Altcoin

Analyst Reveals When The XRP Price Will Hit Double & Triple Digits

Crypto analyst Egrag Crypto has revealed when the XRP price will hit double and triple digits. This provides a bullish outlook for XRP especially amid the recent market crash and its brief drop below the psychological $2 price level.

When The XRP Price Will Hit Double & Triple Digits

In an X post, Egrag Crypto stated that the XRP price will hit double digits in this cycle and triple digits in the next cycle. for triple digits, his accompanying chart showed that XRP could reach as high as $110. Interestingly, crypto analyst Dark Defender also recently predicted that XRP could reach triple digits, although he provided a more bullish outlook for the crypto as he predicted that it could reach $333.

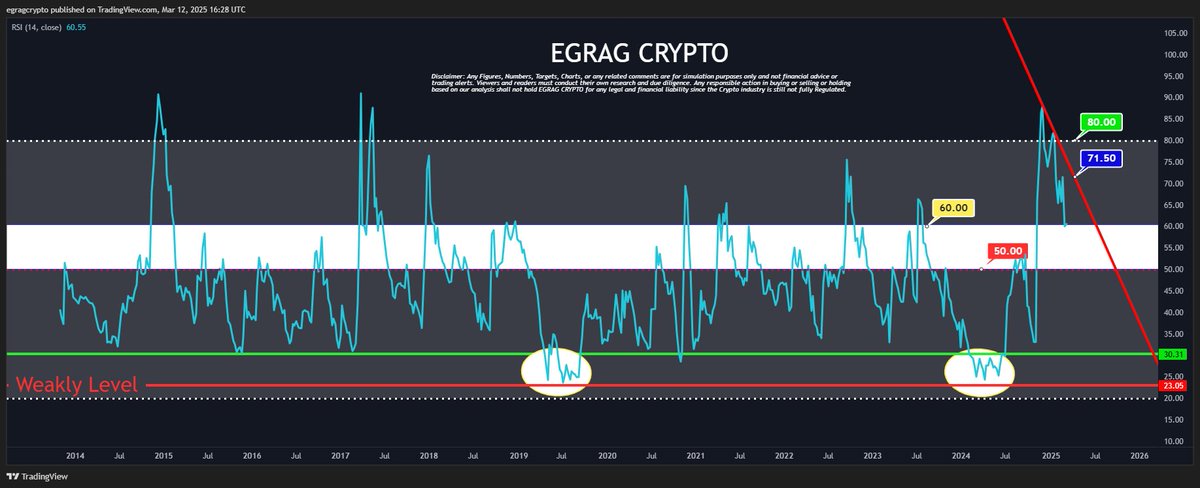

Meanwhile, in another X post, Egrag Crypto suggested that XRP’s recovery could be imminent. While analyzing the weekly Relative Strength Index (RSI), he stated that the crypto simply needs to cross 71.50 and then ‘kaboom,’ indicating a parabolic rally.

He noted that on the 60 level, XRP’s RSI is starting to kick upward. The analyst added that as the crypto builds strength from 60, it could easily climb back above 80. However, he remarked that it first needs to close above 71.50.

Crypto analyst Rose Premium also recently predicted that XRP could soon rally to as high as $3.35. The analyst stated that a bounce from the current support level of $2.12 could drive the crypto’s price towards key targets at $2.32, $2.61, $2.90 and then $3.35.

A Rally To $5 Is Also On The Cards In The Mid Term

Crypto analyst Dark Defender also indicated that an XRP price rally to 45 was also on the cards in the mid-term. This came as he highlighted this price level as one of the targets in his recent analysis.

He noted that XRP has finished the correction on the four-hour time frame. Analyzing the daily chart, he stated that XRP is expected to move towards $2.42 first considering the correction structures. He added that the real momentum will start after XRP stands above Ichimoku clouds.

The analyst highlighted $2.22 and $2.04 as the key support levels to watch out for. Meanwhile, he stated that the targets for XRP at the moment are $4.2932 and $5.8563.

