Market

Solana (SOL) Plunges 38% In a Month

Solana (SOL) has faced intense selling pressure, recently dropping below $120 – its lowest level since February 2024. It has declined more than 38% over the past 30 days, reinforcing its bearish momentum.

With sellers firmly in control, SOL now faces a critical test of support levels, while any potential recovery would need to break through key resistance zones to signal a shift in momentum.

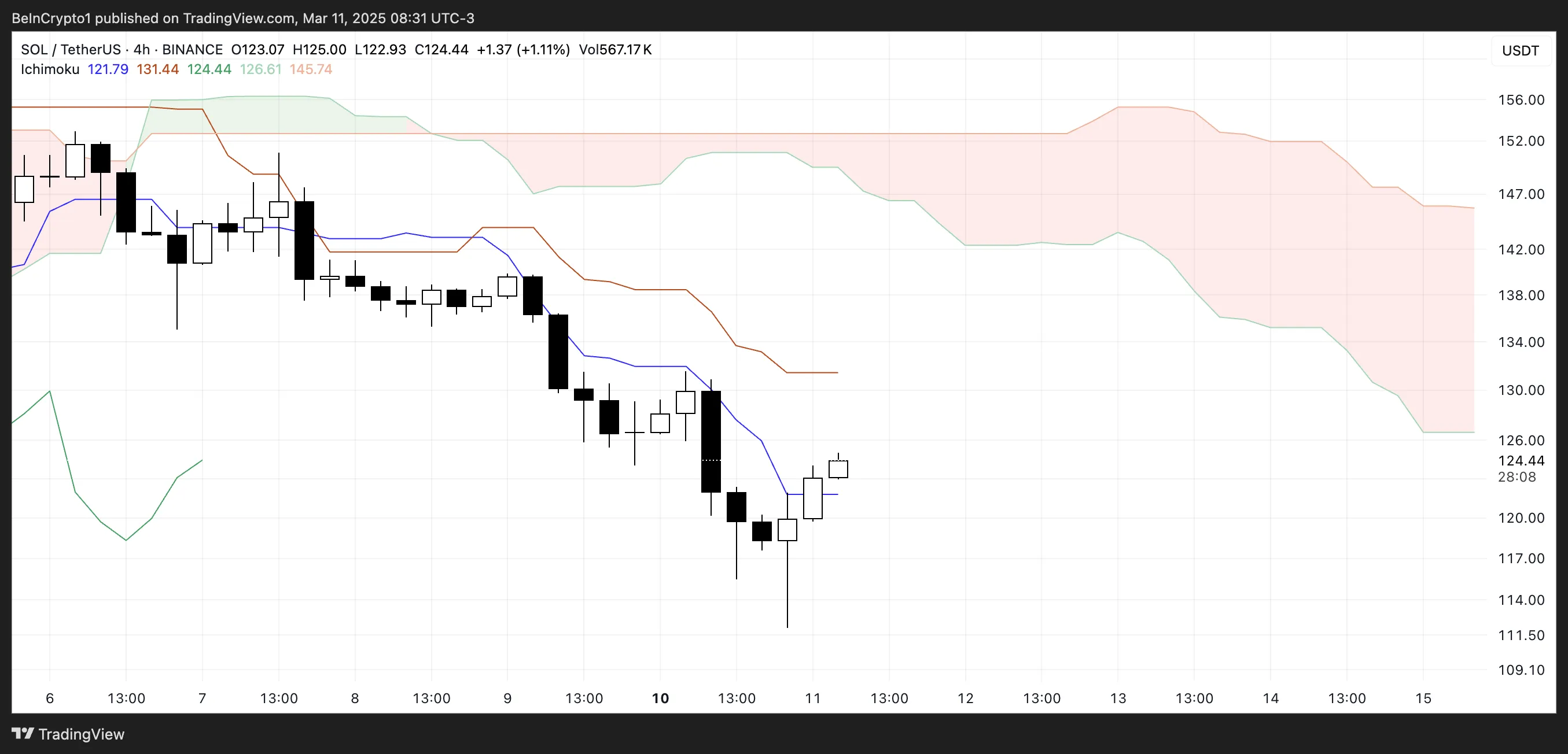

Solana Ichimoku Cloud Shows a Strong Bearish Setup

Solana Ichimoku Cloud shows that the price is currently trading below both the blue Tenkan-sen (conversion line) and the red Kijun-sen (base line), indicating that the short-term trend remains bearish.

The price recently bounced from a local low but has not yet reclaimed these key resistance levels. Additionally, the Ichimoku cloud (Kumo) ahead is red, reflecting bearish sentiment in the market.

The cloud itself is positioned well above the current price, suggesting that even if SOL experiences a short-term recovery, it will likely face strong resistance near the $130 – $135 region.

The positioning of the Tenkan-sen below the Kijun-sen further supports the bearish outlook, as this crossover typically signals downward momentum.

For any signs of a trend reversal, SOL would need to break above both of these lines and ideally enter the cloud, which would indicate a potential transition to a neutral phase.

Until then, the bearish cloud ahead and the current weak price structure suggest that any rallies may be temporary before the broader downtrend resumes.

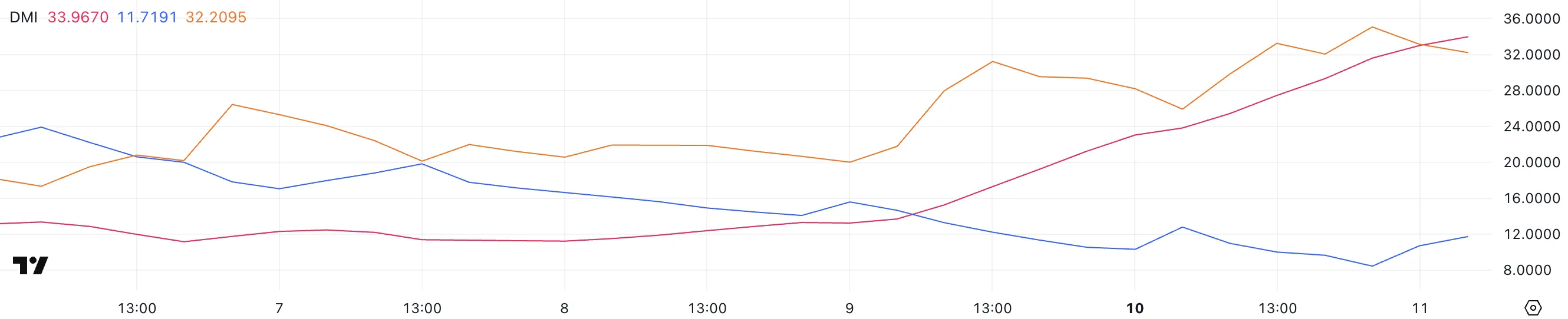

SOL DMI Shows Sellers Are Still In Control

Solana Directional Movement Index (DMI) chart reveals that its Average Directional Index (ADX) is currently at 33.96, a significant increase from 13.2 just two days ago.

The ADX measures trend strength, and a reading above 25 typically indicates a strong trend, while values below 20 suggest a weak or non-existent trend. Given this sharp rise, it confirms that SOL’s ongoing downtrend is gaining strength.

The +DI (positive directional index) has dropped to 11.71 from 15.5 two days ago but has slightly rebounded from 8.43 yesterday. In contrast, the -DI (negative directional index) sits at 32.2, up from 25.9 two days ago, though slightly down from 35 a few hours ago.

The relative positioning of the +DI and -DI lines suggests that sellers are still in control, as the -DI remains significantly higher than the +DI.

The recent dip in -DI from 35 to 32.2 could indicate some short-term relief, but with the ADX climbing quickly, it reinforces that the prevailing downtrend remains intact.

The slight bounce in +DI suggests minor buying pressure, but it’s not enough to shift momentum in favor of bulls. Until +DI rises above -DI or ADX starts declining, SOL’s bearish trend is likely to persist, with sellers dominating price action in the near term.

Will Solana Fall Below $110?

Solana Exponential Moving Average (EMA) lines continue to depict a bearish trend, with the short-term EMAs positioned below the long-term EMAs.

This alignment suggests that downward momentum remains dominant, even though the price is currently attempting a recovery. If this rebound gains strength, Solana’s price could face resistance at $130 and $135, key levels that must be cleared for any potential trend reversal.

A successful break above these resistances could push SOL toward $152.9, a significant level that, if breached with strong buying pressure, might pave the way for a rally toward $179.85 – the price level last seen on March 2, when SOL was added to the US crypto strategic reserve.

However, if the bearish structure remains intact and selling pressure resumes, Solana could retest the $115 and $112 support levels, both of which have previously acted as key price floors.

A failure to hold these supports could open the door for a deeper decline, possibly pushing SOL below $110 for the first time since February 2024.

Given the EMAs’ current positioning, the downtrend remains in control unless Solana reclaims key resistance levels and establishes a bullish crossover, signaling a shift in market sentiment.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Will Bittensor (TAO) Rally? Key Indicators Predict Price Rebound

Bittensor (TAO) price has been facing a tough battle recently. It failed to break out of a descending wedge pattern, resulting in significant losses.

Despite these setbacks, the hope for a recovery remains strong, as several key indicators suggest that a rebound may be on the horizon for the altcoin.

Bittensor Could Be Imitating Its Past

The Relative Strength Index (RSI) for Bittensor is currently recovering from the oversold zone, where it fell for the first time in eight months. This signals a potential turnaround, as the last time TAO entered the oversold region, it managed to bounce back and rally by 60%. Although such a large rally may not be expected this time, the historical pattern suggests that TAO is poised for a recovery.

As the RSI begins to climb back from its lows, investor confidence could start to improve. While the magnitude of the rally may be smaller this time, a return to more neutral or bullish territory is likely, which could help push the price of Bittensor back on an upward trajectory.

Bittensor’s broader macro momentum is also showing signs of potential recovery. The Sharpe Ratio, a key technical indicator, is deeply negative at the moment, but this has historically been a sign of future price recovery. When the Sharpe Ratio reached similar levels in the past, TAO managed to reverse its downtrend, making it a key signal for future upward movement.

As the Sharpe Ratio starts to stabilize, it could indicate that Bittensor’s risk-adjusted returns are improving. This suggests that TAO might be entering a phase where positive returns are more likely, potentially signaling the start of a recovery phase after its recent losses.

TAO Price Set To Bounce Back Soon

TAO recently experienced a significant 45% decline over two weeks, primarily due to its failure to break out of the descending wedge pattern. However, TAO is now trading at $264, having bounced off the lower trend line of this pattern. The altcoin remains stuck under the $300 mark, but it appears poised to breach this resistance in the near future.

If Bittensor can successfully break above the $298 level, it will signal a breakout from the descending wedge pattern. This could trigger a bullish rally, with the price targeting $351. Such a move would confirm the pattern’s completion and open the door for further price increases, marking the start of a recovery phase.

However, if the altcoin fails to break above the $265 barrier, the price could fall back to $229. A drop below this level would invalidate the bullish outlook, even if the descending wedge pattern remains intact. A failure to break through $298 would likely result in more consolidation or further declines.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

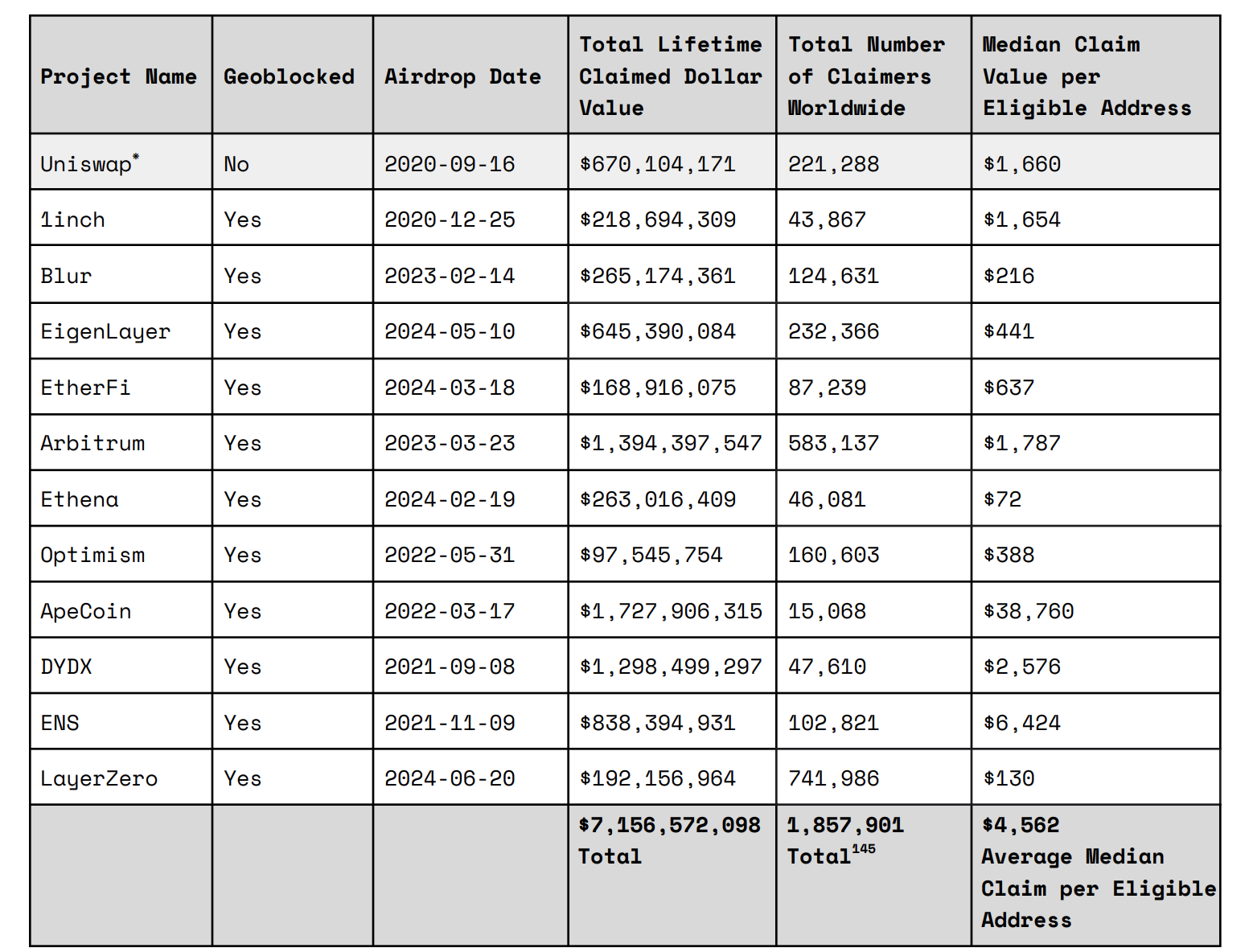

Americans Miss Out on Billions from Crypto Airdrops, Study Finds

A study by Dragonfly indicates that Americans may have missed out on up to $2.64 billion from cryptocurrency airdrops.

Notably, another study by CoinGecko suggests this figure could be as high as $5.02 billion. So, what are the reasons behind this situation?

Americans Face Restrictions in Participating in Cryptocurrency Airdrop

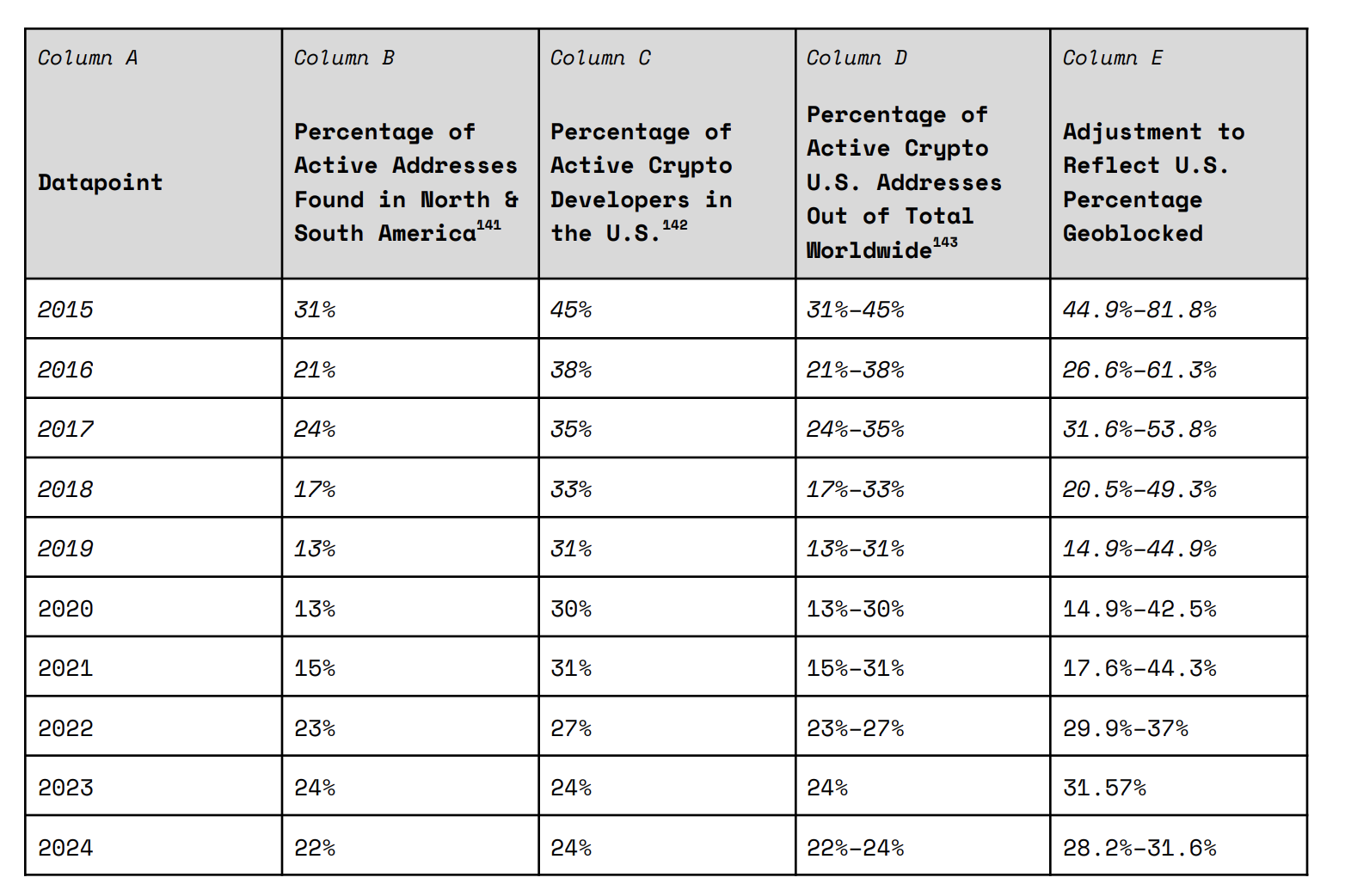

Dragonfly’s research findings are based on 12 cryptocurrency airdrops, including Uniswap and 1inch. Of these, 11 airdrops imposed restrictions on US IP addresses. Dragonfly discovered that the number of Americans affected by this IP blocking ranged from 920,000 to 5.2 million active users. This accounts for 5–10% of the 18.4 to 52.3 million cryptocurrency holders in the US impacted by geoblocking policies in 2024.

Approximately 22–24% of all active cryptocurrency addresses worldwide are US residents. The total value of the airdrops in Dragonfly’s sample amounted to around $7.16 billion. Approximately 1.9 million people globally claimed airdrops, with an average value of about $4,600 per eligible wallet address.

Based on these figures, Dragonfly estimates that Americans lost between $1.84 billion and $2.64 billion from 2020 to 2024 due to the 11 airdrops that blocked US users. Notably, CoinGecko conducted a similar analysis but with a larger sample size. Evaluating 21 airdrops that excluded Americans, CoinGecko estimates the losses could range from $3.49 billion to $5.02 billion.

The exclusion of US IP addresses from participating in crypto airdrops is a measure to avoid penalties from regulatory bodies like the Securities and Exchange Commission (SEC).

US Government Loses Nearly $3 Billion Due to Stringent Policies

The lost federal personal income tax revenue from geoblocked airdrops, based on CoinGecko’s sample from 2020 to 2024, is estimated to range from $418 million to $1.1 billion. The estimated lost state tax revenue ranges from $107 million to $284 million. This represents an estimated tax revenue loss of $525 million to $1.38 billion.

The relocation of cryptocurrency operations overseas has also significantly reduced US tax revenue. The report cites Tether as an example. Companies like Tether establishing headquarters in El Salvador may have cost the US approximately $1.3 billion in federal corporate taxes and $316 million in state taxes.

Crypto projects show caution amid potential legal challenges ahead of the new acting SEC Chair under President Trump’s administration. Blocking and losing a portion of US users is considered a safer option than facing costly litigation as is the case with Ripple, Kraken, or Coinbase.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Cardano Struggles to Climb—ADA Faces Strong Hurdles Ahead

Cardano price started a fresh decline below the $0.75 zone. ADA is correcting some losses and might face resistance near the $0.750 level.

- ADA price started a recovery wave from the $0.650 zone.

- The price is trading below $0.750 and the 100-hourly simple moving average.

- There is a short-term bearish trend line forming with resistance at $0.720 on the hourly chart of the ADA/USD pair (data source from Kraken).

- The pair could start another increase if it clears the $0.750 resistance zone.

Cardano Price Climbs Higher

In the past few days, Cardano saw a bearish wave below the $0.80 level, like Bitcoin and Ethereum. ADA declined below the $0.750 and $0.70 support levels.

Finally, it tested the $0.650 zone. A low was formed at $0.6495 and the price recently started a recovery wave. The price climbed above the $0.680 and $0.70 level. The price tested the 50% Fib retracement level of the downward move from the $0.8169 swing high to the $0.6495 low.

There was a short-term bearish trend line forming with resistance at $0.720 on the hourly chart of the ADA/USD pair. Cardano price is now trading below $0.80 and the 100-hourly simple moving average.

On the upside, the price might face resistance near the $0.750 zone and the 61.8% Fib retracement level of the downward move from the $0.8169 swing high to the $0.6495 low. The first resistance is near $0.7750. The next key resistance might be $0.80.

If there is a close above the $0.80 resistance, the price could start a strong rally. In the stated case, the price could rise toward the $0.950 region. Any more gains might call for a move toward $1.00 in the near term.

Another Decline in ADA?

If Cardano’s price fails to climb above the $0.750 resistance level, it could start another decline. Immediate support on the downside is near the $0.7150 level.

The next major support is near the $0.6880 level. A downside break below the $0.6880 level could open the doors for a test of $0.650. The next major support is near the $0.6320 level where the bulls might emerge.

Technical Indicators

Hourly MACD – The MACD for ADA/USD is losing momentum in the bullish zone.

Hourly RSI (Relative Strength Index) – The RSI for ADA/USD is now below the 50 level.

Major Support Levels – $0.7150 and $0.6880.

Major Resistance Levels – $0.7500 and $0.7750.

-

Market23 hours ago

Market23 hours agoWhat It Means for Ethereum’s Reputation

-

Market22 hours ago

Market22 hours agoRipple CTO and Robert Kiyosaki Advise Buying Bitcoin

-

Altcoin16 hours ago

Altcoin16 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Altcoin22 hours ago

Altcoin22 hours agoCBOE Files For Staking In Fidelity’s Ethereum ETF

-

Altcoin20 hours ago

Altcoin20 hours agoFranklin Templeton Files S-1 For XRP ETF With US SEC

-

Market19 hours ago

Market19 hours agoTraffic Declines Across CEXs, Coinbase and Binance Hit Hard

-

Market18 hours ago

Market18 hours agoDogecoin Price Stuck Under $0.20

-

Market17 hours ago

Market17 hours agoBNB Bulls Take Charge: Price Rebounds Strongly After Recent Dip