Market

Cardano (ADA) Drops 39% After US Crypto Reserve Listing

Cardano (ADA) is facing intense selling pressure, dropping nearly 10% in the last 24 hours and almost 29% over the past week. Since its inclusion in the U.S. strategic crypto reserve, ADA has fallen 39%, struggling to regain bullish momentum.

Indicators like BBTrend and DMI show that bearish sentiment remains strong, with sellers still in control. If the current downtrend continues, ADA could test key support levels, but a reversal could push it back toward major resistance zones.

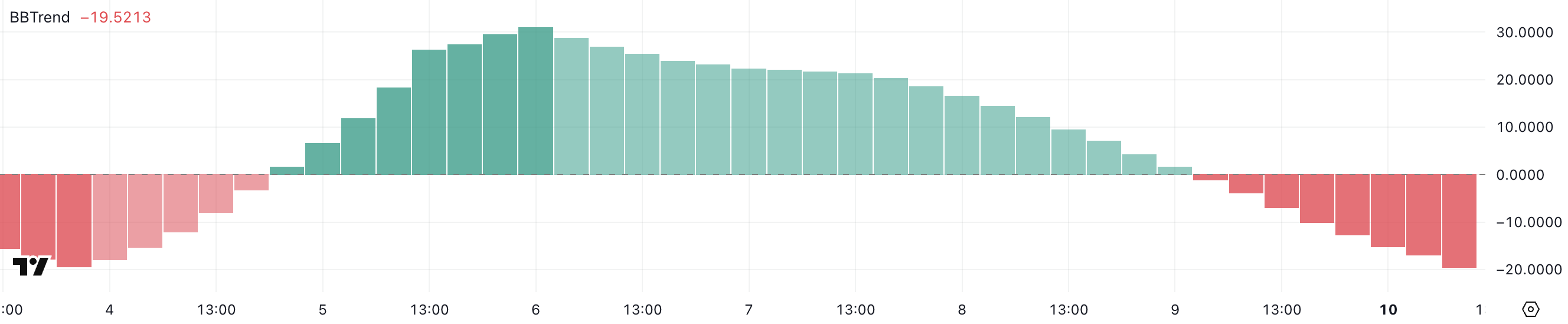

ADA BBTrend Shows the Selling Pressure Is Getting Stronger

Cardano BBTrend indicator is currently at -19.52, continuing its decline since yesterday. Earlier this month, from March 5 to March 8, BBTrend remained positive, reaching a peak of 31 on March 6.

This shift from positive to negative territory suggests a weakening bullish trend, with increasing downside pressure on ADA price. Traders are now watching whether this decline continues or if ADA can regain momentum.

BBTrend, or Bollinger Band Trend, is an indicator that measures price trends based on Bollinger Bands. It shows whether an asset is in a strong, bullish, or bearish phase. When BBTrend is positive, it suggests strong upward momentum, while negative values indicate growing selling pressure.

With ADA’s BBTrend now at -19.52, it signals increasing bearish sentiment, suggesting the price could continue declining unless buyers step in. If the downtrend persists, ADA may test key support levels in the coming days.

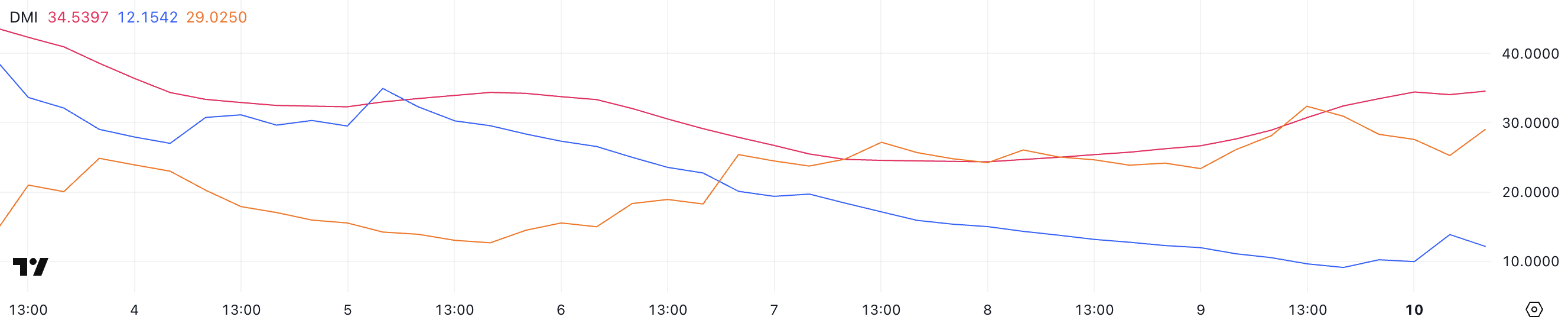

Cardano DMI Shows Sellers Are Still In Control

Cardano Directional Movement Index (DMI) chart shows that its Average Directional Index (ADX) has risen to 34.5, up from 26.6 yesterday. This increase suggests that ADA’s current trend – whether bullish or bearish – is gaining strength.

Given that ADA is in a downtrend, the rising ADX indicates that selling pressure is intensifying, making it more difficult for the price to reverse in the short term.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 indicating a strong trend and above 50 suggesting an extremely strong trend.

Meanwhile, ADA’s +DI (positive directional index) has climbed to 12 from 9.6 yesterday but is slightly down from 13.8 a few hours ago, indicating weak bullish attempts.

At the same time, -DI (negative directional index) is at 29, lower than yesterday’s 32.3 but rising from 25.2 a few hours ago.

This suggests that while sellers still control the trend, some short-term pullbacks are occurring. If -DI remains dominant and ADX continues rising, ADA’s downtrend could extend further.

Will Cardano Fall Below $0.60?

Cardano EMA lines indicate that a potential death cross could form soon, signaling a bearish momentum.

A death cross occurs when a short-term EMA crosses below a longer-term EMA, often leading to increased selling pressure.

If this bearish crossover happens, ADA price could decline further, with the $0.58 support level becoming a key area to watch. A breakdown below this level could trigger even deeper losses.

However, if buyers regain control and ADA can reverse its trend, the price may rise toward the $0.818 resistance level. A breakout above that could open the door for further gains toward $1.02 and even $1.17 if momentum strengthens.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Price Face Major Resistance At $2.9, Why This Analyst Believes $20 Is Still Possible

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

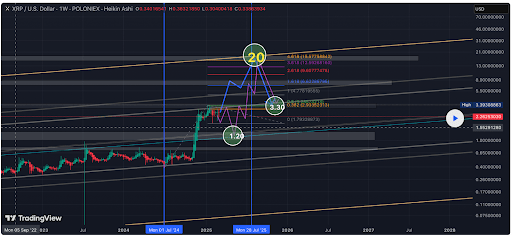

Crypto analyst ElmoX has asserted that the XRP price is still bullish despite the recent crypto market crash. His analysis revealed that XRP is set to face major resistance at $2.9, although he is confident that the crypto will eventually break this resistance and rally to as high as $20.

XRP Price Faces Resistance At $2.9 But Could Still Rally To $20

In a TradingView post, ElmoX outlined two scenarios for the XRP price as it eyes a rally to $20, although he noted that the crypto will retest the major resistance at around $2.92 either way, on its way to a new all-time high (ATH). For the first scenario, the analyst stated that XRP would break this resistance and then skyrocket to $20.

Related Reading

Meanwhile, in the second scenario, ElmoX stated that the XRP price could face another rejection, sending it below the $1.5 level before it witnesses a bullish reversal and rallies to a new ATH. The analyst revealed that he is betting on this second scenario since there is usually a swift crash before an impulsive move to the upside.

