Market

Arbitrum Buyback Plan Arrives Ahead of Major ARB Token Unlock

Arbitrum announced a strategic buyback plan to acquire ARB tokens amid a prolonged price decline. Its backing company, Offchain Labs, marks a significant move to reinforce its commitment to the ecosystem.

The buyback comes as ARB is down over 85% from its all-time high (ATH) and continues to lose ground.

Arbitrum Announces Buyback Program

In a post on X (Twitter), Offchain Labs emphasized that the initiative reflects the ongoing growth of Arbitrum’s ecosystem. According to the firm, technical advancements and strategic DAO initiatives are the primary drivers for the Arbitrum network.

“We’re reinforcing our commitment to the ecosystem and strengthening our alignment by adding ARB to our treasury through a strategic purchase plan,” the company stated.

The firm also assured the community that purchases would follow predetermined parameters to ensure sustainability.

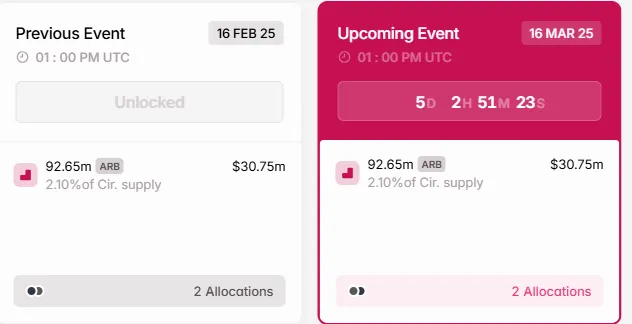

Meanwhile, this announcement comes only days before Arbitrum’s token unlock event. According to data on Tokenomist, the Arbitrum network will unlock 92.65 million ARB tokens worth $30.75 million based on current rates. These tokens constitute 2.1% of the ARB circulating supply.

Therefore, Offchain Labs’ buyback announcement aligns with this token unlocks event, with the plan to purchase ARB likely to absorb the expected supply shock. A recent report indicated that 90% of token unlocks drive prices down.

However, not everyone is convinced that buybacks alone are the right strategy. Yogi, a well-known wallet maxi, criticized the move, arguing that such a strategy lacks long-term vision. He compared it to traditional equity markets, where excessive buybacks often signal a slowdown in innovation.

“Pure buybacks alone feel unimaginative and short-sighted—they create scarcity without driving long-term growth or strategic value,” Yogi wrote.

He suggested a more diversified approach, proposing a framework where 30% of the treasury should be allocated to strategic buybacks and OTC (Over-the-Counter) deals. Further, 30% is directed toward liquidity provision to attract institutional players, and 20% is directed towards a yield-generating treasury for stable dividends.

Yogi also suggested 15% for ecosystem investments and 5% for a protocol insurance fund. In their opinion, this diversified strategy would better align incentives and enhance the protocol’s long-term sustainability.

Criticism Over Buybacks as ARB Price Struggles

Patryk, a researcher at Messari Crypto, echoed similar sentiments. He noted that while such structured plans are beneficial, they can be difficult to outline at the start of a buyback initiative. He suggested that Arbitrum remain flexible and deploy funds into strategic areas over time rather than committing to a rigid framework.

“I think projects will do this eventually. It’s just difficult to announce a concrete plan for the funds at the beginning of buybacks, like those that Arbitrum just announced. Remain flexible,” the researcher suggested.

Despite the ongoing debate, the buyback announcement and token unlocks come as Arbitrum is experiencing renewed market attention. The ARB token recently received a listing on the Robinhood platform.

While the move temporarily boosted the ARB price, it failed to sustain a lasting uptrend. Additionally, Arbitrum has gained significant community support for its BoLD proposal. As BeInCrypto reported, the governance initiative aims to decentralize decision-making further and enhance network security.

While Offchain Labs’ buyback plan signals confidence in the project, questions remain about whether it is enough to restore ARB’s market momentum. The broader sentiment around ARB remains cautious, with the massive token unlocks expected to have price implications.

