Market

AI Agents Thrive Without Crypto: Tokenization Not Required

The artificial intelligence sector is witnessing a rapid surge in the development and deployment of AI agents, but for crypto and Web 3, not all is as it seems.

Most of these AI agents are free and open-source, challenging the notion that tokenized models are necessary for AI evolution.

Non-Tokenized AI Agents Outpace Crypto Solutions in Popularity

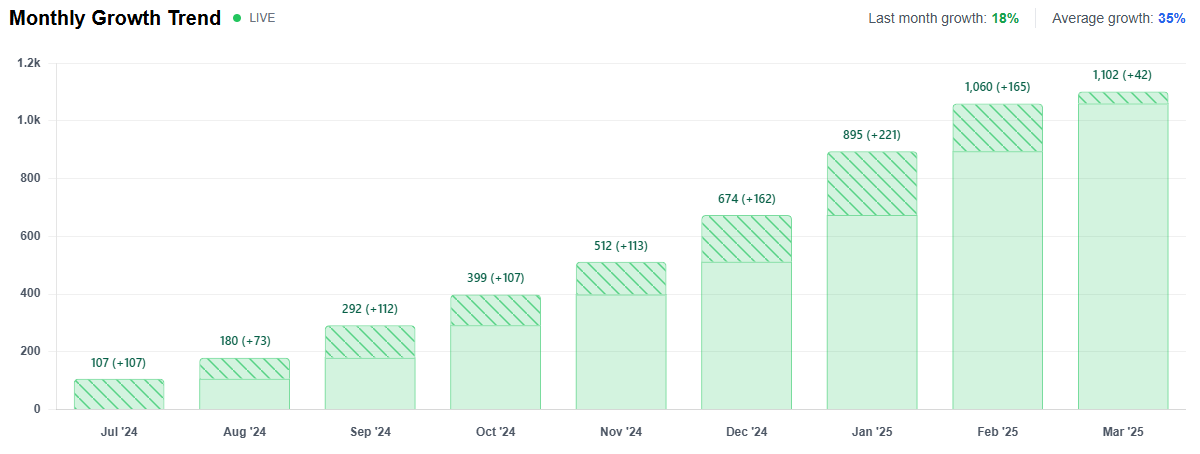

Data from the AI Agents Directory indicates an average monthly increase of 35% in the number of AI agents. However, despite the growing interest, Web3-based artificial intelligence solutions still account for a minimal fraction (3%) of the overall AI agent ecosystem.

Further, data shows that users and developers’ most sought-after AI agents do not include any from the Web3 sector. This highlights the lack of mainstream traction for crypto-integrated AI solutions.

Hitesh Malviya, an analyst and popular figure on X, echoed this sentiment in a post.

“If you look outside the crypto echo chamber, you’ll find that we do have a solid ecosystem of free and better AI agents—and they don’t have tokens, nor might they ever need one. So, what we’re trading in the name of agents is nothing but memes—a value we created out of thin air, like we always do,” Hitesh observed.

The emergence of tools like Manus, ChatGPT Operator, and n8n has made it easier than ever for individuals and businesses to develop and deploy their own tailored AI agents. These platforms allow users to create AI-powered solutions without needing a native token.

This reinforces the idea that tokenization on blockchain is not an essential component of AI agent functionality. Meanwhile, the debate surrounding AI agent tokens has also drawn criticism from industry insiders. On-chain detective ZachXBT recently slammed AI agent tokens, saying 99% are scams.

The blockchain sleuth’s concerns align with broader skepticism regarding tokenized AI projects. Many have been accused of leveraging AI hype without delivering substantive technological advancements.

Similarly, a recent survey of Solana (SOL) ecosystem founders revealed widespread skepticism about the utility of AI agents. As BeInCrypto reported, most Solana developers see AI agents as overhyped.

“The focus on AI agents distracts from core blockchain innovation. They’re more of a gimmick than a necessity in the space,” one respondent noted.

