Bitcoin

Suspicious High-Leverage Trades on Hyperliquid Raise Red Flags

Crypto trading platform Hyperliquid (HYPE) is under scrutiny. Multiple high-leverage trades on Bitcoin (BTC) and Ethereum (ETH) have raised suspicions of potential money laundering activities.

Analysts have noted a pattern of unusually large and frequent leveraged trades executed with near-perfect timing. This led to questions about the funds’ source and the traders’ identities.

Spotonchain Flags High-Stakes Trades

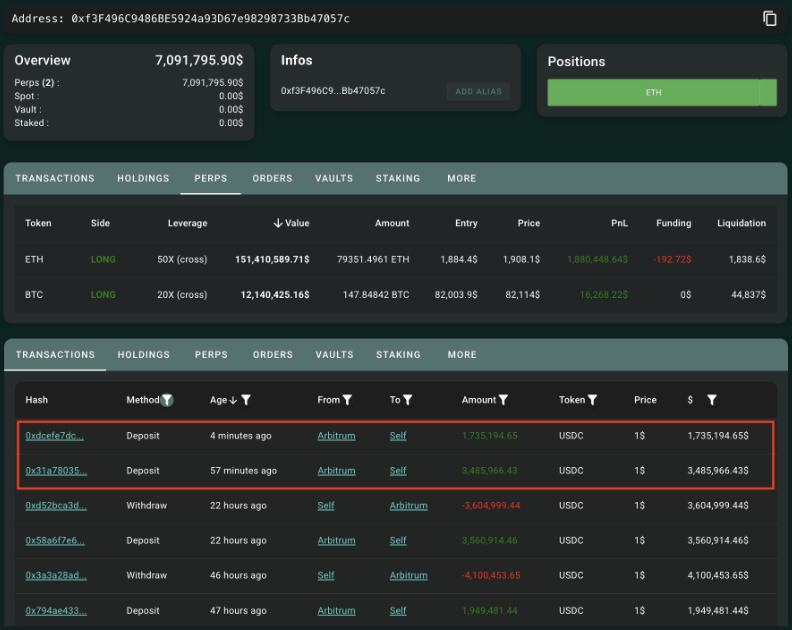

Blockchain analytics platform Spotonchain reported a series of significant leveraged trades executed on the Hyperliquid platform. According to their analysis, a well-funded trader deposited $5.22 million onto the platform to open highly leveraged long positions in BTC and ETH.

The trader placed an ETH long position at 50x leverage, with an entry price of $1,884.4 and a liquidation point of $1,838.2. Additionally, they opened a BTC long position at 20x leverage, entering at $82,003.9 and setting a liquidation price of $61,182.

SpotOnChain further revealed that this trader had a history of executing short-term leveraged trades with a 100% win rate. The trader netted $2.2 million in profit in just two days.

“Notably, in the past 2 days, this whale closed two quick ETH long positions with a 100% win rate, netting $2.2 million in profit,” Spotonchain revealed.

The consistency of these trades has led to speculation that the activity is not random market speculation. Instead, it leans toward a sophisticated laundering operation or insider trading scheme.

AB Kuai Dong, a crypto market analyst, speculated that the funds used in these Hyperliquid trades could be linked to North Korean hackers. The analyst noted that North Korean cybercriminals have been known to test high-frequency trading strategies on crypto platforms as part of money laundering operations.

The analyst suggested they could be an attempt to clean illicit funds obtained through hacking. This assumption is based on the Hyperliquid trades’ anonymity and rapid execution.

“I am very curious about these large anonymous orders of Hyperliquid. Combined with the previous news about North Korean hackers testing Hyper trading, is it possible that these large and frequent 50-fold openings are all gray market funds laundering money?” the analyst posed.

Another analyst known as Ai on X supported this theory by pointing to previous research on high-leverage profits made on Hyperliquid. In early March, Ai reported that three addresses had generated $2.53 million in profit through GMX high-leverage trades.

Gambling or Insider Trading? Experts Weigh In

These addresses were linked to gambling platforms such as Roobet and AlphaPo. They had also interacted with ChangeNOW, an exchange favored by hackers. Ai speculated that the traders might not be insiders but expert gamblers using potentially stolen funds to execute high-risk trades.

“Insider or ultimate gambler? It is indeed more like the latter,” the analyst opined.

Crypto analyst Adolyb, who cited research from Coinbase’s Conor Grogan, provided further evidence of potential illicit activity.

