Market

Ethereum Price Below $2,000 Triggers Bullish Signal After 2 Years

Ethereum (ETH) has seen a significant decline in price, falling from $2,800 to around $1,900 in recent weeks. This drop has triggered a major bearish signal, the first of its kind in two years.

However, the current price action may also suggest that recovery could be on the horizon.

Ethereum Has A Shot At Recovery

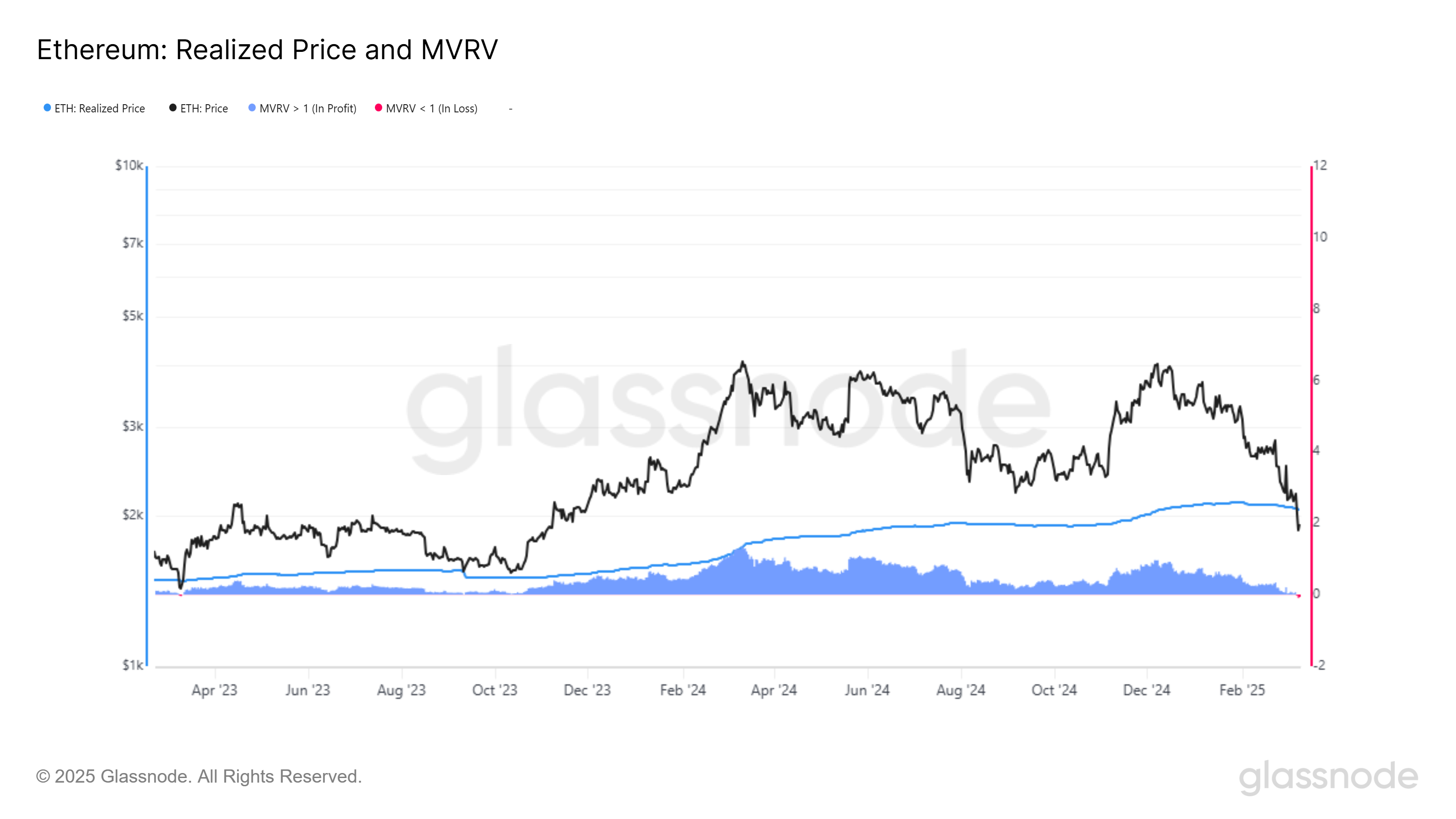

Ethereum’s price recently fell below the Realized Price for the first time in two years, a development that has sparked concern among some investors. This drop has caused the Market Value to Realized Value (MVRV) ratio to decline, indicating that investors are facing approximately 7% losses.

While this may appear bearish at first glance, it actually presents a potential bullish signal. The previous time Ethereum faced this situation, the altcoin rebounded strongly, and the MVRV ratio improved as the price recovered. This pattern has given some market participants hope that the current situation may lead to a similar recovery.

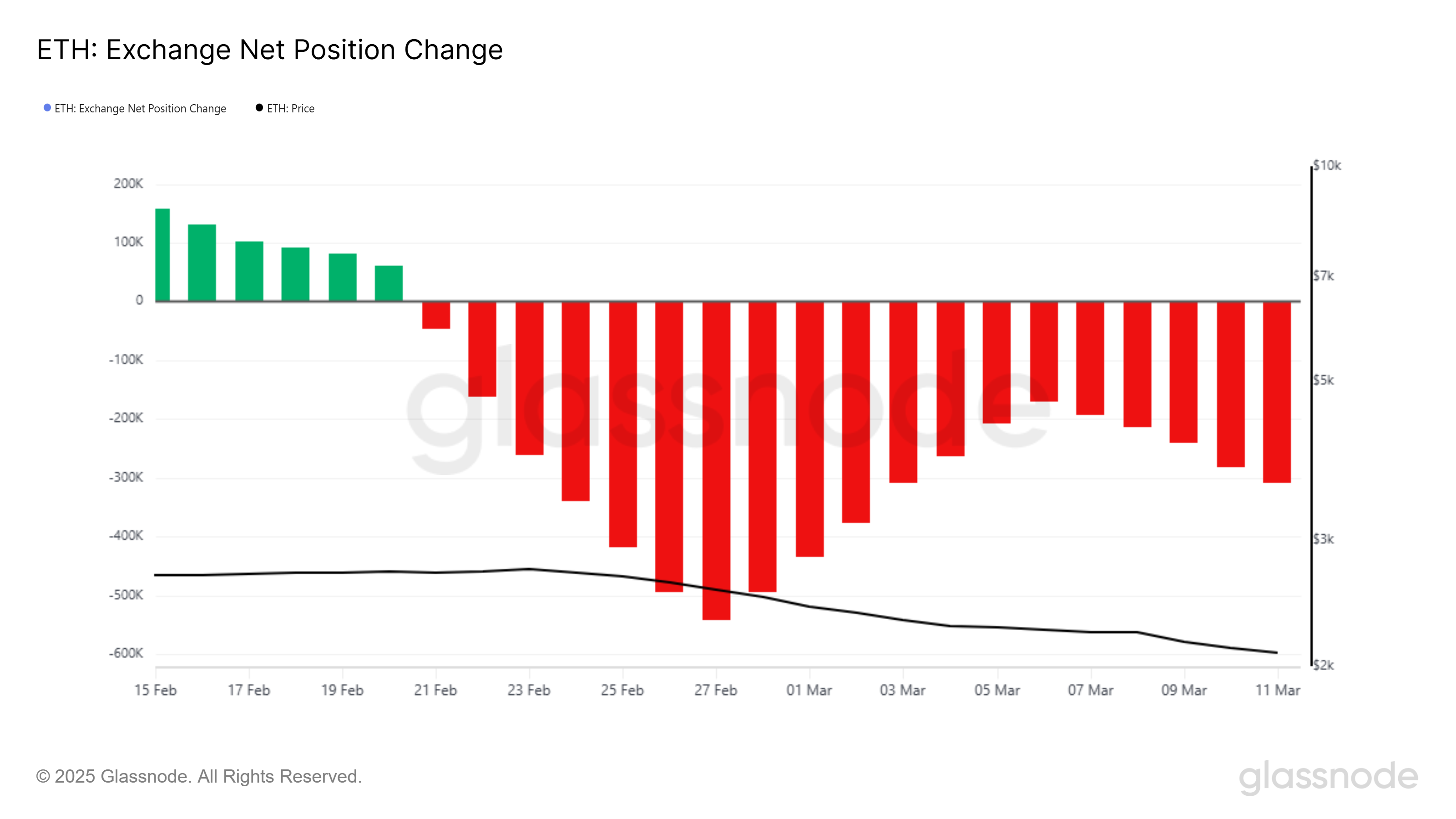

On the macro level, Ethereum’s overall momentum is showing signs of improvement despite the recent downturn. The Exchange Net Position Change, which tracks the flow of ETH into and out of exchanges, has been declining.

This indicates that investors are accumulating Ethereum rather than selling it, which is a positive sign. Investors see the current low prices as an opportunity to buy, anticipating a future price increase.

This shift in investor behavior is reflected in the purchase of 138,000 ETH worth approximately $262 million this week. The inflow of capital into Ethereum supports the idea that many investors are positioning themselves for a rebound.

ETH Price Eyes A Rally

Ethereum is currently trading at $1,897, down 32% over the last two weeks. The altcoin is holding above the support level of $1,862, which could act as a foundation for a potential bounceback. If Ethereum maintains this level, it may find its way to higher prices in the coming weeks.

For Ethereum to confirm a recovery, it must breach and flip $2,141 into support. This level is critical for ETH to move toward $2,344 and secure a more sustained upward movement. The factors discussed, including the RSI recovery and investor accumulation, are likely to contribute to Ethereum’s ability to reach this target.

However, if broader market conditions worsen, Ethereum could fall below the $1,862 support, pushing the price to $1,745 or even $1,625. A drop to these levels would invalidate the bullish outlook and suggest further downside potential.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hyperliquid (HYPE) Hits 3-Month Lows Despite High Revenue

Hyperliquid is one of the most profitable platforms in crypto right now, yet its price has been struggling, dropping over 8% in the last 24 hours and more than 24% in the past seven days. Despite its strong fundamentals, bearish momentum has kept HYPE at its lowest levels since December 2024.

However, the network’s rising revenue has outpaced Solana, Ethereum, and Raydium. This suggests underlying strength that could fuel a rebound if market conditions shift. If HYPE breaks resistance at $14.65, it could trigger a rally toward $20 or even $25.87, but failure to reclaim momentum could send it below $12.

Hyperliquid RSI Has Been Neutral Since March 4

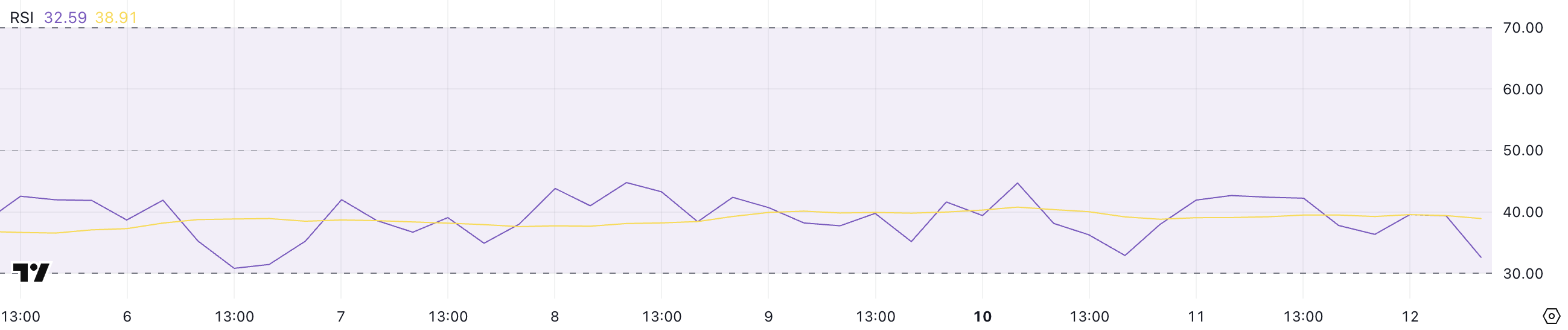

Hyperliquid’s RSI (Relative Strength Index) is currently at 32.59, remaining in neutral territory since March 4. Suspicious high-leverage trades are raising money laundering concerns, leading to the ongoing correction.

The RSI is a momentum oscillator that measures the speed and change of price movements on a scale from 0 to 100, with values above 70 indicating overbought conditions and below 30 signaling oversold conditions.

An RSI between 30 and 50 suggests weak momentum, often aligning with a downtrend or consolidation phase.

HYPE’s RSI has now stayed below 50 for nine consecutive days, reinforcing the lack of bullish momentum. With the current reading at 32.59, the asset is approaching oversold territory but hasn’t yet reached extreme levels.

This suggests that selling pressure remains dominant, but if RSI turns upward and crosses 50, it could signal the start of a stronger recovery.

Until then, Hyperliquid remains in a weak position, with price action struggling to gain upward traction.

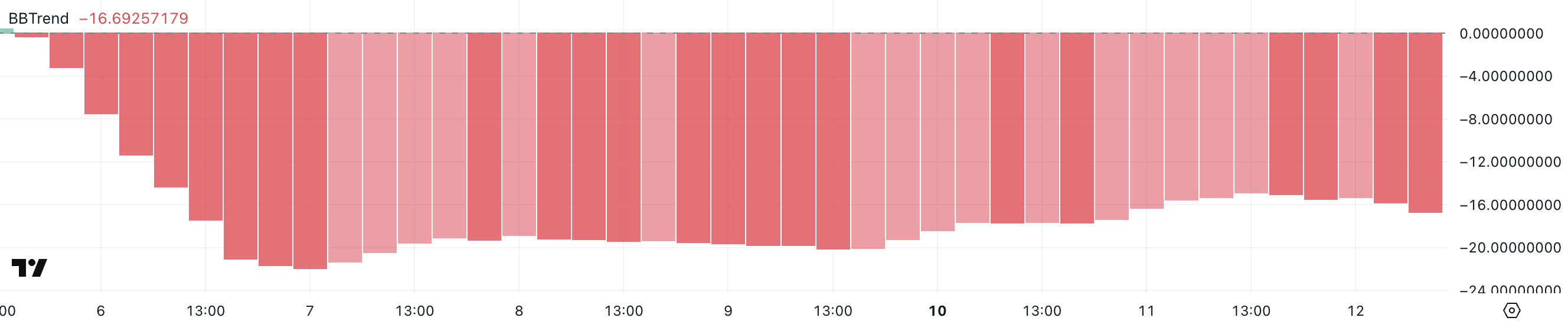

HYPE BBTrend Has Been Negative For One Week

Hyperliquid’s BBTrend is currently at -16.69, remaining negative since March 5 and staying below -10 for the past six days.

BBTrend (Bollinger Band Trend) is an indicator that measures price momentum relative to Bollinger Bands, helping identify bullish or bearish trends.

Values above 10 indicate strong upward momentum, while values below -10 suggest strong downward pressure.

With HYPE BBTrend at -16.69, the bearish trend remains dominant, reinforcing the recent selling pressure.

Staying below -10 for several days suggests that downside momentum has been persistent, limiting any significant recovery attempts.