However, the crypto AI agent sector is not entirely stagnant. Recent reports suggest that new launches within the Web3 space are on the rise again. Despite the criticisms, some developers and investors still see potential in blockchain-integrated AI solutions.

As the AI agent industry grows, experts also examine its impact on the workplace. Discussions among industry leaders suggest that AI agents will play a transformative role in automating tasks, streamlining workflows, and enhancing productivity across various sectors.

The AI agent revolution is moving forward, with or without tokenization. As open-source and non-tokenized AI solutions continue gaining traction, AI-driven automation’s future may depend more on accessibility and practical application rather than speculative token economies.

The market will ultimately decide whether blockchain-based AI agents can carve out a lasting niche or if they will remain overshadowed by their non-tokenized counterparts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Coinbase Lists Aethir, Prompting 8% ATH Price Spike

Coinbase is listing Aethir, the DePIN “GPU-as-a-service” network, prompting an 8% price spike in its ATH token. The DePIN industry is performing generally well, but broader market conditions look bearish.

Coinbase passed up the chance to list ATH in June 2024, and the token has peaked and crashed two times since. Aethir’s price has been stagnant for over a month, and it may be difficult to build strong momentum in this environment.

Coinbase Lists Aethir During Stagnation Period

Aethir, the DePIN “GPU-as-a-service” network, has been relatively quiet recently. It has conducted a couple of major partnerships in the last few months but hasn’t made too many headlines otherwise.

Today, however, Coinbase announced that it’s listing Aethir’s ATH token, causing a burst of new enthusiasm.

“Coinbase will add support for Aethir (ATH) on the Ethereum (ERC-20 token) network. Trading will begin on or after 9AM PT on 13 March, 2025 if liquidity conditions are met. Once sufficient supply of this asset is established trading on our ATH-USD trading pair will launch in phases,” the exchange claimed via social media.

Coinbase, one of the world’s leading crypto exchanges, is a little behind the curve on listing Aethir. Last June, 16 centralized exchanges listed the ATH token, but Coinbase and Binance didn’t go for it.

DePIN revenues grew over 100x in 2024, however, and the industry has continued making advancements in 2025. Market conditions may be more favorable now.

Thanks to the “Coinbase Effect,” token projects typically see massive jumps after they get listed on the exchange. Aethir has also benefitted from this, jumping over 8% after Coinbase made the announcement.

ATH’s price has stagnated for a little over a month, and a bit of bullish momentum could help it grow again.

Still, Coinbase won’t solve all of Aethir’s problems. After the exchange refused to list it in 2024, it spiked the following month before leading to a crash.

It rebuilt this momentum to reach a new all-time high in December, but bearish market conditions have taken their toll. Aethir will need a lot of fresh interest to rebound a third time, but it’s an achievable goal.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Price Surge Incoming? Buyers Gain Momentum

Hedera (HBAR) has dropped nearly 20% in the past seven days, but in the last 24 hours, it has rebounded by almost 5%, signaling a potential trend shift. While the broader trend remains bearish, key indicators suggest that buying pressure is increasing, and a reversal could be forming.

If HBAR breaks resistance at $0.219, it could climb toward $0.258 and even $0.287, but failure to sustain upward momentum could see it retesting $0.179 or lower.

HBAR DMI Shows Buyers Are Taking Control

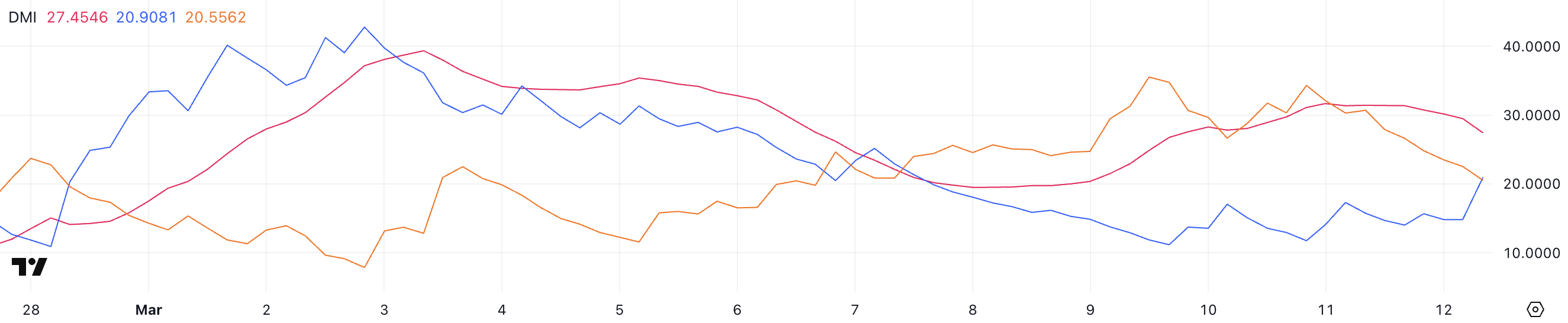

The Average Directional Index (ADX) for HBAR is currently at 27.4, down from 31.4 yesterday, indicating that the downtrend strength is weakening.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 typically signaling a strong trend, while anything below 20 suggests a weak or non-trending market.

Despite the decline, ADX remains above the key 25 threshold, meaning HBAR downtrend is still intact but losing momentum.

Meanwhile, the +DI (Directional Indicator) has risen to 20.9 from 11.7, while the -DI has dropped from 30.3 to 20.5. This shift suggests that selling pressure is fading while buying pressure is increasing.

However, with ADX declining and both directional indicators still close to each other, Hedera has not confirmed a trend reversal yet.

The price remains in a downtrend, but if +DI continues rising above -DI, it could signal the beginning of a shift toward bullish momentum.

Hedera Ichimoku Cloud Suggests The Trend Could Shift Soon

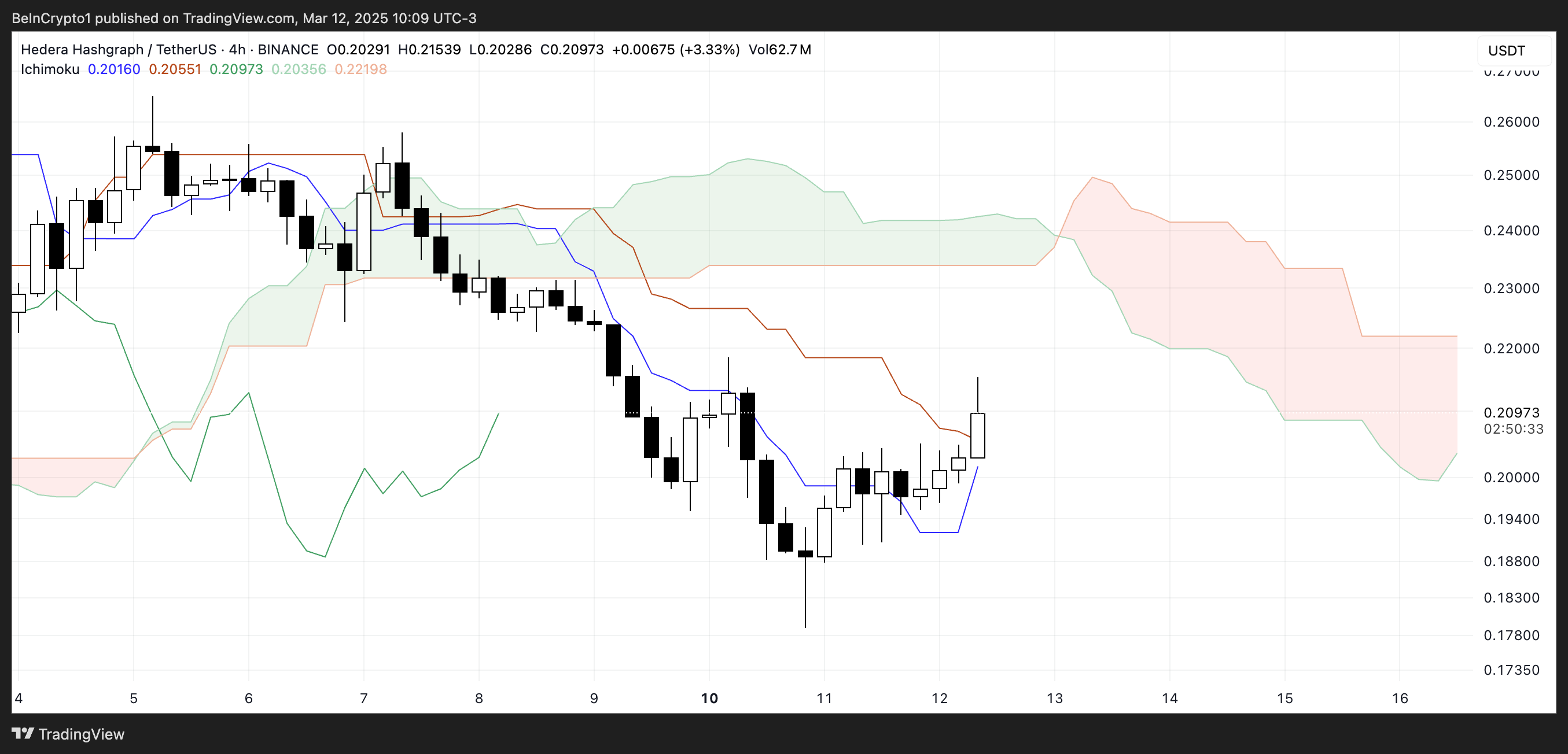

The Ichimoku Cloud chart shows that Hedera price has recently moved above the blue Tenkan-Sen (conversion line), a short-term trend indicator.

This suggests that momentum is shifting, but the price remains below the Kijun-Sen (baseline) and inside the cloud’s resistance zone.

The cloud itself is red ahead, signaling that bearish pressure still dominates. Until the price clears this resistance, the trend remains uncertain.

While the recent price action indicates a potential short-term reversal, the Kumo (cloud) remains bearish, suggesting that the overall trend is still downward.

HBAR would need to break above the cloud to confirm a trend shift more strongly. If the price faces rejection here, it could indicate continued weakness, leading to another downward move.

The battle between buyers and sellers at this level will determine whether HBAR can sustain this rebound or resume its broader downtrend.

Will Hedera Get Close To $0.30 Soon?

Hedera’s EMA lines indicate that the trend is still bearish, as short-term EMAs remain below long-term ones. However, the short-term EMAs are starting to turn upward, suggesting that a trend reversal could be forming.

If HBAR breaks the key resistance at $0.219, it could trigger a rally toward $0.258 and even $0.287, representing a potential 40% upside.

On the downside, if the trend fails to reverse, HBAR could continue its decline and test the $0.179 support level.

A break below that would open the door for a drop below $0.17, marking its lowest price since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana ETF Delay Fuels Bearish Sentiment, $16M Pulled from SOL

On Tuesday, the US Securities and Exchange Commission (SEC) postponed its decision on multiple altcoin exchange-traded funds (ETFs), including Solana’s.

This development has further dampened investor sentiment toward SOL, which has continued to witness significant spot market outflows.

Solana Investors Exit Amid SEC Delay—$16 Million Pulled Under 24 Hours

In a series of filings made on March 11, the SEC announced its plans to postpone its decision on multiple ETFs tied to major assets, one of which is SOL. According to the regulator, it has “designated a longer period” to review the proposed rule changes that would enable the ETFs to become operational.

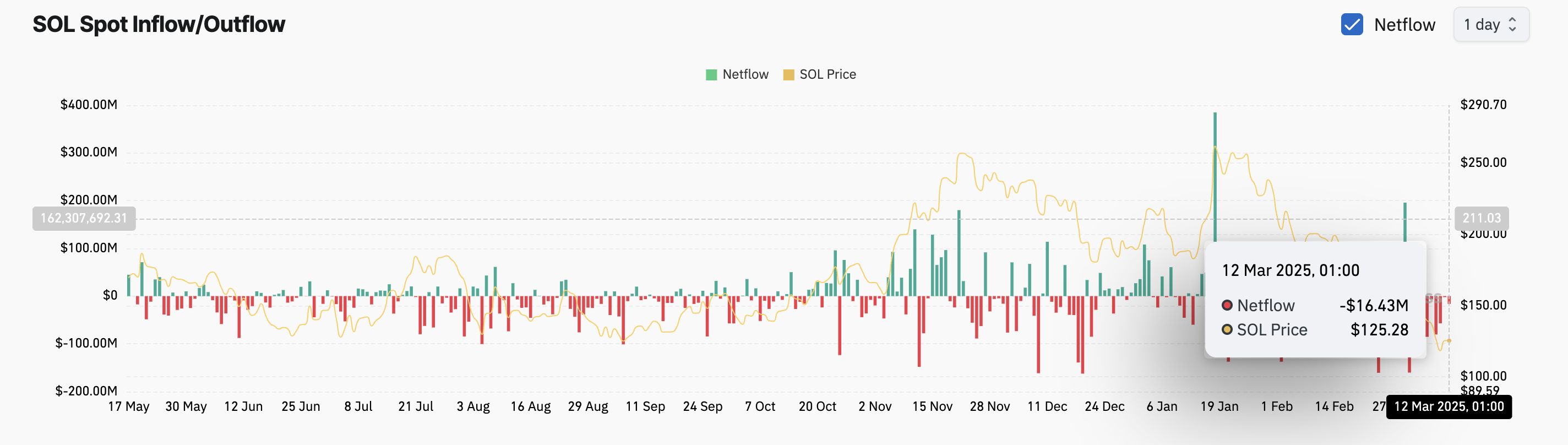

This has exacerbated the bearish sentiment toward SOL, which is reflected in the capital outflows from its spot markets over the past 24 hours. As of this writing, $16.43 million has been removed from the market, marking the seventh day of consecutive outflows, which have now exceeded $250 million.

When an asset experiences spot outflows like this, its investors are selling their holdings. This trend reflects a lack of confidence in SOL’s short-term price recovery, with traders choosing to cash in their accrued gains to prevent further losses on investments.

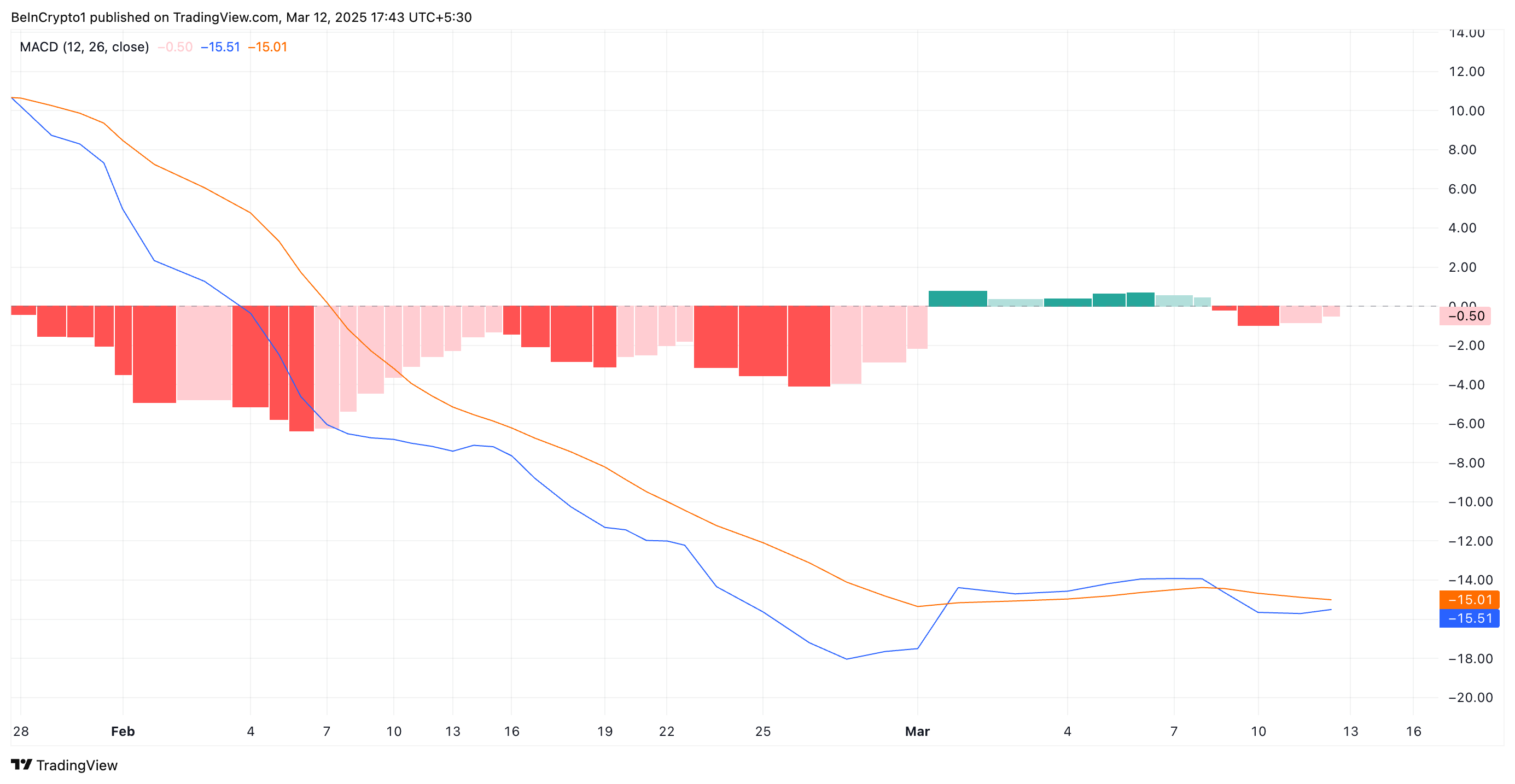

Furthermore, SOL’s Moving Average Convergence Divergence (MACD) indicator, observed on a daily chart, supports this bearish outlook. As of this writing, the coin’s MACD line (blue) is below its signal line (orange).

An asset’s MACD measures its price trends and momentum shifts and identifies potential buy or sell signals based on the crossing of the MACD line, signal line, and changes in the histogram.

When the MACD line rests under the signal line, the market is in a bearish trend. This indicates that SOL selloffs exceed buying activity among market participants, hinting at a further value drop.

Solana at Crossroads: Will SOL Hold $126 or Fall to $110?

SOL trades at $126.82 at press time. With waning buying pressure, it risks falling to $110, a low that it last reached in August 2024.

However, a strong resurgence in buying activity would prevent this. For this to happen, SOL has to establish a strong support flow at $135.22. If successful, it could propel its price to trade at $138.84 and above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market18 hours ago

Market18 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Ethereum18 hours ago

Ethereum18 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Ethereum24 hours ago

Ethereum24 hours agoEthereum Tests Critical MVRV Levels – Failure to Hold $2,060 Could Send ETH To $1,440

-

Market23 hours ago

Market23 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses

-

Altcoin22 hours ago

Altcoin22 hours agoWill Ethereum Price Crash Below $1,500 Before Market Rebound

-

Market15 hours ago

Market15 hours agoPi Coin Centralization Raises Serious Questions About the Future

-

Market19 hours ago

Market19 hours agoBitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

-

Bitcoin18 hours ago

Bitcoin18 hours agoCrypto Market Recovers After Liquidations: Here’s Why