Million Amid Market Downtrend

While XRP experiences slow momentum due to the market’s recent decline, whales are seizing the opportunity to buy the dip, accumulating a significant amount of the token. According to crypto analyst Brett, an XRP whale has executed a large-scale transaction, buying over 167 million XRP, valued at $368.4 million, in a single purchase.

Related Reading

Brett revealed that this whale purchase was made as the market panicked over increasing volatility and price declines. Over the past few weeks, XRP has struggled to recover from bearish trends, joining the ranks of top cryptocurrencies like Bitcoin and Ethereum, which recorded a major price crash earlier in February.

CoinMarketCap’s data shows that the the altcoin’s price has fallen by 11.6% in just one week. This decline comes as the broader crypto market faces massive liquidations totaling hundreds of millions of dollars.

Featured image from Adobe Stock, chart from Tradingview.com

-

Altcoin23 hours ago

Altcoin23 hours agoHere Are The Possible Outcomes of the Ripple vs SEC Case

-

Market23 hours ago

Market23 hours agoBinance Receives a Record $2 Billion Investment from Abu Dhabi

-

Market24 hours ago

Market24 hours agoAI Agents Thrive Without Crypto: Tokenization Not Required

-

Altcoin20 hours ago

Altcoin20 hours agoAnalyst Reveals When The XRP Price Will Hit Double & Triple Digits

-

Market21 hours ago

Market21 hours agoADA Long-Term Holders Show Confidence Amid 22% Price Decline

-

Market20 hours ago

Market20 hours agoEthereum Price Below $2,000 Triggers Bullish Signal After 2 Years

-

Altcoin14 hours ago

Altcoin14 hours agoSolana Price At Risk As Alameda Unstakes $23 Million SOL

-

Market19 hours ago

Market19 hours agoWhy Bitcoin Reserve Bills Fail: VeChain Executive Weighs In