Market

Bitcoin Price Recovery Possible Above $85K—Will Bulls Step In?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

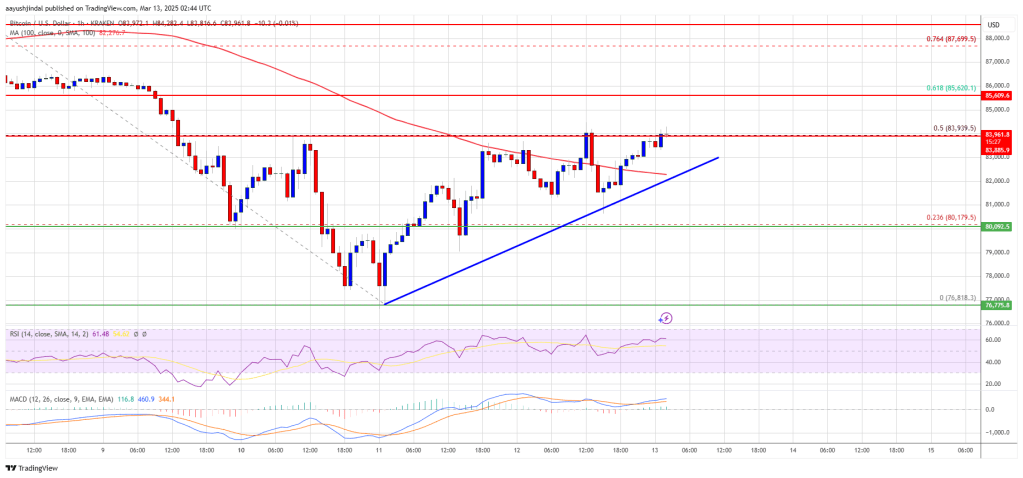

Bitcoin price started a recovery wave above the $80,000 zone. BTC is now rising and might aim for a move above the $84,000 and $85,000 levels.

- Bitcoin started a decent recovery wave above the $80,000 zone.

- The price is trading above $82,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $82,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $84,000 and $85,000 levels.

Bitcoin Price Eyes Breakout

Bitcoin price remained strong above the $78,000 level. BTC formed a base and recently started a recovery wave above the $80,000 resistance level.

The bulls pushed the price above the $82,000 resistance level. The price surpassed the 23.6% Fib retracement level of the downward wave from the $91,060 swing high to the $76,820 low. However, the bears are now active near the $84,000 resistance zone.

Bitcoin price is now trading above $82,000 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $82,000 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $84,000 level and the 50% Fib retracement level of the downward wave from the $91,060 swing high to the $76,820 low. The first key resistance is near the $85,000 level. The next key resistance could be $85,650.

A close above the $85,650 resistance might send the price further higher. In the stated case, the price could rise and test the $86,500 resistance level. Any more gains might send the price toward the $88,000 level or even $96,200.

Another Drop In BTC?

If Bitcoin fails to rise above the $84,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $82,000 level and the trend line. The first major support is near the $81,200 level.

The next support is now near the $80,000 zone. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $76,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $82,000, followed by $81,200.

Major Resistance Levels – $84,000 and $85,000.

Market

Bitcoin Pepe momentum gains steam as crypto market crashes

US inflation eased in February for the first time in four months; an aspect that has aided the much-awaited crypto recovery. Even so, most cryptocurrencies, including majors like Bitcoin, remain under selling pressure amid tariff jitters. The hype surrounding meme coins has also slowed in recent months with several recording double-digit losses.

However, revolutionary projects like Bitcoin Pepe continue to capture the attention of savvy investors worldwide. Less than a month since the launch of its presale, the crypto has sold out its initial five stages as meme coin lovers and Bitcoin enthusiasts alike rush to amass BPEP tokens at an affordable rate.

Pepe readies for a breakout as inflation data bolsters crypto recovery

Since early December 2024 when it hit its all-time high, Pepe has plunged by about 74%. Indeed, this is not an isolated case as some major meme coins like Dogecoin, Shiba Inu, and Popcat have also recorded double-digit losses during the same timeframe.

A look at Pepe’s daily price chart indicates that the crypto may successfully stage a breakout in the ensuing days or weeks. Earlier in the week, the meme coin hit its lowest level in over a year at $0.000005228 as the sell-off continued to weigh on cryptocurrencies. It has since rebounded to $0.000007130 as at the time of writing.

