Market

SEC Drops Rule Targeting Crypto Exchanges, Shifts Approach

The SEC is stepping back from a proposal that could have expanded its control over crypto exchange platforms.

Acting Chair Mark Uyeda is pushing to withdraw the rule, which was introduced under former Chair Gary Gensler. The rule would require more trading venues, including those dealing with digital assets, to register with the agency.

SEC Will Not Regulate Crypto Exchanges

The proposal sought to redefine what qualifies as an exchange by including certain “communications protocols.” This broad approach would have affected multiple digital asset businesses.

Uyeda argues that the definition was unclear and risked regulating protocols that were never intended to fall under the SEC’s oversight.

The rule has been under consideration for years, and Gary Gensler was potentially in favor of implementing it.

Needless to say, had it been implemented, it would’ve been significantly damaging for major exchanges. However, Uyeda has now instructed the agency’s staff to stop pursuing it.

This reversal reflects a broader shift in the SEC’s stance on crypto under the new leadership appointed by President Donald Trump. Several regulatory actions taken during Gensler’s tenure are now being revisited or rolled back.

At the same time, the SEC has dropped multiple enforcement cases against crypto firms. Over the past week, at least six cases have been dismissed, including actions against Kraken, Coinbase, Robinhood, and MetaMask.

This marks a significant change in the SEC’s approach to crypto regulation.

Meanwhile, the agency’s Crypto Task Force, led by Commissioner Hester Peirce, is focusing on industry engagement. The task force includes experts like Richard Gabbert, Michael Selig, Taylor Asher, and Sumeera Younis.

They will host “Spring Sprint Toward Crypto Clarity” roundtables, starting on March 21, to discuss compliance challenges and digital asset policies.

With the SEC shifting its regulatory focus, the crypto industry is watching closely to see how these changes will impact businesses operating in the space.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Trump’s New Order Targets Crypto Debanking and Choke Point 2.0

President Donald Trump is preparing to sign a new executive order targeting regulations that influenced crypto debanking under Joe Biden’s administration.

Reports indicate the order will seek to overturn policies tied to what industry leaders call “Operation Choke Point 2.0.”

Trump to Put an End to Crypto Debanking

This initiative, a reference to an Obama-era crackdown on payday lenders and firearm dealers, allegedly aimed to prevent crypto businesses from securing banking services.

The Trump administration intends to end these restrictions, which have made it difficult for crypto-focused banks to operate.

“The Trump Administration is apparently preparing to sign an executive order that could rescind certain Federal Reserve policies that have prevented crypto banks from accessing so-called master accounts. This would be a big deal for crypto-native banks like Custodia Bank and Caitlin Long, who are currently fighting the Federal Reserve in court over this very issue,” wrote Eleanor Terrett.

The full details of the executive order are still being finalized. It is expected to address Federal Reserve policies on granting master accounts.

Notably, these accounts allow banks to conduct transactions directly with the Fed. During Biden’s presidency, crypto-friendly banks such as Custodia faced repeated denials on holding these accounts.

In short, the regulations indirectly prevented them from accessing key financial infrastructure. If these policies change, it could significantly reshape the US digital assets industry.

“This is notable because the Fed and FDIC have yet to rescind any anti-crypto guidance, despite comments last month from Federal Reserve Chairman Jerome Powell that he was struck by the growing number of apparent crypto debanking cases and that the Fed would take a fresh look at it,” wrote Eleanor Terrett.

However, the Federal Reserve operates independently and is not required to follow directives from the White House or Congress.

Any attempt to influence its policies could face pushback from central bank officials.

If signed, this will be Trump’s third crypto-related executive order since returning to office. His first order, issued on January 23, created a Presidential Working Group on Digital Asset Markets.

Meanwhile, his second order established a US government Bitcoin reserve along with a separate digital asset stockpile.

Despite these moves, Trump’s recent White House Crypto Summit left industry leaders frustrated. Many felt the discussions lacked substance, and his plan for a Bitcoin reserve failed to lift market sentiment.

Instead of buying new Bitcoin, the administration intends to use assets already seized from criminal cases.

Also, broader economic policies have added to market instability. Recent tariffs imposed on China, Mexico, Canada, and potentially the EU have rattled traditional markets.

Institutional investors have reacted by pulling funds from Bitcoin and Ethereum ETFs over the past week.

As a result, Bitcoin dropped below $80,000 for the first time in four months. Ethereum also fell to $1,870, its lowest level since November 2023.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

XRP Active Addresses Surge Despite Its Dip Below $2

XRP has dropped below $2, declining 17% over the past week. However, despite the bearish trend, on-chain data indicates a surge in network activity, raising questions about the underlying market sentiment.

With a pending final decision on the Ripple lawsuit expected a month later, on April 16, the XRP community might be holding on despite the macroeconomic downturn.

XRP Active Addresses Have Tripled in Two Weeks

According to on-chain data from Glassnode, from February 21 to March 10, the number of active XRP addresses more than tripled.

On February 21, XRP had 89,606 active addresses, but by March 2, this figure had spiked to approximately 543,000.

Although there was a minor dip afterward, active addresses rebounded to 531,000 on March 7. As of March 10, XRP still maintains over 370,000 active addresses—far above its previous levels.

At the same time, XRP’s exchange outflows from Binance have significantly declined. On March 7, over $465 million worth of XRP left Binance, marking the highest daily outflow in a month.

However, in the past three days, outflows have sharply decreased, suggesting a slowdown in large-scale withdrawals from the exchange.

The divergence between price action and network activity raises key questions about market sentiment.

A surge in active addresses typically indicates heightened user engagement, suggesting growing demand or increased transaction volume.

However, the decline in Binance outflows may signal reduced accumulation pressure or hesitation among investors to move assets off centralized platforms. This is often interpreted as uncertainty about price direction.

Some analysts argue that XRP’s price decline, despite resilient network participation, could point to short-term speculative trading rather than fundamental weakness.

Meanwhile, the drop in exchange outflows may indicate traders holding onto their assets rather than exiting.

Still, without a corresponding price rally, it suggests an equilibrium where neither buyers nor sellers have a decisive advantage.

While the data reveals strong activity on the XRP Ledger, the market remains in flux.

Whether this heightened engagement translates into future price recovery or continued consolidation remains to be seen.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Market

Pi Network (PI) at Risk – Could It Drop Below $1 in March?

Pi Network (PI) is down more than 19% in the last seven days, continuing its correction while trading below $2 since March 1. Selling pressure remains dominant, with indicators like the DMI and CMF signaling further downside risks.

PI’s EMA lines also suggest a potential death cross, which could lead to a deeper decline toward $0.95 if key support levels break. However, if momentum shifts and buyers step in, PI could attempt to reclaim $2 and possibly push toward new all-time highs above $3.

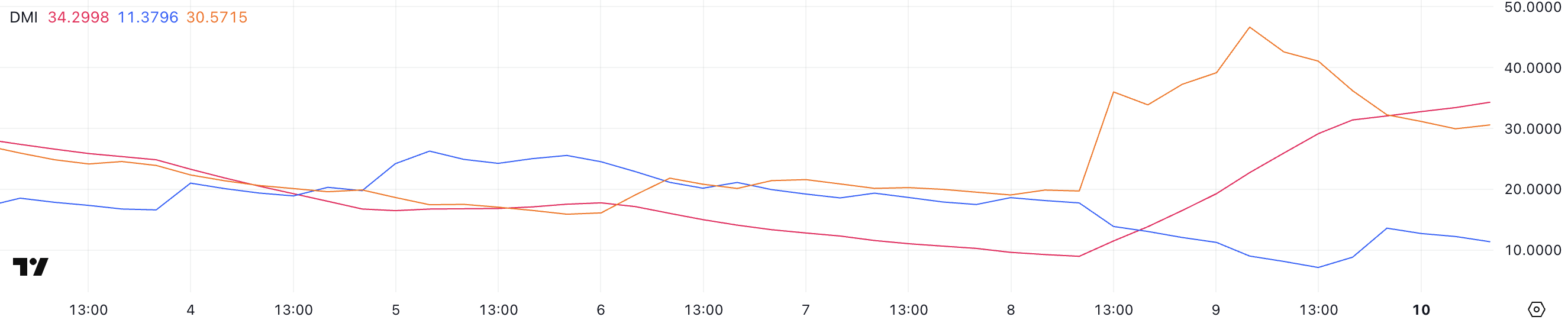

Pi Network DMI Shows Sellers Are Still In Control, Despite The Buying Pressure Yesterday

PI Directional Movement Index (DMI) shows that its Average Directional Index (ADX) has surged to 34.29, up from just 8.97 two days ago.

This sharp increase indicates that the current price trend – whether bullish or bearish – is gaining strength. Given the recent volatility, traders are closely watching whether PI will sustain its momentum or see another shift in trend direction.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 indicating a strong trend and above 50 suggesting an extremely strong trend.

Meanwhile, PI’s +DI (positive directional index) is at 11.37, down from 17.7 two days ago but recovering from 7.14 yesterday. This signals weak but slightly improving bullish attempts.

At the same time, -DI (negative directional index) is at 30.57, up from 19.5 two days ago but lower after reaching 46.6 yesterday.

This suggests that while selling pressure remains dominant, bears may be losing some momentum, leaving room for potential stabilization or a short-term bounce.

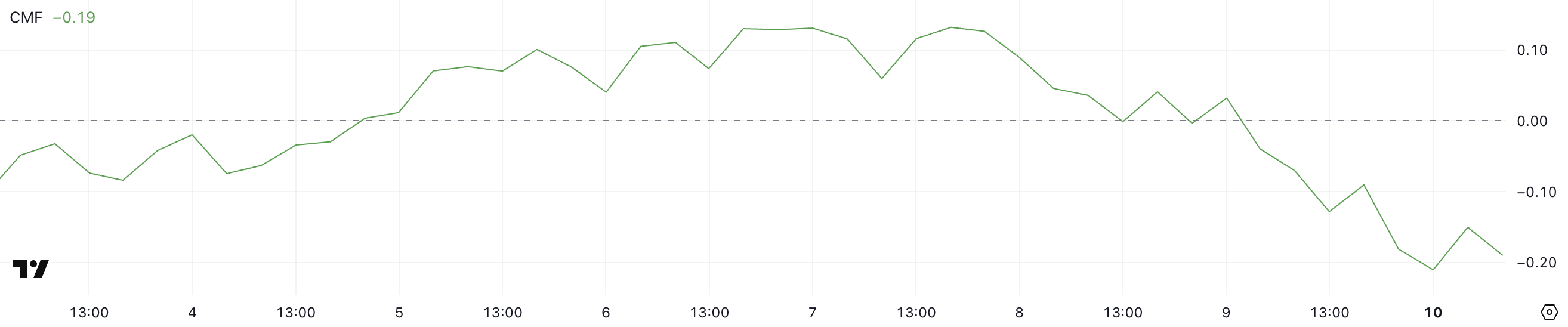

PI CMF Is Reaching All-Time Lows

Pi Network Chaikin Money Flow (CMF) is currently at -0.19, dropping from 0.03 just a day ago. This sharp decline indicates a significant shift in capital flow, suggesting that selling pressure has increased quickly.

A few hours ago, PI’s CMF reached -0.21, marking its lowest level ever. This highlights the intensity of the recent outflows.

CMF is an indicator that measures the volume-weighted flow of money in and out of an asset, ranging from -1 to 1. Positive values indicate buying pressure, while negative values suggest increasing selling pressure.

With PI’s CMF now at -0.19, close to its all-time low, it signals that sellers are in control, potentially driving the price lower. Unless buying activity returns, PI could remain under pressure, struggling to regain bullish momentum.

Will Pi Network Fall Below $1 In March?

Pi Network price is currently trading between a key resistance at $1.51 and a support level at $1.23, with its EMA lines signaling a bearish trend. A potential death cross may form soon, which could accelerate selling pressure.

If this bearish crossover happens and PI loses the $1.23 support, it could drop further, potentially reaching as low as $0.95.

However, if PI manages to regain an uptrend, it could first test resistance at $1.51, with a breakout opening the door for a move toward $2.

A stronger rally could push PI above $3 for the first time, making new all-time highs, despite recent criticism from the Bybit CEO.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

-

Market23 hours ago

Market23 hours agoBitcoin Price Dives Once More—Is a Deeper Correction Underway?

-

Altcoin22 hours ago

Altcoin22 hours agoBTC & Ether Prices Sink, Here’s Why

-

Market21 hours ago

Market21 hours agoPi Network Mainnet Woes: Pioneers Face Transfer Delays

-

Market20 hours ago

Market20 hours agoUS Economic Data Looms, Bitcoin Braces for Volatility

-

Bitcoin19 hours ago

Bitcoin19 hours agoTrump Won’t Buy Bitcoin Until It Hits $60,000: Bitwise Exec

-

Market19 hours ago

Market19 hours ago$620 Million Liquidations Shake the Market

-

Market18 hours ago

Market18 hours agoXRP’s Supply in Profit Shrinks as Bearish Sentiment Rises

-

Altcoin18 hours ago

Altcoin18 hours agoBinance Issues Key Update On These 6 Crypto, What’s Happening?