Altcoin

Can Dogecoin Price Still Hit $5 Despite US SEC’s DOGE ETF Delay?

The crypto market has rebounded strongly from its recent turmoil, reaching a value of $2.65 trillion with a 1.30% increase. In tandem with this trend, Dogecoin’s price has surged by almost 2% over the past day. Analysts remain optimistic about DOGE’s potential for a bullish rally, further fueling the current upward momentum.

Will Dogecoin Price Reach $5?

In a recent X post, market analyst CryptoELITES shared a bullish forecast for Dogecoin price. The analyst predicted that DOGE will reach $5 in the near future. To strengthen their analysis, CryptoELITES presented a historical chart that signals Dogecoin price’s target of $5.

Meanwhile, Trader Tardigrade has identified the formation of a 5-wave Descending Broadening Wedge on the 4-hour chart, indicating an impending breakout. Following a confirmed RSI bullish divergence, Dogecoin ($DOGE) rebounded to test the descending resistance line of the wedge. According to the analyst’s predictions, Dogecoin could reach $0.1780.

Increased Whale Activity and ETF Frenzy Spark Bullish Resurgence

During the last crypto market correction, Dogecoin dipped by nearly 20% falling from $0.22 to $0.17. However, large Dogecoin investors or whales have utilized the opportunity to amass 1.7 billion DOGE worth $298 million in just 72 hours.

Reflecting on this increased whale activity, analyst Lumen projected Dogecoin price’s surge to $0.5. He added that the target is possible if DOGE surges past $0.2 before the ETF approval.

Interestingly, crypto expert DOGECAPITAL posited that the Dogecoin price could reach an ambitious point of $90 by the end of 2025.

In a recent development, the US Securities and Exchange Commission (SEC) has reportedly delayed its decision on approving ETFs for Dogecoin (DOGE), XRP, Solana, and Litecoin, despite growing anticipation. However, ETF Store President Nate Geraci remains optimistic, asserting that the ETFs will ultimately be approved.

Why $2 is a Pivotal Target for Dogecoin Price?

Notably, $2 has been a pivotal target for the Dogecoin price. Many crypto experts have predicted DOGE’s potential rally targeting around $2. For instance, Dogecoin co-founder Billy Markus projected Dogecoin price’s possible surge to $2.3, marking a staggering 500% uptick.

Similarly, analyst Javon Marks underscored DOGE’s potential to hit $2.3, citing historical patterns. According to Changelly, DOGE will reach the projected $2.3 by July 2032.

As of press time, DOGE is valued at $0.1614, with an uptick of 3.64% over the past 24 hours. Despite the daily surge, Dogecoin price saw massive declines of 17% and 34% over the past week and month, respectively.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveal How Ethereum Price $8,000 Move Could Be In Play

Ethereum price is poised for further recovery as analysts have identified hidden bullish divergence that could enhance the previous rally. The pattern which indicates momentum shifts has it that, contrary to the present slump in the price, ETH could be on course to rise above its previous record high of $4,850.

If this pattern holds, Ethereum could be positioned for a climb to $8,000, a move that would likely trigger an altcoin rally.

Hidden Bullish Divergence Signals Ethereum Price Rally to $8,000

Analyst Javon Marks shared on the X platform that Ethereum price has confirmed a Hidden Bullish Divergence, which often signals a continuation of an existing uptrend. The pattern indicates that despite a recent pullback, the underlying momentum remains strong, suggesting a recovery in ETH price.

This technical formation typically appears when an asset’s price makes a higher low while its relative strength index (RSI) forms a lower low. Such a setup often leads to a continuation of the previous uptrend. With Ethereum price already displaying this pattern, analysts believe the next major resistance level to watch is $4,850. A successful breakout above $4,850 could clear the way for Ethereum price to reach $8,000.

Ethereum Drops Below Realized Price

Additionally, Ethereum recently fell below its realized price of $2,054 for the first time since February 2023. The realized price represents the average price at which ETH tokens last moved on-chain, providing insights into the overall market sentiment and profitability of holders.

On-chain data from Glassnode revealed that Ethereum’s market value to realized value (MVRV) ratio dropped to 0.93, indicating an average unrealized loss of 7% for ETH holders. Historically, dips below the realized price have often preceded market recoveries as long-term investors accumulate during these periods.

However, a recent CoinGape price analysis revealed that Ethereum price might see further downside if selling pressure continues to rise. Whale transactions to exchanges have intensified, raising concerns about a potential ETH drop below the $1,500 mark. However, a bullish diamond pattern suggests that ETH could rebound if it breaks key resistance levels.

Momentum Could Trigger Altcoin Rally

Notably, a rally above $4,850 may take Ethereum price to $8,000 and possibly trigger an altseason. Majority of the altcoins replicate the movement of ETH especially when the price is rising sharply.

Moreover, such a rally will bring institutional and retail investors into the market, therefore, a multiplier effect may be observed across other cryptos. This would be good for altcoins as many of them are yet to recover from the effects of recent pullbacks.

Analysts have identified the $1,600 to $1,900 range as a potential support zone for Ethereum price. Recent data from Glassnode shows that around 600,000 to 700,000 ETH were accumulated near the $1,900 level.

If the top altcoin maintains this support and gains momentum, the resistance at $2,200 could be the next hurdle. A successful breakout from will set the stage for an altcoin rally to $4,850, confirming the path to $8,000.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals When The XRP Price Will Hit Double & Triple Digits

Crypto analyst Egrag Crypto has revealed when the XRP price will hit double and triple digits. This provides a bullish outlook for XRP especially amid the recent market crash and its brief drop below the psychological $2 price level.

When The XRP Price Will Hit Double & Triple Digits

In an X post, Egrag Crypto stated that the XRP price will hit double digits in this cycle and triple digits in the next cycle. for triple digits, his accompanying chart showed that XRP could reach as high as $110. Interestingly, crypto analyst Dark Defender also recently predicted that XRP could reach triple digits, although he provided a more bullish outlook for the crypto as he predicted that it could reach $333.

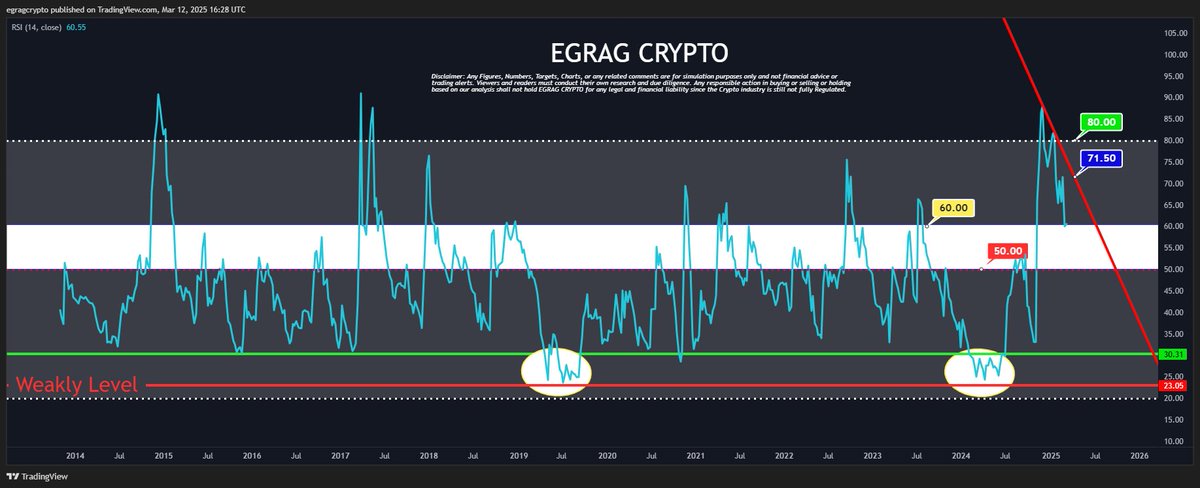

Meanwhile, in another X post, Egrag Crypto suggested that XRP’s recovery could be imminent. While analyzing the weekly Relative Strength Index (RSI), he stated that the crypto simply needs to cross 71.50 and then ‘kaboom,’ indicating a parabolic rally.

He noted that on the 60 level, XRP’s RSI is starting to kick upward. The analyst added that as the crypto builds strength from 60, it could easily climb back above 80. However, he remarked that it first needs to close above 71.50.

Crypto analyst Rose Premium also recently predicted that XRP could soon rally to as high as $3.35. The analyst stated that a bounce from the current support level of $2.12 could drive the crypto’s price towards key targets at $2.32, $2.61, $2.90 and then $3.35.

A Rally To $5 Is Also On The Cards In The Mid Term

Crypto analyst Dark Defender also indicated that an XRP price rally to 45 was also on the cards in the mid-term. This came as he highlighted this price level as one of the targets in his recent analysis.

He noted that XRP has finished the correction on the four-hour time frame. Analyzing the daily chart, he stated that XRP is expected to move towards $2.42 first considering the correction structures. He added that the real momentum will start after XRP stands above Ichimoku clouds.