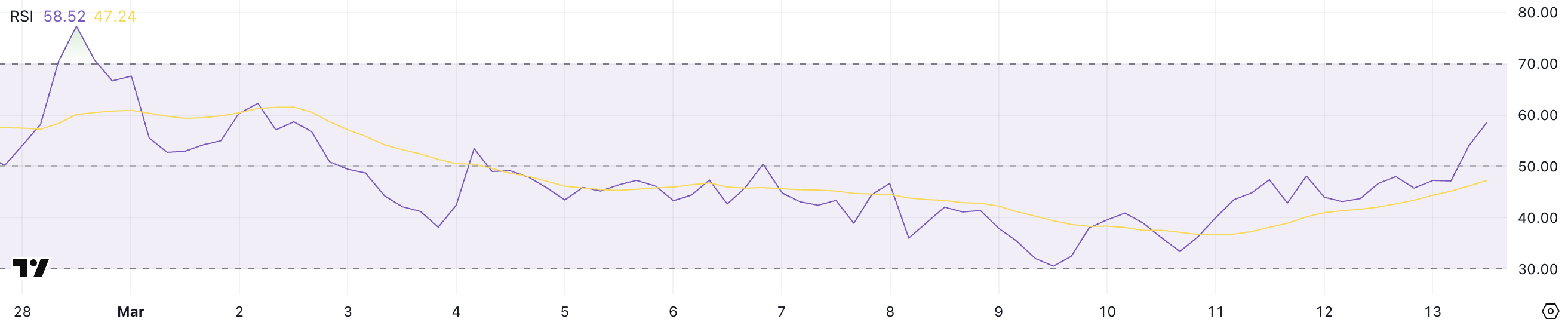

While it is still trading below the 25 and 50-day EMAs, its RSI indicator is facing upwards. Besides, the encouraging US CPI data released on Wednesday has contributed to the observed crypto recovery.

According to Labor Department, the country’s inflation has eased for the first time in four months; slowing beyond expectations in February. The headline CPI dropped to 2.8% from 3% while core inflation was down from 3.3% to 3.2%.

In the short term, the range between the support zone of $0.000005580 and the resistance level of $0.000009246 will be worth watching. Notably, the crypto may face some resistance along the 25-day EMA at $0.000007890 before gathering enough bullish momentum to rebound further.

Bitcoin Pepe’s potential to sustain its momentum growth

The hype surrounding meme coins has cooled in recent months as the bitcoin season persists. Even so, savvy investors are still on the look out for revolutionary projects with huge growth potential. Indeed, it is Bitcoin Pepe’s uniqueness and potential that has attracted a large number of investors in such a short period.

In less than a month, the project has already sold out its initial five stages and has raised over $4.6 million. As its momentum builds steadily, Bitcoin Pepe has secured its position as one of the ICOs crushing it in 2025.

Its vision of building Solana on Bitcoin is seen to be the network’s missing puzzle and investors are rushing to amass some BPEP tokens at an affordable price. Its Layer-2 solution creates an ideal meme trading platform that assures speed and security.

Besides, its pricing model favors long-term holders and early adopters. At the current stage 6, the initial investors have already secured gains of 27.6%. By the end of the 30 stages, their capital investment will have earned cumulative gains of 311.4%. As such, this is the opportune time for savvy investors to board this highly profitable bandwagon. Hurry up and buy Bitcoin Pepe here.

Shift in market sentiment to offer Bitcoin price another chance at retesting crucial zone

The crypto fear & greed index still exudes fear as the selling pressure continues to shape the sector. However, Bitcoin price appears to be finding its floor as the market reacts to the positive US inflation data.

A look at its daily chart indicates that the crypto is still trading below the 25 and 50-day EMAs; a sign that it is not out of the woods yet.

In the short term, the range between the support zone of $80,525 and the 25-day EMA at $88,096 will be worth watching. A shift in the market sentiment may have the bulls break that resistance for a chance to rebound past the crucial zone of $90,000. More specifically, the target will be along the 50-day EMA at $91,498.

Market

Stellar (XLM) Jumps 10% as Bulls Take Charge: What’s Next?

Stellar (XLM) has surged more than 10% in the last 24 hours, attempting to recover from a 15% correction over the past month. Despite this rebound, XLM’s trend remains at an important point, with its market cap now standing at $8.6 billion.

Technical indicators show that buying pressure has increased significantly, with DMI and CMF both pointing to growing accumulation. However, XLM still faces key resistance levels, and whether it can sustain this momentum will determine if the price can break above $0.35 or if further consolidation is ahead.

XLM Chart Shows Buyers Are Now In Control

Stellar’s DMI chart shows that its Average Directional Index (ADX) has dropped to 28.7, down from 35.6 two days ago. ADX is a key indicator that measures the strength of a trend, regardless of direction, with values above 25 typically signaling a strong trend and values below 20 suggesting a weak or consolidating market.

A declining ADX, even while the price moves in a certain direction, indicates that the strength of the trend is fading.

In this case, the drop from 35.6 to 28.7 suggests that Stellar’s bearish trend is weakening, creating an opportunity for a possible shift in momentum.

Looking at the Directional Indicators, +DI has surged to 31.2 from 8, while -DI has dropped to 16.4 from 30.7. This major shift in buying and selling pressure suggests that bulls have regained control after a period of strong selling.

Since Stellar is attempting to transition from a downtrend into an uptrend, this increase in +DI is a positive signal. However, for the new trend to gain strength, ADX would need to stabilize and turn upward, confirming growing momentum.

If ADX continues declining, XLM could consolidate before making a decisive move, but if it rises alongside +DI, it will reinforce a stronger breakout to the upside.

XLM CMF Has Surged Since March 10

Stellar’s Chaikin Money Flow (CMF) indicator has risen to 0.13, recovering from -0.14 just three days ago, after briefly peaking at 0.18 a few hours ago. CMF measures buying and selling pressure by analyzing both price movement and volume on a scale from -1 to 1.

A positive CMF value suggests that buying pressure is dominant, while a negative reading indicates stronger selling activity.

Generally, values above 0.05 signal accumulation, whereas values below -0.05 indicate distribution, making CMF a useful tool for assessing whether capital is flowing into or out of an asset.

With Stellar’s CMF now at 0.13, buying pressure has clearly strengthened, reversing the prior bearish trend seen when CMF was negative.

This shift suggests that investors have been accumulating XLM over the past few days, supporting its recent price recovery. However, since CMF peaked at 0.18 before slightly declining, some short-term profit-taking may have occurred.

If CMF remains in positive territory and trends higher again, it will reinforce further upside potential, but if it starts dropping back toward negative values, it could signal weakening demand and a possible price pullback.

Will Stellar Surpass $0.35 In March?

Stellar’s EMA lines still indicate a bearish trend, with short-term EMAs positioned below the long-term ones. However, the recent upward movement in short-term EMAs suggests that momentum could be shifting, increasing the chances of a trend reversal.

If buying pressure continues, Stellar’s price could rise to test the resistance at $0.309, a key level that would determine whether the recovery can sustain itself.

A breakout above this resistance could fuel further upside, potentially pushing XLM toward $0.349. A stronger uptrend could lead to a rally toward $0.375.

On the downside, if the short-term recovery loses strength and buyers fail to establish an uptrend, Stellar could face renewed selling pressure.

In this scenario, the first key support level to watch would be $0.273, which has acted as a critical zone in previous price action. A breakdown below this level could expose XLM to further losses, with support at $0.252 as the next major level.

If bearish momentum intensifies, the price could decline further, potentially reaching $0.226, marking a deeper correction before any potential reversal.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PENGU and PNUT Still Bearish After Robinhood Listing

Meme coins have struggled to regain momentum despite the recent listing of PENGU and PNUT on Robinhood. While these tokens were expected to surge, their price action has remained subdued, reflecting broader skepticism in the market, especially around meme coins.

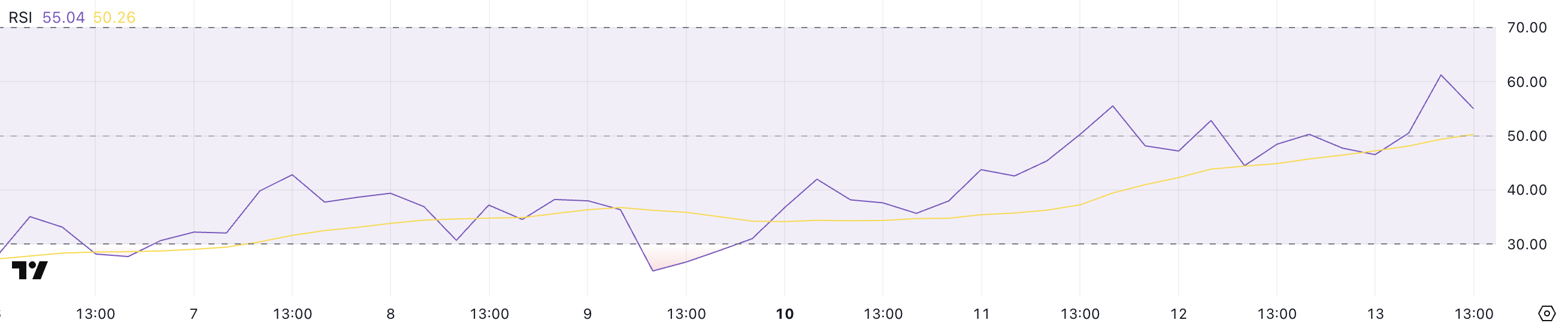

However, their RSI levels indicate room for further growth if buying pressure increases and meme coin sentiment improves. If momentum recovers, both PENGU and PNUT could test key resistance levels, potentially reversing their recent downtrends.

PENGU Has Been Trading In All-Time Lows

PENGU, an NFT token on Solana, has lost nearly 80% of its value in the past two months, with its market cap now at $400 million.

Today’s Robinhood listing saw the token surge by 6%, but technical indicators show it still lacks momentum for a strong recovery.

Its RSI has climbed to 55 from 25 in just four days, indicating increased buying interest.

However, even with the listing, PENGU has yet to see a major rally, as meme coins and NFT tokens face skepticism in the current market.

PENGU’s EMA lines still indicate a bearish trend, but the upward movement in short-term EMAs suggests a possible shift.

If momentum builds, the token could test resistance at $0.0069, with a breakout opening the door for a move toward $0.0075 and $0.0093, breaking above $0.0090 for the first time since March 2.

However, if the downtrend resumes and PENGU loses support at $0.0059, selling pressure could push it as low as $0.0050, marking new lows.

PNUT Is Currently Attempting A Recovery In The Last Few Days

PNUT has been one of the struggling meme coins in recent months, with its price dropping 35% in the last 15 days. However, its RSI has been steadily rising, jumping from 33.4 on March 10 to 58.5 now.

This shift suggests that buying pressure has increased, potentially signaling a short-term recovery. If RSI continues to rise and crosses 60, it could strengthen bullish sentiment, pushing PNUT toward key resistance levels.

Despite this momentum, PNUT’s EMA lines still suggest a bearish trend, as short-term EMAs remain below long-term ones. However, the short-term lines are moving upward, hinting at a possible trend reversal.

If these EMAs form a golden cross, PNUT could gain enough strength to test resistance at $0.211. A breakout above this level could lead to further gains, with the next targets at $0.25 and potentially $0.309.

On the downside, if the current uptrend fails to hold, PNUT could face renewed selling pressure. The key support level to watch is $0.144, which has previously held price declines.

If this level is lost, PNUT could drop further to $0.133, marking new lows and reinforcing the bearish structure.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Bitcoin15 hours ago

Bitcoin15 hours agoUS Strategic Bitcoin Reserve Sparks Crypto Regulation Surge

-

Market13 hours ago

Market13 hours agoPEPE Whales Propel 11% Rally, Fueling Market Optimism

-

Market19 hours ago

Market19 hours agoSolana (SOL) Faces Many Challenges—Can Bulls Hold the Line?

-

Market22 hours ago

Market22 hours agoOndo Finance (ONDO) Bulls Push for a Breakout Above $1

-

Market11 hours ago

Market11 hours agoSolana Hit by Bearish Signal After 3 Years, Price at Risk

-

Market16 hours ago

Market16 hours agoXRP Bulls Ready to Charge—Upside Break May Spark Rally

-

Altcoin16 hours ago

Altcoin16 hours agoChainlink Whale Sells 356K Coins Sparking Concerns; Can LINK Price Hit $45?

-

Market24 hours ago

Market24 hours ago3 AI Coins Smart Wallets Are Buying: VIRTUAL, GROKCOIN, ARC