If the BBTrend starts moving toward 0, it could indicate a weakening downtrend, but for now, Hyperliquid remains in a clearly bearish phase.

Can HYPE Reclaim $20 In March?

Hyperliquid is currently trading at its lowest levels since December 2024, with its EMA lines signaling a strong bearish sentiment.

Short-term EMAs remain well below long-term ones, with large gaps between them indicating strong downside momentum. If the correction continues, HYPE could drop below $12, marking its lowest price in over three months.

However, Hyperliquid revenue has surged past $11 million in the last seven days, outperforming major players like Pump, Solana, Ethereum, and Raydium.

If momentum returns, HYPE could test the $14.65 resistance, with a potential rally toward $17 if broken. A stronger uptrend could push the price above $20, potentially testing $21 and even $25.87 in the coming days.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin Price Recovery Possible Above $85K—Will Bulls Step In?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

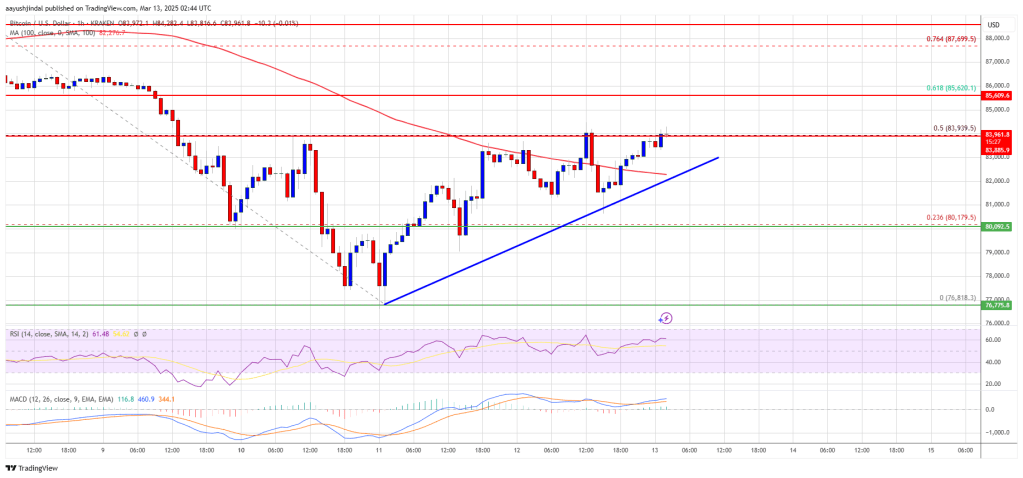

Bitcoin price started a recovery wave above the $80,000 zone. BTC is now rising and might aim for a move above the $84,000 and $85,000 levels.

- Bitcoin started a decent recovery wave above the $80,000 zone.

- The price is trading above $82,000 and the 100 hourly Simple moving average.

- There is a connecting bullish trend line forming with support at $82,000 on the hourly chart of the BTC/USD pair (data feed from Kraken).

- The pair could start another increase if it clears the $84,000 and $85,000 levels.

Bitcoin Price Eyes Breakout

Bitcoin price remained strong above the $78,000 level. BTC formed a base and recently started a recovery wave above the $80,000 resistance level.

The bulls pushed the price above the $82,000 resistance level. The price surpassed the 23.6% Fib retracement level of the downward wave from the $91,060 swing high to the $76,820 low. However, the bears are now active near the $84,000 resistance zone.

Bitcoin price is now trading above $82,000 and the 100 hourly Simple moving average. There is also a connecting bullish trend line forming with support at $82,000 on the hourly chart of the BTC/USD pair.

On the upside, immediate resistance is near the $84,000 level and the 50% Fib retracement level of the downward wave from the $91,060 swing high to the $76,820 low. The first key resistance is near the $85,000 level. The next key resistance could be $85,650.