The analyst highlighted $2.22 and $2.04 as the key support levels to watch out for. Meanwhile, he stated that the targets for XRP at the moment are $4.2932 and $5.8563.

It is worth mentioning that fundamentals such as the XRP ETFs and a potential Ripple SEC settlement provide a bullish outlook for the XRP price. Yesterday, asset manager Franklin Templeton filed the S-1 for its XRP ETF with the US SEC. Meanwhile, Journalist Eleanor Terrett recently reported that the SEC could soon close its case against Ripple.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Here Are The Possible Outcomes of the Ripple vs SEC Case

Despite growing speculations, the prolonged XRP lawsuit remains unresolved. The community is divided on the likelihood of an early settlement of the case. Meanwhile, experts unveil five potential outcomes for the Ripple vs SEC case, fueling further debate.

Let’s break down the potential outcomes of the XRP lawsuit and their implications for the Ripple ecosystem.

XRP Lawsuit Resolution: Things To Know

Though the US Securities and Exchange Commission (SEC) has dismissed several crypto lawsuits over the past few weeks, the settlement of the Ripple case remains uncertain. Experts argue that an early settlement is unlikely to happen. All Things XRP, a leading XRP advocacy platform on X, outlined five potential scenarios for the lawsuit’s resolution, providing more clarity to the matter.

In an X post, All Things XRP unveiled five possible outcomes for the protracted XRP lawsuit. These include the SEC dropping its appeal, a reduced penalty, the appeal court reversing the decision, the fine being upheld but the injunction lifted, and the SEC completely dropping the case. Each outcome has a different likelihood of happening, ranging from 15% to 35%.

Will US SEC Withdraw Appeal in the Ripple vs SEC Case?

Aligning with many expert predictions, All Things XRP highlighted the possibility that the SEC might withdraw its appeal under new leadership, potentially paving the way for a resolution in the Ripple case.

However, the XRP advocate added that the existing $125 million fine and the injunction on institutional XRP sales, as ruled by Judge Torres, would still be in place. Experts consider this outcome plausible, with a likelihood of 35%, as policy shifts are possible, but the injunction’s persistence complicates the situation.

Reduced Penalty and Court Decision Reversal

As All Things XRP noted, there’s a 30% chance that Ripple could negotiate a reduced penalty with the SEC. For example, the $125 million fine could be lowered to $75 million as part of a potential settlement.

However, here too, the injunction remains a significant obstacle, as dissolving it would require court approval. The analyst suggested that Paul Atkins, once confirmed as SEC Chair, might advocate for this approach.

Interestingly, there is also a possibility of overturning Judge Analisa Torres’ XRP ruling, but with only 20% likelihood. The analyst predicted that the Second Circuit might uphold the SEC’s appeal, classifying programmatic XRP sales as securities under the Howey Test. This could lead to a hefty fine of over $500 million and an expanded injunction.

Prominent legal experts like Jeremy Hogan and MetaLawMan pointed out these intricacies as major obstacles to the lawsuit’s early end.

XRP Lawsuit Conclusion: Can Injunction be Lifted with Fine Upheld?

According to All Things XRP, Ripple’s cross-appeal could ultimately uphold the $125 million fine imposed by Judge Torres. In addition, Ripple may convince the court to drop the injunction if it shows there’s no ongoing securities law violations.

Notably, this would pave the way for institutional sales to resume. With a 25% likelihood, this outcome hinges on Ripple’s argument impressing the court and tackling the injunction’s concerns.

SEC To Abandon the Ripple vs SEC Case

With the least probability, the SEC might abandon its case against Ripple, effectively nullifying the $125 million fine and seeking court approval to dissolve the injunction. This outcome, though unlikely, could emerge amidst a broader deregulatory shift. But it would still require court approval, making its likelihood a mere 15%.

Recently, lawyer Jeremy Hogan commented that a March resolution is possible in the XRP lawsuit with the injunction concerns dealt with later.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Market23 hours ago

Market23 hours agoPerpetuals, Made In USA, and Memes

-

Altcoin23 hours ago

Altcoin23 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Market22 hours ago

Market22 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market21 hours ago

Market21 hours agoXRP Bears Continue to Drive Price Down, Risks Further Losses

-

Market24 hours ago

Market24 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip

-

Altcoin24 hours ago

Altcoin24 hours agoAnalyst Predicts XRP Price To Reach $1,000 If This Happens

-

Market16 hours ago

Market16 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs

✓ Share: