Market

Crypto Market Fear Grows as Trump Announces New Tariffs

Trump announces new tariffs against Canada, striking a tough posture against its northern neighbor’s defiant attitude. Trump reiterated his call that the US annex Canada outright, thereby ending its independence.

Like previous announcements, this threat could be explosive for the crypto markets, but the tariffs may be priced in or not take effect. The more pertinent question is whether the US is about to enter a recession.

Trump Gets Tough on Canada Tariffs

President Trump’s planned tariffs have been wreaking havoc on the crypto market, and it looks like they aren’t done yet. At the beginning of February, Canada and Mexico managed to postpone them, significantly helping the crypto market. However, Trump is following through and is placing a new tariff on Canada:

“Based on Ontario, Canada, placing a 25% Tariff on ‘Electricity’ coming into the United States, I have instructed my Secretary of Commerce to add an ADDITIONAL 25% Tariff, to 50%, on all Steel and Aluminum coming into the US from Canada. This will go into effect tomorrow morning, March 12,” Trump claimed on social media.

Trump slightly edited the announcement after first posting it, clarifying that tariffs on Canada have a clear deadline. Trump also pointed to several other priorities in US-Canada relations: dairy sales, automobile manufacturing, military spending, and more. He finished with another call that the US should annex Canada outright.

This last demand, a complete end to Canada’s national autonomy, has been a particular sticking point in the tariff saga. After the US passed tariffs against China, the nation retaliated with a few tariffs of its own.

Canada also retaliated, and this tough posture created a fresh wave of support for its ruling party.

This popularity surge is especially important. It prompted harsher rhetoric on Canada’s part, and Trump has responded in kind. With his new offensive, the situation is escalating. It seems difficult to identify a clear off-ramp for both parties.

What does all of this mean for the crypto market? These tariffs have spelled a consistent bearish outcome for the industry, with markets declining alongside fresh announcements.

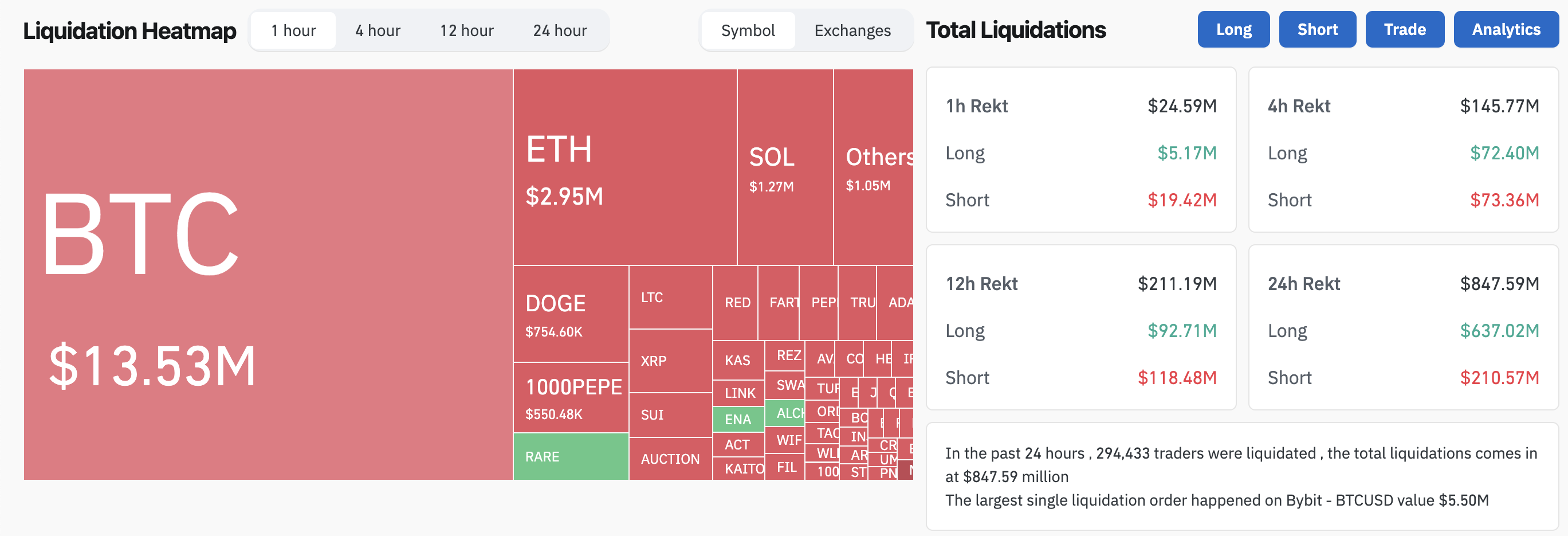

Additionally, crypto liquidations are already high, and Bitcoin’s price is not doing well. New tariffs against Canada could have a severe impact.

However, the market was already falling before Trump announced the new tariffs against Canada. The broader macroeconomic outlook is looking pretty bearish, and these tariffs may not change much on their own.

The crypto community will need to closely follow this situation when/if the tariffs go live tomorrow, and their effects will be more legible then.

Ultimately, “if” is the operant word there. Since Trump already balked from implementing tariffs against Canada and Mexico before, he may blink again.

However, that situation is creating a lot of market uncertainty, which could be much more dangerous than any tariff. If the market loses its confidence, that will definitely affect the crypto market.

The most important question is whether a full-blown recession will happen soon. These tariffs against Canada may or may not actually occur, and if they do, Trump may roll them back within 24 hours.

At this chaotic moment, it’s difficult to say whether any single policy could change everything.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Bitcoin ETF Holdings Dip Below Satoshi As Outflows Continue

Bitcoin ETF outflows have nearly amounted to $750 million in the last two days as the crypto market consistently fell. BlackRock, the largest issuer, has offloaded around 2,000 BTC in the previous 24 hours.

Together, the ETF issuers sold off enough BTC that they collectively hold less than Satoshi. They surpassed him three months ago and continued buying huge amounts of Bitcoin, indicating truly massive sales.

Bitcoin ETF Outflows Continue

Since the Bitcoin ETFs first got SEC approval last year, they’ve had a transformative impact on the market. Lately, however, they’ve been turning bearish.

Towards the end of February, the market saw $2.7 billion in outflows, and this trend continued. The last four consecutive weeks had outflows, and the market already lost nearly $750 million this week alone.

This marks the seventh consecutive day of outflows for this ETF market. IBIT, BlackRock’s product, led these losses with $151 million in the last 24 hours.

In mid-February, some analysts began speculating that BlackRock would begin selling its Bitcoin, and ETF analyst Shaun Edmondson noticed how large of a trend it’s becoming:

“I know the markets are very ‘risk off’ at the moment with the Tariff uncertainty, but this is yet another outflow day from the US Spot ETFs, collectively now falling below Satoshi again. Given the bullish narrative from the SEC, Strategy raising 21 billion, State [Bitcoin Reserve] race and National [Bitcoin Reserve] bill, I find this a little surprising,” Edmondson claimed.

BlackRock alone has offloaded around 2,000 BTC since Edmondson posted yesterday’s daily tallies. It’s unclear how far the ETF issuers want to take this trend, but these Bitcoin sales are very concerning.

These issuers surpassed Satoshi’s Bitcoin holdings in December, so these outflows have already eaten up three months’ worth of vociferous purchasing.

Still, despite this ETF pessimism, Bitcoin’s actual price could be doing a lot worse. The entire crypto market has been hit with massive outflows, and BTC fell accordingly.

However, the US CPI report this morning was better than anticipated, which allowed Bitcoin a little breathing room. It’s anyone’s guess, however, how long this reprieve will actually last.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Binance Receives a Record $2 Billion Investment from Abu Dhabi

Binance announced today that MGX, a sovereign wealth fund from Abu Dhabi, invested $2 billion in the company. The transaction happened entirely using stablecoins.

This is both the largest investment ever made in a crypto-related business and the largest investment ever made using cryptoassets. Binance didn’t specify which stablecoin was used, but the UAE has favored Tether products in the past.

MGX Makes Record Binance Investment

The United Arab Emirates has recently been positioning itself as a crypto hub, and Abu Dhabi is a particular region of interest. MGX, an Abu Dhabi-based Web3 fund that has already made massive AI investments, has today announced a record investment in Binance.

Changpeng “CZ” Zhao, former CEO of Binance, also shared this news on X (formerly Twitter).

“MGX, an Abu Dhabi sovereign wealth fund, invests $2 billion in Binance for a minority stake. The transaction will be 100% in crypto (stablecoins), marking it the largest investment transaction done in crypto to date. This is also the first institutional investment Binance has taken. Onwards,Build!” CZ wrote.

Binance, the world’s largest crypto exchange, also corroborated these claims with its own press release. This MGX investment isn’t Binance’s first entanglement with Abu Dhabi, as the firm considered setting up a headquarters there.

However, in 2023, CEO Richard Teng scrapped its UAE license application, signaling a shift away from the nation.

Since then, however, interest has shifted back. The firm’s press release claimed that roughly one-fifth of its workforce is based in the UAE, for example.

Teng called the development a “significant milestone” and said Binance is “committed to working with regulators worldwide.” This MGX investment will likely increase economic ties in the region.

“We are excited to announce the first-ever institutional investment in Binance by MGX. This is a significant step in advancing digital asset adoption and reinforcing blockchain’s role in global finance,” Binace annouced on X.

Also, Binance claimed that MGX made this $2 billion investment entirely in stablecoins. Last August, Tether launched a stablecoin pegged to the UAE’s currency, and Abu Dhabi subsequently recognized USDT as an Accepted Virtual Asset.

Binance’s announcements have been surprisingly light on the exact details of its future relationship with MGX.

However, they were very clear that it was a big deal. This marks the largest-ever investment in a crypto firm and the largest investment paid entirely in cryptocurrency. Wherever the partnership goes from here, it has already made history.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

AI Agents Thrive Without Crypto: Tokenization Not Required

The artificial intelligence sector is witnessing a rapid surge in the development and deployment of AI agents, but for crypto and Web 3, not all is as it seems.

Most of these AI agents are free and open-source, challenging the notion that tokenized models are necessary for AI evolution.

Non-Tokenized AI Agents Outpace Crypto Solutions in Popularity

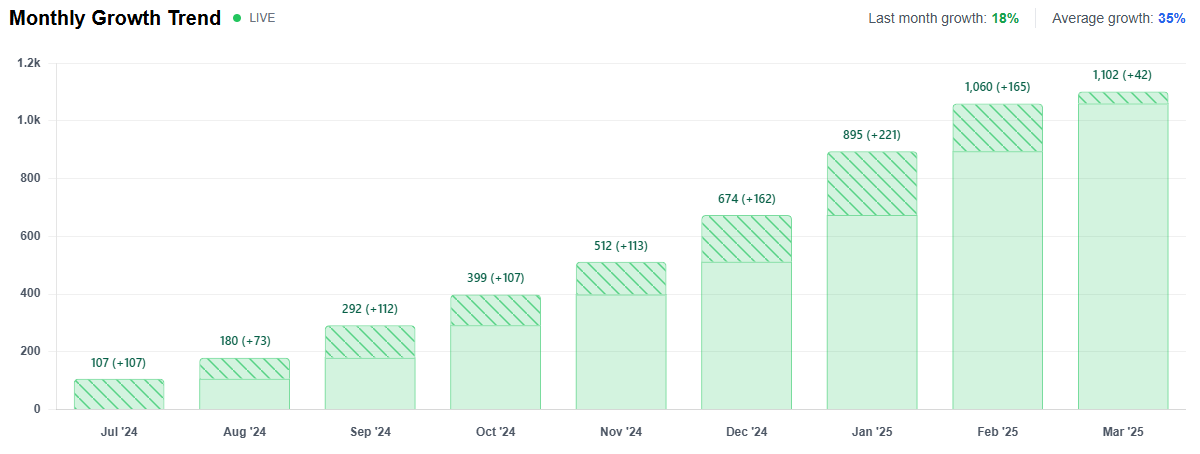

Data from the AI Agents Directory indicates an average monthly increase of 35% in the number of AI agents. However, despite the growing interest, Web3-based artificial intelligence solutions still account for a minimal fraction (3%) of the overall AI agent ecosystem.

Further, data shows that users and developers’ most sought-after AI agents do not include any from the Web3 sector. This highlights the lack of mainstream traction for crypto-integrated AI solutions.

Hitesh Malviya, an analyst and popular figure on X, echoed this sentiment in a post.

“If you look outside the crypto echo chamber, you’ll find that we do have a solid ecosystem of free and better AI agents—and they don’t have tokens, nor might they ever need one. So, what we’re trading in the name of agents is nothing but memes—a value we created out of thin air, like we always do,” Hitesh observed.

The emergence of tools like Manus, ChatGPT Operator, and n8n has made it easier than ever for individuals and businesses to develop and deploy their own tailored AI agents. These platforms allow users to create AI-powered solutions without needing a native token.

This reinforces the idea that tokenization on blockchain is not an essential component of AI agent functionality. Meanwhile, the debate surrounding AI agent tokens has also drawn criticism from industry insiders. On-chain detective ZachXBT recently slammed AI agent tokens, saying 99% are scams.

The blockchain sleuth’s concerns align with broader skepticism regarding tokenized AI projects. Many have been accused of leveraging AI hype without delivering substantive technological advancements.

Similarly, a recent survey of Solana (SOL) ecosystem founders revealed widespread skepticism about the utility of AI agents. As BeInCrypto reported, most Solana developers see AI agents as overhyped.

“The focus on AI agents distracts from core blockchain innovation. They’re more of a gimmick than a necessity in the space,” one respondent noted.

However, the crypto AI agent sector is not entirely stagnant. Recent reports suggest that new launches within the Web3 space are on the rise again. Despite the criticisms, some developers and investors still see potential in blockchain-integrated AI solutions.

As the AI agent industry grows, experts also examine its impact on the workplace. Discussions among industry leaders suggest that AI agents will play a transformative role in automating tasks, streamlining workflows, and enhancing productivity across various sectors.

The AI agent revolution is moving forward, with or without tokenization. As open-source and non-tokenized AI solutions continue gaining traction, AI-driven automation’s future may depend more on accessibility and practical application rather than speculative token economies.

The market will ultimately decide whether blockchain-based AI agents can carve out a lasting niche or if they will remain overshadowed by their non-tokenized counterparts.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Altcoin18 hours ago

Altcoin18 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Market17 hours ago

Market17 hours agoOKX Claims Bybit Misled EU Regulators Over Hack

-

Market21 hours ago

Market21 hours agoTraffic Declines Across CEXs, Coinbase and Binance Hit Hard

-

Market20 hours ago

Market20 hours agoDogecoin Price Stuck Under $0.20

-

Market19 hours ago

Market19 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip

-

Altcoin19 hours ago

Altcoin19 hours agoAnalyst Predicts XRP Price To Reach $1,000 If This Happens

-

Market18 hours ago

Market18 hours agoPerpetuals, Made In USA, and Memes

-

Ethereum18 hours ago

Ethereum18 hours agoEthereum, Dogecoin Lead Large Cap Losses As Bitcoin Moves Into Bear Market Territory