A close above the $85,650 resistance might send the price further higher. In the stated case, the price could rise and test the $86,500 resistance level. Any more gains might send the price toward the $88,000 level or even $96,200.

Another Drop In BTC?

If Bitcoin fails to rise above the $84,000 resistance zone, it could start a fresh decline. Immediate support on the downside is near the $82,000 level and the trend line. The first major support is near the $81,200 level.

The next support is now near the $80,000 zone. Any more losses might send the price toward the $78,000 support in the near term. The main support sits at $76,500.

Technical indicators:

Hourly MACD – The MACD is now gaining pace in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for BTC/USD is now above the 50 level.

Major Support Levels – $82,000, followed by $81,200.

Major Resistance Levels – $84,000 and $85,000.

Market

Ondo Finance (ONDO) Bulls Push for a Breakout Above $1

Ondo Finance (ONDO) is up nearly 7% in the last 24 hours, attempting to reclaim a $3 billion market cap after a sharp 38% correction over the past 30 days. The recent price recovery suggests a potential trend shift, but key resistance levels must be broken for confirmation.

Indicators like the DMI and CMF show that selling pressure is fading while buying interest is increasing. If ONDO breaks past $0.90, it could rally toward $1.08 and even $1.20. However, failure to sustain momentum could lead to another drop below $0.70.

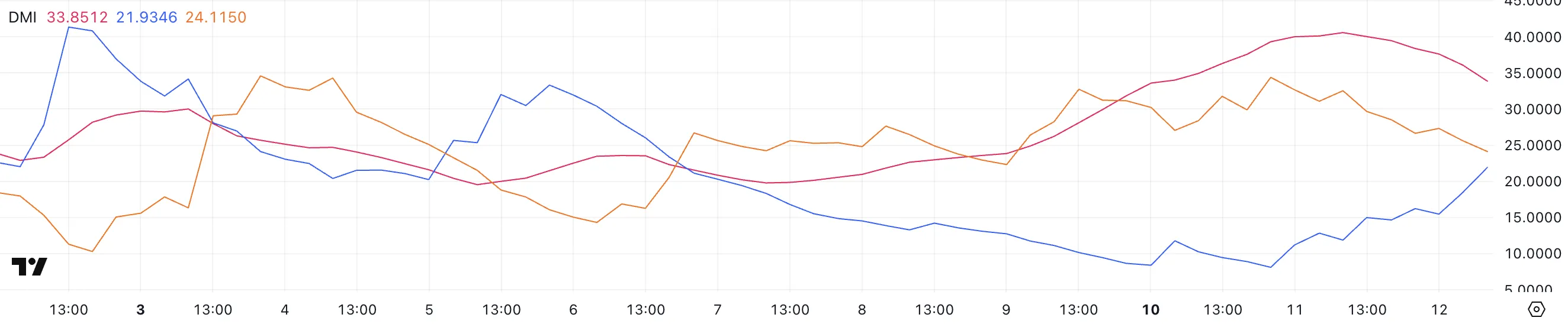

ONDO DMI Shows The Downtred Could Revert Soon

ONDO’s ADX is currently at 33.8, down from 40.5 yesterday. This indicates that while the downtrend remains strong, its intensity is starting to weaken.

The ADX (Average Directional Index) measures trend strength on a scale from 0 to 100, with values above 25 signaling a strong trend and values below 20 suggesting a weak or non-trending market.

Since Ondo Finance ADX is still well above 25, the bearish trend remains dominant, but the decline suggests that momentum could be slowing.

Meanwhile, the +DI has climbed to 21.9 from 11.18, while the -DI has dropped from 34.3 to 24.11, showing that selling pressure is fading while buying pressure is increasing.

However, since -DI remains slightly above +DI, the downtrend is still in place. If +DI continues rising and crosses above -DI, it could confirm a shift in momentum, potentially signaling a trend reversal.

Until then, Ondo Finance remains in a downtrend, but bulls are gaining ground.

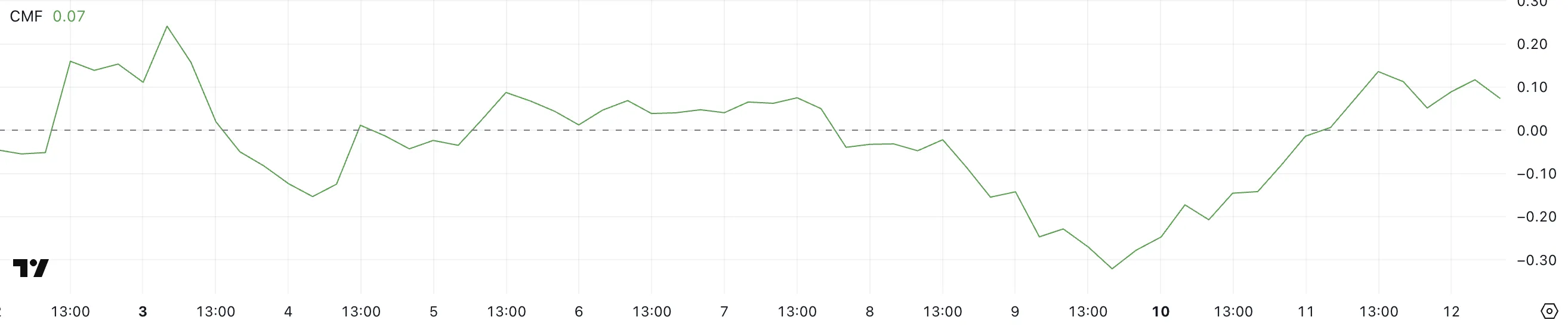

Ondo Finance CMF Surged In The Last Three Days

ONDO’s Chaikin Money Flow (CMF) is currently at 0.07, recovering from a negative low of -0.32 just three days ago.

The CMF measures buying and selling pressure by analyzing both price and volume, with values above 0 indicating accumulation (buying pressure) and values below 0 signaling distribution (selling pressure).

A CMF above 0.05 suggests growing bullish momentum, while prolonged negative readings often align with downtrends.

Ondo Finance CMF turned positive yesterday after spending two consecutive days in negative territory, signaling that buying pressure is increasing.

With CMF now at 0.07, capital inflows are returning, which could support further price recovery. However, since the value is still relatively low, sustained buying volume is needed to confirm a strong uptrend.

If CMF continues rising, it could indicate stronger accumulation, potentially leading to a breakout, establishing ONDO among the top Real-World Assets coins in the market.

Will ONDO Reclaim $1 Soon?

ONDO is currently recovering after dipping below $0.79 for the first time in months, following a broader correction across major RWA coins in the last 30 days.

The recent bounce suggests buyers are stepping in, but the trend remains uncertain, with key resistance levels ahead.

If it breaks above $0.90, it could continue rising toward $0.99, and a further breakout could send it to $1.08 or even $1.20.

However, if the uptrend fails and selling pressure returns, ONDO price could drop to $0.73, with the risk of falling below $0.70 for the first time since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Ethereum23 hours ago

Ethereum23 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Bitcoin23 hours ago

Bitcoin23 hours agoCrypto Market Recovers After Liquidations: Here’s Why

-

Market21 hours ago

Market21 hours agoPi Coin Centralization Raises Serious Questions About the Future

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Reveals Major Backing For These 5 Crypto, Prices To Rally?

-

Market22 hours ago

Market22 hours agoEthereum Price Recovery Capped—Bulls Struggle Near Resistance

-

Altcoin22 hours ago

Altcoin22 hours agoIs Pi Network Heading for Price Pegging? What Happens to Pi Coin Next?

-

Altcoin20 hours ago

Altcoin20 hours agoWill BlackRock XRP ETF Application Convince US SEC for Approval?