“I think now may be a good time to short. Or sell. Or both,” Yogi remarked.

With Arbitrum at a crossroads, the effectiveness of this buyback strategy in revitalizing investor confidence and driving long-term growth will be closely watched. The debate between pure buybacks and strategic reinvestment continues to shape the discourse around Arbitrum’s future.

BeInCrypto data shows ARB was trading for 0.33, down almost 9% since Tuesday’s session opened.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

KAS Surge Propels 15% Rally, Highlighting Investor Confidence

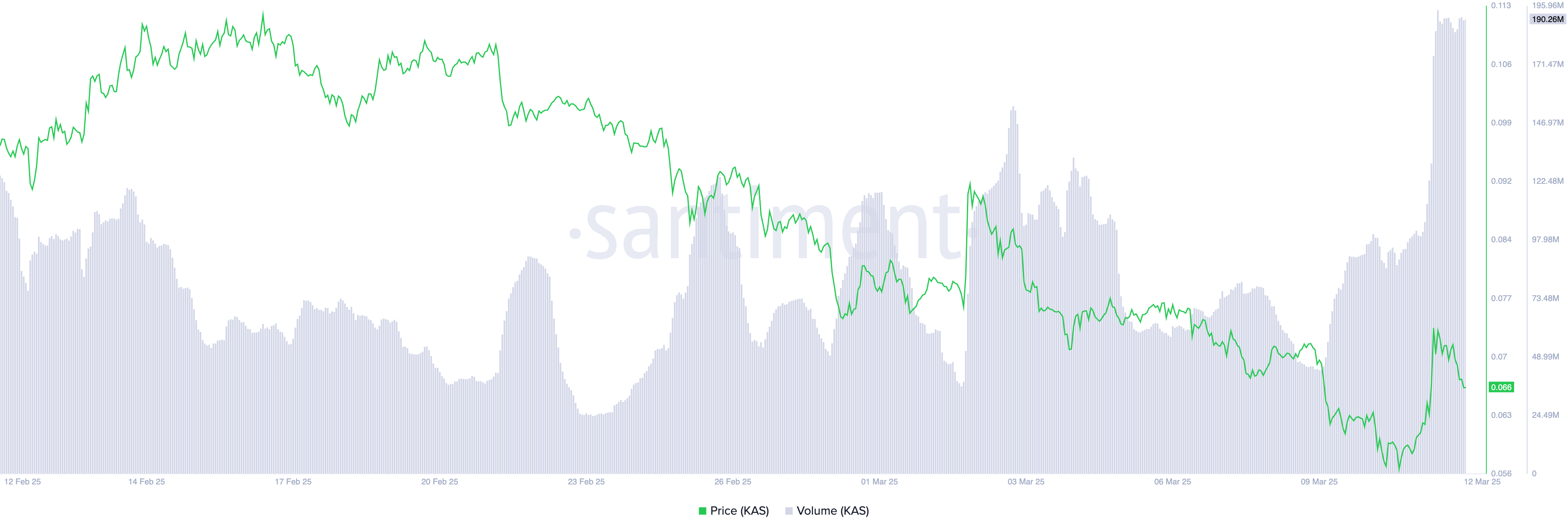

KAS has emerged as the market’s top gainer in the past 24 hours. Its price has surged by 15% after hitting a two-year low during Tuesday’s trading session.

The rebound comes amid a broader resurgence in crypto market activity, with increased trading volumes and rising open interest signaling renewed investor confidence.

KAS Rally Backed by Rising Demand

A corresponding uptick in trading volume has accompanied KAS’ double-digit gains. During the review period, the coin’s daily trading volume totaled $189 million, rising by over 95%.

When an asset’s trading volume rallies alongside its price, it indicates strong market participation and increased investor interest. Higher volume confirms that KAS’ price increase is backed by real demand, not speculative trades.

