Market

Pi Coin Centralization Raises Serious Questions About the Future

According to data from PiScan, the Pi Network’s core team currently holds the majority of the total Pi Coin (PI) supply.

While such concentration may be necessary during the early stages of a network’s development, it also raises significant concerns about the project’s future decentralization.

Pi Coin Supply Concentration: Core Team’s Control Sparks Worries

The latest data reveals that the Pi Network’s core team controls approximately 62.8 billion Pi Coins across six wallets. Additionally, around 20 billion PI sits in roughly 10,000 unlisted wallets that belong to the team.

This brings the total supply held by these entities to about 82.8 billion PI. It represents a major chunk of the total maximum supply of 100 billion.

Further complicating the centralization issues, Pi Network is currently operating with only 43 nodes and three validators globally. In stark contrast, more established Layer 1 networks, such as Bitcoin (BTC), operate with over 21,000 nodes. Moreover, Ethereum (ETH) has over 6,600, and Solana (SOL) has around 4,800 nodes.

The limited number of nodes and validators means that control of the network is concentrated in the hands of a few entities. Therefore, this makes the network much more centralized than its more established counterparts.

That’s not all. This lack of transparency adds another layer of uncertainty.

“Analyzing Pi Network’s source code and on-chain data is currently challenging due to its incomplete openness,” PiScan posted on X.

Meanwhile, Pi Network has also raised doubts regarding privacy and third-party involvement. In the 2025 privacy policy update, Pi Network revealed that it uses ChatGPT for its Know Your Customer (KYC) process. This feature was not mentioned in the previous version of the policy.

“We use ChatGPT, as a trusted AI partner, to automate identity verification and enhance security measures. By using our KYC services, users consent to the use of ChatGPT, and other AI providers that may be later implemented, as part of our KYC process,” the document states.

The introduction of artificial intelligence (AI) into the KYC process brings a new layer of complexity to how user data is shared and processed.

These concerns add to a growing list of issues surrounding Pi Network. The community has previously highlighted technical difficulties during the mainnet migration. In addition, many users, frustrated by the long lockup period and limited immediate access to their tokens, have been trying to sell their accounts.

This dissatisfaction has resulted in a sharp decline in Pi Network’s popularity. According to Google Trends, the search interest for “Pi Network” has dropped significantly since the mainnet launch on February 20.

On launch day, the search interest was at 100, indicating a peak of public attention and excitement surrounding the event. However, this figure has plummeted to just 12 at the time of this report, reflecting a steep decline in interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

ADA Long-Term Holders Show Confidence Amid 22% Price Decline

Cardano’s price has seen a steep 22% decline over the past week, mirroring the broader market downturn. As of this writing, the eighth-largest cryptocurrency by market capitalization retails at $0.73.

However, its long-term holders (LTHs) remain unfazed. On-chain data shows that they are holding onto their assets rather than selling.

Cardano’s Long-Term Holders Double Down

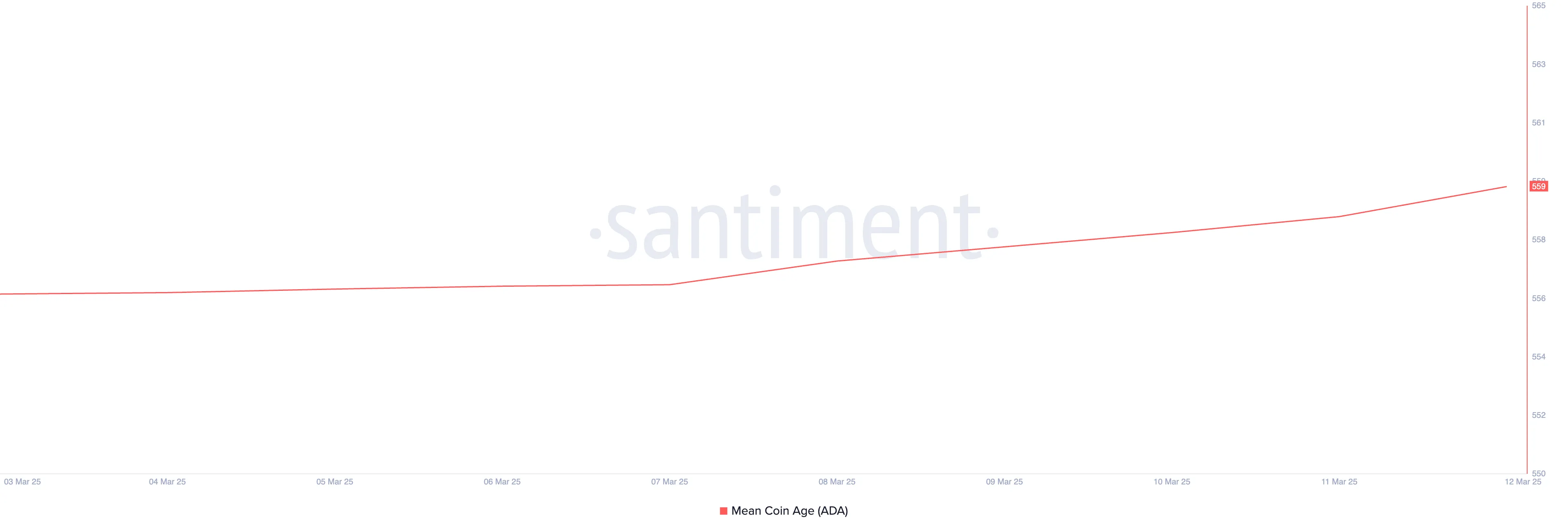

There has been a steady trend of HODLing among ADA’s LTHs, as reflected by its rising Mean Coin Age. According to Santiment, this metric’s value is up 1% since March 3.

An asset’s Mean Coin Age tracks the average age of all its coins in circulation to provide insights into market trends and hodling patterns among investors.

When it rises, it suggests that investors are holding onto their coins, signaling accumulation and confidence in the asset’s long-term value. This reflects strong hands and hints at a potential bullish outlook for ADA, especially in light of recent broader market headwinds.

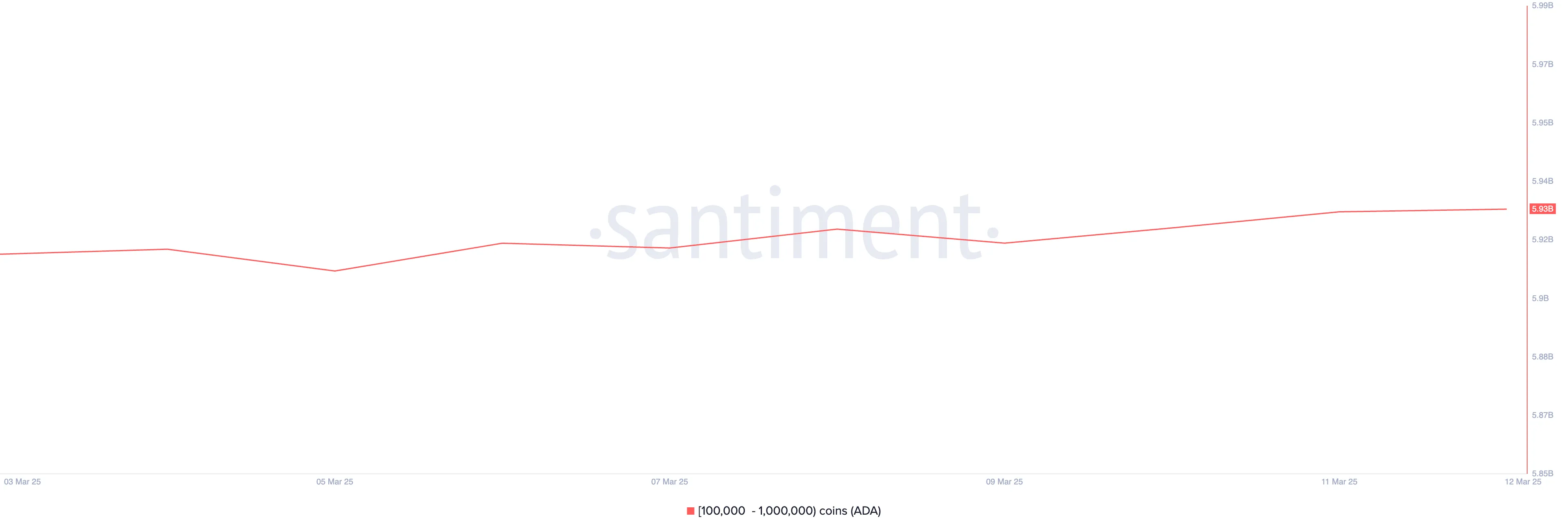

Moreover, ADA whales have increased their accumulation during the period under review, highlighting the surge in positive sentiment toward the altcoin. On-chain data from Santiment shows that large investors holding between 100,000 and 1,000,000 coins have collectively acquired 20 million ADA over the past week.

When large investor holdings increase like this, it signals strong confidence among key holders. It reduces an asset’s available supply, creating upward price pressure.

ADA Eyes $0.94 as Buyers Dominate

On the daily chart, ADA’s Balance of Power (BoP) is positive at 0.30. This indicator compares the strength of buyers and sellers in the market.

When its value is positive, buyers dominate the market, exerting stronger pressure than sellers. The bullish signal suggests upward momentum, which, if sustained, will lead to further ADA price appreciation.

In this instance, the coin’s price could rally toward $0.94. If this resistance is flipped into a support floor, ADA’s price could jump to $1.16.

However, if sellers regain dominance, the coin’s price could fall to $0.60.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETF Holdings Dip Below Satoshi As Outflows Continue

Bitcoin ETF outflows have nearly amounted to $750 million in the last two days as the crypto market consistently fell. BlackRock, the largest issuer, has offloaded around 2,000 BTC in the previous 24 hours.

Together, the ETF issuers sold off enough BTC that they collectively hold less than Satoshi. They surpassed him three months ago and continued buying huge amounts of Bitcoin, indicating truly massive sales.

Bitcoin ETF Outflows Continue

Since the Bitcoin ETFs first got SEC approval last year, they’ve had a transformative impact on the market. Lately, however, they’ve been turning bearish.

Towards the end of February, the market saw $2.7 billion in outflows, and this trend continued. The last four consecutive weeks had outflows, and the market already lost nearly $750 million this week alone.

This marks the seventh consecutive day of outflows for this ETF market. IBIT, BlackRock’s product, led these losses with $151 million in the last 24 hours.

In mid-February, some analysts began speculating that BlackRock would begin selling its Bitcoin, and ETF analyst Shaun Edmondson noticed how large of a trend it’s becoming:

“I know the markets are very ‘risk off’ at the moment with the Tariff uncertainty, but this is yet another outflow day from the US Spot ETFs, collectively now falling below Satoshi again. Given the bullish narrative from the SEC, Strategy raising 21 billion, State [Bitcoin Reserve] race and National [Bitcoin Reserve] bill, I find this a little surprising,” Edmondson claimed.

BlackRock alone has offloaded around 2,000 BTC since Edmondson posted yesterday’s daily tallies. It’s unclear how far the ETF issuers want to take this trend, but these Bitcoin sales are very concerning.

These issuers surpassed Satoshi’s Bitcoin holdings in December, so these outflows have already eaten up three months’ worth of vociferous purchasing.

Still, despite this ETF pessimism, Bitcoin’s actual price could be doing a lot worse. The entire crypto market has been hit with massive outflows, and BTC fell accordingly.

However, the US CPI report this morning was better than anticipated, which allowed Bitcoin a little breathing room. It’s anyone’s guess, however, how long this reprieve will actually last.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Receives a Record $2 Billion Investment from Abu Dhabi

Binance announced today that MGX, a sovereign wealth fund from Abu Dhabi, invested $2 billion in the company. The transaction happened entirely using stablecoins.

This is both the largest investment ever made in a crypto-related business and the largest investment ever made using cryptoassets. Binance didn’t specify which stablecoin was used, but the UAE has favored Tether products in the past.

MGX Makes Record Binance Investment

The United Arab Emirates has recently been positioning itself as a crypto hub, and Abu Dhabi is a particular region of interest. MGX, an Abu Dhabi-based Web3 fund that has already made massive AI investments, has today announced a record investment in Binance.

Changpeng “CZ” Zhao, former CEO of Binance, also shared this news on X (formerly Twitter).

“MGX, an Abu Dhabi sovereign wealth fund, invests $2 billion in Binance for a minority stake. The transaction will be 100% in crypto (stablecoins), marking it the largest investment transaction done in crypto to date. This is also the first institutional investment Binance has taken. Onwards,Build!” CZ wrote.

Binance, the world’s largest crypto exchange, also corroborated these claims with its own press release. This MGX investment isn’t Binance’s first entanglement with Abu Dhabi, as the firm considered setting up a headquarters there.

However, in 2023, CEO Richard Teng scrapped its UAE license application, signaling a shift away from the nation.

Since then, however, interest has shifted back. The firm’s press release claimed that roughly one-fifth of its workforce is based in the UAE, for example.

Teng called the development a “significant milestone” and said Binance is “committed to working with regulators worldwide.” This MGX investment will likely increase economic ties in the region.

“We are excited to announce the first-ever institutional investment in Binance by MGX. This is a significant step in advancing digital asset adoption and reinforcing blockchain’s role in global finance,” Binace annouced on X.

Also, Binance claimed that MGX made this $2 billion investment entirely in stablecoins. Last August, Tether launched a stablecoin pegged to the UAE’s currency, and Abu Dhabi subsequently recognized USDT as an Accepted Virtual Asset.

Binance’s announcements have been surprisingly light on the exact details of its future relationship with MGX.

However, they were very clear that it was a big deal. This marks the largest-ever investment in a crypto firm and the largest investment paid entirely in cryptocurrency. Wherever the partnership goes from here, it has already made history.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin20 hours ago

Altcoin20 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Market21 hours ago

Market21 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip

-

Altcoin21 hours ago

Altcoin21 hours agoAnalyst Predicts XRP Price To Reach $1,000 If This Happens

-

Market20 hours ago

Market20 hours agoPerpetuals, Made In USA, and Memes

-

Market19 hours ago

Market19 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Altcoin24 hours ago

Altcoin24 hours agoFranklin Templeton Files S-1 For XRP ETF With US SEC

-

Market23 hours ago

Market23 hours agoTraffic Declines Across CEXs, Coinbase and Binance Hit Hard