“Coinbase people found out that it is a phishing address with 4 layers of jumps + gambling players,” Adolyb remarked.

According to Grogan, the crypto wallet responsible for some suspicious hyperliquid trades received funds from phishing attacks. He described the account as a “Roobet whale,” suggesting that the trader frequently engaged in high-stakes gambling on platforms historically associated with illicit fund flows.

Grogan noted that this individual had previously liquidated long positions just before a significant market event. According to the analyst, this indicates that their trades were not based on insider knowledge. Rather, stolen funds are used for gambling.

The reports have reignited concerns about the use of high-leverage trading platforms for illicit financial activities. While leverage allows traders to amplify their positions, it also allows criminals to move and disguise large sums of money rapidly.

The anonymity offered by decentralized and offshore exchanges further complicates efforts to track and regulate such transactions. Regulators and blockchain forensic firms will likely increase their scrutiny of similar activities. This is amidst mounting evidence linking Hyperliquid’s high-leverage trades to potentially illicit sources.

BeInCrypto data shows Hyperliquid’s token’s price is down almost 8% since Wednesday’s session opened. As of this writing, HYPE was trading for $13.35.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Bitcoin Price Jumps as US CPI Data Falls Below Expectations

The US CPI (Consumer Price Index) data shows inflation eased to 2.8% in February, a positive surprise as it is below the expected 2.9% Year over Year (YoY).

This softer-than-expected inflation print boosted risk appetite, as traders now see an increased probability of rate cuts by the Federal Reserve (Fed) later in the year.

US CPI Below Expectations at 2.8%

Bitcoin (BTC) responded with a modest upward move, jumping to $83,371. The surge comes as lower inflation reduces the likelihood of further tightening and supports risk-on sentiment. Stock markets also reacted positively, with major indices posting gains following the release.

While inflation cooled in February, the Core CPI came in at 3.1% YoY, also beating estimates of 3.2%. Core inflation excludes volatile items like food and energy. Notably, this marks the first decline in headline and Core CPI since July 2024 and suggests inflation is cooling down in the US.

If inflation continues to trend lower, the Fed could shift to a more dovish stance, potentially opening the door to more liquidity entering the markets. Meanwhile, the reaction for traditional assets was as expected, with the US dollar and Japanese yen dropping.

“Both overall and core are down! This clearly raises expectations for an interest rate cut. Both interest rates and the dollar/yen exchange rate responded with declines. This will be positive for stock prices,” an analyst on X observed.

Some analysts are taking these inflation numbers with a pinch of salt, as Donald Trump’s trade tariffs could lead to higher consumer prices.

Notwithstanding, many analysts view the latest inflation data as a tailwind for Bitcoin, which has historically benefited from easier monetary conditions. Now, all eyes are on the Fed’s upcoming policy guidance as traders look for confirmation that the path to rate cuts is opening up.

“A high print would not be very welcomed (as usual). Especially during uncertain times in the market like now, this kind of economic data usually has an increased impact. A high number would likely move the bond yields back up which is the opposite of what the administration is seemingly trying to achieve currently. Then there’s also FOMC next week and the Fed will definitely be looking at this CPI print as well,” analyst Daan Crypto Trades remarked.

Meanwhile, this CPI data comes after a good JOLTS (Job Openings and Labor Turnover Survey) report on Tuesday, which gave the market a reason to stop falling. Notably, Fed Chair Jerome Powell stated on Friday that the US central bank would take a cautious approach to monetary policy easing, adding that the economy currently “continues to be in a good place.”

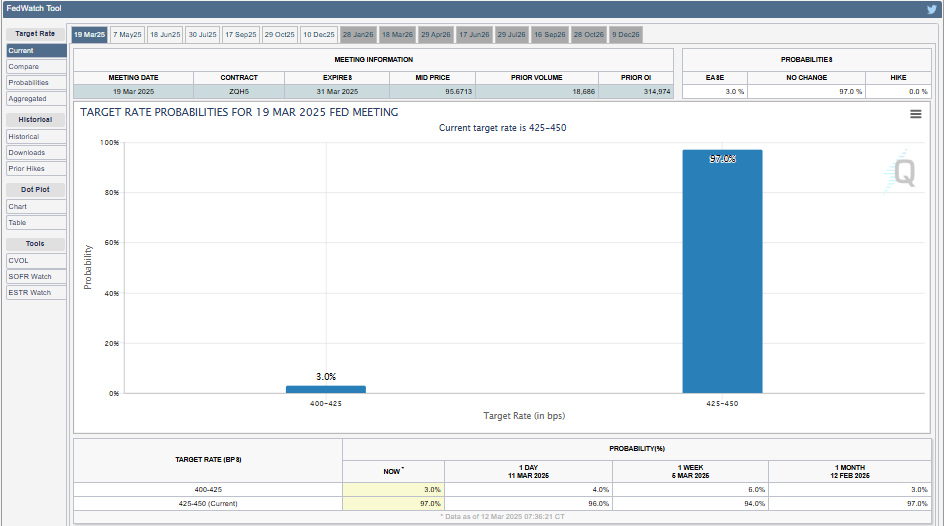

According to data from the CME Fedwatch tool, markets are betting on an interest rate cut at the Fed’s next meeting.

“Inflation just came in at 2.8% which is lower than expectations. The real number is even lower. The Fed should cut rates immediately,” chimed Anthony Pompliano, the founder of Professional Capital Management.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Role of Finality Bridge in Bitcoin’s Future

In an exclusive interview with BeInCrypto, Charlie Hu, a key contributor to Bitlayer, discusses the future of Bitcoin bridging technologies, including the Finality Bridge and the BitVM Bridge. These groundbreaking solutions aim to solve Bitcoin’s limitations in scalability, programmability, and DeFi integration, offering a more secure and efficient way to move Bitcoin assets across blockchain ecosystems.

Hu delves into the technical differences between traditional multisig setups and the innovative trust-minimized approach offered by the BitVM Bridge. He also highlights how the Finality Bridge enables Bitcoin holders to engage in DeFi activities, ultimately contributing to the growth of the DeFi space and improving liquidity.

The Role of the Finality Bridge and BitVM Bridge

The Finality Bridge and BitVM Bridge represent the next evolution in Bitcoin bridging technology. These solutions aim to enhance Bitcoin’s ability to interact with decentralized finance (DeFi) ecosystems, which has traditionally been a challenge due to Bitcoin’s lack of programmability. Charlie Hu explains that the BitVM Bridge is the third generation of Bitcoin bridging technology.

“The BVM bridge is the third-generation Bitcoin bridging solution technology. We have wrapped Bitcoin, which relies on an older multisig setup—a federation of signers where the majority must be honest. However, it’s clear that we can’t rely on wrapped Bitcoin as a long-term bridging solution. We need a new generation of technology that is more trust-minimized and doesn’t depend on the current multisig structure to bridge Bitcoin liquidity from Bitcoin Layer 1 (L1) to EVM (Ethereum Virtual Machine) or other programmable environments,” Hu told BeInCrypto.

Previous systems, like wrapped Bitcoin, relied on older multisig setups, where a federation of signers needed to maintain honesty to ensure security. However, this structure has proven to be unreliable and exposes users to potential risks.

“In contrast, the BitVM bridge is more trust-minimized. We only need to trust one signer to be honest, and that signer can unlock the funds through the two-way pegging mechanism,” Hu continues.

This improvement reduces the potential for malicious actors to compromise the system, addressing vulnerabilities exposed by recent incidents like the Bybit hack. Unlike wrapped Bitcoin, which relied heavily on multisig setups, the BitVM Bridge uses Bitcoin scripts and two-way pegging mechanisms to ensure more secure and efficient transactions between Bitcoin Layer 1 (L1) and Ethereum Virtual Machine (EVM) environments.

Enabling DeFi on Bitcoin

The limitations of Bitcoin Layer 1 in enabling decentralized finance are well-known. Bitcoin L1 does not support smart contracts, meaning it cannot facilitate lending, automated market makers, decentralized exchanges, or any other DeFi activities. Bitcoin’s UTXO-based cash system is primarily designed for payments, but it struggles with scalability and versatility in more complex scenarios.

To address these issues, the Finality Bridge offers a solution by connecting Bitcoin to more programmable, trust-minimized environments, like Layer 2 solutions.

“Without the bridge, you can’t really do DeFi. Bitcoin L1 doesn’t have smart contract capabilities or programmability. You can only make payments. To enable Bitcoin DeFi—where Bitcoin holders want to earn yield, engage in on-chain options, liquid staking, and other creative DeFi use cases—you need to bridge to a programmable, trust-minimized environment like a Layer 2 solution,” Hu explains.

Bitcoin L1’s scalability is constrained by its ability to process only seven transactions per second (TPS), which results in network congestion. This can lead to high fees and failed transactions as users compete to pay for limited block space.

“Many users experienced this during the 2023 ordinals mint,” Hu recalls. “People paid for gas fees, but their transactions failed because they paid too little compared to others who were paying higher fees. This led to a situation where everyone was fighting to pay higher fees, but in the end, they burned their Bitcoin and the transactions still failed.”

The Finality Bridge solves these problems by enabling Bitcoin to interact with Layer 2 solutions, thereby allowing Bitcoin holders to participate in DeFi activities and scale their transactions without the limitations of Bitcoin L1.

The Versatility and Future of the Finality Bridge

One of the significant advantages of the BitVM Bridge is its ability to bridge Bitcoin assets to a wide range of ecosystems, including both EVM and non-EVM chains. Through its recent partnerships with chains such as Arbitrum, Plume, Base, Starknet, and Sonic, the BitVM Bridge is positioning itself to be an essential component in the future of cross-chain interoperability.

Sonic, for example, utilizes Solana VM, which opens the door for Solana ecosystem integration, despite its indirect connection to Bitcoin.

“Our bridge is versatile, supporting both EVM and non-EVM chains, making it highly adaptable,” says Hu. “For example, Sonic (which uses Solana VM) connects us to the Solana ecosystem, even though indirectly.”

Looking ahead, the team plans to integrate more blockchain networks using Cross-Chain Interoperability Protocol (CCIP). However, the primary focus remains on the trust-minimized bridge from Bitcoin L1 to Ethereum L1. This forward-thinking approach allows the Finality Bridge to offer extensibility and compatibility with diverse blockchain ecosystems, fostering greater liquidity and enabling Bitcoin holders to fully participate in DeFi activities across multiple networks.

Trust-Minimized Bridges: A New Paradigm for Bitcoin

The term “trust-minimized” is often used to describe the Finality Bridge. While it is not entirely trustless, it significantly reduces the reliance on multiple signers for securing Bitcoin transactions.

In the past, bridging solutions like wrapped Bitcoin relied on multisig setups, which required the majority of signers to be honest. The Finality Bridge, however, only requires one honest signer from the operators of the BitVM bridge, significantly lowering the trust dependency compared to older systems.

“People argue that it’s not fully trustless, and the controversy stems from this,” Hu acknowledges. “While some claim it’s trustless, it’s more accurate to describe it as ‘trust-minimized.’ It’s not 100% trustless—it’s semi-trustless. We still need to rely on one honest signer out of the BitVM bridge operators. For example, if there are 100 operators, we only need one honest signer, which is 1%.”

This shift in the trust model is crucial in improving the security of Bitcoin bridging solutions. By reducing the number of trusted parties and relying on a single honest actor, the Finality Bridge offers a more resilient approach, ensuring users can securely move their Bitcoin across different blockchain ecosystems without fear of systemic collapse due to dishonesty among signers.

Finality Bridge and Native Yield Generation

The concept of native yield generation is central to the success of Bitcoin in DeFi environments. Through the Finality Bridge, Yield Bitcoin (Yield BTC) becomes an active participant in DeFi protocols, providing liquidity, staking, and lending opportunities. This yield generation is native and on-chain, meaning it occurs directly within the DeFi ecosystem rather than relying on off-chain or tokenized yield systems.

“DeFi is essentially built around core features like liquidity provision, staking, lending, and more,” Hu explains. “We’re bridging Yield Bitcoin to provide a one-to-one minted Bitcoin, which will enter various DeFi protocols through our bridge. This allows Yield BTC to participate in lending, liquidity pools, and other DeFi activities, generating yield.”

Yield BTC holders become liquidity providers in various DeFi protocols, earning yield in return.

“This yield is native, on-chain yield, not some tokenized or off-chain yield system. It’s real yield, generated within DeFi, without relying on incentivized tokens or other artificial mechanisms.”

The integration of Bitcoin into DeFi opens up new possibilities for Bitcoin holders who wish to engage in activities such as lending, liquidity pools, and other advanced DeFi strategies, thus contributing to the overall growth of the DeFi space.

The Finality Bridge’s Impact on the Broader DeFi Ecosystem

Liquidity is a fundamental component of any DeFi ecosystem, and the Finality Bridge plays a crucial role in injecting liquidity into this space. By enabling Bitcoin holders to participate in DeFi activities, the Finality Bridge helps increase the Total Value Locked (TVL) across different protocols. A higher TVL translates into a more thriving DeFi ecosystem, which ultimately benefits all participants, from individual users to developers and institutional investors.

“Simply put, without liquidity, you can’t have DeFi,” Hu says. “No matter how innovative a protocol is, it can’t operate without liquidity. You need seed liquidity, and you need to attract more liquidity from users, whales, and other sources.”

In the broader context of Bitcoin’s role in DeFi, the Finality Bridge is helping to evolve Bitcoin from a payment-focused asset to a fully integrated participant in the decentralized finance sector. As Bitcoin becomes more accessible and usable within DeFi, it will attract more liquidity and users, further strengthening the ecosystem and contributing to its long-term growth.

Target Audience for the Finality Bridge

The Finality Bridge serves a broad range of users, including individual DeFi participants, developers, and institutional investors. On the retail side, the bridge is aimed at Web3 wallet users who are familiar with DeFi concepts such as lending and staking. For institutions, while the discussions are still ongoing, there is potential for partnerships in yield-bearing products, especially if Bitcoin ETF staking becomes a reality.

“We have campaigns targeting on-chain Web3 wallet users, which represent the retail side—DeFi users who understand concepts like lending, staking, and other DeFi use cases,” says Hu.

The team is also preparing for the possibility of Bitcoin ETF staking approval, ensuring they are ready to quickly engage with institutions once the regulatory environment is favorable.

“Once approval happens, we need to be ready with signed MoUs, vetted proof of use cases, case studies, and a track record so we can quickly open up business opportunities.”

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Bitcoin

Crypto Market Recovers After Liquidations: Here’s Why

After a rough start to the week with massive liquidations, the crypto market has finally experienced some relief, with a rebound driven by favorable broader macroeconomic changes.

Liquidations over the past day totaled $384.4 million, a significant drop from previous days. Meanwhile, the global market cap rose 1.1% over the last day.

Crypto Market Recovers After Massive Liquidations

The market’s dip was primarily driven by fears of a global recession, trade wars, and broader macroeconomic uncertainty. As a result, Bitcoin (BTC) and Ethereum (ETH) plunged to monthly and yearly lows.

This sharp decline led to widespread liquidations. Nearly $1 billion was liquidated from the market yesterday. Nonetheless, the latest data paints a slightly more favorable picture.

According to Coinglass data, $384.4 million was liquidated in the past 24 hours. Of this, $138.2 million came from long positions, while $246.2 million were short positions.

Specifically, Bitcoin saw $186.7 million in liquidations, with $146.0 million attributed to short positions. Ethereum experienced $73.6 million in liquidations, with $40.3 million from long positions and $33.1 million from short positions.

Meanwhile, Bitcoin regained ground over $80,000, trading at $82,299. This marked a 3.6% increase over the past day.

Notably, the recovery could be attributed to recent diplomatic developments. According to Bloomberg, Ukraine agreed to a temporary 30-day ceasefire in response to a US proposal. This has reduced geopolitical tensions that had previously weighed on the market.

Furthermore, Ontario suspended 25% tariffs on electricity exports to Michigan, New York, and Minnesota. This was also a major step towards easing trade tensions.

US political figures, including House Speaker Mike Johnson, have also provided much-needed reassurance to the markets. Johnson suggested that President Trump’s economic policies, which initially contributed to market instability, would eventually stabilize the economy.

“Give the president a chance to have these policies play out,” he said.

In addition, White House Press Secretary Karoline Leavitt noted that the market dip represented a temporary state rather than a definitive or permanent trend.

“We are in a period of economic transition,” Leavitt stated.

She emphasized the idea that market numbers, such as stock prices, trading volumes, and liquidations, reflect a specific point in time and can evolve. These combined factors—political reassurances, easing trade tensions, and a reduction in geopolitical risks—have contributed to the crypto market’s recent recovery.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin22 hours ago

Altcoin22 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Ethereum15 hours ago

Ethereum15 hours agoIs Ethereum Foundation’s 30,000 ETH Really At Risk?

-

Market22 hours ago

Market22 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market24 hours ago

Market24 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip

-

Altcoin23 hours ago

Altcoin23 hours agoAnalyst Predicts XRP Price To Reach $1,000 If This Happens

-

Market23 hours ago

Market23 hours agoPerpetuals, Made In USA, and Memes

-

Market15 hours ago

Market15 hours agoCrypto Market Fear Grows as Trump Announces New Tariffs