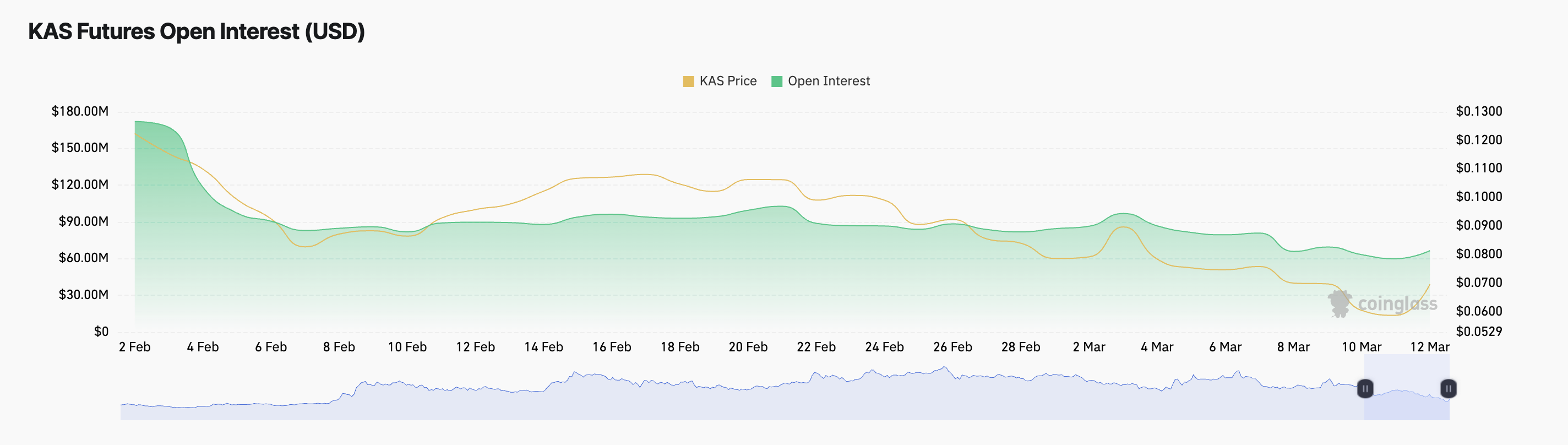

Also, the coin’s rising open interest reflects this. At press time, this is at $64 million, climbing 7% over the past day.

Open interest refers to the total number of outstanding derivative contracts that have not been settled. As it climbs, it suggests increased market participation and fresh capital entering KAS positions. This signals growing confidence in the asset’s price trend and hints at a sustained uptrend if it continues.

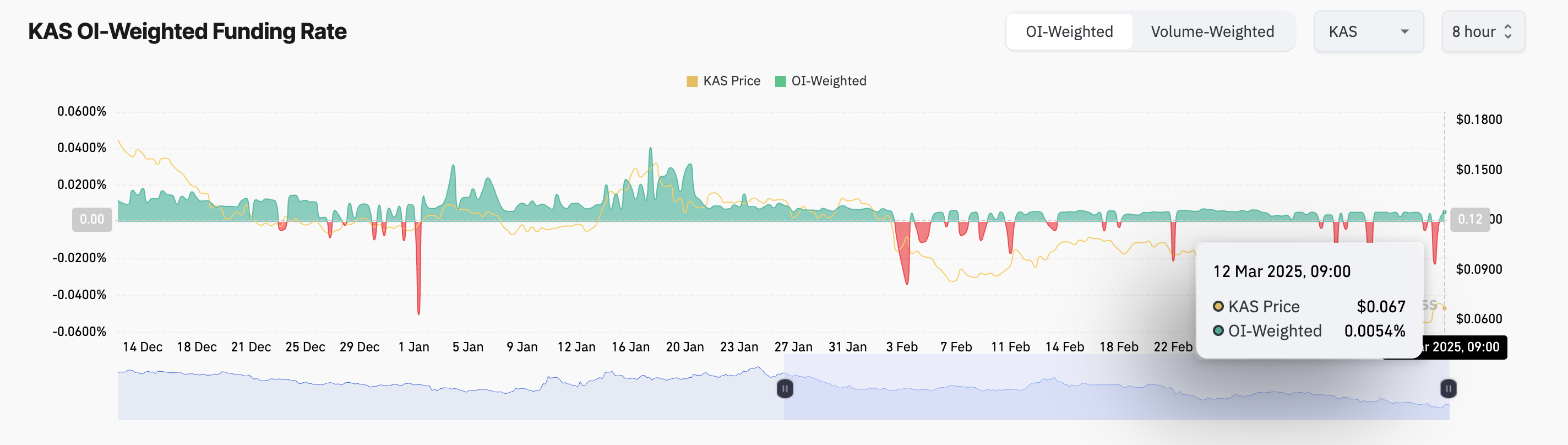

Moreover, the coin’s funding rate has flipped from negative to positive, highlighting the bullish shift in sentiment toward KAS. At press time, this stands at 0.0013%.

The funding rate is the periodic fee exchanged between long and short traders in perpetual futures contracts to keep the contract price aligned with the spot price. When its value is positive, it means long traders are paying short traders. This trend indicates that the market sentiment is bullish, and traders are willing to pay a premium to maintain their long positions.

Kaspa (KAS) Tests Critical Support at $0.065—Breakout or Breakdown Ahead?

KAS currently trades at $0.066, bouncing off the support formed at $0.065. It could continue its uptrend if this price zone is established as a strong support floor. In that case, KAS could exchange hands at $0.081 in the near term.

On the other hand, if selling pressure gains momentum, KAS could shed its recent gains and fall below the $0.065 support toward $0.049.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Eyes Upside Break—Can Bulls Push Through Resistance?

Aayush Jindal, a luminary in the world of financial markets, whose expertise spans over 15 illustrious years in the realms of Forex and cryptocurrency trading. Renowned for his unparalleled proficiency in providing technical analysis, Aayush is a trusted advisor and senior market expert to investors worldwide, guiding them through the intricate landscapes of modern finance with his keen insights and astute chart analysis.

From a young age, Aayush exhibited a natural aptitude for deciphering complex systems and unraveling patterns. Fueled by an insatiable curiosity for understanding market dynamics, he embarked on a journey that would lead him to become one of the foremost authorities in the fields of Forex and crypto trading. With a meticulous eye for detail and an unwavering commitment to excellence, Aayush honed his craft over the years, mastering the art of technical analysis and chart interpretation.

As a software engineer, Aayush harnesses the power of technology to optimize trading strategies and develop innovative solutions for navigating the volatile waters of financial markets. His background in software engineering has equipped him with a unique skill set, enabling him to leverage cutting-edge tools and algorithms to gain a competitive edge in an ever-evolving landscape.

In addition to his roles in finance and technology, Aayush serves as the director of a prestigious IT company, where he spearheads initiatives aimed at driving digital innovation and transformation. Under his visionary leadership, the company has flourished, cementing its position as a leader in the tech industry and paving the way for groundbreaking advancements in software development and IT solutions.

Despite his demanding professional commitments, Aayush is a firm believer in the importance of work-life balance. An avid traveler and adventurer, he finds solace in exploring new destinations, immersing himself in different cultures, and forging lasting memories along the way. Whether he’s trekking through the Himalayas, diving in the azure waters of the Maldives, or experiencing the vibrant energy of bustling metropolises, Aayush embraces every opportunity to broaden his horizons and create unforgettable experiences.

Aayush’s journey to success is marked by a relentless pursuit of excellence and a steadfast commitment to continuous learning and growth. His academic achievements are a testament to his dedication and passion for excellence, having completed his software engineering with honors and excelling in every department.

At his core, Aayush is driven by a profound passion for analyzing markets and uncovering profitable opportunities amidst volatility. Whether he’s poring over price charts, identifying key support and resistance levels, or providing insightful analysis to his clients and followers, Aayush’s unwavering dedication to his craft sets him apart as a true industry leader and a beacon of inspiration to aspiring traders around the globe.

In a world where uncertainty reigns supreme, Aayush Jindal stands as a guiding light, illuminating the path to financial success with his unparalleled expertise, unwavering integrity, and boundless enthusiasm for the markets.

Market

Pi Coin Centralization Raises Serious Questions About the Future

According to data from PiScan, the Pi Network’s core team currently holds the majority of the total Pi Coin (PI) supply.

While such concentration may be necessary during the early stages of a network’s development, it also raises significant concerns about the project’s future decentralization.

Pi Coin Supply Concentration: Core Team’s Control Sparks Worries

The latest data reveals that the Pi Network’s core team controls approximately 62.8 billion Pi Coins across six wallets. Additionally, around 20 billion PI sits in roughly 10,000 unlisted wallets that belong to the team.

This brings the total supply held by these entities to about 82.8 billion PI. It represents a major chunk of the total maximum supply of 100 billion.

Further complicating the centralization issues, Pi Network is currently operating with only 43 nodes and three validators globally. In stark contrast, more established Layer 1 networks, such as Bitcoin (BTC), operate with over 21,000 nodes. Moreover, Ethereum (ETH) has over 6,600, and Solana (SOL) has around 4,800 nodes.

The limited number of nodes and validators means that control of the network is concentrated in the hands of a few entities. Therefore, this makes the network much more centralized than its more established counterparts.

That’s not all. This lack of transparency adds another layer of uncertainty.

“Analyzing Pi Network’s source code and on-chain data is currently challenging due to its incomplete openness,” PiScan posted on X.

Meanwhile, Pi Network has also raised doubts regarding privacy and third-party involvement. In the 2025 privacy policy update, Pi Network revealed that it uses ChatGPT for its Know Your Customer (KYC) process. This feature was not mentioned in the previous version of the policy.

“We use ChatGPT, as a trusted AI partner, to automate identity verification and enhance security measures. By using our KYC services, users consent to the use of ChatGPT, and other AI providers that may be later implemented, as part of our KYC process,” the document states.

The introduction of artificial intelligence (AI) into the KYC process brings a new layer of complexity to how user data is shared and processed.

These concerns add to a growing list of issues surrounding Pi Network. The community has previously highlighted technical difficulties during the mainnet migration. In addition, many users, frustrated by the long lockup period and limited immediate access to their tokens, have been trying to sell their accounts.

This dissatisfaction has resulted in a sharp decline in Pi Network’s popularity. According to Google Trends, the search interest for “Pi Network” has dropped significantly since the mainnet launch on February 20.

On launch day, the search interest was at 100, indicating a peak of public attention and excitement surrounding the event. However, this figure has plummeted to just 12 at the time of this report, reflecting a steep decline in interest.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Ethereum24 hours ago

Ethereum24 hours agoBitcoin drops to $76k after Trump fails to rule out a recession

-

Market21 hours ago

Market21 hours agoBitcoin’s Potential Bottom: Expert Predictions

-

Altcoin21 hours ago

Altcoin21 hours agoBinance Unveils Key Update On CATI & These 5 Crypto, What’s Lies Ahead?

-

Altcoin22 hours ago

Altcoin22 hours agoWake-Up Call for Meme Coin Investors?

-

Market18 hours ago

Market18 hours agoCardano Enters Opportunity Zone, But ADA Holders Are Skeptical

-

Market22 hours ago

Market22 hours agoAnalyst Says Only Buy XRP If It Reaches This Level

-

Altcoin13 hours ago

Altcoin13 hours agoTop Analyst Names 3 Conditions For Cardano To Flip Solana

-

Market16 hours ago

Market16 hours agoTraffic Declines Across CEXs, Coinbase and Binance Hit Hard