Altcoin

Will BlackRock XRP ETF Application Convince US SEC for Approval?

Crypto market analysts believe that a spot XRP ETF filing coming from the world’s largest asset manager BlackRock could speed up the approval process. This discussion sparks within the XRP community as the U.S. Securities and Exchange Commission (SEC) delayed the decision on ETF filing for Ripple cryptocurrency by Canary Capital and Grayscale.

BlackRock May Leverage XRP ETF Delays

On Tuesday, March 11, the US SEC delayed its decision for approval for the Canary spot XRP ETF and the Grayscale ETF, along with the delays in Solana ETF from Canary, VanEck, and others. Bill Morgan, a prominent lawyer and advocate for XRP, has raised speculation about BlackRock’s potential strategy amid ongoing delays in crypto ETF approvals.

Morgan added that BlackRock might see these delays as favourable to them, as it gives the asset manager some additional time to file an XRP-based exchange-traded fund (ETF) and gain a competitive edge in the market.

Although the asset manager hasn’t hinted at filing an Ripple ETF anytime soon, market analysts are hopeful of this development in the future.

Franklin Templeton Files XRP ETF Application

Despite the delays in approval by the US SEC, $1.5 trillion asset manager Franklin Templeton filed an application for an XRP ETF. According to the filing, Coinbase Custody Trust Company will serve as the custodian for the fund’s XRP holdings, ensuring secure storage of the digital assets.

The move marks a significant development in the evolving crypto ETF landscape, with Franklin Templeton joining the growing list of institutions vying to bring XRP-focused financial products to market.

Following the change of regime at the US SEC, and the Trump administration in charge, market analysts are hopeful for an XRP ETF. However, asset managers like BlackRock would be willing to wait for a settlement in the Ripple lawsuit, which could provide a clear path for filing an ETF application. Several market analysts believe that the settlement could happen before Ripple’s appellate brief submission on April 16, 2025.

XRP Price Action Ahead

XRP price is up 5% today amid the current ETF developments with open interest surging 2.28% to $3 billion. The 24-hour liquidations have surged to $ 13.85 million, with more than $7 million in short liquidations.

Mikybull Crypto highlights XRP as one of the strongest performers despite the ongoing market downturn. The analyst points to a daily bullish divergence on XRP’s chart, signaling potential upward momentum. Mikybull anticipates that XRP could see a significant rally once broader market recovery begins.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Analyst Reveals When The XRP Price Will Hit Double & Triple Digits

Crypto analyst Egrag Crypto has revealed when the XRP price will hit double and triple digits. This provides a bullish outlook for XRP especially amid the recent market crash and its brief drop below the psychological $2 price level.

When The XRP Price Will Hit Double & Triple Digits

In an X post, Egrag Crypto stated that the XRP price will hit double digits in this cycle and triple digits in the next cycle. for triple digits, his accompanying chart showed that XRP could reach as high as $110. Interestingly, crypto analyst Dark Defender also recently predicted that XRP could reach triple digits, although he provided a more bullish outlook for the crypto as he predicted that it could reach $333.