It is worth mentioning that fundamentals such as the XRP ETFs and a potential Ripple SEC settlement provide a bullish outlook for the XRP price. Yesterday, asset manager Franklin Templeton filed the S-1 for its XRP ETF with the US SEC. Meanwhile, Journalist Eleanor Terrett recently reported that the SEC could soon close its case against Ripple.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Dogecoin Whales Accumulate Amid Price Crash, Analyst Reveals Catalyst That Could Drive DOGE To $0.5

Crypto analyst Lumen has revealed a significant accumulation trend among Dogecoin whales, which provides a bullish outlook for the DOGE price. The analyst also mentioned what could drive the meme coin’s price to $0.5, marking a bullish reversal for Dogecoin.

Dogecoin Whales Accumulate As Price Eyes Rally To $0.5

In an X post, Lumen revealed that Dogecoin whales accumulated 1.7 billion DOGE ($298 million) in 72 hours, which he noted signals bullish sentiment ahead of a potential Dogecoin ETF approval. These whales’ accumulation has come amid a massive price crash for Dogecoin, which has dropped 20% in a week, falling from around $0.22 to as low as $0.16.

Lumen then went on to give a price projection for the foremost meme coin. He stated that if DOGE reclaims $0.2 before the ETFs approval, there is a possibility that Dogecoin could rally to $0.5 because of the liquidity of ETFs. He added that the world’s richest man, Elon Musk, could also resume bull posting about DOGE as he had done before.

It is worth mentioning that the US Securities and Exchange Commission (SEC) recently postponed the approval process for Grayscale’s Dogecoin ETF, suggesting that the pending DOGE ETF applications are unlikely to be approved anytime soon. However, despite this development, crypto analyst Ali Martinez has predicted that DOGE could soon rebound.

The analyst stated that investor sentiment around Dogecoin is at its most negative in over a year. Martinez added that historically, extreme fear has set the stage for major reversals. In line with this, he remarked that this could be a prime opportunity to be a contrarian.

Current State For DOGE

Crypto analyst Kevin Capital provided insights into Dogecoin’s current price action. He stated that DOGE has had a back test of the macro 0.5 Fibonacci level. It has also back-tested macro trend lines, including the 200-week Simple Moving Average (SMA) and Exponential Moving Average (EMA). Meanwhile, the meme coin’s 3-day Relative Strength Index (RSI) is at historical lows.

The analyst stated that if the Bitcoin price holds up and macroeconomic data and monetary policy adjust, then this might be the last opportunity to buy DOGE relatively cheaply. He added that a lot of factors are at play and there is a lot of work to do but the risk reward at this level is “superb” given the circumstances.

Crypto analyst Trader Tardigrade also provided a bullish outlook for Dogecoin. He stated that DOGE is forming a 5-wave Ascending Broadening Wedge and is approaching a breakout on the 4-hour chart. The analyst added that after a confirmed RSI bullish divergence, DOGE bounced back to the descending line of the wedge, indicating that a reversal may be imminent.

At the time of writing, the DOGE price is trading at around $0.16, up over 2% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

Altcoin

Solana Price At Risk As Alameda Unstakes $23 Million SOL

Solana price could take a major hit after an Alameda address unstaked $23 million SOL in what appears to be an indicator for a potential selloff. On the technicals, Solana is inching toward a death cross for the third time in its history.

Alameda Unstakes 177,000 SOL Amid Distribution Spree

According to an Arkham post, an Alameda Research-associated address has unstaked $23 million SOL, distributing the funds to several addresses. On-chain data indicates that the Alameda staking address received $22.9 million SOL following a staking address unlock.

Upon receipt of the tokens, the funds were distributed to 37 addresses associated with FTX and Alameda. Cumulatively, the 37 recipient addresses hold $178.82 million SOL, sparking fears of a selloff.

Typically, unstaking large amounts of SOL triggers selling pressure for Solana price. In the event of a sale, excess SOL floods the market and if demands fall to match supply, prices take a massive hit.

A move to exchanges will confirm speculation of a selloff with similar moves historically triggering corrections for Solana price.

At the start of March, Solana whales unstaked nearly $1 billion SOL as prices tumbled to multiple-month lows.

Solana Price Marches Toward Death Cross

Onchain indicators say Solana is approaching a death cross for the third time in its history. The death cross is a bearish signal, occurring when the 50-day moving average crosses below the 200-day moving average.

Achieving a death cross could send Solana price to new lows with previous occurrences proving extremely bearish. The first death cross in 2022 saw prices fall by over 90%, exacerbated by FTX’s implosion.

The second death cross in 2022 saw prices take a nose dive before staging a recovery during the “Trump pump.” Experts say projections for SOL to reach $200 are unlikely as it trades at a six-month low.

At the moment, Solana price is trading at $126.53 down by nearly 15% over the last week. For now, traders are proceeding with caution with the biggest indicator being a steep drop in daily trading volume. Over the last 24 hours, trading volume has fallen by 22.71% to settle at $4.1 billion.

Despite the grim numbers, experts say Solana will outperform Ethereum, citing the network’s impressive functionalities.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

PI Network Price Breaks Key Resistance, Is $20 Imminent?

PI Network Coin has gained strong momentum, breaking past key resistance levels as the broader market sustains its bullish consolidation. Notably, with the March 14 Know Your Customer and Mainnet migration deadline approaching, many investors are watching to see if PI Network can keep this momentum.

The PI Network Price Breakout

PI Network has crossed the $1.7 price level, which is designated as a critical resistance point. This breakout has drawn attention from traders and investors who see it as a signal for a potential rally.

According to CoinMarketCap, Pi Coin’s price is $1.719, up 20.67% in the last 24 hours. Additionally, the PI Coin trading volume increased by over 120%, reaching $842.34 million. This comes as it traded from a low of $1.403 to a high of $1.738.

Per social chatter, many traders attribute this recent surge to growing confidence in the cryptocurrency as its migration deadline nears.

Over the past week, PI Network has posted more than a 53% price gain, making it one of the best-performing digital assets in the market. The increased activity comes as many users rush to complete their Know Your Customer verification to secure their holdings before the final migration phase.

Market analysts believe breaking the $1.7 resistance level could set the stage for upward movement. PI Coin could soon test the $2 resistance mark if buying pressure continues. Historical data shows it has not reclaimed this level over the past 14 days.

A successful move past this point could lead to a rally toward $5 in the coming weeks. If achieved, analysts place long-term projections at $20, depending on key developments.

Why is PI Network Soaring As KYC Deadline Draws Close

A major reason for PI Coin’s price surge is the upcoming March 14 KYC and Mainnet migration deadline. PI Network has reminded users that unverified balances will be lost after this date, driving more engagement within the community.

Many users who previously ignored the process are now rushing to complete their verification, increasing PI Coin’s demand.

In addition, speculation about a potential coin listing on the Binance exchange has contributed to the rally. Last month, Binance posted an announcement to its community regarding a possible listing of PI Network on the platform.

While the Binance PI vote indicated that 87.1% of participants favored listing the coin on the exchange, it has yet to make an official announcement.

What Next for PI Coin?

With PI Coin holding above $1.7, many investors believe the price could soon challenge $2. If momentum continues, the next targets could be $5 and $10 before the migration deadline.

However, the key factors that could push PI Coin toward $20 include successful KYC completion, increased adoption, and a major exchange listing. However, analysts advice tempered expectations considering the volatile PI ecosystem.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market24 hours ago

Market24 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Market21 hours ago

Market21 hours agoPi Coin Centralization Raises Serious Questions About the Future

-

Ethereum23 hours ago

Ethereum23 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Bitcoin23 hours ago

Bitcoin23 hours agoCrypto Market Recovers After Liquidations: Here’s Why

-

Altcoin20 hours ago

Altcoin20 hours agoWill BlackRock XRP ETF Application Convince US SEC for Approval?

-

Altcoin19 hours ago

Altcoin19 hours ago21Shares Reduces Fees for Bitcoin Ethereum Core ETP, Lists on Xetra

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Reveals Major Backing For These 5 Crypto, Prices To Rally?

-

Market22 hours ago

Market22 hours agoEthereum Price Recovery Capped—Bulls Struggle Near Resistance

✓ Share: