Market

Will Bittensor (TAO) Rally? Key Indicators Predict Price Rebound

Bittensor (TAO) price has been facing a tough battle recently. It failed to break out of a descending wedge pattern, resulting in significant losses.

Despite these setbacks, the hope for a recovery remains strong, as several key indicators suggest that a rebound may be on the horizon for the altcoin.

Bittensor Could Be Imitating Its Past

The Relative Strength Index (RSI) for Bittensor is currently recovering from the oversold zone, where it fell for the first time in eight months. This signals a potential turnaround, as the last time TAO entered the oversold region, it managed to bounce back and rally by 60%. Although such a large rally may not be expected this time, the historical pattern suggests that TAO is poised for a recovery.

As the RSI begins to climb back from its lows, investor confidence could start to improve. While the magnitude of the rally may be smaller this time, a return to more neutral or bullish territory is likely, which could help push the price of Bittensor back on an upward trajectory.

Bittensor’s broader macro momentum is also showing signs of potential recovery. The Sharpe Ratio, a key technical indicator, is deeply negative at the moment, but this has historically been a sign of future price recovery. When the Sharpe Ratio reached similar levels in the past, TAO managed to reverse its downtrend, making it a key signal for future upward movement.

As the Sharpe Ratio starts to stabilize, it could indicate that Bittensor’s risk-adjusted returns are improving. This suggests that TAO might be entering a phase where positive returns are more likely, potentially signaling the start of a recovery phase after its recent losses.

TAO Price Set To Bounce Back Soon

TAO recently experienced a significant 45% decline over two weeks, primarily due to its failure to break out of the descending wedge pattern. However, TAO is now trading at $264, having bounced off the lower trend line of this pattern. The altcoin remains stuck under the $300 mark, but it appears poised to breach this resistance in the near future.

If Bittensor can successfully break above the $298 level, it will signal a breakout from the descending wedge pattern. This could trigger a bullish rally, with the price targeting $351. Such a move would confirm the pattern’s completion and open the door for further price increases, marking the start of a recovery phase.

However, if the altcoin fails to break above the $265 barrier, the price could fall back to $229. A drop below this level would invalidate the bullish outlook, even if the descending wedge pattern remains intact. A failure to break through $298 would likely result in more consolidation or further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Hedera (HBAR) Price Surge Incoming? Buyers Gain Momentum

Hedera (HBAR) has dropped nearly 20% in the past seven days, but in the last 24 hours, it has rebounded by almost 5%, signaling a potential trend shift. While the broader trend remains bearish, key indicators suggest that buying pressure is increasing, and a reversal could be forming.

If HBAR breaks resistance at $0.219, it could climb toward $0.258 and even $0.287, but failure to sustain upward momentum could see it retesting $0.179 or lower.

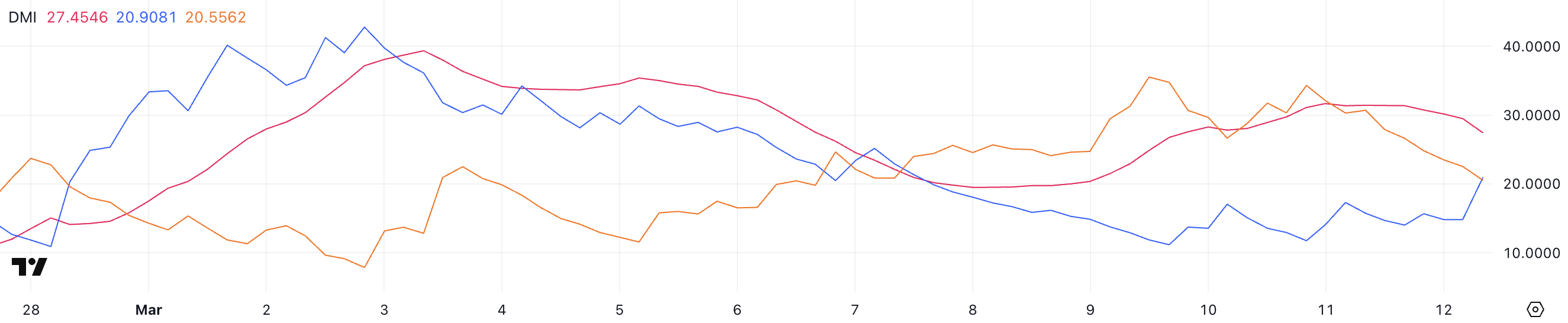

HBAR DMI Shows Buyers Are Taking Control

The Average Directional Index (ADX) for HBAR is currently at 27.4, down from 31.4 yesterday, indicating that the downtrend strength is weakening.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 typically signaling a strong trend, while anything below 20 suggests a weak or non-trending market.

Despite the decline, ADX remains above the key 25 threshold, meaning HBAR downtrend is still intact but losing momentum.

Meanwhile, the +DI (Directional Indicator) has risen to 20.9 from 11.7, while the -DI has dropped from 30.3 to 20.5. This shift suggests that selling pressure is fading while buying pressure is increasing.

However, with ADX declining and both directional indicators still close to each other, Hedera has not confirmed a trend reversal yet.

The price remains in a downtrend, but if +DI continues rising above -DI, it could signal the beginning of a shift toward bullish momentum.

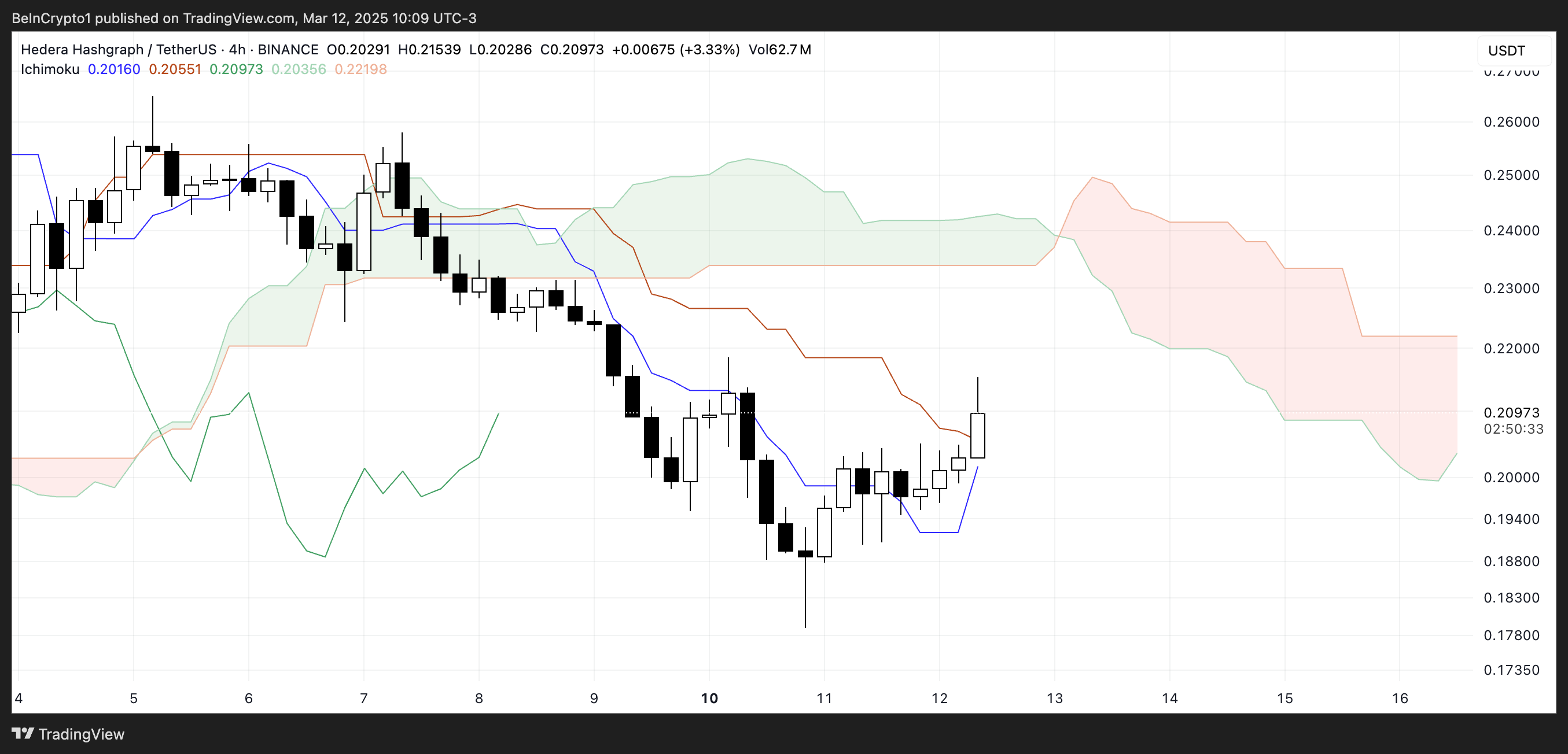

Hedera Ichimoku Cloud Suggests The Trend Could Shift Soon

The Ichimoku Cloud chart shows that Hedera price has recently moved above the blue Tenkan-Sen (conversion line), a short-term trend indicator.

This suggests that momentum is shifting, but the price remains below the Kijun-Sen (baseline) and inside the cloud’s resistance zone.

The cloud itself is red ahead, signaling that bearish pressure still dominates. Until the price clears this resistance, the trend remains uncertain.

While the recent price action indicates a potential short-term reversal, the Kumo (cloud) remains bearish, suggesting that the overall trend is still downward.

HBAR would need to break above the cloud to confirm a trend shift more strongly. If the price faces rejection here, it could indicate continued weakness, leading to another downward move.

The battle between buyers and sellers at this level will determine whether HBAR can sustain this rebound or resume its broader downtrend.

Will Hedera Get Close To $0.30 Soon?

Hedera’s EMA lines indicate that the trend is still bearish, as short-term EMAs remain below long-term ones. However, the short-term EMAs are starting to turn upward, suggesting that a trend reversal could be forming.

If HBAR breaks the key resistance at $0.219, it could trigger a rally toward $0.258 and even $0.287, representing a potential 40% upside.

On the downside, if the trend fails to reverse, HBAR could continue its decline and test the $0.179 support level.

A break below that would open the door for a drop below $0.17, marking its lowest price since November 2024.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Solana ETF Delay Fuels Bearish Sentiment, $16M Pulled from SOL

On Tuesday, the US Securities and Exchange Commission (SEC) postponed its decision on multiple altcoin exchange-traded funds (ETFs), including Solana’s.

This development has further dampened investor sentiment toward SOL, which has continued to witness significant spot market outflows.

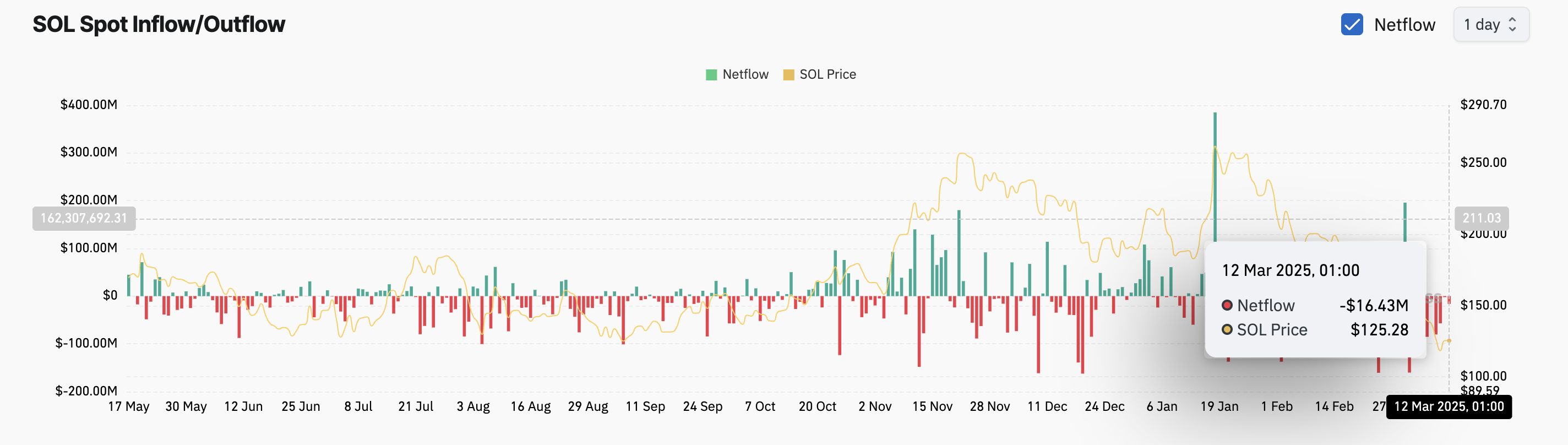

Solana Investors Exit Amid SEC Delay—$16 Million Pulled Under 24 Hours

In a series of filings made on March 11, the SEC announced its plans to postpone its decision on multiple ETFs tied to major assets, one of which is SOL. According to the regulator, it has “designated a longer period” to review the proposed rule changes that would enable the ETFs to become operational.

This has exacerbated the bearish sentiment toward SOL, which is reflected in the capital outflows from its spot markets over the past 24 hours. As of this writing, $16.43 million has been removed from the market, marking the seventh day of consecutive outflows, which have now exceeded $250 million.

When an asset experiences spot outflows like this, its investors are selling their holdings. This trend reflects a lack of confidence in SOL’s short-term price recovery, with traders choosing to cash in their accrued gains to prevent further losses on investments.

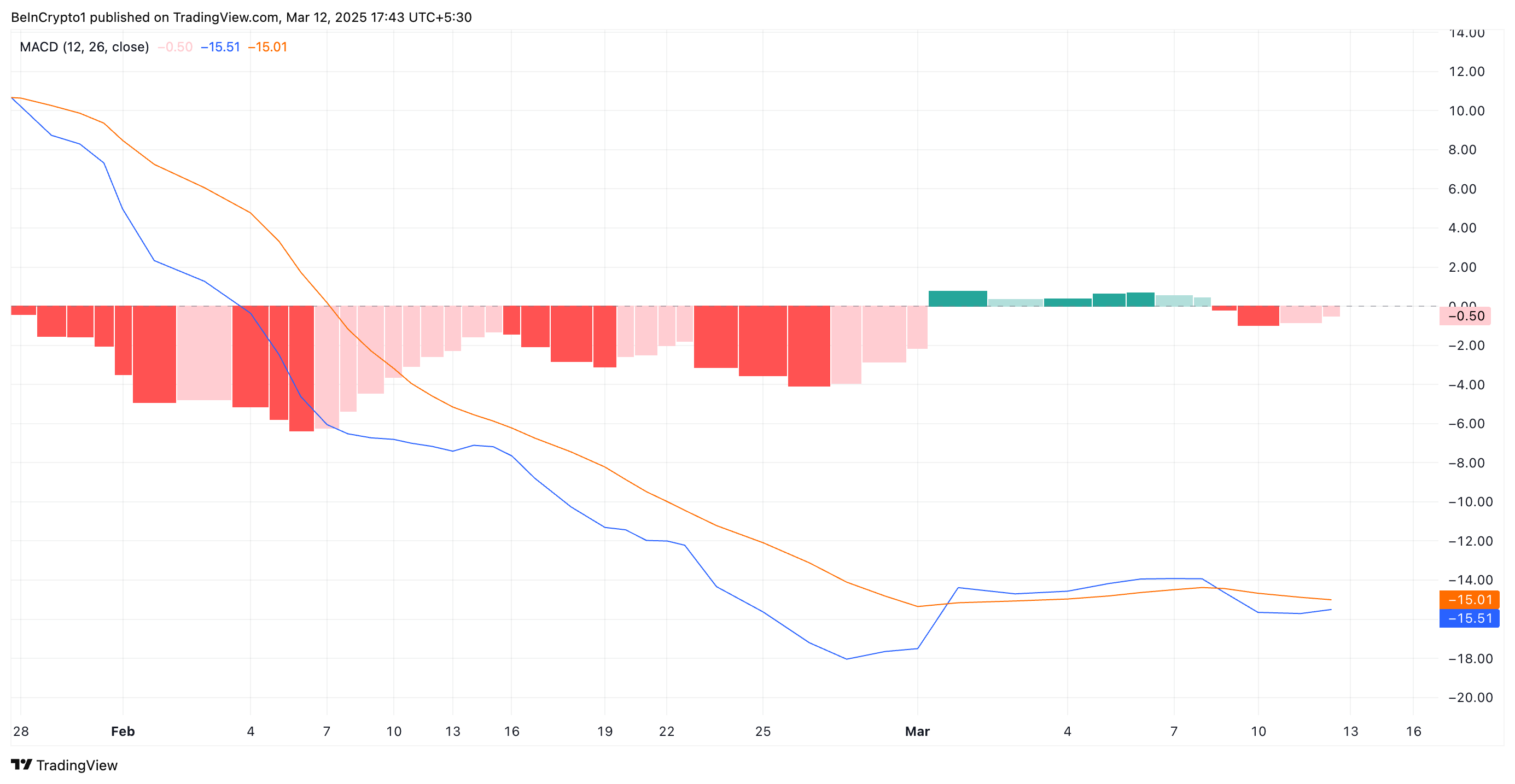

Furthermore, SOL’s Moving Average Convergence Divergence (MACD) indicator, observed on a daily chart, supports this bearish outlook. As of this writing, the coin’s MACD line (blue) is below its signal line (orange).

An asset’s MACD measures its price trends and momentum shifts and identifies potential buy or sell signals based on the crossing of the MACD line, signal line, and changes in the histogram.

When the MACD line rests under the signal line, the market is in a bearish trend. This indicates that SOL selloffs exceed buying activity among market participants, hinting at a further value drop.

Solana at Crossroads: Will SOL Hold $126 or Fall to $110?

SOL trades at $126.82 at press time. With waning buying pressure, it risks falling to $110, a low that it last reached in August 2024.

However, a strong resurgence in buying activity would prevent this. For this to happen, SOL has to establish a strong support flow at $135.22. If successful, it could propel its price to trade at $138.84 and above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Why Bitcoin Reserve Bills Fail: VeChain Executive Weighs In

In an interview with BeInCrypto, Johnny Garcia, Managing Director of Institutional Growth and Capital Markets at VeChain Foundation, addressed the rejection of Bitcoin (BTC) reserve bills. He emphasized that the core issue goes beyond legislative resistance—highlighting the need for greater education for both the public and policymakers.

His remarks come as five states have already dismissed the legislation. As of now, only 18 states are still considering the possibility of integrating digital assets like Bitcoin into their financial systems.

VeChain’s Executive Weighs In on Bitcoin Reserve Bill Rejections

Garcia pointed out that establishing federal or state Bitcoin reserves could drive innovation by modernizing investment frameworks and enhancing operational capabilities.

“This would bring all the benefits we in crypto are quite familiar with: transparency, immediate settlement, managing counterparty risks—to name a few,” Garcia told BeInCrypto.

Yet, he acknowledged that skepticism persists. Garcia noted that many are still unconvinced about a Bitcoin reserve’s utility and economic sense. The debate becomes even more complex when considering funding sources.

“Not every citizen in a given state will agree with their taxes financing crypto purchases—something they could just do themselves,” he commented.

Thus, Garcia emphasized that states would need to focus on educating their citizens about the purpose and objectives of including Bitcoin in their reserve portfolios. He stressed that while regulatory frameworks are crucial, success hinges on demonstrating real-world value beyond speculation.

“The blockchain/DeFi industry needs to step up and show that it can deliver proven solutions that go beyond speculative investment and offer real-world value,” Garcia remarked

He added that to truly change the minds of political and governmental stakeholders, especially those who are instinctively skeptical of crypto, the solutions must extend beyond financial considerations. The exec emphasized that blockchain technology needs to demonstrate its ability to address a broader range of problems.

Garcia highlighted VeChain as a prime example of how blockchain can tackle both new and ongoing issues. He drew attention to VeChain’s use of blockchain to verify sustainability efforts. Garcia noted that such applications make it harder for lawmakers to ignore the technology’s real-world value beyond finance.

Cryptocurrency Reserve Bill Rejections Don’t Represent a Unified View on Crypto

Meanwhile, Garcia cautioned against viewing the rejections at the state level as blanket opposition to cryptocurrency.

“I wouldn’t say this necessarily reflects deeply ingrained opposition to the concept of crypto in the form of reserves, stockpile, or just another alternative investment option,” he shared with BeInCrypto.

According to Bitcoin Laws, a total of 33 Bitcoin reserve bills were introduced in 23 states. However, Montana, Wyoming, North Dakota, Mississippi, and Pennsylvania have rejected the legislation that would have allowed state investments in digital assets, including Bitcoin.

Currently, there are 27 active bills in 18 states. Importantly, Utah, which was once at the forefront of the Bitcoin reserve race, recently dropped out on a technicality. The Utah bill is still progressing but without the ‘Bitcoin Reserve’ provisions, which have been removed.

Garcia offered a more nuanced view of the legislative resistance. According to him, although several states have voted against reserve bills, the opposition often comes by small margins.

He encouraged assessing the specific reasons behind the rejections rather than generalizing. Gracia also welcomed that states are taking the time to consider the issue carefully.

As states navigate their own approaches to cryptocurrency, momentum is growing at the national level. Senator Lummis has reintroduced the BITCOIN Act. This came shortly after former President Trump signed an executive order to create a strategic Bitcoin reserve funded with seized Bitcoins.

Originally introduced in July 2024, Lummis’ BITCOIN Act failed to pass out of Committee in the Senate.

“I am proud to reintroduce landmark legislation that will codify President Trump’s bold vision to establish the United States Strategic Bitcoin Reserve and strengthening our nation’s economic foundation for generations to come,” Lummis wrote on X.

The bill aims to create a US Strategic Bitcoin Reserve, backed by up to 1 million BTC acquired over five years. Moreover, the holdings would be maintained for at least 20 years.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market24 hours ago

Market24 hours agoPerpetuals, Made In USA, and Memes

-

Altcoin24 hours ago

Altcoin24 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Ethereum23 hours ago

Ethereum23 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Market23 hours ago

Market23 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market22 hours ago

Market22 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses

-

Market18 hours ago

Market18 hours agoBitcoin Price Recovers Some Losses—Is a Full Rebound in Sight?

-

Market17 hours ago

Market17 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

-

Ethereum16 hours ago

Ethereum16 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?