ElmoX remarked that the XRP price has barely corrected, which is also why he believes there could still be a massive crash before a rally to a new ATH. Meanwhile, the analyst didn’t provide an exact timing for the potential price correction and subsequent rally to a new ATH and the $20 price target.

Instead, he simply told market participants to be patient. He further warned that the XRP price might sit in price discovery until at least mid-July. His accompanying chart showed that XRP will first drop to as low as $1.20 before it witnesses an impulsive move to as high as $20.

The Altcoin Records A Bullish Close

In an X post, crypto analyst CasiTrades noted that although the XRP price briefly broke below the $2 trendline, the candle closed back above this trendline, reclaiming the consolidation range. She remarked that this is exactly what bulls needed to see. However, the analyst added that a confirmation is needed with XRP holding the range between $2 and $2.03 as support.

Related Reading

CasiTrades stated that a breakdown from consolidation usually leads to further downsides, but the XRP price managed to recover the level quickly, showing that buyers are stepping in. She also noted that the bullish divergence is still holding up to the 1-hour RSI even after the dip with selling pressure weakening, which suggests a shift in momentum is possible.

If the XRP price holds the support between $2 and $2.03, CasiTrades predicts that the crypto could bounce and rally toward $2.25 and $2.70. On the other hand, if XRP loses this level, she stated that the next major support sits at $1.90 which is the 0.5 Fibonacci retracement level. Meanwhile, there is also the possibility that XRP could drop to the 0.618 Fib retracement level at $1.54.

At the time of writing, the XRP price is trading at around $2.10, down over 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from Adobe Stock, chart from Tradingview.com

Market

Cardano Enters Opportunity Zone, But ADA Holders Are Skeptical

Cardano (ADA) has faced a lack of growth in recent weeks despite initially grabbing investors’ attention during a brief rally.

While ADA’s price action showed some promise, the momentum quickly faded, and now, despite entering an opportunity zone, ADA holders remain skeptical, and investor participation has dropped significantly.

Cardano Investors Need To Step Up

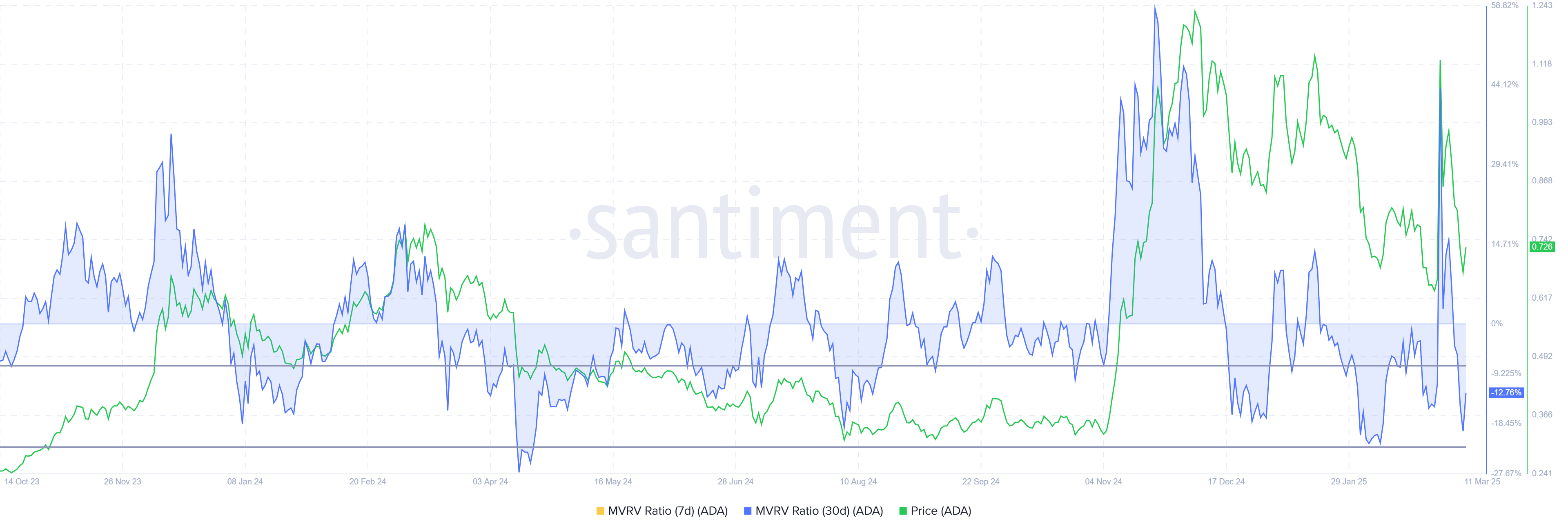

The Market Value to Realized Value (MVRV) Ratio for Cardano shows that ADA holders who purchased within the last month are currently facing 12% losses. This decline has brought ADA into the opportunity zone, which lies between -8% and -22%. Historically, this zone has been a reversal point for ADA, presenting a potential for recovery if investors decide to accumulate at low prices.

However, despite being in the opportunity zone, there is little indication that ADA holders are acting on this opportunity. The skepticism among investors, driven by the altcoin’s failure to sustain recent rallies, has made it difficult for ADA to capitalize on this potential recovery window.

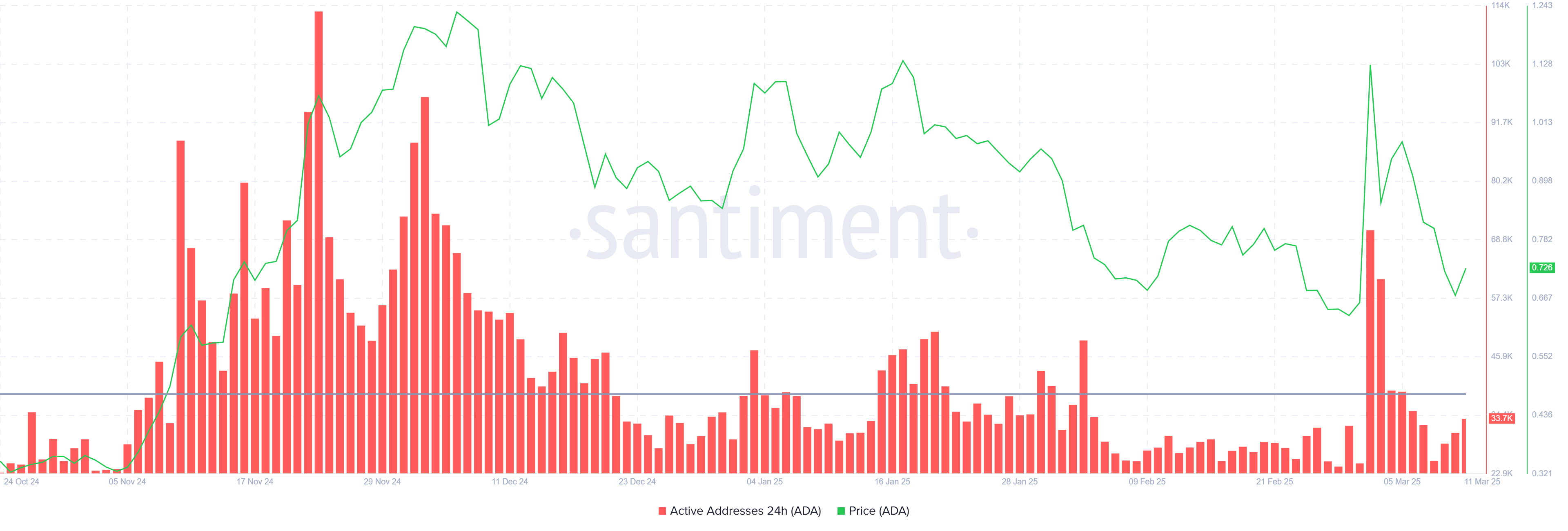

The overall macro momentum for Cardano has also been affected by diminishing participation. Active addresses on the network are currently below the average threshold of 38,600, with the count sitting at 33,700. This decrease in active addresses indicates a decline in investor participation and confidence.

During ADA’s brief rally at the beginning of the month, the number of active addresses surged, but the failure to sustain that momentum has caused skepticism to take over. With investor participation dwindling, ADA’s price could face further challenges if interest in the asset continues to wane.

ADA Price Is Facing Recovery Challenge

Cardano’s price is currently at $0.72 after falling 31% in the last few days. This decline followed ADA’s failure to breach the $0.99 level and flip it into support. The inability to reclaim this critical resistance level has led to further losses, and ADA is now struggling to recover.

As ADA moves farther away from the $1.00 price point, it continues to face challenges in terms of both investor confidence and broader market conditions. At this point, ADA is likely to experience consolidation above the $0.70 level, though a further drop to $0.62 remains a possibility, especially if investor sentiment remains weak.

However, if ADA manages to flip $0.77 into support, it could signal the beginning of a recovery. Successfully holding above this level could push the price back toward $0.85 or higher, invalidating the current bearish outlook. This would require renewed investor interest and a favorable shift in market conditions to support ADA’s upward movement.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Ripple CTO and Robert Kiyosaki Advise Buying Bitcoin

Despite market downturns, figures like Ripple CTO David Schwartz and Robert Kiyosaki advise the community to buy Bitcoin. The market is historically cyclical, and BTC has always recovered in the long term.

There are a few more concrete factors in play, like the increasing M2 money supply providing fresh liquidity. Michael Saylor plans to spend $21 billion on Bitcoin, and he isn’t alone in bullish sentiment.

Should Bitcoin Supporters Buy the Dip?

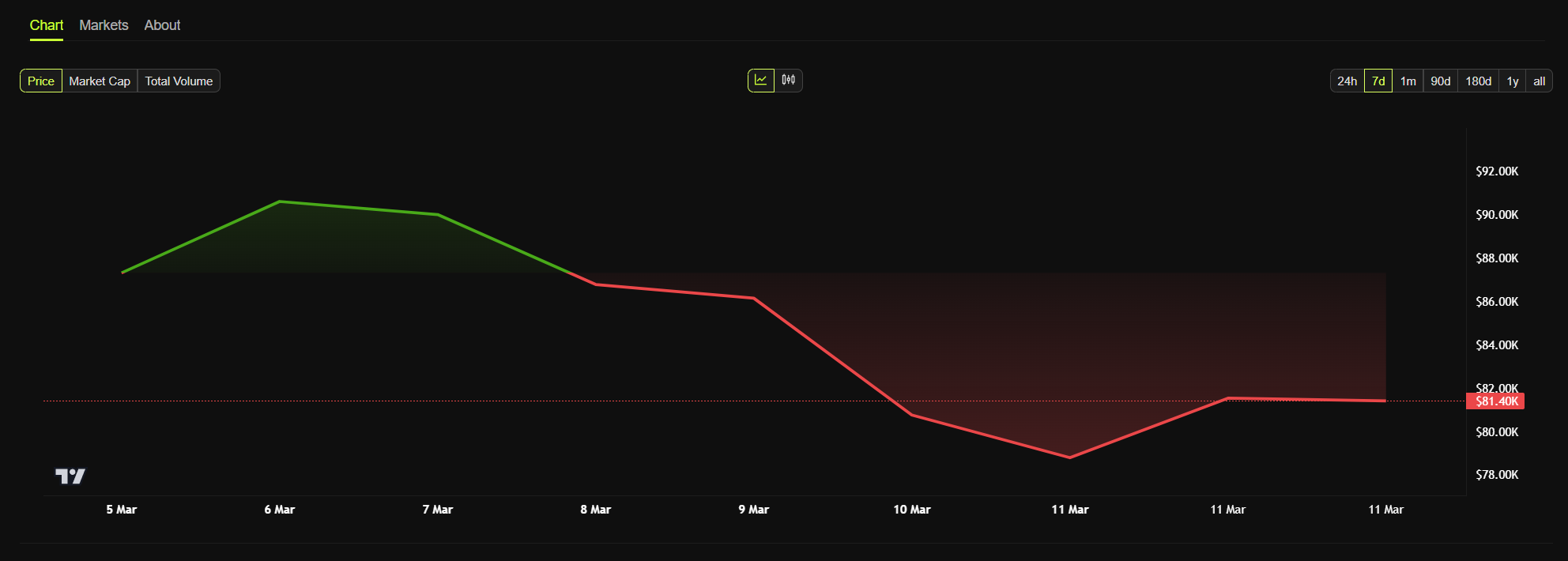

Bitcoin’s price isn’t doing well right now, and the crypto community is scrambling. Several bearish signs have been looming, and President Trump’s long-awaited Crypto Summit didn’t do much to alleviate fears.

This week, the market opened with a huge correction, but some commentators like Ripple CTO David Schwartz think it’s a great time to buy Bitcoin.

“Looks like a buying opportunity to me. There are two kinds of Bitcoiners in the world, those that care about the answer to that question [why would I buy Bitcoin] and those who don’t. I’m 100% okay with both kinds,” Schwartz claimed on social media.

In fairness, Schwartz isn’t alone in saying people should buy Bitcoin right now. Michael Saylor, who directed his company to be one of the largest BTC holders, announced yesterday that Strategy would raise $21 billion in stock sales.

These sales would fund further BTC acquisitions. Why are these figures predicting a short-term crash?

This morning, a few new bearish indicators have opened up. Miners are selling off their holdings, and Trump’s comments about a potential recession have caused further market distress.

On the surface, it seems like there’s nothing but trouble on the horizon.

However, there are a few factors that make this potentially a good moment to play the long game. Arthur Hayes has been predicting a short crash that will rebound to a new all-time high before 2026.

Additionally, the M2 money supply has been recovering, which will enable additional liquidity to buy Bitcoin. Even if a crash happens, it may be temporary:

“The everything bubble is bursting. I am afraid this crash may be the biggest in history. It is normal to be disturbed and fearful. Just do not panic. In 2008, I waited, letting the panic and dust settle and then started to look for great real assets on sale at deep discounts. This crash the world is going through, just might be the opportunity of your life time,” claimed Robert Kiyosaki.

Author and investor Kiyosaki has also been predicting a market dip for many weeks, saying that it will be a momentary setback. Bitcoin will recover, and this will be a great time to buy it at a discount.

Ultimately, no one knows exactly where the market is going. Based on its long history, however, Bitcoin always bounces back. It’s well known that crypto has been through far, far worse.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoMarket Panic and What’s Next?

-

Altcoin23 hours ago

Altcoin23 hours agoEthereum Price Eye Bullish Breakout as This Pattern Develops

-

Regulation23 hours ago

Regulation23 hours agoActing SEC Chair Mark Uyeda Seeks to Drop Rule That Targets DeFi Exchanges

-

Market22 hours ago

Market22 hours agoSEC Drops Rule Targeting Crypto Exchanges, Shifts Approach

-

Ethereum22 hours ago

Ethereum22 hours agoEthereum Price Maintains Movement Inside Ascending Triangle, Is Another Crash Coming?

-

Market21 hours ago

Market21 hours agoTop 3 Cryptos Smart Money Wallets Are Buying After the Crash

-

Market20 hours ago

Market20 hours agoTop 5 Made in USA Cryptos to Watch This Week

-

Altcoin16 hours ago

Altcoin16 hours agoWhat’s Next For Cardano Price As Whales Scoop 180M ADA