Market

ADA Long-Term Holders Show Confidence Amid 22% Price Decline

Cardano’s price has seen a steep 22% decline over the past week, mirroring the broader market downturn. As of this writing, the eighth-largest cryptocurrency by market capitalization retails at $0.73.

However, its long-term holders (LTHs) remain unfazed. On-chain data shows that they are holding onto their assets rather than selling.

Cardano’s Long-Term Holders Double Down

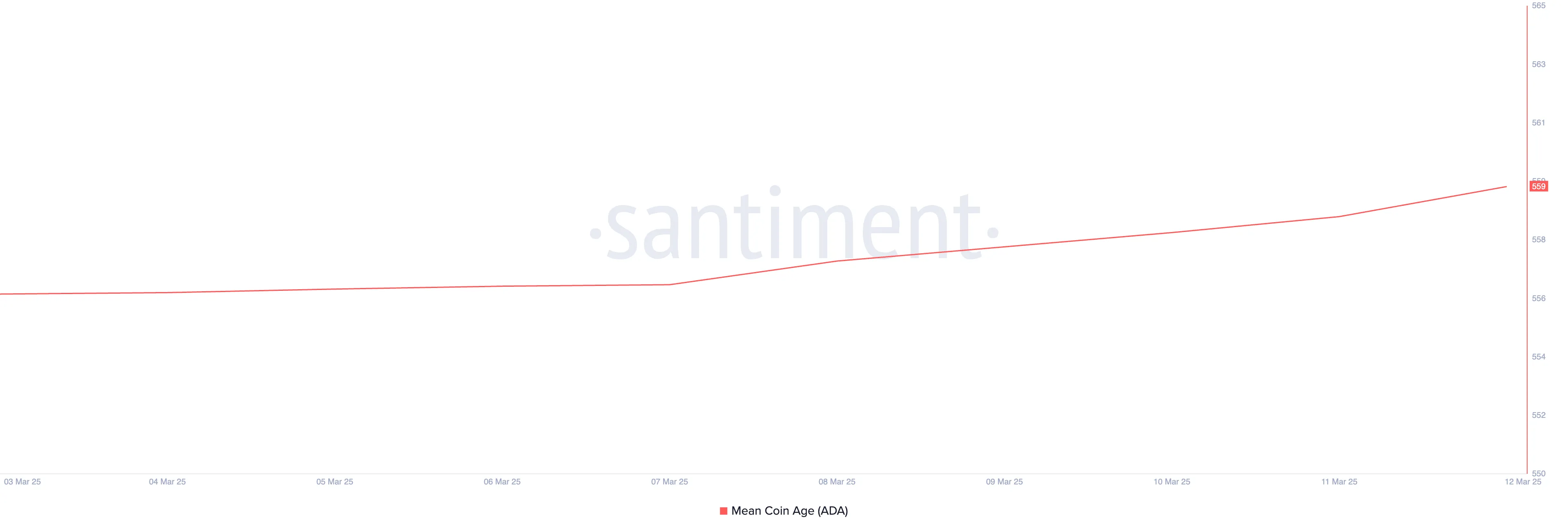

There has been a steady trend of HODLing among ADA’s LTHs, as reflected by its rising Mean Coin Age. According to Santiment, this metric’s value is up 1% since March 3.

An asset’s Mean Coin Age tracks the average age of all its coins in circulation to provide insights into market trends and hodling patterns among investors.

When it rises, it suggests that investors are holding onto their coins, signaling accumulation and confidence in the asset’s long-term value. This reflects strong hands and hints at a potential bullish outlook for ADA, especially in light of recent broader market headwinds.

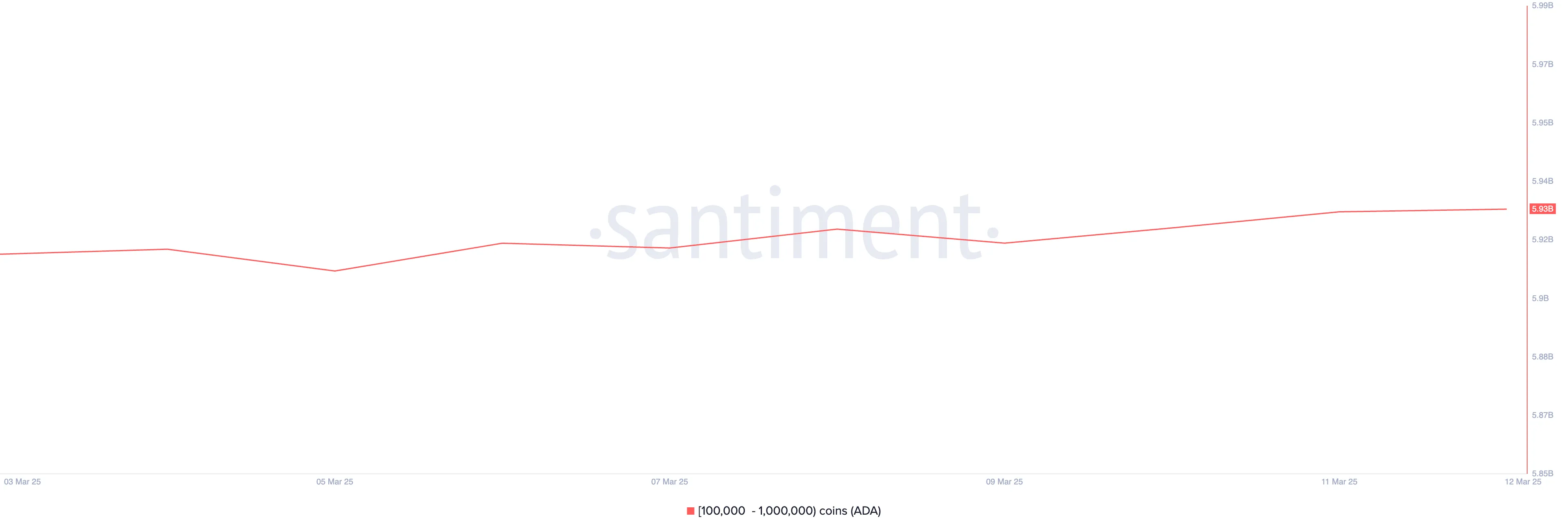

Moreover, ADA whales have increased their accumulation during the period under review, highlighting the surge in positive sentiment toward the altcoin. On-chain data from Santiment shows that large investors holding between 100,000 and 1,000,000 coins have collectively acquired 20 million ADA over the past week.

When large investor holdings increase like this, it signals strong confidence among key holders. It reduces an asset’s available supply, creating upward price pressure.

ADA Eyes $0.94 as Buyers Dominate

On the daily chart, ADA’s Balance of Power (BoP) is positive at 0.30. This indicator compares the strength of buyers and sellers in the market.

When its value is positive, buyers dominate the market, exerting stronger pressure than sellers. The bullish signal suggests upward momentum, which, if sustained, will lead to further ADA price appreciation.

In this instance, the coin’s price could rally toward $0.94. If this resistance is flipped into a support floor, ADA’s price could jump to $1.16.

However, if sellers regain dominance, the coin’s price could fall to $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

PEPE Whales Propel 11% Rally, Fueling Market Optimism

The frog-themed meme coin PEPE has surged 11% in the past 24 hours, significantly outpacing leading meme assets.

While Dogecoin (DOGE) and Shiba Inu (SHIB) have managed modest gains of 3% and 1%, respectively, PEPE has soared by double digits and is looking to extend its rally.

Whales Fuel PEPE’s Surge

PEPE’s rally comes amid a trend of significant whale acquisitions, which have fueled increased demand and bullish momentum for the meme coin.

In a March 12 post on X, on-chain sleuth Lookonchain noted that three whale wallets recently acquired 689.79 billion PEPE, valued at $5 million at current market prices, with all funds originating from Tornado Cash.

According to Lookonchain, the largest buyer, wallet 0x7A7D, spent 1,413.4 ETH ($2.72 million) for 437.7 billion PEPE, while 0x9212 and 0x7779 purchased 158.58 billion PEPE ($1 million) and 93.51 billion PEPE ($574,000), respectively.

Although the move has sparked speculation about the source of these funds, it has also triggered a resurgence in new demand for the meme coin. As its price grows, its daily trading volume also rallies. Over the past 24 hours, volume has surged by 18%, totaling $1.05 billion at press time.

When an asset’s price and trading volume surge simultaneously, it indicates strong market demand and increased buying activity, possibly driven by retail FOMO (fear of missing out) in PEPE’s case. This combination suggests bullish momentum in the meme coin’s market, signaling more gains if the trend continues.

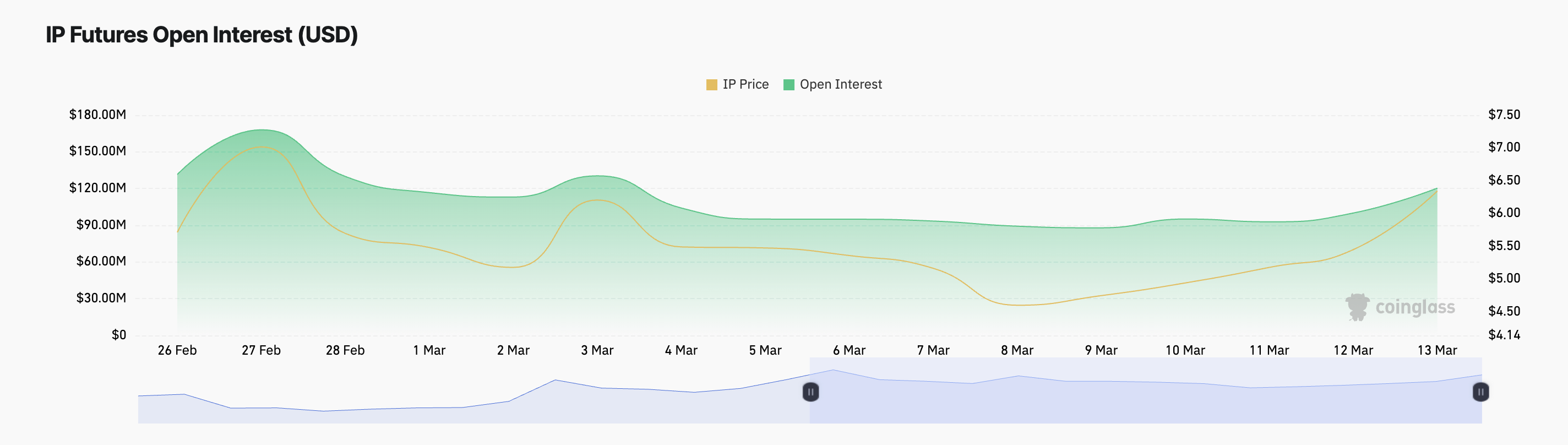

Moreover, in the futures market, PEPE’s rising open interest highlights the capital inflow into it. As of this writing, the metric is at $120 million, rocketing 21% in the past 24 hours.

When an asset’s open interest climbs, especially during a price rally, it indicates increased market participation and capital inflow. If macro factors remain favorable and market sentiment remains bullish, there is a strong likelihood of a sustained PEPE rally.

PEPE Bulls Are Back: Key Indicator Confirms Strength

PEPE’s Elder-Ray Index has returned a positive value for the first time since January 19. This confirms the bullish shift in investors’ sentiment toward the altcoin.

The indicator measures the strength of bulls and bears in the market by analyzing the relationship between an asset’s price and a moving average.

When the Index is positive, it indicates that bulls are in control, suggesting upward momentum and potential price gains. If sustained, this trend could drive PEPE’s price toward $0.0000083.

Conversely, if buying activity weakens, PEPE could break below the support at $0.0000062 and fall to $0.0000048.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

WLFI Token Sale Reaches 99.3% Completion

World Liberty Financial (WLF), a decentralized finance (DeFi) project backed by the Trump family, has successfully sold 99.3% of its recently issued 5 billion WLFI tokens.

The tokens went on sale on January 20, following a surge in demand after the initial public sale.

WLFI Token Achieves Major Milestone

According to the data on the project’s official website, World Liberty Financial has now sold a total of 24.97 billion WLFI tokens out of a 25 billion token supply allocated for public sale.

For context, the total supply of WLFI tokens is 100 billion, with an initial allocation of 20 billion tokens designated for the first public sale. This sale commenced on October 15, 2024, with the token priced at $0.015. Furthermore, the project restricted access to individuals who qualified through a whitelist.

The initial target for the WLFI token sale was set at $300 million. Nonetheless, weak demand in the early stages led to a drastic reduction of the presale target to $30 million.

Despite the initial setback, the tides shifted after Official Trump (TRUMP) and Melania Meme (MELANIA) meme coins were launched. This launch sparked renewed interest in World Liberty Financial, leading to a surge in demand for WLFI tokens.

By January 20, World Liberty Financial had completed its initial token sale, selling 20% of its total token supply. However, seeing the surge in demand, the project released an additional 5% of its token supply at a price of $0.05 per token.

“An additional 5% of our token supply is now available to purchase on our website. We appreciate the overwhelming support and look forward to welcoming so many new people to our community!” the project posted on X.

At the time of writing, only 34.6 million tokens of the 5 billion public sale allocation remain available.

The WLFI token’s primary purpose is governance within the World Liberty Financial Protocol. It allows token holders to propose, discuss, and vote on key protocol decisions. This gives token owners an equal voice in shaping the platform’s development, ensuring fair and democratic changes to its ecosystem.

As an added measure, the tokens will remain non-transferable for the first 12 months post-launch. Moreover, any community-approved changes to this restriction will not take effect until the one-year period concludes.

The milestone comes shortly after World Liberty Financial announced a partnership with Sui (SUI). The aim of this collaboration is to explore opportunities in DeFi. It will also integrate Sui’s technology into WLFI’s token reserve, “Macro Strategy,” supporting leading DeFi projects.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ethereum Price Hits Resistance—Will The Recovery Stall Here?

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price started a recovery wave from the $1,750 zone. ETH is now consolidating and facing hurdles near the $1,920 resistance.

- Ethereum started a recovery wave above the $1,850 level.

- The price is trading below $1,950 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $1,920 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,920 and $1,950 resistance levels to start a decent increase.

Ethereum Price Faces Hurdles

Ethereum price formed a base above the $1,750 level and started a recovery wave, like Bitcoin. ETH was able to clear the $1,800 and $1,820 resistance levels.

The bulls pushed the price above the $1,880 level. There was a move above the 23.6% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low. However, the bears seem to be active near the $1,920 resistance zone.

Ethereum price is now trading below $1,950 and the 100-hourly Simple Moving Average. On the upside, the price seems to be facing hurdles near the $1,920 level.

There is also a short-term bearish trend line forming with resistance at $1,920 on the hourly chart of ETH/USD. The next key resistance is near the $1,950 level or the 50% Fib retracement level of the downward wave from the $2,150 swing high to the $1,752 low.

The first major resistance is near the $2,000 level. A clear move above the $2,000 resistance might send the price toward the $2,060 resistance. An upside break above the $2,060 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,120 resistance zone or even $2,250 in the near term.

Another Decline In ETH?

If Ethereum fails to clear the $1,920 resistance, it could start another decline. Initial support on the downside is near the $1,850 level. The first major support sits near the $1,800 zone.

A clear move below the $1,800 support might push the price toward the $1,750 support. Any more losses might send the price toward the $1,720 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now above the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,920

-

Bitcoin23 hours ago

Bitcoin23 hours agoRole of Finality Bridge in Bitcoin’s Future

-

Market20 hours ago

Market20 hours agoBinance Receives a Record $2 Billion Investment from Abu Dhabi

-

Altcoin23 hours ago

Altcoin23 hours agoCan Dogecoin Price Still Hit $5 Despite US SEC’s DOGE ETF Delay?

-

Market23 hours ago

Market23 hours agoAmericans Miss Out on Billions from Crypto Airdrops, Study Finds

-

Altcoin20 hours ago

Altcoin20 hours agoHere Are The Possible Outcomes of the Ripple vs SEC Case

-

Altcoin17 hours ago

Altcoin17 hours agoAnalyst Reveals When The XRP Price Will Hit Double & Triple Digits

-

Market24 hours ago

Market24 hours agoCardano Struggles to Climb—ADA Faces Strong Hurdles Ahead

-

Bitcoin22 hours ago

Bitcoin22 hours agoBitcoin Price Jumps as US CPI Data Falls Below Expectations