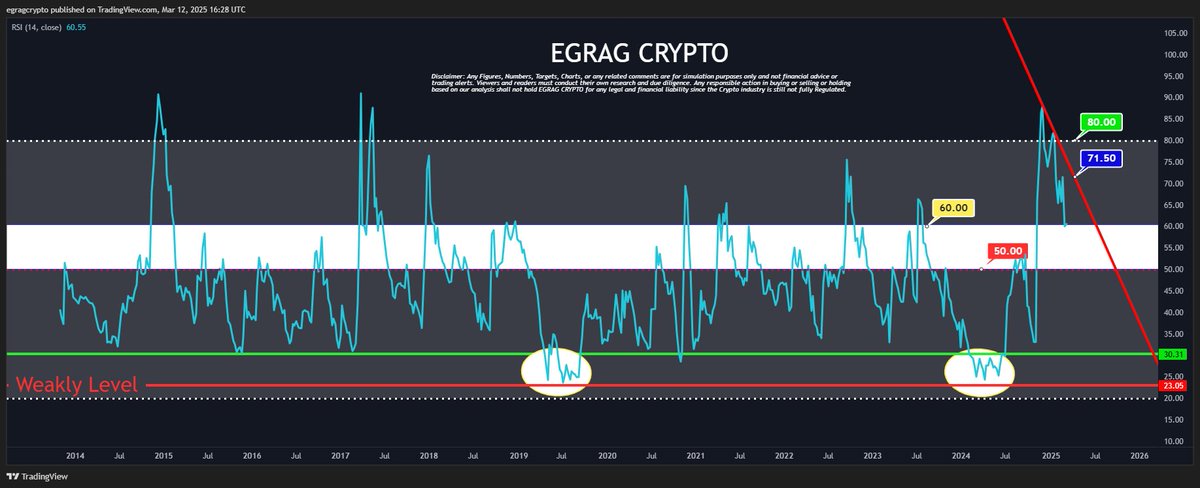

Meanwhile, in another X post, Egrag Crypto suggested that XRP’s recovery could be imminent. While analyzing the weekly Relative Strength Index (RSI), he stated that the crypto simply needs to cross 71.50 and then ‘kaboom,’ indicating a parabolic rally.

He noted that on the 60 level, XRP’s RSI is starting to kick upward. The analyst added that as the crypto builds strength from 60, it could easily climb back above 80. However, he remarked that it first needs to close above 71.50.

Crypto analyst Rose Premium also recently predicted that XRP could soon rally to as high as $3.35. The analyst stated that a bounce from the current support level of $2.12 could drive the crypto’s price towards key targets at $2.32, $2.61, $2.90 and then $3.35.

A Rally To $5 Is Also On The Cards In The Mid Term

Crypto analyst Dark Defender also indicated that an XRP price rally to 45 was also on the cards in the mid-term. This came as he highlighted this price level as one of the targets in his recent analysis.

He noted that XRP has finished the correction on the four-hour time frame. Analyzing the daily chart, he stated that XRP is expected to move towards $2.42 first considering the correction structures. He added that the real momentum will start after XRP stands above Ichimoku clouds.

The analyst highlighted $2.22 and $2.04 as the key support levels to watch out for. Meanwhile, he stated that the targets for XRP at the moment are $4.2932 and $5.8563.

It is worth mentioning that fundamentals such as the XRP ETFs and a potential Ripple SEC settlement provide a bullish outlook for the XRP price. Yesterday, asset manager Franklin Templeton filed the S-1 for its XRP ETF with the US SEC. Meanwhile, Journalist Eleanor Terrett recently reported that the SEC could soon close its case against Ripple.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Here Are The Possible Outcomes of the Ripple vs SEC Case

Despite growing speculations, the prolonged XRP lawsuit remains unresolved. The community is divided on the likelihood of an early settlement of the case. Meanwhile, experts unveil five potential outcomes for the Ripple vs SEC case, fueling further debate.

Let’s break down the potential outcomes of the XRP lawsuit and their implications for the Ripple ecosystem.

XRP Lawsuit Resolution: Things To Know

Though the US Securities and Exchange Commission (SEC) has dismissed several crypto lawsuits over the past few weeks, the settlement of the Ripple case remains uncertain. Experts argue that an early settlement is unlikely to happen. All Things XRP, a leading XRP advocacy platform on X, outlined five potential scenarios for the lawsuit’s resolution, providing more clarity to the matter.

In an X post, All Things XRP unveiled five possible outcomes for the protracted XRP lawsuit. These include the SEC dropping its appeal, a reduced penalty, the appeal court reversing the decision, the fine being upheld but the injunction lifted, and the SEC completely dropping the case. Each outcome has a different likelihood of happening, ranging from 15% to 35%.

Will US SEC Withdraw Appeal in the Ripple vs SEC Case?

Aligning with many expert predictions, All Things XRP highlighted the possibility that the SEC might withdraw its appeal under new leadership, potentially paving the way for a resolution in the Ripple case.

However, the XRP advocate added that the existing $125 million fine and the injunction on institutional XRP sales, as ruled by Judge Torres, would still be in place. Experts consider this outcome plausible, with a likelihood of 35%, as policy shifts are possible, but the injunction’s persistence complicates the situation.

Reduced Penalty and Court Decision Reversal

As All Things XRP noted, there’s a 30% chance that Ripple could negotiate a reduced penalty with the SEC. For example, the $125 million fine could be lowered to $75 million as part of a potential settlement.

However, here too, the injunction remains a significant obstacle, as dissolving it would require court approval. The analyst suggested that Paul Atkins, once confirmed as SEC Chair, might advocate for this approach.

Interestingly, there is also a possibility of overturning Judge Analisa Torres’ XRP ruling, but with only 20% likelihood. The analyst predicted that the Second Circuit might uphold the SEC’s appeal, classifying programmatic XRP sales as securities under the Howey Test. This could lead to a hefty fine of over $500 million and an expanded injunction.

Prominent legal experts like Jeremy Hogan and MetaLawMan pointed out these intricacies as major obstacles to the lawsuit’s early end.

XRP Lawsuit Conclusion: Can Injunction be Lifted with Fine Upheld?

According to All Things XRP, Ripple’s cross-appeal could ultimately uphold the $125 million fine imposed by Judge Torres. In addition, Ripple may convince the court to drop the injunction if it shows there’s no ongoing securities law violations.

Notably, this would pave the way for institutional sales to resume. With a 25% likelihood, this outcome hinges on Ripple’s argument impressing the court and tackling the injunction’s concerns.

SEC To Abandon the Ripple vs SEC Case

With the least probability, the SEC might abandon its case against Ripple, effectively nullifying the $125 million fine and seeking court approval to dissolve the injunction. This outcome, though unlikely, could emerge amidst a broader deregulatory shift. But it would still require court approval, making its likelihood a mere 15%.

Recently, lawyer Jeremy Hogan commented that a March resolution is possible in the XRP lawsuit with the injunction concerns dealt with later.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

Altcoin

Can Dogecoin Price Still Hit $5 Despite US SEC’s DOGE ETF Delay?

The crypto market has rebounded strongly from its recent turmoil, reaching a value of $2.65 trillion with a 1.30% increase. In tandem with this trend, Dogecoin’s price has surged by almost 2% over the past day. Analysts remain optimistic about DOGE’s potential for a bullish rally, further fueling the current upward momentum.

Will Dogecoin Price Reach $5?

In a recent X post, market analyst CryptoELITES shared a bullish forecast for Dogecoin price. The analyst predicted that DOGE will reach $5 in the near future. To strengthen their analysis, CryptoELITES presented a historical chart that signals Dogecoin price’s target of $5.

Meanwhile, Trader Tardigrade has identified the formation of a 5-wave Descending Broadening Wedge on the 4-hour chart, indicating an impending breakout. Following a confirmed RSI bullish divergence, Dogecoin ($DOGE) rebounded to test the descending resistance line of the wedge. According to the analyst’s predictions, Dogecoin could reach $0.1780.

Increased Whale Activity and ETF Frenzy Spark Bullish Resurgence

During the last crypto market correction, Dogecoin dipped by nearly 20% falling from $0.22 to $0.17. However, large Dogecoin investors or whales have utilized the opportunity to amass 1.7 billion DOGE worth $298 million in just 72 hours.

Reflecting on this increased whale activity, analyst Lumen projected Dogecoin price’s surge to $0.5. He added that the target is possible if DOGE surges past $0.2 before the ETF approval.

Interestingly, crypto expert DOGECAPITAL posited that the Dogecoin price could reach an ambitious point of $90 by the end of 2025.

In a recent development, the US Securities and Exchange Commission (SEC) has reportedly delayed its decision on approving ETFs for Dogecoin (DOGE), XRP, Solana, and Litecoin, despite growing anticipation. However, ETF Store President Nate Geraci remains optimistic, asserting that the ETFs will ultimately be approved.

Why $2 is a Pivotal Target for Dogecoin Price?

Notably, $2 has been a pivotal target for the Dogecoin price. Many crypto experts have predicted DOGE’s potential rally targeting around $2. For instance, Dogecoin co-founder Billy Markus projected Dogecoin price’s possible surge to $2.3, marking a staggering 500% uptick.

Similarly, analyst Javon Marks underscored DOGE’s potential to hit $2.3, citing historical patterns. According to Changelly, DOGE will reach the projected $2.3 by July 2032.

As of press time, DOGE is valued at $0.1614, with an uptick of 3.64% over the past 24 hours. Despite the daily surge, Dogecoin price saw massive declines of 17% and 34% over the past week and month, respectively.

Disclaimer: The presented content may include the personal opinion of the author and is subject to market condition. Do your market research before investing in cryptocurrencies. The author or the publication does not hold any responsibility for your personal financial loss.

-

Altcoin20 hours ago

Altcoin20 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Market23 hours ago

Market23 hours agoTraffic Declines Across CEXs, Coinbase and Binance Hit Hard

-

Market22 hours ago

Market22 hours agoDogecoin Price Stuck Under $0.20

-

Market21 hours ago

Market21 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Predicts XRP Price To Reach $1,000 If This Happens

-

Market20 hours ago

Market20 hours agoPerpetuals, Made In USA, and Memes

-

Market19 hours ago

Market19 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

✓ Share: