Market

Ethereum Price Recovery Capped—Bulls Struggle Near Resistance

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Ethereum price failed to clear the $2,000 resistance and trimmed gains. ETH is now consolidating and facing hurdles near the $1,920 resistance.

- Ethereum started a fresh decline below the key support at $2,000.

- The price is trading below $1,950 and the 100-hourly Simple Moving Average.

- There is a short-term bearish trend line forming with resistance at $1,890 on the hourly chart of ETH/USD (data feed via Kraken).

- The pair must clear the $1,890 and $1,950 resistance levels to start a decent increase.

Ethereum Price Faces Resistance

Ethereum price started a fresh decline from the $2,020 resistance, like Bitcoin. ETH declined below the $2,000 support to enter a bearish zone.

The bears gained strength for a move below the $1,820 support. Finally, the bulls appeared near the $1,750 zone. A low was formed at $1,753 and the price is now correcting some losses. There was a move above the $1,780 and $1,850 resistance levels.

It cleared the 23.6% Fib retracement level of the downward wave from the $2,150 swing high to the $1,753 low. Ethereum price is now trading below $1,950 and the 100-hourly Simple Moving Average.

On the upside, the price seems to be facing hurdles near the $1,890 level. There is also a short-term bearish trend line forming with resistance at $1,890 on the hourly chart of ETH/USD. The next key resistance is near the $1,920 level.

The first major resistance is near the $1,950 level and the 50% Fib retracement level of the downward wave from the $2,150 swing high to the $1,753 low. A clear move above the $1,950 resistance might send the price toward the $2,000 resistance.

An upside break above the $2,000 resistance might call for more gains in the coming sessions. In the stated case, Ether could rise toward the $2,120 resistance zone or even $2,250 in the near term.

More Losses In ETH?

If Ethereum fails to clear the $1,890 resistance, it could start another decline. Initial support on the downside is near the $1,845 level. The first major support sits near the $1,800 zone.

A clear move below the $1,800 support might push the price toward the $1,750 support. Any more losses might send the price toward the $1,720 support level in the near term. The next key support sits at $1,650.

Technical Indicators

Hourly MACD – The MACD for ETH/USD is losing momentum in the bearish zone.

Hourly RSI – The RSI for ETH/USD is now below the 50 zone.

Major Support Level – $1,800

Major Resistance Level – $1,890

Market

Bitcoin ETF Holdings Dip Below Satoshi As Outflows Continue

Bitcoin ETF outflows have nearly amounted to $750 million in the last two days as the crypto market consistently fell. BlackRock, the largest issuer, has offloaded around 2,000 BTC in the previous 24 hours.

Together, the ETF issuers sold off enough BTC that they collectively hold less than Satoshi. They surpassed him three months ago and continued buying huge amounts of Bitcoin, indicating truly massive sales.

Bitcoin ETF Outflows Continue

Since the Bitcoin ETFs first got SEC approval last year, they’ve had a transformative impact on the market. Lately, however, they’ve been turning bearish.

Towards the end of February, the market saw $2.7 billion in outflows, and this trend continued. The last four consecutive weeks had outflows, and the market already lost nearly $750 million this week alone.

This marks the seventh consecutive day of outflows for this ETF market. IBIT, BlackRock’s product, led these losses with $151 million in the last 24 hours.

In mid-February, some analysts began speculating that BlackRock would begin selling its Bitcoin, and ETF analyst Shaun Edmondson noticed how large of a trend it’s becoming:

“I know the markets are very ‘risk off’ at the moment with the Tariff uncertainty, but this is yet another outflow day from the US Spot ETFs, collectively now falling below Satoshi again. Given the bullish narrative from the SEC, Strategy raising 21 billion, State [Bitcoin Reserve] race and National [Bitcoin Reserve] bill, I find this a little surprising,” Edmondson claimed.

BlackRock alone has offloaded around 2,000 BTC since Edmondson posted yesterday’s daily tallies. It’s unclear how far the ETF issuers want to take this trend, but these Bitcoin sales are very concerning.

These issuers surpassed Satoshi’s Bitcoin holdings in December, so these outflows have already eaten up three months’ worth of vociferous purchasing.

Still, despite this ETF pessimism, Bitcoin’s actual price could be doing a lot worse. The entire crypto market has been hit with massive outflows, and BTC fell accordingly.

