Market

Binance Receives a Record $2 Billion Investment from Abu Dhabi

Binance announced today that MGX, a sovereign wealth fund from Abu Dhabi, invested $2 billion in the company. The transaction happened entirely using stablecoins.

This is both the largest investment ever made in a crypto-related business and the largest investment ever made using cryptoassets. Binance didn’t specify which stablecoin was used, but the UAE has favored Tether products in the past.

MGX Makes Record Binance Investment

The United Arab Emirates has recently been positioning itself as a crypto hub, and Abu Dhabi is a particular region of interest. MGX, an Abu Dhabi-based Web3 fund that has already made massive AI investments, has today announced a record investment in Binance.

Changpeng “CZ” Zhao, former CEO of Binance, also shared this news on X (formerly Twitter).

“MGX, an Abu Dhabi sovereign wealth fund, invests $2 billion in Binance for a minority stake. The transaction will be 100% in crypto (stablecoins), marking it the largest investment transaction done in crypto to date. This is also the first institutional investment Binance has taken. Onwards,Build!” CZ wrote.

Binance, the world’s largest crypto exchange, also corroborated these claims with its own press release. This MGX investment isn’t Binance’s first entanglement with Abu Dhabi, as the firm considered setting up a headquarters there.

However, in 2023, CEO Richard Teng scrapped its UAE license application, signaling a shift away from the nation.

Since then, however, interest has shifted back. The firm’s press release claimed that roughly one-fifth of its workforce is based in the UAE, for example.

Teng called the development a “significant milestone” and said Binance is “committed to working with regulators worldwide.” This MGX investment will likely increase economic ties in the region.

“We are excited to announce the first-ever institutional investment in Binance by MGX. This is a significant step in advancing digital asset adoption and reinforcing blockchain’s role in global finance,” Binace annouced on X.

Also, Binance claimed that MGX made this $2 billion investment entirely in stablecoins. Last August, Tether launched a stablecoin pegged to the UAE’s currency, and Abu Dhabi subsequently recognized USDT as an Accepted Virtual Asset.

Binance’s announcements have been surprisingly light on the exact details of its future relationship with MGX.

However, they were very clear that it was a big deal. This marks the largest-ever investment in a crypto firm and the largest investment paid entirely in cryptocurrency. Wherever the partnership goes from here, it has already made history.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

3 AI Coins Smart Wallets Are Buying: VIRTUAL, GROKCOIN, ARC

AI coins have been struggling in recent weeks, but smart money wallets are quietly accumulating Virtuals Protocol (VIRTUAL), GrokCoin (GROKCOIN), and AI Rig Complex (ARC). Despite sharp corrections, these three projects have seen notable inflows from experienced traders, suggesting potential rebounds.

VIRTUAL is down 53% in the last 30 days, ARC has dropped 68%, and GROKCOIN fell 33% in the past 24 hours. Yet, on-chain data reveals increasing accumulation. If momentum returns, these AI coins could recover key resistance levels, but further downside remains a risk if the sector fails to regain strength.

Virtuals Protocol (VIRTUAL)

VIRTUAL, once the biggest AI coin in the market, has been in a steep correction, with its price dropping over 53% in the last 30 days. The prolonged decline has weakened market sentiment, as AI-related tokens have lost momentum after their previous hype cycle.

However, despite this heavy sell-off, recent on-chain data suggests that smart money wallets are accumulating, which could indicate that some investors believe the bottom may be near.

If buying pressure continues to increase, VIRTUAL could stabilize and attempt a recovery.

In the last seven days, 21 crypto smart money wallets had a net inflow of $213,430 into VIRTUAL, suggesting renewed confidence from experienced traders.

This accumulation could be the first sign of a potential trend shift, but the price still needs to reclaim key resistance levels to confirm a reversal.

If VIRTUAL regains momentum, it could test $0.80 and $0.97, with a breakout above those levels opening the door for a move toward $1.24. However, for a sustained rally, AI coins need to regain market attention, as recent trends have shifted focus away from this sector.

GrokCoin (GROKCOIN)

GrokCoin (GROKCOIN) is a meme coin that gained rapid popularity due to its origins tied to Elon Musk’s AI, Grok.

The token was initially introduced as a joke following a tweet from Musk but quickly caught the attention of the crypto community.

Despite a 33% drop in the last 24 hours, smart money wallets have shown interest, with 54 wallets accumulating a net total of $133,049 in GROKCOIN over the past week.

This suggests that experienced traders may be positioning for a potential rebound. If GROKCOIN can reverse its current downtrend, it could test resistance levels at $0.0026, with a stronger rally potentially pushing it toward $0.0033.

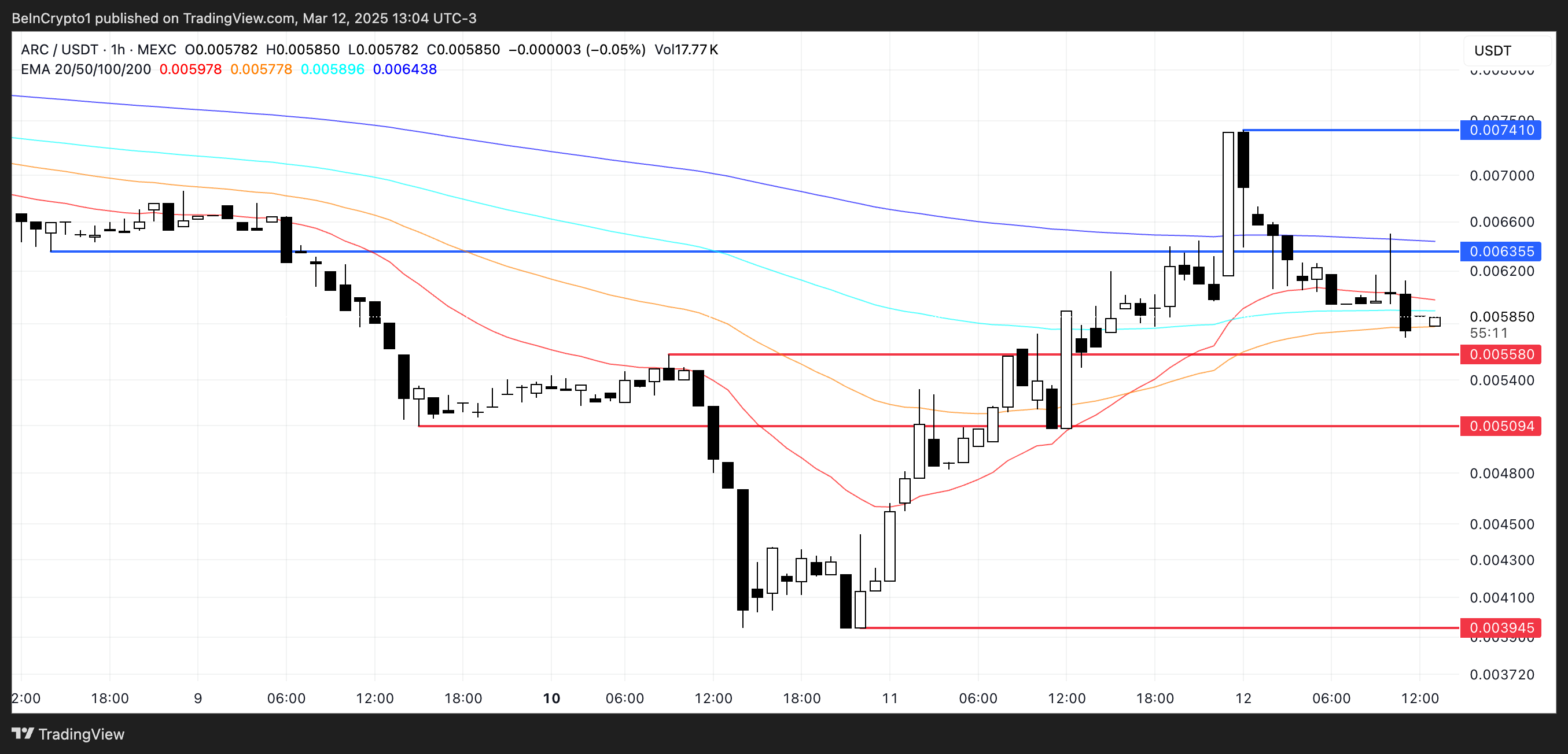

AI Rig Complex (ARC)

ARC has been hit hard by the ongoing correction in AI coins, with its price plunging 68% in the last 30 days. ARC is developing Rig, an open-source framework that enables developers to create portable, modular, and lightweight AI agents.

However, its price action suggests that market sentiment remains weak, with ARC currently trading at its lowest levels ever.

Even with the sharp decline, 14 smart money wallets have accumulated a net total of $47,275 in ARC over the past seven days, signaling potential accumulation.

If ARC can regain momentum, it could test $0.0063 and $0.0074, which would mark a significant recovery from current levels.

However, if the correction continues, support at $0.0055 and $0.0050 will be critical, and a break below them could send ARC as low as $0.0039.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Has Bitcoin (BTC) Price Topped For This Cycle?

Bitcoin (BTC) is at a critical point in its current cycle, with signs that it may be diverging from past halving patterns. Unlike previous cycles, where strong rallies followed halvings, this one has been more uncertain. Bitcoin’s market movements are now largely shaped by macroeconomic shifts and new institutional influences.

Political factors, such as Trump’s pro-crypto stance and state-level Bitcoin adoption, have also added unexpected variables. With these new dynamics in play, the question remains: has Bitcoin already topped the cycle? Or is there still room for another rally beyond $100,000?

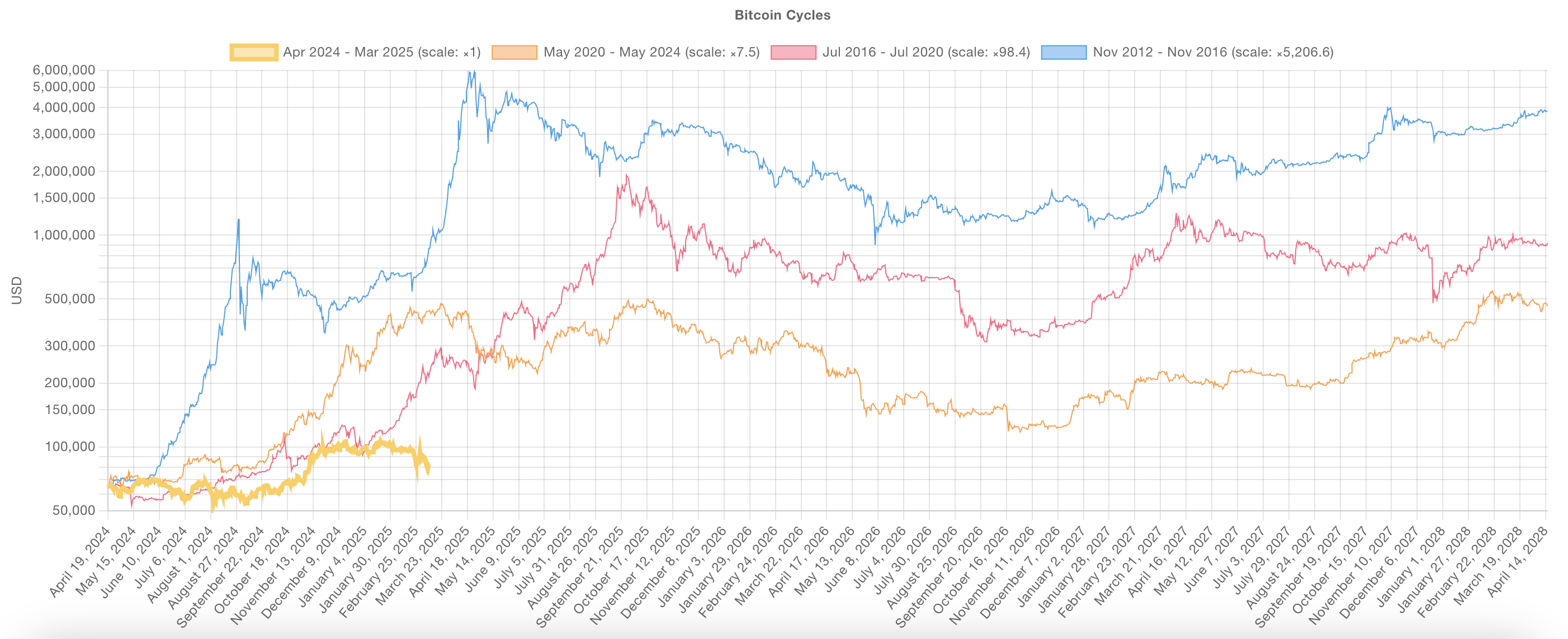

Has BTC Detached From Other Cycles?

The current Bitcoin cycle appears to be diverging from previous ones. It’s showing a different price trajectory compared to past halvings.

Historically, Bitcoin experienced strong rallies at this point in the cycle, particularly in the 2012-2016 and 2016-2020 phases.

However, this cycle saw a surge beginning in October 2024 and December 2024, followed by consolidation in January 2025 and a correction by late February.

This contrasts with prior cycles, where Bitcoin continued rallying aggressively post-halving. The deviation suggests that macroeconomic factors, market structure changes, and the growing presence of institutional investors may be altering Bitcoin’s traditional cycle dynamics.

Unlike the retail-driven speculative booms of past halvings, Bitcoin is now treated as a more mature asset class, which influences its price movement.

Another key factor is the diminishing strength of Bitcoin’s surges as cycles progress. The exponential rallies seen in 2012-2016 and 2016-2020 far exceeded those of the 2020-2024 cycle and the current one.

While this is expected due to Bitcoin’s increasing market capitalization, it also reflects the growing influence of institutional investors, banks, and even governments. In the long term, it’s likely to introduce more stability and structured market behavior.

Despite these shifts, previous cycles also had periods of consolidation and correction before resuming their uptrend. If Bitcoin follows that precedent, this phase could be a temporary reset before another upward move.

However, given the structural changes in the market, this cycle could unfold differently, with less extreme volatility but a more prolonged and sustainable price appreciation rather than the explosive parabolic tops of the past.

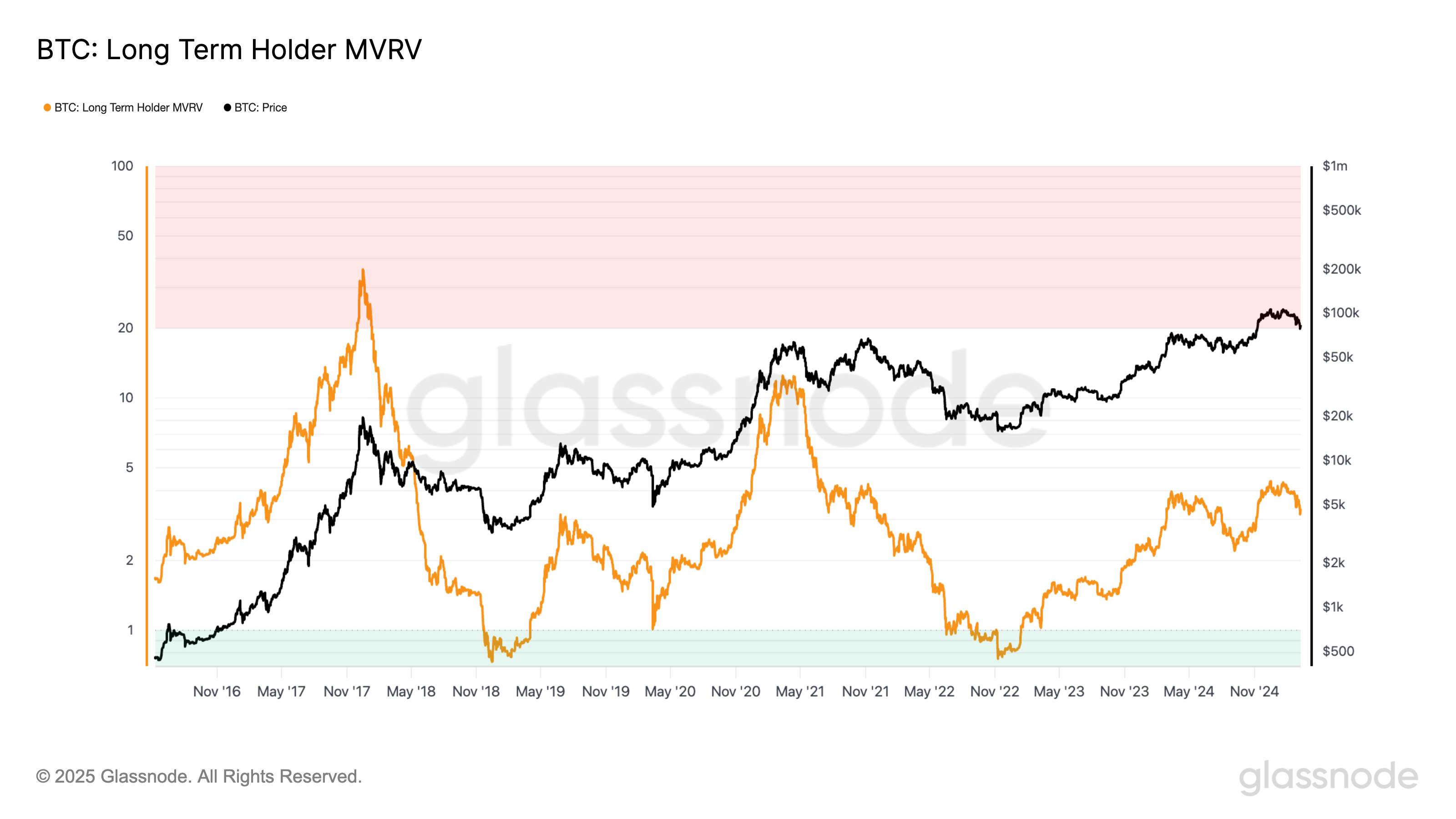

Long-Term Holder MVRV Signals a Shift in Cycle Dynamics

Bitcoin’s Long-Term Holder (LTH) MVRV ratio clearly demonstrates a pattern of diminishing returns across cycles. In the 2016-2020 cycle, LTH MVRV peaked at 35.8, reflecting an extreme level of unrealized profit among long-term holders before distribution began.

By the 2020-2024 cycle, this peak had dropped significantly to 12.2. It showed a lower overall multiple of unrealized profits despite Bitcoin reaching new all-time highs.

In the current cycle, LTH MVRV has so far only peaked at 4.35, indicating that long-term holders have not seen nearly the same level of liquid profits as in past cycles.

This sharp decline across cycles suggests that Bitcoin’s upside potential is compressing over time, which aligns with the broader trend of diminishing returns as the asset matures and market structure changes.

This data implies that Bitcoin’s cyclical growth phases are becoming less explosive. This is likely due to the increasing influence of institutional investors and a more efficient market.

As the market cap expands, significantly more capital inflows are required to drive the same percentage gains seen in early cycles.

While this could suggest that Bitcoin’s long-term growth is stabilizing, it does not necessarily confirm that the cycle has already peaked.

Previous cycles have had periods of consolidation before reaching final highs. Also, institutional participation could lead to more prolonged accumulation phases rather than sudden blow-off tops.

However, if diminishing MVRV peaks continue, it could mean Bitcoin’s ability to deliver extreme cycle-based returns is fading, and this cycle may already be past its most aggressive growth phase.

Bitcoin’s Long-Term Outlook

Despite the differences in this cycle, experts remain optimistic about Bitcoin’s long-term prospects, particularly with increasing adoption at the state level.

Harrison Seletsky, director of business development at SPACE ID, told BeInCrypto:

“Expectations were running high ahead of Friday’s White House Crypto Summit, but the aftermath was somewhat anticlimactic. The market didn’t react with as much excitement since the US is currently holding their confiscated BTC instead of actively buying more. However, there’s a lot more to be excited about than the market is pricing in. It’s encouraging to see that not only has President Trump signed an executive order for a crypto reserve – whatever it may look like in practice – but we’re also seeing this conversation moving ahead at the state level. The day before the Summit also saw Texas pass Senate Bill 21, which allows it to establish a state-controlled crypto reserve, consisting of Bitcoin and other digital assets. A year ago, none of us could have dreamed of this. Texas’s move could open the floodgates for other states to follow suit, as well as state and local level municipalities internationally.”

Nic Puckrin, founder of The Coin Bureau, told BeInCrypto that Bitcoin’s short-term trajectory remains tied to macroeconomic conditions. He points to the fact that investors in the current cycle had unrealistic expectations from the Bitcoin crypto reserve.

Notably, there was a growing perception that the US government would buy billions worth of new BTC, causing a supply shock. From any economic or political concept, that would not have been possible.

It’s hard to imagine Congress approving such a purchase with taxpayers’ money to invest in risk assets. This unrealistic expectation was a catalyst behind the current price corrections.

“The current crypto sell-off reveals a mismatch between expectations and reality. The reserve will now only constitute crypto that the US government already has in its ownership and it won’t be buying new BTC on the market. It’s also important to point out that neither crypto nor stock prices are at the top of Trump’s agenda. In fact, he even dismissed stock price crashes as being the work of globalists. Meanwhile, the improving regulatory landscape and promise of integration with traditional finance rails will cement crypto’s important role in the US financial landscape. It’s worth celebrating this progress, instead of complaining about the gloomy short-term backdrop,” said Puckrin.

Based on all that, this cycle appears to be different from previous ones. So, despite recent corrections, BTC may not have topped yet.

New factors like institutional adoption, Trump’s crypto stance, and geopolitical tensions make historical comparisons less reliable. Unlike past cycles, Bitcoin price action isn’t following a clear post-halving rally.

At the same time, uncertainty is higher than ever. Macro conditions, the trade war, and changing US policies are adding complexity. With Bitcoin now part of the global financial system, its price is reacting to more than just halving cycles. The path forward is unclear, but the cycle isn’t necessarily over.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Lists Aethir, Prompting 8% ATH Price Spike

Coinbase is listing Aethir, the DePIN “GPU-as-a-service” network, prompting an 8% price spike in its ATH token. The DePIN industry is performing generally well, but broader market conditions look bearish.

Coinbase passed up the chance to list ATH in June 2024, and the token has peaked and crashed two times since. Aethir’s price has been stagnant for over a month, and it may be difficult to build strong momentum in this environment.

Coinbase Lists Aethir During Stagnation Period

Aethir, the DePIN “GPU-as-a-service” network, has been relatively quiet recently. It has conducted a couple of major partnerships in the last few months but hasn’t made too many headlines otherwise.

Today, however, Coinbase announced that it’s listing Aethir’s ATH token, causing a burst of new enthusiasm.

“Coinbase will add support for Aethir (ATH) on the Ethereum (ERC-20 token) network. Trading will begin on or after 9AM PT on 13 March, 2025 if liquidity conditions are met. Once sufficient supply of this asset is established trading on our ATH-USD trading pair will launch in phases,” the exchange claimed via social media.

Coinbase, one of the world’s leading crypto exchanges, is a little behind the curve on listing Aethir. Last June, 16 centralized exchanges listed the ATH token, but Coinbase and Binance didn’t go for it.

DePIN revenues grew over 100x in 2024, however, and the industry has continued making advancements in 2025. Market conditions may be more favorable now.

Thanks to the “Coinbase Effect,” token projects typically see massive jumps after they get listed on the exchange. Aethir has also benefitted from this, jumping over 8% after Coinbase made the announcement.

ATH’s price has stagnated for a little over a month, and a bit of bullish momentum could help it grow again.

Still, Coinbase won’t solve all of Aethir’s problems. After the exchange refused to list it in 2024, it spiked the following month before leading to a crash.

It rebuilt this momentum to reach a new all-time high in December, but bearish market conditions have taken their toll. Aethir will need a lot of fresh interest to rebound a third time, but it’s an achievable goal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market21 hours ago

Market21 hours agoBitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

-

Market20 hours ago

Market20 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Market24 hours ago

Market24 hours agoEthereum (ETH) Might Test $1,700

-

Altcoin24 hours ago

Altcoin24 hours agoWill Ethereum Price Crash Below $1,500 Before Market Rebound

-

Market17 hours ago

Market17 hours agoPi Coin Centralization Raises Serious Questions About the Future

-

Market23 hours ago

Market23 hours agoSolana (SOL) Plunges 38% In a Month

-

Market22 hours ago

Market22 hours agoSEC Delays XRP and Solana ETF Approvals

-

Ethereum19 hours ago

Ethereum19 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?