However, the US CPI report this morning was better than anticipated, which allowed Bitcoin a little breathing room. It’s anyone’s guess, however, how long this reprieve will actually last.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Receives a Record $2 Billion Investment from Abu Dhabi

Binance announced today that MGX, a sovereign wealth fund from Abu Dhabi, invested $2 billion in the company. The transaction happened entirely using stablecoins.

This is both the largest investment ever made in a crypto-related business and the largest investment ever made using cryptoassets. Binance didn’t specify which stablecoin was used, but the UAE has favored Tether products in the past.

MGX Makes Record Binance Investment

The United Arab Emirates has recently been positioning itself as a crypto hub, and Abu Dhabi is a particular region of interest. MGX, an Abu Dhabi-based Web3 fund that has already made massive AI investments, has today announced a record investment in Binance.

Changpeng “CZ” Zhao, former CEO of Binance, also shared this news on X (formerly Twitter).

“MGX, an Abu Dhabi sovereign wealth fund, invests $2 billion in Binance for a minority stake. The transaction will be 100% in crypto (stablecoins), marking it the largest investment transaction done in crypto to date. This is also the first institutional investment Binance has taken. Onwards,Build!” CZ wrote.

Binance, the world’s largest crypto exchange, also corroborated these claims with its own press release. This MGX investment isn’t Binance’s first entanglement with Abu Dhabi, as the firm considered setting up a headquarters there.

However, in 2023, CEO Richard Teng scrapped its UAE license application, signaling a shift away from the nation.

Since then, however, interest has shifted back. The firm’s press release claimed that roughly one-fifth of its workforce is based in the UAE, for example.

Teng called the development a “significant milestone” and said Binance is “committed to working with regulators worldwide.” This MGX investment will likely increase economic ties in the region.

“We are excited to announce the first-ever institutional investment in Binance by MGX. This is a significant step in advancing digital asset adoption and reinforcing blockchain’s role in global finance,” Binace annouced on X.

Also, Binance claimed that MGX made this $2 billion investment entirely in stablecoins. Last August, Tether launched a stablecoin pegged to the UAE’s currency, and Abu Dhabi subsequently recognized USDT as an Accepted Virtual Asset.

Binance’s announcements have been surprisingly light on the exact details of its future relationship with MGX.

However, they were very clear that it was a big deal. This marks the largest-ever investment in a crypto firm and the largest investment paid entirely in cryptocurrency. Wherever the partnership goes from here, it has already made history.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AI Agents Thrive Without Crypto: Tokenization Not Required

The artificial intelligence sector is witnessing a rapid surge in the development and deployment of AI agents, but for crypto and Web 3, not all is as it seems.

Most of these AI agents are free and open-source, challenging the notion that tokenized models are necessary for AI evolution.

Non-Tokenized AI Agents Outpace Crypto Solutions in Popularity

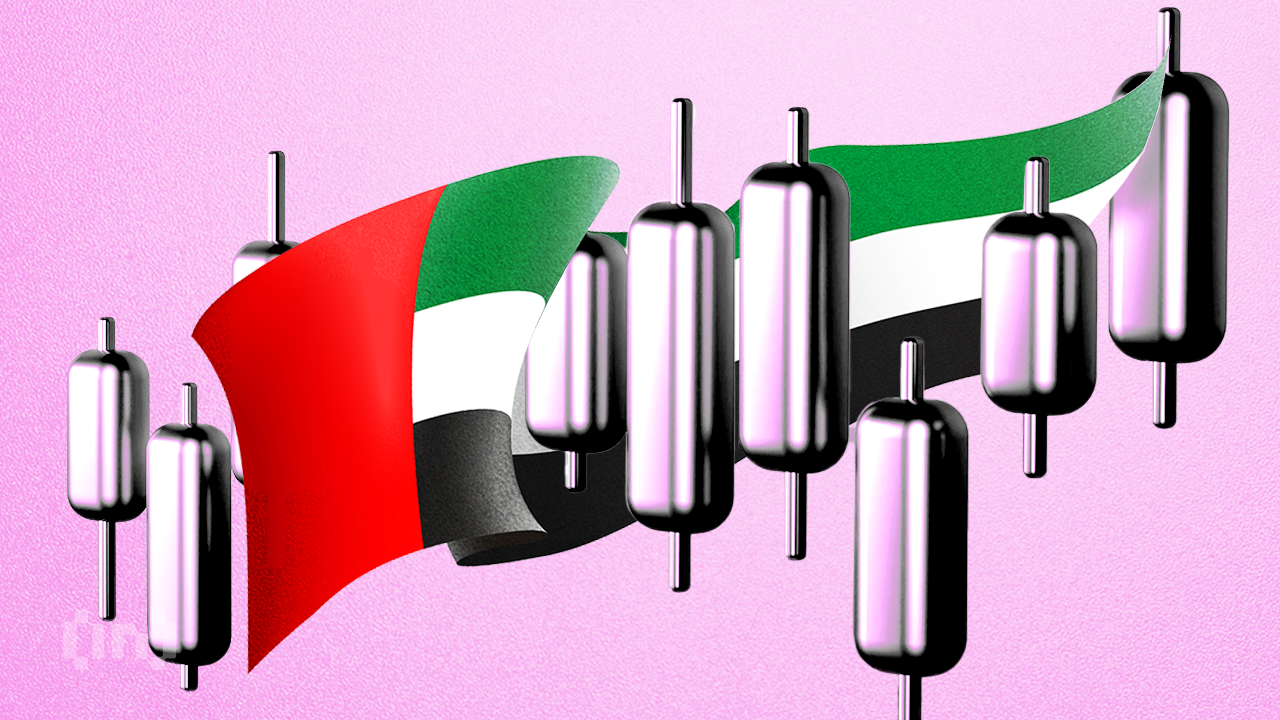

Data from the AI Agents Directory indicates an average monthly increase of 35% in the number of AI agents. However, despite the growing interest, Web3-based artificial intelligence solutions still account for a minimal fraction (3%) of the overall AI agent ecosystem.

Further, data shows that users and developers’ most sought-after AI agents do not include any from the Web3 sector. This highlights the lack of mainstream traction for crypto-integrated AI solutions.

Hitesh Malviya, an analyst and popular figure on X, echoed this sentiment in a post.

“If you look outside the crypto echo chamber, you’ll find that we do have a solid ecosystem of free and better AI agents—and they don’t have tokens, nor might they ever need one. So, what we’re trading in the name of agents is nothing but memes—a value we created out of thin air, like we always do,” Hitesh observed.

The emergence of tools like Manus, ChatGPT Operator, and n8n has made it easier than ever for individuals and businesses to develop and deploy their own tailored AI agents. These platforms allow users to create AI-powered solutions without needing a native token.

This reinforces the idea that tokenization on blockchain is not an essential component of AI agent functionality. Meanwhile, the debate surrounding AI agent tokens has also drawn criticism from industry insiders. On-chain detective ZachXBT recently slammed AI agent tokens, saying 99% are scams.

The blockchain sleuth’s concerns align with broader skepticism regarding tokenized AI projects. Many have been accused of leveraging AI hype without delivering substantive technological advancements.

Similarly, a recent survey of Solana (SOL) ecosystem founders revealed widespread skepticism about the utility of AI agents. As BeInCrypto reported, most Solana developers see AI agents as overhyped.

“The focus on AI agents distracts from core blockchain innovation. They’re more of a gimmick than a necessity in the space,” one respondent noted.

However, the crypto AI agent sector is not entirely stagnant. Recent reports suggest that new launches within the Web3 space are on the rise again. Despite the criticisms, some developers and investors still see potential in blockchain-integrated AI solutions.

As the AI agent industry grows, experts also examine its impact on the workplace. Discussions among industry leaders suggest that AI agents will play a transformative role in automating tasks, streamlining workflows, and enhancing productivity across various sectors.

The AI agent revolution is moving forward, with or without tokenization. As open-source and non-tokenized AI solutions continue gaining traction, AI-driven automation’s future may depend more on accessibility and practical application rather than speculative token economies.

The market will ultimately decide whether blockchain-based AI agents can carve out a lasting niche or if they will remain overshadowed by their non-tokenized counterparts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin19 hours ago

Altcoin19 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Market19 hours ago

Market19 hours agoPerpetuals, Made In USA, and Memes

-

Ethereum19 hours ago

Ethereum19 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory

-

Market18 hours ago

Market18 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market23 hours ago

Market23 hours agoXRP Price Face Major Resistance At $2.9, Why This Analyst Believes $20 Is Still Possible

-

Altcoin23 hours ago

Altcoin23 hours agoFranklin Templeton Files S-1 For XRP ETF With US SEC

-

Market22 hours ago

Market22 hours agoTraffic Declines Across CEXs, Coinbase and Binance Hit Hard

-

Market21 hours ago

Market21 hours agoDogecoin Price Stuck Under $0.20